Application of Discriminant Analysis for Avoiding the Risk of Quarry Operation Failure

Abstract

:1. Introduction

2. Literature Review

3. Material and Methods

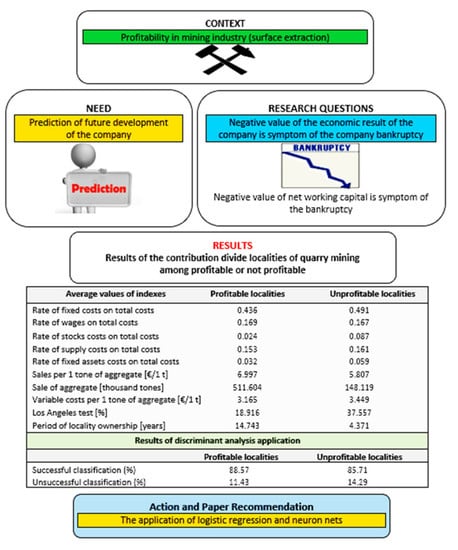

- We assumed that a negative value of the economic result of the company is a symptom of the company’s bankruptcy.

- We assumed that a negative value of net working capital is a symptom of bankruptcy.

- n—Number of companies in the class;

- m—Number of discriminants;

- Di—Discrimination score for i-company;

- Xij—Value of discriminant in i-company (j = 1, … m);

- dj—Coefficient of linear discrimination function, correspondent to;

- j—Discriminant (for j = 1, … m).

- Discriminants report multivariable normality of distribution;

- Class of healthy companies and companies, threatened by bankruptcy, have the same covariance matrix.

4. Results

5. Discussion

- A prevailing majority of correlations are statistically unimportant.

- Pair correlations are an insufficient method for the classification of the quarry from the perspective of future economic results.

- There is therefore a need to use a more sophisticated method. Dependence of yet described 10 parameters had been evaluated by discrimination multivariable analysis with the aim to follow up the dependence of individual parameters among themselves.

- The use of the control sample proved the suitability of the mentioned method used for the classification of localities from the perspective of their future economic results. The mentioned 10 parameters properly described influences, considerable for economic results of the locality in the future.

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Agarwal, Vineet, and Richard Taffler. 2008. Comparing the performance of market-based and accounting-based bankruptcy prediction models. Journal of Banking and Finance 32: 1541–51. [Google Scholar] [CrossRef] [Green Version]

- Altman, Edward I. 1968. Financial ratios, discriminant analysis and prediction of corporate bankruptcy. The Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Altman, Edward I. 1981. Application of Classification Techniques in Business, Banking and Finance. Contemporary Studies in Economic and Financial Analysis. Greenwich: JAI Press. [Google Scholar]

- Altman, Edward I. 2013. Predicting financial distress of companies: Revisiting the Z-Score and ZETA® models. In Handbook of Research Methods and Applications in Empirical Finance. Edited by Adrian R. Bell, Chris Brooks and Marcel Prokopczuk. Cheltenham: Edward Elgar Publishing, pp. 428–56. [Google Scholar] [CrossRef]

- Altman, Edward I., Robert G. Halderman, and Paul Narayanan. 1977. ZETATM Analysis: A new model to identify bankruptcy risk of corporations. Journal of Banking and Finance 1: 29–54. [Google Scholar] [CrossRef]

- Altman, Edward I., Malgorzata Iwanicz-Drozdowska, Erkii K. Laitien, and Arto Suvas. 2014. Distressed Firm and Bakruptcy Prediction in an International Context: A Review and Empirical Analysis of Altman’s z Score Model. pp. 1–47. Available online: https://ssrn.com/abstract=2536340 (accessed on 22 November 2019).

