What Explains the Sovereign Credit Default Swap Spreads Changes in the GCC Region?

Abstract

:1. Introduction

2. Literature Review

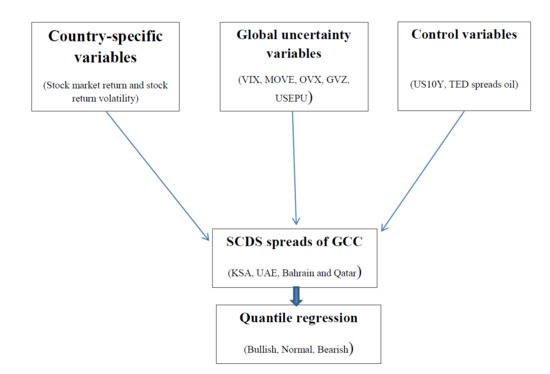

3. Model Specification and Methodology

4. Data Description

4.1. Data Description

4.2. Preliminary Analysis

5. Empirical Results and Discussion

5.1. Empirical Results for UAE

5.2. Empirical Results for Saudi Arabia

5.3. Empirical Results for Bahrain

5.4. Empirical Results for Qatar

5.5. Robustness Check

6. Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- António, Afonso, João Tovar Jalles, and Mina Kazemi. 2020. The effects of macroeconomic, fiscal and monetary policy announcements on sovereign bond spreads. International Review of Law and Economics 63: 105924. [Google Scholar]

- Aizenman, Joshua, Michael Hutchison, and Yothin Jinjarak. 2013. What is the risk of European sovereign debt defaults? Fiscal space, CDS spreads and market pricing of risk. Journal of International Money and Finance 34: 37–59. [Google Scholar] [CrossRef] [Green Version]

- Akyildirim, Erdinc, Shaen Corbet, Duc Khuong Nguyen, and Ahmet Sensoy. 2020. Regulatory Changes and Long-run Relationships of the EMU Sovereign Debt Markets: Implications for Future Policy Framework. International Review of Law and Economics 63: 105907. [Google Scholar] [CrossRef]

- Ang, Andrew, and Francis A. Longstaff. 2013. Systemic sovereign credit risk: Lessons from the US and Europe. Journal of Monetary Economics 60: 493–510. [Google Scholar] [CrossRef]

- Arezki, Rabah, and Markus Brückner. 2012. Resource windfalls and emerging market sovereign bond spreads: The role of political institutions. World Bank Economic Review 26: 78–99. [Google Scholar] [CrossRef] [Green Version]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, and Scarlet J. Terry. 2020. COVID Included Economic Uncertainty, Working Paper 26983. Available online: http://www.nber.org/papers/w26983 (accessed on 22 June 2020).

- Baum, Christopher F., and Chi Wan. 2010. Macroeconomic uncertainty and credit default swap spreads. Applied Financial Economics 20: 1163–71. [Google Scholar] [CrossRef] [Green Version]

- Beirne, John, and Marcel Fratzscher. 2013. The pricing of sovereign risk and contagion during the European sovereign debt crisis. Journal of International Money and Finance 34: 60–82. [Google Scholar] [CrossRef] [Green Version]

- Bouri, Elie, Maria E. de Boyrie, and Ivelina Pavlova. 2017. Volatility transmission from commodity markets to sovereign CDS spreads in emerging and frontier countries. International Review of Financial Analysis 49: 155–65. [Google Scholar] [CrossRef]

- Bouri, Elie, Syed Jawad, Hussain Shahzad, Naveed Raza, and David Roubaud. 2018. Oil volatility and sovereign risk of BRICS. Energy Economics 70: 258–69. [Google Scholar] [CrossRef]

- Chan, Kam Fong, and Alasta Marsden. 2014. Macro risk factors of credit default swap indices in a regime-switching framework. Journal of International Financial Markets, Institutions and Money 29: 285–308. [Google Scholar] [CrossRef]

- Chan, Kam C., Hung-Gay Fung, and Gaiyan Zhang. 2009. On the relationship between Asian credit default swap and equity markets. Journal of Asia Business Studies 4: 3–12. [Google Scholar] [CrossRef]

- Chan-Lau, Jorge A., and Yoon Sook Kim. 2004. Equity Prices, Credit Default Swaps, and Bond Spreads in Emerging Markets. Washington: International Monetary Fund. [Google Scholar]

