Exploring the Causal Nexus between Energy Consumption, Environmental Pollution and Economic Growth: Empirical Evidence from Central and Eastern Europe

Abstract

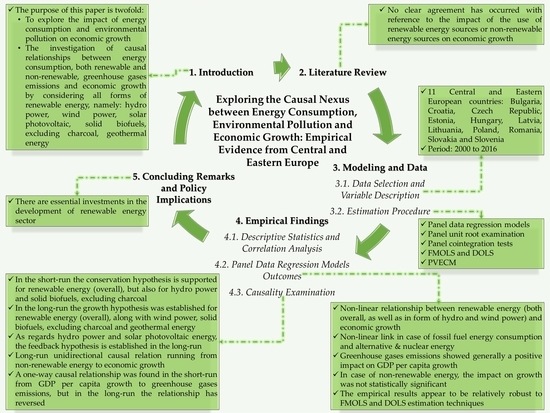

:1. Introduction

2. Literature Review

3. Modeling and Data

3.1. Data Selection and Variable Description

3.2. Estimation Procedure

4. Empirical Findings

4.1. Descriptive Statistics and Correlation Analysis

4.2. Panel Data Regression Models Outcomes

4.3. Causality Examination

- Model 1: Short-run unidirectional causal relation running from economic growth to gross inland consumption of renewable energies and greenhouse gases emissions. In addition, there occurs a long-run causality running from gross inland consumption of renewable energies, gross inland consumption - waste, non-renewable, greenhouse gases emissions to economic growth. The short-run and long-run findings are in line with Hu, Guo, Wang, Zhang and Wang [39].

- Model 2: Short-run one-way causal association running from economic growth to gross inland energy consumption—hydro power and greenhouse gases emissions. Besides, there ensues a bi-directional long-run causal relation between gross inland energy consumption—hydro power and economic growth

- Model 3: Short-run unidirectional causal link running from economic growth to greenhouse gases emissions. As well, there occurs a one-way long-run causality running from gross inland energy consumption—wind power, gross inland consumption—waste, non-renewable, greenhouse gases emissions to economic growth.

- Model 4: Short-run unidirectional causal connection running from economic growth to greenhouse gases emissions. Furthermore, there appears a two-way causal connection between gross inland energy consumption - solar photovoltaic and economic growth.

- Model 5: Short-run unidirectional causal associations running from economic growth to gross inland energy consumption - solid biofuels, excluding charcoal and greenhouse gases emissions. Likewise, one-way causal relation running from gross inland consumption - waste, non-renewable to economic growth befalls. As concerns long-run causalities, there appears a causal connection running from gross inland energy consumption - solid biofuels, excluding charcoal, gross inland consumption - waste, non-renewable and greenhouse gases emissions to economic growth.

- Model 6: Short-run one-way causal relation running from economic growth to greenhouse gases emissions. Also, unidirectional causal links running from gross inland energy consumption - geothermal energy and gross inland consumption - waste, non-renewable to economic growth. With reference to long-run causalities, there ensues a causal link running from gross inland energy consumption - geothermal energy, gross inland consumption - waste, non-renewable and greenhouse gases emissions to economic growth.

5. Concluding Remarks and Policy Implications

Author Contributions

Funding

Conflicts of Interest

References

- Ellabban, O.; Abu-Rub, H.; Blaabjerg, F. Renewable energy resources: Current status, future prospects and their enabling technology. Renew. Sust. Energy Rev. 2014, 39, 748–764. [Google Scholar] [CrossRef]

- Adams, S.; Klobodu, E.K.; Apio, A. Renewable and non-renewable energy, regime type and economic growth. Renew. Energy 2018, 125, 755–767. [Google Scholar] [CrossRef]

- Gozgor, G.; Lau, C.K.M.; Lu, Z. Energy consumption and economic growth: New evidence from the OECD countries. Energy 2018, 153, 27–34. [Google Scholar] [CrossRef] [Green Version]

- Apergis, N.; Payne, J.E. Renewable energy consumption and economic growth: Evidence from a panel of OECD countries. Energy Policy 2010, 38, 656–660. [Google Scholar] [CrossRef]

- Al-mulali, U.; Fereidouni, H.G.; Lee, J.Y.M. Electricity consumption from renewable and non-renewable sources and economic growth: Evidence from Latin American countries. Renew. Sust. Energy Rev. 2014, 30, 290–298. [Google Scholar] [CrossRef]

- Ito, K. CO2 emissions, renewable and non-renewable energy consumption, and economic growth: Evidence from panel data for developed countries. Econ. Bull. 2016, 36, 553. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Paramati, S.R.; Ozturk, I.; Bhattacharya, S. The effect of renewable energy consumption on economic growth: Evidence from top 38 countries. Appl. Energy 2016, 162, 733–741. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R. The impact of renewable energy consumption to economic growth: A panel data application. Energy Econ. 2016, 53, 58–63. [Google Scholar] [CrossRef]

- Rafindadi, A.A.; Ozturk, I. Impacts of renewable energy consumption on the German economic growth: Evidence from combined cointegration test. Renew. Sust. Energy Rev. 2017, 75, 1130–1141. [Google Scholar] [CrossRef]

- Destek, M.A.; Aslan, A. Renewable and non-renewable energy consumption and economic growth in emerging economies: Evidence from bootstrap panel causality. Renew. Energy 2017, 111, 757–763. [Google Scholar] [CrossRef]

- Le, T.H.; Nguyen, C.P. Is energy security a driver for economic growth? Evidence from a global sample. Energy Policy 2019, 129, 436–451. [Google Scholar] [CrossRef]

- Razmi, S.F.; Bajgiran, B.R.; Behname, M.; Salari, T.E.; Razmi, S.M.J. The relationship of renewable energy consumption to stock market development and economic growth in Iran. Renew. Energy 2020, 145, 2019–2024. [Google Scholar] [CrossRef]

- Zou, C.; Zhao, Q.; Zhang, G.; Xiong, B. Energy revolution: From a fossil energy era to a new energy era. Nat. Gas. Ind. B 2016, 3, 1–11. [Google Scholar] [CrossRef] [Green Version]

- Alper, A.; Oguz, O. The role of renewable energy consumption in economic growth: Evidence from asymmetric causality. Renew. Sust. Energ Rev. 2016, 60, 953–959. [Google Scholar] [CrossRef]

- European Parliament. Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the Promotion of the Use of Energy from Renewable Sources and Amending and Subsequently Repealing Directives 2001/77/EC and 2003/30/EC; European Parliament: Brussels, Belgium, 2009. [Google Scholar]

- European Commission. Renewable Energy Progress Report; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- Central Europe Energy Partners. Energy Security Quest in Central and Eastern Europe. Achievements and Challenges; Central Europe Energy Partners: Brussels, Belgium, 2016. [Google Scholar]

- Marinas, M.C.; Dinu, M.; Socol, A.G.; Socol, C. Renewable energy consumption and economic growth. Causality relationship in Central and Eastern European countries. PLoS ONE 2018, 13. [Google Scholar] [CrossRef] [PubMed]

- Menegaki, A.N. Growth and renewable energy in Europe: A random effect model with evidence for neutrality hypothesis. Energy Econ. 2011, 33, 257–263. [Google Scholar] [CrossRef]

- Akadiri, S.S.; Alola, A.A.; Akadiri, A.C.; Alola, U.V. Renewable energy consumption in EU-28 countries: Policy toward pollution mitigation and economic sustainability. Energy Policy 2019, 132, 803–810. [Google Scholar] [CrossRef]

- Charfeddine, L.; Kahia, M. Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: A panel vector autoregressive (PVAR) analysis. Renew. Energy 2019, 139, 198–213. [Google Scholar] [CrossRef]

- Maji, I.K.; Sulaiman, C. Renewable energy consumption and economic growth nexus: A fresh evidence from West Africa. Energy Rep. 2019, 5, 384–392. [Google Scholar] [CrossRef]

- Aydin, M. The effect of biomass energy consumption on economic growth in BRICS countries: A country-specific panel data analysis. Renew. Energy 2019, 138, 620–627. [Google Scholar] [CrossRef]

- Bildirici, M.; Ozaksoy, F. An analysis of biomass consumption and economic growth in transition countries. Econ. Res. Ekon. Istraz. 2018, 31, 386–405. [Google Scholar] [CrossRef]

- Payne, J.E. On Biomass Energy Consumption and Real Output in the US. Energy Source Part B 2011, 6, 47–52. [Google Scholar] [CrossRef]

- Bildirici, M.E. Relationship between biomass energy and economic growth in transition countries: Panel ARDL approach. GCB Bioenergy 2014, 6, 717–726. [Google Scholar] [CrossRef]

- Kang, S.H.; Islam, F.; Tiwari, A.K. The dynamic relationships among CO2 emissions, renewable and non-renewable energy sources, and economic growth in India: Evidence from time-varying Bayesian VAR model. Struct. Chang. Econ. D 2019, 50, 90–101. [Google Scholar] [CrossRef]

- Stern, D.I. The role of energy in economic growth. Ann. Ny. Acad. Sci. 2011, 1219, 26–51. [Google Scholar] [CrossRef] [PubMed]

- Luqman, M.; Ahmad, N.; Bakhsh, K. Nuclear energy, renewable energy and economic growth in Pakistan: Evidence from non-linear autoregressive distributed lag model. Renew. Energy 2019, 139, 1299–1309. [Google Scholar] [CrossRef]

- Eren, B.M.; Taspinar, N.; Gokmenoglu, K.K. The impact of financial development and economic growth on renewable energy consumption: Empirical analysis of India. Sci. Total Environ. 2019, 663, 189–197. [Google Scholar] [CrossRef] [PubMed]

- Bulut, U.; Muratoglu, G. Renewable energy in Turkey: Great potential, low but increasing utilization, and an empirical analysis on renewable energy-growth nexus. Energy Policy 2018, 123, 240–250. [Google Scholar] [CrossRef]

