When Does Earnings Management Matter? Evidence across the Corporate Life Cycle for Non-Financial Chinese Listed Companies

Abstract

:1. Introduction

Why China?

2. Literature Review and Hypothesis Development

3. Research Design

3.1. Sample Selection

3.2. Variables Measurement

3.2.1. Dependent Variable Measurement: Accrual-Base Earnings Management

- = Sum of accruals, it is measured by operating income of firm ‘i’ at time ‘t’ minus operating cash flow of firm ‘i’ at time ‘t’.

- = Beginning level of total assets of firm ‘i’ at time ‘t’.

- = Change in sales revenues minus change in account receivables of firm ‘i’ at time ‘t’.

- = It is the sum of fixed assets (plant, property, and equipment) of firm ‘i’ at time ‘t’.

- = Denotes the residual term and captures the level of discretionary accruals. Therefore, this is the basic proxy for DAC.

- = The lag value on Return on Asset. ROA is calculated as the net income divided by the total assets of firm ‘i’ at time ‘t’, and other variables are the same as explained in the previous model.

- = Ratio of total assets of the firm ‘i’ at time ‘t’ to total assets − book value of firm equity + firms market value. The rest of the variables are the same as explained in the first model.

3.2.2. Dependent Variable Measurement: Real Earnings Management

- = The cash-flow (firm ‘i’ at time ‘t’) from operations.

- Level of total assets firm ‘i’ at time t − 1.

- = Sales volume of firm ‘i’ at time ‘t’.

- The sale volume of firm ‘i’ at time ‘t’—sales volume of firm ‘i’ at time t − 1.

- The residual term, which captures abnormal cash flows level of firm ‘i’ at time ‘t’.

- Sum of CGS (cost of goods sold) and change in level of inventory of firm ‘i’ at time ‘t’.

- Residual term, which captures abnormal production cost of firm ‘i’ at time ‘t’.

- The sum of sales, general and administration expenditures, and research and development expenditures of firm ‘i’ at time ‘t’.

- Residual term, which captures abnormal discretionary expenses of firm ‘i’ at time ‘t’.

3.2.3. Independent Variable: Corporate Life Cycle Stages

3.2.4. Measurement of Control Variables

3.3. Empirical Models

- = Absolute value of all three discretionary accrual measures, individually, it is used as a proxy of AEM.

- = Absolute value of real earnings management metrics namely: REM_CFO, REM_PROD, REM_DISEXP and REM_COM, respectively.

- = Vector of dummy variables which represents different corporate life-cycle stages, wherein represents the introduction, growth, maturity and decline stage of CLC respectively.

- = Self-financing ratio, calculated as the cash-flow from operations/net fixed assets.

- = Net profit margin, it is measured as net-income/total sales.

- = Represents the firm’s tangibility level, measured as net PPE ÷ book value of assets.

- = Represents the yearly stock return of firm ‘i’ at time ‘t’.

- = Denotes error term.

4. Empirical Results

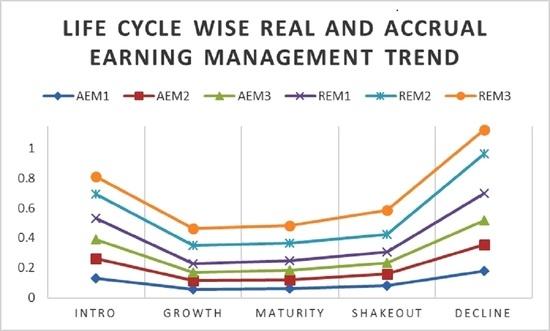

4.1. Univariate Analysis

4.2. Multivariate Analysis

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Abad, David, M. Fuensanta Cutillas Gomariz, Juan Pedro Sánchez-Ballesta, and Jose Yagüe. 2018. Real earnings management and information asymmetry in the equity market. European Accounting Review 27: 209–35. [Google Scholar] [CrossRef] [Green Version]

- Agustia, Dian, Nur Pratama Abdi Muhammad, and Yani Permatasari. 2020. Earnings management, business strategy, and bankruptcy risk: Evidence from Indonesia. Heliyon 6: 1–9. [Google Scholar] [CrossRef] [PubMed]

- Agyei, Samuel Kwaku, Edward Marfo-Yiadom, Abraham Ansong, and Anthony Adu Asare Idun. 2020. Corporate Tax Avoidance Incentives of Banks in Ghana. Journal of African Business 2: 544–59. [Google Scholar] [CrossRef]

- Akbar, Ahsan, Minhas Akbar, Wenjin Tang, and M. Azeem Qureshi. 2019. Is Bankruptcy Risk Tied to Corporate Life-Cycle? Evidence from Pakistan. Sustainability 11: 678. [Google Scholar] [CrossRef] [Green Version]

