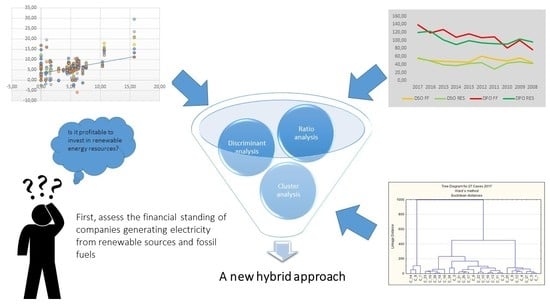

Comparison of the Financial Standing of Companies Generating Electricity from Renewable Sources and Fossil Fuels: A New Hybrid Approach

Abstract

:1. Introduction

2. Data and Methods

- A = (Current Assets − Current Liabilities)/Total Assets,

- B = Retained Earnings/Total Assets,

- C = Earnings Before Interest and Taxes/Total Assets, and

- D = Book Value of Equity/Total Liabilities.

- = distance r from the r′-group,

- = distance of i object from i′ object,

- = number of elements in group r,

- z = number of groups.

3. Results

3.1. Ratio Analysis and Student’s T-Test

3.2. Altman Model

3.3. Cluster Analysis

4. Discussion

5. Conclusions

Funding

Conflicts of Interest

Nomenclature

| FF | fossil fuels |

| RES | renewable energy sector |

| RER | renewable energy resources |

| EMIS | Emerging Markets Information Service |

| NAICS | North American Industry Classification System |

| ROA | return on assets |

| DR | debt ratio |

| SWC | size of working capital |

| CR | current ratio |

| TAT | total asset turnover |

| ETL | EBIT to total liabilities ratio |

| DSI | days sales in inventory |

| ETA | EBIT to total assets ratio |

| CFA | capital to fixed asset ratio |

| CaR | cash ratio |

| ETS | EBIT to sales ratio |

| DSO | days sales outstanding |

| QR | quick ratio |

| ROE | return on equity |

| DPO | days payable outstanding |

| LTA | logarithm of total assets |

Appendix A

| Ratio | M 0 | M 1 | t-Value | df | p | Valid N 0 | Valid N 1 | Std. Dev. 0 | Std. Dev. 1 | F-ratio Variances | p Variances |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 0.05 | 0.03 | 1.03 | 24.00 | 0.31 | 15.00 | 11.00 | 0.07 | 0.03 | 6.47 | 0.01 |

| DR | 0.50 | 0.49 | 0.10 | 25.0 | 0.92 | 16.00 | 11.00 | 0.18 | 0.17 | 1.12 | 0.88 |

| SWC | 0.06 | 0.07 | −0.16 | 24.00 | 0.88 | 16.00 | 10.00 | 0.16 | 0.09 | 2.75 | 0.13 |

| CR | 1.62 | 1.28 | 0.98 | 24.00 | 0.34 | 16.00 | 10.00 | 0.94 | 0.71 | 1.77 | 0.39 |

| TAT | 0.51 | 0.50 | 0.03 | 23.00 | 0.98 | 14.00 | 11.00 | 0.24 | 0.27 | 1.30 | 0.65 |

| ETL | 0.07 | 0.11 | −0.70 | 24.00 | 0.49 | 15.00 | 11.00 | 0.18 | 0.12 | 2.22 | 0.21 |

| DSI | 27 | 24 | 0.40 | 25.00 | 0.69 | 16.00 | 11.00 | 21.34 | 19.38 | 1.21 | 0.77 |

| ETA | 0.06 | 0.04 | 0.51 | 25.00 | 0.61 | 16.00 | 11.00 | 0.08 | 0.03 | 8.27 | 0.00 |

| CFA | 1.11 | 1.05 | 0.60 | 25.00 | 0.56 | 16.00 | 11.00 | 0.27 | 0.28 | 1.03 | 0.93 |

| CaR | 0.71 | 0.90 | −0.63 | 25.00 | 0.54 | 16.00 | 11.00 | 0.73 | 0.83 | 1.30 | 0.63 |

