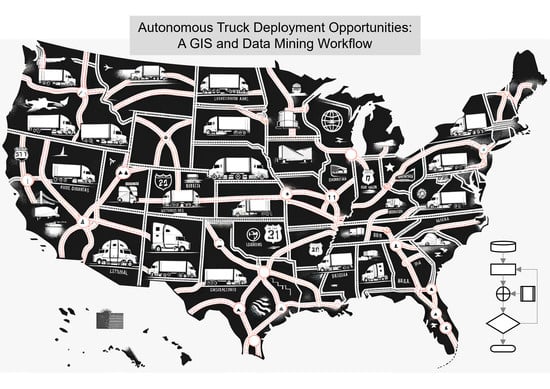

Ranking Opportunities for Autonomous Trucks Using Data Mining and GIS

Abstract

:1. Introduction

2. Literature Review

3. Methods

3.1. Datasets

3.2. Data Mining

4. Results

4.1. Filter 1: SH and LH Split

4.2. Filter 2: Top Zone Cluster

4.3. Filter 3: Shortest Paths

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- ATA. ATA Truck Tonnage Index Increased 2.4% in May. 20 June 2023. Available online: https://www.trucking.org/news-insights/ata-truck-tonnage-index-increased-24-may (accessed on 16 July 2023).

- Kim, E.; Kim, Y.; Park, J. The Necessity of Introducing Autonomous Trucks in Logistics 4.0. Sustainability 2022, 14, 3978. [Google Scholar] [CrossRef]

- Bridgelall, R.; Patterson, D.A.; Tolliver, D.D. Policy Implications of Truck Platooning and Electrification. Energy Policy 2020, 139, 111313. [Google Scholar] [CrossRef]

- Nowak, G.; Viereckl, R.; Kauschke, P.; Starke, F. The Era of Digitized Trucking: Charting Your Transformation to a New Business Model. PWC. Strategy. 2019. Available online: https://www.strategyand.pwc.com/report/digitized-trucking (accessed on 15 May 2023).

- Chafkin, M. Even after $100 Billion, Self-Driving Cars Are Going Nowhere; Bloomberg: New York, NY, USA, 2022. [Google Scholar]

- Clevenger, S. Who’s Who in Self-Driving Truck Development. Transport Topics, 23 November 2022. [Google Scholar]

- Slowik, P.; Sharpe, B. Automation in the Long Haul: Challenges and Opportunities of Autonomous Heavy-Duty Trucking in the United States; The International Council on Clean Transportation: Washington, DC, USA, 2018. [Google Scholar]

- Mohan, A.; Vaishnav, P. Impact of automation on long haul trucking operator-hours in the United States. Humanit. Soc. Sci. Commun. 2022, 9, 82. [Google Scholar] [CrossRef]

- Makuto, N.; Kristman, V.; Bigelow, P.; Bédard, M. Factors associated with depressive symptoms in long-haul truck drivers. Transp. Res. Interdiscip. Perspect. 2023, 21, 100851. [Google Scholar] [CrossRef]

- Collie, B.; Decker, J.; Fishman, J.; Wegscheider, A.K.; Wiesinger, M.; Sridhara, R. Mapping the Future of Autonomous Trucking; Boston Consulting Group: Boston, MA, USA, 2022. [Google Scholar]

- Meldert, A.B. Introducing Autonomous Vehicles in Logistics; KU Leuven, Faculty of Business and Economics: Leuven, Belgium, 2016. [Google Scholar]

- Zhang, L.; Chen, F.; Ma, X.; Pan, X. Fuel economy in truck platooning: A literature overview and directions for future research. J. Adv. Transp. 2020, 2020, 2604012. [Google Scholar] [CrossRef]

- Danaf, M.; Hu, O.; Place, M.; Ifrach, B.; Hautefeuille, L. The Future of Self-Driving Technology in Trucking: A Roadmap for Evolving Freight Transportation with Autonomous Trucks; Uber Freight: San Francisco, CA, USA, 2021. [Google Scholar]

- Bracy, J.M.B.; Bao, K.Q.; Mundy, R.A. Highway infrastructure and safety implications of AV technology in the motor carrier industry. Res. Transp. Econ. 2019, 77, 100758. [Google Scholar] [CrossRef]

- Nevland, E.A.; Gingerich, K.; Park, P.Y. A data-driven systematic approach for identifying and classifying long-haul truck parking locations. Transp. Policy 2020, 96, 48–59. [Google Scholar] [CrossRef]

