Is Window-Dressing around Going Public Beneficial? Evidence from Poland

Abstract

:1. Introduction

2. Brief Theoretical Background

3. Sources of Data and Methodology

4. Descriptive Statistics and Risk Premiums

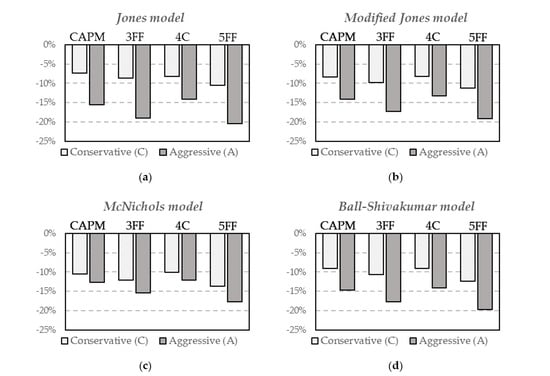

5. Earnings Manipulation and Calendar-Time Portfolio Returns: Empirical Results

6. Discussion of Empirical Results and Future Research

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Aharony, Joseph, Chan-Jane Lin, and Martin P. Loeb. 1993. Initial Public Offerings, Accounting Choices, and Earnings Management. Contemporary Accounting Research 10: 61–81. [Google Scholar] [CrossRef]

- Ahmad-Zaluki, Nurwati A., Kevin Campbell, and Alan Goodacre. 2011. Earnings management in Malaysian IPOs: The East Asian crisis, ownership control, and post-IPO performance. International Journal of Accounting 46: 111–37. [Google Scholar] [CrossRef]

- Alhadab, Mohammad, and Iain Clacher. 2018. The impact of audit quality on real and accrual earnings management around IPOs. British Accounting Review 50: 442–61. [Google Scholar] [CrossRef]

- Ang, James S., and Shaojun Zhang. 2015. Evaluating Long-Horizon Event Study Methodology. In Handbook of Financial Econometrics and Statistics. Edited by Cheng-Few Lee and John C. Lee. New York: Springer, pp. 383–411. [Google Scholar]

- Armstrong, Chris, George Foster, and Daniel J. Taylor. 2015. Abnormal accruals in newly public companies: Opportunistic misreporting or economic activity? Management Science 62: 1316–38. [Google Scholar] [CrossRef]

- Ball, Ray, and Lakshmanan Shivakumar. 2005. Earnings quality in UK private firms: Comparative loss recognition timeliness. Journal of Accounting and Economics 39: 83–128. [Google Scholar] [CrossRef]

- Ball, Ray, and Lakshmanan Shivakumar. 2006. The Role of Accruals in Asymmetrically Timely Gain and Loss Recognition. Journal of Accounting Research 44: 207–42. [Google Scholar] [CrossRef]

- Ball, Ray, and Lakshmanan Shivakumar. 2008. Earnings quality at initial public offerings. Journal of Accounting and Economics 45: 324–49. [Google Scholar] [CrossRef]

- Barber, Brad M., and John D. Lyon. 1997. Detecting long-run abnormal stock returns: The empirical power and specification of test statistics. Journal of Financial Economics 43: 341–72. [Google Scholar] [CrossRef]

- Beneish, Messod D. 1998. Discussion of “Are accruals during initial public offerings opportunistic?”. Review of Accounting Studies 3: 209–21. [Google Scholar] [CrossRef]

- Brown, Philip, Wendy Beekes, and Peter Verhoeven. 2011. Corporate governance, accounting and finance: A review. Accounting & Finance 51: 96–172. [Google Scholar] [CrossRef]

- Carhart, Mark M. 1997. On Persistence in Mutual Fund Performance. Journal of Finance 52: 57–82. [Google Scholar] [CrossRef] [Green Version]

- Chan, Konan, Louis K. Chan, Narasimhan Jegadeesh, and Josef Lakonishok. 2001. Earnings quality and stock returns. National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Chen, Ken Y., Kuen-Lin Lin, and Jian Zhou. 2005. Audit quality and earnings management for Taiwan IPO firms. Managerial Auditing Journal 20: 86–104. [Google Scholar] [CrossRef]

- Cohen, Daniel A., and Paul Zarowin. 2010. Accrual-based and real earnings management activities around seasoned equity offerings. Journal of Accounting and Economics 50: 2–19. [Google Scholar] [CrossRef] [Green Version]