- Akbar, Minhas, Ahsan Akbar, Petra Maresova, Minghui Yang, and H. Muhammad Arshad. 2020. Unraveling the Bankruptcy Risk‒Return Paradox across the Corporate Life Cycle. Sustainability 12: 3547. [Google Scholar] [CrossRef]

- Akhtar, Shumi. 2012. Capital structure and business cycles. Accounting & Finance 52: 25–48. [Google Scholar]

- Al-Hadi, Ahmed, Mostafa Monzur, and Ahsan Habib. 2016. Risk committee, firm life cycle, and market risk disclosures. Corporate Governance: An International Review 24: 145–70. [Google Scholar] [CrossRef]

- Alzoubi, Ebraheem Saleem Salem. 2018. Audit quality, debt financing, and earnings management: Evidence from Jordan. Journal of International Accounting, Auditing and Taxation 30: 69–84. [Google Scholar] [CrossRef]

- An, Zhe, Donghui Li, and Jin Yu. 2016. Earnings management, capital structure, and the role of institutional environments. Journal of Banking & Finance 68: 131–52. [Google Scholar]

- Anagnostopoulou, Seraina C., and Andrianos E. Tsekrekos. 2017. The effect of financial leverage on real and accrual-based earnings management. Accounting and Business Research 47: 191–236. [Google Scholar] [CrossRef]

- Austin, Chelsea Rae, and Ryan Wilson. 2015. Are Reputational Costs a Determinant of Tax Avoidance? 2013 American Taxation Association Midyear Meeting: Tax Avoidance in an International Setting. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2216879 (accessed on 1 December 2020).

- Bakarich, M. Kathleen, Mahumd Hossain, and Joseph Weintrop. 2019. Different time, different tone: Company life cycle. Journal of Contemporary Accounting & Economics 15: 69–86. [Google Scholar]

- Bender, Ruth. 2013. Corporate Financial Strategy. Abingdon: Routledge. [Google Scholar]

- Bouwman, Christa H. S. 2014. Managerial optimism and earnings smoothing. Journal of Banking & Finance 41: 283–303. [Google Scholar]

- Bulan, Laarni, and Zhipeng Yan. 2009. The pecking order of financing in the firm’s life cycle. Banking and Finance Letters 1: 129–40. [Google Scholar]

- Bulan, Laarni, and Yan Zhipeng. 2010. Firm Maturity and the Pecking Order Theory. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1760505 (accessed on 1 December 2020).

- Can, Gökberk. 2020. Do Life Cycles Affect Financial Reporting Quality? Evidence from Emerging Market. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3530338 (accessed on 1 December 2020).

- Cang, Yongtao, Yiyun Chu, and Thomas W. Lin. 2014. An exploratory study of earnings management detectability, analyst coverage and the impact of IFRS adoption: Evidence from China. Journal of Accounting and Public Policy 33: 356–71. [Google Scholar] [CrossRef]

- Carroll, Glenn. 1985. Concentration and specialization: Dynamics of niche width in populations of organizations. American Journal of Sociology 90: 1262–83. [Google Scholar] [CrossRef]

- Chang, Hye Sun. 2015. Firm Life Cycle and Detection of Accrual-Based Earnings Manipulation. Ph.D. dissertation, University of Illinois at Urbana-Champaign, Champaign, IL, USA. [Google Scholar]

- Chen, Bing-Xuan Lin, Yaping Wang, and Liansheng Wu. 2010. The frequency and magnitude of earnings management: Time-series and multi-threshold comparisons. International Review of Economics & Finance 19: 671–85. [Google Scholar]

- Cohen, Daniel, and Paul Zarowin. 2010. Accrual-based and real earnings management activities around seasoned equity offerings. Journal of Accounting and Economics 50: 2–19. [Google Scholar] [CrossRef] [Green Version]

- DeAngelo, Harry, Linda DeAngelo, and Rene M. Stulz. 2006. Dividend policy and the earned/contributed capital mix: A test of the life-cycle theory. Journal of Financial Economics 81: 227–54. [Google Scholar] [CrossRef]

- DeFond, Mark L., and James Jiambalvo. 1994. Debt covenant violation and manipulation of accruals. Journal of Accounting and Economics 17: 145–76. [Google Scholar] [CrossRef]

- Dickinson, Victoria. 2011. Cash flow patterns as a proxy for firm life cycle. The Accounting Review 86: 1969–94. [Google Scholar] [CrossRef]

- Dickinson, Victoria, Haimanot Kassa, and Philipp D. Schaberl. 2018. What information matters to investors at different stages of a firm’s life cycle? Advances in Accounting 42: 22–33. [Google Scholar] [CrossRef]

- Doukakis, Leonidas C. 2014. The effect of mandatory IFRS adoption on real and accrual-based earnings management activities. Journal of Accounting and Public Policy 33: 551–72. [Google Scholar] [CrossRef]

- Doukas, John A., and Ozgur B. Kan. 2004. Excess cash flows and diversification discount. In Financial Management. Hoboken: Wiley, pp. 71–88. [Google Scholar]

- Doyle, Jeffrey, Weili Ge, and Sarah McVay. 2007. Determinants of weaknesses in internal control over financial reporting. Journal of Accounting and Economics 44: 193–223. [Google Scholar] [CrossRef]

- Drake, Katharine D. 2015. Does Firm Life Cycle Inform the Relation between Book-Tax Differences and Earnings persistence? Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2547778 (accessed on 1 December 2020).

