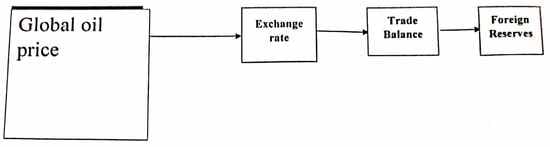

Effects of Global Oil Price on Exchange Rate, Trade Balance, and Reserves in Nigeria: A Frequency Domain Causality Approach

Abstract

:1. Introduction

2. Literature Review

3. Data Analysis

3.1. Variable Definition and Data Sources

3.2. Descriptive Analysis

3.3. Unit Root Tests

3.4. Cointegration Tests

4. Methodology

5. Discussion of Results

6. Conclusions and Policy Recommendations

Conflicts of Interest

Appendix A

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | −1829.76 | NA | 4.83 | 30.28 | 30.32 | 30.3 |

| 1 | −1539.23 | 566.67 | 4.24 | 25.54 | 25.68 | 25.6 |

| 2 | −1527.29 | 22.89 | 3.72 | 25.41 | 25.64 | 25.5 |

| 3 | −1514.97 | 23.2 | 3.24 * | 25.27 * | 25.59 * | 25.4 * |

| 4 | −1513.16 | 3.36 | 3.36 | 25.31 | 25.72 | 25.48 |

| 5 | −1510.4 | 5.02 | 3.43 | 25.33 | 25.83 | 25.54 |

| 6 | −1507.18 | 5.75 | 3.48 | 25.34 | 25.94 | 25.59 |

| 7 | −1505.52 | 2.9 | 3.62 | 25.38 | 26.07 | 25.66 |

| 8 | −1502.87 | 4.55 | 3.71 | 25.4 | 26.19 | 25.72 |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | −797.4 | NA | 1.88 | 13.21 | 13.26 | 13.23 |

| 1 | −600.78 | 383.47 | 7.78 | 10.02 | 10.17 * | 10.09 |

| 2 | −583.03 | 34.05 | 6.20 | 9.80 | 10.03 | 9.90 |

| 3 | −578.02 | 9.41 | 6.10 * | 9.79 * | 10.11 | 9.92 * |

| 4 | −576.98 | 1.94 | 6.40 | 9.83 | 10.25 | 10.00 |

| 5 | −573.23 | 6.81 | 6.43 | 9.84 | 10.35 | 10.04 |

| 6 | −570.5 | 4.87 | 6.57 | 9.86 | 10.46 | 10.10 |

| 7 | −569.51 | 1.74 * | 6.91 | 9.91 | 10.6 | 10.19 |

| 8 | −566.6 | 4.99 | 7.05 | 9.93 | 10.71 | 10.25 |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | −1255.15 | NA | 3.63 | 20.78 | 20.83 | 20.8 |

| 1 | −876.02 | 739.46 | 7.35 | 14.58 | 14.72 * | 14.64 |

| 2 | −869.03 | 13.39 | 7.00 | 14.53 | 14.76 | 14.62 |

| 3 | −861.57 | 14.06 | 6.61 * | 14.47 * | 14.94 | 14.6 * |

| 4 | −860.89 | 1.26 | 6.99 | 14.53 | 15.08 | 14.7 |

| 5 | −859.52 | 2.47 | 7.30 | 14.57 | 15.22 | 14.78 |

| 6 | −858.64 | 1.59 | 7.69 | 14.62 | 15.22 | 14.87 |

| 7 | −853.06 | 9.78 * | 7.50 | 14.6 | 15.29 | 14.88 |

| 8 | −851.47 | 2.72 | 7.82 | 14.64 | 15.42 | 14.95 |

References

- Al-Ezzee, Ibrahim. 2011. Real influences of Real Exchange rate and Oil price changes on the growth of real GDP: Case of Bahrain. Paper presented at International Conference of Management and Service Science IPEDR 8, Wuhan, China, August 12–14. [Google Scholar]

- Aliyu, Shehu Usman Rano. 2009. Impact of Oil Price shock and Exchange Rate Volatility on Economic Growth in Nigeria: An Empirical Investigation. Research Journal of International Studies 11: 4–15. [Google Scholar]

- Asghar, Zahid, and Irum Abid. 2007. Performance of Lag Length Selection Criteria in Three Different Situations. Paper No. 40042. Posted 13 July 2012. Available online: https://mpra.ub.uni-muechen.de/40042/MPRA (accessed on 5 December 2018).

