Assessment of Upstream Petroleum Fiscal Regimes in Myanmar

Abstract

:1. Introduction

2. Theoretical Framework: Concept of Economic Rent

3. Literature Survey

3.1. Upstream Petroleum Fiscal Regimes

3.2. Quantitative Method for Petroleum Fiscal Regimes Assessment

3.3. Host Government Take (GT)

3.4. Non-Discounted Cash Flow Method (NDCF) and Discounted Cash Flow Method (DCF)

3.5. Prompt and Intuitive Method

3.6. Front Loading Index (FLI)

3.7. Composite Score (CS)

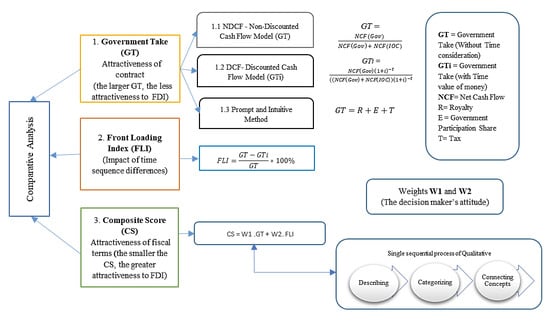

4. Quantitative Analysis for the Assessment of Upstream Petroleum Fiscal Regimes

4.1. Method

4.1.1. Modelling Framework

4.1.2. Host Government Take (GT)

Prompt and Intuitive Method

Non-Discounted Cash Flow Method (NDCF)

4.1.3. Government Take (GTi) through Discounted Cash Flow Method (DCF)

4.1.4. Front Loading Index (FLI)

4.1.5. Composite Score (CS)

4.2. Data

5. Results

5.1. Analysis of Results in GT and GTi

5.2. Analysis of Results in FLI

5.3. Analysis of Results in CS

6. Summary, Policy Recommendations, and Further Studies

6.1. Summary

6.2. Policy Recommendations

6.3. Further Studies

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Abidin, Faris Anwar Zainal. 2015. At an Investment Crossroads: Malaysia versus Indonesia. Paper presented at SPE/IATMI Asia Pacific Oil & Gas Conference and Exhibition, Society of Petroleum Engineers, Nusa Dua, Indonesia, October 20–22. [Google Scholar]

- Adenikinju, Adeola, and Oladele Oderinde. 2009. Economics of Offshore Oil Investment Projects and Production Sharing Contracts: A Meta Modeling Analysis. Paper presented at the 14th Annual Conference of African Econometric Society, Abuja, Nigeria, July 8–10. [Google Scholar]

- Asian Development Bank (ADB). 2014. Myanmar Unlocking the Potential: Country Diagnostic Study. Available online: http://adb.org/sites/default/files/pub/2014/myanmar-unlocking-potential.pdf (accessed on 22 June 2016).

- Banfi, Silvia, Massimo Filippini, and Cornelia Luchsinger. 2004. Resource Rent Taxation—A New Perspective for the (Swiss) Hydropower Sector. Politiche Pubbliche, Sviluppo E Crescita, side pubblica, Editor. p. 21. Available online: https://www.ethz.ch/content/dam/ethz/special-interest/mtec/cepe/cepe-dam/documents/research/cepe-wp/CEPE_WP34.pdf (accessed on 20 July 2016).

- Banfi, Silvia, Massimo Filippini, and Adrian Mueller. 2005. An estimation of the Swiss hydropower rent. Energy Policy 33: 927–37. [Google Scholar] [CrossRef]

- Baunsgaard, Thomas. 2001. A Primer on Mineral Taxation. No. 1–139. Washington, DC: International Monetary Fund. [Google Scholar]

- Bindemann, Kirsten. 1999. Production-Sharing Agreements: An Economic Analysis. Oxford: Oxford Institute for Energy Studies. [Google Scholar]

- Boodoo, Craig. 2012. Trinidad and Tobago’s Measures to Enhance Its Competitiveness in the Upstream Deep-Water Petroleum Industry Post 2006: Have They Been Successful? Available online: www.dundee.ac.uk/cepmlp/gateway/files.php?file=cepmlp_car16 (accessed on 13 June 2016).