- Edwards, Alexander, Casey Schwab, and Terry Shevlin. 2016. Financial constraints and cash tax savings. The Accounting Review 91: 859–81. [Google Scholar] [CrossRef]

- Erokhin, Vasilii, and Tianming Gao. 2020. China and the Eurasian Economic Union: A Future of Agricultural Trade in BRICS+ Format. In Regional Trade and Development Strategies in the Era of Globalization. Pennsylvania: IGI Global, pp. 68–92. [Google Scholar]

- Faff, Robert, Wing Chun Kwok, Edward J. Podolski, and George Wong. 2016. Do corporate policies follow a life-cycle? Journal of Banking & Finance 69: 95–107. [Google Scholar]

- Farrell, Kathleen, Emre Unlu, and Jin Yu. 2014. Stock repurchases as an earnings management mechanism: The impact of financing constraints. Journal of Corporate Finance 25: 1–15. [Google Scholar] [CrossRef]

- Fields, L. Paige, Manu Gupta, Mike Wilkins, and Shage Zhang. 2018. Refinancing pressure and earnings management: Evidence from changes in short-term debt and discretionary accruals. Finance Research Letters 25: 62–68. [Google Scholar] [CrossRef] [Green Version]

- Ghazali, Aziatul Waznah, Nur Aima Shafie, and Zuraidah Mohd Sanusi. 2015. Earnings management: An analysis of opportunistic behaviour, monitoring mechanism and financial distress. Procedia Economics and Finance 28: 190–201. [Google Scholar] [CrossRef] [Green Version]

- Graham, John A., Michelle Hanlon, Terry Shevlin, and Nemit Shroff. 2014. Incentives for tax planning and avoidance: Evidence from the field. The Accounting Review 89: 991–1023. [Google Scholar] [CrossRef] [Green Version]

- Gray, Barbara, and Sony S. Ariss. 1985. Politics and strategic change across organizational life cycles. Academy of Management Review 10: 707–23. [Google Scholar] [CrossRef]

- Gunny, Katherine A. 2010. The relation between earnings management using real activities manipulation and future performance: Evidence from meeting earnings benchmarks. Contemporary Accounting Research 27: 855–88. [Google Scholar] [CrossRef]

- Habib, Ahan, and Mostafa Monzur Hasan. 2017. Firm life cycle, corporate risk-taking and investor sentiment. Accounting & Finance 57: 465–97. [Google Scholar]

- Habib, Ahsan, and Mostafa Monzur Hasan. 2019. Corporate life cycle research in accounting, finance and corporate governance: A survey, and directions for future research. International Review of Financial Analysis 61: 188–201. [Google Scholar] [CrossRef]

- Habib, Ahsan, Borhan Uddin Bhuiyan, and Ainel Islam. 2013. Financial distress, earnings management and market pricing of accruals during the global financial crisis. Managerial Finance 39: 156–80. [Google Scholar] [CrossRef]

- Habib, Ahsan, Borhan Uddin Bhuiyan, and Mostafa Monzur Hasan. 2019. IFRS adoption, financial reporting quality and cost of capital: A life cycle perspective. Pacific Accounting Review 31: 497–522. [Google Scholar] [CrossRef]

- Hamers, Lars, Annelies Renders, and Patrick Vorst. 2016. Firm Life Cycle and Analyst Forecast Behavior. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2874845 (accessed on 1 December 2020).

- Hasan, Mostafa Monzur, and Ahsan Habib. 2017. Firm life cycle and idiosyncratic volatility. International Review of Financial Analysis 50: 164–75. [Google Scholar] [CrossRef]

- Hasan, Mostafa Monzur, Mahmud Hossain, and Ahsan Habib. 2015. Corporate life cycle and cost of equity capital. Journal of Contemporary Accounting & Economics 11: 46–60. [Google Scholar]

- Hasan, Mostafa Monzu, Ahmed Al-Hadi, Grantley Taylor, and Grant Richardson. 2017. Does a firm’s life cycle explain its propensity to engage in corporate tax avoidance? European Accounting Review 26: 469–501. [Google Scholar] [CrossRef] [Green Version]

- Healy, Paul M., and James M. Wahlen. 1999. A review of the earnings management literature and its implications for standard setting. Accounting Horizons 13: 365–83. [Google Scholar] [CrossRef]

- Hribar, Paul, and Daniel W. Collins. 2002. Errors in estimating accruals: Implications for empirical research. Journal of Accounting Research 40: 105–34. [Google Scholar] [CrossRef]

