Examining the Development of a Geothermal Risk Mitigation Scheme in Greece

Abstract

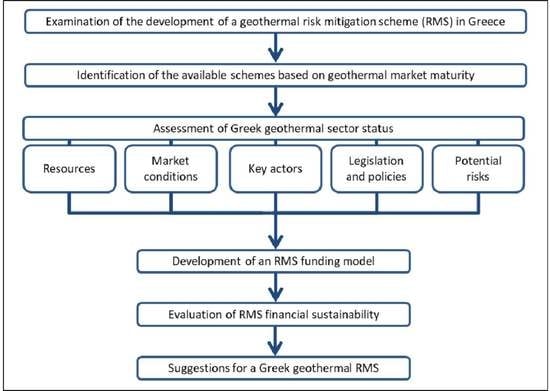

:1. Introduction

2. Country Status

2.1. Geothermal Assessment

2.2. Market Conditions in Greece

2.3. Key Public Institutions

2.4. Risk Assessment

2.5. Legislation and Policies

2.5.1. Geothermal Legislative Framework

2.5.2. Support Schemes for Geothermal Energy

2.5.3. Legislation and Policies on Geothermal RMS

- The Hellenic Survey of Geology & Mineral Exploration has been performing exploration activities throughout low-temperature (<90 °C) geothermal fields in Greece; thus, through public funding, the possible exploration and geological risks are reduced for potential investors.

- Municipalities, with funds from the National Strategic Reference Framework (NSRF), develop infrastructure for district heating networks. Thus, costs related to lack of funding and relevant aspects are reduced.

- Acknowledges the importance of risk mitigation;

- Proposes the use of preferential loans through special funds;

- Proposes the provision of insurance for the initial collateral damage of loaning schemes.

3. Materials and Methods

- t: year under consideration, taking values from 1 to n;

- n: the upper-year limit of the RMS, taking values from 1 to 10; in the examined RMS 10-year cash flow scenarios, n = tmax = 10;

- FCt: the scheme’s annual fixed cost, expressed in EUR; it includes staff cost, office costs, travel, overhead, operating cost of the technical committee, cost of experts’, depreciation costs, and other costs; it is independent of the number of projects insured and was set to EUR 240,000 in all scenarios (see Table A1 for analysis);

- VCt: the scheme’s annual variable cost, i.e., the cost resulting from the reparations for the failed projects (the number of failed projects each year depends on the success rates assumed by each scenario; see Table 3), and is expressed in EUR; it is the product of the applied risk coverage (ranging from 5% to 100%; see Table 2) and the insured capital of failed projects.

- LC: the scheme’s launching capital, set to EUR 10,000,000 in all examined scenarios.

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Type | Cost |

|---|---|

| Staff cost | 60,000 |

| Project expert cost/year | 90,000 |

| Office costs | 12,000 |

| Travels | 12,000 |

| Overhead services (legal, banking, data, accountant, etc.) | 36,000 |

| Operation costs of the technical committee | 20,000 |

| Depreciation | 5000 |

| Others | 5000 |

| Total | 240,000 |

| Year | No. | Project Identification and Type | Geological Formation, Identification of the Aquifer | Contract Duration | Available Data (G&G Studies, Project Concept) | Project Capacity, MW, Expected Production, MWh/year | Insured Cost, EUR |

|---|---|---|---|---|---|---|---|

| 1 | 1 | Milos production well | Metamorphic basement | 4 months | Complete field picture | 10 MWe | 1,600,000 |

| 2 | Milos reinjection well | Metamorphic basement | 4 months | complete field picture | - | 1,600,000 | |

| 3 | 1st Aristino production well | Andesites | 3 months | Part of field explored | 7 MWth | 650,000 | |

| 4 | 2nd Aristino production well | Andesites | 3 months | Part of field explored | 7 MWth | 650,000 | |

| 5 | 3rd Aristino production well | Andesites | 3 months | Part of field explored | 7 MWth | 650,000 | |

| 2 | 6 | Nisyros production well | Marble, limestone | 4 months | Part of field explored | 5 MWe | 1,900,000 |