- Anagnostopoulos, Ioannis, and Anas Rizeq. 2019. Confining value from neural network. A sectoral study prediction of takeover targets in the US technology sectors. Managerial Finance 45: 1433–57. [Google Scholar] [CrossRef]

- Andrawis, Robert R., Amir F. Atiya, and Hisham El-Shishiny. 2011. Combination of long term and short-term forecasts, with application to tourism demand forecasting. International Journal of Forecasting 27: 870–86. [Google Scholar] [CrossRef]

- Atiya, Amir F. 2001. Bankruptcy prediction for credit risk using neural networks: A survey and new results. IEEE Transactioncs on Neural Network 12: 929–35. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Atiya, Amir F. 2020. Why does forecast combination work so well? International Journal of Forecasting 36: 197–200. [Google Scholar] [CrossRef]

- Aziz, Adnan M., and Humayon A. Dar. 2006. Prediction corporate bankruptcy: Where we stand? Corporate Governance 6: 18–33. [Google Scholar] [CrossRef] [Green Version]

- Balcaen, Sofie, and Hubert Ooghe. 2006. 35 years of studies on business failure: An overview of the classic statistical methodologies and their related problems. The British Accounting Review 38: 63–93. [Google Scholar] [CrossRef]

- Bauer, Julian, and Vineet Agarwal. 2014. Are hazard models superior to traditional bankruptcy prediction approaches? A comprehensive test. Journal of Banking and Finance 40: 432–42. [Google Scholar] [CrossRef]

- Beaver, William H. 1966. Financial Ratios as Predictors of Failure. Journal of Accounting Research 4: 71–111. [Google Scholar] [CrossRef]

- Bhimani, Alnoor, Mohamed Azzim Gulamhussen, and Samuel Da-Rocha Lopes. 2010. Accounting and no accounting determinants of default: An analysis of privately held firms. Journal of Accounting and Public Policy 29: 571–32. [Google Scholar] [CrossRef]

- Bobinaite, Viktorija. 2015. Financial sustainability of wind electricity sectors in the Baltic States. Renewable and Sustainable Energy Reviews 47: 794–815. [Google Scholar] [CrossRef]

- Borlea, Sorin N., and Monica V. Achim. 2014. Assessing bankruptcy risk of Romanian metallurgical companies. Metalurgija 53: 279–82. [Google Scholar]

- Chava, Sudheer, and Robert A. Jarrow. 2008. Bankruptcy prediction with industry effects. In Financial Derivatives Pricing. Edited by R. A. Jarrow. Singapore: World Scientific Publishing Co., pp. 517–49. [Google Scholar] [CrossRef]

- Csikósová, Adriana, Katarína Čulková, and Mária Janošková. 2018. Financial Health of the Company and Bankruptcy Avoiding. Ostrava: VŠB—Technical University of Ostrava. [Google Scholar]

- Csikósová, Adriana, Mária Janošková, and Katarína Čulková. 2019. Limitation of Financial Health Prediction in Companies from Post-Communist Countries. Journal of Risk and Financial Management 12: 15. [Google Scholar] [CrossRef] [Green Version]

- Eisenbeis, Robert A. 1977. Pitfalls in the Application of Discriminant Analysis in Business, Finance, and Economics. Journal of Finance 32: 875–900. [Google Scholar] [CrossRef]

- Fedorova, Elena A., Evgenii V. Gilenko, and Sergey E. Dovzhenko. 2013. Models for bankruptcy forecasting: Case study of Russian Enterprises. Studies on Russian Economic Development 24: 159–64. [Google Scholar] [CrossRef]

- Fitzpatrick, Paul J. 1932. A Comparison of Ratios of Successful Industrial Enterprises with Those of Failed Firm. Certified Public Accountant 12: 598–605. [Google Scholar]

- Freed, Ned S., and Fred Glover. 1981. Simple but powerful goal programming models for discriminant problems. European Journal of Operational Research 7: 44–60. [Google Scholar] [CrossRef]

- Gass, Saul I., and Arjang A. Assad. 2005. An Annotated Timeline of Operations Research. An Informal History. Berlin/Heidelberg: Springer. [Google Scholar]

- Geng, Ruibin, Indranil Bose, and Xi Chen. 2015. Prediction of financial distress: An empirical study of listed Chinese companies using data mining. European Journal of Operational Research 241: 236–47. [Google Scholar] [CrossRef]

- Gijbels, Irene, Marek Omelka, Michal Pešta, and Noel Veraverbeke. 2017. Score tests for covariate effects in conditional copulas. Journal of Multivariate Analysis 159: 111–33. [Google Scholar] [CrossRef]

- Glover, Fr. 1990. In Memory of Darwin Klingman: A Tribute to an Esteemed Colleague and Friend. Interfaces 20: 3–4. [Google Scholar] [CrossRef] [Green Version]

- He, Dongwei, Kai Yu, and Jun Wu. 2020. Industry characteristics, court location, and bankruptcy resolution. Journal of Management Analytics 7: 389–423. [Google Scholar] [CrossRef]

