Analysis of Restructuring the Mexican Electricity Sector to Operate in a Wholesale Energy Market

Abstract

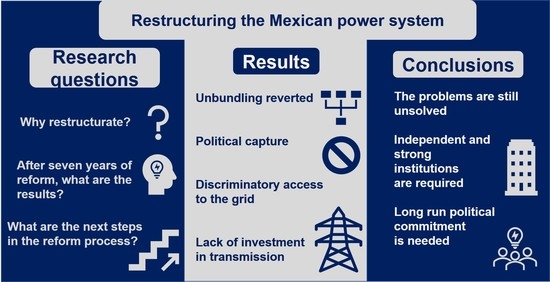

:1. Introduction

2. Theoretical Framework

2.1. Why Restructure?

2.2. Textbook Model and International Experience

- Separate segments vertical to the electricity industry, structurally (unbundling) or functionally (internal walls or rings, separating subsidiaries within the same organization).

- It creates a competitive segment of the electricity industry (generation, commercialization).

- It creates regulated segments (transmission, distribution, system operation).

- It avoids cross-subsidies among state companies.

- It allows for advanced regulation when the number of participants increases.

- Privatize the State’s assets in the electricity industry.

- It encourages improvement in the performance of the companies.

- It hinders the use of these companies in favor of costly political agendas.

- Increases the possibility of private investment, reducing the risk taken by the State in electricity projects, allowing the State to invest in other sectors.

- Restructure the generation sector horizontally.

- It creates many competitors to avoid market power and ensures that the wholesale energy market will deliver significant competitive results.

- Integrate the system operation, transmission, and distribution horizontally.

- It unifies system operation, centralizes unit dispatch, and maintains frequency, voltage, and stability parameters within their ranges.

- Create an ISO to manage the voluntary wholesale energy market.

- It expands competition, facilitates economic transactions among market participants, and minimizes the regulator’s intervention in the wholesale energy market.

- Enforce regulatory rules supporting open access to the power grid.

- It guarantees open and non-unduly discriminatory access to networks.

- Itemize retail tariffs for captive consumers.

- It differentiates the regulated tariff items from market items and allows the consumer to choose among suppliers.

- The supplier of small captive users must purchase energy in the wholesale energy market.

- Create an independent regulatory agency.

- With a good knowledge of costs, quality of service, and performance of transmission and distribution companies.

- Create transition mechanisms compatible with a well-designed market.

- Pre-existing pricing arrangements for captive users before they migrate to the retail market.

2.3. Regulation

3. Restructuring of the Mexican Electricity Sector

3.1. Background

3.2. Restructuring Process

- Generation.

- Transmission.

- Distribution.

- Basic Supply.

- Commercialization other than Basic Supply.

- Primary Fuels Supply.

- Vertical separation of the power sector activities.

- Horizontal restructuring in the generation sector.

- Horizontal integration of system operation, transmission, and distribution.

- The Centro Nacional de Control de Energía (CENACE) was created as an ISO to operate the voluntary wholesale energy markets.

- Regulatory Rules supporting network non-discriminatory access.

- Creation of an independent regulator.

- Itemization of retail tariffs for captive consumers in order to highlight the regulated tariffs and to allow the consumer to choose among suppliers without incumbent affection.

- The supplier of small captive users must acquire power in the wholesale energy market and long-term auctions.

- Transition mechanisms compatible with a well-designed market.

- Establish the required terms of strict legal separation or otherwise order the divestiture of assets to promote open access and efficient operation of the electricity sector (LIE art. 8 and 9).

- Establish, conduct and coordinate the country’s energy policy.

- Prepare and issue documents for the development of the electricity industry.

- Ensure the coordination of the CENACE, the National Natural Gas Control Center, the regulator CRE and other authorities relevant to the electricity industry.

- Evaluate in coordination with the CRE the performance of CENACE.

- Resolve social impact assessments of projects related to the electricity industry.

- Establish requirements and criteria for acquiring and granting Clean Energy Certificates.

- Prepare, coordinate and instruct infrastructure projects to comply with the country’s energy policy.

- Authorize the programs and instruct the expansion and modernization projects of the National Transmission Network and the General Distribution Networks, to the transporters, distributors or private companies.

- Verify compliance with the LIE, its regulations, rules and other applicable provisions.

- Investigate, denounce, and impose sanctions corresponding to its attributions (LIE art. 162).