| 7 | Nisyros reinjection well | Marble, limestone | 4 months | Part of field explored | - | 1,900,000 | |

| 8 | 1st Aristino reinjection well | Andesites | 3 months | Part of field explored | - | 650,000 | |

| 9 | 2nd Aristino reinjection well | Andesites | 3 months | Part of field explored | - | 650,000 | |

| 10 | 3rd Aristino reinjection well | Andesites | 3 months | Part of field explored | - | 650,000 | |

| 3 | 11 | Methana production well | Crystalline basement | 4 months | Geophysics only | 5 MWe | 1,700,000 |

| 12 | Methana deep well | Crystalline basement | 4 months | Geophysics only | - | 1,700,000 | |

| 13 | Methana reinjection well | Crystalline basement | 4 months | Geophysics only | - | 1,700,000 | |

| 14 | 1st Nea Kessani production well | Base conglomerate | 3 months | Field explored | 4 MWth | 650,000 | |

| 15 | 2nd Nea Kessani production well | Base conglomerate | 3 months | Field explored | 4 MWth | 650,000 | |

| 16 | Low-enthalpy well | Base conglomerate | 3 months | Field explored | - | 650,000 | |

| 17 | 3rd Nea Kessani production well | Base conglomerate | 3 months | Field explored | 4 MWth | 650,000 | |

| 4 | 18 | Lesvos production well | Crystalline basement | 6 months | Geophysics only | 8 MWe | 3,700,000 |

| 19 | Lesvos deep well | Crystalline basement | 6 months | Geophysics only | - | 3,700,000 | |

| 20 | 1st Nea Kessani reinjection well | Base conglomerate | 3 months | Field explored | - | 650,000 | |

| 21 | 2nd Nea Kessani reinjection well | Base conglomerate | 3 months | Field explored | - | 650,000 | |

| 22 | 3rd Nea Kessani reinjection well | Base conglomerate | 3 months | Field explored | - | 650,000 | |

| 5 | 23 | Lesvos reinjection well | Crystalline basement | 6 months | Geophysics only | - | 3,700,000 |

| 24 | Soussaki production well | Limestones | 6 months | New area | 5 MWe | 3,100,000 | |

| 25 | 1st Nigrita production well | Base conglomerate | 3 months | Part of field explored | 4 MWth | 650,000 | |

| 26 | 2nd Nigrita production well | Base conglomerate | 3 months | Part of field explored | 4 MWth | 650,000 | |

| 27 | Low-enthalpy well | Base conglomerate | 3 months | Part of field explored | - | 650,000 | |

| 28 | 3rd Nigrita production well | Base conglomerate | 3 months | Part of field explored | 4 MWth | 650,000 | |

| 6 | 29 | Soussaki deep well | Limestones | 6 months | New area | - | 3,100,000 |

| 30 | Soussaki reinjection well | Limestones | 6 months | New area | - | 3,100,000 | |

| 31 | 1st Nigrita reinjection well | Base conglomerate | 3 months | Part of field explored | - | 650,000 | |

| 32 | 2nd Nigrita reinjection well | Base conglomerate | 3 months | Part of field explored | - | 650,000 | |

| 33 | 3rd Nigrita reinjection well | Base conglomerate | 3 months | Part of field explored | - | 650,000 | |

| 7 | 34 | Samothraki production well | Diabases | 6 months | New area | 5 MWe | 3,700,000 |

| 35 | Samothraki deep well | Diabases | 6 months | New area | - | 3,700,000 | |

| 36 | 1st Lithotopos production well | Base conglomerate | 3 months | Field explored | 4 MWth | 650,000 | |

| 37 | 2nd Lithotopos production well | Base conglomerate | 3 months | Field explored | 4 MWth | 650,000 | |

| 38 | 3rd Lithotopos production well | Base conglomerate | 3 months | Field explored | 4 MWth | 650,000 | |

| 8 | 39 | Samothraki reinjection well | Diabases | 6 months | New area | - | 3,700,000 |

| 40 | Chios deep well | Detrital formations | 6 months | New area | - | 3,700,000 | |

| 41 | 1st Lithotopos reinjection well | Base conglomerate | 3 months | Field explored | - | 650,000 | |