- Ho, Chun-Yu, Patrick McCarthy, Yi Yang, and Xuan Ye. 2013. Bankruptcy in the pulp and paper industry: Market’s reaction and prediction. Empirical Economics 45: 1205–32. [Google Scholar] [CrossRef]

- Kieschnick, Robert, Mark Laplante, and Rabih Moussawi. 2013. Working Capital Management and Shareholders’ Wealth. Review of Finance 17: 1827–52. [Google Scholar] [CrossRef]

- Koehler, Gary J., and Selcuk S. Erenguc. 1990. Minimising misclassifications in linear discriminant analysis. Decision Sciences 21: 63–85. [Google Scholar] [CrossRef]

- Kourentzes, Nikolaos, Devon Barrow, and Fotios Petropoulos. 2019. Another look at forectas selection and combination: Evidence from forecasting pooling. International Journal of Production Economics 209: 226–35. [Google Scholar] [CrossRef] [Green Version]

- Kovacova, Maria, Tomas Kliestik, Katarina Valaskova, Pavol Durana, and Zuzana Juhaszova. 2019. Systematic review of variables applied in bankruptcy prediction models of Visegrad group countries. Oeconomia Copernicana 10: 743–72. [Google Scholar] [CrossRef] [Green Version]

- Kristof, Tomas, and Miklos Virag. 2020. A comprehensive review of corporate bankruptcy prediction in Hungary. Journal of Risk and Financial Management 13: 35. [Google Scholar] [CrossRef] [Green Version]

- Kwak, Wikil, Susan W. Eldridge, Yyong Shi, and Gang Kou. 2011. Predicting auditor changes using financial distress variables, and the Multiple Criteria Linear Programming (MCLP) and other data mining approaches. Journal of Applied Business Research 27: 73–84. [Google Scholar] [CrossRef] [Green Version]

- Lyandres, Evgeny, and Alexei Zhdanov. 2013. Investment opportunities and bankruptcy prediction. Journal of Financial Markets 16: 439–76. [Google Scholar] [CrossRef]

- Maciak, Matus, Michal Pešta, and Barbora Peštová. 2020. Change point in dependent and non-stationary panels. Statistical Papers 61: 1385–407. [Google Scholar] [CrossRef]

- Meloun, Milan, and Jiri Militký. 2004. Statistical Analysis of Experimental Data (In Czech). Praha: Academia. [Google Scholar]

- Mensah, Yaw M. 1984. An examination of the stationarity of multivariate bankruptcy prediction models: A methodological study. Journal of Accounting Research 22: 380–95. [Google Scholar] [CrossRef]

- Mihalovič, Matus. 2018. Applicability of scoring models in firms’ default prediction. The case of Slovakia. Political Ekonomie 66: 689–708. [Google Scholar] [CrossRef] [Green Version]

- Odom, Marcus D., and Ramesh Sharda. 1990. A Neural network model for bankruptcy prediction. In Proceedings of the IJCNN International Joint Conference on Neural Networks, San Diego, CA, USA, June 17–21; pp. 163–68. [Google Scholar] [CrossRef]

- Ohlson, James A. 1980. Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research 18: 109–31. [Google Scholar] [CrossRef] [Green Version]

- Pešta, Michal, and Martin Wendler. 2020. Nuisance-parameter-free change point detection in non-stationary series. TEST 29: 379–408. [Google Scholar] [CrossRef]

- Pisula, Tomasz. 2020. An Ensemble Classifier-Based Scoring Model for Prediction Bankruptcy of Polish Companies in the Podkarpackie Voivodeship. Journal of Risk and Financial Management 13: 37. [Google Scholar] [CrossRef] [Green Version]

- Shumway, Tyler. 2001. Forecasting bankruptcy more accurately: A simple hazard model. Journal of Business 74: 101–24. [Google Scholar] [CrossRef] [Green Version]

- Smith, Raymond F., and Arthur H. Winakor. 1935. Changes in the Financial Structure of Unsuccessful Industrial Corporations. Urbana: University of Illinois. [Google Scholar]

- Štefko, Robert, Jarmila Horvathová, and Martina Mokrišová. 2020. Bankruptcy prediction with the use of Data Envelopment Analysis: An empirical study of Slovak Businesses. Journal of Risk and Financial Management 13: 212. [Google Scholar] [CrossRef]