- Dahlquist, Magnus, and Frank de Jong. 2008. Pseudo Market Timing: A Reappraisal. Journal of Financial and Quantitative Analysis 43: 547. [Google Scholar] [CrossRef]

- Darrough, Masako, and Srinivasan Rangan. 2005. Do Insiders Manipulate Earnings When They Sell Their Shares in an Initial Public Offering? Journal of Accounting Research 43: 1–33. [Google Scholar] [CrossRef]

- Dechow, Patricia M., and Ilia D. Dichev. 2002. The Quality of Accruals and Earnings: The Role of Accrual Estimation Errors. Accounting Review 77: 35–59. [Google Scholar] [CrossRef]

- Dechow, Patricia M., Richard G. Sloan, and Amy P. Sweeney. 1995. Detecting Earnings Management. Accounting Review 70: 193–225. Available online: http://www.jstor.org/stable/248303 (accessed on 16 May 2015).

- DeFond, Mark L., and James Jiambalvo. 1994. Debt covenant violation and manipulation of accruals. Journal of Accounting and Economics 17: 145–76. [Google Scholar] [CrossRef]

- DuCharme, Larry L., Paul H. Malatesta, and Stephan E. Sefcik. 2001. Earnings Management: IPO Valuation and Subsequent Performance. Journal of Accounting, Auditing & Finance 16: 369–96. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1998. Market efficiency, long-term returns, and behavioral finance. Journal of Financial Economics 49: 283–306. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 2015. A five-factor asset pricing model. Journal of Financial Economics 116: 1–22. [Google Scholar] [CrossRef] [Green Version]

- Fama, Eugene F., and Kenneth R. French. 2016. Dissecting Anomalies with a Five-Factor Model. Review of Financial Studies 29: 69–103. [Google Scholar] [CrossRef]

- Friedlan, John M. 1994. Accounting Choices of Issuers of Initial Public Offerings. Contemporary Accounting Research 11: 1–31. [Google Scholar] [CrossRef]

- Gaver, Jennifer J., Kenneth M. Gaver, and Jeffrey R. Austin. 1995. Additional evidence on bonus plans and income management. Journal of Accounting and Economics 19: 3–28. [Google Scholar] [CrossRef]

- Graham, John R., Campbell R. Harvey, and Shiva Rajgopal. 2005. The economic implications of corporate financial reporting. Journal of Accounting and Economics 40: 3–73. [Google Scholar] [CrossRef] [Green Version]

- Gunny, Katherine A. 2010. The Relation Between Earnings Management Using Real Activities Manipulation and Future Performance: Evidence from Meeting Earnings Benchmarks. Contemporary Accounting Research 27: 855–88. [Google Scholar] [CrossRef]

- Healy, Paul M. 1985. The effect of bonus schemes on accounting decisions. Journal of Accounting and Economics 7: 85–107. [Google Scholar] [CrossRef]

- Holthausen, Robert W., David F. Larcker, and Richard G. Sloan. 1995. Annual bonus schemes and the manipulation of earnings. Journal of Accounting and Economics 19: 29–74. [Google Scholar] [CrossRef]

- Hong, Bryan, Zhichuan Li, and Dylan Minor. 2016. Corporate Governance and Executive Compensation for Corporate Social Responsibility. Journal of Business Ethics 136: 199–213. [Google Scholar] [CrossRef]

- Jegadeesh, Narasimhan, and Jason Karceski. 2009. Long-run performance evaluation: Correlation and heteroskedasticity-consistent tests. Journal of Empirical Finance 16: 101–11. [Google Scholar] [CrossRef]

- Jones, Jennifer J. 1991. Earnings Management During Import Relief Investigations. Journal of Accounting Research 29: 193–228. [Google Scholar] [CrossRef]

- Kothari, Stephen P., Natalie Mizik, and Sugata Roychowdhury. 2016. Managing for the Moment: The Role of Earnings Management via Real Activities versus Accruals in SEO Valuation. Accounting Review 91: 559–86. [Google Scholar] [CrossRef]

- Krishnan, C. N. V., Vladimir I. Ivanov, Ronald W. Masulis, and Ajai K. Singh. 2011. Venture Capital Reputation, Post-IPO Performance, and Corporate Governance. Journal of Financial and Quantitative Analysis 46: 1295–333. [Google Scholar] [CrossRef]

