Challenges and Trends in Sustainable Corporate Finance: A Bibliometric Systematic Review

Abstract

:1. Introduction

- To investigate the state-of-the-art SCF in the literature; and

- To identify future debates and study trends to enhance future studies.

2. Method

2.1. Proposed Analysis Steps

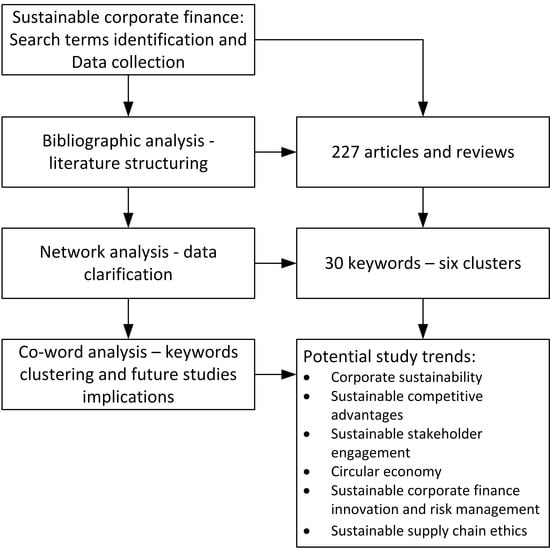

- Identifying search terms to extract SCF publications from the Scopus database.

- Conducting a bibliographic analysis to classify the SCF literature structure using VOSviewer software.

- Approaching the network analysis for data clarification to extract available descriptive information, such as publication time, journal, countries/territories and keywords.

- Analyzing the keywords, co-occurrence frequencies and keywords clustering using co-word analysis to specify future study implications.

2.2. Data Collection

2.3. Bibliometric Analysis

2.4. Network Analysis

2.5. Co-Word Analysis

3. Results

3.1. Bibliometric and Network Analysis Results

3.2. Co-Word Analysis

4. Discussion and Implications

4.1. Corporate Finance in Sustainability

4.2. Sustainable Competitive Advantages

4.3. Sustainable Stakeholder Engagement

4.4. Circular Economy

4.5. Sustainable Corporate Finance Innovation and Risk Management

4.6. Sustainable Supply Chain Ethics

5. Concluding Remarks

- Future studies on corporate sustainability can inspect novel resources of competitive advantages and the value creation related to a firm’s activities or funding accomplishments in both the short and long term. Requirements exist for implications regarding control structure rights, the establishment of monitoring positions and sustainable return generation studies, such as in financial crises and market risks control. Additionally, the consequences of sustainability index inclusion and exclusion on corporate value also need to be further investigated.

- Sustainable competitive advantages can possibly offer better SCF performance. However, there are still gaps remaining in financing and investment decision interactions, the competitive environment and organizational structure, sustainable investments, sustainable technologies and strategies. To create unique combinations of organizational processes to gather strategic knowledge and better performance, how to set a sustainable competitive scale and guideline actions for firms according to their capabilities is recommended.

- Sustainable stakeholder engagement, ownership responsibility, public pressure, social network and political connections remain unclear. The multidimensional approaches to the sustainable development concept instantaneously connect to the TBL, and various value creation conventional syntheses and optimizing sustainable investments and financial returns need to be explored.

- CE still requires many studies on fiscal availability; for example, the quality of the firm’s financial resources and public subsidies, interest in financial resources, capital assessments and venture capital need to be addressed. Collaboration within the CE, such as on financial issues in industrial symbiosis, external ventures, financing synergy partnerships, circular infrastructure and activities, learning and innovation and enabling cross-cooperation and coordination among the circular network, is recommended.

- Novel financial innovation models that indicate systemic attributes and constraints and circumstances forecasts, debt provision and loan contracts and collaborative innovation among supply chain partners represent potential study opportunities to balance environmental, social and financial performances. However, qualitative risk categories still tolerate firms having more stable cash flows and extensive cost reductions. In potential financial crises, studies on financial entities, such as banks, credit rating agencies and institutional investors, are needed for financial decision-making processes. Risk management policies or financial provisions for social responsibilities, environmental contamination or wildlife habitat restorations are becoming more urgent. Sustainable financial flows related to natural disasters, wars, terrorism and pandemic risks are arguably becoming relevant data on firms’ resilience to corporate finance risk.

- A sustainable supply chain ethical framework is necessary for SCF ethical apprehensions because financial decisions remain unclear. Trust in finance, a firm’s behavior, moral pricing requests and sustainable financial policy must be further discovered. From the supply chain viewpoint, collaborative capabilities based on the moral standard and demographic and gender equality problems also call for future studies.

Author Contributions

Funding

Conflicts of Interest

References

- Aid, Graham, Mats Eklund, Stefan Anderberg, and Leenard Baas. 2017. Expanding roles for the Swedish waste management sector in inter-organizational resource management. Resources, Conservation and Recycling 124: 85–97. [Google Scholar] [CrossRef]

- Albelda, Esther. 2011. The role of management accounting practices as facilitators of the environmental management. Sustainability Accounting, Management and Policy Journal 2: 76–100. [Google Scholar] [CrossRef]

- Allen, Franklin, Jun Qian, and Meijun Qian. 2005. Law, finance, and economic growth in China. Journal of Financial Economics 77: 57–116. [Google Scholar] [CrossRef] [Green Version]

- Ambrosini, Véronique, Cliff Bowman, and Nardine Collier. 2009. Dynamic capabilities: An exploration of how firms renew their resource base. British Journal of Management 20: S9–S24. [Google Scholar] [CrossRef] [Green Version]

- Ang, James. 2019. 100 research ideas: Extending the frontiers of research in corporate finance. Global Finance Journal, 100483, in press. [Google Scholar] [CrossRef]

- Ansari, Zulfiquar N., and Ravi Kant. 2017. A state-of-art literature review reflecting 15 years of focus on sustainable supply chain management. Journal of Cleaner Production 142: 2524–43. [Google Scholar] [CrossRef]

- Aragón-Correa, J. Alberto, and Sanjay Sharma. 2003. A contingent resource-based view of proactive corporate environmental strategy. Academy of Management Review 28: 71–88. [Google Scholar] [CrossRef] [Green Version]

- Aranda-Usón, Alfonso, Pilar Portillo-Tarragona, Luz María Marín-Vinuesa, and Sabina Scarpellini. 2019. Financial resources for the circular economy: A perspective from businesses. Sustainability 11: 888. [Google Scholar] [CrossRef] [Green Version]

- Arseculeratne, Dinuk, and Rashad Yazdanifard. 2013. Barriers to Cross Cultural Communication and the Steps Needed to Be Taken for a MNC to Succeed in the Global Market. 1–9. Available online: https://www.researchgate.net/publication/258401174 (accessed on 23 August 2020).