| ETS | 0.11 | 0.09 | 0.59 | 24.00 | 0.56 | 15.00 | 11.00 | 0.11 | 0.05 | 6.29 | 0.01 |

| DSO | 54 | 56 | −0.20 | 24.00 | 0.84 | 15.00 | 11.00 | 33.30 | 25.94 | 1.65 | 0.43 |

| QR | 0.81 | 0.84 | −0.10 | 23.00 | 0.92 | 15.00 | 10.00 | 0.55 | 0.51 | 1.18 | 0.83 |

| ROE | 0.07 | 0.05 | 0.37 | 22.00 | 0.71 | 13.00 | 11.00 | 0.09 | 0.06 | 2.25 | 0.21 |

| DPO | 139 | 119 | 0.57 | 24.00 | 0.57 | 16.00 | 10.00 | 104.01 | 38.51 | 7.30 | 0.00 |

| LTA | 5.30 | 6.06 | −2.39 | 25.00 | 0.02 | 16.00 | 11.00 | 0.63 | 1.02 | 2.67 | 0.08 |

| Ratio | M 0 | M 1 | t-Value | df | p | Valid N 0 | Valid N 1 | Std. Dev. 0 | Std. Dev. 1 | F-ratio Variances | p Variances |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 0.06 | 0.03 | 1.69 | 27 | 0.10 | 17 | 12 | 0.07 | 0.03 | 6.06 | 0.00 |

| DR | 0.52 | 0.50 | 0.25 | 27 | 0.81 | 17 | 12 | 0.21 | 0.19 | 1.24 | 0.73 |

| SWC | 0.08 | 0.06 | 0.42 | 25 | 0.68 | 16 | 11 | 0.14 | 0.09 | 2.35 | 0.17 |

| CR | 1.48 | 1.18 | 1.11 | 25 | 0.28 | 16 | 11 | 0.73 | 0.56 | 1.72 | 0.39 |

| TAT | 0.63 | 0.51 | 1.50 | 25 | 0.15 | 15 | 12 | 0.18 | 0.23 | 1.62 | 0.39 |

| ETL | 0.15 | 0.11 | 0.80 | 26 | 0.43 | 16 | 12 | 013 | 0.11 | 1.53 | 0.48 |

| DSI | 26 | 22 | 0.61 | 27 | 0.55 | 17 | 12 | 17.60 | 17.60 | 1.00 | 0.97 |

| ETA | 0.09 | 0.05 | 1.61 | 27 | 0.12 | 17 | 12 | 0.08 | 0.04 | 5.06 | 0.01 |

| CFA | 1.09 | 1.03 | 0.63 | 27 | 0.53 | 17 | 12 | 0.29 | 0.25 | 1.39 | 0.59 |

| CaR | 0.61 | 0.63 | −0.08 | 26 | 0.94 | 17 | 11 | 0.62 | 0.38 | 2.75 | 0.11 |

| ETS | 0.14 | 0.09 | 1.44 | 27 | 0.16 | 17 | 12 | 0.10 | 0.06 | 2.95 | 0.07 |

| DSO | 50 | 49 | 0.03 | 26 | 0.98 | 16 | 12 | 26.36 | 21.99 | 1.44 | 0.55 |

| QR | 0.85 | 0.77 | 0.39 | 25 | 0.70 | 16 | 11 | 056 | 0.39 | 2.08 | 0.24 |

| ROE | 0.11 | 0.06 | 1.23 | 25 | 023 | 15 | 12 | 0.12 | 0.08 | 2.32 | 0.17 |

| DPO | 109 | 122 | −0.44 | 29 | 0.66 | 20 | 11 | 84.69 | 62.00 | 1.87 | 0.31 |

| LTA | 5.24 | 6.08 | −2.88 | 30 | 0.01 | 20 | 12 | 0.65 | 1.00 | 2.33 | 0.10 |

| Ratio | M 0 | M 1 | t-Value | df | p | Valid N 0 | Valid N 1 | Std. Dev. 0 | Std. Dev. 1 | F-ratio Variances | p Variances |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 001 | −0.08 | 1.57 | 28 | 0.13 | 18 | 12 | 0.14 | 0.16 | 1.28 | 0.63 |