- Li, Frank. 2016. Endogeneity in CEO power: A survey and experiment. Investment Analysts Journal 45: 149–62. [Google Scholar] [CrossRef]

- Liberty, Susan E., and Jerold L. Zimmerman. 1986. Labor union contract negotiations and accounting choices. Accounting Review 61: 692–712. [Google Scholar]

- Lintner, John. 1969. The Valuation of Risk Assets and the Selection of Risky Investments in Stock Portfolios and Capital Budgets: A Reply. The Review of Economics and Statistics 51: 222–24. [Google Scholar] [CrossRef]

- Lizińska, Joanna, and Leszek Czapiewski. 2018a. Earnings Management and the Long-Term Market Performance of Initial Public Offerings in Poland. In Finance and Sustainability: Proceedings from the Finance and Sustainability Conference, Wroclaw 2017. Edited by Agnieszka Bem, Karolina Daszyńska-Żygadło, Taťána Hajdíková and Péter Juhász. Springer Proceedings in Business and Economics. Cham: Springer International Publishing, vol. 62, pp. 121–34. [Google Scholar]

- Lizińska, Joanna, and Leszek Czapiewski. 2018b. Towards Economic Corporate Sustainability in Reporting: What Does Earnings Management around Equity Offerings Mean for Long-Term Performance? Sustainability 10: 4349. [Google Scholar] [CrossRef]

- Lyon, John D., Brad M. Barber, and Chih-Ling Tsai. 1999. Improved Methods for Tests of Long-Run Abnormal Stock Returns. Journal of Finance 54: 165–201. [Google Scholar] [CrossRef] [Green Version]

- McNichols, Maureen F. 2000. Research design issues in earnings management studies. Journal of Accounting and Public Policy 19: 313–45. [Google Scholar] [CrossRef]

- McNichols, Maureen F., and G. Peter Wilson. 1988. Evidence of Earnings Management from the Provision for Bad Debts. Journal of Accounting Research 26: 1. [Google Scholar] [CrossRef]

- Pastor-Llorca, María J., and Francisco Poveda-Fuentes. 2011. Earnings Management and the Long-Run Performance of Spanish Initial Public Offerings. In Initial Public Offerings (IPO): An International Perspective of IPOs. Edited by Greg N. Gregoriou. Quantitative Finance. Burlington: Elsevier Science, pp. 81–112. [Google Scholar]

- Perry, Susan E., and Thomas H. Williams. 1994. Earnings management preceding management buyout offers. Journal of Accounting and Economics 18: 157–79. [Google Scholar] [CrossRef]

- Pourciau, Susan. 1993. Earnings management and nonroutine executive changes. Journal of Accounting and Economics 16: 317–36. [Google Scholar] [CrossRef]

- Roberts, Michael R., and Toni M. Whited. 2005. Endogeneity in empirical corporate finance. Handbook of the Economics of Finance 2: 493–572. [Google Scholar] [CrossRef]

- Ronen, Joshua, and Varda Yaari. 2008. Earnings Management: Emerging Insights in Theory, Practice, and Research. Springer Series in Accounting Scholarship. New York: Springer. [Google Scholar]

- Roosenboom, Peter, Tjalling van der Goot, and Gerard Mertens. 2003. Earnings management and initial public offerings: Evidence from the Netherlands. International Journal of Accounting 38: 243–66. [Google Scholar] [CrossRef]

- Roychowdhury, Sugata. 2006. Earnings management through real activities manipulation. Journal of Accounting and Economics 42: 335–70. [Google Scholar] [CrossRef]

- Schultz, Paul. 2003. Pseudo Market Timing and the Long-Run Underperformance of IPOs. Journal of Finance 58: 483–517. [Google Scholar] [CrossRef]

- Sharpe, William F. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance 19: 425–42. [Google Scholar] [CrossRef]

- Sloan, Richard G. 1996. Do stock prices fully reflect information in accruals and cash flows about future earnings? Accounting Review 71: 289–315. [Google Scholar]

- Teoh, Siew Hong, Ivo Welch, and Tak J. Wong. 1998a. Earnings Management and the Long-Run Market Performance of Initial Public Offerings. Journal of Finance 53: 1935–74. [Google Scholar] [CrossRef]