- Hribar, Paul, and Nir Yehuda. 2007. Life-Cycle, Cost of Capital, Earnings Persistence and Stock Returns. New York: University of Iowa and Columbia University, Unpublished work. [Google Scholar]

- Hribar, Paul, and Nir Yehuda. 2015. The Mispricing of Cash Flows and Accruals at Different Life-Cycle Stages. Contemporary Accounting Research 32: 1053–72. [Google Scholar] [CrossRef]

- Irvine, Paul J., and Jeffrey Pontiff. 2009. Idiosyncratic return volatility, cash flows, and product market competition. The Review of Financial Studies 22: 1149–77. [Google Scholar] [CrossRef]

- Jaafar, Hartini, and Hazianti Abdul Halim. 2016. Refining the firm life cycle classification method: A firm value perspective. Journal of Economics, Business and Management 4: 112–19. [Google Scholar] [CrossRef]

- Jacoby, Gady, Jialong Li, and Mingzhi Liu. 2019. Financial distress, political affiliation and earnings management: The case of politically affiliated private firms. The European Journal of Finance 25: 508–23. [Google Scholar] [CrossRef]

- Jenkins, David S., Gregory D. Kane, and Uma Velury. 2004. The impact of the corporate life-cycle on the value-relevance of disaggregated earnings components. Review of Accounting and Finance 3: 5–20. [Google Scholar] [CrossRef]

- Jiang, Xinfeng, and Ahsan Akbar. 2018. Does increased representation of female executives improve corporate environmental investment? Evidence from China. Sustainability 10: 4750. [Google Scholar] [CrossRef] [Green Version]

- Kardan, Behzad, Mahdi Salehi, and Rahimeh Abdollahi. 2016. The relationship between the outside financing and the quality of financial reporting: Evidence from Iran. Journal of Asia Business Studies 10: 20–40. [Google Scholar] [CrossRef] [Green Version]

- Karniouchina, Ekaterina V., Stephen J. Carson, Jeremy C. Short, and David J. Ketchen Jr. 2013. Extending the firm vs. industry debate: Does industry life cycle stage matter? Strategic Management Journal 34: 1010–18. [Google Scholar] [CrossRef]

- Kervin, John B. 1992. Methods for Business Research. New York: Harper Collins. [Google Scholar]

- Khan, Muhammad Kaleem, Ying He, Umair Akram, and Suleman Sarwar. 2017. Financing and monitoring in an emerging economy: Can investment efficiency be increased? China Economic Review 45: 62–77. [Google Scholar] [CrossRef]

- Khan, Muhammad Khalil, Imran Ali Sandano, Cornelius B. Pratt, and Tahir Farid. 2018. China’s belt and road initiative: A global model for an evolving approach to sustainable regional development. Sustainability 10: 4234. [Google Scholar] [CrossRef] [Green Version]

- Kim, Sang Ho, and Youhan An. 2018. The effect of ownership-control disparity on the Chinese firm’s real activity earnings management. Pacific Accounting Review 30: 482–99. [Google Scholar] [CrossRef]

- Koester, Allison, Terry Shevlin, and Din Wangerin. 2013. Does operational efficiency spill over onto the tax return. Paper Presented at the Tax Symposium 2013, Chapel Hill, NC, USA, January 25–26; pp. 1–49. [Google Scholar]

- Kothari, Andrew J. Leone, and Charles E. Wasley. 2005. Performance matched discretionary accrual measures. Journal of Accounting and Economics 39: 163–97. [Google Scholar] [CrossRef]

- Krishnan, Gopal V., Emma-Riikka Myllymäki, and Neerav Nagar. 2018. Does Financial Reporting Quality Vary Across Firm Life Cycle? pp. 1–64. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3233512 (accessed on 25 October 2018).

- Krishnan, Gopal V., Emma-Riikka Myllymäki, and Neerav Nagar. 2020. Does Financial Reporting Quality vary across Firm Life Cycle? Journal of Business Finance and Economics, 1–72. [Google Scholar] [CrossRef]

- Laaksonen, Silva, and Heikki Sipilä. 2006. Lyhyen Elinkaaren Omaavien Pk-Yritysten Liiketoiminnan Päättymisen Syyt Espoon ja Kauniaisten Alueella. Laurea Julkaisut B16. Available online: https://www.theseus.fi/bitstream/handle/10024/114671/Laurea%20julkaisut%20B16.pdf?sequence=1 (accessed on 1 December 2020).