- Aydin, M. Renewable and non-renewable electricity consumption-economic growth nexus: Evidence from OECD countries. Renew. Energy 2019, 136, 599–606. [Google Scholar] [CrossRef]

- Zafar, M.W.; Shahbaz, M.; Hou, F.; Sinha, A. From nonrenewable to renewable energy and its impact on economic growth: The role of research & development expenditures in Asia-Pacific Economic Cooperation countries. J. Clean. Prod. 2019, 212, 1166–1178. [Google Scholar]

- Kocak, E.; Sarkgunesi, A. The renewable energy and economic growth nexus in Black Sea and Balkan countries. Energy Policy 2017, 100, 51–57. [Google Scholar] [CrossRef]

- Kahouli, B. Does static and dynamic relationship between economic growth and energy consumption exist in OECD countries? Energy Rep. 2019, 5, 104–116. [Google Scholar] [CrossRef]

- Narayan, S.; Doytch, N. An investigation of renewable and non-renewable energy consumption and economic growth nexus using industrial and residential energy consumption. Energy Econ. 2017, 68, 160–176. [Google Scholar] [CrossRef]

- Tugcu, C.T.; Ozturk, I.; Aslan, A. Renewable and non-renewable energy consumption and economic growth relationship revisited: Evidence from G7 countries. Energy Econ. 2012, 34, 1942–1950. [Google Scholar] [CrossRef]

- Tuna, G.; Tuna, V.E. The asymmetric causal relationship between renewable and NON-RENEWABLE energy consumption and economic growth in the ASEAN-5 countries. Resour. Policy 2019, 62, 114–124. [Google Scholar] [CrossRef]

- Hu, Y.; Guo, D.M.; Wang, M.X.; Zhang, X.; Wang, S.Y. The Relationship between Energy Consumption and Economic Growth: Evidence from China’s Industrial Sectors. Energies 2015, 8, 9392–9406. [Google Scholar] [CrossRef]

- Ocal, O.; Aslan, A. Renewable energy consumption-economic growth nexus in Turkey. Renew. Sust. Energy Rev. 2013, 28, 494–499. [Google Scholar] [CrossRef]

- Ozcan, B.; Ozturk, I. Renewable energy consumption-economic growth nexus in emerging countries: A bootstrap panel causality test. Renew. Sust. Energy Rev. 2019, 104, 30–37. [Google Scholar] [CrossRef]

- Carpio, L.G.T. Cointegration Relationships to Estimate the Marginal Cost of Deficit in Planning a Hydrothermal System: The Case of Brazil. Int. J. Energy Econ. Policy 2014, 4, 117–124. [Google Scholar]

- Hamit-Haggar, M. Greenhouse gas emissions, energy consumption and economic growth: A panel cointegration analysis from Canadian industrial sector perspective. Energy Econ. 2012, 34, 358–364. [Google Scholar] [CrossRef]

- Bao, C.; Xu, M. Cause and effect of renewable energy consumption on urbanization and economic growth in China’s provinces and regions. J. Clean. Prod. 2019, 231, 483–493. [Google Scholar] [CrossRef]

- Chen, Y.L.; Zhao, J.C.; Lai, Z.Z.; Wang, Z.; Xia, H.B. Exploring the effects of economic growth, and renewable and non-renewable energy consumption on China’s CO2 emissions: Evidence from a regional panel analysis. Renew. Energy 2019, 140, 341–353. [Google Scholar] [CrossRef]

- Fan, W.; Hao, Y. An empirical research on the relationship amongst renewable energy consumption, economic growth and foreign direct investment in China. Renew. Energy 2020, 146, 598–609. [Google Scholar] [CrossRef]

- Mohamed, H.; Ben Jebli, M.; Ben Youssef, S. Renewable and fossil energy, terrorism, economic growth, and trade: Evidence from France. Renew. Energy 2019, 139, 459–467. [Google Scholar] [CrossRef]

- Georgantopoulos, A. Electricity Consumption and Economic Growth: Analysis and Forecasts using VAR/VEC Approach for Greece with Capital Formation. Int. J. Energy Econ. Policy 2012, 2, 263–278. [Google Scholar]

- Cheratian, I.; Goltabar, S. Energy Consumption and Regional Economic Growth: The Case of Iranian Manufacturing Sector; University Library of Munich: Munich, Germany, 2017. [Google Scholar]

- Azlina, A.A.; Mustapha, N.H.N. Energy, Economic Growth and Pollutant Emissions Nexus: The case of Malaysia. Proc. Soc. Behv. 2012, 65, 1–7. [Google Scholar] [CrossRef]

- Burakov, D.; Freidin, M. Financial Development, Economic Growth and Renewable Energy Consumption in Russia: A Vector Error Correction Approach. Int. J. Energy Econ. Policy 2017, 7, 39–47. [Google Scholar]

- Ozturk, I. A literature survey on energy-growth nexus. Energy Policy 2010, 38, 340–349. [Google Scholar] [CrossRef]

- Zaman, K.; bin Abdullah, A.; Khan, A.; Nasir, M.R.B.; Hamzah, T.A.A.T.; Hussain, S. Dynamic linkages among energy consumption, environment, health and wealth in BRICS countries: Green growth key to sustainable development. Renew. Sust. Energy Rev. 2016, 56, 1263–1271. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N.; Rasoulinezhad, E. Impact of the Fukushima Nuclear Disaster: Analysis on Japan’s Oil Consuming Sectors. ADB I. Ser. Dev. Econ. 2017, 117–133. [Google Scholar] [CrossRef]

- Kahia, M.; Ben Aissa, M.S.; Charfeddine, L. Impact of renewable and non-renewable energy consumption on economic growth: New evidence from the MENA Net Oil Exporting Countries (NOECs). Energy 2016, 116, 102–115. [Google Scholar] [CrossRef]

- Alam, M.M.; WahidMurad, M. The impacts of economic growth, trade openness and technological progress on renewable energy use in organization for economic co-operation and development countries. Renew. Energy 2020, 145, 382–390. [Google Scholar] [CrossRef]

- Rosado, J.A.; Sánchez, M.I.A. The Influence of Economic Growth and Electric Consumption on Pollution in South America Countries. Int. J. Energy Econ. Policy 2017, 7, 121–126. [Google Scholar]

- Obradovic, S.; Lojanica, N. Energy use, CO2 emissions and economic growth - causality on a sample of SEE countries. Econ. Res. Ekon. Istraz. 2017, 30, 511–526. [Google Scholar] [CrossRef]

- Ozturk, I.; Acaravci, A. The causal relationship between energy consumption and GDP in Albania, Bulgaria, Hungary and Romania: Evidence from ARDL bound testing approach. Appl. Energy 2010, 87, 1938–1943. [Google Scholar] [CrossRef]

- Lu, W.C. Greenhouse Gas Emissions, Energy Consumption and Economic Growth: A Panel Cointegration Analysis for 16 Asian Countries. Int. J. Environ. Res. Publ. Health 2017, 14, 1436. [Google Scholar] [CrossRef] [PubMed]

- Yao, S.; Zhang, S.; Zhang, X. Renewable energy, carbon emission and economic growth: A revised environmental Kuznets Curve perspective. J. Clean. Prod. 2019, 235, 1338–1352. [Google Scholar] [CrossRef]

- Adu, D.T.; Denkyirah, E.K. Economic growth and environmental pollution in West Africa: Testing the Environmental Kuznets Curve hypothesis. Kasetsart J. Soc. Sci. 2018, in press. [Google Scholar] [CrossRef]

- Gutierrez, L. On the power of panel cointegration tests: A Monte Carlo comparison. Econ. Lett. 2003, 80, 105–111. [Google Scholar] [CrossRef]

- European Parliament. Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the Promotion of the Use of Energy from Renewable Sources (Text with EEA Relevance.); European Parliament: Brussels, Belgium, 2018. [Google Scholar]

| Study | Period | Dataset | Quantitative Methods | Empirical Findings |

|---|---|---|---|---|

| Alam and WahidMurad [56] | 1970–2012 | 25 OECD nations | Autoregressive distributed lag (ARDL), pooled mean group (PMG), mean group (MG) and dynamic fixed effect (DFE) | Economic growth drives renewable energy use in the long-term, but a contrary outcome ensues in the short-term |

| Aydin [23] | 1992–2013 | BRICS states | Bootstrap panel causality | Biomass energy positively influence economic growth in all countries, except Brazil |

| Aydin [32] | 1980–2015 | 26 OECD states | Dumitrescu-Hurlin and Panel frequency causality tests | No causality among economic growth and renewable electricity consumption Bidirectional temporary, and permanent causality among renewable-nonrenewable electricity consumption and economic growth |

| Bao and Xu [44] | 1997–2015 | 30 provinces in China | Bootstrap panel causality | No causality between renewable energy consumption and economic growth in 53% of provinces and 43% of geographical regions |

| Charfeddine and Kahia [21] | 1980–2015 | MENA region | Panel vector autoregressive | Weak positive impacts of renewable energy consumption on economic growth |

| Chen, Zhao, Lai, Wang and Xia [45] | 1995–2012 | 30 provinces of China | Panel Granger causality | Bidirectional causalities among renewable energy, CO2 emissions and economic growth |

| Eren, Taspinar and Gokmenoglu [30] | 1971–2015 | India | Dynamic ordinary least squares, Granger causality test under VECM | Bidirectional causality amid renewable energy consumption and economic growth |

| Fan and Hao [46] | 2000–2015 | 31 Chinese provinces | Vector error-correction model | Renewable energy consumption per capita growth rate is not a Granger cause of economic growth neither long-term nor short-term |

| Kahouli [35] | 1990–2015 | 34 OECD nations | OLS pooled, within, GLS, 3SLS, GMM | A 1% increase in energy consumption rises the economic growth by 0.12% and 0.017% respectively |

| Maji and Sulaiman [22] | 1995–2014 | 15 West African states | Panel dynamic ordinary least squares | Renewable energy use is negatively linked to the economic growth |

