Empirical Credit Risk Ratings of Individual Corporate Bonds and Derivation of Term Structures of Default Probabilities

Abstract

:1. Introduction

1.1. Brief Review of the Literature

1.1.1. GB and Interest Analysis

1.1.2. CB and Credit Risk Analysis

1.2. Overall Summary of Our Paper

- A. Crisk-rating system

- B. Derivation of TSDP for each Crisk-rating class

1.2.1. Crisk-Rating System

1.2.2. Derivation of TSDP for Each Crisk-Rating Class

1.3. Detailed Summary

- (1)

- Definition of CRiPS and its empirical effectiveness

- (2)

- Crisk analysis of R&I credit ratings via CRiPS measures

- (3)

- Crisk-homogeneous grouping by cluster analysis and fixed interval scheme (FIS) via S-CRiPS measure

- (4)

- TSDPs for individual firms, cluster groups with industry categories, and Crisk-rating classes

2. Definition of CRiPS and Its Empirical Effectiveness

2.1. GB Pricing Model

- (1)

- the longer the maturity of each bond, the larger the variance of each price;

- (2)

- the larger the difference of maturities of two bonds, the smaller the covariance; and

- (3)

- the closer the two cash flow points, the larger the covariance of the discount factors and .

2.2. Investors’ Preferences in the GB Markets and Attribute Effects on Prices

- (1)

- Investors with income motives hold GBs until maturity, such as life insurance companies, pensions, Japanese postal banks, banks, etc.

- (2)

- Investors with trading motives buy and sell GBs for capital gains along changes of TSIR, such as trust funds, hedge funds, and investment banking.

2.3. CRiPS Measure

3. Crisk Analysis of R&I Credit Ratings via CRiPS Measures

| (1) G1: AAA, AA+, AA, AA−, | (2) G2: A+, A, |

| (3) G3: A−, | (4) G4: BBB+, BBB, BBB−, C+. |

3.1. Electric Power Industry

- (1)

- In graph 1, in September 2006, in the middle of the growing economy, the CRiPSs of the CBs were almost perfectly on a straight line, and the term of 10 years attains the largest (best) value of −1.6 yen among the five cases (graphs), which is larger (better) than August 2010 in graph 5. Around the term of 7 through 10 years, the two divided lines in graph 1 are confirmed to correspond to the Crisk preferences of some issuers for CBs in the electric power industry. The differences of the market Crisk preferences for some specific issuers in August 2010 are identified in terms of TSDPs in Section 5.

- (2)

- In August 2007, when the economy was around the peak of the business cycle, investors who expected a coming downturn of the economy deformed the pattern of the CRiPSs with stronger Crisk preferences and some maturity preferences appearing around the 7-year term (see graph 2). In fact, around the terms of 5–7 years, the CRiPSs in the upper line in graph 2, about −0.7 yen, were better than in graph 1, implying that more of those CBs were bought. In addition, the Crisk preference became stronger for terms of 6–10 years.

- (3)

- The maturity preference continued until the financial crisis period in graph 3. CBs of about 7-year maturity were strongly preferred, though the level of the CRiPS was lower (worse) than in graph 2. What is notable here is that the CRiPSs around 10 years are large enough in absolute value to be close to −3 yen, which is significant relative to those of graphs 1 and 2. The gap between the 7-year and 10-year CRiPSs is as big as 2 yen. This implies that the linearity observed in graph 1 was disturbed by a big crisis.

- (4)

- In graph 4, one year later, the CRiPSs returned to the same shape as in graph 2, though the level is a bit lower (worse), and no issuer preference is observed here.

- (5)

- Under the continuation of bad economies in Japan and world, some maturity preferences seem to appear in graph 5, though no issuer preference can be seen.

3.2. Trading and Metal Industries

4. Crisk-Homogeneous Grouping by Cluster Analysis and FIS via S-CRiPS Measure

- (1)

- Three-stage centroid clustering, and

- (2)

- fixed interval filtering with x-yen split rule.

- (1)

- First, we apply a three-stage centroid cluster method to the S-CRiPSs to get 14 Crisk-homogeneous cluster groups (CGs). The first cluster group (CG1) of the CBs that are closest together in the S-CRiPS is found to be the largest group in terms of number of CBs, implying that even three-stage centroid clustering does not sufficiently classify CBs because of the mutual closeness of too many S-CRiPSs.