- Guerrero, S.E.; Pulikanti, S.; Wieghart, B.; Bryan, J.G.; Strow, T. Modeling Truck Parking Demand at Commercial and Industrial Establishments. Transp. Res. Rec. J. Transp. Res. Board 2023, 2677, 1157–1168. [Google Scholar] [CrossRef]

- Schuster, A.M.; Agrawal, S.; Britt, N.; Sperry, D.; Van Fossen, J.A.; Wang, S.; Mack, E.A.; Liberman, J.; Cotten, S.R. Will automated vehicles solve the truck driver shortages? Perspectives from the trucking industry. Technol. Soc. 2023, 74, 102313. [Google Scholar] [CrossRef]

- Tengilimoglu, O.; Carsten, O.; Wadud, Z. Infrastructure requirements for the safe operation of automated vehicles: Opinions from experts and stakeholders. Transp. Policy 2023, 133, 209–222. [Google Scholar] [CrossRef]

- Merhebi, G.H.; Joumblat, R.; Elkordi, A. Assessment of the Effect of Different Loading Combinations Due to Truck Platooning and Autonomous Vehicles on the Performance of Asphalt Pavement. Sustainability 2023, 15, 10805. [Google Scholar] [CrossRef]

- Zarif, R.; Starks, C.; Sussman, A.; Kukreja, A. Autonomous Trucks Lead the Way. Deloitte Insights, 17 February 2021. [Google Scholar]

- Dong, C.; Akram, A.; Andersson, D.; Arnäs, P.-O.; Stefansson, G. The impact of emerging and disruptive technologies on freight transportation in the digital era: Current state and future trends. Int. J. Logist. Manag. 2021, 32, 386–412. [Google Scholar] [CrossRef]

- Waschik, R.; Taylor, C.L.; Friedman, D.; Boatner, J. Macroeconomic Impacts of Automated Driving Systems in Long-Haul Trucking; Federal Highway Administration (FHWA): Washington, DC, USA, 2021. [Google Scholar]

- Huang, Y.; Kockelman, K.M. What will autonomous trucking do to U.S. trade flows? Application of the random-utility-based multi-regional input–output model. Transportation 2020, 47, 2529–2556. [Google Scholar] [CrossRef]

- Zhao, J.; Lee, J.Y. Effect of Connected and Autonomous Vehicles on Supply Chain Performance. Transp. Res. Rec. J. Transp. Res. Board 2023, 2677, 402–424. [Google Scholar] [CrossRef]

- Monios, J.; Bergqvist, R. Logistics and the networked society: A conceptual framework for smart network business models using electric autonomous vehicles (EAVs). Technol. Forecast. Soc. Change 2020, 151, 119824. [Google Scholar] [CrossRef]

- Fritschy, C.; Spinler, S. The Impact of Autonomous Trucks on Business Models in the Automotive and Logistics Industry—A Delphi-Based Scenario Study. Technol. Forecast. Soc. Change 2019, 148, 119736. [Google Scholar] [CrossRef]

- Sindi, S.; Woodman, R. Implementing Commercial Autonomous Road Haulage in Freight Operations: An Industry Perspective. Transp. Res. Part A Policy Pract. 2021, 152, 235–253. [Google Scholar] [CrossRef]

- Jaller, M.; Otero, C.; Pourrahmani, E.; Fulton, L. Automation, Electrification, and Shared Mobility in Freight; University of California, Institute of Transportation Studies: Berkeley, CA, USA, 2020. [Google Scholar]

- NCSL. Autonomous Vehicles. Self-Driving Vehicles Enacted Legislation. 18 February 2020. Available online: https://www.ncsl.org/transportation/autonomous-vehicles (accessed on 18 November 2023).

- Alawadhi, M.; Almazrouie, J.; Kamil, M.; Khalil, K.A. Review and Analysis of the Importance of Autonomous Vehicles Liability: A Systematic Literature Review. Int. J. Syst. Assur. Eng. Manag. 2020, 11, 1227–1249. [Google Scholar] [CrossRef]

- Kroesen, M.; Milakis, D.; van Wee, B. Automated Vehicles: Changes in expert opinions over time. Transp. Policy 2023, 136, 1–10. [Google Scholar] [CrossRef]

- Mishler, S.; Chen, J. Effect of Automation Failure Type on Trust Development in Driving Automation Systems. Appl. Ergon. 2023, 106, 103913. [Google Scholar] [CrossRef] [PubMed]