- Boykett, Tim, Marta Peirano, Simone Boria, Heather Kelley, Elisabeth Schimana, Andreas Dekrout, and Rachel OReily. 2012. Oil Contracts: How to Read and Understand a Petroleum Contract. Version 1.1. Available online: http://www.eisourcebook.org/cms/January%202016/Oil%20Contratcs,%20How%20to%20Read%20and%20Understand%20them%202011.pdf (accessed on 15 June 2016).

- Cameron, Peter. 2006. Stabilisation in Investment Contracts and Changes of Rules in Host Countries: Tools for Oil & Gas Investors. Houston: Association of International Petroleum Negotiators. [Google Scholar]

- Cottarelli, Carlo. 2012. Fiscal Regimes for Extractive Industries: Design and Implementation. Washington, DC: International Monetary Fund, p. 67. [Google Scholar]

- Dickson, Timothy. 1999. Taxing Our Resources for the Future. Paper Posted at Economic Research and Analysis (ERA). Available online: http://www. eraweb.net (accessed on 13 March 2016).

- Emhjellen, Magne, and Chris Alaouze. 2001. Discounted Net Cashflow and Modern Asset Pricing Method: Project Selection and Policy Implications. Working Paper No. 35/02. Available online: https://brage.bibsys.no/xmlui/bitstream/handle/11250/165814/A35_02.pdf?sequence=1 (accessed on 24 June 2016).

- Ernst & Young. 2015. Global Oil and Gas Tax Guide. Available online: http://www.ey.com/Publication/vwLUAssets/EY-2015-Global-oil-and-gas-tax-guide/$FILE/EY-2015-Global-oil-and-gas-tax-guide.pdf (accessed on 25 June 2016).

- Evans-Pritchard, Ambrose. 2015. Saudi Arabia May Go Broke before the US Oil Industry Buckles. The Telegraph. Available online: http://www.telegraph.co.uk/finance/oilprices/11768136/Saudi-Arabia-may-go-broke-before-the-US-oil-industry-buckles.html (accessed on 1 July 2016).

- Ghebremusse, Sara. 2015. Conceptualizing the Developmental State in Resource-Rich Sub-Saharan Africa. Law and Development Review 8: 467–502. [Google Scholar] [CrossRef]

- Gudmestad, Ove. T., Anatoly. B. Zolotukhin, and Erik. T. Jarlsby. 2010. Petroleum Resources with Emphasis on Offshore Fields. Southampton: WIT Press. [Google Scholar]

- Hao, Hong, and Mark J. Kaiser. 2010. Modeling China’s offshore production sharing contracts using meta-analysis. Petroleum Science 7: 283–88. [Google Scholar] [CrossRef]

- Henriksen, Anne De Piante, and Ann Jensen Traynor. 1999. A practical R&D project-selection scoring tool. IEEE Transactions on Engineering Management 46: 158–70. [Google Scholar]

- Hunter, Tina. 2008. Review of the Australian Upstream Petroleum Sector: Submission to the Australian Productivity Commission. Research Report. Available online: https://www.pc.gov.au/inquiries/completed/upstream-petroleum/submissions/sub009.pdf (accessed on 11 June 2016).

- Hvozdyk, Lyudmyla, and Valerie Mercer-Blackman. 2010. What Determines Investment in the Oil Sector?: A New Era for National and International Oil Companies. Washington, DC: Inter-American Development Bank. [Google Scholar]

- Iledare, Omowumi O. 2004. Analyzing the Impact of Petroleum Fiscal Arrangements and Contract Terms on Petroleum E&P Economics and the Host Government Take. Paper presented at the Nigeria Annual International Conference and Exhibition, Abuja, Nigeria, August 2–4. [Google Scholar]

- Iledare, Omowumi, and Mark Kaiser. 2006. Physical and Economic Performance Measures in Petroleum Lease Sales & Development: A Case Study of the US Gulf of Mexico Region, 1983–1999. Paper presented at the Nigeria Annual International Conference and Exhibition, Abuja, Nigeria, July 31–August 2; January. [Google Scholar]