- Baak, SaangJoon. 2004. Exchange rate volatility and trade among the Asia pacific. East Asian Economic Review 8: 93–115. Available online: http://repec.org/esFEAM04/up.29293.1080736850.pdf (accessed on 7 December 2018). [CrossRef]

- Bayat, Tayfur, Saban Nazlioglu, and Selim Kayhan. 2015. Exchange rate and oil price interactions in transition economics: Czech Republic, Hungary and Poland. Panoeconomicus 62: 267–85. [Google Scholar] [CrossRef]

- Benhabib, Abderrezak, Si Mohammed Kamel, and Samir Maliki. 2014. The Relationship between Oil Price and the Algerian Exchange Rate. Topics in Middle Eastern and African Economies 16: 127–41. [Google Scholar]

- Bouri, Elie, David Roubaud, Rania Jammazi, and Ata Assaf. 2017a. Uncovering frequency domain causality between gold and the stock markets of China and India: Evidence from implied volatility indices. Finance Research Letters. [Google Scholar] [CrossRef]

- Bouri, Elie, Imad Kachacha, Donald Lien, and David Roubaud. 2017b. Short- and long-run causality across the implied volatility of crude oil and agricultural commodities. Economics Bulletin 37: 1077–88. [Google Scholar]

- Breitung, Jörg, and Bertrand Candelon. 2006. Testing for short run and long run causality: A frequency domain approach. Journal of Econometrics 132: 363–78. [Google Scholar] [CrossRef]

- Central Bank of Nigeria Statistical Bulletin. 2018. Annual Publication; Abuja: Central Bank of Nigeria.

- Centre for Study of Economies of Africa. 2018. 4 Dep. Street off Danube Street, Maitama, Abuja, FCT, Nigeria. Available online: www.cseaafrica.org (accessed on 25 December 2018).

- Chen, Shiu-Sheng, and Hung-Chyn Chen. 2007. Oil prices and real exchange rates. Energy Economics 29: 390–404. [Google Scholar] [CrossRef]

- Coudert, Virginie, Valérie Mignon, and Alexis Penot. 2008. Oil Price and the Dollar. Energy Studies Review 15: 1–20. [Google Scholar] [CrossRef]

- Croux, Christophe, and Peter Reusens. 2013. Do stock prices contain predictive power for the future economic activity? A Granger causality analysis in the frequency domain. Journal of Macroeconomics 35: 93–103. [Google Scholar] [CrossRef] [Green Version]

- Danmola, Rasaq Akonji, and Adijat Olubunkola Olateju. 2013. The Impact of monetary policy on current Account Balance. Journal of Humanities and Social Sciences 7: 67–72. [Google Scholar]

- Dergiades, Theologos, Costas Milas, and Theodore Panagiotidis. 2015. Tweets, Google trends, and sovereign spreads in the GIIPS. Oxford Economic Papers 67: 406–32. [Google Scholar] [CrossRef]

- Dickey, David A., and Wayne A. Fuller. 1981. Distribution of the estimators for autoregressive time series with a Unit Root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Energy Information Administration, US Federal Statistical System. 2018. Available online: http://www.eia.gov (accessed on 20 December 2018).

- Geweke, John. 1982. Measurement of linear dependence and feedback between multiple time series. Journal of American Statistical Association 77: 304–24. [Google Scholar] [CrossRef]

- Gounder, Rukmani, and Matthew Bartleet. 2007. Oil price shocks and economic growth: Evidence for New Zealand, 1989–2006. Paper presented at the New Zealand Association of Economist Annual Conference, Christchurch, New Zealand, June 27–29. [Google Scholar]

- Habib, Maurizio Michael, and Margarita M. Kalamova. 2007. Are There Oil Currencies? The Real Exchange Rate of Oil Exporting Countries. Working Paper Series 839. Frankfurt: European Central Bank. [Google Scholar]

- Hassan, Syeda Anam, and Khalid Zaman. 2012. Effect of oil prices on trade balance: New insights into the cointegration relationship from Pakistan. Economic Modeling 29: 2125–43. [Google Scholar] [CrossRef]

- Huang, Xu, Emmanuel Silva, and Hossein Hassani. 2018. Causality between oil prices and tourist arrivals. Stats 1: 134–54. [Google Scholar] [CrossRef]

- Johansen, Søren. 1988. Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control 12: 231–54. [Google Scholar] [CrossRef]

- Joseph, Afolabi Ibikunle, and Akhanolu Isaac. 2011. An Empirical investigation of the link between exchange rate volatility and trade in Nigeria. Journal of Emerging Trends in Economics and Management Sciences 2: 175–83. [Google Scholar]