- Sun, Jie, Hui Li, Qing-Hua Huang, and Kai-Yu He. 2014. Predicting financial distress and corporate failure: A review from the state-of-the-art definitions, modeling, sampling, and featuring approaches. Knowledge-Based Systems 57: 41–56. [Google Scholar] [CrossRef]

- Sun, Jie, Mengjie Zhou, Wenguo Ai, and Hui Li. 2019. Dynamic prediction of relative financial mistress based on imbalanced data stream: From the view of one industry. Risk Management 21: 215–42. [Google Scholar] [CrossRef]

- Syamni, Ghazali, M. Shabri Abd Majid, and Widyana Verawaty Siregar. 2018. Bankruptcy prediction models and stock prices of the coal mining industry in Indonesia. Etikonomi 17: 57–68. [Google Scholar] [CrossRef]

- Tam, Kar Yan. 1991. Neural network models and prediction of bank bankruptcy. Omega-International Journal of Management Science 9: 429–45. [Google Scholar] [CrossRef]

- Zavgren, Christine V. 1983. The prediction of corporate failure: The state of the art. Journal of Accounting Literature 2: 1–37. [Google Scholar]

| Locality | Rate of Fix Cost on Total cost (%) | Rate of Wages on Total Costs (%) | Rate of Stocks Costs on Total Costs (%) | Rate of Supply Costs on Total Costs (%) | Rate of Fixed Assets Costs on Total Costs (%) | Sales on 1 Ton of Aggregate (Eur/ton) | Sale of Aggregate (Tons) | Variable Costs per 1 Ton (Eur) | Los Angeles Test (%) | Period of Locality Ownership (Years) |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0.41 | 0.19 | 0.00 | 0.25 | 0.06 | 10.18 | 217,841 | 3.32 | 12.90 | 17 |

