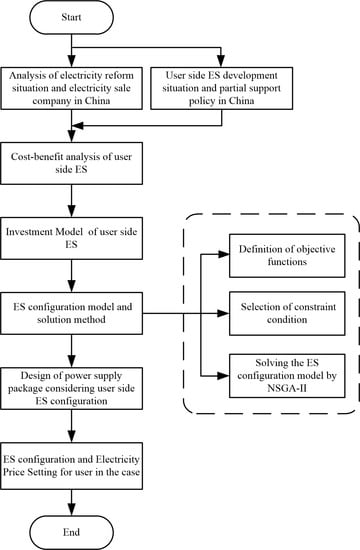

Design of Power Supply Package for Electricity Sales Companies Considering User Side Energy Storage Configuration

Abstract

:1. Introduction

- (1)

- Incorporating ES configuration, this paper proposes a novel business model as a value-added service into retail electricity contracts. All that mattered is that power customers and electricity sales companies can be benefit from the innovative business model. For customers, the business model helps them to improve power supply reliability while reducing electricity bills. For electricity sales companies, the business model helps them to cultivate customer loyalty to enhance their competitiveness in the retail market. In addition, the model reduces the power supply costs of electricity sales companies by load shifting.

- (2)

- This paper creates a charging model of ES surcharge. The electricity sales companies add the ES cost to the electricity bill by additional electricity charges. Not only does it reduce the pressure of the user’s initial investment, but it can also promote signing long-term power purchase contracts with each other.

2. Development of User Side ES in China

3. ES System Cost–Benefit Analysis

3.1. ES Investment Cost Analysis

3.2. Benefits of ES

3.3. Analysis of Investment Mode of ES

4. ES Configuration Model and Solution Method

4.1. Objective Function

- (1)

- Maximum annual income

- (2)

- Minimum user load volatility

4.2. Constraint Condition

4.2.1. Energy Constraint

4.2.2. Power Constraint

4.2.3. Peak Load Shifting Constraint

4.2.4. Preventing Peak-to-Valley Inversion Constraints

4.2.5. Battery Performance Constraints

4.3. Model Solving

- (1)

- They can only find the optimal local solution of the optimization problem;

- (2)

- The result of the solution is strongly dependent on the initial value.

- (1)

- Fast non-dominated sorting algorithm. On the one hand, it reduces the complexity of the calculation. On the other hand, it combines the parent population and the offspring population. It can select excellent individuals from the combined population to improve the reliability of selection.

- (2)

- Introducing an elite strategy. It can reduce the rate of abandonment of elite individuals in the evolutionary process, thereby improving the accuracy of the optimization results.

- (3)

- Taken congestion and congestion comparison operators. There is no need to specify shared parameters manually. Not only can the diversity of the population be ensured, but individuals can also diffuse from the quasi-Pareto domain to the Pareto domain.

5. Electricity Storage Price Setting

6. Case Analysis

6.1. Brief Introduction to the Case

6.2. ES Capacity Configuration

6.2.1. Spare Capacity QRE and Power Configuration

6.2.2. Adjustable Capacity QAD Configuration

6.3. Improved Power Supply Reliability

6.4. Electricity Sales Package of the Electricity Sales Company

7. Conclusions

- (1)

- A novel business model incorporating ES configuration as a value-added service into retail electricity contracts is proposed in this paper. In the case study, it was confirmed that the user side ES plays a significant role in improving power supply reliability and reducing electricity expenses.

- (2)

- The NSGA-II is used to optimize the configuration of the ES capacity on the user side in this paper. Combined with the case study, the optimized ES can reduce the user’s electricity bill and reduce the user load fluctuation.

- (3)

- This study models the charging system that allocates the ES configuration cost to the user’s electricity bill. In this model, it can not only reduce the pressure on users to invest in ES, but also promote the signing of long-term power supply contracts between users and electricity sales companies. The latter can enhance the competitiveness of electricity sales companies as well.

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| ES | Energy storage |

| ESCN | The statistics of China ES network |

| HESS | hybrid energy storage system |

| EB | energy-based |

| NSGA | The non-dominated sorting genetic algorithm |

| NSGA-II | The non-dominated sorting genetic algorithm with elite strategy |

| RS-1 | The reliability of service in total |

| DOD | The depth of discharge |

Notations

| CB | The cost of the ES battery |

| CT | The cost of the ES converter |

| CM | The cost of the system’s operation and maintenance |

| r | The discount rate |

| QRE | The reserve capacity |

| QAD | The adjustable capacity |

References

- Central Committee of the Communist Party of China. Some Opinions on Further Deepening the Reform of the Electric Power System [2015] No. 9 [A]; Beijing, The State Department: Beijing, China, 2015.