| Mohamed, Ben Jebli and Ben Youssef [47] | 1980–2015 | France | Autoregressive distributed lag (ARDL) | Short-run unidirectional causality running from renewable energy consumption to GDP, whereas bidirectional causality in the long-run |

| Ozcan and Ozturk [41] | 1990–2016 | 17 emerging states | Bootstrap panel causality | No association between renewable energy consumption and economic growth in 16 states One-way causality running from renewable energy consumption to real GDP in Poland |

| Tuna and Tuna [38] | 1980–2015 | ASEAN-5 countries | Symmetric and asymmetric causality analysis | Economic growth and renewable energy consumption are not connected Significant connection between non-renewable energy consumption and economic growth |

| Zafar, Shahbaz, Hou and Sinha [33] | 1990–2015 | APEC states | Heterogenous causality analysis | Bidirectional causal relations between economic growth, renewable energy consumption, and non-renewable energy consumption |

| Variables | Definitions | Unit of Measurement | Source | Data Availability |

|---|---|---|---|---|

| Variables regarding economic growth | ||||

| GROWTH | Annual percentage growth rate of GDP per capita based on constant local currency. Aggregates are based on constant 2010 U.S. dollars | % | World Bank (NY.GDP.PCAP.KD.ZG) | 1961–2018 |

| Variables regarding renewable energy | ||||

| Overall | ||||

| REC | Renewable energy consumption (% of total final energy consumption). Renewable energy consumption is the share of renewable energy in total final energy consumption | % | World Bank (EG.FEC.RNEW.ZS) | 1990–2015 |

| Eurostat (nrg_ind_335a) | 2004–2016 | |||

| By type of renewable energy | ||||

| GIC_RE | Gross inland consumption of renewable energies (logarithmic values) | Thousand tonnes of oil equivalent (TOE) | Eurostat (nrg_107a) | 1990–2016 |

| GIC_HP | Gross inland energy consumption - Hydro power (logarithmic values) | Thousand tonnes of oil equivalent (TOE) | Eurostat (nrg_107a) | 1990–2016 |

| GIC_WP | Gross inland energy consumption - Wind power (logarithmic values) | Thousand tonnes of oil equivalent (TOE) | Eurostat (nrg_107a) | 1990–2016 |

| GIC_SP | Gross inland energy consumption - Solar photovoltaic (logarithmic values) | Thousand tonnes of oil equivalent (TOE) | Eurostat (nrg_107a) | 1990–2016 |

| GIC_SB | Gross inland energy consumption - Solid biofuels, excluding charcoal (logarithmic values) | Thousand tonnes of oil equivalent (TOE) | Eurostat (nrg_107a) | 1990–2016 |

| GIC_GE | Gross inland energy consumption - Geothermal energy (logarithmic values) | Thousand tonnes of oil equivalent (TOE) | Eurostat (nrg_107a) | 1990–2016 |

| Variables regarding alternative & nuclear energy | ||||

| ANE | Alternative & nuclear energy (% of total energy use). Clean energy is noncarbohydrate energy that does not produce carbon dioxide when generated. It includes hydropower and nuclear, geothermal, and solar power, among others | % | World Bank (EG.USE.COMM.CL.ZS) | 1990–2015 |

| Variables regarding non-renewable energy | ||||

| GIC_NRE | Gross inland consumption - Waste, non-renewable (logarithmic values) | Thousand tonnes of oil equivalent (TOE) | Eurostat (nrg_108a) | 1990–2016 |

| Variables regarding fossil fuel energy | ||||

| FFEC | Fossil fuel energy consumption (% of total). Fossil fuel comprises coal, oil, petroleum, and natural gas products. | % | World Bank (EG.USE.COMM.FO.ZS) | 1960–2015 |

| FCSFF | Final consumption of solid fossil fuels (logarithmic values) | Thousand tonnes | Eurostat (nrg_cb_sff) | 1990–2017 |

| Variables regarding environmental pollution | ||||

| GHG | Greenhouse gases emissions (CO2, N2O in CO2 equivalent, CH4 in CO2 equivalent, HFC in CO2 equivalent, PFC in CO2 equivalent, SF6 in CO2 equivalent, NF3 in CO2 equivalent). All sectors and indirect CO2 (excluding LULUCF and memo items, including international aviation) (logarithmic values) | Million tonnes | Eurostat (env_air_gge) | 1985–2017 |

| Country-level control variables | ||||

| EI | Energy intensity which measures the energy consumption of an economy and its energy efficiency. It is the ratio between gross inland consumption of energy and GDP (logarithmic values) | Kilograms of oil equivalent (KGOE) per thousand euro | Eurostat (nrg_ind_ei) | 1990–2017 |

| ED | Energy dependence which shows the extent to which an economy relies upon imports in order to meet its energy needs. It is calculated as net imports divided by the sum of gross inland energy consumption plus maritime bunkers. | % | Eurostat (t2020_rd320) | 1990–2016 |

| TRADE | Trade (% of GDP). Trade is the sum of exports and imports of goods and services measured as a share of gross domestic product. | % | World Bank (NE.TRD.GNFS.ZS) | 1960–2018 |

| DCPS | Domestic credit to private sector (% of GDP). IT refers to financial resources provided to the private sector by financial corporations, such as through loans, purchases of nonequity securities, and trade credits and other accounts receivable, that establish a claim for repayment. | % | World Bank (FS.AST.PRVT.GD.ZS) | 1960–2018 |

| UP | Urban population (% of total population) | % | World Bank (SP.URB.TOTL.IN.ZS) | 1960–2018 |

| EF | Economic freedom | Score | The Heritage Foundation | 1995–2019 |

| PS | Political Stability and Absence of Violence/Terrorism which measures perceptions of the likelihood of political instability and/or politically-motivated violence, including terrorism | Ranges from −2.5 (weak) to 2.5 (strong) governance | World Bank (Worldwide Governance Indicators) | 1996–2017 |

| Variables | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| GROWTH | 187 | 3.74 | 4.29 | −14.56 | 12.92 |