- Da Silva, Paulo Pereira. 2014. Sovereign credit risk and stock markets: Does the markets’ dependency increase with financial Distress? International Journal of Financial Studies 2: 145–67. [Google Scholar] [CrossRef] [Green Version]

- Drago, Danilo, and Raffaele Gallo. 2016. The impact and the spillover effect of a sovereign rating announcement on the euro area CDS market. Journal of International Money and Finance 67: 264–86. [Google Scholar] [CrossRef]

- Drago, Danilo, Caterina Tommaso, and John Thornton. 2017. What determines bank CDS spreads? Evidence from European and US banks. Finance Research Letters 22: 140–45. [Google Scholar] [CrossRef] [Green Version]

- Eyssell, Thomas, Hung Gay Fung, and Gaiyan Zhang. 2013. Determinants and Price Discovery of China Sovereign Credit Default Swaps. China Economic Review 24: 1–15. [Google Scholar] [CrossRef]

- Galil, Koresh, Offer Shapir, Dan Amiram, and Uri Ben-Zion. 2014. The determinants of CDS spreads. Journal of Banking & Finance 41: 271–82. [Google Scholar]

- Gómez-Puig, Marta, and Simon Sosvilla-Rivero. 2014. Causality and contagion in EMU sovereign debt markets. International Review of Economics & Finance 33: 12–27. [Google Scholar]

- Gruppe, Mario, and Carsten Lange. 2014. Spain and the European sovereign debt crisis. European Journal of Political Economy 34: S3–S8. [Google Scholar] [CrossRef]

- Gruppe, Mario, and Carsten Lange. 2017. Interest rate convergence, sovereign credit risk and the European debt crisis: A survey. Journal of Risk Finance 18: 432–42. [Google Scholar] [CrossRef]

- Gulf Business. n.d. Available online: https://gulfbusiness.com/bahrains-credit-default-swaps-surpass-2016-peak/ (accessed on 17 June 2020).

- Hendricks, Wallace, and Roger Koenker. 1991. Hierarchical spline models for conditional quantiles and the demand for electricity. Journal of the American Statistical Association 87: 58–68. [Google Scholar] [CrossRef]

- Hilscher, Jens, and Yves Nosbusch. 2010. Determinants of sovereign risk: macroeconomic fundamentals and the pricing of sovereign debt. Review of Finance 14: 235–62. [Google Scholar] [CrossRef] [Green Version]

- Jeanneret, Alexandre. 2018. Sovereign credit spreads under good/bad governance. Journal of Banking and Finance 93: 230–46. [Google Scholar] [CrossRef]

- Koenker, Roger. 2005. Quantile Regression. Cambridge: Cambridge University Press. [Google Scholar]

- Koenker, Roger, and Gilbert J. Bassett. 1978. Regression quantiles. Econometrica 46: 33–50. [Google Scholar] [CrossRef]

- Koenker, Roger, and Gilbert Bassett. 1982. Robust Tests for Heteroscedasticity Based on Regression Quantiles. Econometrica 50: 43–61. [Google Scholar] [CrossRef] [Green Version]

- Lee, Hwang, and Jung-Soon Hyun. 2019. The asymmetric effect of equity volatility on credit default swap spreads. Journal of Banking & Finance 98: 125–36. [Google Scholar]

- Liu, Yang, and Bruce Morley. 2012. Sovereign credit default swaps and the macroeconomy. Applied Economics Letters 19: 129–32. [Google Scholar] [CrossRef] [Green Version]

- Longstaff, Francis A., Jun Pan, Lasse H. Pedersen, and Kenneth J. Singleton. 2011. How sovereign is sovereign credit risk? American Economic Journal 3: 75–103. [Google Scholar] [CrossRef] [Green Version]

- Merton, C. Robert. 1974. On the Pricing of Corporate Debt: The Risk Structure of Interest Rates. Journal of Finance 29: 449–70. [Google Scholar]

- Moro, Beniamino. 2014. Lessons from the European economic and financial great crisis: A survey. European Journal of Political Economy 34: S9–S24. [Google Scholar] [CrossRef]

- Nader, Naifar, Syed Jawad Hussain Shahzad, and Shawkat Hammoudeh. 2020. Dynamic nonlinear impacts of oil price returns and financial uncertainties on credit risks of oil-exporting countries. Energy Economics 88: 104747. [Google Scholar] [CrossRef]