- Lan, Yang, Lilli Wang, and Xueyong Zhang. 2013. Determinants and features of voluntary disclosure in the Chinese stock market. China Journal of Accounting Research 6: 265–85. [Google Scholar] [CrossRef] [Green Version]

- Lazzem, Safa, and Faouzi Jilani. 2018. The impact of leverage on accrual-based earnings management: The case of listed French firms. Research in International Business and Finance 44: 350–58. [Google Scholar] [CrossRef]

- Lester, Donald L., and John A. Parnell. 2008. Firm size and environmental scanning pursuits across organizational life cycle stages. Journal of Small Business and Enterprise Development 15: 540–54. [Google Scholar] [CrossRef]

- Lester, Donald L., John A. Parnell, and Shawn Carraher. 2003. Organizational life cycle: A five-stage empirical scale. The International Journal of Organizational Analysis 11: 339–54. [Google Scholar] [CrossRef] [Green Version]

- Levie, Jonathan, and Banyamin B. Lichtenstein. 2010. A terminal assessment of stages theory: Introducing a dynamic states approach to entrepreneurship. Entrepreneurship Theory and Practice 34: 317–50. [Google Scholar] [CrossRef] [Green Version]

- Li, Ting, and Nataliya Zaiats. 2017. Information environment and earnings management of dual class firms around the world. Journal of Banking & Finance 74: 1–23. [Google Scholar]

- Li, Yuanhui, Xiao Li, Erwei Xiang, and Hadrian Geri Djajadikerta. 2020. Financial Distress, Internal Control, and Earnings Management: Evidence from China. Journal of Contemporary Accounting & Economics 16: 1–18. [Google Scholar]

- Lippitt, Gordon L., and Warren H. Schmidt. 1967. Crises in a developing organization. Harvard Business Review 2: 102–12. [Google Scholar]

- Mangoting, Yenny, and Claudia Tysia Onggara. 2019. The Firm Life Cycle Dynamics of Tax Avoidance. Paper presented at the International Conference on Tourism, Economics, Accounting, Management, and Social Science, Bali, Indonesia, October 10–11. [Google Scholar]

- Miller, Danny, and Peter H. Friesen. 1984. A longitudinal study of the corporate life cycle. Management Science 30: 1161–83. [Google Scholar] [CrossRef]

- Mokhova, Natalia, and Marek Zinecker. 2013. Liquidity, probability of bankruptcy and the corporate life cycle: The evidence from Czech Republic. International Journal of Globalisation and Small Business 5: 189–208. [Google Scholar] [CrossRef]

- Morck, Randall, Bernard Yeung, and Wayne Yu. 2000. The information content of stock markets: Why do emerging markets have synchronous stock price movements? Journal of Financial Economics 58: 215–60. [Google Scholar] [CrossRef] [Green Version]

- Nagar, Neerav, and Suresh Radhakrishnan. 2017. Firm Life Cycle and Real-Activity Based Earnings Management. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2701680 (accessed on 1 May 2017).

- Noronha, Carlos, Yun Zeng, and Gerald Vinten. 2008. Earnings management in China: An exploratory study. Managerial Auditing Journal 23: 367–85. [Google Scholar] [CrossRef]

- O’Connor, Thomas, and Julie Byrne. 2015. Governance and the corporate life-cycle. International Journal of Managerial Finance 11: 23–43. [Google Scholar] [CrossRef]

- Pappas, Kostas, Eamoon Walsh, and Alice Liang Xu. 2019. Real earnings management and Loan Contract terms. The British Accounting Review 51: 373–401. [Google Scholar] [CrossRef]

- Prabhakar, Akhilesh Chnadra, and Vasilii Erokhin. 2020. Globalization: Reshaping the World Economy in the 21st Century. In Regional Trade and Development Strategies in the Era of Globalization. Pennsylvania: IGI Global, pp. 1–24. [Google Scholar]

- Quinn, Robert E., and Kim Cameron. 1983. Organizational life cycles and shifting criteria of effectiveness: Some preliminary evidence. Management Science 29: 33–51. [Google Scholar] [CrossRef] [Green Version]

- Raman, Kartik, and Husayn Shahrur. 2008. Relationship-specific investments and earnings management: Evidence on corporate suppliers and customers. The Accounting Review 83: 1041–81. [Google Scholar] [CrossRef]

- Rautanen, Jani. 2013. External Financing during a Company’s Life Cycle. Bachelor’s dissertation, Turku University of Applied Sciences, Turku, Finland; pp. 1–71. [Google Scholar]

- Richardson, Grant, Roman Lanis, and Grantley Taylor. 2015. Financial distress, outside directors and corporate tax aggressiveness spanning the global financial crisis: An empirical analysis. Journal of Banking & Finance 52: 112–29. [Google Scholar]

- Ringle, Christian M., Sven Wende, and Jan-Michael Becker. 2015. SmartPLS 3. Bönningstedt: SmartPLS. [Google Scholar]

- Rodríguez-Pérez, Gonzalo, and Stefan van Hemmen. 2010. Debt, diversification and earnings management. Journal of Accounting and Public Policy 29: 138–59. [Google Scholar] [CrossRef]

