Study on China’s Renewable Energy Policy Reform and Improved Design of Renewable Portfolio Standard

Abstract

:1. Introduction

1.1. Research Background

1.2. Review of the Literatures

1.2.1. Research on Renewable Portfolio Standard Policy Application

1.2.2. Research on China’s Renewable Portfolio Standard Policy Design

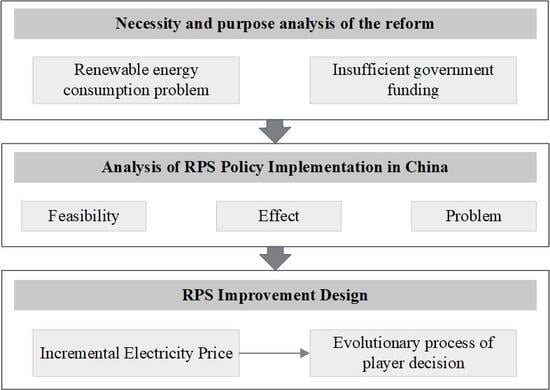

1.3. Structure of This Paper

2. Materials and Methods

2.1. Necessity and Purpose Analysis of Policy Shift

2.1.1. Renewable Energy Consumption Problem

2.1.2. Insufficient Subsidies for Renewable Energy Power Generation

2.2. Revenue Function Model

2.2.1. China’s Renewable Portfolio Standard Policy

2.2.2. Determination of Stakeholders and Revenue Functions

2.2.3. Determination of the Conditions for Successful Implementation of Renewable Portfolio Standard

2.3. Policy Improvement Design

2.4. Evolutionary Game Model

3. Research Process and Discussion

3.1. Discussion on Results Based on Revenue Function Model

3.1.1. Policy Feasibility and Effectiveness Analysis

3.1.2. Possible Problems with Renewable Portfolio Standard Policy Implementation

3.2. Improvement Design of Renewable Portfolio Standard Policy

3.2.1. Minimum Trading Price of Green Certificates

3.2.2. “Incremental Electricity Price” Policy

3.3. Evolution Analysis of Decision-Making Behaviors of Players under the “Incremental Electricity Price” Policy

3.3.1. Assumptions of the Evolutionary Game Model

3.3.2. The Players’ Payoff Functions

3.3.3. Replicator Dynamic Equations

3.3.4. Evolutionary Stable Strategy Analysis

3.3.5. Application Analysis of the “Incremental Electricity Price” Policy

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Nomenclature

| Feed-in-tariff of renewable energy power generation | |

| Benchmark feed-in-tariff of local desulfurized coal unit power generation | |

| Subsidized electricity price for renewable energy power generation under the FiT policy | |

| Average price of green certificates transactions between power generation companies and grid companies | |

| Average subsidized electricity price for renewable energy power generation under the RPS policy | |

| Revenue of power generation company | |

| Average feed-in tariff of fossil energy power | |

| Average feed-in tariff of renewable energy power and | |

| Average unit power generation cost of fossil energy | |

| Average unit management cost of renewable energy | |

| Average unit power generation cost of renewable energy | |

| Average unit management cost of renewable energy | |

| Revenue of the power grid companies | |

| Average selling price of the power grid enterprises to the consumers | |

| Average operation and maintenance cost of unit renewable energy power transmission | |

| Average operation and maintenance cost of unit fossil energy power transmission | |

| A | Renewable energy power generation quota target undertaken by the power grid enterprises () |

| Average unit penalty price | |

| Average environmental income obtained by the governments for unit renewable energy power generation | |

| Average price of green certificate transactions between grid companies and users |

References

- Tvaronavičienė, M.; Prakapienė, D.; Garškaitė-Milvydienė, K.; Prakapas, R.; Nawrot, Ł. Energy efficiency in the long run in the selected European countries. Econ. Sociol. 2018, 11, 245–254. [Google Scholar] [CrossRef] [PubMed]

- Kharlamova, G.; Nate, S.; Chernyak, O. Renewable energy and security for Ukraine: Challenge or smart way. J. Int. Stud. 2016, 9, 88–115. [Google Scholar] [CrossRef] [PubMed]