| 2 | 0.45 | 0.20 | 0.00 | 0.15 | 0.02 | 5.95 | 175,617 | 2.55 | 19.00 | 17 |

| 3 | 0.31 | 0.06 | 0.01 | 0.29 | 0.02 | 7.05 | 1,064,687 | 3.46 | 16.10 | 17 |

| 4 | 0.38 | 0.29 | 0.00 | 0.10 | 0.03 | 8.27 | 48,880 | 4.02 | 19.40 | 17 |

| 5 | 0.36 | 0.18 | 0.00 | 0.32 | 0.06 | 6.29 | 89,729 | 3.47 | 15.60 | 17 |

| 6 | 0.30 | 0.07 | 0.00 | 0.35 | 0.03 | 5.44 | 1,307,878 | 2.64 | 16.50 | 17 |

| 7 | 0.47 | 0.17 | 0.00 | 0.26 | 0.03 | 6.72 | 175,095 | 3.06 | 18.90 | 17 |

| 8 | 0.43 | 0.22 | 0.00 | 0.19 | 0.10 | 6.63 | 24,422 | 4.78 | 16.60 | 17 |

| 9 | 0.40 | 0.18 | 0.00 | 0.13 | 0.02 | 8.84 | 143,402 | 3.50 | 12.50 | 17 |

| 10 | 0.36 | 0.11 | 0.00 | 0.23 | 0.04 | 6.43 | 131,193 | 3.59 | 16.90 | 17 |

| 11 | 0.40 | 0.11 | 0.02 | 0.08 | 0.03 | 6.65 | 246,381 | 3.16 | 17.90 | 17 |

| 12 | 0.41 | 0.21 | 0.00 | 0.02 | 0.03 | 7.22 | 64,856 | 3.42 | 23.00 | 17 |

| 13 | 0.37 | 0.11 | 0.00 | 0.14 | 0.04 | 6.53 | 153,329 | 3.73 | 19.20 | 17 |

| 14 | 0.46 | 0.30 | 0.00 | 0.01 | 0.04 | 6.92 | 74,809 | 3.40 | 19.20 | 17 |

| 15 | 0.45 | 0.25 | 0.00 | 0.02 | 0.04 | 7.59 | 125,925 | 3.16 | 16.40 | 17 |

| 16 | 0.41 | 0.15 | 0.03 | 0.09 | 0.04 | 6.24 | 199,413 | 3.40 | 23.80 | 8 |

| 17 | 0.49 | 0.15 | 0.01 | 0.03 | 0.02 | 8.07 | 402,465 | 2.51 | 16.60 | 4 |

| 18 | 0.41 | 0.25 | 0.02 | 0.05 | 0.03 | 6.63 | 92,302 | 3.64 | 17.60 | 12 |

| 19 | 0.38 | 0.10 | 0.08 | 0.28 | 0.01 | 6.83 | 336,432 | 3.83 | 18.90 | 4 |

| 20 | 0.37 | 0.18 | 0.00 | 0.08 | 0.02 | 9.06 | 237,114 | 3.75 | 13.30 | 6 |

| 21 | 0.58 | 0.19 | 0.01 | 0.03 | 0.03 | 5.55 | 234,952 | 1.63 | 37.00 | 6 |

| 22 | 0.46 | 0.11 | 0.00 | 0.07 | 0.03 | 8.25 | 371,913 | 2.64 | 13.90 | 6 |

| 23 | 0.35 | 0.13 | 0.04 | 0.29 | 0.04 | 8.67 | 170,649 | 4.12 | 21.10 | 1 |

| 24 | 0.36 | 0.07 | 0.05 | 0.21 | 0.00 | 7.07 | 1,706,360 | 3.52 | 22.75 | 8 |

| 25 | 0.43 | 0.12 | 0.20 | 0.06 | 0.01 | 4.61 | 246,040 | 1.88 | 35.00 | 25 |

| 26 | 0.58 | 0.23 | 0.10 | 0.08 | 0.01 | 10.94 | 500,407 | 2.91 | 16.00 | 15 |

| 27 | 0.55 | 0.27 | 0.15 | 0.13 | 0.10 | 7.07 | 416,928 | 2.19 | 24.00 | 25 |

| 28 | 0.58 | 0.32 | 0.03 | 0.02 | 0.05 | 6.77 | 464,397 | 4.59 | 14.00 | 2 |

| 29 | 0.25 | 0.03 | 0.00 | 0.52 | 0.00 | 2.32 | 212,307 | 1.93 | 22.00 | 25 |

| 30 | 0.48 | 0.24 | 0.03 | 0.12 | 0.06 | 7.21 | 98,564 | 3.75 | 15.00 | 25 |

| 31 | 0.43 | 0.20 | 0.00 | 0.21 | 0.02 | 5.84 | 1,969,777 | 2.15 | 15.00 | 15 |

| 32 | 0.45 | 0.26 | 0.01 | 0.30 | 0.02 | 4.96 | 669,401 | 1.96 | 20.00 | 25 |

| 33 | 0.57 | 0.11 | 0.00 | 0.07 | 0.02 | 8.63 | 1,335,755 | 3.94 | 20.00 | 15 |

| 34 | 0.75 | 0.05 | 0.00 | 0.08 | 0.00 | 7.08 | 3,269,696 | 1.57 | 18.00 | 25 |

| 35 | 0.40 | 0.10 | 0.02 | 0.10 | 0.02 | 6.38 | 927,227 | 3.59 | 18.00 | 9 |

| Locality | Rate of Fix Cost on Total Cost (%) | Rate of Wages on Total Costs (%) | Rate of Stocks Costs on Total Costs (%) | Rate of Supply Costs on Total Costs (%) | Rate of Fixed Assets Costs on Total Costs (%) | Sales on 1 Ton of Aggregate (Eur per ton) | Sale of Aggregate (Tons) | Variable Costs per 1 Ton (Eur) | Los Angeles Test (%) | Period of Locality Ownership (Years) |