| 42 | 2nd Lithotopos reinjection well | Base conglomerate | 3 months | Field explored | - | 650,000 | |

| 43 | 3rd Lithotopos reinjection well | Base conglomerate | 3 months | Field explored | - | 650,000 | |

| 9 | 44 | Chios production well | Detrital formations | 6 months | New area | 5 MWe | 3,700,000 |

| 45 | Chios reinjection well | Detrital formations | 6 months | New area | - | 3,700,000 | |

| 46 | Akropotamos production well | Base conglomerate | 3 months | Part of field explored | 7 MWth | 650,000 | |

| 47 | Akropotamos production well | Base conglomerate | 3 months | Part of field explored | 7 MWth | 650,000 | |

| 48 | Low-enthalpy well | Base conglomerate | 3 months | Part of field explored | - | 650,000 | |

| 49 | Akropotamos production well | Base conglomerate | 3 months | Part of field explored | 7 MWth | 650,000 | |

| 10 | 50 | Thera (Santorini) production well | Crystalline basement | 4 months | New area | 5 MWe | 2,500,000 |

| 51 | Thera (Santorini) deep well | Crystalline basement | 4 months | New area | - | 2,500,000 | |

| 52 | Thera reinjection well | Crystalline basement | 4 months | New area | - | 2,500,000 | |

| 53 | Akropotamos reinjection well | Base conglomerate | 3 months | Part of field explored | - | 650,000 | |

| 54 | Akropotamos reinjection well | Base conglomerate | 3 months | Part of field explored | - | 650,000 |

References

- Agrawal, A. Risk mitigation strategies for renewable energy project financing. Strateg. Plan. Energy Environ. 2012, 32, 9–20. [Google Scholar] [CrossRef]

- Gehringer, M. Alternative design of geothermal support mechanisms and risk mitigation funds. In Proceedings of the GRC Proceedings, Geothermal Resources Council Transactions, Salt Lake City, UT, USA, 1–4 October 2017; Volume 41. [Google Scholar]

- Kreuter, H.; Baisch, C. Lessons learned from the German risk mitigation schemes and a concept for different geothermal play types. In Proceedings of the Geothermal Resource Council Meetings, Geothermal Resources Council Transactions, Reno, NV, USA, 4–17 October 2018; Volume 42, pp. 2336–2344. [Google Scholar]

- Dumas, P.; Garabetian, T.; Le Guénan, T.; Kępińska, B.; Kasztelewicz, A.; Karytsas, S.; Siddiqi, G.; Lupi, N.; Seyidov, F.; Nador, A.; et al. Risk mitigation and insurance schemes adapted to geothermal market maturity: The right scheme for my market. In Proceedings of the European Geothermal Congress 2019, Den Haag, The Netherlands, 11–14 June 2019. [Google Scholar]

- Dumas, P.; Garabatian, T. Financing geothermal projects in Europe: An overview of the available instruments. Tech. Poszuk. Geol. 2017, 56, 189–201. [Google Scholar]

- Shortall, R.; Davidsdottir, B.; Axelsson, G. Geothermal energy for sustainable development: A review of sustainability impacts and assessment frameworks. Renew. Sustain. Energy Rev. 2015, 44, 391–406. [Google Scholar] [CrossRef]

- Soltani, M.; Kashkooli, F.M.; Souri, M.; Rafiei, B.; Jabarifar, M.; Gharali, K.; Nathwani, J.S. Environmental, economic, and social impacts of geothermal energy systems. Renew. Sustain. Energy Rev. 2021, 140, 110750. [Google Scholar] [CrossRef]

- Sigfússon, B.; Uihlein, A. JRC Geothermal Energy Status Report Technology, Market and Economic Aspects of Geothermal Energy in Europe; European Union: Luxembourg, 2015. [Google Scholar]

- Agemar, T.; Weber, J.; Schulz, R. Deep geothermal energy production in Germany. Energies 2014, 7, 4397–4416. [Google Scholar] [CrossRef]

- Dumas, P. Policy and regulatory aspects of geothermal energy: A European perspective. In Geothermal Energy and Society; Springer: Cham, Switzerland, 2019; pp. 19–37. [Google Scholar]