- Jiuliang, Xue, and Jin Fenglan. 2001. An Economic Evaluation Study of Sharing Mode in International Petroleum Cooperation. Techno-Economics in Petrochemicals 17: 20–27. [Google Scholar]

- Johnston, Daniel. 1994. International Petroleum Fiscal Systems and Production Sharing Contracts. Houston: PennWell Books. [Google Scholar]

- Johnston, Daniel. 2008. Changing fiscal landscape. The Journal of World Energy Law & Business 1: 31–54. [Google Scholar] [Green Version]

- Johnston, David, Daniel Johnston, and Tony Rogers. 2008. International Petroleum Taxation for the Independent Petroleum Association of America. Washington, DC: IPAA. [Google Scholar]

- Kaiser, Mark J. 2007. Fiscal system analysis—Concessionary systems. Energy 32: 2135–47. [Google Scholar] [CrossRef]

- Kaiser, Mark J., and Allan G. Pulsipher. 2004. Fiscal System Analysis: Concessionary and Contractual Systems Used in Offshore Petroleum Arrangements; New Orleans: US Department of the Interior, Minerals Management Service, Gulf of Mexico OCS Region, OCS Study MMS. Available online: https://www.boem.gov/ESPIS/2/2977.pdf (accessed on 15 July 2016).

- Kemp, Alexander George, and Linda Stephen. 2011. The Short and Long Term Prospects for Activity in the UK Continental Shelf: The 2011 Perspective. North Sea Study Occasional Paper No. 122. Aberdeen: Aberdeen Centre for Research in Energy Economics and Finance. [Google Scholar]

- Kemp, Alexander George, and Linda Stephen. 2012. A Comparative Study of Tax Reliefs for New Developments in the UK Continental Shelf after Budget 2012. North Sea Study Occasional Paper No. 124. Aberdeen: Aberdeen Centre for Research in Energy Economics and Finance. [Google Scholar]

- Khine, Thandar. 2008. Foreign Direct Investment Relations between Myanmar and ASEAN. IDE Discussion Paper 149. Mihama-ku: Institute of Developing Economies. [Google Scholar]

- Kyari, Adam Konto. 2013. A Theoretical and Empirical Investigation into the Design and Implementation of an Appropriate Tax Regime: An Evaluation of Nigeria’s Petroleum Taxation Arrangements. Ph.D. thesis, Robert Gordon University, Aberdeen, UK. [Google Scholar]

- Laughton, David Graham, Jacob. Shimon Sagi, and Michael Robert Samis. 2000. Modern asset pricing and project evaluation in the energy industry. Journal of Energy Literature 6: 3–46. [Google Scholar]

- Løvås, Kjell, and Petter Osmundsen. 2009. Petroleum taxation: Experience and issues. UiS Working Paper in Economics and Finance 2009/8. Available online: http://www1.uis.no/ansatt/odegaard/uis_wps_econ_fin/uis_wps_2009_8_lovas_osmundsen.pdf (accessed on 15 July 2016).

- Lubiantara, Benny. 2007. The Analysis of the Marginal Field Incentive—Indonesian Case. Oil, Gas & Energy Law Journal (OGEL). 5, no. 2. Available online: https://www.ogel.org/article.asp?key=2432 (accessed on 18 July 2016).

- Luo, Dongkun, and Na Yan. 2010. Assessment of fiscal terms of international petroleum contracts. Petroleum Exploration and Development 37: 756–62. [Google Scholar] [CrossRef]

- Mabadi, Amir. Hossein. 2008. Legal Strategies in Upstream Oil and Gas Contracts to Attract Foreign Investment: Iran’s Case. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1745427 (accessed on 19 July 2016).

- Manaf, Nor Aziah Abd, Natrah Saad, Zuaini Ishak, and Abdulsalam Mas’ud. 2014. Effects of Fiscal Regime Changes on Investment Climate of Malaysia’s Marginal Oil Fields: Proposed Model. Procedia-Social and Behavioral Sciences 164: 55–61. [Google Scholar] [CrossRef]

- McLaughlin, Tim. 2012. Myanmar reforms to lead growth: IMF. Myanmar Times 26 November 2012. Available online: https://www.mmtimes.com/business/3358-myanmar-reforms-to-lead-growth-imf.html (accessed on 21 July 2016).