- Cheng, C.; Luo, B.; Miao, S.; Wu, X. Mid-Term Electricity Market Clearing Price Forecasting with Sparse Data: A Case in Newly-Reformed Yunnan Electricity Market. Energies 2016, 9, 804. [Google Scholar] [CrossRef]

- Xu, P.; Tao, X. Cooperative game of electricity retailers in China’s spot electricity market. Energy 2017, 145, 152–170. [Google Scholar]

- Xiao, X.Y.; Ma, Y.Q.; Mo, W.X.; Chen, W.; Xu, Z. Premium Power Based Value-added Service Model for Power Supply Company Under the Opening Electricity Retail Side. J. Electr. Power Sci. Technol. 2016, 31, 4–10. [Google Scholar]

- Chen, H.U.; Songhuai, D.U.; Juan, S.U.; Guangyi, T.O.N.G.; Mengzhen, W.A.N.G. Preliminary research of trading approach and management modes of Chinese electricity retail companies under new electricity market reform. Power Syst. Technol. 2016, 40, 3293–3299. [Google Scholar]

- Weng, G.M.; Li, C.Y.V.; Chan, K.Y. Three-electrolyte electrochemical energy storage systems using both anion-and cation-exchange membranes as separators. Energy 2019, 167, 1011–1018. [Google Scholar] [CrossRef]

- Yao, Y.; Zhang, P.; Chen, S. Aggregating Large-Scale Generalized Energy Storages to Participate in Energy Market and Regulation Market. Energies 2019, 12, 1024. [Google Scholar] [CrossRef]

- Nawar, S.; Huskinson, B.; Aziz, M. Benzoquinone-hydroquinone couple for flow battery. MRS Proc. 2013, 1491, mrsf12-1491-c08-09. [Google Scholar] [CrossRef]

- Yuan, L.X.; Wang, Z.H.; Zhang, W.X.; Hu, X.L.; Chen, J.T.; Huang, Y.H.; Goodenough, J.B. Development and challenges of LiFePO4 cathode material for lithium-ion batteries. Energy Environ. Sci. 2011, 4, 269–284. [Google Scholar] [CrossRef]

- Kollimalla, S.K.; Mishra, M.K.; Narasamma, N.L. Design and Analysis of Novel Control Strategy for Battery and Supercapacitor Storage System. IEEE Trans. Sustain. Energy 2014, 5, 1137–1144. [Google Scholar] [CrossRef]

- Hou, R.; Nguyen, T.T.; Kim, H.M.; Song, H.; Qu, Y. An Energy-Based Control Strategy for Battery, Energy Storage Systems: A Case Study on Microgrid Applications. Energies 2017, 10, 215. [Google Scholar] [CrossRef]

- Xu, Y.; Lang, T. Optimal Operation and Economic Value of Energy Storage at Consumer Locations. IEEE Trans. Autom. Control 2017, 62, 792–807. [Google Scholar] [CrossRef]

- Yang, B.; Yi, J.; Wan, Y. Research on battery selection of large-scale energy storage power stations in Beijing. Energy Conserv. 2018, 37, 20–24. [Google Scholar]

- Büngeler, J.; Cattaneo, E.; Riegel, B.; Sauer, D.U. Advantages in energy efficiency of flooded lead-acid batteries when using partial state of charge operation. J. Power Sources 2018, 375, 53–58. [Google Scholar] [CrossRef]

- Sun, L.; Zhen, Y.; Zhou, L.; Li, X.; Zhou, P. Experimental study on over discharge induced internal short circuit of NCM batteries. Chin. J. Power Sources 2018, 42, 1454–1457. [Google Scholar]

- Mei, C.; Zhao, W. Application safety analysis and system design of lithium iron phosphate battery in substation. Electr. Eng. 2019, 20, 70–73. [Google Scholar]

- Yang, J.; Huang, Y.; Fei, F.; Guo, M.; Pang, A. Research of economic benefits of energy storage technique under different business operational modes. Electr. Eng. 2018, 19, 80–84. [Google Scholar]

- Song, D.; Ma, X. Discussion on Commercial Application of Energy Storage Technology. Shanghai Energy Conserv. 2019, 2019, 116–119. [Google Scholar]

- Li, R.; Zhang, X.; Xu, Y.; Sun, W.; Zhou, X.; Guo, C.; Chen, H. Research on Optimal Configuration of hybrid Energy Storage capacity for wind-solar generation system. Energy Storage Sci. Technol. 2019, 8, 512–522. [Google Scholar]

- Ding, Y.; Xu, Q.; Lv, Y.; Li, L. Optimal Configuration of User-side Energy Storage Considering Power Demand Management. Power Syst. Technol. 2019, 3, 1179–1186. [Google Scholar]

- Li, Z.; Zhang, J.W.; Yu, L.G.; Zhang, J.W. Electrospun porous nanofibers for electrochemical energy storage. J. Mater. Sci. 2017, 52, 6173–6195. [Google Scholar] [CrossRef]

- Zheng, J. Energy Storage Industry Strategy Research. Machinery 2018, 56, 1–8. [Google Scholar]

- Zhang, J. Policy Helps Energy Storage to Achieve Commercial Development. Sino Glob. Energy 2018, 23, 80–85. [Google Scholar]

- Guidance on Promoting Energy Storage Technology and Industrial Development. Available online: http://www.ndrc.gov.cn/gzdt/201710/t20171011_863348.html (accessed on 22 September 2017).

- Notice on Piloting Market-Based Trading of Distributed Power Generation. Available online: http://zfxxgk.nea.gov.cn/auto87/201711/t20171113_3055.htm (accessed on 31 October 2017).