- Lee, C.W.; Zhong, J. Financing and risk management of renewable energy projects with a hybrid bond. Renew. Energy 2015, 75, 779–787. [Google Scholar] [CrossRef]

- Pan, S.Y.; Gao, M.; Shah, K.J.; Zheng, J.; Pei, S.L.; Chiang, P.C. Establishment of enhanced geothermal energy utilization plans: Barriers and strategies. Renew. Energy 2019, 132, 19–32. [Google Scholar] [CrossRef]

- Witter, J.B.; Trainor-Guitton, W.J.; Siler, D.L. Uncertainty and risk evaluation during the exploration stage of geothermal development: A review. Geothermics 2019, 78, 233–242. [Google Scholar] [CrossRef]

- Guerrero-Liquet, G.C.; Sánchez-Lozano, J.M.; García-Cascales, M.S.; Lamata, M.T.; Verdegay, J.L. Decision-making for risk management in sustainable renewable energy facilities: A case study in the Dominican Republic. Sustainability 2016, 8, 455. [Google Scholar] [CrossRef] [Green Version]

- Dumas, P.; Serrano, C. GEORISK: Developing geothermal projects by mitigating risks. In Proceedings of the 1st Geoscience & Engineering in Energy Transition Conference, Strasbourg, France, 16–18 November 2020; European Association of Geoscientists & Engineers: Strasbourg, France; Volume 1, pp. 1–5. [Google Scholar]

- Boissavy, C. Report and Guidelines for Establishing a Risk Mitigation Scheme (RMS) for Countries in EU and Abroad. GEORISK Project; Del. 5.1. June 2021. Available online: https://ec.europa.eu/research/participants/documents/downloadPublic?documentIds=080166e5decd8241&appId=PPGMS (accessed on 15 February 2022).

- Kępińska, B.; Kujbus, A.; Karytsas, S.; Boissavy, C.; Mendrinos, D.; Karytsas, C.; Kasztelewicz, A. Risk insurance fund for geothermal energy projects in selected European countries–operational and financial simulation. Miner. Resour. Manag. 2021, 37, 139–158. [Google Scholar]

- European Geothermal Energy Council (EGEC). Risk Mitigation Frameworks for Geothermal and Other Renewable Energy Technologies–Factsheet. July 2021. Available online: https://www.georisk-project.eu/risk-mitigation-frameworks-for-geothermal-and-other-renewable-energy-technologies-factsheet-available/ (accessed on 15 February 2022).

- Speer, B.; Economy, R.; Lowder, T.; Schwabe, P.; Regenthal, S. Geothermal Exploration Policy Mechanisms: Lessons for the United States from International Applications (No. NREL/TP-6A20-61477); National Renewable Energy Lab (NREL): Golden, CO, USA, 2014. [Google Scholar]

- Sanyal, S.K.; Robertson-Tait, A.; Jayawardena, M.; Huttrer, G.; Berman, L.W. Comparative Analysis of Approaches to Geothermal Resource Risk Mitigation: A Global Survey; No. 105172; The World Bank: Washington, DC, USA, 2016; pp. 1–46. [Google Scholar]

- Apak, S.; Atay, E.; Tuncer, G. Financial risk management in renewable energy sector: Comparative analysis between the European Union and Turkey. Procedia-Soc. Behav. Sci. 2011, 24, 935–945. [Google Scholar] [CrossRef] [Green Version]

- MARSH. Scoping Study on Financial Risk Management Instruments for Renewable Energy Projects; Reference Document; United Nations Environment Programme. 2004. Available online: http://www.globalclearinghouse.org/Infradev/assets%5C10/documents/UNEP%20-%20Scoping%20Study%20on%20Financial%20Risk%20Management%20Instruments%20for%20Renewable%20Energy%20Projects%20%20%28n%20a%29.pdf (accessed on 15 February 2022).