| DR | 0.58 | 0.52 | 0.64 | 28 | 0.53 | 18 | 12 | 0.24 | 0.24 | 1.01 | 1.00 |

| SWC | −0.02 | 0.00 | −0.15 | 28 | 0.88 | 18 | 12 | 0.26 | 0.28 | 1.17 | 0.74 |

| CR | 1.45 | 1.27 | 0.53 | 27 | 0.60 | 18 | 11 | 0.91 | 0.92 | 1.03 | 0.92 |

| TAT | 0.64 | 0.54 | 1.18 | 26 | 0.25 | 16 | 12 | 0.21 | 0.23 | 1.22 | 0.71 |

| ETL | 0.05 | −0.05 | 0.97 | 27 | 0.34 | 17 | 12 | 0.23 | 0.34 | 2.19 | 0.15 |

| DSI | 32 | 27 | 057 | 27 | 0.57 | 17 | 12 | 25.83 | 18.07 | 2.04 | 0.23 |

| ETA | 0.02 | −0.06 | 1.42 | 28 | 0.17 | 18 | 12 | 0.15 | 0.19 | 1.63 | 0.36 |

| CFA | 0.99 | 1.04 | −0.33 | 28 | 0.74 | 18 | 12 | 0.42 | 0.34 | 1.50 | 0.50 |

| CaR | 0.54 | 0.62 | −0.36 | 27 | 0.72 | 18 | 11 | 0.61 | 0.67 | 1.23 | 0.68 |

| ETS | 0.06 | −0.11 | 1.74 | 28 | 0.09 | 18 | 12 | 0.20 | 0.32 | 2.45 | 0.09 |

| DSO | 48 | 40 | 0.86 | 27 | 0.40 | 17 | 12 | 27.89 | 20.08 | 1.93 | 0.27 |

| QR | 0.90 | 1 | 0.23 | 27 | 0.82 | 18 | 11 | 0.67 | 0.70 | 1.08 | 0.85 |

| ROE | 0.06 | −0.24 | 1.63 | 27 | 0.12 | 17 | 12 | 0.46 | 0.51 | 1.23 | 0.69 |

| DPO | 126 | 102 | 0.93 | 27 | 0.36 | 18 | 11 | 76.62 | 56.08 | 1.87 | 0.32 |

| LTA | 5.25 | 6.06 | −2.61 | 28 | 0.01 | 18 | 12 | 0.69 | 1.01 | 2.13 | 0.16 |

| Ratio | M 0 | M 1 | t-Value | df | p | Valid N 0 | Valid N 1 | Std. Dev. 0 | Std. Dev. 1 | F-ratio Variances | p Variances |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 0.05 | 0.03 | 0.94 | 26 | 0.36 | 16 | 12 | 0.06 | 0.04 | 1.95 | 0.27 |

| DR | 0.53 | 0.48 | 0.59 | 27 | 0.56 | 17 | 12 | 0.20 | 0.23 | 1.35 | 0.57 |

| SWC | 0.00 | 0.02 | −0.33 | 27 | 0.74 | 17 | 12 | 0.23 | 0.23 | 1.06 | 0.89 |

| CR | 1.40 | 1.40 | −0.01 | 26 | 0.99 | 17 | 11 | 0.85 | 0.74 | 1.31 | 0.68 |

| TAT | 0.70 | 0.55 | 1.87 | 26 | 0.07 | 16 | 12 | 0.23 | 0.19 | 1.49 | 0.51 |

| ETL | 0.10 | 0.13 | −0.66 | 24 | 0.52 | 15 | 11 | 0.12 | 0.13 | 1.28 | 0.65 |

| DSI | 36 | 29 | 0.82 | 27 | 0.42 | 17 | 12 | 27.87 | 17.77 | 2.46 | 0.13 |

| ETA | 0.05 | 0.05 | 0.13 | 25 | 0.90 | 15 | 12 | 0.05 | 0.04 | 1.73 | 0.37 |

| CFA | 1.02 | 1.00 | 0.14 | 27 | 0.89 | 17 | 12 | 0.36 | 0.36 | 1.03 | 099 |

| CaR | 0.40 | 0.80 | −1.80 | 25 | 0.08 | 17 | 10 | 0.52 | 0.59 | 1.29 | 0.63 |

| ETS | 008 | 0.10 | −0.34 | 26 | 0.74 | 16 | 12 | 0.09 | 0.08 | 1.16 | 0.82 |

| DSO | 47 | 37 | 1.24 | 24 | 0.23 | 15 | 11 | 24.11 | 13.96 | 2.98 | 0.09 |

| QR | 0.77 | 1 | −1.19 | 25 | 0.25 | 17 | 10 | 0.58 | 0.56 | 1.08 | 0.94 |

| ROE | 0.10 | 0.04 | 1.24 | 26 | 0.23 | 16 | 12 | 0.13 | 0.13 | 1.10 | 0.89 |

| DPO | 108 | 90 | 107 | 25 | 0.29 | 16 | 11 | 44.46 | 37.45 | 1.41 | 0.59 |

| LTA | 5.41 | 610 | −2.42 | 27 | 0.02 | 17 | 12 | 0.51 | 1.02 | 4.08 | 0.01 |

| Ratio | M 0 | M 1 | t-Value | df | p | Valid N 0 | Valid N 1 | Std. Dev. 0 | Std. Dev. 1 | F-ratio Variances | p Variances |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 0.03 | 0.03 | −0.02 | 25 | 0.98 | 15 | 12 | 0.05 | 0.03 | 1.98 | 0.26 |