- Kasperowicz, R.; Pinczyński, M.; Khabdullin, A. Modeling the power of renewable energy sources in the context of classical electricity system transformation. J. Int. Stud. 2017, 10, 264–272. [Google Scholar] [CrossRef]

- Dong, F.; Shi, L. Design and Simulation of Renewable Portfolio Standard and Tradable Green Certification Mechanism. Autom. Electr. Power Syst 2019, 1–9. [Google Scholar] [CrossRef]

- Fang, D.B.; Zhao, C.Y.; Yu, Q. Government regulation of renewable energy generation and transmission in China’s electricity market. Renew. Sustain. Energy Rev. 2018, 93, 775–793. [Google Scholar] [CrossRef]

- Yu, L.; Zhu, S.; Lianyong, F.; Hao, Y. Comparison and Enlightenment of FIT and RPS for Renewable Energy. Sino-Glob. Energy 2018, 23, 13–20. [Google Scholar]

- Upton, G.B.; Snyder, B.F. Renewable energy potential and adoption of renewable portfolio standards. Util. Policy 2015, 36, 67–70. [Google Scholar] [CrossRef]

- Zhao, W.H.; Bao, X.J.T.; Yuan, G.H.; Wang, X.M.; Bao, H.B. The Equilibrium Model for the Coexistence of Renewable Portfolio Standards and Emissions Trading: The Supply Chain Analysis. Energies 2019, 12, 439. [Google Scholar] [CrossRef]

- Li, W.; Lu, C.; Zhang, Y.W. Prospective exploration of future renewable portfolio standard schemes in China via a multi-sector CGE model. Energy Policy 2019, 128, 45–56. [Google Scholar] [CrossRef]

- Bao, X.J.T.; Zhao, W.H.; Wang, X.M.; Tan, Z.F. Impact of policy mix concerning renewable portfolio standards and emissions trading on electricity market. Renew. Energy 2019, 135, 761–774. [Google Scholar] [CrossRef]

- Alizada, K. Rethinking the diffusion of renewable energy policies: A global assessment of feed-in tariffs and renewable portfolio standards. Energy Res. Soc. Sci. 2018, 44, 346–361. [Google Scholar] [CrossRef]

- Anguelov, N.; Dooley, W.F. Renewable Portfolio Standards and Policy Stringency: An Assessment of Implementation and Outcomes. Rev. Policy Res. 2019, 36, 195–216. [Google Scholar] [CrossRef]

- Carley, S.; Davies, L.L.; Spence, D.B.; Zirogiannis, N. Empirical evaluation of the stringency and design of renewable portfolio standards. Nat. Energy 2018, 3, 754–763. [Google Scholar] [CrossRef]

- Park, H.; Kim, C. Do Shifts in Renewable Energy Operation Policy Affect Efficiency: Korea’s Shift from FIT to RPS and Its Results. Sustainability 2018, 10, 1723. [Google Scholar] [CrossRef]

- Kwon, T.H. Policy synergy or conflict for renewable energy support: Case of RPS and auction in South Korea. Energy Policy 2018, 123, 443–449. [Google Scholar] [CrossRef]

- Dong, Y.L.; Shimada, K. Evolution from the renewable portfolio standards to feed-in tariff for the deployment of renewable energy in Japan. Renew. Energy 2017, 107, 590–596. [Google Scholar] [CrossRef]

- Yin, H.T.; Powers, N. Do state renewable portfolio standards promote in-state renewable generation? Energy Policy 2010, 38, 1140–1149. [Google Scholar] [CrossRef]

- Zhao, E.; Liu, P. Policy Effects of Feed-in Tariff and Tradable Green Certificate—Based on the Development of Biomass Power Industry in China. Ind. Technol. Econ. 2013, 9, 125–137. [Google Scholar] [CrossRef]

- Wang, T.; Gong, Y.; Jiang, C.W. A review on promoting share of renewable energy by green-trading mechanisms in power system. Renew. Sustain. Energy Rev. 2014, 40, 923–929. [Google Scholar] [CrossRef]

- Qian, Z. Research on Optimization Model of Generation Expansion Planning in Low-Carbon Economy with the Complementary Mode of RFS and FIT; North China Electric Power University: Beijing, China, 2017. [Google Scholar]