- Determine the reliability and safety policy of the SEN (LIE art. 132).

- Request information and facilitate the transparency of the wholesale energy market (LIE arts. 158 and 159).

4. Electricity Reform: Progress and Results

4.1. Investment in the Electricity Sector

4.2. Regulatory Capture

4.3. International Agreements

5. Discussion

5.1. Reform from 2013 to 2018

5.2. Reform Reversion from 2018 to 2021

5.2.1. Distorted Unbundling

5.2.2. Regulatory Capture

5.2.3. Failure in Granting Non-Unduly Discriminatory Access to the Grid

5.3. Lack of Investment in Transmission

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| ASF | Auditoria Superior de la Federación (Federal Superior Audit Office) |

| CCM | Marginal Congestion Component |

| CENACE | Centro Nacional de Control de Energía (Energy Control National Center) |

| CFE | Comisión Federal de Electricidad (Electricity Federal Company) |

| CRE | Comisión Reguladora de Energía (Regulatory Energy Commission) |

| FSUE | Fondo de Servicio Universal Eléctrico (Universal Electricity Service Fund) |

| FTRs | Financial Transmission Rights |

| IPP | Independent Power Producer |

| ICL | Intermediación de Contratos Legados (Legacy Contracts) |

| ISO | Independent System Operator |

| LCFE | Ley de la Comisión Federal de Electricidad (Electricity Federal Company Law) |

| LIE | Ley de la Industria Eléctrica (Electric Industry Law) |

| LORCME | Ley de los Órganos Reguladores Coordinados en Materia Energética (Law of the Coordinated Regulatory Bodies) |

| LSPEE | Ley del Servicio Público de Energía Eléctrica (Public Electricity Service Law) |

| MRO | Operating Reserve Margin |

| PIDIREGAS | Proyectos de Inversión en Infraestructura Productiva con Registro Diferido en el Gasto Público (Productive Infrastructure Investment Projects with Deferred Registration in Public Expenditure) |

| PRODESEN | Programa de Desarrollo del Sistema Eléctrico Nacional (Official Power System Planning Program) |

| SEN | Sistema Eléctrico Nacional (National Electric System) |

| SENER | Secretaría de Energía (Ministry of Energy) |

| SHCP | Secretaría de Hacienda y Crédito Público (Ministry of Finance and Public Credit) |

| SIN | Sistema Interconectado Nacional (National Interconnected System) |

| USMCA | United States Mexico and Canada Agreement |

References

- Jamasb, T.; Nepal, R.; Timilsina, G.R. A quarter century effort yet to come of age: A survey of electricity sector reform in developing countries. Energy J. 2017, 38. [Google Scholar] [CrossRef] [Green Version]

- Sioshansi, F.P. Competitive Electricity Markets: Design, Implementation, Performance; Elsevier: Amsterdam, The Netherlands, 2011; ISBN 0080557716. [Google Scholar]

- Robinson, C. Energy Policy: The Return of the Regulatory State. Econ. Aff. 2016, 36, 33–47. [Google Scholar] [CrossRef]

- Secretaría de la Economía Nacional Ley de la Industria Eléctrica. Available online: http://www.dof.gob.mx/nota_to_imagen_fs.php?codnota=4451737&fecha=11/02/1939&cod_diario=188127 (accessed on 20 May 2021).

- Congreso de la Unión Ley del Servicio Público de Energía Eléctrica. Available online: http://www.dof.gob.mx/nota_detalle.php?codigo=4830116&fecha=22/12/1975 (accessed on 20 May 2021).

- Congreso de la Unión Decreto que Reforma, Adiciona y Deroga Diversas Disposiciones de la Ley del Servicio Público de Energía Eléctrica. Available online: http://dof.gob.mx/nota_detalle.php?codigo=4705440&fecha=23/12/1992 (accessed on 20 May 2021).

- Del Río Monges, J.A.; Rosales Reyes, M.; Ortega Olvera, V.; Maya Hernández, S.O. Análisis de la Reforma Energética; Instituto Belisario Domínguez: Mexico City, Mexico, 2016; ISBN 9786078320561. [Google Scholar]

- Presidencia de la República Decreto por el que se Reforman y Adicionan Diversas Disposiciones de la Constitución Política de los Estados Unidos Mexicanos, en Materia de Energía. Available online: http://dof.gob.mx/nota_detalle.php?codigo=5327463&fecha=20/12/2013 (accessed on 6 December 2020).