- (1)

- Alternatively, as an absolute criterion for grouping and rating CBs, we propose the Crisk rating system with a set of fixed intervals filtering Crisks in terms of 10 times S-CRiPS, i.e., 10, where each 10 × S-CRiPS of a CB is assigned to a rating interval in the half line (−∞,0]. It is noted that by the definition of Equation (13), 10 is 10-year-maturity-equivalent CRiPS measure of and the straight line connecting (0,0) and (, ) passes (10, 10). The choice of a set of fixed intervals is made by dividing the half line (−∞,0] by an x-yen split, where x-yen is the basic unit of making intervals for 10s. For Japanese CBs, x = 1 is proposed (below), except for large S-CRiPSs in absolute value, and each CB is empirically rated by the number of fixed intervals. The market price–based categorical rates thus made can be used for investment decision-making and credit portfolio analysis in asset management, since the ratings are universally comparable over all CBs.

4.1. Crisk-Homogenous Groups via Cluster Analysis

- (1)

- All 1545 CBs, including subordinated bonds, are clustered into six groups. The result is given in the upper part of Table 3. Clusters 3, 4, 5, and 6, which are very far away from 1 and 2 in centroid distance (13.86 − 4.67 = 9.19), are recognized as independent clusters and named CG11, CG12, CG13, and CG14. These clusters do not include many CBs; CG11 consists of CBs issued by Promise (BBB+, nonbank) and Daikyo (BBB, real estate), and CG12–CG14 consist of CBs issued by Aiful (CCC+, nonbank) only. Hence, it is difficult to derive the TSDPs for these groups due to a lack of samples. The members of these clusters are excluded in the second stage cluster analysis.

- (2)

- The 1529 remaining CBs, whose CRiPS measures are greater than −4 yen, are again clustered into six groups, and the middle part of Table 3 gives the result. Here again, clusters 3, 4, 5, and 6 are separated from 1 and 2, and form independent clusters CG7, CG8, CG9, and CG10. The centroid distance between clusters 1 and 2 and clusters 3–6 is still as large as 1.83 − 1.03 = 0.80 (yen).

- (3)

- The remaining 1505 CBs, whose CRiPS measures are greater than −1.5, are then clustered into six groups. Though these are relatively indistinguishable, we call them CG1 through CG6 in order of Crisk quality. CG1 still contains 988 CBs. The centroid distance between groups 1 and 2 and 3–6 is as small as 0.458 − 0.317 = 0.141. We stop here, because a further breakdown would not yield meaningfully distinguishable groups.

4.2. Crisk-Rating System with Fixed Interval Scheme for S-CRiPSs

4.3. Comparison of Our Crisk Rating and R&I Rating

5. TSDPs for Individual Firms, Cluster Groups with Industry Categories, and Crisk-Rating Classes

- (1)

- For some individual firms in the electric power, international distribution (trading), and metal industries, where the firms issue relatively many CBs

- (2)

- For the top seven cluster groups identified above (CG1–CG7)

- (3)

- For industry groups CG1(1), CG1(2), …, CG1(14) obtained by decomposing CG1

- (4)

- For Crisk-rating classes F1, F2, …, F7

5.1. Model for Pricing CBs and Deriving TSDPs

5.2. TSDPs of Individual Firms and Credit-Homogeneous Groups

5.2.1. TSDPs of Individual Firms in the Electric Power Industry

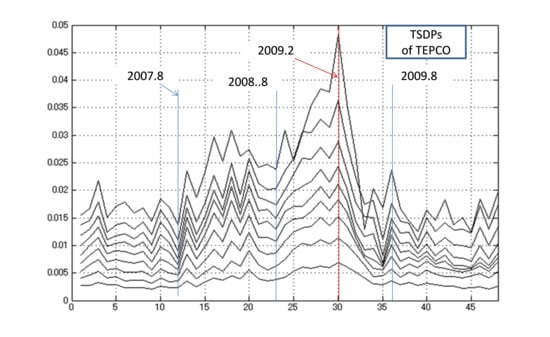

Monthly Changes of TSDPs of TEPCO from September 2006 through August 2010

- (1)

- In the time series of 10-year DPs, the maximum DP is 4.8% in February 2009, which is due to the financial crisis that started in September 2008. It is interesting to note that the JGB market was affected the worst in November 2008, though the reason for the time lag of TEPCO’s CBs is not clear.

- (2)

- The period of the first 12 months from September 2006 was in the upturn economy during which TEPCO enjoyed high revenues, and hence the TSDPs are overall lower, with 10-year DPs of about 1.6%. The curves of the TSDPs are not steep.

- (3)

- In the second 12 months starting from September 2007, the TSDPs rose rapidly and the 10-year DP attained 3% in February 2008, when the economy went down.