- Simpson, J.R.; Mishra, S.; Talebian, A.; Golias, M.M. An estimation of the future adoption rate of autonomous trucks by freight organizations. Res. Transp. Econ. 2019, 76, 100737. [Google Scholar] [CrossRef]

- Monios, J.; Bergqvist, R. The transport geography of electric and autonomous vehicles in road freight networks. J. Transp. Geogr. 2019, 80, 102500. [Google Scholar] [CrossRef]

- Engholm, A.; Björkman, A.; Joelsson, Y.; Kristoffersson, I.; Pernestål, A. The Emerging Technological Innovation System of Driverless Tucks. Transp. Res. Procedia 2020, 49, 145–159. [Google Scholar] [CrossRef]

- Tamakloe, R.; Park, D. Discovering latent topics and trends in autonomous vehicle-related research: A structural topic modelling approach. Transp. Policy 2023, 139, 1–20. [Google Scholar] [CrossRef]

- Wang, S.; Yu, B.; Ma, Y.; Liu, J.; Zhou, W. Impacts of different driving automation levels on highway geometric design from the perspective of trucks. J. Adv. Transp. 2021, 2021, 5541878. [Google Scholar] [CrossRef]

- Zhang, J.; Wu, K.; Cheng, M.; Yang, M.; Cheng, Y.; Li, S. Safety evaluation for connected and autonomous vehicles’ exclusive lanes considering penetrate ratios and impact of trucks using surrogate safety measures. J. Adv. Transp. 2020, 2020, 5847814. [Google Scholar] [CrossRef]

- BTS. Bureau of Transportation Statistics (BTS). United States Department of Transportation, Bureau of Transportation Statistics (BTS). 16 May 2023. Available online: https://www.bts.gov/faf (accessed on 1 July 2023).

- D.o.C.U.S. Census Bureau. DATA.GOV. 13 January 2021. Available online: https://catalog.data.gov/dataset/tiger-line-shapefile-2016-nation-u-s-primary-roads-national-shapefile (accessed on 19 July 2023).

- ArcGIS. USA Major Cities. 27 September 2022. Available online: https://www.arcgis.com/home/item.html?id=9df5e769bfe8412b8de36a2e618c7672 (accessed on 15 May 2023).

- ATRI. Top 100 Truck Bottlenecks—2023. American Transport Research Institute (ATRI). 2023. Available online: https://truckingresearch.org/2023/02/top-100-truck-bottlenecks-2023/ (accessed on 13 July 2023).

- FreightWaves. How much weight can a big rig carry? FreightWaves, 1 January 2020. [Google Scholar]

- FMCSA. Hours-of-Service Regulations. Federal Motor Carrier Safety Administration (FMCSA). 28 March 2022. Available online: https://www.fmcsa.dot.gov/regulations/hours-service/summary-hours-service-regulations (accessed on 11 July 2023).

- Phadke, A.; Khandekar, A.; Abhyankar, N.; Wooley, D.; Rajagopal, D. Why Regional and Long-Haul Trucks Are Primed for Electrification Now? Lawrence Berkeley National Lab.: Berkeley, CA, USA, 2021. [Google Scholar]

- USDOT. Driving Automation Systems in Long-Haul Trucking and Bus Transit: Preliminary Analysis of Potential Workforce Impacts; US DOT: Washington, DC, USA, 2021.

- Chandler, M.D.; Bunn, T.L.; Slavova, S. Narrative and quantitative analyses of workers’ compensation-covered injuries in short-haul vs. long-haul trucking. Int. J. Inj. Control. Saf. Promot. 2017, 24, 120–130. [Google Scholar] [CrossRef]

- ATRI. The Nation’s Top Truck Bottlenecks 2023; American Transportation Research Institute (ATRI): Arlington, VA, USA, 2023. [Google Scholar]

| Author(s) | Method | Description | Application |

|---|---|---|---|

| [21] | Systematic Literature Review | Reviewed a wide range of existing literature to identify technologies that will disrupt future freight transportation. | Used to understand the role of ATs among disruptive technologies in freight transport. |

| [23] | Econometric Modeling | Developed economic models to predict the impact of ATs on ton-mile production and rail flows. | Applied to forecast changes in ton-mile production and the influence of ATs on rail transportation. |

| [26] | Business Model Analysis | Analyzed how ATs will change traditional business models in the transportation sector. | Focused on projecting shifts towards automated driving systems and holistic business models. |