- Rosner, Rebecca L. 2003. Earnings manipulation in failing firms. Contemporary Accounting Research 20: 361–408. [Google Scholar] [CrossRef]

- Roychowdhury, Sugata. 2006. Earnings management through real activities manipulation. Journal of Accounting and Economics 42: 335–70. [Google Scholar] [CrossRef]

- Spence, A. Michael. 1979. Investment strategy and growth in a new market. The Bell Journal of Economics 10: 1–19. [Google Scholar] [CrossRef]

- Suberi, Adilah Zafria Mohd, Grace Hsu, and Anee Wyatt. 2012. The Relation between Firm Growth and Accounting Quality: A Test of the Life Cycle Hypothesis: Working Paper. Brisbane: University of Queensland, Australia. [Google Scholar]

- Vacca, Andrea, Antonio Iazzi, Demitris Vrontis, and Monica Fait. 2020. The Role of Gender Diversity on Tax Aggressiveness and Corporate Social Responsibility: Evidence from Italian Listed Companies. Sustainability 12: 2007. [Google Scholar] [CrossRef] [Green Version]

- Wang, Teng-Shih, Yi-Mien Lin, Edward M. Werner, and Hsihui Chang. 2018. The relationship between external financing activities and earnings management: Evidence from enterprise risk management. International Review of Economics & Finance 58: 312–29. [Google Scholar]

- Wang, Zanxin, Minhas Akbar, and Ahsan Akbar. 2020. The Interplay between Working Capital Management and a Firm’s Financial Performance across the Corporate Life Cycle. Sustainability 12: 1661. [Google Scholar] [CrossRef] [Green Version]

- Wasimullah, I. U. Toor, and Z. Abbas. 2010. Can high leverage control the opportunistic behavior of managers: Case Analysis of textile sector of Pakistan. International Research Journal of Finance and Economics 47: 137–44. Available online: https://www.researchgate.net/publication/287397802_Can_high_leverage_control_the_opportunistic_behavior_of_managers_Case_analysis_of_textile_sector_of_Pakistan (accessed on 1 December 2020).

- Yoo, Jiyeon, Sangryul Lee, and Sambock Park. 2019. The effect of firm life cycle on the relationship between R&D expenditures and future performance, earnings uncertainty, and sustainable growth. Sustainability 11: 2371. [Google Scholar]

- Zadband, Vahid Khosravi, and Hamed Omrani. 2014. The Effect of Corporate Life Cycle on Financial Reporting Quality Companies Listed in Tehran Stock Exchange. International Journal of Management & Information Technology 9: 1564–71. [Google Scholar]

- Zaman, Gheorghe, and Lulia Monica Oehler-Şincai. 2019. Computation of China’s Export Performance. Romanian Journal of Economic Forecasting 22: 1–70. [Google Scholar]

- Zaman, Gheorghe, and Lulia Monica Oehler-Şincai. 2020. ESTG BRI: Principles for a Sustainable Belt and Road Initiative. China-CEE Institute Working Paper 9. Hungary: China-CEE Institute, pp. 1–16. [Google Scholar]

- Zamri, Norhayati, Rahayu Abduk Rahman, and Noor Saatila Mohd Isa. 2013. The Impact of Leverage on Real Earnings Management. Procedia Economics and Finance 7: 86–95. [Google Scholar] [CrossRef] [Green Version]

- Zamrudah, Rikazh, and Riza Kautsar Salman. 2013. Earnings management prediction (a study of company’s life cycle). The Indonesian Accounting Review 3: 107–20. [Google Scholar] [CrossRef]

- Zang, Amy Y. 2012. Evidence on the Trade-Off between Real Activities Manipulation and Accrual-Based Earnings Management. The Accounting Review 87: 675–703. [Google Scholar] [CrossRef]

- Zhang, Xiaofei, and Longbing Xu. 2020. Firm life cycle and debt maturity structure: Evidence from China. Accounting & Finance, 1–40. [Google Scholar] [CrossRef]

| 1 | |

| 2 | Sum of accruals is the combination of discretionary and non-discretionary accruals. DAC occur when the manager shows opportunistic behavior towards manipulation of earnings while, non-DAC arise due to the normal activities of firm managers. In other words, DAC are the activities which are undertaken by managers voluntarily in order to notice the earnings manipulation. In measurements, calculation of total accruals can be done either through direct method (net income − operating cash-flows) or indirect method (assess each component: like depreciation reversal and WCR). In this study we employ the direct approach to measure the DAC, because its superiority, results quality and ease of use, the direct approach is preferable over indirect approach (Hribar and Collins 2002). |

| CLC Stages | |||||

|---|---|---|---|---|---|

| Cash-Flow Activities | Introduction | Growth | Maturity | Decline | Shake-Out |

| Operating | − | + | + | − | Any other combination other than prior combinations. |