- Choi, G.; Huh, S.Y.; Heo, E.; Lee, C.Y. Prices versus quantities: Comparing economic efficiency of feed-in tariff and renewable portfolio standard in promoting renewable electricity generation. Energy Policy 2018, 113, 239–248. [Google Scholar] [CrossRef]

- Sun, P.; Nie, P.Y. A comparative study of feed-in tariff and renewable portfolio standard policy in renewable energy industry. Renew. Energy 2015, 74, 255–262. [Google Scholar] [CrossRef]

- Dongming, R. China’s Renewable Portfolio Standards and Implementing Countermeasures. Autom. Electr. Power Syst. 2011, 35, 25–28. [Google Scholar]

- Zhao, X.G.; Liang, J.; Ren, L.Z.; Zhang, Y.Z.; Xu, J. Top-level Institutional Design for the Energy Low-carbon Transition: Renewable Portfolio Standards. Power Syst. Technol. 2018, 42, 1164–1169. [Google Scholar]

- Feng, Y.; Liu, Q.; Liu, Y.; Wang, S. Touching Fault Analysis and Clearing Action Strategy for AC/DC Crossed Transmission Lines. Autom. Electr. Power Syst. 2017, 41, 137–141. [Google Scholar]

- Zhao, W.; Gao, J.; Yu, J.; Song, Y. Generation rights trade model with carbon trading and green certificate trading mechanisms. Renew. Energy Resour. 2016, 34, 1129–1137. [Google Scholar]

- Jiacai, L.; Gong, C. International Experience and China Renewable Portfolio Standard (RPS) Design. Pac. J. 2008, 10, 44–51. [Google Scholar] [CrossRef]

- Zhao, X.G.; Ren, L.Z.; Zhang, Y.Z.; Wan, G. Evolutionary game analysis on the behavior strategies of power producers in renewable portfolio standard. Energy 2018, 162, 505–516. [Google Scholar] [CrossRef]

- Zuo, Y.; Zhao, X.G.; Zhang, Y.Z.; Zhou, Y. From feed-in tariff to renewable portfolio standards: An evolutionary game theory perspective. J. Clean. Prod. 2019, 213, 1274–1289. [Google Scholar] [CrossRef]

- Zhang, Q.; Wang, G.; Li, Y.; Li, H.L.; McLellan, B.; Chen, S.Y. Substitution effect of renewable portfolio standards and renewable energy certificate trading for feed-in tariff. Appl. Energy 2018, 227, 426–435. [Google Scholar] [CrossRef]

- Wang, B.; Wei, Y.M.; Yuan, X.C. Possible design with equity and responsibility in China’s renewable portfolio standards. Appl. Energy 2018, 232, 685–694. [Google Scholar] [CrossRef]

- Ye, W. Analysis and Suggestion on Electricity Pricing Mechanism of Renewable Energy in China. Water Power 2018, 44, 81–84. [Google Scholar]

- Liu, S.Y.; Bie, Z.H.; Lin, J.; Wang, X.F. Curtailment of renewable energy in Northwest China and market-based solutions. Energy Policy 2018, 123, 494–502. [Google Scholar] [CrossRef]

- Li, W.; Liu, L.G.; Zhang, S.; Zhang, H.Z. Will the tradable green certifications and renewable portfolio standard policy work well in China: A recursive CGE analysis. J. Renew. Sustain. Energy 2018, 10, 055904. [Google Scholar] [CrossRef]

- Wind. Available online: http://www.wind.com.cn/ (accessed on 3 May 2018).

- China’s Current Renewable Energy Subsidy Policy and Benchmarking Feed-in Tariff. Available online: http://www.china-nengyuan.com/news/120495.html (accessed on 20 May 2018).