- Mommer, Bernard. 2001. Fiscal Regimes and Oil Revenues in the UK, Alaska and Venezuela. OIES Working Papers WPM, Oxford Institute for Energy Studies, Oxford, UK. [Google Scholar]

- Mommer, Bernard. 2002. Global Oil and the Nation State. Oxford: Oxford University Press. [Google Scholar]

- Nakhle, Carole. 2004. Petroleum Taxation: A Critical Evaluation with Special Application to the UK Continental Shelf. Ph.D. dissertation, University of Surrey, Guildford, UK. [Google Scholar]

- Nakhle, Carole. 2007. Do high oil prices justify an increase in taxation in a mature oil province? The case of the UK continental shelf. Energy Policy 35: 4305–18. [Google Scholar] [CrossRef]

- Nakhle, Carole. 2008. Petroleum Taxation. London: Routledge. [Google Scholar]

- Nakhle, Carole. 2015. Licensing and Upstream Petroleum Fiscal Regimes: Assessing Lebanon’s Choices. Beirut: The Lebanese Centre for Policy Studies. [Google Scholar]

- 2015) Natural Resource Governace Institute (NRGI). 2015. Oil, Gas, and Mining Fiscal Terms. Available online: http://www.resourcegovernance.org/training/resource_center/backgrounders/oil-gas-and-mining-fiscal-terms (accessed on 22 July 2016).

- Odularu, Gbadebo Olusegun. 2008. Crude oil and the Nigerian economic performance. Oil and Gas Business. 1–29. Available online: https://s3.amazonaws.com/academia.edu.documents/5921722/odularo_1.pdf?AWSAccessKeyId=AKIAIWOWYYGZ2Y53UL3A&Expires=1543583443&Signature=l9llq1FWiEYvOOEX%2BN4mgOM9sOM%3D&response-content-disposition=inline%3B%20filename%3DCrude_Oil_and_the_Nigerian_Economic_Perf.pdf (accessed on 22 July 2016).

- Putrohari, Rovicky Dwi, Anggoro Kasyanto, Heri Suryanto, and Ida Marianna Abdul Rashid. 2007. PSC Term and Condition and Its Implementation in South East Asia Region. Paper presented at the Indonesian Petroleum Association 31st Annual Convention and Exhibition May 2007; Available online: http://archives.datapages.com/data/ipa_pdf/078/078001/pdfs/IPA07-BC-127.htm (accessed on 23 July 2016).

- Raja, Atif. 1999. Should Neutrality be the Major Objective in the Decision-Making Process of the Government and the Firm? CEPMLP Annual Review. 3. Available online: www.dundee.ac.uk/cepmlp/main/html/car_article2.htm (accessed on 13 June 2016).

- Robinson, Gwen. 2012. Myanmar: Opening up. Financial Times, April 19, 18. [Google Scholar]

- Rowland, Chris, and Danny Hann. 1987. Economics of North Sea Oil Taxation. Berlin: Springer. [Google Scholar]

- Sen, Anupama. 2014. Out of Gas: An Empirical Analysis of the Fiscal Regime for Exploration in India, 1999–2010. Available online: http://www.usaee.org/usaee2014/submissions/OnlineProceedings/ANUPAMA%20SEN%20Online%20Proceedings%20Paper%20%20IAEE%202014%20NY.pdf (accessed on 24 July 2016).

- Serova, Dina. 2015. Petroleum Fiscal System Design and Cost-Related Incentives in Oil and Gas Projects. Master’s thesis, Norwegian School of Economics, Bergen, Norway. [Google Scholar]

- Sieminski, Adam. 2014. International Energy Outlook. Available online: http://www.eia.gov/forecasts/ieo/pdf/0484%282014%29.pdf (accessed on 29 July 2016).