- Liebreich, M. Financing RE: Risk management in financing renewable energy projects. Refocus 2005, 6, 18–20. [Google Scholar] [CrossRef]

- Abba, Z.Y.I.; Balta-Ozkan, N.; Hart, P. A holistic risk management framework for renewable energy investments. Renew. Sustain. Energy Rev. 2022, 160, 112305. [Google Scholar] [CrossRef]

- Holburn, G.L. Assessing and managing regulatory risk in renewable energy: Contrasts between Canada and the United States. Energy Policy 2012, 45, 654–665. [Google Scholar] [CrossRef]

- Leblanc, E. Challenges of the renewable energy industry generate new demands for risk advisory: How to value an insurance package from a financing perspective? Geneva Pap. Risk Insur.-Issues Pract. 2008, 33, 147–152. [Google Scholar] [CrossRef]

- Gatzert, N.; Kosub, T. Risks and risk management of renewable energy projects: The case of onshore and offshore wind parks. Renew. Sustain. Energy Rev. 2016, 60, 982–998. [Google Scholar] [CrossRef]

- Kitzing, L. Risk implications of renewable support instruments: Comparative analysis of feed-in tariffs and premiums using a mean-variance approach. Energy 2014, 64, 495–505. [Google Scholar] [CrossRef] [Green Version]

- Waissbein, O.; Glemarec, Y.; Bayraktar, H.; Schmidt, T.S. Derisking renewable energy investment. In A Framework to Support Policymakers in Selecting Public Instruments to Promote Renewable Energy Investment in Developing Countries; United Nations Development Programme (UNDP): New York, NY, USA, 2013. [Google Scholar]

- Mohamed, S.P.; Firoz, N.; Sadhikh, M.; Dadu, M. Risk analysis in implementation of solar energy projects in Kerala. J. Phys. Conf. Ser. 2019, 1355, 012026. [Google Scholar] [CrossRef]

- Imolauer, K.; Ueltzen, M. Risk mitigation systems in comparison. In Proceedings of the World Geothermal Congress, Melbourne, Australia, 19–25 April 2015. [Google Scholar]

- Nádor, A.; Kujbus, A.; Choropanitis, I.; Karytsas, S. Study on Technical Measures, GEORISK Project; Del. 2.4. December 2019. Available online: https://ec.europa.eu/research/participants/documents/downloadPublic?documentIds=080166e5ca948ec3&appId=PPGMS (accessed on 15 February 2022).

- Kępińska, B.; Kasztelewicz, A.; Miecznik, M. Policy and Regulatory Mapping Report, GEORISK Project; Del. 4.1. July 2021. Available online: https://ec.europa.eu/research/participants/documents/downloadPublic?documentIds=080166e5e062270e&appId=PPGMS (accessed on 15 February 2022).

- Lupi, N.; Siddiqi, G. Risk Mitigation Tools: Framework Conditions for Establishing a Risk Mitigation Scheme, GEORISK Project; Del. 3.2. July 2019. Available online: https://www.georisk-project.eu/wp-content/uploads/2019/10/D3.2-Proposal-on-how-to-establish-an-insurance-scheme.pdf (accessed on 15 February 2022).

- Karytsas, S.; Polyzou, O. Social acceptance of geothermal power plants. In Thermodynamic Analysis and Optimization of Geothermal Power Plants; Elsevier: Amsterdam, The Netherlands, 2021; pp. 65–79. [Google Scholar]

- Mendrinos, D.; Choropanitis, I.; Polyzou, O.; Karytsas, C. Exploring for Geothermal Resources in Greece. Geothermics 2010, 39, 124–137. [Google Scholar] [CrossRef]

- Karytsas, S.; Polyzou, O.; Karytsas, C. Social aspects of geothermal energy in Greece. In Geothermal Energy and Society; Springer: Cham, Switzerland, 2019; pp. 123–144. [Google Scholar]

- European Geothermal Energy Council (EGEC). Country Fiche: Greece. 2019. Available online: https://www.egec.org/wp-content/uploads/2019/11/Country-Fiches-EL.pdf. (accessed on 15 February 2022).