- Artiach, Tracy, Darren Lee, David Nelson, and Julie Walker. 2010. The determinants of corporate sustainability performance. Accounting & Finance 50: 31–51. [Google Scholar]

- Azzimonti, Marina. 2018. Partisan conflict and private investment. Journal of Monetary Economics 93: 114–31. [Google Scholar] [CrossRef] [Green Version]

- Baboukardos, Diogenis. 2018. The valuation relevance of environmental performance revisited: The moderating role of environmental provisions. The British Accounting Review 50: 32–47. [Google Scholar] [CrossRef] [Green Version]

- Baker, H. Kent, Satish Kumar, and Debidutta Pattnaik. 2020. Twenty-five years of the journal of corporate finance: A scientometric analysis. Journal of Corporate Finance, 101572, in press. [Google Scholar] [CrossRef]

- Bals, Cristof. 2019. Toward a supply chain finance (SCF) ecosystem–Proposing a framework and agenda for future research. Journal of Purchasing and Supply Management 25: 105–17. [Google Scholar] [CrossRef]

- Banerji, Sanjay, and Dawei Fang. 2020. Money as a Weapon: Financing a Winner-Take-All Competition. Working Paper. February 20, Gothenburg: University of Gothenburg. [Google Scholar]

- Barton, Dominic, and Mark Wiseman. 2015. The cost of confusing shareholder value and short-term profit. Financial Times 31: 2015. [Google Scholar]

- Bennedsen, Morten, and Daniel Wolfenzon. 2000. The balance of power in closely held corporations. Journal of Financial Economics 58: 113–39. [Google Scholar] [CrossRef] [Green Version]

- Bennedsen, M., M. Tsoutsoura, and D. Wolfenzon. 2019. Drivers of effort: Evidence from employee absenteeism. Journal of Financial Economics 133: 658–84. [Google Scholar] [CrossRef]

- Bhatt, Yogesh, Karminder Ghuman, and Amandeep Dhir. 2020. Sustainable manufacturing. Bibliometrics and content analysis. Journal of Cleaner Production 260: 120988. [Google Scholar] [CrossRef]

- Bocken, Nancy M. P., Ingrid De Pauw, Conny Bakker, and Bram Van Der Grinten. 2016. Product design and business model strategies for a circular economy. Journal of Industrial and Production Engineering 33: 308–20. [Google Scholar] [CrossRef] [Green Version]

- Bocken, Nancy M. P., Samuel W. Short, Padmakshi Rana, and Steve Evans. 2014. A literature and practice review to develop sustainable business model archetypes. Journal of Cleaner Production 65: 42–56. [Google Scholar] [CrossRef] [Green Version]

- Bova, Francesco, Kalin Kolev, Jacob K. Thomas, and X. Frank Zhang. 2015. Non-executive employee ownership and corporate risk. The Accounting Review 90: 115–45. [Google Scholar] [CrossRef]

- Božič, Valentina, and Ljubica Knežević Cvelbar. 2016. Resources and capabilities driving performance in the hotel industry. Tourism and Hospitality Management 22: 225–46. [Google Scholar] [CrossRef]

- Brammer, Stephen, and Andrew Millington. 2008. Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strategic Management Journal 29: 1325–43. [Google Scholar] [CrossRef]

- Brogaard, Jonathan, and Andrew Detzel. 2015. The asset-pricing implications of government economic policy uncertainty. Management Science 61: 3–18. [Google Scholar] [CrossRef] [Green Version]

- Buysse, Kristel, and Alain Verbeke. 2003. Proactive environmental strategies: A stakeholder management perspective. Strategic Management Journal 24: 453–70. [Google Scholar] [CrossRef]

- Callon, Michel, Jean-Pierre Courtial, William A. Turner, and Serge Bauin. 1983. From translations to problematic networks: An introduction to co-word analysis. Information (International Social Science Council) 22: 191–235. [Google Scholar] [CrossRef]

- Campello, Murillo. 2006. Debt financing: Does it boost or hurt firm performance in product markets? Journal of Financial Economics 82: 135–72. [Google Scholar] [CrossRef]

- Cao, Mei, and Qingyu Zhang. 2011. Supply chain collaboration: Impact on collaborative advantage and firm performance. Journal of Operations Management 29: 163–80. [Google Scholar] [CrossRef]

- Carroll, Archie B., and Kareem M. Shabana. 2010. The business case for corporate social responsibility: A review of concepts, research and practice. International Journal of Management Reviews 12: 85–105. [Google Scholar] [CrossRef]

- Cassell, Cory A., Shawn X. Huang, Juan Manuel Sanchez, and Michael D. Stuart. 2012. Seeking safety: The relation between CEO inside debt holdings and the riskiness of firm investment and financial policies. Journal of Financial Economics 103: 588–610. [Google Scholar] [CrossRef]

- Caviggioli, Federico, and Elisa Ughetto. 2019. A bibliometric analysis of the research dealing with the impact of additive manufacturing on industry, business and society. International Journal of Production Economics 208: 254–68. [Google Scholar] [CrossRef]

- Cecere, Grazia, Nicoletta Corrocher, and Maria Luisa Mancusi. 2018. Financial constraints and public funding of eco-innovation: Empirical evidence from European SMEs. Small Business Economics 54: 285–302. [Google Scholar] [CrossRef] [Green Version]

- Chan, Kam C., Hung-Gay Fung, and Chunghua Shen. 2019. Effects of government, changing technology and social network in greater China markets: From shadow banking to corporate finance: An Introduction. International Review of Economics & Finance 63: 1–3. [Google Scholar]

- Chen, Jun, Tao-Hsien Dolly King, and Min-Ming Wen. 2020. Non-executive Ownership and Private Loan Pricing. Journal of Corporate Finance 64: 101638. [Google Scholar] [CrossRef]

- Chen, Wei, Wenjing Liu, Yong Geng, Mark T. Brown, Cuixia Gao, and Rui Wu. 2017. Recent progress on emergy research: A bibliometric analysis. Renewable and Sustainable Energy Reviews 73: 1051–60. [Google Scholar] [CrossRef]

- Cheng, Beiting, Ioannis Ioannou, and George Serafeim. 2014. Corporate social responsibility and access to finance. Strategic Management Journal 35: 1–23. [Google Scholar] [CrossRef]

- Cheng, Chak Hung Jack, Ching-Wai Jeremy Chiu, William B. Hankins, and Anna-Leigh Stone. 2018. Partisan conflict, policy uncertainty and aggregate corporate cash holdings. Journal of Macroeconomics 58: 78–90. [Google Scholar] [CrossRef]

- Chertow, Marian R. 2000. Industrial symbiosis: Literature and taxonomy. Annual Review of Energy and The Environment 25: 313–37. [Google Scholar] [CrossRef] [Green Version]

- Cheung, Adrian Wai Kong. 2011. Do stock investors value corporate sustainability? Evidence from an event study. Journal of Business Ethics 99: 145–65. [Google Scholar] [CrossRef]

- Chiu, Wen-Ta, and Yuh-Shan Ho. 2007. Bibliometric analysis of tsunami research. Scientometrics 73: 3–17. [Google Scholar] [CrossRef]