- Teoh, Siew Hong, Ivo Welch, and Tak J. Wong. 1998b. Earnings management and the underperformance of seasoned equity offerings. Journal of Financial Economics 50: 63–99. [Google Scholar] [CrossRef]

- Teoh, Siew Hong, Tak J. Wong, and Gita R. Rao. 1998c. Are Accruals during Initial Public Offerings Opportunistic? Review of Accounting Studies 3: 175–208. [Google Scholar] [CrossRef]

- Teoh, Siew Hong, and Tak J. Wong. 1997. Analysts’ Credulity about Reported Earnings and Overoptimism in New Equity Issues. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Viswanathan, S., and Bin Wei. 2008. Endogenous Events and Long-Run Returns. Review of Financial Studies 21: 855–88. [Google Scholar] [CrossRef]

- Wongsunwai, Wan. 2013. The Effect of External Monitoring on Accrual-Based and Real Earnings Management: Evidence from Venture-Backed Initial Public Offerings. Contemporary Accounting Research 30: 296–324. [Google Scholar] [CrossRef]

- Wu, Ching-Chih, and Tung-Hsiao Yang. 2018. Insider Trading and Institutional Holdings in Seasoned Equity Offerings. Journal of Risk and Financial Management 11: 53. [Google Scholar] [CrossRef]

- Xie, Hong. 2001. The Mispricing of Abnormal Accruals. Accounting Review 76: 357–73. [Google Scholar] [CrossRef]

- Zang, Amy Y. 2012. Evidence on the Trade-Off between Real Activities Manipulation and Accrual-Based Earnings Management. Accounting Review 87: 675–703. [Google Scholar] [CrossRef]

| Company Characteristics | Mean | Median | |||

|---|---|---|---|---|---|

| IPO | WSE * | IPO | WSE * | ||

| Total assets (mln PLN) | Y-1 | 757 mln | 1.095 mln | 66 mln | 1.171 mln |

| Total assets (mln PLN) | Y0 | 906 mln | 1.226 mln | 113 mln | 1.223 mln |

| Revenues (mln PLN) | Y-1 | 544 mln | 985 mln | 95 mln | 995 mln |

| Revenues (mln PLN) | Y0 | 635 mln | 1.095 mln | 124 mln | 1.103 mln |

| Leverage | Y-1 | 56.1% | 55.9% | 58.1% | 51.6% |

| Leverage | Y0 | 39.3% | 53.3% | 39.4% | 51.6% |

| Return on assets | Y-1 | 13.0% | 3.7% | 8.3% | 4.8% |

| Return on assets | Y0 | 8.6% | 4.0% | 6.8% | 6.5% |

| Return on equity | Y-1 | 30.8% | 3.0% | 22.0% | 16.0% |

| Return on equity | Y0 | 15.2% | 9.2% | 11.8% | 15.7% |

| Operating return on assets | Y-1 | 16.6% | 6.7% | 11.2% | 8.1% |

| Operating return on assets | Y0 | 10.6% | 6.8% | 8.6% | 8.2% |

| Operating return on equity | Y-1 | 42.7% | 10.6% | 32.8% | 19.2% |

| Operating return on equity | Y0 | 19.0% | 16.4% | 14.9% | 19.2% |

| CAPM (C) | CAPM (A) | 3FF (C) | 3FF (A) | 4C (C) | 4C (A) | 5FF (C) | 5FF (A) | |

|---|---|---|---|---|---|---|---|---|

| Panel A: Calendar-Time Portfolio Regressions for the Conservative and Aggressive Portfolio | ||||||||

| Intercept | −0.006 | −0.013 *** | −0.007 * | −0.016 *** | −0.007 * | −0.012 *** | −0.009 ** | −0.017 *** |

| (−1.566) | (−2.955) | (−1.971) | (−3.954) | (−1.691) | (−2.748) | (−2.439) | (−4.438) | |

| RMP | 0.803 *** | 0.925 *** | 0.774 *** | 0.856 *** | 0.773 *** | 0.821 *** | 0.719 *** | 0.782 *** |

| (13.063) | (13.407) | (13.200) | (13.347) | (12.769) | (12.727) | (12.440) | (12.704) | |