| [25] | Case Study | Examined specific examples or scenarios to extrapolate broader trends in AT development. | Explored how ATs may lead to a shift toward a network operator model in transportation. |

| [32] | Experimental Simulation | Conducted driving simulations to gauge participant reactions to AT systems. | Applied to assess trust in AT systems and the impact of takeover requests during critical events. |

| [33] | Bass Modeling | Utilized Bass diffusion models to estimate the adoption rate of ATs based on various factors. | Used to predict market penetration of ATs considering technology improvement, acceptance, price, and marketing. |

| [10] | Scenario Planning Tools | Developed models to determine the most promising routes for AT deployment based on multiple criteria. | Applied to assist AT companies in selecting locations for initial testing and deployment. |

| [30] | Legal Analysis | Examined the legal implications and changes due to autonomous vehicle deployment. | Focused on the shift of liability from human drivers to autonomous systems in ATs. |

| Dataset | Description | Source |

|---|---|---|

| FAF5.5 | Regional Freight Database (Update 2023) | [39] |

| FAF5 Regions | Metadata for FAF 5.5 (Update 2023) | [39] |

| Primary Roads | U.S. Primary Roads National Shapefile (Update 2021) | [40] |

| Major Cities | U.S. Major Cities (Update 2022) | [41] |

| Truck Bottlenecks | Ranks the top 100 U.S. truck bottlenecks (2022) | [42] |

| Miles Band | STL (M) | STL % | STM (B) | STM % | $M/K-Ton |

|---|---|---|---|---|---|

| <100 | 245 | 43% | 226 | 9% | 0.85 |

| 100–249 | 235 | 41% | 820 | 34% | 0.76 |

| 250–499 | 51 | 9% | 388 | 16% | 1.64 |

| 500–749 | 13 | 2% | 175 | 7% | 3.00 |

| 750–999 | 9 | 2% | 167 | 7% | 3.18 |

| 1000–1499 | 9 | 2% | 250 | 10% | 3.59 |

| 1500–2000 | 4 | 1% | 152 | 6% | 4.14 |

| >2000 | 4 | 1% | 220 | 9% | 5.83 |

| STL (M) | STM (T) | Trillion USD | ||||

|---|---|---|---|---|---|---|

| Year | LH | SH | LH | SH | LH | SH |

| 2017 | 480 | 89 | 46 | 60 | 8.7 | 5.0 |

| 2018 | 488 | 90 | 47 | 61 | 9.0 | 5.0 |

| 2019 | 485 | 89 | 47 | 60 | 8.9 | 4.9 |

| 2020 | 470 | 86 | 46 | 59 | 8.5 | 4.7 |

| 2021 | 479 | 85 | 47 | 58 | 8.6 | 4.8 |

| 2023 | 491 | 93 | 47 | 63 | 9.3 | 5.4 |

| 2025 | 507 | 98 | 49 | 66 | 9.8 | 5.8 |

| 2030 | 537 | 106 | 52 | 72 | 10.8 | 6.4 |

| 2035 | 568 | 115 | 55 | 79 | 11.8 | 7.1 |

| 2040 | 606 | 126 | 59 | 87 | 13.0 | 8.0 |

| 2045 | 653 | 139 | 64 | 96 | 14.5 | 8.9 |

| 2050 | 705 | 153 | 69 | 106 | 16.0 | 10.0 |

| Route Terminals | STL (K) | Miles | Highways |

|---|---|---|---|

| Atlanta GA–San Francisco CA | 13 | 2601.5 | I20, I10, I5 |

| Chicago IL–Atlanta GA | 86 | 712.8 | I65, I24, I75 |

| Chicago IL–Des Moines IA | 243 | 334.2 | I80, I88 |

| Chicago IL–San Francisco CA | 36 | 2135.9 | I88, I80 |

| Dallas TX–Atlanta GA | 136 | 789.9 | I20 |

| Dallas TX–Chicago IL | 91 | 992.4 | I35, I44, I55 |

| Dallas TX–Des Moines IA | 34 | 745.5 | I35, I335, I70, I35 |

| Dallas TX–Houston TX | 2659 | 239.8 | I45 |

| Dallas TX–Los Angeles CA | 173 | 1437.7 | I20, I10 |