- Siew, Wei-Hun. 2001. Financial Evaluation Techniques Used to Evaluate Risk and Appraise Projects in the Oil Industry. Unpublished Ph.D. thesis, University of Dundee, Dundee, UK. [Google Scholar]

- Sunley, Emil M., Thomas Baunsgaard, and Dominique Simard. 2003. Revenue from the oil and gas sector: Issues and country experience. In Fiscal Policy Formulation and Implementation in Oil-Producing Countries. Washington, DC: International Monetary Fund, pp. 153–83. [Google Scholar]

- Thiri Swe, Wint, and Nnaemeka Vincent Emodi. Unpublished. Analysis of Myanmar Upstream Petroleum Fiscal Regimes: The Investors’ perspective.

- Tilton, John E. 2003. Assessing the threat of mineral depletion. Minerals and Energy-Raw Materials Report 18: 33–42. [Google Scholar] [CrossRef]

- United States Energy Information Administration (EIA). 2014. Available online: https://www.eia.gov/ (accessed on 27 July 2016).

- Wenrui, Jia, Xu Qing, Wang Yanling, and Yang Xueyan. 1999. The Development Strategy for China’s Oil Industry, 1996–2010. Beijing: Petroleum Industry Press. [Google Scholar]

- Zahidi, Sara. 2010. Comparative analysis of upstream petroleum fiscal systems of Pakistan, Thailand and other countries with medium ranked oil reserves. Paper presented at the International Conference on Energy and Sustainable Development: Issues and Strategies (ESD), Chiang Mai, Thailand, June 2–4; pp. 1–14. [Google Scholar]

- Zhao, Xu, and Carol Dahl. 2014. How OECD Countries Subsidizes Oil and Natural Gas Producers and Modeling the Consequences. Paper presented at the 37th IAEE International Conference on Energy & the Economy, New York, NY, USA, June 15–18. [Google Scholar]

| 1 | |

| 2 | Net Present Value. |

| 3 | Internal Rate of Return. |

| 4 | For example, business tax, value-added tax, import tax levied on the investment. |

| 5 | For example, royalty, profit split, host government participation, bonus based on income and profit levels. |

| 6 | Luo and Yan (2010) also made an average assumption for the sliding scales of petroleum fiscal regimes. |

| 7 | |

| 8 | Attitudes of the decision makers for the weights regarding the indicators GT and FLI were explained in Section 3 in detail. |

| 9 | Can be provided at a request to the authors. |

| 10 | Luo and Yan (2010). |

| 11 | CS = W1 × GT + W2 × FLI. |

| 12 | In FLI in Table 7, the three highest attractiveness rank countries adopt the PSC system while the three lowest attractiveness rank countries practice the concessionary system. Likewise, In CS in Table 8, the two highest attractiveness rank countries adopt PSC while the two lowest rank countries use concessionary. Hence, it is better to analyze separately for PSC and concessionary. |

| 13 | |

| 14 | Discounted Cash Flow Model for the calculation of GTi. |

| 15 | Non-Discounted Cash Flow Model for the calculation of GT. |

| 16 | The attractiveness rank of U.S. in terms of FLI (Table 8). |

| 17 | The smaller the FLI, the less risk the IOCs will face in the earlier stage, and the more attractive the contract fiscal terms are to the IOCs (Luo and Yan 2010). |

| 18 | Scores and weightings should be determined using a technique such as Delphin or Peer review or a questionnaire (Henriksen and Traynor 1999). |

| 19 | Cost recovery regime is used only in PSC fiscal system. |

| 20 | 25% of foreign earnings comes from natural gas export in Myanmar. |

| 21 | Cost Recovery—50% in Myanmar, 100% in Indonesia, 90% in Cambodia, 70% in Vietnam (Table 7). Cost recovery regime is used only in the PSC system. |

| 22 | The stability of the fiscal regime is also considered to maintain the investor’s confidence. |

| 23 | Assessment and comparison of fiscal terms in different countries can help the IOC in selection of investment areas and adjust its business strategy according to its own situation, to achieve greater operational efficiency and secure and increase the value of assets. |

| No. | Concept | Author |

|---|---|---|

| 1 | Economic rent is extra revenue earn by investors. | Raja (1999) |

| 2 | The true value of the natural resource is the difference between the revenues generated from resource extraction and the costs of extraction. | Dickson (1999) |