| SBM | 0.537 *** | 0.581 *** | 0.560 *** | 0.603 *** | 0.699 *** | 0.764 *** | ||

| (4.759) | (4.712) | (4.786) | (4.838) | (5.939) | (6.095) | |||

| HML | 0.190 | 0.589 *** | 0.147 | 0.470 *** | 0.357 ** | 0.779 *** | ||

| (1.300) | (3.689) | (0.987) | (2.959) | (2.340) | (4.795) | |||

| WML | −0.053 | −0.221 *** | ||||||

| (−0.730) | (−2.844) | |||||||

| RMW | 0.102 | 0.024 | ||||||

| (0.844) | (0.185) | |||||||

| CMA | −0.528 *** | −0.716 *** | ||||||

| (−3.458) | (−4.401) | |||||||

| p-value for F | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| adj. R2 | 0.588 | 0.600 | 0.650 | 0.678 | 0.648 | 0.693 | 0.684 | 0.725 |

| Panel B: Equivalent Regressions of the Difference between the Conservative and Aggressive Portfolio Returns | ||||||||

| α(A)–α(C) | −0.007 ** | −0.009 ** | −0.005 | −0.008 ** | ||||

| p-value | 0.036 | 0.012 | 0.109 | 0.018 | ||||

| CAPM (C) | CAPM (A) | 3FF (C) | 3FF (A) | 4C (C) | 4C (A) | 5FF (C) | 5FF (A) | |

|---|---|---|---|---|---|---|---|---|

| Panel A: Calendar-Time Portfolio Regressions for the Conservative and Aggressive Portfolio | ||||||||

| Intercept | −0.007 * | −0.012 *** | −0.008 ** | −0.014 *** | −0.007 * | −0.011 ** | −0.009 ** | −0.016 *** |

| (−1.784) | (−2.652) | (−2.215) | (−3.549) | (−1.712) | (−2.513) | (−2.616) | (−4.061) | |

| RMP | 0.799 *** | 0.942 *** | 0.770 *** | 0.876 *** | 0.760 *** | 0.849 *** | 0.711 *** | 0.806 *** |

| (13.071) | (13.573) | (13.171) | (13.504) | (12.694) | (12.846) | (12.403) | (12.828) | |

| SBM | 0.529 *** | 0.583 *** | 0.564 *** | 0.598 *** | 0.684 *** | 0.774 *** | ||

| (4.713) | (4.676) | (4.874) | (4.680) | (5.856) | (6.046) | |||

| HML | 0.202 | 0.547 *** | 0.144 | 0.440 *** | 0.362 ** | 0.745 *** | ||

| (1.387) | (3.383) | (0.976) | (2.709) | (2.393) | (4.489) | |||

| WML | −0.093 | −0.189 ** | ||||||

| (−1.291) | (−2.367) | |||||||

| RMW | 0.059 | 0.072 | ||||||

| (0.492) | (0.549) | |||||||

| CMA | −0.564 *** | −0.677 *** | ||||||

| (−3.718) | (−4.073) | |||||||

| p-value for F | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| adj. R2 | 0.588 | 0.606 | 0.649 | 0.678 | 0.653 | 0.686 | 0.686 | 0.720 |

| Panel B: Equivalent Regressions of the Difference between the Conservative and Aggressive Portfolio Returns | ||||||||

| α(A)–α(C) | −0.005 | −0.006 * | −0.004 | −0.007 * | ||||

| p-value | 0.109 | 0.053 | 0.160 | 0.053 | ||||

| CAPM (C) | CAPM (A) | 3FF (C) | 3FF (A) | 4C (C) | 4C (A) | 5FF (C) | 5FF (A) | |

|---|---|---|---|---|---|---|---|---|

| Panel A: Calendar-Time Portfolio Regressions for the Conservative and Aggressive Portfolio | ||||||||

| Intercept | −0.009 ** | −0.011 ** | −0.010 ** | −0.013 *** | −0.008 ** | −0.010 ** | −0.011 *** | −0.015 *** |

| (−2.147) | (−2.579) | (−2.602) | (−3.388) | (−2.010) | (−2.463) | (−3.065) | (−4.032) | |

| RMP | 0.897 *** | 0.827 *** | 0.865 *** | 0.771 *** | 0.853 *** | 0.749 *** | 0.795 *** | 0.710 *** |

| (13.995) | (12.905) | (14.025) | (12.749) | (13.478) | (12.139) | (13.342) | (12.103) | |