- Huang, S.; Yu, K.; Jia, J. Evolutionary Game Analysis of IPO Pricing in Book-Building. Chin. J. Manag. Sci. 2018, 26, 78–89. [Google Scholar] [CrossRef]

- Wang, L.; Zheng, J. Research on low-carbon diffusion considering the game among enterprises in the complex network context. J. Clean. Prod. 2019, 210, 1–11. [Google Scholar] [CrossRef]

- Cui, H.; Zhao, T.; Wu, R. CO2 emissions from China’s power industry: Policy implications from both macro and micro perspectives. J. Clean. Prod. 2018, 200, 746–755. [Google Scholar] [CrossRef]

- Ye, Z.; Wu, Y.; Li, C.; You, P. The Design and Implementation of Electricity Universal Service Tariffs Policy in China. Price Theory Pract. 2017, 9, 20–25. [Google Scholar]

- Liu, Z.; Zhu, P.; Li, X. Optimization and Effect Evaluation of Increasing Block Pricing—Based on the Perspective of Personal Carbon Trading. Res. Econ. Manag. 2018, 39, 108–122. [Google Scholar] [CrossRef]

- Liu, S.; Ye, Z. China’s Sales Side Time-of-Use Electricity Price Policy Implementation Experience and Enlightenment. Price Theory Pract. 2014, 6, 40–41, 64. [Google Scholar]

- Hofbauer, J.; Schuster, P.; Sigmund, K. A note on evolutionary stable strategies and game dynamics. J. Biol. 1979, 81, 609–612. [Google Scholar] [CrossRef] [Green Version]

| Province | Installed Capacity (GW) | Generation Ratio (%) | Ratio of Installed Capacity (%) | Abandoned Wind Rate (in the First Quarter of 2018) (%) |

|---|---|---|---|---|

| Hebei | 12.16 | 9.3 | 18.2 | 2.6 |

| Inner Mongolia | 27.37 | 11.6 | 23.0 | 21.3 |

| Heilongjiang | 5.70 | 11.2 | 19.3 | 8.5 |

| Gansu | 12.82 | 16.0 | 26.3 | 19.5 |

| Ningxia | 9.76 | 11.2 | 22.8 | 2.5 |

| Xinjiang | 18.06 | 10.1 | 21.3 | 21.6 |

| Power Generation Categories | Resource Area Categories | 2014 (RMB/kWh) | 2015 (RMB/kWh) | 2016 (RMB/kWh) | 2017 (RMB/kWh) | 2018 (RMB/kWh) |

|---|---|---|---|---|---|---|

| Wind | Category I | 0.51 | 0.49 | 0.47 | 0.47 | 0.44 |

| Category II | 0.54 | 0.52 | 0.50 | 0.50 | 0.47 | |

| Category III | 0.58 | 0.56 | 0.54 | 0.54 | 0.51 | |

| Category IV | 0.61 | 0.61 | 0.60 | 0.60 | 0.58 | |

| Photoelectric | Category I | 0.90 | 0.90 | 0.80 | 0.65 | 0.55 |

| Category II | 0.95 | 0.95 | 0.88 | 0.75 | 0.65 | |

| Category III | 1.00 | 1.00 | 0.98 | 0.85 | 0.75 |

| Payoff of Players | Users | ||

|---|---|---|---|

| Participating in (y) | Not Participating in (1 − y) | ||

| Power grid companies | Adopting (x) | f1, π1 | f2, π2 |

| Not adopting (1 − x) | f3, π3 | f4, π4 | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dong, F.; Shi, L.; Ding, X.; Li, Y.; Shi, Y. Study on China’s Renewable Energy Policy Reform and Improved Design of Renewable Portfolio Standard. Energies 2019, 12, 2147. https://doi.org/10.3390/en12112147

Dong F, Shi L, Ding X, Li Y, Shi Y. Study on China’s Renewable Energy Policy Reform and Improved Design of Renewable Portfolio Standard. Energies. 2019; 12(11):2147. https://doi.org/10.3390/en12112147

Chicago/Turabian StyleDong, Fugui, Lei Shi, Xiaohui Ding, Yuan Li, and Yongpeng Shi. 2019. "Study on China’s Renewable Energy Policy Reform and Improved Design of Renewable Portfolio Standard" Energies 12, no. 11: 2147. https://doi.org/10.3390/en12112147

APA StyleDong, F., Shi, L., Ding, X., Li, Y., & Shi, Y. (2019). Study on China’s Renewable Energy Policy Reform and Improved Design of Renewable Portfolio Standard. Energies, 12(11), 2147. https://doi.org/10.3390/en12112147