- Chomsky, Noam. 2007. Failed States: The abuse of Power and the Assault on Democracy. New York: Metropolitan Books. [Google Scholar]

- Çolak, Gönül, Art Durnev, and Yiming Qian. 2017. Political uncertainty and IPO activity: Evidence from US gubernatorial elections. Journal of Financial and Quantitative Analysis 52: 2523–64. [Google Scholar] [CrossRef] [Green Version]

- Cookson, J. 2017. Anthony. Leverage and strategic preemption: Lessons from entry plans and incumbent investments. Journal of Financial Economics 123: 292–312. [Google Scholar] [CrossRef]

- Cruz-Cázares, Claudio, Cristina Bayona-Sáez, and Teresa García-Marco. 2013. You can’t manage right what you can’t measure well: Technological innovation efficiency. Research Policy 42: 1239–50. [Google Scholar] [CrossRef]

- Cui, X. G., L. Y. Wang, and H. Xu. 2007. High-speed growth, financial crisis and risk forecasting. Accounting Research 12: 55–62. (In Chinese). [Google Scholar]

- Daddi, Tiberio, Benedetta Nucci, and Fabio Iraldo. 2017. Using Life Cycle Assessment (LCA) to measure the environmental benefits of industrial symbiosis in an industrial cluster of SMEs. Journal of Cleaner Production 147: 157–64. [Google Scholar] [CrossRef]

- Darnall, Nicole, Irene Henriques, and Perry Sadorsky. 2010. Adopting proactive environmental strategy: The influence of stakeholders and firm size. Journal of Management Studies 47: 1072–94. [Google Scholar] [CrossRef]

- Dasgupta, Sudipto, and Alminas Žaldokas. 2019. Anticollusion enforcement: Justice for consumers and equity for firms. The Review of Financial Studies 32: 2587–624. [Google Scholar] [CrossRef]

- Del Río, Pablo, Desiderio Romero-Jordán, and Cristina Peñasco. 2017. Analysing firm-specific and type-specific determinants of eco-innovation. Technological and Economic Development of Economy 23: 270–95. [Google Scholar] [CrossRef]

- Dumay, John, Cristiana Bernardi, James Guthrie, and Paola Demartini. 2016. Integrated reporting: A structured literature review. Accounting Forum 40: 166–85. [Google Scholar] [CrossRef]

- Dunphy, D., A. Griffiths, and S. Benn. 2003. The Drivers of Change: Organisational Change for Corporate Sustainability. London: Routledge. [Google Scholar]

- Dyllick, Thomas, and Kai Hockerts. 2002. Beyond the business case for corporate sustainability. Business Strategy and The Environment 11: 130–41. [Google Scholar] [CrossRef]

- Edmans, Alex, and Qi Liu. 2011. Inside debt. Review of Finance 15: 75–102. [Google Scholar] [CrossRef] [Green Version]

- Eisenhardt, Kathleen M., and Jeffrey A. Martin. 2000. Dynamic capabilities: What are they? Strategic Management Journal 21: 1105–21. [Google Scholar] [CrossRef]

- Ekholm, Tommi, Hamed Ghoddusi, Volker Krey, and Keywan Riahi. 2013. The effect of financial constraints on energy-climate scenarios. Energy Policy 59: 562–72. [Google Scholar] [CrossRef]

- El-Gamal, Mahmoud A. 2009. A Muslim’s perspective on the financial crisis. The American Economist 53: 31–34. [Google Scholar] [CrossRef]

- Engel, Jerome S. 2011. Accelerating corporate innovation: Lessons from the venture capital model. Research-Technology Management 54: 36–43. [Google Scholar] [CrossRef]

- Engert, Sabrina, Romana Rauter, and Rupert J. Baumgartner. 2016. Exploring the integration of corporate sustainability into strategic management: A literature review. Journal of Cleaner Production 112: 2833–50. [Google Scholar] [CrossRef]

- Ertz, Myriam, and Sébastien Leblanc-Proulx. 2018. Sustainability in the collaborative economy: A bibliometric analysis reveals emerging interest. Journal of Cleaner Production 196: 1073–85. [Google Scholar] [CrossRef]

- Esty, Daniel C., and Andrew Winston. 2009. Green to Gold: How Smart Companies Use Environmental Strategy to Innovate, Create Value, and Build Competitive Advantage. Hoboken: John Wiley & Sons. [Google Scholar]

- Etzion, Dror. 2007. Research on organizations and the natural environment, 1992-present: A review. Journal of Management 33: 637–64. [Google Scholar] [CrossRef] [Green Version]

- Fahimnia, Behnam, Joseph Sarkis, and Hoda Davarzani. 2015. Green supply chain management: A review and bibliometric analysis. International Journal of Production Economics 162: 101–14. [Google Scholar] [CrossRef]

- Fatemi, Ali M., and Iraj J. Fooladi. 2013. Sustainable finance: A new paradigm. Global Finance Journal 24: 101–13. [Google Scholar] [CrossRef]

- Feng, Yunting, Qinghua Zhu, and Kee-Hung Lai. 2017. Corporate social responsibility for supply chain management: A literature review and bibliometric analysis. Journal of Cleaner Production 158: 296–307. [Google Scholar] [CrossRef]

- Fondevila, Miguel Marco, José M. Moneva, and Sabina Scarpellini. 2019. Environmental disclosure and Eco-innovation interrelation. The case of Spanish firms. Revista de Contabilidad-Spanish Accounting Review 22: 73–87. [Google Scholar]

- Franco, Maria A. 2017. Circular economy at the micro level: A dynamic view of incumbents’ struggles and challenges in the textile industry. Journal of Cleaner Production 168: 833–45. [Google Scholar] [CrossRef]

- Freund, Steven, Saira Latif, and Hieu V. Phan. 2018. Executive compensation and corporate financing policies: Evidence from CEO inside debt. Journal of Corporate Finance 50: 484–504. [Google Scholar] [CrossRef]

- Funk, Karina. 2003. Sustainability and performance. MIT Sloan Management Review 44: 65. [Google Scholar]

- Galaz, Victor, Beatrice Crona, Alice Dauriach, Bert Scholtens, and Will Steffen. 2018. Finance and the Earth system–Exploring the links between financial actors and non-linear changes in the climate system. Global Environmental Change 53: 296–302. [Google Scholar] [CrossRef] [Green Version]

- Galaz, Victor, Johan Gars, Fredrik Moberg, Björn Nykvist, and Cecilia Repinski. 2015. Why ecologists should care about financial markets. Trends in Ecology & Evolution 30: 571–80. [Google Scholar]

- Gao, Cuixia, Mei Sun, Yong Geng, Rui Wu, and Wei Chen. 2016. A bibliometric analysis based review on wind power price. Applied Energy 182: 602–12. [Google Scholar] [CrossRef]