| DR | 0.47 | 0.45 | 0.22 | 29 | 0.83 | 19 | 12 | 0.20 | 0.23 | 1.31 | 0.59 |

| SWC | 0.07 | 0.00 | 0.81 | 29 | 0.42 | 19 | 12 | 0.24 | 0.22 | 1.16 | 0.82 |

| CR | 1.27 | 1.24 | 0.12 | 26 | 0.91 | 17 | 11 | 0.64 | 0.68 | 1.12 | 0.81 |

| TAT | 0.69 | 0.54 | 1.51 | 28 | 0.14 | 18 | 12 | 0.32 | 0.19 | 2.98 | 0.07 |

| ETL | 0.07 | 0.15 | −1.10 | 26 | 0.28 | 16 | 12 | 0.20 | 0.11 | 3.49 | 0.04 |

| DSI | 40 | 30 | 0.96 | 29 | 0.35 | 19 | 12 | 33.60 | 19.18 | 3.07 | 0.06 |

| ETA | 0.03 | 0.05 | −0.81 | 26 | 0.43 | 16 | 12 | 0.08 | 0.04 | 3.80 | 0.03 |

| CFA | 1.03 | 1.02 | 0.08 | 27 | 0.94 | 17 | 12 | 0.22 | 0.25 | 1.36 | 0.56 |

| CaR | 0.23 | 0.54 | −2.45 | 26 | 0.02 | 17 | 11 | 0.25 | 0.42 | 2.82 | 0.06 |

| ETS | 0.06 | 0.10 | −0.77 | 29 | 0.45 | 19 | 12 | 0.18 | 0.10 | 3.61 | 0.03 |

| DSO | 46 | 42 | 0.59 | 26 | 0.56 | 16 | 12 | 15.06 | 18.99 | 1.59 | 0.40 |

| QR | 0.59 | 0.79 | −1.22 | 26 | 0.23 | 17 | 11 | 0.43 | 0.44 | 1.06 | 0.88 |

| ROE | 0.07 | 0.07 | −0.06 | 27 | 0.96 | 17 | 12 | 0.16 | 0.10 | 2.59 | 0.12 |

| DPO | 116 | 99 | 0.85 | 28 | 0.40 | 19 | 11 | 59.34 | 38.79 | 2.34 | 0.17 |

| LTA | 5.42 | 6.13 | −2.60 | 29 | 0.01 | 19 | 12 | 0.51 | 1.02 | 4.03 | 0.01 |

| Ratio | M 0 | M 1 | t-Value | df | p | Valid N 0 | Valid N 1 | Std. Dev. 0 | Std. Dev. 1 | F-ratio Variances | p Variances |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 0.07 | 0.03 | 2.38 | 27 | 0.02 | 17 | 12 | 0.05 | 0.03 | 3.20 | 0.06 |