- Cámara de Diputados Ley de la Industria Eléctrica. Available online: https://www.dof.gob.mx/nota_detalle.php?codigo=5355986&fecha=11/08/2014 (accessed on 6 December 2020).

- López Obrador, A.M. Iniciativa con Proyecto de Decreto por la que se Adicionan y Reforman Diversas Disposiciones de la Ley de la Industria Eléctrica. Available online: http://archivos.diputados.gob.mx/portalHCD/archivo/INICIATIVA_PREFERENTE_01FEB21.pdf (accessed on 23 May 2021).

- Alpizar–Castro, I.; Rodríguez–Monroy, C. Review of Mexico׳ s Energy Reform in 2013: Background, Analysis of the Reform and Reactions. Renew. Sustain. Energy Rev. 2016, 58, 725–736. [Google Scholar] [CrossRef]

- Ibarra-Yunez, A. Energy reform in Mexico: Imperfect unbundling in the electricity sector. Util. Policy 2015, 35, 19–27. [Google Scholar] [CrossRef]

- Zenón, E.; Rosellón, J. Optimal transmission planning under the Mexican new electricity market. Energy Policy 2017, 104, 349–360. [Google Scholar] [CrossRef]

- Kunz, F.; Rosellón, J.; Kemfert, C. Introduction of nodal pricing into the new mexican electricity market through ftr allocations. Energy J. 2017, 38. [Google Scholar] [CrossRef]

- Stoft, S. Power System Economics: Designing Markets for Electricity; Wiley-IEEE Press: Piscataway, NJ, USA, 2002; ISBN 0-471-15040-1. [Google Scholar]

- Nepal, R.; Jamasb, T. Reforming small electricity systems under political instability: The case of Nepal. Energy Policy 2012, 40, 242–251. [Google Scholar] [CrossRef]

- Bye, T.; Hope, E. Deregulation of electricity markets: The Norwegian experience. Econ. Polit. Wkly. 2005, 40, 5269–5278. [Google Scholar]

- Sioshansi, F.P.; Pfaffenberger, W. Electricity Market Reform: An International Perspective; Elsevier: Amsterdam, The Netherlands, 2006; ISBN 0080462715. [Google Scholar]

- Bhattacharya, K.; Bollen, M.H.J.; Daalder, J.E. Operation of Restructured Power Systems; Springer Science & Business Media: New York, NY, USA, 2012; ISBN 1461514657. [Google Scholar]

- Hall, D.; Nguyen, T.A. Electricity liberalisation in developing countries. Prog. Dev. Stud. 2017, 17, 99–115. [Google Scholar] [CrossRef]

- Sen, A.; Jamasb, T. Diversity in unity: An empirical analysis of electricity deregulation in Indian states. Energy J. 2012, 33. [Google Scholar] [CrossRef]

- Ryu, H.; Kim, Y.; Jang, P.; Aldana, S. Restructuring and Reliability in the Electricity Industry of OECD Countries: Investigating Causal Relations between Market Reform and Power Supply. Energies 2020, 13, 4746. [Google Scholar] [CrossRef]

- Litvinov, E.; Zhao, F.; Zheng, T. Electricity Markets in the United States: Power Industry Restructuring Processes for the Present and Future. IEEE Power Energy Mag. 2019, 17, 32–42. [Google Scholar] [CrossRef]

- Hobbs, B.F.; Oren, S.S. Three Waves of U.S. Reforms: Following the Path of Wholesale Electricity Market Restructuring. IEEE Power Energy Mag. 2019, 17, 73–81. [Google Scholar] [CrossRef]

- Bacon, R.W. Privatization and reform in the global electricity supply industry. Annu. Rev. Energy Environ. 1995, 20, 119–143. [Google Scholar] [CrossRef]

- Littlechild, S. Electricity: Regulatory Developments around the World. Available online: https://hepg.hks.harvard.edu/files/hepg/files/littlechild_12-01_beesley_lect.pdf?m=1523368781 (accessed on 6 December 2020).