- Gao, Kaijuan, Hanxiao Shen, Xi Gao, and Kam C. Chan. 2019. The power of sharing: Evidence from institutional investor cross-ownership and corporate innovation. International Review of Economics & Finance 63: 284–96. [Google Scholar]

- Gardberg, Naomi A., and Charles J. Fombrun. 2006. Corporate citizenship: Creating intangible assets across institutional environments. Academy of Management Review 31: 329–46. [Google Scholar] [CrossRef] [Green Version]

- Geng, Yong, Wei Chen, Zhe Liu, Anthony S. F. Chiu, Wenyi Han, Zhiqing Liu, Shaozhuo Zhong, Yiying Qian, Wei You, and Xiaowei Cui. 2017. A bibliometric review: Energy consumption and greenhouse gas emissions in the residential sector. Journal of Cleaner Production 159: 301–16. [Google Scholar] [CrossRef]

- Ghisellini, Patrizia, Maddalena Ripa, and Sergio Ulgiati. 2018. Exploring environmental and economic costs and benefits of a circular economy approach to the construction and demolition sector. A literature review. Journal of Cleaner Production 178: 618–43. [Google Scholar] [CrossRef]

- Gibson, Robert B. 2010. Beyond the pillars: Sustainability assessment as a framework for effective integration of social, economic and ecological considerations in significant decision-making. In Tools, Techniques and Approaches for Sustainability: Collected Writings in Environmental Assessment Policy and Management. Singapore: World Scientific, pp. 389–410. [Google Scholar]

- Gómez-Bezares, Fernando, Wojciech Przychodzen, and Justyna Przychodzen. 2016. Corporate sustainability and shareholder wealth—Evidence from British companies and lessons from the crisis. Sustainability 8: 276. [Google Scholar] [CrossRef] [Green Version]

- Halila, Fawzi, and Jonas Rundquist. 2011. The development and market success of eco-innovations. European Journal of Innovation Management 14: 278–302. [Google Scholar] [CrossRef]

- Hall, Bronwyn H., Adam Jaffe, and Manuel Trajtenberg. 2005. Market value and patent citations. RAND Journal of Economics 36: 16–38. [Google Scholar]

- Hansen, Morten T., Herminia Ibarra, and Urs Peyer. 2013. The best-performing CEOs in the world. Harvard Business Review 91: 81–95. [Google Scholar]

- Haushalter, David, Sandy Klasa, and William F. Maxwell. 2007. The influence of product market dynamics on a firm’s cash holdings and hedging behavior. Journal of Financial Economics 84: 797–825. [Google Scholar] [CrossRef]

- Hernández-Linares, Remedios, and María Concepción López-Fernández. 2018. Entrepreneurial orientation and the family firm: Mapping the field and tracing a path for future research. Family Business Review 31: 318–51. [Google Scholar] [CrossRef]

- Hillman, Amy J., and Gerald D. Keim. 2001. Shareholder value, stakeholder management, and social issues: What’s the bottom line? Strategic Management Journal 22: 125–39. [Google Scholar] [CrossRef]

- Hoberg, Gerard, Gordon Phillips, and Nagpurnanand Prabhala. 2014. Product market threats, payouts, and financial flexibility. The Journal of Finance 69: 293–324. [Google Scholar] [CrossRef]

- Hochberg, Yael V., and Laura Lindsey. 2010. Incentives, targeting, and firm performance: An analysis of non-executive stock options. The Review of Financial Studies 23: 4148–86. [Google Scholar] [CrossRef]

- Hollindale, Janice, Pamela Kent, James Routledge, and Larelle Chapple. 2019. Women on boards and greenhouse gas emission disclosures. Accounting & Finance 59: 277–308. [Google Scholar]

- Hong, Ng Yen, and Ong Tze San. 2016. Assessing the relationship among corporate governance, sustainability disclosure and financial performance. Asia-Pacific Management Accounting Journal 11: 129–46. [Google Scholar]

- Huerga, Angel, and Carlos Rodríguez-Monroy. 2019. Mandatory Convertible Notes as a Sustainable Corporate Finance Instrument. Sustainability 11: 897. [Google Scholar] [CrossRef] [Green Version]

- Ismail, Kamariah, Aslan Amat Senin, and Akintunde M. Ajagbe. 2011. A conceptualised approach towards building a growth model for venture capitalists financing of TBFs. International Journal of Innovation, Management and Technology 2: 315–20. [Google Scholar]

- Jens, Candace E. 2017. Political uncertainty and investment: Causal evidence from US gubernatorial elections. Journal of Financial Economics 124: 563–79. [Google Scholar] [CrossRef] [Green Version]

- Jia, Fu, Constantin Blome, Hui Sun, Yang Yang, and Bangdong Zhi. 2020. Towards an integrated conceptual framework of supply chain finance: An information processing perspective. International Journal of Production Economics 219: 18–30. [Google Scholar] [CrossRef]

- Jin, Ruoyu, Shang Gao, Ali Cheshmehzangi, and Emmanuel Aboagye-Nimo. 2018. A holistic review of off-site construction literature published between 2008 and 2018. Journal of Cleaner Production 202: 1202–19. [Google Scholar] [CrossRef] [Green Version]

- Johnsen, D. Bruce. 2003. Socially responsible investing: A critical appraisal. Journal of Business Ethics 43: 219–22. [Google Scholar] [CrossRef]

- Johnson, Daniel K. N., and Kristina M. Lybecker. 2012. Paying for green: An economics literature review on the constraints to financing environmental innovation. Electronic Green Journal 1: 1–10. [Google Scholar] [CrossRef]

- Kaptein, Muel, and Johan Ferdinand Dietrich Bernardus Wempe. 2002. The Balanced Company: A Theory of Corporate Integrity. Oxford: Oxford University Press. [Google Scholar]

- Katz-Gerro, Tally, and Jordi López Sintas. 2019. Mapping circular economy activities in the European Union: Patterns of implementation and their correlates in small and medium-sized enterprises. Business Strategy and the Environment 28: 485–96. [Google Scholar] [CrossRef]

- Ketata, Ihsen, Wolfgang Sofka, and Christoph Grimpe. 2015. The role of internal capabilities and firms’ environment for sustainable innovation: Evidence for Germany. R&D Management 45: 60–75. [Google Scholar]

- Khoo, Joye, and Adrian Waikong Cheung. 2020. Does geopolitical uncertainty affect corporate financing? Evidence from MIDAS regression. Global Finance Journal, 100519, in press. [Google Scholar] [CrossRef]

- Kiefer, Christoph P., Pablo Del Rio Gonzalez, and Javier Carrillo-Hermosilla. 2019. Drivers and barriers of eco-innovation types for sustainable transitions: A quantitative perspective. Business Strategy and the Environment 28: 155–72. [Google Scholar] [CrossRef] [Green Version]

- Kim, Seokchin, Hyunchul Lee, and Joongi Kim. 2016. Divergent effects of external financing on technology innovation activity: Korean evidence. Technological Forecasting and Social Change 106: 22–30. [Google Scholar] [CrossRef]

