An Analysis of Bitcoin’s Price Dynamics

Abstract

:1. Introduction

2. Background and Literature Review

2.1. Introduction to Cryptocurrencies and Bitcoin

2.2. Literature Review

2.3. Theoretical Foundation

2.3.1. Stock Price Theories and Momentum Theory

2.3.2. Volatility

3. Research Design

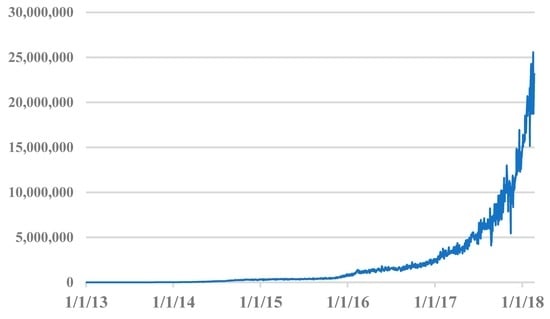

3.1. Data

3.2. Descriptive Statistics

3.3. Econometric Method

3.3.1. Autoregressive Distributed Lag Model

3.3.2. The Generalized Autoregressive Conditional Heteroscedasticity Model

3.4. Model Estimation

4. Empirical Results

4.1. Main Model (Model 1)

4.1.1. ARDL (1)

4.1.2. GARCH (1)

4.2. Reduced Model (Model 2)

4.2.1. ARDL (1)

4.2.2. GARCH (1)

4.3. Model Including Hashrate (Model 3)

4.4. Model Assessment

5. Discussion and Conclusions

5.1. Discussion

5.2. Conclusions

Appendix A

| ADF-Test | Zivot–Andrews | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Variable | Lag | C, T | t-Statistic | Result | Structural Break | Lag | t-Statistic | Result | |

| BTC | 4 | C, T | −2.095 | I(1) | 2016w26 | 2 | −3.983 | I(1) | |

| Hashrate | 8 | C, T | −3.425 | I(0) | 2013w49 | 4 | −5.142 | ** | I(0) |

| Volume | 10 | C, T | −1.991 | I(1) | 2014w38 | 1 | −6.059 | *** | I(0) |

| S&P 500 | 6 | C, T | −2.043 | I(1) | 2015w34 | 1 | −5.299 | ** | I(0) |

| Gold | 2 | C, T | −2.974 | I(1) | 2016w4 | 2 | −4.748 | I(1) | |

| Oil | 1 | C, T | −1.173 | I(1) | 2014w40 | 1 | −3.767 | I(1) | |

| VIX | 15 | C, T | −2.119 | I(1) | 2015w34 | 0 | −6.133 | *** | I(0) |

| 1 | C, T | −2.481 | I(1) | 2016w25 | 0 | −4.709 | I(1) | ||

| ADF-Test | Zivot–Andrews | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Variable | Lag | C, T | t-Statistic | Result | Structural Break | Lag | t-Statistic | Result | ||