- Office of the Comptroller of the Currency. 2019. Quarterly Report on Bank Trading and Derivatives Activities, Third Quarter 2019. [Google Scholar]

- Pan, Jun, and Kenneth J. Singleton. 2008. Default and Recovery Implicit in the Term Structure of Sovereign CDS Spreads. Journal of Finance 63: 2345–84. [Google Scholar] [CrossRef] [Green Version]

- Pavlova, Ivelina, Maria E. de Boyrie, and Ali M. Parhizgari. 2018. A dynamic spillover analysis of crude oil effects on the sovereign credit risk of exporting countries. The Quarterly Review of Economics and Finance 68: 10–22. [Google Scholar] [CrossRef]

- Pires, Pedro, João Pedro Pereira, and Luà s Filipe Martins. 2013. The empirical determinants of credit default swap spreads: a quantile regression approach. European Financial Management 21: 556–89. [Google Scholar] [CrossRef]

- Qian, Zongxin, and Qian Luo. 2015. Regime-Dependent Determinants of China’s Sovereign Credit Default Swap Spread. Emerging Markets Finance and Trade 52: 10–21. [Google Scholar] [CrossRef]

- Reuters. 2018. Available online: http://fingfx.thomsonreuters.com/gfx/rngs/GULF-QATAR-QIA/010041PS3P9/index.html (accessed on 12 June 2020).

- Reuters. 2020. Available online: https://www.reuters.com/article/saudi-credit-oil/saudi-arabia-credit-default-swaps-spike-ihs-markit-idUSD5N29W01B (accessed on 12 June 2020).

- Rodríguez, Iván, Dandapani Krishnan, and Lawrence Edward. 2019. Measuring Sovereign Risk: Are CDS Spreads Better than Sovereign Credit Ratings? Financial Management 48: 229–56. [Google Scholar] [CrossRef]

- Sensoy, Ahmet, Duc Khuong Nguyen, Ahmed Rostom, and Erk Hacihasanoglu. 2019. Dynamic integration and network structure of the EMU sovereign bond markets. Annals of Operations Research 281: 297–314. [Google Scholar] [CrossRef] [Green Version]

- Stolbov, Mikhail. 2016. Determinants of sovereign credit risk: The case of Russia. Post-Communist Economies 29: 51–70. [Google Scholar] [CrossRef]

- Wang, Ping, and Tomoe Moore. 2012. The integration of the credit default swap markets during the us subprime crisis: Dynamic correlation analysis. Journal of International Financial Markets, Institutions and Money 22: 1–15. [Google Scholar] [CrossRef] [Green Version]

- Wang, Hao, Hao Zhou, and Yi Zhou. 2013. Credit default swap spreads and variance risk premia. Journal of Banking & Finance 37: 3733–46. [Google Scholar]

- Wegener, Christoph, Tobias Basse, Frederik Kunze, and Hans-Jörg von Mettenheim. 2016. Oil prices and sovereign credit risk of oil producing countries: an empirical investigation. Quantitative Finance 16: 1961–68. [Google Scholar] [CrossRef]

- Yu, Sherry. 2016. The effect of political factors on sovereign default. Review of Political Economy 28: 397–416. [Google Scholar] [CrossRef]

| 1 | The credit events include failure to pay interest or principal on, and the restructuring of, one or more obligations issued by the sovereign. |

| 2 | |

| 3 | The collapse came after Saudi Arabia announced that it would increase production after the OPEC and Russia failed to reach an agreement to address the falling demand caused by the coronavirus crisis. |

| 4 | |

| 5 | Generalized AutoRegressive Conditional Heteroskedasticity (GARCH). |

| 6 | The 5 years CDS spread has commonly been used in previous studies, including Wang et al. (2013); Galil et al. (2014); and Lee and Hyun (2019); among others. |

| 7 | The end of the period is 17 January 2020, in order to ensure that the global COVID-19 crisis does not overlap with our sample period. We assumed that the coronavirus crisis period started from 24 January 2020, the date at which the World Health Organization (WHO) assessed the risk of coronavirus to be high at the global level. |

| 8 | “A decline in oil prices over the past few weeks, from around $80 per barrel in mid-May to $74 on Sunday, has lifted the CDS of Saudi Arabia and Qatar by 7 bps and 10 bps, respectively. Bahrain’s CDS soared 82 points since mid-May”. Source: (Gulf Business n.d.). |