- Klasa, Sandy, Hernan Ortiz-Molina, Matthew Serfling, and Shweta Srinivasan. 2018. Protection of trade secrets and capital structure decisions. Journal of Financial Economics 128: 266–86. [Google Scholar] [CrossRef]

- Klette, Tor Jakob, Samuel Kortum, Jarle Møen, Atle Seierstad, Peter Thompson, and Galina Vereshchagina. 2004. Innovating Firms and Aggregate Innovation. Journal of Political Economy. [Google Scholar] [CrossRef] [Green Version]

- Lassala, Carlos, Andreea Apetrei, and Juan Sapena. 2017. Sustainability matter and financial performance of companies. Sustainability 9: 1498. [Google Scholar] [CrossRef] [Green Version]

- Lee, Ki-Hoon, and Byung Min. 2015. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. Journal of Cleaner Production 108: 534–42. [Google Scholar]

- Li, Wei’an, P. Wang, and Y. Xu. 2015. Charitable donation, political connection and debt financing: Resource exchange between private enterprises and the government. Nankai Management Review 18: 4–14. [Google Scholar]

- Li, Weian, Minna Zheng, Yaowei Zhang, and Guangyao Cui. 2020. Green governance structure, ownership characteristics, and corporate financing constraints. Journal of Cleaner Production 260: 121008. [Google Scholar] [CrossRef]

- Li, Zhen, Huixiang Zeng, Xu Xiao, Jin Cao, Chaoji Yang, and Kaixin Zhang. 2019. Resource value flow analysis of paper-making enterprises: A Chinese case study. Journal of Cleaner Production 213: 577–87. [Google Scholar] [CrossRef]

- Liao, Lin, Le Luo, and Qingliang Tang. 2015. Gender diversity, board independence, environmental committee and greenhouse gas disclosure. The British Accounting Review 47: 409–24. [Google Scholar] [CrossRef]

- Linder, Marcus, and Mats Williander. 2017. Circular business model innovation: Inherent uncertainties. Business Strategy and The Environment 26: 182–96. [Google Scholar] [CrossRef]

- Liu, Yong, and Yin Bai. 2014. An exploration of firms’ awareness and behavior of developing circular economy: An empirical research in China. Resources, Conservation and Recycling 87: 145–52. [Google Scholar] [CrossRef]

- Liu, Yue, Ying Qu, Zhen Lei, and Han Jia. 2017. Understanding the evolution of sustainable consumption research. Sustainable Development 25: 414–30. [Google Scholar] [CrossRef]

- Lizińska, Joanna, and Leszek Czapiewski. 2018. Towards Economic Corporate Sustainability in Reporting: What Does Earnings Management around Equity Offerings Mean for Long-Term Performance? Sustainability 10: 4349. [Google Scholar] [CrossRef] [Green Version]

- López, Fernando J. Díaz, and Carlos Montalvo. 2015. A comprehensive review of the evolving and cumulative nature of eco-innovation in the chemical industry. Journal of Cleaner Production 102: 30–43. [Google Scholar] [CrossRef] [Green Version]

- Ma, Song. 2020. The life cycle of corporate venture capital. The Review of Financial Studies 33: 358–94. [Google Scholar] [CrossRef]

- Maciková, Lucia, Marián Smorada, Peter Dorčák, Benjamin Beug, and Peter Markovič. 2018. Financial aspects of sustainability: An evidence from Slovak companies. Sustainability 10: 2274. [Google Scholar] [CrossRef] [Green Version]

- Margolis, Joshua D., and James P. Walsh. 2003. Misery loves companies: Rethinking social initiatives by business. Administrative science quarterly 48: 268–305. [Google Scholar] [CrossRef] [Green Version]

- Marti, Carmen Pilar, M. Rosa Rovira-Val, and Lisa G. J. Drescher. 2015. Are firms that contribute to sustainable development better financially? Corporate Social Responsibility and Environmental Management 22: 305–19. [Google Scholar] [CrossRef] [Green Version]

- Masi, Donato, Steven Day, and Janet Godsell. 2017. Supply chain configurations in the circular economy: A systematic literature review. Sustainability 9: 1602. [Google Scholar] [CrossRef] [Green Version]

- Merli, Roberto, Michele Preziosi, and Alessia Acampora. 2018. How do scholars approach the circular economy? A systematic literature review. Journal of Cleaner Production 178: 703–22. [Google Scholar] [CrossRef]

- Moktadir, Md Abdul, Towfique Rahman, Md Hafizur Rahman, Syed Mithun Ali, and Sanjoy Kumar Paul. 2018. Drivers to sustainable manufacturing practices and circular economy: A perspective of leather industries in Bangladesh. Journal of Cleaner Production 174: 1366–80. [Google Scholar] [CrossRef]

- Moneva, Jose M., and Eduardo Ortas. 2008. Are stock markets influenced by sustainability matter? Evidence from European companies. International Journal of Sustainable Economy 1: 1–16. [Google Scholar] [CrossRef]

- Mora, Luca, Roberto Bolici, and Mark Deakin. 2017. The first two decades of smart-city research: A bibliometric analysis. Journal of Urban Technology 24: 3–27. [Google Scholar] [CrossRef]

- Mueller, Holger M., Paige P. Ouimet, and Elena Simintzi. 2017. Within-firm pay inequality. The Review of Financial Studies 30: 3605–35. [Google Scholar] [CrossRef] [Green Version]

- Ng, Thiam Hee, and Jacqueline Yujia Tao. 2016. Bond financing for renewable energy in Asia. Energy Policy 95: 509–17. [Google Scholar] [CrossRef] [Green Version]

- Ociepa-Kubicka, Agnieszka, and Piotr Pachura. 2017. Eco-innovations in the functioning of companies. Environmental Research 156: 284–90. [Google Scholar] [CrossRef]

- Oh, Seungwoo, Ahreum Hong, and Junseok Hwang. 2017. An analysis of CSR on firm financial performance in stakeholder perspectives. Sustainability 9: 1023. [Google Scholar] [CrossRef] [Green Version]

- Ormazabal, Marta, Vanessa Prieto-Sandoval Carmen Jaca, and Javier Santos. 2016. An overview of the circular economy among SMEs in the Basque country: A multiple case study. Journal of Industrial Engineering and Management (JIEM) 9: 1047–58. [Google Scholar] [CrossRef] [Green Version]

- Ormazabal, Marta, Vanessa Prieto-Sandoval, Rogério Puga-Leal, and Carmen Jaca. 2018. Circular economy in Spanish SMEs: Challenges and opportunities. Journal of Cleaner Production 185: 157–67. [Google Scholar] [CrossRef]

- Ouyang, Caiyue, Jiacai Xiong, and Lyu Fan. 2019. Do insiders share pledging affect executive pay-for-performance sensitivity? International Review of Economics & Finance 63: 226–39. [Google Scholar]