| BTC | 2 | C, T | −6.899 | *** | I(0) | 2013w50 | 2 | −6.670 | *** | I(0) |

| Hashrate | 9 | C, T | −1.812 | I(1) | 2014w39 | 4 | −6.299 | *** | I(0) | |

| Volume | 15 | C, T | −5.105 | *** | I(0) | 2014w6 | 1 | −11.382 | *** | I(0) |

| S&P 500 | 3 | C, T | −8.091 | *** | I(0) | 2016w7 | 1 | −15.302 | *** | I(0) |

| Gold | 4 | C, T | −7.399 | *** | I(0) | 2014w12 | 2 | −12.356 | *** | I(0) |

| Oil | 7 | C, T | −4.421 | *** | I(0) | 2016w7 | 1 | −12.900 | *** | I(0) |

| VIX | 15 | C, T | −5.267 | *** | I(0) | 2017w17 | 0 | −14.305 | *** | I(0) |

| 1 | C, T | −12.17 | *** | I(0) | 2013w48 | 0 | −18.273 | *** | I(0) | |

| ARDL | GARCH | |||||

|---|---|---|---|---|---|---|

| Period | (1) | (2) | (3) | (1) | (2) | (3) |

| Outliers | Yes | Yes | No | Yes | Yes | No |

| Dummies | Yes | Yes | No | Yes | Yes | No |

| Observations | 264 | 205 | 56 | 264 | 205 | 56 |

| R2 | 0.32 | 0.27 | 0.65 | |||

| Adjusted R2 | 0.29 | 0.23 | 0.54 | |||

| AIC | −483.83 | −359.30 | −117.63 | −545.39 | −432.77 | −548.31 |

| Ramsey RESET, p-value | 0.0000 | 0.0000 | 0.911 | |||

| Durbin–Watson | 2.07 | 2.13 | 2.01 | |||

| Ljung-Box Q Stat | 0.4265 | 0.5193 | 0.5088 | |||

| ADF, residual value | 0.0002 | 0.0017 | 0.0000 | 0.0000 | 0.0004 | 0.0000 |

| ARDL | GARCH | |||||

|---|---|---|---|---|---|---|

| Period | (1) | (2) | (3) | (1) | (2) | (3) |

| Outliers | Yes | Yes | No | Yes | Yes | No |

| Dummies | Yes | Yes | No | Yes | Yes | No |

| Observations | 264 | 205 | 56 | 264 | 205 | 56 |

| R2 | 0.31 | 0.25 | 0.56 | |||

| Adjusted R2 | 0.29 | 0.23 | 0.50 | |||

| AIC | −489.41 | −366.10 | −117.35 | −552.80 | −442.78 | −554.30 |

| Ramsey RESET, p-value | 0.0000 | 0.0000 | 0.765 | |||

| Durbin–Watson | 2.08 | 2.14 | 1.85 | |||

| Ljung-Box Q Stat | 0.4155 | 0.5127 | 0.5041 | |||

| ADF, residual value | 0.0003 | 0.0024 | 0.0008 | 0.0000 | 0.0005 | 0.0000 |

| ARDL | GARCH | |||||

|---|---|---|---|---|---|---|

| Period | (1) | (2) | (3) | (1) | (2) | (3) |

| Outliers | Yes | Yes | No | Yes | Yes | No |

| Dummies | Yes | Yes | No | Yes | Yes | No |

| Observations | 264 | 205 | 56 | 264 | 205 | 56 |

| R2 | 0.33 | 0.27 | 0.68 | |||

| Adjusted R2 | 0.29 | 0.22 | 0.57 | |||

| AIC | −482.70 | −357.37 | −120.47 | −543.71 | −430.78 | −548.59 |

| Ramsey RESET, p-value | 0.0000 | 0.0000 | 0.817 | |||

| Durbin–Watson | 2.06 | 2.13 | 1.87 | |||

| Ljung-Box Q Stat | 0.4265 | 0.5187 | 0.5075 | |||

| ADF, residual value | 0.0001 | 0.0014 | 0.0004 | 0.0000 | 0.0005 | 0.0000 |

| Model 1 | Model 2 | Model 3 | |||

|---|---|---|---|---|---|

| Variable | VIF-Value | Variable | VIF-Value | Variable | VIF-Value |

| 1.29 | 1.26 | 1.29 | |||

| 1.11 | 1.04 | 1.11 | |||

| 4 | 1.09 | 4.01 | |||

| 1.24 | 1.17 | 1.24 | |||

| 1.15 | 1.16 | 1.16 | |||

| 4.03 | 4.06 | ||||

| 1.13 | 1.14 | ||||

| 1.25 | 1.25 | ||||

| 1.18 | 1.18 | ||||

| 1.02 | |||||

References

- Aalborg, Halvor Aarhus, Peter Molnár, and Jon Erik de Vries. 2018. What can explain the price, volatility and trading volume of Bitcoin? Finance Research Letters. forthcoming. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Elie Bouri, Rangan Gupta, and David Roubaud. 2017. Can volume predict Bitcoin returns and volatility? A quantiles-based approach. Economic Modelling 64: 74–81. [Google Scholar] [CrossRef]

- Baur, Dirk G., and Thomas K.J. McDermott. 2012. Safe haven assets and investor behavior under uncertainty. Institute for International Integration Studies. Available online: https://rbnz.govt.nz/-/media/ReserveBank/Files/Publications/Seminars%20and%20workshops/feb2012/4682207.pdf (accessed on 14 January 2018).