- Joskow, P.L. Lessons learned from electricity market liberalization. Energy J. 2008, 29. [Google Scholar] [CrossRef]

- Fotouhi Ghazvini, M.A.; Ramos, S.; Soares, J.; Castro, R.; Vale, Z. Liberalization and customer behavior in the Portuguese residential retail electricity market. Util. Policy 2019, 59, 100919. [Google Scholar] [CrossRef]

- Hartley, P.R.; Medlock, K.B.; Jankovska, O. Electricity reform and retail pricing in Texas. Energy Econ. 2019, 80, 1–11. [Google Scholar] [CrossRef]

- Shin, K.J.; Managi, S. Liberalization of a retail electricity market: Consumer satisfaction and household switching behavior in Japan. Energy Policy 2017, 110, 675–685. [Google Scholar] [CrossRef]

- Urpelainen, J.; Yang, J. Global patterns of power sector reform, 1982–2013. Energy Strateg. Rev. 2019, 23, 152–162. [Google Scholar] [CrossRef]

- Bensch, G. The effects of market-based reforms on access to electricity in developing countries: A systematic review. J. Dev. Eff. 2019, 11, 165–188. [Google Scholar] [CrossRef] [Green Version]

- Ponce-Jara, M.A.; Castro, M.; Pelaez-Samaniego, M.R.; Espinoza-Abad, J.L.; Ruiz, E. Electricity sector in Ecuador: An overview of the 2007–2017 decade. Energy Policy 2018, 113, 513–522. [Google Scholar] [CrossRef]

- Mastropietro, P.; Rodilla, P.; Rangel, L.E.; Batlle, C. Reforming the colombian electricity market for an efficient integration of renewables: A proposal. Energy Policy 2020, 139, 111346. [Google Scholar] [CrossRef]

- Daglish, T.; de Bragança, G.G.F.; Owen, S.; Romano, T. Pricing effects of the electricity market reform in Brazil. Energy Econ. 2021, 97, 105197. [Google Scholar] [CrossRef]

- Stiglitz, J. Whither reform. In Proceedings of the Keynote Address for the Annual Bank Conference on Development Economics, Washington, DC, USA, 20–21 April 1998; World Bank: Washington, DC, USA, 1999. [Google Scholar]

- Brousseau, E.; Glachant, J.-M. New Institutional Economics; Brousseau, E., Glachant, J.-M., Eds.; Cambridge University Press: Cambridge, UK, 2008; ISBN 9780511754043. [Google Scholar]

- Majone, G. The rise of the regulatory state in Europe. W. Eur. Polit. 1994, 17, 77–101. [Google Scholar] [CrossRef]

- Gilardi, F. Policy credibility and delegation to independent regulatory agencies: A comparative empirical analysis. J. Eur. Public Policy 2002, 9, 873–893. [Google Scholar] [CrossRef]

- Mulder, M. Information asymmetry in retail energy markets. In Regulation of Energy Markets; Springer: Cham, Switzerland, 2021; pp. 113–131. [Google Scholar]

- Dal Bó, E.; Rossi, M.A. Corruption and inefficiency: Theory and evidence from electric utilities. J. Public Econ. 2007, 91, 939–962. [Google Scholar] [CrossRef]

- Nepal, R.; Jamasb, T. Caught between theory and practice: Government, market, and regulatory failure in electricity sector reforms. Econ. Anal. Policy 2015, 46, 16–24. [Google Scholar] [CrossRef] [Green Version]

- Larsen, A.; Pedersen, L.H.; Sørensen, E.M.; Olsen, O.J. Independent regulatory authorities in European electricity markets. Energy Policy 2006, 34, 2858–2870. [Google Scholar] [CrossRef]

- Ritchie, H.; Roser, M. Energy. Available online: https://ourworldindata.org/energy (accessed on 10 May 2021).

- Presidencia de la República Ley del Servicio Público de Energía Eléctrica. Available online: https://www.senado.gob.mx/comisiones/energia/docs/marco_LSPEE.pdf (accessed on 4 April 2021).

- SHCP. Proyecto del Presupuesto de Egresos de la Federación 2020. Pidiregas. Available online: https://www.ppef.hacienda.gob.mx/es/PPEF2020/pidiregas (accessed on 26 April 2021).

- SENER. Sistema de Información Energética. Available online: https://sie.energia.gob.mx/bdiController.do?action=temas (accessed on 12 May 2021).

- CFE. Estados Financieros Consolidados de CFE al 31 de Diciembre de 2017. Available online: https://www.cfe.mx/finanzas/reportes-financieros/Documents/2017/CierreE.F.2017.pdf?csf=1&e=8SjuhD (accessed on 31 March 2021).