| Investing | − | − | − | + | |

| Investing | − | − | − | + | |

| Financing | + | + | − | − or + | |

| Variables | Mean | Std.Dev | Min. | Max. |

|---|---|---|---|---|

| |DAC| Hribar and Collins (2002) | 0.0778 | 0.2367 | 0.0000 | 12.8292 |

| |DAC| Kothari et al. (2005) | 0.0776 | 0.2368 | 0.0000 | 12.8404 |

| |DAC| Raman and Shahrur (2008) | 0.0755 | 0.2140 | 0.0000 | 12.8439 |

| |REM_CFO| Roychowdhury (2006) | 0.0779 | 0.2330 | 0.0000 | 11.8620 |

| |REM_PROD| Roychowdhury (2006) | 0.1322 | 0.6943 | 0.0000 | 51.0721 |

| |REM_DISEXP| Roychowdhury (2006) | 0.1262 | 0.3287 | 0.0000 | 18.9045 |

| |REM_COM| Roychowdhury (2006) | 0.3355 | 0.9755 | 0.0065 | 59.7092 |

| Variables | Mean | Std.Dev | Min. | Max. |

|---|---|---|---|---|

| INTRO | 0.1434 | 0.3505 | 0.0000 | 1.0000 |

| GROWTH | 0.3156 | 0.4648 | 0.0000 | 1.0000 |

| MATURITY | 0.3103 | 0.4626 | 0.0000 | 1.0000 |

| DECLINE | 0.0385 | 0.1924 | 0.0000 | 1.0000 |

| SHAKEOUT | 0.1922 | 0.3940 | 0.0000 | 1.0000 |

| SFR | 0.2942 | 18.5344 | −1047.6100 | 946.6590 |

| NPM | 0.0771 | 1.6017 | −44.0997 | 109.7490 |

| Tangibility | 0.1685 | 0.1699 | −0.6875 | 1.0000 |

| YSTOCKRET | 0.1590 | 0.6285 | −0.7168 | 3.2581 |

| No. | Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | INTRO | 1.00 | ||||||||

| 2 | GROWTH | −0.28 | 1.00 | |||||||

| 3 | MATURITY | −0.27 | −0.46 | 1.00 | ||||||

| 4 | SHAKEOUT | −0.20 | −0.33 | −0.33 | 1.00 | |||||

| 5 | DECLINE | −0.08 | −0.14 | −0.13 | −0.10 | 1.00 | ||||

| 6 | SFR | −0.07 | 0.03 | 0.05 | 0.02 | −0.11 | 1.00 | |||

| 7 | NPM | −0.01 | 0.01 | 0.00 | 0.00 | −0.01 | 0.01 | 1.00 | ||

| 8 | Tangibility | −0.12 | 0.04 | 0.15 | −0.07 | −0.09 | −0.01 | −0.02 | 1.00 | |

| 9 | YSTOCKRET | −0.03 | 0.03 | 0.00 | 0.00 | −0.01 | 0.01 | 0.01 | 0.02 | 1.00 |

| Variables | Hribar and Collins (2002) | Kothari et al. (2005) | Raman and Shahrur (2008) | Roychowdhury (2006) | Roychowdhury (2006) | Roychowdhury (2006) | Roychowdhury (2006) |

|---|---|---|---|---|---|---|---|

| |DAC| | |DAC| | |DAC| | |REM_CFO| | |REM_PROD| | |REM_DISEXP| | |REM_COM| | |

| INTRO | 1.08 | 1.08 | 1.08 | 1.08 | 1.08 | 1.08 | 1.08 |

| GROW | 1.37 | 1.37 | 1.37 | 1.37 | 1.37 | 1.37 | 1.37 |

| MATU | 1.50 | 1.50 | 1.50 | 1.49 | 1.50 | 1.49 | 1.50 |

| DECLI | 1.02 | 1.02 | 1.02 | 1.02 | 1.02 | 1.02 | 1.02 |

| SFR | 1.02 | 1.02 | 1.02 | 1.02 | 1.02 | 1.02 | 1.02 |

| NPM | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| Tangibility | 1.90 | 1.90 | 1.91 | 1.90 | 1.90 | 1.90 | 1.90 |

| YSTOCKRET | 1.06 | 1.06 | 1.06 | 1.06 | 1.07 | 1.06 | 1.06 |

| Variables | Hribar and Collins (2002) | Kothari et al. (2005) | Raman and Shahrur (2008) |