| 9 | GARCH models are commonly used to model the volatility of stock returns. |

| 10 | Hilscher and Nosbusch (2010) showed that the TED spread is an indicator of aggregated liquidity and used it as explanatory variables to explain the variation of SCDS spreads. |

| 11 | Arbor Investment Planner |

| 12 | We controlled the autocorrelation problem by using the serial correlation LM test in EViews. |

| 13 | |

| 14 | The test consists of testing the equality of the slope parameters () across two quantiles τ1 and τ2: α2(τ2) − α2(τ1) = (Q2(τ2) − Q1(τ2)) − (Q2(τ1) − Q1(τ1)) = (Q2(τ2) − Q2(τ1)) − (Q1(τ2) − Q1(τ1)) = 0 |

| 15 | Results of the Wald test statistics which are not reported here (because the limitation of space) but are available upon request. |

| Variables | Definition | Expected Sign |

|---|---|---|

| Dependent variable | ||

| SCDS | 5 years sovereign CDS spread change, in basis points. | |

| Country-specific explanatory variables | ||

| SR | The return of the country stock index. | − |

| SV | Volatility estimated by using GARCH (1,1) model of country stock return | + |

| Global uncertainty factors explanatory variables | ||

| VIX | Implied volatility on S&P 500 index options. | + |

| MOVE | Implied volatility on the global bond market | + |

| OVX | The market’s expectation of 30 days volatility of crude oil prices | + |

| GVZ | The market’s expectation of 30 days volatility of gold prices | + |

| USEPU | The Global Economic Policy Uncertainty Index | + |

| Control variables | ||

| US10Y | The 10 years US Treasury rate. It is considered as the proxy of the world interest rates | + |

| TED | The TED spread is the difference between the three-month Treasury bill and the three-month LIBOR based in US dollars | − |

| OIL | The US crude oil prices | − |

| VIX | MOVE | OVX | GVZ | USEPU | OIL | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean | 0.176648 | 0.113437 | 0.470155 | 0.107451 | 14.71749 | 65.99800 | 32.49104 | 15.45600 | 114.6228 | 64.02631 |

| Median | −0.44500 | −0.410000 | −0.16000 | −0.32000 | 13.76000 | 64.60140 | 29.86000 | 14.96000 | 103.7200 | 56.74000 |

| Maximum | 67.50000 | 69.94000 | 205.0000 | 68.94500 | 30.11000 | 117.8877 | 78.97000 | 31.84000 | 339.3700 | 110.5300 |

| Minimum | −36.6650 | −19.25500 | −57.4500 | −18.5100 | 9.140000 | 45.73230 | 14.50000 | 8.890000 | 4.050000 | 29.42000 |

| Std. Dev. | 8.279204 | 6.829199 | 19.13227 | 5.786802 | 3.804784 | 13.51715 | 11.32463 | 4.194197 | 52.24724 | 21.14197 |

| Skewness | 4.991018 | 4.326324 | 3.589452 | 5.098268 | 1.461999 | 0.646180 | 0.901142 | 0.760953 | 1.270832 | 0.802497 |

| Kurtosis | 25.77698 | 41.20713 | 39.84791 | 60.04097 | 5.411215 | 3.026889 | 3.576884 | 3.217882 | 5.567362 | 2.376500 |

| Jarque-Bera | 8203.10 * | 22,700.08 * | 20,845.9 * | 49,665.1 * | 212.463 * | 24.7156 * | 52.9693 * | 34.9626 * | 193.052 * | 43.8537 * |

| ADF test | −23.60 * (0.000) | −24.37 * (0.000) | −26.58 * (0.000) | −25.00 * (0.000) | −3.29 * (0.069) | −4.61 * (0.001) | −3.29 * (0.069) | −5.93 * (0.000) | −13.56 * (0.000) | −17.32 * (0.000) |

| US10Y | TED | SASR | QASR | BHSR | AESR | SASV | QASV | BHSV | AESV | |

| Mean | 2.322987 | 0.299681 | 0.000720 | 0.000899 | 0.001242 | 0.001739 | 0.059480 | 0.065511 | 0.011835 | 0.048036 |