- Becker, Jörg, Dominic Breuker, Tobias Heide, Justus Holler, Hans Peter Rauer, and Rainer Böhme. 2013. Can We Afford Integrity by Proof-of-Work? Scenarios Inspired by the Bitcoin Currency. In The Economics of Information Security and Privacy. Berlin and Heidelberg: Springer Heidelberg, pp. 135–56. [Google Scholar]

- Böhme, Rainer, Nicolas Christin, Benjamin Edelman, and Tyler Moore. 2015. Bitcoin: Economics, Technology, and Governance. Journal of Economic Perspectives 29: 213–38. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Bouoiyour, Jamal, and Refk Selmi. 2015. What Does Bitcoin Look Like? Annals of Economics and Finance 16: 449–92. [Google Scholar]

- Bouoiyour, Jamal, and Refk Selmi. 2016. Bitcoin: A beginning of a new phase? Economics Bulletin 36: 1430–40. [Google Scholar]

- Bouoiyour, Jamal, Refk Selmi, Aviral Kumar Tiwari, and Olaolu Richard Olayeni. 2016. What drives Bitcoin price? Economics Bulletin 36: 843–50. [Google Scholar]

- Bouri, Elie, Georges Azzi, and Anne Haubo Dyhrberg. 2016. On the Return-Volatility Relationship in the Bitcoin Market around the Price Crash of 2013. Available online: https://ssrn.com/abstract=2869855 or http://dx.doi.org/10.2139/ssrn.2869855 (accessed on 5 February 2018).[Green Version]

- Bouri, Elie, Naji Jalkh, Peter Molnár, and David Roubaud. 2017a. Bitcoin for energy commodities before and after the December 2013 crash: Diversifier, hedge or safe haven? In Applied Economics. vol. 49, pp. 5063–73. [Google Scholar] [CrossRef]

- Bouri, Elie, Peter Molnár, Georges Azzi, David Roubaud, and Lars Ivar Hagfors. 2017b. On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Finance Research Letters 20: 192–8. [Google Scholar] [CrossRef]

- Bouri, Elie, Chi Keung Marco Lau, Brian Lucey, and David Roubaud. 2018a. Trading volume and the predictability of return and volatility in the cryptocurrency market. In Finance Research Letters. forthcoming. [Google Scholar] [CrossRef]

- Bouri, Elie, Rangan Gupta, Amine Lahiani, and Muhammad Shahbaz. 2018b. Testing for asymmetric nonlinear short- and long-run relationships between bitcoin, aggregate commodity and gold prices. Resources Policy 57: 224–35. [Google Scholar] [CrossRef]

- Bouri, Elie, Mahamitra Das, Rangan Gupta, and David Roubaud. 2018c. Spillovers between Bitcoin and other assets during bear and bull markets. Applied Economics 50: 5935–49. [Google Scholar] [CrossRef]

- Brandvold, Morten, Peter Molnár, Kristian Vagstad, and Ole Christian Andreas Valstad. 2015. Price discovery on Bitcoin exchanges. Journal of International Financial Markets, Institutions and Money 36: 18–35. [Google Scholar] [CrossRef]

- Cheah, Eng-Tuck, and John Fry. 2015. Speculative bubbles in Bitcoin markets? An empirical investigation into the fundamental value of Bitcoin. Economics Letters 130: 32–36. [Google Scholar] [CrossRef] [Green Version]

- Ciaian, Pavel, Miroslava Rajcaniova, and d’Artis Kancs. 2016. The economics of BitCoin price formation. Applied Economics 48: 1799–815. [Google Scholar] [CrossRef]

- Corbet, Shaen, Brian Lucey, and Larisa Yarovaya. 2017. Datestamping the Bitcoin and Ethereum bubbles. Finance Research Letters 26: 81–88. [Google Scholar] [CrossRef]