| REC | 187 | 17.13 | 8.47 | 3.73 | 38.70 |

| GIC_RE | 187 | 2207.11 | 1882.50 | 488.10 | 8970.40 |

| GIC_HP | 187 | 334.67 | 385.26 | 0.40 | 1737.50 |

| GIC_WP | 187 | 50.94 | 144.92 | 0.00 | 1082.40 |

| GIC_SP | 187 | 14.31 | 41.26 | 0.00 | 194.70 |

| GIC_SB | 187 | 1646.64 | 1462.48 | 91.30 | 6987.70 |

| GIC_GE | 187 | 16.44 | 27.54 | 0.00 | 119.90 |

| ANE | 171 | 14.16 | 10.79 | 0.02 | 44.32 |

| GIC_NRE | 187 | 76.12 | 112.93 | 0.00 | 741.50 |

| FFEC | 171 | 69.88 | 17.60 | 13.06 | 96.25 |

| FCSFF | 187 | 2951.13 | 5860.30 | 26.00 | 22,050.00 |

| GHG | 187 | 87.37 | 109.34 | 10.59 | 419.89 |

| EI | 187 | 308.93 | 109.98 | 175.98 | 778.63 |

| ED | 187 | 43.52 | 17.51 | 6.80 | 81.80 |

| TRADE | 187 | 115.85 | 32.33 | 58.08 | 184.55 |

| DCPS | 185 | 47.38 | 19.25 | 0.19 | 101.29 |

| UP | 187 | 62.99 | 7.58 | 50.75 | 74.33 |

| EF | 187 | 64.93 | 6.49 | 47.30 | 78.00 |

| PS | 165 | 0.69 | 0.31 | 0.00 | 1.30 |

| Variables | GROWTH | REC | GIC_RE | GIC_HP | GIC_WP | GIC_SP | GIC_SB | GIC_GE | ANE | GIC_NRE |

|---|---|---|---|---|---|---|---|---|---|---|

| GROWTH | 1 | |||||||||

| REC | −0.1 | 1 | ||||||||

| GIC_RE | −0.07 | −0.16 * | 1 | |||||||

| GIC_HP | −0.04 | 0.13 † | 0.41 *** | 1 | ||||||

| GIC_WP | −0.04 | −0.00 | 0.69 *** | 0.17 * | 1 | |||||

| GIC_SP | −0.11 | −0.01 | 0.25 *** | 0.15 * | 0.25 *** | 1 | ||||

| GIC_SB | −0.05 | −0.20 ** | 0.98 *** | 0.26 *** | 0.65 *** | 0.14 † | 1 | |||

| GIC_GE | 0.06 | −0.03 | 0.12 † | −0.07 | 0.1 | 0 | 0.13 † | 1 | ||

| ANE | −0.01 | −0.22 ** | −0.38 *** | −0.06 | −0.21 ** | 0.19 * | −0.44 *** | 0.13 † | 1 | |

| GIC_NRE | −0.04 | −0.33 *** | 0.76 *** | −0.04 | 0.62 *** | 0.22 ** | 0.78 *** | 0.05 | −0.22 ** | 1 |

| FFEC | 0.03 | −0.37 *** | 0.55 *** | 0.31 *** | 0.18 * | 0.07 | 0.53 *** | 0.20 ** | 0.03 | 0.45 *** |

| FCSFF | −0.01 | −0.43 *** | 0.68 *** | −0.11 | 0.39 *** | −0.02 | 0.78 *** | −0.08 | −0.37 *** | 0.73 *** |

| GHG | 0.02 | −0.42 *** | 0.81 *** | 0.08 | 0.45 *** | 0.04 | 0.88 *** | 0.02 | −0.38 *** | 0.76 *** |

| EI | 0.22 ** | −0.31 *** | −0.19 ** | −0.08 | −0.16 * | −0.08 | −0.17 * | −0.09 | 0.17 * | −0.12 † |

| ED | 0.03 | 0.09 | −0.48 *** | −0.24 ** | −0.26 *** | −0.20 ** | −0.49 *** | 0.15 * | 0.40 *** | −0.33 *** |

| TRADE | −0.03 | 0.01 | −0.38 *** | −0.47 *** | −0.14 † | 0.21 ** | −0.38 *** | 0.29 *** | 0.28 *** | −0.04 |

| DCPS | −0.34 *** | 0.40 *** | −0.20 ** | −0.26 *** | 0.02 | 0.02 | −0.20 ** | −0.01 | −0.13 † | −0.1 |

| UP | 0.03 | −0.06 | −0.16 * | −0.59 *** | −0.08 | 0.18 * | −0.07 | 0.11 | −0.06 | 0.04 |

| EF | −0.11 | 0.12 | −0.15 * | −0.50 *** | 0.11 | 0.18 * | −0.1 | −0.04 | −0.06 | 0.03 |

| PS | 0.04 | −0.27 *** | −0.18 * | −0.50 *** | −0.13 † | −0.04 | −0.13 † | −0.05 | 0.22 ** | 0.19 * |

| Variables | FFEC | FCSFF | GHG | EI | ED | TRADE | DCPS | UP | EF | PS |

| FFEC | 1 | |||||||||

| FCSFF | 0.54 *** | 1 | ||||||||

| GHG | 0.61 *** | 0.96 *** | 1 | |||||||

| EI | −0.1 | 0 | 0.03 | 1 | ||||||

| ED | 0.04 | −0.46 *** | −0.52 *** | −0.22 ** | 1 | |||||

| TRADE | −0.43 *** | −0.35 *** | −0.40 *** | −0.21 ** | 0.33 *** | 1 | ||||

| DCPS | −0.43 *** | −0.23 ** | −0.31 *** | −0.32 *** | 0.08 | 0.35 *** | 1 | |||

| UP | −0.21 ** | 0.04 | −0.03 | 0.41 *** | −0.11 | 0.24 *** | 0.11 | 1 | ||

| EF | −0.60 *** | −0.08 | −0.17 * | −0.12 | −0.06 | 0.58 *** | 0.38 *** | 0.54 *** | 1 | |

| PS | −0.04 | 0.1 | −0.03 | −0.39 *** | 0.27 *** | 0.42 *** | 0.02 | −0.05 | 0.22 ** | 1 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FE | RE | FE | RE | FE | RE | FE | RE | FE | RE | FE | RE | |

| REC | −0.02 | 0.02 | 0.05 | 0.16 | ||||||||

| (−0.37) | (0.32) | (0.18) | (0.84) | |||||||||

| REC_SQ | −0.00 | −0.00 | ||||||||||

| (−0.27) | (−0.56) | |||||||||||

| GIC_RE | −8.79 *** | −2.17 * | −51.83 *** | −57.07 *** | ||||||||

| (−4.56) | (−1.98) | (−3.58) | (−4.60) | |||||||||

| GIC_RE_SQ | 2.80 ** | 3.58 *** | ||||||||||

| (3.00) | (4.48) | |||||||||||

| GIC_NRE | −0.40 | −0.33 | −0.39 | −0.68 | ||||||||

| (−1.23) | (−1.18) | (−0.67) | (−1.19) | |||||||||

| GIC_NRE_SQ | −0.00 | 0.08 | ||||||||||

| (−0.01) | (0.76) | |||||||||||

| GHG | 21.69 *** | 0.96 | 22.03 *** | −0.51 | ||||||||

| (4.37) | (0.84) | (4.30) | (−0.97) | |||||||||

| EI | 1.91 | 7.25 ** | 1.76 | 3.75 * | 6.37 † | 3.28 | 4.92 | −3.45 † | 9.77 ** | 4.76 * | 9.77 ** | 5.66 * |

| (0.49) | (2.59) | (0.44) | (2.23) | (1.83) | (1.16) | (1.43) | (−1.82) | (2.70) | (2.04) | (2.69) | (2.25) | |

| ED | 0.02 | 0.06 | 0.01 | 0.01 | 0.02 | 0.01 | −0.02 | 0.01 | 0.06 | 0.03 | 0.06 | 0.04 |

| (0.35) | (1.49) | (0.30) | (0.46) | (0.53) | (0.35) | (−0.37) | (0.27) | (1.23) | (0.76) | (1.23) | (1.03) | |

| TRADE | 0.07 ** | 0.05 ** | 0.07 ** | 0.01 | 0.15 *** | 0.05 * | 0.16 *** | 0.02 | 0.10 *** | 0.04 * | 0.10 *** | 0.05 * |

| (3.01) | (2.62) | (2.93) | (0.38) | (5.43) | (2.39) | (6.03) | (1.42) | (3.57) | (2.29) | (3.39) | (2.35) | |

| DCPS | −0.13 *** | −0.09 *** | −0.14 *** | −0.09 *** | −0.08 ** | −0.09 *** | −0.07 ** | −0.10 *** | −0.10 *** | −0.09 *** | −0.10 *** | −0.09 *** |

| (−5.41) | (−3.72) | (−4.98) | (−4.12) | (−3.26) | (−3.82) | (−3.29) | (−5.10) | (−4.01) | (−3.84) | (−3.99) | (−3.81) | |

| UP | −0.24 | −0.18 | −0.27 | 0.02 | −0.40 | −0.07 | −0.25 | 0.25 *** | −0.86 * | −0.07 | −0.86 * | −0.12 |

| (−0.63) | (−1.11) | (−0.68) | (0.36) | (−1.10) | (−0.52) | (−0.70) | (3.47) | (−2.27) | (−0.56) | (−2.23) | (−0.84) | |

| EF | 0.10 | −0.05 | 0.10 | −0.07 | 0.10 | −0.12 | −0.02 | −0.29 *** | 0.04 | −0.12 | 0.04 | −0.10 |

| (0.75) | (−0.46) | (0.78) | (−0.95) | (0.76) | (−1.10) | (−0.18) | (−3.32) | (0.28) | (−1.12) | (0.27) | (−0.89) | |

| PS | 2.48 | 2.01 | 2.44 | 1.95 | 2.61 | 1.48 | 1.43 | −2.13 † | 1.25 | 1.61 | 1.25 | 1.45 |

| (1.34) | (1.16) | (1.31) | (1.42) | (1.42) | (0.90) | (0.78) | (−1.67) | (0.64) | (1.01) | (0.64) | (0.86) | |

| _cons | −87.28 * | −32.41 | −86.04 * | −11.87 | 35.41 | 11.13 | 206.47 ** | 254.84 *** | −8.57 | −13.22 | −8.52 | −17.48 |

| (−2.28) | (−1.58) | (−2.22) | (−1.01) | (1.02) | (0.48) | (3.12) | (4.68) | (−0.24) | (−0.87) | (−0.24) | (−1.04) | |

| F statistic | 9.30 *** | 8.32 *** | 10.76 *** | 11.10 *** | 7.40 *** | 6.53 *** | ||||||

| R-sq. within | 0.37 | 0.37 | 0.37 | 0.41 | 0.29 | 0.29 | ||||||

| Hausman test Prob > chi2 | 0.0017 | 0.0000 | 0.0014 | 0.0000 | 0.1082 | 0.2668 | ||||||

| Turning Point | 9.25 | 7.96 | ||||||||||

| Obs. | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 |

| N Countries | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FE | RE | FE | RE | FE | RE | FE | RE | FE | RE | FE | RE | |

| GIC_HP | −3.43 ** | −1.02 * | −6.67 ** | −1.03 | ||||||||

| (−2.61) | (−2.22) | (−3.26) | (−0.98) | |||||||||

| GIC_HP_SQ | 0.48 * | 0.02 | ||||||||||

| (2.05) | (0.14) | |||||||||||

| GIC_WP | −0.36 | −0.24 | −0.74 * | −0.38 | ||||||||

| (−1.59) | (−1.17) | (−2.32) | (−1.08) | |||||||||

| GIC_WP_SQ | 0.11 † | 0.08 | ||||||||||

| (1.67) | (1.22) | |||||||||||

| GIC_SP | 0.45 * | −0.19 | 0.53 † | 0.26 | ||||||||

| (2.12) | (−1.00) | (1.78) | (0.77) | |||||||||

| GIC_SP_SQ | −0.03 | −0.14 | ||||||||||

| (−0.40) | (−1.63) | |||||||||||

| GHG | 22.01 *** | 0.27 | 23.20 *** | −0.41 | 21.21 *** | −0.03 | 22.16 *** | −0.93 † | 24.34 *** | −0.79 † | 24.01 *** | −0.62 |

| (4.54) | (0.38) | (4.80) | (−0.91) | (4.30) | (−0.05) | (4.49) | (−1.89) | (4.83) | (−1.90) | (4.69) | (−1.45) | |

| EI | 1.70 | 3.49 | 1.55 | 1.91 | 0.67 | 3.35 | 1.16 | 2.71 | 4.01 | 2.58 † | 4.02 | 2.24 |

| (0.45) | (1.61) | (0.42) | (1.32) | (0.17) | (1.48) | (0.29) | (1.62) | (1.03) | (1.75) | (1.03) | (1.51) | |

| ED | 0.00 | 0.04 | −0.01 | 0.03 | 0.01 | 0.02 | 0.02 | 0.00 | 0.04 | −0.00 | 0.04 | −0.00 |

| (0.10) | (1.22) | (−0.32) | (0.89) | (0.31) | (0.64) | (0.36) | (0.02) | (0.88) | (−0.03) | (0.83) | (−0.20) | |

| TRADE | 0.08 ** | 0.02 | 0.08 *** | −0.00 | 0.08 ** | 0.03 | 0.08 *** | 0.01 | 0.06 * | 0.01 | 0.06 * | 0.01 |

| (3.30) | (1.35) | (3.59) | (−0.23) | (3.28) | (1.63) | (3.37) | (0.37) | (2.57) | (0.63) | (2.60) | (0.85) | |

| DCPS | −0.12 *** | −0.08 *** | −0.12 *** | −0.09 *** | −0.13 *** | −0.08 *** | −0.12 *** | −0.08 *** | −0.13 *** | −0.09 *** | −0.13 *** | −0.09 *** |