| 3. | The surplus return above the value of the capital, labor and other factors of production for resource exploitation or surplus revenue of the resource after the costs of capital and labor inputs. | Banfi et al. (2004) |

| 4. | The idea of surplus return drives from the reason of ownership in which the state should receive compensation above the normal taxes paid by other industries. | Tilton (2003) |

| 5. | In general, the studies contend that a tax based on economic rent is likely to be an ideal tax. | Nakhle (2004) |

| 6. | Economic rent concept is important since the government attempts to capture as much economic rent possible through various levies, taxes, royalties, and bonuses. | Lubiantara (2007) |

| 7. | A fiscal regime that has been designed to capture the economy tends to increase when economic rent increases, and reduce government take when economic rent decreases. | Nakhle (2008) |

| 8. | The reason to adopt the economic rent theory as a framework is that taxes levied on economic rent will not act as a disincentive on investor to undertake any activity. | Nakhle (2008) |

| 9. | Economic rent constitutes a justifiable base for petroleum taxation. | Kyari (2013) |

| Indicator | Necessary Parameters | Data Source | Previous Studies |

|---|---|---|---|

| GT (NDCF) | Production profile, CAPEX, OPEX, DD& Price Fiscal Term Variables (Royalty, Bonus, Cost Recovery, Profit Split, Tax) | Kaiser (2007) US Energy Information Administration 1. Ernst & Young (2015). Global Oil & Gas Tax Guide 2. PSC Features for Offshore Petroleum Exploration: Ministry of Energy, Myanmar | Same Assumptions 1. (Kaiser (2007) 2. Bindemann (1999) 3. Johnston (1994) Assumption of oil price and relevant taxes is sufficient: - to calculate expected cash flows to determine the investor’s return and government take (GT) (Nakhle 2004) |

| GT (DCF) | Discount Rate (10%) | Nakhle (2004). Petroleum taxation. | Assumption 10 per cent in real terms, - as was applied in the majority of published studies, - to mirror to industry’s discount rate. |

| CS | Weights (Attitude of Decision Makers) | Primary source of data by survey questionnaire to subject matter experts of Korean companies. | Scores and Weightings should be determined using a technique such as Delphin or Peer review or a questionnaire (Henriksen and Traynor 1999). |

| Comparative Analysis | Country Selection | Primary source by survey questionnaire |

| Descriptions | Cambodia | Indonesia | Myanmar | Vietnam | ||||

|---|---|---|---|---|---|---|---|---|

| Gov | IOC | Gov | IOC | Gov | IOC | Gov | IOC | |

| Royalty Rate | 12.5% | 12.5% | 6% | |||||

| FTP | 10% | |||||||

| Profit Petroleum | 35% | 65% | 60% | 40% | 60% | 40% | 40% to 80% | |

| Cost Recovery | 90% | 100% | 50% | 70% | ||||

| Production Bonus | Negotiable | 1 MM$ To 10 MM$ | Negotiable | |||||

| Domestic requirement | To meet the domestic demand | 25% | 25% | - | ||||

| Training Fund | 1.5 L to 2.5 L | Negotiable | 0.5 L to 1 L | Subject to Each Contract | ||||

| R&D Fund | Nil | Nil | 0.5% of Profit | Nil | ||||

| Government Participation | Subject to agreement | 10% | 20% to 25% | 15% | ||||

| Tax | 25% | 44% | 25% | 35% to 55% | ||||

| Descriptions | Cambodia | Indonesia | Myanmar | Vietnam | ||||

|---|---|---|---|---|---|---|---|---|

| Gov | IOC | Gov | IOC | Gov | IOC | Gov | IOC | |

| Royalty Rate | 12.50% | 12.50% | 6% | |||||

| FTP | 10% | |||||||

| Profit Petroleum | 35% | 65% | 60% | 40% | 60% | 40% | 40–80% | 60–20% |

| Cost Recovery | 90% | 100% | 50% | 70% | ||||

| Tax | 25% | 44% | 25% | 35–55% | ||||

| Host Gov Participation | Open and subject to the petroleum agreement | 10% | 15–25% (if reserves is greater than 5 trillion cubic feet) | Subject to negotiation. Normally 15% | ||||