- Papachristou, M.; Andritsos, N.; Arvanitis, A.; Dalampakis, P.; Mendrinos, D. Review of geothermal applications in Greece and Worldwide. In Proceedings of the 12th National Conference on Mild Energy Sources, Thessaloniki, Greece, 7–9 April 2021. [Google Scholar]

- Papachristou, M.; Dalampakis, P.; Arvanitis, A.; Mendrinos, D.; Andritsos, N. Geothermal developments in Greece–Country update 2015–2020. Presented at the World Geothermal Congress 2020+1, Reykjavik, Iceland. 13 April 2021. [Google Scholar]

- Seyidov, F. Report on Risk Assessment. GEORISK Project, Del. 2.2. October 2019. Available online: https://www.georisk-project.eu/publications/report-on-risk-assessment/ (accessed on 15 February 2022).

- Ministry of Environment and Energy. National Energy and Climate Plan (NECP). 2019. Available online: https://energy.ec.europa.eu/system/files/2020-01/el_final_necp_main_el_0.pdf (accessed on 15 February 2022).

- Le Guenan, T.; Calcagno, P.; Veloso, F.; Hamm, V.; Loschetter, A.; Maurel, C.; Dumas, P. The H2020 GEORISK Project-Inventory and Assessment of Risks Associated to the Development of Deep Geothermal Heating and Power Projects. In Proceedings of the World Geothermal Congress 2020, Reykjavik, Iceland, 26 April–2 May 2020. [Google Scholar]

- Sweerts, B.; Dalla Longa, F.; van der Zwaan, B. Financial de-risking to unlock Africa’s renewable energy potential. Renew. Sustain. Energy Rev. 2019, 102, 75–82. [Google Scholar] [CrossRef]

- Compernolle, T.; Welkenhuysen, K.; Petitclerc, E.; Maes, D.; Piessens, K. The impact of policy measures on profitability and risk in geothermal energy investments. Energy Econ. 2019, 84, 104524. [Google Scholar] [CrossRef]

- Sanchez-Alfaro, P.; Sielfeld, G.; Van Campen, B.; Dobson, P.; Fuentes, V.; Reed, A.; Palma-Behnke, R.; Morata, D. Geothermal barriers, policies and economics in Chile–Lessons for the Andes. Renew. Sustain. Energy Rev. 2015, 51, 1390–1401. [Google Scholar] [CrossRef] [Green Version]

- Sen, S.; Ganguly, S. Opportunities, barriers and issues with renewable energy development—A discussion. Renew. Sustain. Energy Rev. 2017, 69, 1170–1181. [Google Scholar] [CrossRef]

- North, D.C. Toward a theory of institutional change. Political Econ. Inst. Compet. Represent. 1993, 31, 61–69. [Google Scholar]

- Geothermal Energy Department, Center for Renewable Energy Sources and Saving (CRES). Estimation of Risk Mitigation Schemes Fixed Costs—Own Estimations; Geothermal Energy Department, Center for Renewable Energy Sources and Saving (CRES): Athens, Greece, 2021. [Google Scholar]

| No | Geothermal Capacity (MWth) | Geothermal Energy Use (TJ) | |

|---|---|---|---|

| Small family-owned agricultural enterprises | 22 | 28 | 274 |

| Corporate-owned greenhouses | 2 | 17 | 187 |

| Spas | 45 | 43 | 260 |

| GSHPs | 3700 | 175 | 1050 |

| Assumption | |

|---|---|

| Project types | All deep geothermal projects are included, both low and high enthalpy, and short term contracts, including drilling and testing wells. |

| Project definition | High-enthalpy field: drilling, completion, and operation of one successful doublet for power generation. Low-enthalpy field: three successful doublets for the delivery of district heating. |

| Geological structures | All possible formations. |

| Type of contract | Grant, insurance premium paid in advance, and fee financed afterward. |

| Hypothetical result of the project | Successful, unsuccessful |

| RMS launching capital | EUR 10,000,000 |

| RMS fixed costs (not directly related to the projects) | EUR 240,000 (See Table A1 in Appendix A for analysis.) |

| Drilling costs | Estimated based on local geological and reservoir settings; the estimates are somewhat conservative, corresponding to the lower end of the cost spectrum. |

| Insurance premium | A range from 1% to 20% was taken into consideration (sensitivity analysis performed). |