- Opinions on Innovation and Improvement of the Price Mechanism for Promoting Green Development. Available online: http://www.gov.cn/xinwen/2018-07/02/content_5302737.htm (accessed on 21 June 2018).

- Liu, Z.; Zhang, Z.; Yang, B.; Wang, Z.; Qi, F. Evaluation of Great Blackout Social Comprehensive Loss of Power Grid. Power Syst. Technol. 2017, 41, 2928–2940. [Google Scholar]

- Kapila, S.; Oni, A.O.; Kumar, A. Development of techno-economic models for large-scale energy storage systems. Energy 2017, 140, 656–672. [Google Scholar] [CrossRef]

- Gao, C. User Side Energy Storage System Input and Output Analysis. Appl. Energy Technol. 2017, 1, 28–30. [Google Scholar] [CrossRef]

- Ma, X.; Zhou, C.; Liu, Y.; Wang, L.; Guo, X.; Yu, Z. Business Mode and Economic Analysis of User-Side Battery Energy Storage System in Industrial Parks. South. Power Syst. Technol. 2018, 12, 44–51. [Google Scholar]

- Shen, H. Research on Investment Decision-making of Energy-saving Benefit-sharing Contract Energy Management Project. Value Eng. 2018, 37, 60–61. [Google Scholar]

- Deb, K.; Pratap, A.; Agarwal, S.; Meyarivan, T.A.M.T. A fast and elitist multiobjective genetic algorithm: NSGA-II. IEEE Trans. Evol. Comput. 2002, 6, 182–197. [Google Scholar] [CrossRef] [Green Version]

- Tomoiagă, B.; Chindriş, M.; Sumper, A.; Sudria-Andreu, A.; Villafafila-Robles, R. Pareto Optimal Reconfiguration of Power Distribution Systems Using a Genetic Algorithm Based on NSGA-II. Energies 2013, 6, 1439–1455. [Google Scholar] [CrossRef] [Green Version]

- Dongguan Electricity Price List. Available online: http://drc.gd.gov.cn/spjg/content/post_846130.html (accessed on 26 July 2010).

- Marom, R.; Amalraj, S.F.; Leifer, N.; Jacob, D.; Aurbach, D. A review of advanced and practical lithium battery materials. J. Mater. Chem. 2011, 21, 9938–9954. [Google Scholar] [CrossRef]

| Policy Name | Content Focus |

|---|---|

| Guidance on promoting energy storage technology and industrial development [24]. | (1) The construction of distributed ES systems on the user side are encouraged, ES configuration by electricity sales companies with distribution network management rights and qualified residential users is supported in China. (2) ES is allowed to participate in electricity trading through the market-oriented way in China. |

| Notice on piloting market-based trading of distributed power generation [25]. | Distributed power generation projects to install ES facilities to improve power supply flexibility and stability are encouraged in China. |

| Opinions on innovation and improvement of the price mechanism for promoting green development [26]. | Market participants to sign trading contracts that include peak, valley and flat time prices and electricity are encouraged in China. |

| Electricity Price Category | Flat Section Price | Valley Price | Peak Price | |

|---|---|---|---|---|

| Basic electricity price | Transformer capacity (Yuan/kVA.month) | 23.00 | ||

| Maximum demand (Yuan/kW.month) | 32.00 | |||

| Electricity price (Cent/kWh) | 60.84 | 30.42 | 100.39 | |

| Time Division | Time Range |

|---|---|

| Peak | 09:00–12:00; 19:00–22:00 |

| Valley | 00:00–08:00 |

| Flat section | 08:00–09:00; 12:00–19:00; 22:00–24:00 |

| Contract Period (Years) | 1 | 2 | 3 | 4 | 5 |

| Electricity Price (Yuan/kWh) | 1.37 | 1.07 | 0.96 | 0.91 | 0.88 |

| Contract Period (Years) | 6 | 7 | 8 | 9 | 10 |

| Electricity Price (Yuan/kWh) | 0.86 | 0.84 | 0.83 | 0.82 | 0.81 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mu, Q.; Gao, Y.; Yang, Y.; Liang, H. Design of Power Supply Package for Electricity Sales Companies Considering User Side Energy Storage Configuration. Energies 2019, 12, 3219. https://doi.org/10.3390/en12173219

Mu Q, Gao Y, Yang Y, Liang H. Design of Power Supply Package for Electricity Sales Companies Considering User Side Energy Storage Configuration. Energies. 2019; 12(17):3219. https://doi.org/10.3390/en12173219

Chicago/Turabian StyleMu, Qitian, Yajing Gao, Yongchun Yang, and Haifeng Liang. 2019. "Design of Power Supply Package for Electricity Sales Companies Considering User Side Energy Storage Configuration" Energies 12, no. 17: 3219. https://doi.org/10.3390/en12173219

APA StyleMu, Q., Gao, Y., Yang, Y., & Liang, H. (2019). Design of Power Supply Package for Electricity Sales Companies Considering User Side Energy Storage Configuration. Energies, 12(17), 3219. https://doi.org/10.3390/en12173219