| Dallas TX–San Francisco CA | 20 | 1817.5 | I20, I10, I5 |

| Des Moines IA–Atlanta GA | 30 | 1006.8 | I80, I74, I65, I24, I75 |

| Des Moines IA–San Francisco CA | 15 | 1801.7 | I80 |

| Houston TX–Atlanta GA | 50 | 811.6 | I10, I59, I20 |

| Houston TX–Chicago IL | 87 | 1189.4 | I10, I55, I57 |

| Houston TX–Des Moines IA | 16 | 985.3 | I45, I35, I335, I70, I35 |

| Houston TX–Los Angeles CA | 115 | 1551.5 | I10 |

| Houston TX–San Francisco CA | 35 | 1931.2 | I10, I5 |

| Los Angeles CA–Atlanta GA | 77 | 2221.8 | I10, I20 |

| Los Angeles CA–Chicago IL | 159 | 2083.0 | I15, I80, I88 |

| Los Angeles CA–Des Moines IA | 50 | 1748.8 | I15, I80 |

| Los Angeles CA–San Francisco CA | 1790 | 382.5 | I5 |

| Lubbock TX–Atlanta GA | 79 | 1303.5 | I27, I40, I24, I75 |

| Lubbock TX–Chicago IL | 85 | 1175.7 | I27, I40, I44, I55 |

| Lubbock TX–Dallas TX | 523 | 582.3 | I27, I40, I35 |

| Lubbock TX–Des Moines IA | 21 | 922.1 | I27, I40, I35, I335, I70, I35 |

| Lubbock TX–Houston TX | 1864 | 820.3 | I27, I40, I35, I45 |

| Lubbock TX–Los Angeles CA | 91 | 1195.9 | I27, I40, I15 |

| Lubbock TX–San Francisco CA | 25 | 1571.6 | I27, I40, I15, I10, I5 |

| Route | STL (K) | Weight | Value | Top Bottlenecks and Rank |

|---|---|---|---|---|

| I45 | 4539 | 25.3% | 5.2% | Houston, TX: #3 at I69/US59, #19 at I610. Dallas, TX: #16 at I30 |

| I27 | 2689 | 15.0% | 7.5% | |

| I40 | 2689 | 15.0% | 14.3% | Nashville, TN: #9 atI440 |

| I35 | 2549 | 14.2% | 1.3% | |

| I5 | 1883 | 10.5% | 2.0% | |

| I10 | 597 | 3.3% | 2.0% | Houston, TX: #11 at I45. Baton Rouge, LA: #20 at I110 |

| I80 | 533 | 3.0% | 5.7% | Chicago, IL: #12 at I94 |

| I20 | 470 | 2.6% | 4.5% | Atlanta, GA: #5 at I285W, #17 at I285E |

| I88 | 438 | 2.4% | 9.2% | Chicago, IL: #2 at I290, I294 |

| I15 | 325 | 1.8% | 1.6% | San Bernardino, CA: #10 at I10 |

| I55 | 263 | 1.5% | 2.2% | |

| I24 | 194 | 1.1% | 0.9% | Nashville, TN: #9 at I40/I440 |

| I75 | 194 | 1.1% | 0.9% | McDonough, GA: #13, Atlanta #18. |

| I44 | 176 | 1.0% | 16.1% | |

| I65 | 116 | 0.6% | 0.4% | |

| I57 | 87 | 0.5% | 0.4% | |

| I70 | 71 | 0.4% | 0.7% | |

| I335 | 71 | 0.4% | 4.2% | |

| I59 | 50 | 0.3% | 10.4% | |

| I74 | 30 | 0.2% | 10.4% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bridgelall, R.; Jones, R.; Tolliver, D. Ranking Opportunities for Autonomous Trucks Using Data Mining and GIS. Geographies 2023, 3, 806-823. https://doi.org/10.3390/geographies3040044

Bridgelall R, Jones R, Tolliver D. Ranking Opportunities for Autonomous Trucks Using Data Mining and GIS. Geographies. 2023; 3(4):806-823. https://doi.org/10.3390/geographies3040044

Chicago/Turabian StyleBridgelall, Raj, Ryan Jones, and Denver Tolliver. 2023. "Ranking Opportunities for Autonomous Trucks Using Data Mining and GIS" Geographies 3, no. 4: 806-823. https://doi.org/10.3390/geographies3040044

APA StyleBridgelall, R., Jones, R., & Tolliver, D. (2023). Ranking Opportunities for Autonomous Trucks Using Data Mining and GIS. Geographies, 3(4), 806-823. https://doi.org/10.3390/geographies3040044