- Dwyer, Gerald P. 2015. The economics of Bitcoin and similar private digital currencies. Journal of Financial Stability 17: 81–91. [Google Scholar] [CrossRef] [Green Version]

- Dyhrberg, Anne Haubo. 2016. Bitcoin, gold and the dollar—A GARCH volatility analysis. Finance Research Letters 16: 85–92. [Google Scholar] [CrossRef]

- Enders, Walter. 2009. Applied Economic Time Series, 3rd ed. Hoboken: John Wiley & Sons. [Google Scholar]

- Engle, Robert F. 1982. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica: Journal of the Econometric Society 50: 987–1007. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1976. Efficient capital markets: Reply. The Journal of Finance 31: 143–45. [Google Scholar] [CrossRef]

- Garcia, David, Claudio J. Tessone, Pavlin Mavrodiev, and Nicolas Perony. 2014. The digital traces of bubbles: Feedback cycles between socio-economics signals in the Bitcoin economy. Journal of the Royal Society Interface 11: 1–28. [Google Scholar] [CrossRef] [PubMed]

- Georgoula, Ifigeneia, Demitrios Pournarakis, Christos Bilanakos, Dionisios Sotiropoulos, and George M. Giaglis. 2015. Using Time-Series and Sentiment Analysis to Detect the Determinants of Bitcoin Prices. Available online: http://ssrn.com/abstract=2607167 (accessed on 30 January 2018).

- Glosten, Lawrence R., Ravi Jagannathan, and David E. Runkle. 1993. On the relation between the expected value and the volatility of the nominal excess return on stocks. The Journal of Finance 48: 1779–801. [Google Scholar] [CrossRef]

- Google Trends Help. 2018. Available online: https://support.google.com/trends/?hl=en#topic=6248052 (accessed on 15 February 2018).

- Hansen, Bruce E. 2001. The New Econometrics of Structural Change: Dating Breaks in U.S. Labour Productivity. Journal of Economic Perspectives 15: 117–28. [Google Scholar] [CrossRef]

- Hayes, Adam S. 2015. Cryptocurrency value formation: An empirical study leading to a cost of production model for valuing bitcoin. Telematics and Informatics 34: 1308–21. [Google Scholar] [CrossRef]

- Hayes, Adam S. 2018. Bitcoin price and its marginal cost of production: Support for a fundamental value. Applied Economics Letters 5: 1–7. [Google Scholar] [CrossRef]

- Im, Kyung So, M. Hashem Pesaran, and Yongcheol Shin. 2003. Testing for unit roots in heterogeneous panels. Journal of Econometrics 115: 53–74. [Google Scholar] [CrossRef]

- Jegadeesh, Narasimhan, and Sheridan Titman. 1993. Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. The Journal of Finance 48: 65–91. [Google Scholar] [CrossRef] [Green Version]

- Jegadeesh, Narasimhan, and Sheridan Titman. 2001. Profitability of momentum strategies: An evaluation of alternative explanations. The Journal of Finance 56: 699–720. [Google Scholar] [CrossRef]

- Kjærland, Frode, Maria Meland, Are Oust, and Vilde Øyen. 2018. How can Bitcoin Price Fluctuations be Explained? International Journal of Economics and Financial Issues 8: 323–32. [Google Scholar]

- Kristoufek, Ladislav. 2013. BitCoin meets Google Trends and Wikipedia: Quantifying the relationship between phenomena of the Internet era. Scientific Reports 3: 3415. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Kristoufek, Ladislav. 2015. What Are the Main Drivers of the Bitcoin Price? Evidence from Wavelet Coherence Analysis. PLoS ONE 10: e0123923. [Google Scholar] [CrossRef] [PubMed]

- Nakamoto, Satoshi. 2008. Bitcoin: A Peer-to-Peer Electronic Cash System. Available online: http://bitcoin.org/bitcoin.pdf (accessed on 9 January 2018).

- Nica, Octavian, Karolina Piotrowska, and Klaus Reiner Schenk-Hoppé. 2017. Cryptocurrencies: Economic Benefits and Risks. FinTech Working Paper. Manchester: University of Manchester, Available online: https://ssrn.com/abstract=3059856 (accessed on 10 March 2018).