- (4)

- In September 2008 during the Lehman shock, the 10-year DP was 2.6%, which is a bit amazing because our end-of-month CB price did not respond to the shock on the spot. However, the DPs then increased dramatically to 4.8% in February 2009, and thereafter decreased greatly within five months.

- (5)

- The period August 2009 through August 2010 is somewhat similar to the period in (1) except that the DP curves in this period have flat areas in the middle term, corresponding to Figure 7.

5.2.2. TSDPs of Individual Firms in International Distribution Industry

Monthly Changes of TSDPs of Mitsubishi Corp. for September 2006 through August 2010

5.2.3. TSDPs of Individual Firms in Metal (Steel/Nonsteel/Mining) Industry

5.2.4. TSDPs of CG1–CG7

5.2.5. TSDPs of Crisk-Rating Classes

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Covariance Structure of CB Prices in Equation (15)

References

- Bharath, T. Sreedhar, and Tyler Shumway. 2008. Forecasting Default with the Merton Distance to Default Model; Forecasting Default with the Merton Distance to Default Model. Review of Financial Studies 21: 1339–69. [Google Scholar] [CrossRef]

- Chava, Sudheer, and Robert A. Jarrow. 2004. Bankruptcy prediction with industry effects. Review of Finance 8: 537–69. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Canlin Li. 2006. Forecasting the term structure of government bond yields. Journal of Econometrics 130: 337–64. [Google Scholar] [CrossRef]

- Duan, Jin-Chaun, Jie Sun, and Tao Wang. 2011. Multiperiod Corporate Default Prediction-A Forward Intensity Approach. RMI working paper No.10/07. Singapore: Risk Management Institute, National University of Singapore. [Google Scholar]

- Duffie, Darrell. 2011. Measuring Corporate Default Risk. Clarendon Lectures in Finance. Oxford: Oxford University Press. [Google Scholar]

- Friewald, Nils, Rainer Jankowitsch, and Marti G. Subrahmanyam. 2012. Illiquidity or credit deterioration: Astudy of liquidity in the US corporate bond market during financial crises. Journal of Financial Economics 105: 18–36. [Google Scholar] [CrossRef]

- Kariya, Takeaki. 1993. Quantitative Portfolio Analysis—MTV Approach. Boston: Kluwer Academic Publishers (now Springer Verlag). [Google Scholar]

- Kariya, Takeaki. 2013. A CB (Corporate Bond) Pricing Model for Deriving Default Probabilities and Recovery Rates. Festschrift for Professor Morris L. Eaton. Beachwood: IMS. [Google Scholar]

- Kariya, Takeaki, and Hiroshi Kurata. 2004. Generalized Least Squares. New York: John Wiley. [Google Scholar]

- Kariya, Takeaki, and Hiroshi Tsuda. 1994. New bond pricing models with applications to Japanese Government Bond. Financial Engineering and the Japanese Markets 1: 1–20. [Google Scholar] [CrossRef]

- Kariya, Takeaki, Jingsui Wang, Zhu Wang, Eiichi Doi, and Yoshiro Yamamura. 2012. Empirically Effective Bond Pricing Model and Analysis on Term Structures of Implied Interest Rates in Financial Crisis. Asia-Pacific Financial Markets 19: 259–92. [Google Scholar] [CrossRef]

- Kariya, Takeaki, Yoshiro Yamamura, Yoko Tanokura, and Zhu Wang. 2015. Credit Risk Analysis on Euro Government Bonds--Term Structures of Default Probabilities. Asia-Pacific Financial Markets 22: 397–427. [Google Scholar] [CrossRef]

- Kariya, Takeaki, Yoko Tanokura, Hideyuki Takada, and Yoshiro Yamamura. 2016. Measuring Credit Risk of Individual Corporate Bonds in US Energy Sector. Asia-Pacific Financial Markets 23: 229–62. [Google Scholar] [CrossRef]

- Kariya, Takeaki, Yoshiro Yamamura, and Zhu Wang. 2016. Empirically effective bond pricing model for USGBs and analysis on term structures of implied interest rates in financial crisis. Communications in Statistics-Theory and Methods 45: 1580–606. [Google Scholar] [CrossRef]