| Risk coverage | A range from 5% to 100% was taken into consideration (sensitivity analysis performed). It is paid when a geothermal project is considered unsuccessful (it does yield desired heat output). |

| High-Enthalpy Proven | High-Enthalpy Unexplored | Low Enthalpy | |

|---|---|---|---|

| Scenario A | 90% | 50% | 90% |

| Scenario B | 90% | 67% | 90% |

| Scenario C | 90% | 75% | 90% |

| Scenario D | 90% | No development | 90% |

| PREMIUM | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1% | 2% | 3% | 4% | 5% | 6% | 7% | 8% | 9% | 10% | 11% | 12% | 13% | 14% | 15% | 16% | 17% | 18% | 19% | 20% | ||

| COVERAGE | 5% | 7.419 | 8.256 | 9.092 | 9.929 | 10.765 | 11.602 | 12.438 | 13.275 | 14.111 | 14.948 | 15.784 | 16.621 | 17.457 | 18.294 | 19.130 | 19.967 | 20.803 | 21.640 | 22.476 | 23.313 |

| 10% | 6.402 | 7.238 | 8.075 | 8.911 | 9.748 | 10.584 | 11.421 | 12.257 | 13.094 | 13.930 | 14.767 | 15.603 | 16.440 | 17.276 | 18.113 | 18.949 | 19.786 | 20.622 | 21.459 | 22.295 | |

| 15% | 5.384 | 6.221 | 7.057 | 7.894 | 8.730 | 9.567 | 10.403 | 11.240 | 12.076 | 12.913 | 13.749 | 14.586 | 15.422 | 16.259 | 17.095 | 17.932 | 18.768 | 19.605 | 20.441 | 21.278 | |

| 20% | 4.367 | 5.203 | 6.040 | 6.876 | 7.713 | 8.549 | 9.386 | 10.222 | 11.059 | 11.895 | 12.732 | 13.568 | 14.405 | 15.241 | 16.078 | 16.914 | 17.751 | 18.587 | 19.424 | 20.260 | |

| 25% | 3.349 | 4.186 | 5.022 | 5.859 | 6.695 | 7.532 | 8.368 | 9.205 | 10.041 | 10.878 | 11.714 | 12.551 | 13.387 | 14.224 | 15.060 | 15.897 | 16.733 | 17.570 | 18.406 | 19.243 | |

| 30% | 2.332 | 3.168 | 4.005 | 4.841 | 5.678 | 6.514 | 7.351 | 8.187 | 9.024 | 9.860 | 10.697 | 11.533 | 12.370 | 13.206 | 14.043 | 14.879 | 15.716 | 16.552 | 17.389 | 18.225 | |

| 35% | 1.314 | 2.151 | 2.987 | 3.824 | 4.660 | 5.497 | 6.333 | 7.170 | 8.006 | 8.843 | 9.679 | 10.516 | 11.352 | 12.189 | 13.025 | 13.862 | 14.698 | 15.535 | 16.371 | 17.208 | |

| 40% | 297 | 1.133 | 1.970 | 2.806 | 3.643 | 4.479 | 5.316 | 6.152 | 6.989 | 7.825 | 8.662 | 9.498 | 10.335 | 11.171 | 12.008 | 12.844 | 13.681 | 14.517 | 15.354 | 16.190 | |

| 45% | −721 | 116 | 952 | 1.789 | 2.625 | 3.462 | 4.298 | 5.135 | 5.971 | 6.808 | 7.644 | 8.481 | 9.317 | 10.154 | 10.990 | 11.827 | 12.663 | 13.500 | 14.336 | 15.173 | |

| 50% | −1.739 | −902 | −66 | 771 | 1.608 | 2.444 | 3.281 | 4.117 | 4.954 | 5.790 | 6.627 | 7.463 | 8.300 | 9.136 | 9.973 | 10.809 | 11.646 | 12.482 | 13.319 | 14.155 | |

| 55% | −2.756 | −1.920 | −1.083 | −247 | 590 | 1.427 | 2.263 | 3.100 | 3.936 | 4.773 | 5.609 | 6.446 | 7.282 | 8.119 | 8.955 | 9.792 | 10.628 | 11.465 | 12.301 | 13.138 | |