|---|---|---|---|---|---|---|---|---|---|---|

| 36 | 0.43 | 0.15 | 0.07 | 0.04 | 0.00 | 3.81 | 293,112 | 3.42 | 18.90 | 1 |

| 37 | 0.25 | 0.18 | 0.04 | 0.24 | 0.00 | 2.45 | 86,074 | 5.79 | 19.20 | 1 |

| 38 | 0.46 | 0.17 | 0.03 | 0.27 | 0.09 | 8.15 | 84,053 | 3.69 | 29.40 | 8 |

| 39 | 0.40 | 0.19 | 0.01 | 0.11 | 0.02 | 6.34 | 52,946 | 3.32 | 16.70 | 17 |

| 40 | 0.41 | 0.27 | 0.00 | 0.01 | 0.06 | 7.08 | 71,226 | 4.23 | 19.30 | 17 |

| 41 | 0.63 | 0.10 | 0.00 | 0.02 | 0.06 | 9.24 | 162,129 | 3.27 | 9.20 | 4 |

| 42 | 0.53 | 0.14 | 0.00 | 0.06 | 0.03 | 6.42 | 49,539 | 3.67 | 7.80 | 4 |

| 43 | 0.30 | 0.11 | 0.07 | 0.37 | 0.00 | 6.10 | 116,129 | 4.76 | 16.10 | 1 |

| 44 | 0.43 | 0.33 | 0.08 | 0.04 | 0.00 | 1.98 | 157,043 | 3.64 | 100.00 | 1 |

| 45 | 0.60 | 0.16 | 0.00 | 0.13 | 0.00 | 2.53 | 54,214 | 6.78 | 100.00 | 1 |

| 46 | 0.80 | 0.07 | 0.28 | 0.09 | 0.17 | 6.59 | 17,322 | 1.86 | 19.30 | 1 |

| 47 | 0.66 | 0.34 | 0.27 | 0.04 | 0.08 | 4.51 | 216,107 | 1.18 | 24.20 | 1 |

| 48 | 0.47 | 0.21 | 0.14 | 0.39 | 0.12 | 3.32 | 92,273 | 2.19 | 100.00 | 1 |

| 49 | 0.34 | 0.15 | 0.10 | 0.25 | 0.02 | 7.00 | 139,741 | 4.65 | 24.30 | 1 |

| 50 | 0.24 | 0.04 | 0.08 | 0.59 | 0.05 | 7.25 | 152,905 | 5.77 | 15.70 | 1 |

| 51 | 0.35 | 0.04 | 0.00 | 0.43 | 0.17 | 5.11 | 32,576 | 3.64 | 13.80 | 1 |

| 52 | 0.64 | 0.15 | 0.20 | 0.06 | 0.10 | 9.31 | 74,446 | 4.03 | 26.70 | 2 |

| 53 | 0.74 | 0.01 | 0.00 | 0.04 | 0.55 | 2.55 | 5,791 | 4.90 | 13.90 | 3 |

| 54 | 0.32 | 0.12 | 0.00 | 0.21 | 0.04 | 4.45 | 60,482 | 3.05 | 0.00 | 6 |

| 55 | 0.49 | 0.13 | 0.14 | 0.04 | 0.04 | 3.60 | 439,199 | 2.01 | 55.00 | 6 |

| 56 | 0.50 | 0.22 | 0.06 | 0.05 | 0.03 | 5.82 | 433,876 | 2.66 | 32.50 | 2 |

| 57 | 0.59 | 0.19 | 0.05 | 0.12 | 0.09 | 6.54 | 207,516 | 3.10 | 20.00 | 2 |

| 58 | 0.65 | 0.16 | 0.16 | 0.03 | 0.03 | 7.11 | 177,723 | 2.61 | 100.00 | 2 |

| 59 | 0.54 | 0.15 | 0.12 | 0.14 | 0.01 | 3.55 | 121,240 | 3.03 | 25.00 | 5 |

| 60 | 0.60 | 0.20 | 0.03 | 0.01 | 0.04 | 12.05 | 77,250 | 2.82 | 28.00 | 5 |

| 61 | 0.45 | 0.39 | 0.05 | 0.13 | 0.02 | 7.93 | 152,517 | 4.05 | 24.00 | 3 |

| 62 | 0.26 | 0.08 | 0.13 | 0.65 | 0.00 | 6.28 | 68,175 | 4.67 | 100.00 | 3 |

| 63 | 0.65 | 0.37 | 0.27 | 0.03 | 0.08 | 6.06 | 567,897 | 2.13 | 20.00 | 2 |

| 64 | 0.54 | 0.27 | 0.15 | 0.18 | 0.02 | 8.31 | 180,917 | 2.94 | 20.00 | 25 |

| 65 | 0.46 | 0.10 | 0.10 | 0.18 | 0.03 | 7.48 | 166,184 | 3.82 | 16.00 | 9 |

| 66 | 0.57 | 0.13 | 0.20 | 0,15 | 0.01 | 3.56 | 78,333 | 2.80 | 30.00 | 3 |

| 67 | 0.38 | 0.06 | 0.08 | 0.42 | 0.03 | 5.45 | 105,303 | 3.31 | 20.00 | 3 |

| 68 | 0.53 | 0.11 | 0.05 | 0.10 | 0.01 | 5.81 | 275,746 | 3.47 | 25.00 | 4 |

| 69 | 0.12 | 0.03 | 0.00 | 0.01 | 0.00 | 4.22 | 192,807 | 2.22 | 24.50 | 3 |

| 70 | 0.85 | 0.32 | 0.10 | 0.02 | 0.07 | 5.28 | 21,393 | 1.25 | 100.00 | 4 |

| Average Values of Indexes | Profitable Localities | Unprofitable Localities |

|---|---|---|

| Rate of fixed costs on total costs | 0.436 | 0.491 |