| U.S | Canada | Australia | Mozambique | |||||

|---|---|---|---|---|---|---|---|---|

| Gov | IOC | Gov | Cont | Gov | IOC | Gov | IOC | |

| Royalty Rate (Onshore) | 12.5–30% | 10–45% | 0–12.5% | 6–10% | ||||

| (Offshore) | 18.75% | |||||||

| Average Royalty Rate | 20 | 27.0% | 6.25% | 8% | ||||

| Corporate Income Tax | CIT 35%, State Income Tax 0–12% | Federal Corporate Tax 15% | 30% | 32% | ||||

| Profit-Based Tax | Provincial Tax Rate 10% to 16% | 40% | ||||||

| Depreciation | 10 year Straight-Line | Nil | Immediate write-off | Nil | ||||

| Bonus | Nil | Negotiable | Signature Bonus 0.5–5% of assets | |||||

| Tax-Loss | Carried back 2 years | Carried forward 20 years and backward 3 years | Carried back 2 years | Carried forward 5 years | ||||

| Fiscal Term Policy | Country | ROY (%) | Tax (%) | ROY + Tax (%) | Cost Recovery (%) | Profit Split (%) | Gov-Participation (%) | Depreciation (Year) (Straight Line Method) |

|---|---|---|---|---|---|---|---|---|

| Concessionary | Mozambque | 8 | 32 | 40 | Not applicable | |||

| Australia | 6.25 | 30 | 36.25 | Not applicable | ||||

| Canada | 27.5 | 15 | 42.5 | Not applicable | ||||

| U.S | 20 | 35 | 55 | 10 | ||||

| PSC | Cambodia | 12.25 | 25 | 37.25 | 90 | 35 | Negotiable | 5 |

| Myanmar | 12.25 | 25 | 37.25 | 50 | 60 | 15 to 25 | 5 | |

| Indonesia | 10 | 44 | 54 | 100 | 60 | 10 | 5 | |

| Vietnam | 6 | 55 | 61 | 70 | 40 | Negotiable | 5 |

| Country | GT (Without Time Consideration) | GTi (With Time Value of Money) | FLI (Front Loading Index) |

|---|---|---|---|

| Myanmar | 63.37% | 22.06% | 65.19% |

| Cambodia | 41.01% | 17.13% | 58.23% |

| Indonesia | 49.32% | 23.34% | 52.67% |

| Vietnam | 58.31% | 23.34% | 59.97% |

| Australia | 43.92% | 14.08% | 67.94% |

| U.S. | 72.74% | 25.67% | 64.71% |

| Canada | 58.36% | 18.00% | 69.15% |

| Mozambique | 49.39% | 16.15% | 67.30% |

| Country | CS (Composite Score) | Attractiveness Rank |

|---|---|---|

| Cambodia | 51.00% | 1 |

| Indonesia | 51.26% | 2 |

| Australia | 57.85% | 3 |

| Vietnam | 59.27% | 4 |

| Mozambique | 59.78% | 5 |

| Myanmar | 64.43% | 6 |

| Canada | 64.62% | 7 |

| U.S. | 68.08% | 8 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Swe, W.T.; Emodi, N.V. Assessment of Upstream Petroleum Fiscal Regimes in Myanmar. J. Risk Financial Manag. 2018, 11, 85. https://doi.org/10.3390/jrfm11040085

Swe WT, Emodi NV. Assessment of Upstream Petroleum Fiscal Regimes in Myanmar. Journal of Risk and Financial Management. 2018; 11(4):85. https://doi.org/10.3390/jrfm11040085

Chicago/Turabian StyleSwe, Wint Thiri, and Nnaemeka Vincent Emodi. 2018. "Assessment of Upstream Petroleum Fiscal Regimes in Myanmar" Journal of Risk and Financial Management 11, no. 4: 85. https://doi.org/10.3390/jrfm11040085

APA StyleSwe, W. T., & Emodi, N. V. (2018). Assessment of Upstream Petroleum Fiscal Regimes in Myanmar. Journal of Risk and Financial Management, 11(4), 85. https://doi.org/10.3390/jrfm11040085