- Pagani, Margherita, and Catherine Pardo. 2017. The impact of digital technology on relationships in a business network. Industrial Marketing Management 67: 185–92. [Google Scholar] [CrossRef]

- Pan, Shu-Yuan, Michael Alex Du, I-Te Huang, I-Hung Liu, E. E. Chang, and Pen-Chi Chiang. 2015. Strategies on implementation of waste-to-energy (WTE) supply chain for circular economy system: A review. Journal of Cleaner Production 108: 409–21. [Google Scholar]

- Peng, Xuan, XiongYuan Wang, and Lina Yan. 2019. How does customer concentration affect informal financing? International Review of Economics & Finance 63: 152–62. [Google Scholar]

- Peylo, Benjamin Tobias. 2012. A Synthesis of Modern Portfolio Theoryand Sustainable Investment. The Journal of Investing 21: 33–46. [Google Scholar] [CrossRef]

- Phan, Hieu V. 2014. Inside debt and mergers and acquisitions. Journal of Financial and Quantitative Analysis 49: 1365–401. [Google Scholar] [CrossRef]

- Polzin, Friedemann, Mark Sanders, and Florian Täube. 2017. A diverse and resilient financial system for investments in the energy transition. Current Opinion in Environmental Sustainability 28: 24–32. [Google Scholar] [CrossRef] [Green Version]

- Portillo-Tarragona, Pilar, Sabina Scarpellini, Jose M. Moneva, Jesus Valero-Gil, and Alfonso Aranda-Usón. 2018. Classification and measurement of the firms’ resources and capabilities applied to eco-innovation projects from a resource-based view perspective. Sustainability 10: 3161. [Google Scholar] [CrossRef] [Green Version]

- Pratt, Kimberley, Michael Lenaghan, and Edward T. A. Mitchard. 2016. Material flows accounting for Scotland shows the merits of a circular economy and the folly of territorial carbon reporting. Carbon Balance and Management 11: 21. [Google Scholar] [CrossRef] [Green Version]

- Raghuram, Sumita, Philipp Tuertscher, and Raghu Garud. 2010. Research note—mapping the field of virtual work: A cocitation analysis. Information Systems Research 21: 983–99. [Google Scholar] [CrossRef]

- Richard, Pierre J., and Timothy M. Devinney. 2005. Modular strategies: B2B technology and architectural knowledge. California Management Review 47: 86–113. [Google Scholar] [CrossRef] [Green Version]

- Rizos, Vasileios, Arno Behrens, Wytze Van der Gaast, Erwin Hofman, Anastasia Ioannou, Terri Kafyeke, Alexandros Flamos, Roberto Rinaldi, Sotiris Papadelis, Martin Hirschnitz-Garbers, and et al. 2016. Implementation of circular economy business models by small and medium-sized enterprises (SMEs): Barriers and enablers. Sustainability 8: 1212. [Google Scholar] [CrossRef] [Green Version]

- Rossi, Matteo, Giuseppe Festa, Alain Devalle, and Jens Mueller. 2020. When corporations get disruptive, the disruptive get corporate: Financing disruptive technologies through corporate venture capital. Journal of Business Research 118: 378–88. [Google Scholar] [CrossRef]

- Rossi, Matteo, Giuseppe Festa, Armando Papa, and Paola Scorrano. 2019. Corporate venture capitalists’ ambidexterity: Myth or truth? IEEE Transactions on Engineering Management. [Google Scholar] [CrossRef]

- Rubera, Gaia, and Ahmet H. Kirca. 2012. Firm innovativeness and its performance outcomes: A meta-analytic review and theoretical integration. Journal of Marketing 76: 130–47. [Google Scholar] [CrossRef]

- Sabat, Hemant Kumar. 2002. The evolving mobile wireless value chain and market structure. Telecommunications Policy 26: 505–35. [Google Scholar] [CrossRef]

- Salzmann, Oliver, Aileen Ionescu-Somers, and Ulrich Steger. 2005. The business case for corporate sustainability: Literature review and research options. European Management Journal 23: 27–36. [Google Scholar] [CrossRef]

- Scarpellini, Sabina, Luz María Marín-Vinuesa, Alfonso Aranda-Usón, and Pilar Portillo-Tarragona. 2020. Dynamic capabilities and environmental accounting for the circular economy in businesses. Sustainability Accounting, Management and Policy Journal. in press. [Google Scholar] [CrossRef] [Green Version]

- Schaltegger, Stefan, Florian Lüdeke-Freund, and Erik G. Hansen. 2012. Business cases for sustainability: The role of business model innovation for corporate sustainability. International Journal of Innovation and Sustainable Development 6: 95–119. [Google Scholar] [CrossRef]

- Scholtens, Bert, and Yangqin Zhou. 2008. Stakeholder relations and financial performance. Sustainable Development 16: 213–32. [Google Scholar] [CrossRef]

- Sertsios, Giorgo. 2020. Corporate finance, industrial organization, and organizational economics. Journal of Corporate Finance 64: 101680. [Google Scholar] [CrossRef]

- Seru, Amit. 2014. Firm boundaries matter: Evidence from conglomerates and R&D activity. Journal of Financial Economics 111: 381–405. [Google Scholar]

- Shahbazi, Sasha, Magnus Wiktorsson, Martin Kurdve, Christina Jönsson, and Marcus Bjelkemyr. 2016. Material efficiency in manufacturing: Swedish evidence on potential, barriers and strategies. Journal of Cleaner Production 127: 438–50. [Google Scholar] [CrossRef]

- Sharma, Sanjay, and Mark Starik, eds. 2002. Research in corporate sustainability: The evolving theory and practice of organizations in the natural environment. Edward Elgar Publishing 2002: 1–29. [Google Scholar]

- Siegrist, Manuel, Gary Bowman, Evelyn Mervine, and Colette Southam. 2020. Embedding environment and sustainability into corporate financial decision-making. Accounting & Finance 60: 129–47. [Google Scholar]

- Sihvonen, Siru, and Jouni Partanen. 2017. Eco-design practices with a focus on quantitative environmental targets: An exploratory content analysis within ICT sector. Journal of Cleaner Production 143: 769–83. [Google Scholar] [CrossRef]

- Slack, Richard, and Ioannis Tsalavoutas. 2018. Integrated reporting decision usefulness: Mainstream equity market views. Accounting Forum 42: 184–98. [Google Scholar] [CrossRef] [Green Version]

- Soppe, Aloy. 2004. Sustainable corporate finance. Journal of Business Ethics 53: 213–24. [Google Scholar] [CrossRef]

- Soppe, Aloy. 2009. Sustainable finance as a connection between corporate social responsibility and social responsible investing. Indian School of Business WP Indian Management Research Journal 1: 13–23. [Google Scholar]

- Stewart, Raphaëlle, and Monia Niero. 2018. Circular economy in corporate sustainability strategies: A review of corporate sustainability reports in the fast-moving consumer goods sector. Business Strategy and the Environment 27: 1005–22. [Google Scholar] [CrossRef] [Green Version]