- CFE. Estados Financieros Consolidados Al 31 de Diciembre de 2019, 2018 y 2017. Available online: https://www.cfe.mx/finanzas/reportes-financieros/Documents/2019/CFEysubs_efc_2019.pdf?csf=1&e=ESmGFx (accessed on 24 May 2021).

- CFE. Estados Financieros Consolidados al Cierre de 2016. Available online: https://www.cuentapublica.hacienda.gob.mx/work/models/CP/2016/tomo/VIII/TVV.05.DAR.pdf (accessed on 24 May 2021).

- CFE. Estados Financieros Consolidados por los Años que Terminaron el 31 de Diciembre de 2013 y 2012. Available online: https://www.cuentapublica.hacienda.gob.mx/work/models/CP/2014/tomo/VII/TOQ/TOQ.05.DAR.pdf (accessed on 24 May 2021).

- CFE. Estados Financieros Consolidados por los Años que Terminaron el 31 de diciembre de 2015 y 2014. Available online: https://www.cuentapublica.hacienda.gob.mx/work/models/CP/2015/tomo/VIII/TOQ.05.DAR.pdf (accessed on 24 May 2021).

- CFE. Informe Anual Comisión Federal de Electricidad 2016. Available online: https://www.cfe.mx/finanzas/reportes-financieros/InformeAnualDocumentos/InformeAnual2016CFE.pdf?csf=1&e=eUcCiv (accessed on 24 May 2021).

- CFE. Informe Anual Comisión Federal de Electricidad 2017. Available online: https://www.cfe.mx/finanzas/reportes-financieros/Informe%20Anual%20Documentos/InformeAnual2017_CFE_vF-031018.pdf?csf=1&e=pGmKXe (accessed on 24 May 2021).

- SENER. Prospectiva del Sector Eléctrico 2017–2031. Available online: https://www.gob.mx/cms/uploads/attachment/file/284345/Prospectiva_del_Sector_El_ctrico_2017.pdf (accessed on 6 December 2020).

- Cámara de Diputados Ley de la Comisión Federal de Electricidad. Available online: https://www.dof.gob.mx/nota_detalle.php?codigo=5355990&fecha=11/08/2014#:~:text=DECRETO%20por%20el%20que%20se,de%20Obras%20P%C3%BAblicas%20y%20Servicios (accessed on 6 December 2020).

- SENER. Términos para la Estricta Separación Legal de la Comisión Federal de Electricidad. Available online: http://www.dof.gob.mx/nota_detalle.php?codigo=5422390&fecha=11/01/2016 (accessed on 21 March 2021).

- CENACE. Resultados DFT Legados. Available online: https://www.cenace.gob.mx/Paginas/SIM/ResultadosDFTLeg.aspx (accessed on 6 December 2020).

- Garcia Sanchez, G.J. Las Letras Pequeñas de la Reforma Energética de México (Spanish edition of The Fine Print of the Mexican Energy Reform). La Nueva Reforma Energética México; Duncan, W., Ed.; Mexico Institute, Woodrow Wilson Internation Center for Scholars: Washington, DC, USA, 2018; pp. 18–62. [Google Scholar]

- CENACE. Disponibilidad de Entrega Física. Available online: https://www.cenace.gob.mx/Paginas/SIM/DispEntregaFisica.aspx (accessed on 25 May 2021).

- CENACE. Capacidad Demandada y RAP. Available online: https://www.cenace.gob.mx/Paginas/SIM/CapacidadDemandadaRAP.aspx (accessed on 25 May 2021).

- SENER. Programa de Desarrollo del Sistema Eléctrico Nacional 2018–2032. Available online: https://www.gob.mx/cms/uploads/attachment/file/331770/PRODESEN-2018-2032-definitiva.pdf (accessed on 26 March 2021).

- ASF. CFE Corporativo: Desempeño de la Comisión Federal de Electricidad. Available online: https://www.asf.gob.mx/Trans/Informes/IR2019b/Documentos/Auditorias/2019_0431_a.pdf (accessed on 6 December 2020).

- CENACE. Precios Marginales Locales. Available online: https://www.cenace.gob.mx/Paginas/SIM/Reportes/PreciosEnergiaSisMEM.aspx (accessed on 22 April 2021).

- CRE. ACUERDO Núm. A/045/2015. Available online: https://www.cfe.mx/industria/tarifas/Documents/Acuerdo%20A-045-2015%20Tarifas%20de%20Transmisi%C3%B3n%20enero%202016%20a%20diciembre%202018.pdf (accessed on 14 May 2021).