| Rate of wages on total costs | 0.169 | 0.167 |

| Rate of stocks costs on total costs | 0.024 | 0.087 |

| Rate of supply costs on total costs | 0.153 | 0.161 |

| Rate of fixed assets costs on total costs | 0.032 | 0.059 |

| Sales per 1 ton of aggregate (€/1 t) | 6.997 | 5.807 |

| Sale of aggregate (thousand tons) | 511.604 | 148.119 |

| Variable costs per 1 ton of aggregate (€/1 t) | 3.165 | 3.449 |

| Los Angeles test (%) | 18.916 | 37.557 |

| Period of locality ownership (years) | 14.743 | 4.371 |

| Correlation of Economic Result | Correlation Coefficient for Profitable Localities | Correlation Coefficient for Unprofitable Localities |

|---|---|---|

| Rate of fixed costs on total costs | 0.0985 | −0.1001 |

| Rate of wages on total costs wages on total costs | −0.0097 | −0.1241 |

| Rate of stocks costs on total costs | −0.1976 | −0.0061 |

| Rate of supply costs on total costs | −0.0388 | 0.2075 |

| Rate of fixed assets costs on total costs | −0.1092 | 0.1793 |

| Sales per 1 ton of aggregate (€/1 t) | 0.2051 | 0.2267 |

| Sale of aggregate (thousand tons) | 0.7483 | −0.3368 |

| Variable costs per 1 ton of aggregate (€/1 t) | −0.1381 | −0.1614 |

| Los Angeles test (%) | −0.1881 | 0.0215 |

| Period of locality ownership (years) | 0.2970 | 0.3538 |

| Results of Discriminant Analysis Application | |

|---|---|

| Variable (Discriminant) | Coefficient of Discrimination Function |

| Rate of fixed costs on total costs | a1 = −5.213 |

| Rate of wages on total costs | a2 = 2.850 |

| Rate of stocks costs on total costs | a 3 = −13.648 |

| Rate of supply costs on total costs | a4 = −1.688 |

| Rate of fixed assets costs on total costs | a5 = 0.711 |

| Sales per 1 ton of aggregate (€/1 t) | a6 = 0.312 |

| Sale of aggregate (thousand tons) | a7 = 0.002 |

| Variable costs per 1 ton of aggregate (€/1 t) | a8 = −0.378 |

| Los Angeles test (%) | a9 = −0.016 |

| Period of locality ownership (years) | a10 = 0.236 |

| Optimal Limit Value | C = 0.133726 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Csikosova, A.; Janoskova, M.; Culkova, K. Application of Discriminant Analysis for Avoiding the Risk of Quarry Operation Failure. J. Risk Financial Manag. 2020, 13, 231. https://doi.org/10.3390/jrfm13100231

Csikosova A, Janoskova M, Culkova K. Application of Discriminant Analysis for Avoiding the Risk of Quarry Operation Failure. Journal of Risk and Financial Management. 2020; 13(10):231. https://doi.org/10.3390/jrfm13100231

Chicago/Turabian StyleCsikosova, Adriana, Maria Janoskova, and Katarina Culkova. 2020. "Application of Discriminant Analysis for Avoiding the Risk of Quarry Operation Failure" Journal of Risk and Financial Management 13, no. 10: 231. https://doi.org/10.3390/jrfm13100231

APA StyleCsikosova, A., Janoskova, M., & Culkova, K. (2020). Application of Discriminant Analysis for Avoiding the Risk of Quarry Operation Failure. Journal of Risk and Financial Management, 13(10), 231. https://doi.org/10.3390/jrfm13100231