- Su, Biwei, Almas Heshmati, Yong Geng, and Xiaoman Yu. 2013. A review of the circular economy in China: Moving from rhetoric to implementation. Journal of Cleaner Production 42: 215–27. [Google Scholar] [CrossRef]

- Su, Zhong-qin, Zuoping Xiao, and Lin Yu. 2019. Do political connections enhance or impede corporate innovation? International Review of Economics & Finance 63: 94–110. [Google Scholar]

- Tate, Geoffrey, and Liu Yang. 2015. Female leadership and gender equity: Evidence from plant closure. Journal of Financial Economics 117: 77–97. [Google Scholar] [CrossRef]

- Teece, David J. 2007. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strategic Management Journal 28: 1319–50. [Google Scholar] [CrossRef] [Green Version]

- Teece, David J., Gary Pisano, and Amy Shuen. 1997. Dynamic capabilities and strategic management. Strategic Management Journal 18: 509–33. [Google Scholar] [CrossRef]

- Thapa, Chandra, Sandeep Rao, Hisham Farag, and Santosh Koirala. 2020. Access to internal capital, creditor rights and corporate borrowing: Does group affiliation matter? Journal of Corporate Finance 62: 101585. [Google Scholar] [CrossRef]

- Tranfield, David, David Denyer, and Palminder Smart. 2003. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management 14: 207–22. [Google Scholar] [CrossRef]

- Triguero, Ángela, María C. Cuerva, and Carlos Álvarez-Aledo. 2017. Environmental innovation and employment: Drivers and synergies. Sustainability 9: 2057. [Google Scholar] [CrossRef] [Green Version]

- Tseng, Ming-Lang, and Tat-Dat Bui. 2017. Identifying eco-innovation in industrial symbiosis under linguistic preferences: A novel hierarchical approach. Journal of Cleaner Production 140: 1376–89. [Google Scholar] [CrossRef]

- Van Eck, Nees Jan, and Ludo Waltman. 2014. CitNetExplorer: A new software tool for analyzing and visualizing citation networks. Journal of Informetrics 8: 802–23. [Google Scholar] [CrossRef] [Green Version]

- Van Eck, N. J., and L. Waltman. 2019. Manual for VOSviewer version 1. 6.11. Acesso em 14. Leiden: Univeristeit Leiden. [Google Scholar]

- Velenturf, Anne P. M., and Phil Purnell. 2017. Resource recovery from waste: Restoring the balance between resource scarcity and waste overload. Sustainability 9: 1603. [Google Scholar] [CrossRef] [Green Version]

- Volpin, Paolo F. 2002. Governance with poor investor protection: Evidence from top executive turnover in Italy. Journal of Financial Economics 64: 61–90. [Google Scholar] [CrossRef]

- Wagner, Marcus. 2010. The role of corporate sustainability performance for economic performance: A firm-level analysis of moderation effects. Ecological Economics 69: 1553–60. [Google Scholar] [CrossRef] [Green Version]

- Wang, Zhaojing, Hao Hu, Jie Gong, Xiaoping Ma, and Wuyue Xiong. 2019. Precast supply chain management in off-site construction: A critical literature review. Journal of Cleaner Production 232: 1204–17. [Google Scholar] [CrossRef]

- Warusawitharana, Missaka. 2015. Research and development, profits, and firm value: A structural estimation. Quantitative Economics 6: 531–65. [Google Scholar] [CrossRef] [Green Version]

- Whelan, Tensie, and Carly Fink. 2016. The comprehensive business case for sustainability. Harvard Business Review 21: 2012. [Google Scholar]

- Wichaisri, Sooksiri, and Apichat Sopadang. 2018. Trends and future directions in sustainable development. Sustainable Development 26: 1–17. [Google Scholar] [CrossRef]

- Wilson, Mel. 2003. Corporate sustainability: What is it and where does it come from. Ivey Business Journal 67: 1–5. [Google Scholar]

- Witjes, Sjors, and Rodrigo Lozano. 2016. Towards a more Circular Economy: Proposing a framework linking sustainable public procurement and sustainable business models. Resources, Conservation and Recycling 112: 37–44. [Google Scholar] [CrossRef] [Green Version]

- Wu, Qiang, Qile He, Yanqing Duan, and Nicholas O’Regan. 2012. Implementing dynamic capabilities for corporate strategic change toward sustainability. Strategic Change 21: 231. [Google Scholar] [CrossRef]

- Xu, Xinhan, Xiangfeng Chen, Fu Jia, Steve Brown, Yu Gong, and Yifan Xu. 2018. Supply chain finance: A systematic literature review and bibliometric analysis. International Journal of Production Economics 204: 160–73. [Google Scholar] [CrossRef]

- Yeo, Woondong, Seonho Kim, Hyunwoo Park, and Jaewoo Kang. 2015. A bibliometric method for measuring the degree of technological innovation. Technological Forecasting and Social Change 95: 152–62. [Google Scholar] [CrossRef]

- Zaman, Qamar Uz, M. Kabir Hassan, Waheed Akhter, and M. A. Meraj. 2018. From interest tax shield to dividend tax shield: A corporate financing policy for equitable and sustainable wealth creation. Pacific-Basin Finance Journal 52: 144–62. [Google Scholar] [CrossRef]

- Zamfir, Ana-Maria, Cristina Mocanu, and Adriana Grigorescu. 2017. Circular economy and decision models among European SMEs. Sustainability 9: 1507. [Google Scholar] [CrossRef] [Green Version]

- Zhao, Yujie, Donghua Zhou, Kangsheng Zhao, and Ping Zhou. 2019. Is the squeaky wheel getting the grease? Earnings management and government subsidies. International Review of Economics & Finance 63: 297–312. [Google Scholar]

- Zhong, Shaozhuo, Yong Geng, Wenjing Liu, Cuixia Gao, and Wei Chen. 2016. A bibliometric review on natural resource accounting during 1995–2014. Journal of Cleaner Production 139: 122–32. [Google Scholar] [CrossRef]

- Ziegler, Andreas. 2012. Is it beneficial to be included in a sustainability stock index? A panel data study for European firms. Environmental and Resource Economics 52: 301–25. [Google Scholar] [CrossRef] [Green Version]

- Zollo, Maurizio, and Sidney G. Winter. 2002. Deliberate learning and the evolution of dynamic capabilities. Organization Science 13: 339–51. [Google Scholar] [CrossRef]