| Median | 2.341800 | 0.268000 | 0.002588 | 0.002389 | 0.000643 | 0.001679 | 0.046700 | 0.056000 | 0.011300 | 0.041500 |

| Maximum | 3.232800 | 0.630000 | 0.088193 | 0.113316 | 0.048713 | 0.066499 | 0.351500 | 0.240200 | 0.018300 | 0.158400 |

| Minimum | 1.357900 | 0.147500 | −0.10093 | −0.07470 | −0.03610 | −0.07099 | 0.025900 | 0.038800 | 0.006440 | 0.020000 |

| Std. Dev. | 0.418174 | 0.107263 | 0.023724 | 0.025078 | 0.011226 | 0.020932 | 0.038858 | 0.029732 | 0.002684 | 0.026098 |

| Skewness | −0.10001 | 0.977268 | −0.33641 | 0.066625 | 0.094246 | −0.09993 | 2.932230 | 3.072336 | 0.241667 | 1.801075 |

| Kurtosis | 2.178910 | 3.152711 | 5.130470 | 4.284913 | 4.711037 | 3.977335 | 15.62012 | 14.84408 | 2.157301 | 6.677409 |

| Jarque–Bera | 105.642 * | 56.854 * | 73.8342 * | 24.683 * | 43.833 * | 147.76 * | 2864.54 * | 2633.49 * | 139.65 * | 391.96 * |

| ADF test | −20.71 * (0.000) | −14.41 * (0.000) | −16.51 * (0.000) | −16.99 * (0.000) | −16.90 * (0.000) | −17.43 * (0.000) | −5.12 * (0.000) | −5.52 * (0.000) | −17.72 * (0.000) | −5.91 * (0.000) |

| Bearish Market | Normal Market | Bullish Market | ||||||

|---|---|---|---|---|---|---|---|---|

| OLS | Q(0.05) | Q(0.10) | Q(0.25) | Q(0.50) | Q(0.75) | Q(0.90) | Q(0.95) | |

| VIX | 0.403557 * (0.000) | 0.299196 ** (0.048) | 0.355261 * (0.002) | 0.192164 * (0.008) | 0.223908 * (0.009) | 0.198862 (0.227) | 0.62065 * (0.006) | 0.627964 * (0.006) |

| MOVE | −0.066711 * (0.016) | −0.068831 (0.245) | −0.042818 (0.284) | −0.021443 (0.429) | −0.021807 (0.380) | −0.06096 ** (0.046) | −0.085132 (0.112) | −0.08074 (0.243) |

| OVX | −0.011056 (0.685) | −0.15167 ** (0.032) | −0.10862 ** (0.017) | −0.0567 *** (0.0919) | −0.029624 (0.227) | 0.0770 *** (0.056) | 0.166449 * (0.004) | 0.10632 (0.161) |

| GVZ | 0.053892 (0.523) | −0.035950 (0.893) | −0.083687 (0.562) | 0.017886 (0.808) | 0.074085 (0.324) | 0.109426 (0.204) | 0.118539 (0.312) | 0.110533 (0.536) |

| USEPU | −0.001938 (0.691) | −0.007819 (0.449) | −0.000192 (0.978) | −0.002280 (0.605) | −0.005608 (0.106) | −0.003736 (0.556) | 0.005298 (0.648) | 0.003176 (0.788) |

| OIL | 0.394622 * (0.000) | −0.285126 (0.342) | −0.149634 (0.476) | −0.066789 (0.641) | −0.0634 (0.742) | 0.200708 (0.532) | 0.427536 (0.231) | 0.267276 (0.501) |

| US10Y | 0.648354 ** (0.012) | 0.688775 (0.378) | 0.234283 (0.954) | −0.1954178 (0.460) | −0.923813 (0.731) | 0.2431990 (0.619) | 0.982146 (0.206) | 0.154541 ** (0.049) |

| TED | 0.24417 ** (0.010) | −0.099158 (0.675) | 0.923280 (0.952) | 0.346184 (0.746) | 0.519967 (0.590) | 0.9359298 (0.565) | 0.4309 *** (0.059) | 0.58748 ** (0.047) |

| SR | −0.49092 * (0.000) | −0.0253831 (0.941) | −0.188450 (0.479) | −0.2284 *** (0.072) | −0.15310 (0.250) | −0.161951 (0.296) | −0.49733 ** (0.051) | −0.70991 ** (0.010) |