- Polasik, Michal, Anna Iwona Piotrowska, Tomasz Piotr Wisniewski, Radoslaw Kotkowski, and Geoffrey Lightfoot. 2015. Price Fluctuations and the Use of Bitcoin: An Empirical Inquiry. International Journal of Electronic Commerce 20: 9–49. [Google Scholar] [CrossRef] [Green Version]

- Santoni, Gary J. 1987. The great bull markets 1924–29 and 1982–87: Speculative bubbles or economic fundamentals? Federal Reserve Bank of St. Louis Review 69: 16–29. [Google Scholar] [CrossRef]

- Segendorf, Björn. 2014. What is bitcoin? Sveriges Riksbank Economic Review 2: 71–87. [Google Scholar]

- Sovbetov, Yhlas. 2018. Factors Influencing Cryptocurrency Prices: Evidence from Bitcoin, Ethereum, Dash, Litcoin, and Monero. Journal of Economics and Financial Analysis 2: 1–27. [Google Scholar]

- Vogelsang, Timothy J., and Pierre Perron. 1998. Additional Tests for a Unit Root Allowing for a Break in the Trend Function at an Unknown Time. International Economic Review 39: 1073–100. [Google Scholar] [CrossRef]

- Yermack, David. 2013. Is Bitcoin a Real Currency? An economic appraisal. National Bureau of Economic Research Working Paper Series No. 19747. Available online: http://www.nber.org/papers/w19747 (accessed on 18 January 2018).

| 1. | Bitcoin rewards are currently at 12.5 coins per block, but the protocol requires that the reward is halved every 210,000 mined blocks. Mining 210,000 blocks takes approximately four years. Given the current level of network processing power, the next halving will take place around early June 2020, bringing the mining reward down to 6.25 coins. |

| 2. | Cognitive biases are errors in thinking that affect the decisions and judgments that people make. |

| 3. | Google does not differentiate between the upper- and lowercase letters, meaning that searches made on “Bitcoin” or “bitcoin” are considered the same. |

| 4. | The following post-estimation tests have been conducted for OLS-assumptions: Ramsey RESET test, Durbin–Watson, Variance Inflation Factors (VIF), and Adjusted Dickey–Fuller. For GARCH: Ljung Box Q-statistics. |

| 5. | The long-term effect of a variable is calculated in following way: ßt + ßt−1 + ... + ßt−n/(1 − ß1∆lnBTCt−1). |

| 6. | |

| 7. |

| Variable | Description | Source |

|---|---|---|

| BTC | exchange rate between Bitcoin and the US Dollar | Quandl |

| Hashrate | the estimated number of giga hashes per second the Bitcoin network is performing | Quandl |

| Volume | total output volume of Bitcoin | Quandl |

| S&P 500 | S&P 500 is an index of the 500 largest US listed Corporations | Thomson Reuters Eikon |

| Gold | Goldman Sachs Commodity Index Gold | Thomson Reuters Eikon |

| Oil | WTI Crude Oil Spot Price in USD per barrel | Thomson Reuters Eikon |

| VIX | implicit volatility of options on the S&P 500, a measure of the expected market volatility the next 30 days | Thomson Reuters Eikon |

| normalized weekly statistics on the search term “Bitcoin”, corrected for trends | Google Trend |

| Variable | Obs. | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|

| BTC | 267 | 1372.9 | 2836.016 | 13.47221 | 17,612.51 |

| Hashrate | 267 | 2,132,903 | 3,936,302 | 20.80583 | 2.26 × 107 |

| Volume | 267 | 238,664.5 | 85,023.81 | 73,429.4 | 558,364.4 |

| S&P 500 | 267 | 2053.9 | 296.3 | 1462.5 | 2844.4 |

| Gold | 267 | 1270.8 | 114.3 | 1063.0 | 1685.2 |

| Oil | 267 | 66.7 | 24.7 | 28.5 | 108.9 |

| VIX | 267 | 14.4 | 3.6 | 9.3 | 31.5 |

| 267 | 7.3 | 13.4 | 1 | 100 |

| ARDL | GARCH | |||||

|---|---|---|---|---|---|---|

| Time Period | (1) | (2) | (3) | (1) | (2) | (3) |

| 0.19 (2.23) ** | 0.222 (2.14) ** | 0.206 (1.04) | 0.225 (5.43) *** | 0.329 (6.44) *** | 0.293 (4.98) *** | |