- Zupic, Ivan, and Tomaž Čater. 2015. Bibliometric methods in management and organization. Organizational Research Methods 18: 429–72. [Google Scholar] [CrossRef]

| ID | Countries/Territories | Documents | Citations | Average Published Year |

|---|---|---|---|---|

| 1 | Australia | 18 | 525 | 2014.667 |

| 2 | Austria | 1 | 1 | 2019 |

| 3 | Brazil | 2 | 7 | 2018.5 |

| 4 | Canada | 9 | 289 | 2013.333 |

| 5 | China | 20 | 157 | 2016.75 |

| 6 | Colombia | 1 | 1 | 2013 |

| 7 | Croatia | 1 | 15 | 2012 |

| 8 | Czech Republic | 1 | 11 | 2017 |

| 9 | Denmark | 3 | 134 | 2012.333 |

| 10 | Finland | 1 | 27 | 2014 |

| 11 | France | 10 | 147 | 2015.8 |

| 12 | Germany | 10 | 301 | 2015 |

| 13 | Greece | 5 | 29 | 2014.4 |

| 14 | Hong Kong | 4 | 313 | 2013.75 |

| 15 | Hungary | 1 | 0 | 2009 |

| 16 | India | 11 | 61 | 2015.455 |

| 17 | Indonesia | 8 | 55 | 2017.875 |

| 18 | Iran | 2 | 19 | 2017.5 |

| 19 | Iraq | 1 | 0 | 2020 |

| 20 | Italy | 18 | 175 | 2018.167 |

| 21 | Japan | 1 | 27 | 2019 |

| 22 | Lithuania | 1 | 1 | 2019 |

| 23 | Malaysia | 5 | 231 | 2016 |

| 24 | Morocco | 1 | 10 | 2018 |

| 25 | Netherlands | 5 | 67 | 2016.8 |

| 26 | New Zealand | 3 | 178 | 2008.333 |

| 27 | Norway | 4 | 67 | 2014 |

| 28 | Pakistan | 6 | 21 | 2017.167 |

| 29 | Philippines | 3 | 2 | 2017.667 |

| 30 | Poland | 6 | 55 | 2016.667 |

| 31 | Romania | 3 | 24 | 2016.333 |

| 32 | Russian Federation | 7 | 12 | 2017.429 |

| 33 | Saudi Arabia | 2 | 5 | 2017.5 |

| 34 | Singapore | 4 | 82 | 2017.25 |

| 35 | Slovakia | 1 | 11 | 2017 |

| 36 | South Africa | 8 | 7 | 2017.5 |

| 37 | South Korea | 7 | 146 | 2018.143 |

| 38 | Spain | 19 | 191 | 2017.316 |

| 39 | Sweden | 1 | 21 | 2018 |

| 40 | Switzerland | 3 | 86 | 2011.667 |

| 41 | Taiwan | 7 | 55 | 2018 |

| 42 | Thailand | 3 | 29 | 2017.667 |

| 43 | Turkey | 4 | 9 | 2019.75 |

| 44 | United Arab Emirates | 1 | 41 | 2018 |

| 45 | United Kingdom | 10 | 195 | 2016.1 |

| 46 | United States | 38 | 1551 | 2012.526 |

| 47 | Viet Nam | 2 | 6 | 2019.5 |

| 48 | Zimbabwe | 1 | 1 | 2013 |

| ID | Keywords | Cluster | Occurrences | Average Published Year | Average Citations |

|---|---|---|---|---|---|

| 1 | Corporate environmental performance | Corporate finance in corporate sustainability | 8 | 2017.125 | 40.625 |

| 2 | Corporate social performance | 16 | 2015.0625 | 30.8125 | |

| 3 | Corporate sustainability | 17 | 2016.4706 | 20.2353 | |

| 4 | Environmental management | 3 | 2011.6667 | 36.6667 | |

| 5 | Environmental sustainability | 3 | 2015 | 113.3333 | |

| 6 | Sustainable corporate finance | 3 | 2015.6667 | 11.3333 | |

| 7 | Triple bottom line | 4 | 2011.5 | 37 | |

| 8 | Carbon emissions | Sustainable competitive advantages | 3 | 2017.3333 | 23.6667 |

| 9 | Competitive advantage | 3 | 2015 | 19 | |

| 10 | Environmental performance | 6 | 2017.6667 | 3.8333 | |

| 11 | Firm performance | 3 | 2017.3333 | 36 | |

| 12 | Return on equity | 3 | 2018.3333 | 1 | |

| 13 | Socially responsible investment | 4 | 2015.75 | 18.5 | |

| 14 | Environmental accounting | Sustainable stakeholder engagement | 3 | 2010 | 3 |

| 15 | Environmental policy | 3 | 2019 | 9.3333 | |

| 16 | Stakeholder engagement | 4 | 2018 | 20.25 | |

| 17 | Sustainability performance | 8 | 2016.375 | 10.5 | |

| 18 | Sustainable development | 24 | 2015.8333 | 25 | |

| 19 | Circular economy | Circular economy | 4 | 2018.75 | 7.75 |

| 20 | Eco-innovation | 4 | 2017.75 | 10 | |

| 21 | Environmental management accounting | 3 | 2019 | 9.6667 | |

| 22 | Resource-based view | 3 | 2019 | 9 | |

| 23 | Corporate finance | Sustainable corporate finance (SCF) innovation and risk management | 35 | 2015.9429 | 8.2571 |

| 24 | Innovation | 3 | 2011.3333 | 2.6667 | |

| 25 | Risk management | 3 | 2015 | 5.6667 | |

| 26 | Venture capital | 3 | 2008.3333 | 4.3333 | |

| 27 | Corporate governance | Sustainable supply chain ethics | 14 | 2017.2857 | 4.7143 |

| 28 | Ethics | 3 | 2016.6667 | 60 | |

| 29 | Supply chain management | 3 | 2016.6667 | 60.3333 | |

| 30 | Sustainability | 33 | 2016.4545 | 31.2727 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bui, T.D.; Ali, M.H.; Tsai, F.M.; Iranmanesh, M.; Tseng, M.-L.; Lim, M.K. Challenges and Trends in Sustainable Corporate Finance: A Bibliometric Systematic Review. J. Risk Financial Manag. 2020, 13, 264. https://doi.org/10.3390/jrfm13110264

Bui TD, Ali MH, Tsai FM, Iranmanesh M, Tseng M-L, Lim MK. Challenges and Trends in Sustainable Corporate Finance: A Bibliometric Systematic Review. Journal of Risk and Financial Management. 2020; 13(11):264. https://doi.org/10.3390/jrfm13110264

Chicago/Turabian StyleBui, Tat Dat, Mohd Helmi Ali, Feng Ming Tsai, Mohammad Iranmanesh, Ming-Lang Tseng, and Ming K Lim. 2020. "Challenges and Trends in Sustainable Corporate Finance: A Bibliometric Systematic Review" Journal of Risk and Financial Management 13, no. 11: 264. https://doi.org/10.3390/jrfm13110264

APA StyleBui, T. D., Ali, M. H., Tsai, F. M., Iranmanesh, M., Tseng, M. -L., & Lim, M. K. (2020). Challenges and Trends in Sustainable Corporate Finance: A Bibliometric Systematic Review. Journal of Risk and Financial Management, 13(11), 264. https://doi.org/10.3390/jrfm13110264