| SBM | 0.533 *** | 0.529 *** | 0.562 *** | 0.549 *** | 0.704 *** | 0.729 *** | ||

| (4.498) | (4.551) | (4.598) | (4.605) | (5.792) | (6.098) | |||

| HML | 0.229 | 0.463 *** | 0.163 | 0.374 ** | 0.422 *** | 0.663 *** | ||

| (1.488) | (3.075) | (1.049) | (2.466) | (2.681) | (4.283) | |||

| WML | −0.106 | −0.156 ** | ||||||

| (−1.396) | (−2.105) | |||||||

| RMW | 0.057 | 0.141 | ||||||

| (0.459) | (1.155) | |||||||

| CMA | −0.678 *** | −0.572 *** | ||||||

| (−4.304) | (−3.691) | |||||||

| p-value for F | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| adj. R2 | 0.621 | 0.582 | 0.673 | 0.652 | 0.675 | 0.659 | 0.716 | 0.696 |

| Panel B: Equivalent Regressions of the Difference between the Conservative and Aggressive Portfolio Returns | ||||||||

| α(A)–α(C) | −0.002 | −0.003 | −0.002 | −0.003 | ||||

| p-value | 0.304 | 0.212 | 0.332 | 0.176 | ||||

| CAPM (C) | CAPM (A) | 3FF (C) | 3FF (A) | 4C (C) | 4C (A) | 5FF (C) | 5FF (A) | |

|---|---|---|---|---|---|---|---|---|

| Panel A: Calendar-time portfolio regressions for the conservative and aggressive portfolio | ||||||||

| Intercept | −0.008 * | −0.012 *** | −0.009 ** | −0.015 *** | −0.008 * | −0.012 *** | −0.010 *** | −0.016 *** |

| (−1.810) | (−2.953) | (−2.222) | (−3.965) | (−1.737) | (−2.908) | (−2.632) | (−4.526) | |

| RMP | 0.851 *** | 0.884 *** | 0.818 *** | 0.822 *** | 0.809 *** | 0.797 *** | 0.750 *** | 0.762 *** |

| (12.922) | (13.584) | (12.790) | (13.790) | (12.296) | (13.148) | (12.020) | (13.140) | |

| SBM | 0.515 *** | 0.611 *** | 0.543 *** | 0.629 *** | 0.683 *** | 0.794 *** | ||

| (4.186) | (5.334) | (4.276) | (5.375) | (5.371) | (6.718) | |||

| HML | 0.237 | 0.511 *** | 0.179 | 0.409 *** | 0.428 ** | 0.683 *** | ||

| (1.488) | (3.441) | (1.106) | (2.742) | (2.594) | (4.460) | |||

| WML | −0.092 | −0.177 ** | ||||||

| (−1.163) | (−2.421) | |||||||

| RMW | 0.060 | 0.095 | ||||||

| (0.462) | (0.787) | |||||||

| CMA | −0.659 *** | −0.565 *** | ||||||

| (−3.995) | (−3.683) | |||||||

| p-value for F | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| adj. R2 | 0.582 | 0.607 | 0.632 | 0.692 | 0.634 | 0.700 | 0.675 | 0.729 |

| Panel B: Equivalent regressions of the difference between the conservative and aggressive portfolio returns | ||||||||

| α(A)–α(C) | −0.005 | −0.006 * | −0.004 | −0.006 * | ||||

| p-value | 0.120 | 0.071 | 0.173 | 0.071 | ||||

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lizińska, J.; Czapiewski, L. Is Window-Dressing around Going Public Beneficial? Evidence from Poland. J. Risk Financial Manag. 2019, 12, 18. https://doi.org/10.3390/jrfm12010018

Lizińska J, Czapiewski L. Is Window-Dressing around Going Public Beneficial? Evidence from Poland. Journal of Risk and Financial Management. 2019; 12(1):18. https://doi.org/10.3390/jrfm12010018

Chicago/Turabian StyleLizińska, Joanna, and Leszek Czapiewski. 2019. "Is Window-Dressing around Going Public Beneficial? Evidence from Poland" Journal of Risk and Financial Management 12, no. 1: 18. https://doi.org/10.3390/jrfm12010018

APA StyleLizińska, J., & Czapiewski, L. (2019). Is Window-Dressing around Going Public Beneficial? Evidence from Poland. Journal of Risk and Financial Management, 12(1), 18. https://doi.org/10.3390/jrfm12010018