| −0.042 (1.41) | −0.027 (0.79) | −0.134 (2.33) ** | −0.046 (2.61) *** | −0.022 (1.26) | −0.15 (0.62) | |

| 1.772 (2.16) ** | 2.55 (2.69) *** | −1.707 (1.04) | 1.038 (1.59) | 1.272 (1.85) * | 1.318 (1.90) * | |

| −0.072 (0.50) | −0.075 (0.47) | −0.141 (0.40) | −0.001 (0.00) | 0.021 (0.17) | 0.005 (0.04) | |

| 0.142 (0.95) | 0.147 (0.87) | 0.341 (0.77) | 0.023 (0.18) | 0.027 (0.22) | 0.005 (0.04) | |

| 0.552 (1.06) | 0.546 (0.92) | 1.135 (1.08) | −0.013 (0.06) | −0.006 (0.003) | −0.063 (0.27) | |

| −0.415 (0.62) | −0384 (0.49) | −0.337 (0.35) | 0.049 (0.18) | 0.068 (0.24) | 0.048 (0.17) | |

| 0.029 (0.34) | 0.126 (1.34) | −0.279 (1.92) * | 0.008 (0.12) | −0.039 (0.56) | −0.186 (0.93) | |

| 0.109 (3.60) *** | 0.102 (2.84) *** | 0.140 (3.16) *** | 0.045 (2.85) *** | 0.030 (1.61) | 0.022 (1.18) | |

| 0.105 (3.46) *** | 0.093 (2.58) ** | 0.176 (4.04) *** | 0.088 (4.27) *** | 0.081 (4.34) *** | 0.076 (3.86) *** | |

| 0.082 (2.18) ** | 0.088 (1.98) ** | 0.022 (0.39) | 0.053 (2.76) *** | 0.062 (3.35) *** | 0.057 (3.00) *** | |

| ARCH Effect | 0.562 (3.52) *** | 0.771 (3.42) *** | 0.599 (3.62) *** | |||

| GARCH Effect | 0.315 (2.42) ** | 0.214 (1.61) | 0.374 (3.00) *** | |||

| Adjusted R2 | 0.29 | 0.23 | 0.54 | |||

| Observations | 264 | 205 | 56 | 264 | 205 | 56 |

| ARDL | GARCH | |||||

|---|---|---|---|---|---|---|

| Time Period | (1) | (2) | (3) | (1) | (2) | (3) |

| 0.187 (2.05) ** | 0.226 (2.05) ** | 0.065 (0.46) | 0.215 (5.24) *** | 0.318 (6.05) *** | 0.293 (5.01) *** | |

| 1.411 (3.45) *** | 1.364 (2.99) *** | 1.59 (1.62) | 0.926 (2.76) *** | 0.873 (2.62) *** | 0.779 (2.27) ** | |

| 0.105 (3.50) *** | 0.099 (2.79) *** | 0.100 (1.82) * | 0.033 (2.43) ** | 0.023 (1.5) | 0.09 (0.99) | |

| 0.097 (3.18) *** | 0.089 (2.43) ** | 0.122 (2.82) | 0.083 (4.66) *** | 0.08 (4.68) *** | 0.075 (3.91) *** | |

| 0.077 (2.01) ** | 0.084 (1.88) * | 0.061 (1.06) | 0.047 (2.63) *** | 0.06 (3.35) *** | 0.055 (2.84) *** | |