| (−4.80) | (−3.61) | (−4.83) | (−4.32) | (−5.06) | (−3.33) | (−4.75) | (−3.64) | (−5.18) | (−4.17) | (−5.05) | (−4.05) | |

| UP | −0.14 | −0.10 | −0.32 | −0.01 | −0.07 | 0.00 | 0.03 | 0.05 | −0.20 | 0.03 | −0.21 | 0.04 |

| (−0.37) | (−0.96) | (−0.83) | (−0.14) | (−0.17) | (0.00) | (0.07) | (0.81) | (−0.53) | (0.48) | (−0.55) | (0.71) | |

| EF | 0.05 | −0.17 | 0.03 | −0.16 † | 0.12 | −0.09 | 0.05 | −0.09 | 0.11 | −0.07 | 0.11 | −0.08 |

| (0.36) | (−1.60) | (0.27) | (−1.95) | (0.89) | (−0.86) | (0.39) | (−1.13) | (0.86) | (−0.90) | (0.89) | (−0.97) | |

| PS | 2.13 | 0.69 | 1.80 | 0.14 | 2.87 | 1.21 | 2.53 | 1.19 | 2.49 | 0.94 | 2.54 | 0.85 |

| (1.18) | (0.44) | (1.00) | (0.10) | (1.56) | (0.79) | (1.37) | (0.89) | (1.37) | (0.76) | (1.39) | (0.69) | |

| _cons | −74.34 * | 4.54 | −63.20 † | 13.63 | −91.40 * | −10.20 | −100.46 ** | −2.55 | −113.63 ** | −2.09 | −112.21 ** | −1.41 |

| (−2.00) | (0.27) | (−1.70) | (1.33) | (−2.45) | (−0.75) | (−2.68) | (−0.27) | (−2.94) | (−0.22) | (−2.88) | (−0.15) | |

| F statistic | 10.48 *** | 10.06 *** | 9.73 *** | 9.14 *** | 10.07 *** | 9.03 *** | ||||||

| R-sq. within | 0.40 | 0.41 | 0.38 | 0.39 | 0.39 | 0.39 | ||||||

| Hausman test Prob > chi2 | 0.0001 | 0.0000 | 0.0001 | 0.0000 | 0.0000 | 0.0000 | ||||||

| Turning Point | 6.93 | 3.41 | ||||||||||

| Obs. | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 |

| N Countries | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 |

| Variables | (1) | (2) | (3) | (4) | ||||

|---|---|---|---|---|---|---|---|---|

| FE | RE | FE | RE | FE | RE | FE | RE | |

| GIC_SB | −8.16 *** | −1.66 | −20.42 | −19.13 | ||||

| (−4.31) | (−1.46) | (−1.60) | (−1.57) | |||||

| GIC_SB_SQ | 0.87 | 1.14 | ||||||

| (0.97) | (1.38) | |||||||

| GIC_GE | 0.39 | 0.08 | −0.26 | −1.45 | ||||

| (0.88) | (0.31) | (−0.19) | (−1.56) | |||||

| GIC_GE_SQ | 0.20 | 0.37 † | ||||||

| (0.50) | (1.74) | |||||||

| GHG | 22.07 *** | −0.87 † | 21.86 *** | −0.58 | ||||

| (4.45) | (−1.74) | (4.38) | (−1.09) | |||||

| EI | 6.36 † | 4.23 | 5.61 | 3.87 | 1.80 | 3.07 * | 2.08 | 3.82 * |

| (1.81) | (1.47) | (1.56) | (1.23) | (0.46) | (2.10) | (0.53) | (2.55) | |

| ED | 0.02 | 0.02 | 0.01 | 0.01 | 0.02 | 0.00 | 0.02 | 0.02 |

| (0.44) | (0.56) | (0.12) | (0.29) | (0.52) | (0.10) | (0.55) | (0.61) | |

| TRADE | 0.14 *** | 0.05 * | 0.13 *** | 0.06 ** | 0.07 ** | 0.00 | 0.07 ** | −0.00 |

| (5.10) | (2.32) | (5.09) | (3.03) | (2.90) | (0.25) | (2.85) | (−0.29) | |

| DCPS | −0.08 *** | −0.09 *** | −0.08 *** | −0.09 *** | −0.14 *** | −0.09 *** | −0.14 *** | −0.08 *** |

| (−3.51) | (−3.80) | (−3.58) | (−3.83) | (−5.50) | (−4.01) | (−5.42) | (−3.80) | |

| UP | −0.66 † | −0.08 | −0.71 † | −0.10 | −0.37 | 0.02 | −0.40 | −0.06 |

| (−1.83) | (−0.51) | (−1.95) | (−0.54) | (−0.89) | (0.39) | (−0.95) | (−0.77) | |

| EF | 0.07 | −0.11 | 0.03 | −0.13 | 0.08 | −0.07 | 0.08 | −0.01 |

| (0.53) | (−0.97) | (0.25) | (−1.06) | (0.61) | (−0.86) | (0.61) | (−0.06) | |

| PS | 2.25 | 1.72 | 1.94 | 1.58 | 2.28 | 1.42 | 2.23 | 1.13 |

| (1.22) | (1.03) | (1.04) | (0.92) | (1.23) | (1.08) | (1.19) | (0.87) | |

| _cons | 48.58 | 0.39 | 102.03 | 69.43 | −79.39 * | −4.64 | −78.21 † | −7.91 |

| (1.35) | (0.02) | (1.55) | (1.30) | (−2.02) | (−0.50) | (−1.98) | (−0.85) | |

| F statistic | 10.39 *** | 9.33 *** | 9.41 *** | 8.45 *** | ||||

| R-sq. within | 0.37 | 0.37 | 0.37 | 0.37 | ||||

| Hausman test Prob > chi2 | 0.0020 | 0.0166 | 0.0000 | 0.0000 | ||||

| Obs. | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 | 163.00 |

| N Countries | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FE | RE | FE | RE | FE | RE | FE | RE | FE | RE | FE | RE | |

| ANE | 0.25 ** | 0.01 | 0.19 | −0.27 * | ||||||||

| (3.03) | (0.16) | (0.82) | (−2.45) | |||||||||

| ANE_SQ | 0.00 | 0.01 † | ||||||||||

| (0.31) | (1.91) | |||||||||||

| FFEC | 0.02 | 0.06 | 0.72 ** | −0.27 * | ||||||||

| (0.16) | (0.54) | (2.72) | (−2.03) | |||||||||

| FFEC_SQ | −0.01 ** | 0.00 † | ||||||||||

| (−2.92) | (1.66) | |||||||||||

| FCSFF | 1.13 | −0.32 | −4.06 | −3.42 | ||||||||

| (0.89) | (−0.77) | (−0.95) | (−1.42) | |||||||||

| FCSFF_SQ | 0.45 | 0.22 | ||||||||||

| (1.27) | (1.24) | |||||||||||

| GHG | 28.85 *** | 1.28 | 29.20 *** | −0.76 | 24.23 *** | 0.49 | 29.52 *** | −1.09 | ||||

| (5.39) | (1.01) | (5.32) | (−1.63) | (4.14) | (0.25) | (4.95) | (−0.76) | |||||

| EI | −2.07 | 8.28 * | −2.32 | 3.32 † | 2.63 | 9.15 ** | 2.27 | 2.58 | 9.53 ** | 5.17 * | 9.57 ** | 4.67 * |

| (−0.46) | (2.56) | (−0.51) | (1.86) | (0.59) | (2.72) | (0.53) | (1.21) | (2.61) | (2.34) | (2.63) | (2.42) | |

| ED | 0.16 ** | 0.09 † | 0.16 ** | 0.02 | 0.04 | 0.06 | −0.01 | 0.04 | 0.05 | 0.03 | 0.05 | 0.04 |

| (2.65) | (1.79) | (2.65) | (0.82) | (0.52) | (0.93) | (−0.20) | (0.94) | (1.03) | (1.04) | (1.07) | (1.32) | |

| TRADE | 0.08 ** | 0.06 ** | 0.08 ** | 0.02 | 0.08 ** | 0.07 ** | 0.09 *** | 0.01 | 0.09 *** | 0.03 † | 0.10 *** | 0.02 |

| (3.28) | (2.74) | (3.20) | (1.42) | (2.88) | (2.75) | (3.50) | (0.31) | (3.47) | (1.73) | (3.67) | (1.44) | |

| DCPS | −0.16 *** | −0.08 ** | −0.16 *** | −0.09 *** | −0.14 *** | −0.08 ** | −0.14 *** | −0.10 *** | −0.10 *** | −0.09 *** | −0.09 *** | −0.09 *** |

| (−5.81) | (−3.29) | (−5.77) | (−3.75) | (−5.04) | (−3.21) | (−5.33) | (−4.02) | (−3.97) | (−3.75) | (−3.54) | (−3.84) | |

| UP | 0.06 | −0.18 | 0.08 | 0.05 | −0.06 | −0.21 | −0.25 | 0.05 | −0.73 † | −0.06 | −0.77 * | −0.02 |

| (0.15) | (−0.98) | (0.17) | (0.79) | (−0.12) | (−1.10) | (−0.57) | (0.66) | (−1.87) | (−0.49) | (−1.98) | (−0.27) | |

| EF | −0.01 | −0.08 | −0.00 | −0.18 † | 0.10 | −0.04 | −0.01 | −0.11 | 0.03 | −0.10 | 0.02 | −0.11 |

| (−0.07) | (−0.58) | (−0.01) | (−1.89) | (0.69) | (−0.27) | (−0.07) | (−0.88) | (0.21) | (−0.99) | (0.13) | (−1.21) | |

| PS | 1.82 | 2.44 | 1.77 | 1.50 | 2.89 | 2.68 | 2.63 | 1.10 | 1.87 | 1.83 | 2.02 | 1.22 |

| (0.94) | (1.29) | (0.91) | (1.05) | (1.44) | (1.41) | (1.35) | (0.78) | (0.95) | (1.16) | (1.02) | (0.81) | |