- Ng, Yuen-Ling, Wai-Mun Har, and Geoi-Mei Tan. 2008. Real Exchange rate and trade balance relationship: An Empirical study on Malaysia. International Journal of Business and Management 3: 130–37. Available online: https://ssrn.com/abstract=1398329 (accessed on 23 December 2018). [CrossRef]

- Nikbakht, Leili. 2010. Oil prices and exchange rate: The case of OPEC. Business Intelligence Journal 3: 88–92. [Google Scholar]

- Ogbonna, BigBen Chukwuma. 2011. The impact of exchange rate variation on trade balance: Evidence from Nigeria, 1970–2005. Journal of Research in National Development 9: 393–403. [Google Scholar]

- Oladipupo, Adesina Oladipupo, and Faith Ogheneovo Onotaniyohuwo. 2011. Impact of exchange rate on balance of payment in Nigeria. African Research Review 5: 73–88. [Google Scholar] [CrossRef]

- Olayungbo, David Oluseun, Olalekan Yinusa, and Anthony Enisan Akinlo. 2011. Effect of Exchange Rate Volatility on Trade in Some Sub-Saharan African Countries. Modern Economy 2: 538. [Google Scholar] [CrossRef]

- Olomola, Philip A., and Akintoye V. Adejumo. 2006. Oil price shock and macroeconomic Activities in Nigeria. International Research Journal of Finance and Economics 3: 28–34. [Google Scholar]

- Ozer, Mustafa, and Melik Kamisli. 2016. Frequency domain causality analysis of interactions between financial markets of Turkey. International Business Research 9: 176–86. [Google Scholar] [CrossRef]

- Ozlale, Ümit, and Didem Pekkurnaz. 2010. Oil price and current account: A structural analysis for the Turkish economy. Energy Policy 38: 4489–96. [Google Scholar] [CrossRef]

- Phillips, Peter Charles Bonest, and Pierre Perron. 1988. Testing for a unit root in time series regressions. Biometrica 75: 335–46. [Google Scholar] [CrossRef]

- Qiangian, Zhang. 2011. The impact of international oil price fluctuation on China’s economy. Energy Procedia 5: 1360–64. [Google Scholar] [CrossRef]

- Rautava, Jouko. 2004. The role of oil prices and the real exchange rate in Russia’s economy—A Cointegration approach. Journal of Comparative Economics 32: 315–27. [Google Scholar] [CrossRef]

- Rose, Andrew K. 1990. Exchange Rates and Trade Balance. Some evidence from developing countries. Economic Letters 34: 271–75. [Google Scholar] [CrossRef]

- Shafi, Khuram, Liu Hua, and Nazeer Amna. 2013. Exchange rate volatility and oil price shocks. International Journal of Academic Research in Business and Social Sciences 5. [Google Scholar]

- Shehu, Abba Abubakar, and Zhang Youtang. 2012. Exchange rate volatility, trade flows and economic growth in a small open Economy. International Review of Business Research Paper 8: 118–31. [Google Scholar]

- Tiwari, Aviral Kumar, and Phouphet Kyophilavong. 2017. Exchange rate and international reserves in India: A frequency Domain Analysis. South Asia Economic Journal 18: 76–93. [Google Scholar] [CrossRef]

- Tiwari, Aviral Kumar, and Olaolu Richard Olayeni. 2013. Oil price and trade balance: wavelet based analysis for India. Economics Bulletin 33: 2270–86. [Google Scholar]

- Tiwari, Aviral Kumar, Süleyman Bolat, and Özgür Koçbulut. 2015. Revisit budget deficit and inflation: Evidence from time and frequency domain analyses. Theoretical Economic Letters 5: 357–69. [Google Scholar] [CrossRef]

- Tsen, Wong Hock. 2009. Term-of-trade and trade balance: Some empirical evidence of Asian economies. The International Trade Journal XXIII: 422–57. [Google Scholar] [CrossRef]

- Udoh, Edet Joshua, Sunday Brownson Akpan, Daniel Etim John, and Inimfon Vincent Patrick. 2012. Cointegration between exchange rate volatility and key macroeconomic fundamentals: evidence from Nigeria. Modern Economy 3: 846–55. [Google Scholar] [CrossRef]

- Wu, Po-Chin, Shiao-Yen Liu, and Sheng-Chieh Pan. 2013. Nonlinear bilateral trade balance-fundamentals nexus: A panel regression approach. International Review of Economics and Finance 27: 318–29. [Google Scholar] [CrossRef]

- Yanfeng, Wei. 2013. The dynamic relationships between oil prices and the Japanese economy: A frequency domain analysis. Review of Economic &Finance 3: 57–67. [Google Scholar]