- Bashian, A.; Hojat, M.; Javidi, M.H.; Golmohamadi, H. Security-Based Tariff for Wheeling Contracts Considering Fair Congestion Cost Allocation. J. Control. Autom. Electr. Syst. 2014, 25, 368–380. [Google Scholar] [CrossRef] [Green Version]

- Olmos, L.; Pérez-Arriaga, I.J. A comprehensive approach for computation and implementation of efficient electricity transmission network charges. Energy Policy 2009, 37, 5285–5295. [Google Scholar] [CrossRef] [Green Version]

- Pascual, C.; Victor, D.G.; de Castro Medinas, R.F. Will Mexican Energy Reform Survive Political Transition? What Mexicans Think; Brookings Institution: Washington, DC, USA, 2018. [Google Scholar]

- ASF. Informe del Resultado de la Fiscalización Superior de la Cuenta Pública 2019: CFE Fibra E. Available online: https://informe.asf.gob.mx/Documentos/Auditorias/2019_0429_a.pdf (accessed on 11 January 2021).

- Subsecretaría de Electricidad, S. Estados Financieros FSUE 2014–2019. Available online: https://base.energia.gob.mx/dgaic/da/q/subsecretariaelectricidad/fondoserviciouniversalelectrico/sener_07_reglasoperacionfondoserviciouniversalelectrico.pdf (accessed on 11 January 2021).

- CFE. Cancelación del Concurso Abierto No. CFE-0036-CASOA-0001-2018. Available online: http://dof.gob.mx/nota_detalle.php?codigo=5549643&fecha=05/02/2019 (accessed on 25 May 2021).

- García, J.; Marín, R. Mercados y Sostenibilidad para un Sector Energético Competitivo; Editorial Aranzadi, SA: Barcelona, Spain, 2015; ISBN 978-84-9099-357-6. [Google Scholar]

- SHCP. Presupuesto de Egresos de la Federación para el Ejercicio Fiscal 2020. Available online: https://www.dof.gob.mx/nota_detalle.php?codigo=5581629&fecha=11/12/2019 (accessed on 4 April 2021).

- SHCP. Presupuesto de Egresos de la Federación para el Ejercicio Fiscal 2015. Available online: http://www.dof.gob.mx/nota_detalle.php?codigo=5374053&fecha=03/12/2014 (accessed on 11 January 2021).

- SHCP. Presupuesto de Egresos de la Federación para el Ejercicio Fiscal 2016. Available online: http://dof.gob.mx/nota_detalle.php?codigo=5417699&fecha=27/11/2015 (accessed on 11 January 2021).

- SHCP. Presupuesto de Gresos de la Federación para el Ejercicio Fiscal 2017. Available online: https://www.dof.gob.mx/nota_detalle.php?codigo=5463184&fecha=30/11/2016 (accessed on 11 January 2021).

- SHCP. Presupuesto de Egresos de la Federación para el Ejercicio Fiscal 2018. Available online: http://www.dof.gob.mx/nota_detalle.php?codigo=5506080&fecha=29/11/2017 (accessed on 11 January 2021).

- SHCP. Presupuesto de Egresos de la Federación para el Ejercicio Fiscal 2019. Available online: http://dof.gob.mx/nota_detalle.php?codigo=5547479&fecha=28/12/2018 (accessed on 11 January 2021).

- CRE. Informe de Labores 2019. Available online: https://www.gob.mx/cms/uploads/attachment/file/544126/CRE_Informe_de_Labores_2019.pdf (accessed on 16 December 2020).

- Poder Ejecutivo Federal Iniciativa de reforma de la Ley de la Industria Eléctrica. Available online: https://www.senado.gob.mx/comisiones/energia/docs/reforma_energetica/dictamen2.pdf (accessed on 22 February 2021).

- Presidencia de la República Decreto Promulgatorio del Tratado Integral y Progresista de Asociación Transpacífico, Hecho en Santiago de Chile, el Ocho de Marzo de Dos Mil Dieciocho. Available online: https://dof.gob.mx/nota_detalle.php?codigo=5545130&fecha=29/11/2018&print=true (accessed on 25 March 2021).

- SENER. Acuerdo por el que se Modifican los Términos para la Estricta Separación Legal de la Comisión Federal de Electricidad, Publicados el 11 de Enero de 2016. Available online: https://www.dof.gob.mx/nota_detalle.php?codigo=5555005&fecha=25/03/2019 (accessed on 24 March 2021).