- Nelson, Charles R., and Andrew F. Siegel. 1987. Parsimonious modeling of yield curves. Journal of Business 60: 473–89. [Google Scholar] [CrossRef]

| I | II | III | IV | |

|---|---|---|---|---|

| M3 | 0.051 | 0.109 | 0.189 | 0.082 |

| M0 | 0.071 | 0.144 | 0.219 | 0.118 |

| AAA | AA+ | AA | AA− | A+ | A | A− | BBB+ | BBB | BBB− | C+ | NA | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| # | 9 | 497 | 119 | 172 | 179 | 152 | 162 | 95 | 52 | 1 | 7 | 100 | 1545 |

| % | 0.6 | 54.0 | 8.2 | 11.9 | 12.4 | 10.5 | 11.2 | 6.6 | 3.6 | 0.0 | 0.5 | NA | 100 |

| 1st | 1 | 2 | 3(CG11) | 4(CG12) | 5(CG13) | 6(CG14) | Total # |

| # of CBs | 1504 | 25 | 9 | 2 | 4 | 1 | 1545 |

| Max | −0.33 | −15.89 | −46.19 | −122.24 | −155.88 | −175.78 | |

| Min | −14.80 | −38.09 | −58.54 | −138.54 | −160.19 | −175.78 | |

| 2nd | 1 | 2 | 3(CG7) | 4(CG8) | 5(CG9) | 6(CG10) | Total |

| # of CBs | 1339 | 165 | 7 | 1 | 7 | 10 | 1529 |

| Max | −0.33 | −6.20 | −15.89 | −21.65 | −24.71 | −30.48 | |

| Min | −6.14 | −14.80 | −18.98 | −21.65 | −28.20 | −38.09 | |

| 3rd | 1(CG1) | 2(CG2) | 3(CG3) | 4(CG4) | 5(CG5) | 6(CG6) | Total |

| # of CBs | 988 | 351 | 80 | 38 | 37 | 10 | 1504 |

| Max | −0.33 | −3.03 | −6.20 | −8.26 | −10.51 | −13.67 | |

| Min | −3.02 | −6.14 | −8.10 | −10.27 | −13.01 | −14.80 | |

| Final Cluster Groups | |||||||

| CG1 | CG2 | CG3 | CG4 | CG5 | CG6 | CG7 | |

| # of CBs | 988 | 351 | 80 | 38 | 37 | 10 | 7 |

| Max | −0.33 | −3.03 | −6.20 | −8.26 | −10.51 | −13.67 | −15.89 |

| Min | −3.02 | −6.14 | −8.10 | −10.27 | −13.01 | −14.80 | −18.98 |

| CG8 | CG9 | CG10 | CG11 | CG12 | CG13 | CG14 | Total |

| 1 | 7 | 10 | 9 | 2 | 4 | 1 | 1545 |

| −21.65 | −24.71 | −30.48 | −46.19 | −122.24 | −155.88 | −175.78 | |

| −21.65 | −28.20 | −38.09 | −58.54 | −138.54 | −160.19 | −175.78 | |

| Inds | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CG1 | 24 | 16 | 41 | 30 | 49 | 19 | 44 | 53 | 459 | 124 | 56 | 6 | 1 | 14 | 52 |

| CG2 | 18 | 9 | 46 | 23 | 30 | 13 | 27 | 7 | 2 | 81 | 42 | 1 | 18 | 22 | 12 |

| FIS-1 | FIS-2 | FIS-3 | FIS-4 | FIS-5 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| F | 0.5 Yen | # | F | 1 Yen | # | F | M1 Yen | # | F | 1.5 Yen | # | F | 2 Yen | # |

| 1 | [−0.5,0) | 10 | 1 | [−1,0) | 42 | 1 | [−1,0) | 42 | 1 | [−1.5,0) | 213 | 1 | [−2,0) | 618 |

| 2 | [−1.0,−0.5) | 32 | 2 | [−2,−1) | 576 | 2 | [−2,−1) | 576 | 2 | [−3.0,−1.5) | 773 | 2 | [−4,−2) | 526 |

| 3 | [−1.5,−1.0) | 171 | 3 | [−3,−2) | 368 | 3 | [−3,−2) | 368 | 3 | [−4.5,−3.0) | 214 | 3 | [−6,−4) | 186 |

| 4 | [−2.0,−1.5) | 405 | 4 | [−4,−3) | 158 | 4 | [−4,−3) | 158 | 4 | [−6.0,−4.5) | 130 | 4 | [−8,−6) | 86 |

| 5 | [−2.5,−2.0) | 223 | 5 | [−5,−4) | 111 | 5 | [−5,−4) | 111 | 5 | [−7.5,−6.0) | 64 | 5 | [−10,−8) | 35 |

| 6 | [−3.0,−2.5) | 145 | 6 | [−6,−5) | 75 | 6 | [−6,−5) | 75 | 6 | [−9.0,−7.5) | 41 | 6 | (−∞,−10) | 94 |