- Yousefi, Ayoub, and Tony S. Wirjanto. 2004. The empirical role of the exchange rate on the crude-oil Price formation. Energy and Economics 26: 783–99. [Google Scholar] [CrossRef]

- Zheng, Yun. 2012. The Impact of Bilateral Exchange Rate on Trade between Thailand and China. Available online: http://eprints.utcc.ac.th/id/eprint/1340 (accessed on 12 December 2018).

| Author(s) | Country/Countries | Sample Period | Methodology | Results/Conclusion of the Study |

|---|---|---|---|---|

| Danmola and Olateju (2013) | Nigeria | 1980 to 2010 | OLS | Exchange rate volatility has a positive influence on GDP, FDI, and trade. |

| Shehu and Youtang (2012) | Sub-Sahara African countries with exclusive reference to Nigeria | 1970 to 2009 | Augmented Dickey Fuller (ADF), Granger causality test | The study concluded that the exchange rate has significant impact in influencing exports, imports, and economic growth. |

| Udoh et al. (2012) | Nigeria | 1968 to 2010 | Cointegration test, ECM | The study showed that exchange rate volatility reduces with external reserves, lending interest rate, and import. |

| Zheng (2012) | Thailand and China | 1997 to 2011 | GLS | The results indicated that the exchange rate volatility has a positive impact on the Thailand export to China and the exchange rate has no significant impact on GDP. |

| Joseph and Isaac (2011) | Nigeria | 1970 to 2009 | GARCH | The study showed indirect and insignificant relations between trade and exchange rate. |

| Ogbonna (2011) | Nigeria | 1970 to 2005 | OLS | The study revealed that there is no cointegration for trade balance model. |

| Oladipupo and Onotaniyohuwo (2011) | Nigeria | 1970 to 2008 | OLS | The study claimed that exchange rate has significant effects on balance of payments. |

| Olayungbo et al. (2011) | Sub-Sahara African countries | 1986 to 2005 | OLS and panel generalised method of moment | The result showed that exchange rate has positive effect on aggregate trade. |

| Ng et al. (2008) | Malaysia | 1955 to 2006 | VECM | The results concluded the existence of long run effects between trade balance and exchange rate. |

| Baak (2004) | East Asian countries | 1981 to 2004 | ECM | The study showed that exchange rate volatility had a significant short and long run effects on exports. |

| Rose (1990) | Organization for Economic Cooperation and Development countries (OECD) | Parametric and Non-parametric | The study concluded that exchange rate has insignificant impact on trade balance. | |

| Author(s) | Country/Countries | Sample Period | Methodology | Results/Conclusion of the Study |

|---|---|---|---|---|

| Tiwari and Olayeni (2013) | India | 1980 to 2011 | Wavelet analysis | The study showed that oil price has negative effect on trade balance |

| Wu et al. (2013) | China and G7 countries | 1975 to 2010 | Panel smooth transition regression | The study affirmed that trade balance responded significantly to the changes in income, oil price, and import. |

| Hassan and Zaman (2012) | Pakistan | 1975 to 2010 | ARDL | The result showed that there is a significant negative effect of oil price on both exchange rate and trade balance. |

| Qiangian (2011) | China | 1999 to 2008 | VECM | The study revealed that there exists a long-term equilibrium relationship among oil price and output, inflation, trade balance, and money supply. |

| Ozlale and Pekkurnaz (2010) | Turkey | 1999 to 2009 | VAR | The study affirmed that oil price has significant effects on trade balance in the short run. |

| Tsen (2009) | Asian countries (Japan, Hong Kong, and Singapore) | 1960 to 2016 | VAR | The study showed that the variables of term of trade and oil price shock affect the trade balance both in the long run and short run. |

| Author(s) | Country/Countries | Sample Period | Methodology | Results/Conclusion of the Study |

|---|---|---|---|---|

| Shafi et al. (2013) | France | 1971 to 2012 | ECM | The study concluded that the impact of oil price on exchange rate is positive in the long run. |

| Benhabib et al. (2014) | Algeria | 2003 to 2013 | VAR | The study indicated that oil price has impacted Algerian currency. |

| Al-Ezzee (2011) | Bahrain | 1980 to 2005 | VECM | The study affirmed the existence of a long run relationship between real GDP growth, global oil price, and exchange rate. |

| Nikbakht (2010) | OPEC members | 2000 to 2007 | Panel cointegration test | The result showed that oil price may have a dominant share of real exchange rate movement. |

| Aliyu (2009) | Nigeria | 1986 to 2007 | VAR | The study suggested the diversification of both the infrastructure and the economy. |