| SV | 0.25207 ** (0.012) | 0.156730 (0.384) | 0.128522 (0.354) | 0.2431400 (0.805) | 0.132963 (0.243) | 0.25890 ** (0.043) | 0.1687529 (0.442) | 0.9472227 (0.749) |

| Cons | −0.2925 *** (0.052) | −0.1804 *** (0.057) | −2.386325 (0.254) | −1. 693504 (0.284) | −2.499234 (0.100) | −1.8513 ** (0.0396) | −6.301212 (0.105) | −2.51419 (0.529) |

| 0.354595 | 0.126566 | 0.081582 | 0.022699 | 0.009995 | 0.049028 | 0.219688 | 0.347211 | |

| Bearish Market | Normal Market | Bullish Market | ||||||

|---|---|---|---|---|---|---|---|---|

| OLS | Q(0.05) | Q(0.10) | Q(0.25) | Q(0.50) | Q(0.75) | Q(0.90) | Q(0.95) | |

| VIX | 0.614607 * (0.000) | 0.126596 (0.733) | 0.3915 *** (0.086) | 0.280375 ** (0.022) | 0.220379 (0.163) | 0.601670 ** (0.013) | 0.17932 * (0.002) | 0.165968 ** (0.017) |

| MOVE | −0.079254 (0.705) | 0.021085 (0.738) | 0.006633 (0.908) | −0.0698 (0.101) | −0.026685 (0.414) | −0.097626 * (0.007) | −0.0979 (0.166) | −0.18464 (0.137) |

| OVX | −0.023262 (0.603) | −0.23270 * (0.004) | −0.22483 * (0.008) | −0.0691 (0.1146) | −0.004285 (0.911) | 0.053015 (0.289) | 0.040896 (0.589) | 0.077236 (0.540) |

| GVZ | 0.116505 (0.368) | −0.125584 (0.538) | −0.136307 (0.446) | 0.19923 *** (0.0934) | 0.121066 (0.208) | 0.19129 *** (0.0699) | 0.043347 (0.803) | 0.079957 (0.805) |

| USEPU | −0.008763 (0.252) | 0.000432 (0.974) | −0.005346 (0.570) | −0.008643 (0.168) | −0.008739 (0.181) | −0.010961 (0.189) | 0.007366 (0.609) | 0.024907 (0.246) |

| OIL | 0.371513 * (0.000) | −0.443619 (0.200) | −0.431538 (0.105) | −0.222985 (0.288) | 0.080278 (0.756) | 0.388657 (0.236) | 0.411847 (0.200) | 0.275961 (0.444) |

| US10Y | 0.4292648 (0.288) | 0.840462 (0.298) | −0.421948 (0.946) | 0.2578716 (0.520) | −0.115139 (0.760) | 0.3705774 (0.459) | 0.13105 (0.103) | 0.905986 (0.290) |

| TED | 0.450843 * (0.003) | 0.331194 (0.160) | 0.4004 *** (0.075) | 0.23095 *** (0.077) | 0.23144 *** (0.060) | 0.14669 (0.430) | 0.401295 (0.923) | 0.74591 (0.120) |

| SR | −0.67018 * (0.000) | −0.188162 (0.560) | −0.45782 ** (0.041) | −0.519427 * (0.000) | −0.419634 ** (0.029) | −0.52136 * (0.001) | −0.86341 ** (0.017) | −0.184567 * (0.004) |

| SV | 0.544869 (0.563) | −0.1691723 (0.592) | −0.1274608 (0.620) | 0.8544111 (0.532) | 0.5425824 (0.435) | 0.1663579 (0.190) | 0.160966 (0.578) | 0.6348521 (0.249) |

| Cons | −0.1409 *** (0.075) | −0.1895153 (0.729) | −0.242412 (0.519) | −0.3207 *** (0.095) | −0.263138 (0.271) | −0.374841 (0.205) | −0.598677 (0.134) | −0.938339 (0.197) |

| 0.215724 | 0.137334 | 0.084704 | 0.037561 | 0.030137 | 0.079923 | 0.189339 | 0.275252 | |