| 60% | −3.774 | −2.937 | −2.101 | −1.264 | −428 | 409 | 1.246 | 2.082 | 2.919 | 3.755 | 4.592 | 5.428 | 6.265 | 7.101 | 7.938 | 8.774 | 9.611 | 10.447 | 11.284 | 12.120 | |

| 65% | −4.791 | −3.955 | −3.118 | −2.282 | −1.445 | −609 | 228 | 1.065 | 1.901 | 2.738 | 3.574 | 4.411 | 5.247 | 6.084 | 6.920 | 7.757 | 8.593 | 9.430 | 10.266 | 11.103 | |

| 70% | −5.809 | −4.972 | −4.136 | −3.299 | −2.463 | −1.626 | −790 | 47 | 884 | 1.720 | 2.557 | 3.393 | 4.230 | 5.066 | 5.903 | 6.739 | 7.576 | 8.412 | 9.249 | 10.085 | |

| 75% | −6.826 | −5.990 | −5.153 | −4.317 | −3.480 | −2.644 | −1.807 | −971 | −134 | 703 | 1.539 | 2.376 | 3.212 | 4.049 | 4.885 | 5.722 | 6.558 | 7.395 | 8.231 | 9.068 | |

| 80% | −7.844 | −7.007 | −6.171 | −5.334 | −4.498 | −3.661 | −2.825 | −1.988 | −1.152 | −315 | 522 | 1.358 | 2.195 | 3.031 | 3.868 | 4.704 | 5.541 | 6.377 | 7.214 | 8.050 | |

| 85% | −8.861 | −8.025 | −7.188 | −6.352 | −5.515 | −4.679 | −3.842 | −3.006 | −2.169 | −1.333 | −496 | 341 | 1.177 | 2.014 | 2.850 | 3.687 | 4.523 | 5.360 | 6.196 | 7.033 | |

| 90% | −9.879 | −9.042 | −8.206 | −7.369 | −6.533 | −5.696 | −4.860 | −4.023 | −3.187 | −2.350 | −1.514 | −677 | 160 | 996 | 1.833 | 2.669 | 3.506 | 4.342 | 5.179 | 6.015 | |

| 95% | −10.896 | −10.060 | −9.223 | −8.387 | −7.550 | −6.714 | −5.877 | −5.041 | −4.204 | −3.368 | −2.531 | −1.695 | −858 | −22 | 815 | 1.652 | 2.488 | 3.325 | 4.161 | 4.998 | |

| 100% | −11.914 | −11.077 | −10.241 | −9.404 | −8.568 | −7.731 | −6.895 | −6.058 | −5.222 | −4.385 | −3.549 | −2.712 | −1.876 | −1.039 | −203 | 634 | 1.471 | 2.307 | 3.144 | 3.980 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Karytsas, S.; Mendrinos, D.; Oikonomou, T.I.; Choropanitis, I.; Kujbus, A.; Karytsas, C. Examining the Development of a Geothermal Risk Mitigation Scheme in Greece. Clean Technol. 2022, 4, 356-376. https://doi.org/10.3390/cleantechnol4020021

Karytsas S, Mendrinos D, Oikonomou TI, Choropanitis I, Kujbus A, Karytsas C. Examining the Development of a Geothermal Risk Mitigation Scheme in Greece. Clean Technologies. 2022; 4(2):356-376. https://doi.org/10.3390/cleantechnol4020021

Chicago/Turabian StyleKarytsas, Spyridon, Dimitrios Mendrinos, Theoni I. Oikonomou, Ioannis Choropanitis, Attila Kujbus, and Constantine Karytsas. 2022. "Examining the Development of a Geothermal Risk Mitigation Scheme in Greece" Clean Technologies 4, no. 2: 356-376. https://doi.org/10.3390/cleantechnol4020021

APA StyleKarytsas, S., Mendrinos, D., Oikonomou, T. I., Choropanitis, I., Kujbus, A., & Karytsas, C. (2022). Examining the Development of a Geothermal Risk Mitigation Scheme in Greece. Clean Technologies, 4(2), 356-376. https://doi.org/10.3390/cleantechnol4020021