- López Obrador, A.M. Memorandum a Servidores Públicos e Integrantes de los Órganos Reguladores del Sector Energético. Available online: https://energiahoy.com/wp-content/uploads/2020/08/MEMORA%CC%81NDUM-2020.pdf (accessed on 25 May 2021).

- CENACE. Acuerdo de Confiabilidad por el Virus SARS-Cov2 (COVID-19). Available online: https://www.cenace.gob.mx/Docs/16_MARCOREGULATORIO/SENyMEM/(Acuerdo%202020-05-01%20CENACE)%20Acuerdo%20para%20garantizar%20la%20eficiencia,%20Calidad,%20Confiabilidad,%20Continuidad%20y%20seguridad.pdf (accessed on 28 April 2021).

| Verifiable Capacity (MW) | |||||

|---|---|---|---|---|---|

| Market Participants | 2016 | 2017 | 2018 | 2019 | 2020 |

| CFE | 37,279.07 | 38,597.53 | 39,368.33 | 38,913.34 | 38,798.70 |

| IPP | 12,464.35 | 12,554.65 | 12,555.65 | 13,470.39 | 15,263.97 |

| ICL | 7853.00 | 10,462.73 | 10,444.19 | 11,616.16 | 11,861.43 |

| Generators | 298.40 | 1200.61 | 2326.56 | 5553.86 | 8833.88 |

| Total | 57,894.82 | 62,815.51 | 64,694.72 | 69,553.75 | 74,757.98 |

| Demanded Capacity (MW) | |||||

|---|---|---|---|---|---|

| Market Participant | 2016 | 2017 | 2018 | 2019 | 2020 |

| CFE basic service supplier | 33,858.57 | 35,015 | 36,865 | 36,733 | 31,987 |

| ICL supplier | 4963.14 | 5768.29 | 5780.05 | 5740.96 | 5940.99 |

| Qualified supplier | 0.00 | 121.27 | 186.98 | 546.37 | 1336.38 |

| Generators | 64.21 | 86.98 | 182.60 | 215.56 | 206.17 |

| Total | 38,884.92 | 40,991.97 | 43,014.71 | 43,235.69 | 39,470.38 |

| Year | Energy Received (GWh) | Energy Delivered (GWh) | Lost Energy (GWh) | Lost Energy (%) |

|---|---|---|---|---|

| 2013 | 253,805.8 | 249,787.4 | 4018.4 | 1.58 |

| 2014 | 260,398.3 | 256,262.4 | 4135.9 | 1.59 |

| 2015 | 265,350.2 | 261,075.7 | 4274.5 | 1.61 |

| 2016 | 273,020.1 | 268,550.2 | 4469.9 | 1.64 |

| 2017 | 301,150.5 | 293,423.8 | 7726.7 | 2.57 |

| 2018 | 311,126.5 | 303,352.7 | 7773.8 | 2.50 |

| 2019 | 317,909.0 | 309,299.9 | 8609.1 | 2.71 |

| Subsidiaries | Average Age of Plants (years) | Produced Energy (GWh) | Average Cost (USD/MWh) | Economic Loss (Million USD) |

|---|---|---|---|---|

| Totals | 231,939.20 | 73.77 * | 3239.63 | |

| CFE Generation I | 36.1 | 24,587.20 | 94.85 | 510.61 |

| CFE Generation II | 33.5 | 26,324.55 | 108.02 | 903.18 |

| CFE Generation III | 33.7 | 29,071.01 | 95.38 | 836.78 |

| CFE Generation IV | 39.8 | 27,102.83 | 64.81 | 267.16 |

| CFE Generation VI | 41.8 | 32,640.18 | 107.50 | 722.44 |

| IPP | ||||

| CFE Generation V | 12.1 | 92,213.42 | 43.21 | |

| Concept | Amount (USD Million) | Percentage (%) |

|---|---|---|

| Total | 3078.54 | 100.0 |

| Generation | 1636.57 | 53.2 |

| Transmission and distribution | 1389.25 | 45.1 |

| Basic supply | 52.73 | 1.7 |

| Subsidies granted by SHCP to domestic and agricultural users | ||

| Estimated total subsidies | 5998.89 | 100 |

| Subsidies granted by SHCP | 3961.85 | 66 |

| Subsidies charged to CFE liabilities | 2037.04 | 34 |

| Index | ||

|---|---|---|

| Holder status | ||

| 1. Term of office | 7 years (Art. 7, LORCME) | 0.80 |

| 2. Who names him? | The head of the Executive proposes, and the Senate approves (Art. 7, LORCME) | 0.75 |