| 7 | [−3.5,−3.0) | 81 | 7 | [−7,−6) | 46 | 7 | [−8,−6) | 86 | 7 | [−10.5,−9.0) | 22 | |||

| 8 | [−4.0,−3.5) | 77 | 8 | [−8,−7) | 40 | 8 | [−11,−8) | 48 | 8 | (−∞,−10.5) | 88 | |||

| 9 | [−4.5,−4.0) | 56 | 9 | [−9,−8) | 19 | 9 | [−15,−11) | 40 | ||||||

| 10 | [−5.0,−4.5) | 55 | 10 | [−10,−9) | 16 | 10 | (−∞,−15) | 41 | ||||||

| 11 | [−5.5,−5.0) | 36 | 11 | (−∞,−10) | 94 | |||||||||

| 12 | [−6.0,−5.5) | 39 | ||||||||||||

| 13 | [−7.0,−6.0) | 46 | ||||||||||||

| 14 | [−8.0,−7.0) | 40 | ||||||||||||

| 15 | [−9.0,−8.0) | 19 | ||||||||||||

| 16 | [−10.0,−9.0) | 16 | ||||||||||||

| 17 | (−∞,−10) | 94 | ||||||||||||

| Market Grouping via FIR-3 (Total 1545 CBs) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| R&I | F1 [−1,0] | F2 [−2,−1] | F3 [−3,−2] | F4 [−4,−3] | F5 [−5,−4] | F6 [−6,−5] | F7 [−8,−6] | F8 [−11,−8] | F9 [−15,−11) | F10 (−∞,−15) | Total % | # CBs |

| AAA | 0.0 | 22.2 | 77.8 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 100 | 9 |

| AA+ | 6.6 | 84.9 | 8.5 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 100 | 497 |

| AA | 0.8 | 52.1 | 45.4 | 1.7 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 100 | 119 |

| AA− | 3.5 | 27.9 | 66.3 | 1.7 | 0.0 | 0.0 | 0.6 | 0.0 | 0.0 | 0.0 | 100 | 172 |

| A+ | 0.6 | 12.8 | 52.0 | 14.0 | 7.8 | 6.1 | 3.4 | 3.4 | 0.0 | 0.0 | 100 | 179 |

| A | 0.0 | 0.7 | 13.8 | 46.7 | 9.9 | 3.9 | 7.9 | 8.6 | 8.6 | 0.0 | 100 | 152 |

| A− | 0.0 | 0.6 | 8.6 | 25.3 | 27.2 | 11.1 | 9.9 | 6.2 | 2.5 | 8.6 | 100 | 162 |

| BBB+ | 0.0 | 0.0 | 1.1 | 5.3 | 20.0 | 14.7 | 27.4 | 9.5 | 9.5 | 12.6 | 100 | 95 |

| BBB | 0.0 | 0.0 | 0.0 | 0.0 | 9.6 | 28.8 | 34.6 | 9.6 | 11.5 | 5.8 | 100 | 52 |

| BBB− | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 100 | 100 | 1 |

| CCC+ | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 100 | 100 | 7 |

| None | 1.0 | 17.0 | 22.0 | 11.0 | 14.0 | 11.0 | 7.0 | 5.0 | 8.0 | 4.0 | 100 | 100 |

| # of CBs | 42 | 576 | 368 | 158 | 111 | 75 | 86 | 48 | 40 | 41 | 100 | 1545 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kariya, T.; Yamamura, Y.; Inui, K. Empirical Credit Risk Ratings of Individual Corporate Bonds and Derivation of Term Structures of Default Probabilities. J. Risk Financial Manag. 2019, 12, 124. https://doi.org/10.3390/jrfm12030124

Kariya T, Yamamura Y, Inui K. Empirical Credit Risk Ratings of Individual Corporate Bonds and Derivation of Term Structures of Default Probabilities. Journal of Risk and Financial Management. 2019; 12(3):124. https://doi.org/10.3390/jrfm12030124

Chicago/Turabian StyleKariya, Takeaki, Yoshiro Yamamura, and Koji Inui. 2019. "Empirical Credit Risk Ratings of Individual Corporate Bonds and Derivation of Term Structures of Default Probabilities" Journal of Risk and Financial Management 12, no. 3: 124. https://doi.org/10.3390/jrfm12030124

APA StyleKariya, T., Yamamura, Y., & Inui, K. (2019). Empirical Credit Risk Ratings of Individual Corporate Bonds and Derivation of Term Structures of Default Probabilities. Journal of Risk and Financial Management, 12(3), 124. https://doi.org/10.3390/jrfm12030124