| _cons | −114.72 ** | −40.22 † | −115.35 ** | −2.41 | −116.08 ** | −46.60 † | −133.36 ** | 5.59 | −23.04 | −15.34 | −7.65 | −2.68 |

| (−2.84) | (−1.83) | (−2.84) | (−0.22) | (−2.78) | (−1.92) | (−3.25) | (0.38) | (−0.62) | (−1.06) | (−0.20) | (−0.20) | |

| F statistic | 11.73 *** | 10.49 *** | 9.99 *** | 10.38 *** | 7.28 *** | 6.68 *** | ||||||

| R-sq. within | 0.45 | 0.45 | 0.41 | 0.45 | 0.29 | 0.30 | ||||||

| Hausman test Prob > chi2 | 0.0001 | 0.0000 | 0.0016 | 0.0000 | 0.0822 | 0.0254 | ||||||

| Turning Point | 21.79 | 61.65 | 58.90 | |||||||||

| Obs. | 147.00 | 147.00 | 147.00 | 147.00 | 147.00 | 147.00 | 147.00 | 147.00 | 163.00 | 163.00 | 163.00 | 163.00 |

| N Countries | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 | 11.00 |

| Variables | Individual Intercept | Individual Intercept and Trend | |||||||

|---|---|---|---|---|---|---|---|---|---|

| LLC | IPS | ADF | PP | LLC | Breitung | IPS | ADF | PP | |

| GROWTH | −6.90174 *** | −3.96103 *** | 50.9227 *** | 43.2968 ** | −6.69439 *** | −5.73562 *** | −2.45819 ** | 36.7605 * | 28.2302 |

| REC | −1.31809 † | −0.17702 | 32.946 † | 13.723 | −2.26364 * | 0.47829 | 0.44736 | 16.0841 | 13.1755 |

| GIC_RE | −1.1228 | 1.60339 | 11.7935 | 11.6056 | −2.80331 ** | −0.34208 | −2.26011 * | 38.397 * | 45.725 ** |

| GIC_HP | −6.96696 *** | −4.47805 *** | 70.1189 *** | 75.6626 *** | −8.88236 *** | −5.15165 *** | −6.16503 *** | 73.2824 *** | 84.2836 *** |

| GIC_WP | −5.23055 *** | −1.56794 † | 36.4819 * | 36.4513 * | −2.34938 ** | −2.2268 * | −2.02057 * | 41.9568 ** | 32.1473 † |

| GIC_SP | 0.40807 | −1.79472 * | 34.0867 * | 5.72862 | −0.22866 | −0.55778 | 0.53087 | 13.1755 | 6.17012 |

| GIC_SB | −3.12339 *** | −0.73143 | 28.4519 | 30.0339 | −3.27258 *** | −3.26658 *** | −2.58845 ** | 49.1377 *** | 39.4065 * |

| GIC_GE | −5.13934 *** | −3.75471 *** | 109.909 *** | 56.5613 *** | −11.1184 *** | −0.61685 | −5.51118 *** | 36.2505 ** | 47.3417 *** |

| ANE | 9.79899 | 6.70808 | 16.3012 | 18.2857 | 2.70998 | 6.2306 | 1.55309 | 31.9507 † | 29.1787 |

| GIC_NRE | −2.72926 ** | −0.96062 | 21.9413 | 26.113 † | −5.73345 *** | −1.12788 | −2.22262 * | 40.4008 ** | 32.4695 † |

| FFEC | 2.42668 | 4.62482 | 8.03924 | 9.46648 | −4.33684 *** | 0.20966 | −0.9976 | 25.068 | 27.5785 |

| FCSFF | −0.26265 | 1.68298 | 12.0379 | 14.7373 | −3.39523 *** | 0.53438 | −0.22193 | 24.5564 | 22.5693 |

| GHG | −0.3103 | 0.54099 | 20.5066 | 24.4963 | −3.55962 *** | −0.08462 | −0.92484 | 23.5981 | 33.7867 † |

| EI | −0.50163 | 2.91843 | 6.57342 | 7.9067 | −2.49301 ** | −3.4904 *** | −2.10879 * | 35.8173 * | 30.8822 † |

| ED | −1.45494 † | 0.16032 | 19.5415 | 20.6316 | −3.8485 *** | −2.31955 * | −2.5373 ** | 40.9637 ** | 41.0899 ** |

| TRADE | −0.93972 | 1.46882 | 10.022 | 8.63366 | −2.14837 * | −2.47378 ** | −2.27035 * | 37.5733 * | 17.9834 |

| DCPS | −5.613 *** | −2.34553 ** | 40.1903 * | 21.2872 | 1.25848 | 2.38234 | 2.4204 | 16.4332 | 30.245 |

| UP | 0.69466 | 2.99352 | 23.0441 | 10.6287 | −0.66227 | −1.60956 † | −0.78243 | 52.1571 *** | 45.6346 ** |

| EF | −3.69312 *** | −1.42637 † | 39.1717 * | 74.9349 *** | −0.99155 | −0.93456 | 0.33 | 19.7591 | 41.877 ** |

| PS | −6.14953 *** | −4.35309 *** | 55.5461 *** | 58.6936 *** | −2.90664 ** | −0.53716 | −0.39607 | 22.4669 | 44.5648 ** |

| Variables | Individual Intercept | Individual Intercept and Trend | |||||||

|---|---|---|---|---|---|---|---|---|---|

| LLC | IPS | ADF | PP | LLC | Breitung | IPS | ADF | PP | |

| ∆GROWTH | −13.7771 *** | −10.2456 *** | 124.977 *** | 185.021 *** | −12.1995 *** | −9.8142 *** | −7.68283 *** | 89.8084 *** | 157.831 *** |

| ∆REC | −7.24218 *** | −6.14147 *** | 77.3734 *** | 88.7526 *** | −5.77747 *** | −3.49864 *** | −4.60234 *** | 59.4871 *** | 106.215 *** |

| ∆GIC_RE | −10.4765 *** | −9.27085 *** | 113.873 *** | 151.437 *** | −7.62154 *** | −4.16298 *** | −6.08874 *** | 75.6519 *** | 118.336 *** |

| ∆GIC_HP | −12.1606 *** | −11.5908 *** | 141.743 *** | 223.058 *** | −11.184 *** | −3.58305 *** | −10.2428 *** | 118.633 *** | 200.003 *** |

| ∆GIC_WP | −10.7399 *** | −8.54294 *** | 104.201 *** | 104.661 *** | −4.47528 *** | −4.64069 *** | −5.3869 *** | 65.5345 *** | 92.6303 *** |

| ∆GIC_SP | −6.71 *** | −4.89794 *** | 55.085 *** | 55.1324 *** | −6.13839 *** | −5.90048 *** | −3.29078 *** | 39.8082 ** | 49.369 *** |

| ∆GIC_SB | −16.1945 *** | −13.06 *** | 141.88 *** | 146.195 *** | −13.4004 *** | −5.2971 *** | −10.6235 *** | 105.273 *** | 125.301 *** |

| ∆GIC_GE | −18.0995 *** | −12.4213 *** | 93.0906 *** | 100.281 *** | −14.1561 *** | −1.6953 * | −9.18449 *** | 70.0375 *** | 90.0524 *** |

| ∆ANE | −0.49088 | −4.5109 *** | 81.0679 *** | 93.3293 *** | −6.7824 *** | 2.80549 | −4.90358 *** | 69.2393 *** | 94.0696 *** |

| ∆GIC_NRE | −14.5487 *** | −11.3964 *** | 136.666 *** | 152.312 *** | −12.404 *** | −5.00157 *** | −9.02222 *** | 102.364 *** | 135.854 *** |

| ∆FFEC | −9.51232 *** | −7.11352 *** | 88.0822 *** | 103.447 *** | −9.40467 *** | −2.23285 * | −5.85189 *** | 73.7374 *** | 106.926 *** |

| ∆FCSFF | −12.5787 *** | −10.1268 *** | 121.057 *** | 136.041 *** | −11.7699 *** | −7.74202 *** | −8.64515 *** | 99.4985 *** | 141.298 *** |

| ∆GHG | −10.7791 *** | −8.99511 *** | 108.532 *** | 117.281 *** | −8.22499 *** | −3.66921 *** | −5.89332 *** | 71.9385 *** | 110.865 *** |

| ∆EI | −9.28656 *** | −7.5924 *** | 92.6394 *** | 124.363 *** | −8.70982 *** | −5.19758 *** | −5.51272 *** | 66.0557 *** | 105.936 *** |

| ∆ED | −12.1815 *** | −11.5876 *** | 138.195 *** | 181.372 *** | −8.69297 *** | −6.09338 *** | −8.45513 *** | 97.3108 *** | 153.257 *** |

| ∆TRADE | −9.02789 *** | −6.40096 *** | 77.6798 *** | 92.478 *** | −7.98708 *** | −7.34229 *** | −3.94193 *** | 49.7837 *** | 62.9515 *** |

| ∆DCPS | −5.07428 *** | −3.49334 *** | 50.9138 *** | 50.9921 *** | −6.45018 *** | −1.17449 | −3.42556 *** | 51.1635 *** | 47.5118 ** |

| ∆UP | 2.29312 | −2.51674 ** | 53.6031 *** | 89.7118 *** | 2.89682 | 1.49789 | −2.79057 ** | 44.6388 ** | 76.2224 *** |

| ∆EF | −9.90931 *** | −7.83449 *** | 96.0649 *** | 109.672 *** | −11.0559 *** | −3.55227 *** | −7.72458 *** | 87.6569 *** | 98.6266 *** |

| ∆PS | −10.09 *** | −8.19166 *** | 98.6169 *** | 125.865 *** | −8.98325 *** | −3.30695 *** | −6.80943 *** | 82.317 *** | 146.228 *** |

| Models | Cointegration Test Null Hypothesis: No cointegration | Individual Intercept | Individual Intercept and Individual Trend | No Intercept or Trend | ||||

|---|---|---|---|---|---|---|---|---|

| Statistic | Weighted Statistic | Statistic | Weighted Statistic | Statistic | Weighted Statistic | |||