| Bearish Market | Normal Market | Bullish Market | ||||||

|---|---|---|---|---|---|---|---|---|

| OLS | Q(0.05) | Q(0.10) | Q(0.25) | Q(0.50) | Q(0.75) | Q(0.90) | Q(0.95) | |

| VIX | 0.1255761 * (0.000) | 0.12298 (0.138) | 0.14142 (0.133) | 0.521540 (0.119) | 0.56698 *** (0.071) | 0.128753 * (0.007) | 0.192076 * (0.000) | 0.20904 ** (0.010) |

| MOVE | −0.143960 (0.154) | −0.079333 (0.740) | −0.227672 (0.220) | −0.206202 (0.140) | −0.097762 (0.284) | −0.110543 (0.390) | −0.153265 (0.455) | −0.4963 *** (0.099) |

| OVX | −0.016238 (0.869) | −0.369626 (0.255) | −0.190992 (0.352) | −0.024492 (0.852) | 0.070901 (0.424) | 0.067166 (0.604) | 0.02018 ** (0.924) | 0.19729 (0.522) |

| GVZ | 0.357137 (0.273) | 0.129175 (0.860) | 0.625370 (0.306) | 0.309764 (0.410) | 0.218162 (0.380) | −0.056784 (0.879) | 0.242823 (0.698) | 1.604163 (0.194) |

| USEPU | −0.023624 (0.182) | −0.013316 (0.717) | −0.035652 (0.216) | −0.006293 (0.789) | −0.010950 (0.474) | 0.005890 (0.777) | −0.026769 (0.232) | −0.023628 (0.510) |

| OIL | 0.1326370 * (0.000) | −0.1796350 (0.193) | −0.155873 (0.849) | −0.376219 (0.579) | −0.07120 (0.924) | −0.96555 (0.302) | −0.171069 (0.119) | −0.1575388 (0.216) |

| US10Y | 0.16912 *** (0.066) | −0.1740826 (0.466) | −0.1580101 (0.398) | 0.565123 (0.968) | −0.4537271 (0.652) | 0.648916 (0.734) | 0.1851903 (0.360) | 0.88652 (0.230) |

| TED | 0.2010183 (0.557) | 0.6758793 (0.499) | 0.2488100 (0.714) | −0.7979146 (0.838) | −0.2739825 (0.412) | −0.3947647 (0.930) | −0.8821718 (0.868) | −0.555821 (0.516) |

| SR | −0.100955 (0.119) | 0.2379357 (0.203) | 0.1821272 (0.907) | −0.552687 (0.599) | −0.9506433 (0.143) | −0.21048 ** (0.039) | −0.15193 ** (0.027) | −0.2356 (0.404) |

| SV | 0.4342134 (0.275) | 0.688286 (0.328) | 0.7582168 (0.109) | 0.4564775 (0.315) | −0.6411987 (0.821) | −0.4857256 (0.319) | 0.708989 (0.896) | 0.147812 (0.180) |

| Cons | −16.130 *** (0.059) | −34.238 (0.138) | −28.4280 ** (0.032) | −10.20636 (0.399) | −5.15431 (0.442) | 0.09145 ** (0.043) | −3.075692 (0.818) | −19.2775 (0.411) |

| 0.240510 | 0.054523 | 0.027635 | 0.023172 | 0.018959 | 0.087324 | 0.167924 | 0.234852 | |

| Bearish Market | Normal Market | Bullish Market | ||||||

|---|---|---|---|---|---|---|---|---|

| OLS | Q(0.05) | Q(0.10) | Q(0.25) | Q(0.50) | Q(0.75) | Q(0.90) | Q(0.95) | |

| VIX | 0.40764 * (0.000) | 0.162880 (0.490) | 0.245047 (0.176) | 0.120688 (0.278) | 0.303683 * (0.007) | 0.450933 * (0.008) | 0.757003 * (0.007) | 0.876437 * (0.008) |

| MOVE | −0.07826 ** (0.029) | 0.063602 (0.493) | −0.041738 (0.490) | −0.047498 (0.235) | −0.0564 *** (0.060) | −0.0670 ** (0.032) | −0.1037 ** (0.039) | −0.058494 (0.455) |

| OVX | 0.002798 (0.935) | −0.124946 (0.108) | −0.058007 (0.298) | −0.024400 (0.470) | −0.024456 (0.407) | 0.042208 (0.339) | 0.067911 (0.310) | 0.073529 (0.443) |