| ARCH Effect | 0.581 (3.58) *** | 0.696 (3.59) *** | 0.497 (3.59) *** | |||

| GARCH Effect | 0.324 (2.64) *** | 0.269 (2.05) ** | 0.426 (3.53) *** | |||

| Adjusted | 0.29 | 0.23 | 0.50 | |||

| Observations | 264 | 205 | 56 | 264 | 205 | 56 |

| ARDL | GARCH | |||||

|---|---|---|---|---|---|---|

| Time Period | (1) | (2) | (3) | (1) | (2) | (3) |

| 0.19 (2.25) ** | 0.222 (2.10) ** | 0.206 (1.66) | 0.225 (5.28) *** | 0.329 (6.28) *** | 0.258 (3.89) *** | |

| 0.067 (0.96) | 0.22 (0.26) | 0.274 (2.51) *** | 0.031 (0.50) | −0.005 (0.08) | −0.039 (0.57) | |

| −0.041 (1.36) | −0.027 (0.78) | −0.139 (2.51) ** | 0.04 (2.64) *** | −0.022 (1.27) | −0.139 (0.34) | |

| 1.725 (2.11) ** | 2.532 (2.68) *** | −1.952 (1.33) | 1.023 (1.55) | 1.274 (1.86) * | 1.472 (1.98) ** | |

| −0.069 (2.11) ** | −0.075 (0.47) | −0.073 (0.22) | 0.008 (0.06) | 0.02 (0.16) | −0.012 (0.10) | |

| 0.137 (0.92) | 0.145 (0.85) | 0.324 (0.77) | 0.019 (0.15) | 0.028 (0.22) | 0.067 (0.53) | |

| 0.53 (1.01) | 0.537 (0.90) | 0.918 (0.87) | −0.03 (0.13) | −0.004 (0.02) | −0.061 (0.24) | |

| −0.404 (0.60) | −0.38 (0.49) | −0.393 (0.41) | 0.04 (0.15) | 0.068 (0.23) | 0.020 (0.08) | |

| 0.023 (0.27) | 0.123 (1.32) | −0.294 (2.19) ** | 0.004 (0.07) | 0.04 (0.57) | −0.234 (1.17) | |

| 0.108 (3.58) *** | 0.102 (2.84) *** | 0.118 (2.53) ** | 0.046 (2.83) *** | 0.03 (1.57) | 0.021 (1.09) | |

| 0.104 (3.41) *** | 0.093 (2.56) ** | 0.165 (3.96) *** | 0.088 (4.68) *** | 0.081 (4.32) *** | 0.076 (3.41) *** | |

| 0.081 (2.17) ** | 0.088 (1.98) ** | 0.014 −0.25 | 0.056 (2.87) *** | 0.062 (3.35) *** | 0.055 (2.87) *** | |

| ARCH Effect | 0.547 (3.64) *** | 0.768 (3.41) *** | 0.436 (3.72) *** | |||

| GARCH Effect | 0.345 (2.76) *** | 0.214 (1.6) | 0.538 (5.43) *** | |||

| Adjusted R2 | 0.29 | 0.23 | 0.54 | |||

| Observations | 264 | 205 | 56 | 264 | 205 | 56 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kjærland, F.; Khazal, A.; Krogstad, E.A.; Nordstrøm, F.B.G.; Oust, A. An Analysis of Bitcoin’s Price Dynamics. J. Risk Financial Manag. 2018, 11, 63. https://doi.org/10.3390/jrfm11040063

Kjærland F, Khazal A, Krogstad EA, Nordstrøm FBG, Oust A. An Analysis of Bitcoin’s Price Dynamics. Journal of Risk and Financial Management. 2018; 11(4):63. https://doi.org/10.3390/jrfm11040063

Chicago/Turabian StyleKjærland, Frode, Aras Khazal, Erlend A. Krogstad, Frans B. G. Nordstrøm, and Are Oust. 2018. "An Analysis of Bitcoin’s Price Dynamics" Journal of Risk and Financial Management 11, no. 4: 63. https://doi.org/10.3390/jrfm11040063

APA StyleKjærland, F., Khazal, A., Krogstad, E. A., Nordstrøm, F. B. G., & Oust, A. (2018). An Analysis of Bitcoin’s Price Dynamics. Journal of Risk and Financial Management, 11(4), 63. https://doi.org/10.3390/jrfm11040063