| (1) | GROWTH GIC_RE GIC_NRE GHG | Panel v-Statistic | 0.6573 | −0.2063 | −1.0122 | −1.8655 | 1.593567 † | 0.5236 |

| Panel rho-Statistic | 1.1613 | 0.1353 | 2.4363 | 1.3683 | −0.0494 | −0.8533 | ||

| Panel PP-Statistic | −1.0097 | −4.388106 *** | −0.0694 | −4.149261 *** | −1.966598 * | −4.119584 *** | ||

| Panel ADF-Statistic | −3.526123 *** | −4.183999 *** | −3.815184 *** | −3.141432 *** | −3.937107 *** | −4.853927 *** | ||

| Group rho-Statistic | 1.8762 | 2.7500 | 0.7474 | |||||

| Group PP-Statistic | −5.920569 *** | −5.887616 *** | −4.422535 *** | |||||

| Group ADF-Statistic | −4.670699 *** | −4.571894 *** | −6.278814 *** | |||||

| (2) | GROWTH GIC_HP GIC_NRE GHG | Panel v-Statistic | 0.2706 | −0.8449 | −1.4776 | −2.5197 | 0.9923 | −0.0017 |

| Panel rho-Statistic | 0.5821 | −0.6721 | 2.1909 | 0.7286 | −0.0488 | −1.2525 | ||

| Panel PP-Statistic | −1.328952 † | −4.123649 *** | 0.0992 | −3.494839 *** | −2.34537 ** | −3.912896 *** | ||

| Panel ADF-Statistic | −3.771992 *** | −4.84523 *** | −3.195887 *** | −4.459679 *** | −4.379419 *** | −4.4589 *** | ||

| Group rho-Statistic | 1.1695 | 2.1332 | 0.3878 | |||||

| Group PP-Statistic | −3.292138 *** | −2.864356 ** | −3.801121 *** | |||||

| Group ADF-Statistic | −4.730334 *** | −4.594582 *** | −5.20292 *** | |||||

| (3) | GROWTH GIC_WP GIC_NRE GHG | Panel v-Statistic | 0.1054 | −1.4261 | −1.7741 | −3.2077 | 0.6965 | −0.8162 |

| Panel rho-Statistic | 1.6393 | 0.3372 | 3.1580 | 1.7840 | 0.6843 | −0.3450 | ||

| Panel PP-Statistic | −1.1291 | −2.996734 ** | 0.5329 | −2.483543 ** | −2.350431 ** | −2.976007 ** | ||

| Panel ADF-Statistic | −4.499004 *** | −3.84786 *** | −3.519147 *** | −3.152495 *** | −5.153644 *** | −3.690897 *** | ||

| Group rho-Statistic | 2.1799 | 3.3200 | 1.6551 | |||||

| Group PP-Statistic | −2.458006 ** | −2.287809 * | −3.7542 *** | |||||

| Group ADF-Statistic | −4.524503 *** | −3.507934 *** | −5.215354 *** | |||||

| (4) | GROWTH GIC_SP GIC_NRE GHG | Panel v-Statistic | 0.1716 | −1.3792 | −1.1726 | −2.8189 | 0.6574 | −0.8327 |

| Panel rho-Statistic | 0.9537 | 0.1421 | 2.5476 | 1.1571 | −0.0319 | −0.7238 | ||

| Panel PP-Statistic | −1.0344 | −2.75519 ** | −0.5412 | −2.947274 ** | −2.194545 * | −2.869475 ** | ||

| Panel ADF-Statistic | −2.960689 ** | −3.166734 *** | −3.977643 *** | −3.551811 *** | −3.880574 *** | −3.1983 *** | ||

| Group rho-Statistic | 1.5873 | 2.3262 | 0.6861 | |||||

| Group PP-Statistic | −3.297258 *** | −3.671301 *** | −2.891769 ** | |||||

| Group ADF-Statistic | −4.039305 *** | −4.387975 *** | −4.376709 *** | |||||

| (5) | GROWTH GIC_SB GIC_NRE GHG | Panel v-Statistic | 0.7630 | −0.1529 | −1.1085 | −1.8501 | 1.694589 * | 0.6482 |

| Panel rho-Statistic | 0.9035 | −0.0259 | 2.5113 | 1.3290 | −0.1153 | −0.8155 | ||

| Panel PP-Statistic | −1.0999 | −4.488867 *** | 0.3311 | −4.239184 *** | −1.917521 * | −4.146968 *** | ||

| Panel ADF-Statistic | −3.828555 *** | −4.686977 *** | −3.545358 *** | −3.224496 *** | −3.423087 *** | −4.842158 *** | ||

| Group rho-Statistic | 1.5825 | 2.7842 | 0.6704 | |||||

| Group PP-Statistic | −5.395727 *** | −4.641839 *** | −4.428507 *** | |||||

| Group ADF-Statistic | −5.166204 *** | −4.065294 *** | −5.404952 *** | |||||

| (6) | GROWTH GIC_GE GIC_NRE GHG | Panel v-Statistic | 0.0976 | −1.1020 | −1.4757 | −2.6795 | 0.6874 | −0.5623 |

| Panel rho-Statistic | 0.8503 | 0.1464 | 2.0266 | 1.4847 | −0.0280 | −0.5866 | ||

| Panel PP-Statistic | −1.0889 | −4.786446 *** | −0.3699 | −4.353957 *** | −1.724867 * | −3.355975 *** | ||

| Panel ADF-Statistic | −2.796113 ** | −4.616111 *** | −2.830491 ** | −4.222887 *** | −2.985534 ** | −3.475282 *** | ||

| Group rho-Statistic | 1.2233 | 2.3277 | 0.7182 | |||||

| Group PP-Statistic | −5.961946 *** | −4.367956 *** | −3.917662 *** | |||||

| Group ADF-Statistic | −4.605147 *** | −3.685566 *** | −3.810538 *** | |||||

| Null Hypothesis: No Cointegration | Models | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| GROWTH GIC_RE GIC_NRE GHG | GROWTH GIC_HP GIC_NRE GHG | GROWTH GIC_WP GIC_NRE GHG | GROWTH GIC_SP GIC_NRE GHG | GROWTH GIC_SB GIC_NRE GHG | GROWTH GIC_GE GIC_NRE GHG | |

| ADF (t-Statistic) | −1.808431 * | −1.428961 † | −1.688975 * | −2.057094 * | −1.693414 * | −1.123465 |

| Residual variance | 14.30643 | 14.32726 | 14.33496 | 14.02509 | 14.17931 | 14.34368 |

| HAC Variance | 3.527403 | 3.530453 | 3.382771 | 4.675912 | 3.564634 | 3.570635 |

| Models | Hypothesized No. of CE(s) | Fisher Stat. (from Trace Test) | Fisher Stat. (from Max-Eigen Test) | |

|---|---|---|---|---|

| (1) | GROWTH GIC_RE GIC_NRE GHG | None | 180.4 *** | 116.1 *** |

| At most 1 | 89.04 *** | 57.62 *** | ||

| At most 2 | 52.26 *** | 41.63 ** | ||

| At most 3 | 40.39 ** | 40.39 ** | ||

| (2) | GROWTH GIC_HP GIC_NRE GHG | None | 147.5 *** | 108.6 *** |

| At most 1 | 60.44 *** | 55.53 *** | ||

| At most 2 | 24.63 | 22.66 | ||

| At most 3 | 24.08 | 24.08 | ||

| (3) | GROWTH GIC_WP GIC_NRE GHG | None | 219 *** | 180.6 *** |

| At most 1 | 95.37 *** | 59.06 *** | ||

| At most 2 | 60.64 *** | 49.25 *** | ||

| At most 3 | 40.61 ** | 40.61 ** | ||

| (4) | GROWTH GIC_SP GIC_NRE GHG | None | 198 *** | 139.9 *** |

| At most 1 | 88.17 *** | 70.27 *** | ||

| At most 2 | 37.04 ** | 37.67 ** | ||

| At most 3 | 18.41 | 18.41 | ||

| (5) | GROWTH GIC_SB GIC_NRE GHG | None | 176.1 *** | 121.2 *** |

| At most 1 | 81.89 *** | 48.86 *** | ||

| At most 2 | 52.25 *** | 43.54 ** | ||

| At most 3 | 38.74 * | 38.74 * | ||

| (6) | GROWTH GIC_GE GIC_NRE GHG | None | 172.9 *** | 121 *** |

| At most 1 | 73.55 *** | 64.59 *** | ||

| At most 2 | 26.31 * | 27.6 * | ||

| At most 3 | 14.15 | 14.15 | ||

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GIC_RE | −4.73 *** (−3.53) | −32.75 *** (−4.14) | ||||||||||

| GIC_RE_SQ | 1.83 *** (3.71) | |||||||||||

| GIC_HP | −5.53 *** (−3.83) | −6.88 ** (−2.71) | ||||||||||

| GIC_HP_SQ | 0.25 (1.01) | |||||||||||

| GIC_WP | −0.53 ** (−3.24) | −1.08 *** (−3.86) | ||||||||||

| GIC_WP_SQ | 0.14 ** (2.75) | |||||||||||

| GIC_SP | 0.36 * (2.13) | 0.73 *** (3.65) | ||||||||||

| GIC_SP_SQ | −0.10 * (−1.99) | |||||||||||

| GIC_SB | −4.55 ** (−3.03) | −14.63 * (−2.17) | ||||||||||

| GIC_SB_SQ | 0.68 (1.46) | |||||||||||

| GIC_GE | −0.26 (−0.90) | −1.53 (−1.34) | ||||||||||

| GIC_GE_SQ | 0.37 (1.15) | |||||||||||

| GIC_NRE | 0.51 * (2.22) | 0.69 ** (3.21) | 0.37 (1.39) | 0.36 (1.36) | 0.29 (1.07) | 0.28 (1.16) | 0.23 (0.89) | 0.16 (0.69) | 0.38 (1.64) | 0.46 * (2.10) | 0.40 (1.52) | 0.34 (1.41) |