| 3. Grounds for dismissal | For policy and non-policy reasons (Art. 9, LORCME) | 0.67 |

| 4. Can the Presiding Commissioner hold other positions within the government during his or her tenure? | No (Art. 8, LORCME) | 1.00 |

| 5. Is it possible to renew the position? | Yes, one-time (Art.7, LORCME) | 0.50 |

| 6. Is independence required for the assignment of the position? | Yes (Art.8, LORCME) | 1.00 |

| Commission status | ||

| 7. Term of office | 7 years (Art. 6, LORCME) | 0.8 |

| 8. Who names him? | Proposed by the Executive and approved by the Senate (Art.6 LORCME). | 0.75 |

| 9. Grounds for dismissal | For policy and non-policy reasons (Art. 9, LORCME) | 0.67 |

| 10. Can commissioners hold other positions during their term of office? | No (Art. 8, LORCME) | 1 |

| 11. Is it possible to renew the position? | Yes, one-time (Art.6, LORCME) | 0.5 |

| 12. Is independence required for the assignment of the position? | Yes (Art.8, LORCME) | 1 |

| Relationship with government and parliament | ||

| 13. Is it formally independent from the government? | Yes (Art. 3 LORCME) | 1 |

| 14. What are the obligations to the government? | None | 1 |

| 15. What are the obligations to parliament? | Submission of an annual report for informational purposes (Art. 23 LORCME) | 0.67 |

| 16. Who, other than the court, can overrule its decisions? | Nobody | 1 |

| Organizational and financial autonomy | ||

| 17. What is the origin of the budget? | Regulated activities and Congress (Art. 3 LORCME) | 0.5 |

| 18. How is the budget managed? | The budget is administered by the agency itself, subject to approval by the SHCP. (Art. 30, LORCME) | 1 |

| 19. Who decides the internal organization of the agency? | Agency (Art. 22, LORCME) | 1 |

| 20. Who is in charge of the agency’s personnel policy? | The committe (Art. 23, LORCME) | 1 |

| Areas of competence to regulate | ||

| 21. Tariffs | Agency and government | 0.25 |

| 22. Permits | Only the agency | 1.00 |

| 23. Permit modification | Only the agency | 1.00 |

| 24. Network access | CRE and CENACE | 0.75 |

| 25. Power quality | The CRE | 1.00 |

| 26. Authority to regulate through economic sanctions | Yes | 1.00 |

| Independence Index | 0.83 |

| Year | Electricity | Oil | Liquified Petrolum Gas | Natural Gas | Hydrocarbons |

|---|---|---|---|---|---|

| 2016 | 158 | 1370 | 5269 | 48 | 170 |

| 2017 | 126 | 470 | 235 | 81 | 164 |

| 2018 | 131 | 551 | 398 | 93 | 214 |

| 2019 | 94 | 521 | 280 | 48 | 169 |

| 2020 | 22 | 287 | 213 | 42 | 99 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Percino-Picazo, J.C.; Llamas-Terres, A.R.; Viramontes-Brown, F.A. Analysis of Restructuring the Mexican Electricity Sector to Operate in a Wholesale Energy Market. Energies 2021, 14, 3331. https://doi.org/10.3390/en14113331

Percino-Picazo JC, Llamas-Terres AR, Viramontes-Brown FA. Analysis of Restructuring the Mexican Electricity Sector to Operate in a Wholesale Energy Market. Energies. 2021; 14(11):3331. https://doi.org/10.3390/en14113331

Chicago/Turabian StylePercino-Picazo, Juan C., Armando R. Llamas-Terres, and Federico A. Viramontes-Brown. 2021. "Analysis of Restructuring the Mexican Electricity Sector to Operate in a Wholesale Energy Market" Energies 14, no. 11: 3331. https://doi.org/10.3390/en14113331

APA StylePercino-Picazo, J. C., Llamas-Terres, A. R., & Viramontes-Brown, F. A. (2021). Analysis of Restructuring the Mexican Electricity Sector to Operate in a Wholesale Energy Market. Energies, 14(11), 3331. https://doi.org/10.3390/en14113331