| Coudert et al. (2008) | US | 1974 to 2004 | VECM | The relationship between the dollar real exchange rate and oil price seems to be transmitted through US international investment position. |

| Chen and Chen (2007) | G7 countries | 1992 to 2005 | Panel co-integration | The study found that there is a link between oil price and exchange rate. |

| Gounder and Bartleet (2007) | New Zealand | 1989 to 2006 | VAR | Oil price has substantial effect on inflation and exchange rate in New Zealand. |

| Habib and Kalamova (2007) | Russia, Norway, and Saudi –Arabia | 1980 to 2006 | VAR | There is no significant evidence to maintain that the diverse exchange rate regimes of the countries may account for the different empirical results on the impact of oil price. |

| Olomola and Adejumo (2006) | Nigeria | 1970 to 2003 | VAR | The findings showed that while oil price significantly influenced exchange rate, it did not have a significant effect on output and inflation in Nigeria. |

| Rautava (2004) | Russia | 1995 to 2001 | VAR | The study found that the economy was influenced significantly by fluctuations in both long run equilibrium and short run direct impact. |

| Yousefi and Wirjanto (2004) | OPEC Countries | 1970 to 1999 | Novel empirical approach | The study revealed that regional price correlations appeared to be indicative of segmentation within the OPEC market structure. |

| Statistics | Exchange Rate | Oil Price | Reserve | Trade Balance |

|---|---|---|---|---|

| Mean | 97.79 | 43.58 | 19,163 | 168,856 |

| Median | 116.04 | 28.92 | 9101.47 | 79,865.46 |

| Maximum | 306.4 | 123.78 | 60,875.24 | 718,742 |

| Minimum | 1 | 12.93 | 913 | 141.59 |

| Std-dev | 80.96 | 29.62 | 17,121.85 | 198,198 |

| Jacque-Bera | 9.38 | 18.33 | 14.53 | 25.11 |

| Prob. | 0.00 | 0.00 | 0.00 | 0.00 |

| observation | 129 | 129 | 129 | 129 |

| Variables | Levels | First Diff. | Variables | Level | First Diff. |

|---|---|---|---|---|---|

| Exchange rate | 0.637 | −8.9128 *** | Exchange rate | 1.0743 | −8.8182 *** |

| Oil price | −1.5666 | −9.5175 *** | Oil price | −1.4847 | −8.9468 *** |

| Reserve | −1.0742 | −4.0827 *** | Reserve | −0.9562 | −8.0429 *** |

| Trade Balance | −2.6008 | −15.4233 | Trade Balance | −3.5938 | - |

| Coint. Rank | Eigen Value | Critical Value | Prob. | Trace Stat. | Critical Value | Prob. |

|---|---|---|---|---|---|---|

| Oil price and reserve | ||||||

| 14.76 | 14.26 | 0.04 ** | 15.45 | 15.49 | 0.05 * | |

| 0.68 | 3.84 | 0.41 | 0.68 | 3.84 | 0.41 | |

| Oil price and trade balance | ||||||

| 11.6 | 14.26 | 0.13 | 13.43 | 15.49 | 0.10 | |

| 1.82 | 3.84 | 0.18 | 1.82 | 3.84 | 0.18 | |

| Oil price and exchange rate | ||||||

| 11.49 | 15.49 | 0.18 | 10.61 | 14.26 | 0.17 | |

| 0.88 | 3.84 | 0.35 | 0.87 | 3.84 | 0.35 | |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Olayungbo, D.O. Effects of Global Oil Price on Exchange Rate, Trade Balance, and Reserves in Nigeria: A Frequency Domain Causality Approach. J. Risk Financial Manag. 2019, 12, 43. https://doi.org/10.3390/jrfm12010043

Olayungbo DO. Effects of Global Oil Price on Exchange Rate, Trade Balance, and Reserves in Nigeria: A Frequency Domain Causality Approach. Journal of Risk and Financial Management. 2019; 12(1):43. https://doi.org/10.3390/jrfm12010043

Chicago/Turabian StyleOlayungbo, D. O. 2019. "Effects of Global Oil Price on Exchange Rate, Trade Balance, and Reserves in Nigeria: A Frequency Domain Causality Approach" Journal of Risk and Financial Management 12, no. 1: 43. https://doi.org/10.3390/jrfm12010043

APA StyleOlayungbo, D. O. (2019). Effects of Global Oil Price on Exchange Rate, Trade Balance, and Reserves in Nigeria: A Frequency Domain Causality Approach. Journal of Risk and Financial Management, 12(1), 43. https://doi.org/10.3390/jrfm12010043