|---|---|---|---|

| |DAC| | |DAC| | |DAC| | |

| INTRO | 0.0478 *** | 0.0479 *** | 0.0483 *** |

| (8.78) | (8.80) | (8.67) | |

| GROWTH | −0.0010 | −0.0011 | 0.0011 |

| (−0.23) | (−0.25) | (0.23) | |

| MATURITY | 0.0020 | 0.0020 | 0.0048 |

| (0.44) | (0.43) | (1.02) | |

| DECLINE | 0.0560 *** | 0.0563 *** | 0.0534 *** |

| (6.02) | (6.05) | (5.61) | |

| SFR | −0.0008 *** | −0.0008 *** | −0.0007 *** |

| (−9.89) | (−9.92) | (−8.78) | |

| NPM | 0.0042 *** | 0.0042 *** | 0.0050 *** |

| (3.60) | (3.58) | (4.03) | |

| Tangibility | −0.0981 *** | −0.0989 *** | −0.1060 *** |

| (−5.55) | (−5.59) | (−5.80) | |

| YSTOCKRET | 0.0225 *** | 0.0226 *** | 0.0222 *** |

| (10.33) | (10.35) | (10.00) | |

| Constant | 0.0794 *** | 0.0794 *** | 0.0794 *** |

| (16.81) | (16.79) | (16.33) | |

| R2 | 0.1048 | 0.105 | 0.0988 |

| Prob > F | 0.0000 | 0.0000 | 0.0000 |

| Hausman test P value | 0.0000 | 0.0000 | 0.0000 |

| BP LM test P value | 1.0000 | 1.0000 | 1.0000 |

| Observations | 24,118 | 24,118 | 23,415 |

| Group id’s | 3139 | 3139 | 3137 |

| Variables | Roychowdhury (2006) | Roychowdhury (2006) | Roychowdhury (2006) | Roychowdhury (2006) |

|---|---|---|---|---|

| |REM_CFO| | |REM_PROD| | |REM_DISEXP| | |REM_COM| | |

| INTRO | 0.0615 *** | 0.0338 * | 0.000582 | 0.0925 *** |

| (10.68) | (1.85) | (0.09) | (3.73) | |

| GROWTH | −0.0093 * | 0.0242 | −0.0019 | 0.0111 |

| (−1.84) | (1.52) | (−0.34) | (0.51) | |

| MATURITY | −0.0063 | 0.0090 | −0.0030 | 0.0012 |

| (−1.29) | (0.59) | (−0.54) | (0.06) | |

| DECLINE | 0.0873 *** | 0.0743 ** | 0.0068 | 0.1700 *** |

| (8.92) | (2.45) | (0.62) | (4.12) | |

| SFR | −0.0006 *** | −0.0011 *** | −0.0000 | −0.0017 *** |

| (−6.95) | (−4.48) | (−0.12) | (−4.97) | |

| NPM | 0.0025 ** | 0.0020 | −0.0016 | 0.0027 |

| (2.10) | (0.56) | (−1.23) | (0.55) | |

| Tangibility | −0.0641 *** | −0.1730 *** | −0.0792 *** | −0.3140 *** |

| (−3.43) | (−2.96) | (−3.77) | (−3.94) | |

| YSTOCKRET | 0.0275 *** | 0.0572 *** | 0.0308 *** | 0.118 *** |

| (11.90) | (7.92) | (11.83) | (12.03) | |

| Constant | 0.0768 *** | 0.1330 *** | 0.1340 *** | 0.3410 *** |

| (15.42) | (8.42) | (23.86) | (15.93) | |

| R2 | 0.0841 | 0.0187 | 0.006 | 0.0269 |

| Prob > F | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Hausman p value | 0.0000 | 0.0001 | 0.0000 | 0.0000 |

| BP-LM test p value | 1.0000 | 1.0000 | 1.0000 | 1.0000 |

| Observations | 24,325 | 22,722 | 24,325 | 22,722 |

| Group id’s | 3140 | 3140 | 3140 | 3140 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hussain, A.; Akbar, M.; Kaleem Khan, M.; Akbar, A.; Panait, M.; Catalin Voica, M. When Does Earnings Management Matter? Evidence across the Corporate Life Cycle for Non-Financial Chinese Listed Companies. J. Risk Financial Manag. 2020, 13, 313. https://doi.org/10.3390/jrfm13120313

Hussain A, Akbar M, Kaleem Khan M, Akbar A, Panait M, Catalin Voica M. When Does Earnings Management Matter? Evidence across the Corporate Life Cycle for Non-Financial Chinese Listed Companies. Journal of Risk and Financial Management. 2020; 13(12):313. https://doi.org/10.3390/jrfm13120313

Chicago/Turabian StyleHussain, Ammar, Minhas Akbar, Muhammad Kaleem Khan, Ahsan Akbar, Mirela Panait, and Marian Catalin Voica. 2020. "When Does Earnings Management Matter? Evidence across the Corporate Life Cycle for Non-Financial Chinese Listed Companies" Journal of Risk and Financial Management 13, no. 12: 313. https://doi.org/10.3390/jrfm13120313

APA StyleHussain, A., Akbar, M., Kaleem Khan, M., Akbar, A., Panait, M., & Catalin Voica, M. (2020). When Does Earnings Management Matter? Evidence across the Corporate Life Cycle for Non-Financial Chinese Listed Companies. Journal of Risk and Financial Management, 13(12), 313. https://doi.org/10.3390/jrfm13120313