| GHG | 3.36 (0.91) | 3.66 (1.14) | 13.71 ** (3.52) | 13.91 *** (3.71) | 5.96 (1.32) | 7.91 † (1.90) | 24.99 *** (5.88) | 22.82 *** (6.87) | 4.84 (1.31) | 4.06 (1.22) | 18.54 *** (4.32) | 19.54 *** (5.07) |

| Turning Point | 8.95 | 3.78 | 3.59 | |||||||||

| R-squared | 0.22 | 0.25 | 0.25 | 0.26 | 0.21 | 0.24 | 0.28 | 0.28 | 0.21 | 0.22 | 0.25 | 0.27 |

| Adjusted R2 | 0.16 | 0.18 | 0.19 | 0.19 | 0.15 | 0.17 | 0.21 | 0.20 | 0.15 | 0.15 | 0.17 | 0.18 |

| S.E. of regression | 4.03 | 3.96 | 3.93 | 3.93 | 4.04 | 3.99 | 3.79 | 3.80 | 4.03 | 4.04 | 3.98 | 3.95 |

| Long-run variance | 14.53 | 13.49 | 13.88 | 13.73 | 14.82 | 14.10 | 20.91 | 20.05 | 14.96 | 14.88 | 22.89 | 23.07 |

| Mean dependent var | 3.67 | 3.67 | 3.67 | 3.67 | 3.67 | 3.67 | 3.79 | 3.79 | 3.67 | 3.67 | 3.95 | 3.95 |

| S.D. dependent var | 4.38 | 4.38 | 4.38 | 4.38 | 4.38 | 4.38 | 4.26 | 4.26 | 4.38 | 4.38 | 4.37 | 4.37 |

| Sum squared resid | 2626.06 | 2526.50 | 2506.59 | 2486.93 | 2646.34 | 2565.93 | 1868.21 | 1866.15 | 2637.04 | 2633.11 | 1808.47 | 1764.68 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| GIC_RE | −4.78 ** (−3.15) | −18.06 (−1.55) | ||||||||||

| GIC_RE_SQ | 0.99 (1.33) | |||||||||||

| GIC_HP | −5.00 * (−2.35) | −6.30 (−1.56) | ||||||||||

| GIC_HP_SQ | 0.24 (0.60) | |||||||||||

| GIC_WP | −0.53 * (−2.47) | −0.90 † (−1.92) | ||||||||||

| GIC_WP_SQ | 0.08 (1.03) | |||||||||||

| GIC_SP | 0.31 (1.40) | 0.91 * (2.56) | ||||||||||

| GIC_SP_SQ | −0.16 † (−1.79) | |||||||||||

| GIC_SB | −5.30 ** (−3.02) | −7.65 (−0.74) | ||||||||||

| GIC_SB_SQ | 0.27 (0.35) | |||||||||||

| GIC_GE | −0.21 (−0.56) | 2.07 (1.08) | ||||||||||

| GIC_GE_SQ | −0.74 (−1.38) | |||||||||||

| GIC_NRE | 0.63 * (2.40) | 0.74 ** (2.65) | 0.28 (0.80) | 0.31 (0.79) | 0.32 (0.88) | 0.31 (0.80) | 0.06 (0.19) | 0.45 (1.34) | 0.61 * (2.42) | 0.66 * (2.52) | 0.34 (0.99) | 0.32 (0.89) |

| GHG | 5.03 (1.22) | 6.32 (1.65) | 13.44 ** (2.62) | 13.72 * (2.57) | 5.60 (0.90) | 6.51 (0.90) | 23.12 *** (4.10) | 20.18 *** (3.51) | 4.59 (1.13) | 5.28 (1.34) | 15.55 * (2.59) | 15.82 ** (2.78) |

| Turning Point | 2.90 | |||||||||||

| R-squared | 0.65 | 0.70 | 0.56 | 0.58 | 0.55 | 0.57 | 0.66 | 0.67 | 0.65 | 0.69 | 0.59 | 0.65 |

| Adjusted R2 | 0.52 | 0.55 | 0.40 | 0.37 | 0.38 | 0.36 | 0.54 | 0.50 | 0.53 | 0.54 | 0.45 | 0.47 |

| S.E. of regression | 3.03 | 2.95 | 3.38 | 3.46 | 3.44 | 3.50 | 2.88 | 2.83 | 3.01 | 2.97 | 3.25 | 3.17 |

| Long-run variance | 8.37 | 6.10 | 12.02 | 11.56 | 11.36 | 10.26 | 7.21 | 4.95 | 8.30 | 6.41 | 10.02 | 8.37 |

| Mean dependent var | 3.67 | 3.67 | 3.67 | 3.67 | 3.67 | 3.67 | 3.79 | 3.57 | 3.67 | 3.67 | 3.95 | 3.95 |

| S.D. dependent var | 4.38 | 4.38 | 4.38 | 4.38 | 4.38 | 4.38 | 4.26 | 3.98 | 4.38 | 4.38 | 4.37 | 4.37 |

| Sum squared resid | 1185.26 | 1019.35 | 1475.28 | 1404.01 | 1524.27 | 1430.62 | 869.65 | 670.74 | 1171.29 | 1034.64 | 983.14 | 845.48 |

| Models | Excluded | Short-Run (or Weak) Granger Causality | Long-Run Granger Causality | |||

|---|---|---|---|---|---|---|

| Dependent Variables | ||||||

| (1) | ∆GROWTH | ∆GIC_RE | ∆GIC_NRE | ∆GHG | ECT | |

| ∆GROWTH | - | 12.16608 *** | 0.0358 | 4.575656 * | −0.650736 *** | |

| ∆GIC_RE | 0.2910 | - | 0.0014 | 0.1387 | 0.00226 | |

| ∆GIC_NRE | 1.8857 | 0.5728 | - | 2.0177 | −0.005545 | |

| ∆GHG | 1.8259 | 0.0875 | 0.4724 | - | −0.000431 | |

| (2) | ∆GROWTH | ∆GIC_HP | ∆GIC_NRE | ∆GHG | ECT | |

| ∆GROWTH | - | 12.44028 *** | 0.0679 | 4.453685 * | −0.623155 *** | |

| ∆GIC_HP | 0.0218 | - | 0.0096 | 0.0016 | 0.008495 † | |

| ∆GIC_NRE | 1.6179 | 0.2780 | - | 2.0062 | −0.002347 | |

| ∆GHG | 1.5346 | 0.0013 | 0.5426 | - | −0.000169 | |

| (3) | ∆GROWTH | ∆GIC_WP | ∆GIC_NRE | ∆GHG | ECT | |

| ∆GROWTH | - | 0.4345 | 0.0693 | 5.215753 * | −0.695215 *** | |

| ∆GIC_WP | 0.7020 | - | 0.2963 | 0.4705 | −0.003194 | |

| ∆GIC_NRE | 2.6104 | 1.0871 | - | 2.0827 | −0.000684 | |

| ∆GHG | 1.8882 | 0.5178 | 0.6447 | - | −0.000711 | |

| (4) | ∆GROWTH | ∆GIC_SP | ∆GIC_NRE | ∆GHG | ECT | |

| ∆GROWTH | - | 1.8278 | 0.0433 | 5.01971 * | −0.625064 *** | |

| ∆GIC_SP | 0.2757 | - | 0.2725 | 1.1539 | −0.041202 * | |

| ∆GIC_NRE | 1.9297 | 0.2016 | - | 2.2359 | −0.000836 | |

| ∆GHG | 2.0533 | 0.0021 | 0.7406 | - | −0.000113 | |

| (5) | ∆GROWTH | ∆GIC_SB | ∆GIC_NRE | ∆GHG | ECT | |

| ∆GROWTH | - | 6.037748 * | 0.0212 | 4.704533 * | −0.630974 *** | |

| ∆GIC_SB | 1.6281 | - | 0.0172 | 0.0424 | 0.00251 | |

| ∆GIC_NRE | 2.872704 † | 0.1072 | - | 2.0756 | −0.007051 | |

| ∆GHG | 2.3318 | 0.0256 | 0.4379 | - | −0.000348 | |

| (6) | ∆GROWTH | ∆GIC_GE | ∆GIC_NRE | ∆GHG | ECT | |

| ∆GROWTH | - | 2.4456 | 0.0757 | 4.484724 * | −0.603736 *** | |

| ∆GIC_GE | 7.652844 ** | - | 0.3904 | 0.8456 | 0.006859 | |

| ∆GIC_NRE | 3.321896 † | 0.0359 | - | 2.2385 | −0.003832 | |

| ∆GHG | 1.4562 | 0.0394 | 0.5213 | - | 0.0000456 | |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Armeanu, D.Ş.; Gherghina, Ş.C.; Pasmangiu, G. Exploring the Causal Nexus between Energy Consumption, Environmental Pollution and Economic Growth: Empirical Evidence from Central and Eastern Europe. Energies 2019, 12, 3704. https://doi.org/10.3390/en12193704

Armeanu DŞ, Gherghina ŞC, Pasmangiu G. Exploring the Causal Nexus between Energy Consumption, Environmental Pollution and Economic Growth: Empirical Evidence from Central and Eastern Europe. Energies. 2019; 12(19):3704. https://doi.org/10.3390/en12193704

Chicago/Turabian StyleArmeanu, Daniel Ştefan, Ştefan Cristian Gherghina, and George Pasmangiu. 2019. "Exploring the Causal Nexus between Energy Consumption, Environmental Pollution and Economic Growth: Empirical Evidence from Central and Eastern Europe" Energies 12, no. 19: 3704. https://doi.org/10.3390/en12193704

APA StyleArmeanu, D. Ş., Gherghina, Ş. C., & Pasmangiu, G. (2019). Exploring the Causal Nexus between Energy Consumption, Environmental Pollution and Economic Growth: Empirical Evidence from Central and Eastern Europe. Energies, 12(19), 3704. https://doi.org/10.3390/en12193704