| GVZ | 0.108436 (0.301) | −0.194096 (0.497) | 0.100982 (0.555) | 0.039498 (0.662) | 0.093631 (0.243) | 0.185015 (0.038) | 0.172142 (0.264) | −0.190432 (0.409) |

| USEPU | −0.000130 (0.983) | 0.000942 (0.946) | 0.001341 (0.852) | −0.002978 (0.598) | −0.001841 (0.690) | 0.003180 (0.599) | −0.008621 (0.414) | 0.003468 (0.817) |

| OIL | 0.32878 * (0.000) | −0.351817 (0.228) | −0.3756 *** (0.074) | −0.17387 * (0.003) | −0.058149 (0.816) | 0.274695 (0.422) | 0.368764 (0.324) | 0.301819 (0.505) |

| US10Y | 0.981574 * (0.002) | 0.5474248 (0.491) | 0.6015854 (0.187) | −0.1414253 (0.717) | −0.025659 (0.994) | 0.7233461 (0.172) | 0.16900 * (0.007) | 15.39974 (0.120) |

| TED | 0.312085 ** (0.010) | 0.260031 (0.278)1 | 0.2328925 (0.232) | 0.1207233 (0.420) | 0.22401 *** (0.068) | 0.2408620 (0.162) | 0.6698690 (0.782) | 0.36681 (0.336) |

| SR | −0.32012 ** (0.013) | 0.4205332 (0.895) | −0.4573764 (0.815) | −0.6450515 (0.657) | −0.285719 * (0.002) | −0.2653 *** (0.063) | −0.2149 *** (0.051) | −0.3719 *** (0.059) |

| SV | 0.254085 ** (0.026) | 0.36953 ** (0.045) | −0.6095467 (0.695) | 0.1080026 (0.337) | 0.18551 *** (0.060) | 0.1756954 (0.131) | 0.137486 (0.996) | −0.9570934 (0.857) |

| Cons | −4.2393 ** (0.037) | −9.1020 *** (0.083) | −6.0958 *** (0. 08) | −1.572784 (0.444) | −2.2503906 (0.185) | −5.4984 ** (0.019) | −2.588255 (0.562) | −0.431895 (0.946) |

| 0.261624 | 0.063681 | 0.054827 | 0.037046 | 0.049386 | 0.094146 | 0.195487 | 0.263636 | |

| Saudi Arabia | Bahrain | Qatar | UAE | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Bearish | Normal | Bullish | Bearish | Normal | Bullish | Bearish | Normal | Bullish | Bearish | Normal | Bullish | |

| VIX | S | NS | S | NS | S | S | NS | S | S | S | S | S |

| MOVE | NS | NS | S | NS | NS | S | NS | S | S | NS | NS | S |

| OVX | S | NS | NS | NS | NS | NS | NS | NS | NS | S | NS | NS |

| GVZ | S | NS | S | NS | NS | S | NS | NS | NS | NS | NS | NS |

| USEPU | NS | NS | NS | NS | NS | NS | NS | NS | NS | NS | NS | NS |

| OIL | NS | NS | NS | NS | NS | NS | S | NS | NS | NS | NS | NS |

| US10Y | NS | NS | NS | NS | NS | NS | NS | NS | S | NS | NS | S |

| TED | S | S | NS | NS | NS | NS | NS | S | NS | S | NS | S |

| SR | S | S | S | NS | NS | S | NS | S | S | NS | NS | S |

| SV | NS | NS | S | NS | NS | S | S | S | NS | NS | NS | S |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Naifar, N. What Explains the Sovereign Credit Default Swap Spreads Changes in the GCC Region? J. Risk Financial Manag. 2020, 13, 245. https://doi.org/10.3390/jrfm13100245

Naifar N. What Explains the Sovereign Credit Default Swap Spreads Changes in the GCC Region? Journal of Risk and Financial Management. 2020; 13(10):245. https://doi.org/10.3390/jrfm13100245

Chicago/Turabian StyleNaifar, Nader. 2020. "What Explains the Sovereign Credit Default Swap Spreads Changes in the GCC Region?" Journal of Risk and Financial Management 13, no. 10: 245. https://doi.org/10.3390/jrfm13100245

APA StyleNaifar, N. (2020). What Explains the Sovereign Credit Default Swap Spreads Changes in the GCC Region? Journal of Risk and Financial Management, 13(10), 245. https://doi.org/10.3390/jrfm13100245