| DR | 0.45 | 0.44 | 0.12 | 30 | 0.91 | 20 | 12 | 0.22 | 0.25 | 1.33 | 0.57 |

| SWC | 0.04 | 0.06 | −0.72 | 27 | 0.48 | 18 | 11 | 0.11 | 0.08 | 1.88 | 0.31 |

| CR | 1.39 | 1.25 | 0.60 | 27 | 0.55 | 18 | 11 | 0.60 | 0.61 | 1.04 | 0.91 |

| TAT | 0.78 | 0.58 | 1.79 | 30 | 0.08 | 20 | 12 | 0.35 | 0.21 | 2.72 | 0.09 |

| ETL | 0.21 | 0.16 | 0.93 | 27 | 0.36 | 17 | 12 | 0.16 | 0.09 | 2.95 | 0.07 |

| DSI | 38 | 28 | 0.96 | 30 | 0.35 | 20 | 12 | 32.75 | 17.55 | 3.48 | 0.04 |

| ETA | 0.07 | 0.05 | 0.59 | 30 | 0.56 | 20 | 12 | 0.09 | 0.03 | 10.44 | 0.00 |

| CFA | 1.07 | 1.08 | −0.20 | 26 | 0.85 | 17 | 11 | 0.12 | 0.10 | 1.35 | 0.65 |

| CaR | 0.28 | 0.57 | −2.26 | 27 | 0.03 | 18 | 11 | 0.26 | 0.43 | 2.75 | 0.06 |

| ETS | 0.12 | 0.11 | 0.19 | 30 | 0.85 | 20 | 12 | 0.13 | 0.11 | 1.58 | 0.44 |

| DSO | 61 | 44 | 1.49 | 29 | 0.15 | 19 | 12 | 34.30 | 21.77 | 2.48 | 0.13 |

| QR | 0.76 | 0.82 | −0.34 | 28 | 0.73 | 19 | 11 | 0.52 | 0.45 | 1.32 | 0.67 |

| ROE | 0.13 | 0.06 | 1.18 | 30 | 0.25 | 20 | 12 | 0.21 | 0.07 | 9.65 | 0.00 |

| DPO | 107 | 94 | 0.67 | 29 | 051 | 20 | 11 | 57.43 | 36.87 | 2.43 | 0.15 |

| LTA | 5.42 | 6.09 | −2.53 | 30 | 0.02 | 20 | 12 | 0.48 | 1.00 | 4.30 | 0.01 |

| Ratio | M 0 | M 1 | t-Value | df | p | Valid N 0 | Valid N 1 | Std. Dev. 0 | Std. Dev. 1 | F-ratio Variances | p Variances |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 0.08 | 0.06 | 0.69 | 25 | 0.50 | 16 | 11 | 0.07 | 0.03 | 5.21 | 0.01 |

| DR | 0.45 | 0.40 | 0.60 | 27 | 0.55 | 18 | 11 | 0.19 | 0.21 | 1.18 | 0.74 |

| SWC | 0.05 | 0.04 | 0.12 | 27 | 0.91 | 18 | 11 | 0.23 | 0.17 | 1.90 | 0.30 |

| CR | 1.51 | 1.34 | 0.55 | 26 | 0.59 | 18 | 10 | 0.77 | 0.71 | 1.16 | 0.86 |

| TAT | 0.80 | 0.71 | 0.88 | 25 | 0.38 | 16 | 11 | 0.26 | 0.23 | 1.30 | 0.69 |

| ETL | 0.29 | 0.22 | 0.85 | 25 | 0.41 | 16 | 11 | 0.25 | 0.12 | 4.67 | 0.02 |

| DSI | 34 | 26 | 1.01 | 27 | 0.32 | 18 | 11 | 22.27 | 17.16 | 1.68 | 0.40 |

| ETA | 0.10 | 0.08 | 0.86 | 25 | 0.40 | 16 | 11 | 0.08 | 0.03 | 5.92 | 0.01 |

| CFA | 1.08 | 1.06 | 0.18 | 25 | 0.86 | 16 | 11 | 0.17 | 0.21 | 1.52 | 0.45 |

| CaR | 0.49 | 0.68 | −0.96 | 26 | 0.35 | 18 | 10 | 0.43 | 0.58 | 1.78 | 0.29 |

| ETS | 0.09 | 0.12 | −0.53 | 27 | 0.60 | 18 | 11 | 0.19 | 0.07 | 7.97 | 0.00 |

| DSO | 53 | 29 | 2.70 | 27 | 0.01 | 18 | 11 | 26.02 | 18.38 | 2.00 | 0.26 |

| QR | 0.89 | 0.98 | −0.37 | 26 | 0.72 | 18 | 10 | 0.59 | 0.66 | 1.26 | 0.65 |

| ROE | 0.15 | 0.11 | 0.84 | 25 | 0.41 | 16 | 11 | 0.15 | 0.06 | 6.90 | 0.00 |

| DPO | 109 | 92 | 0.77 | 27 | 0.45 | 18 | 11 | 59.68 | 51.54 | 1.34 | 0.65 |

| LTA | 5.40 | 6,16 | −3.01 | 27 | 0.01 | 18 | 11 | 0.46 | 0.90 | 3.77 | 0.02 |

| Ratio | M 0 | M 1 | t-Value | df | p | Valid N 0 | Valid N 1 | Std. Dev. 0 | Std. Dev. 1 | F-ratio Variances | p Variances |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 0.08 | 0.04 | 1.95 | 28 | 0.06 | 19 | 11 | 0.06 | 0.02 | 7.09 | 0.00 |

| DR | 0.40 | 0.35 | 0.86 | 30 | 0.40 | 21 | 11 | 0.16 | 0.16 | 1.03 | 1.00 |

| SWC | 0.12 | 0.09 | 0.66 | 28 | 0.52 | 20 | 10 | 0.12 | 0.08 | 2.24 | 0.22 |

| CR | 1.75 | 1.53 | 0.74 | 28 | 0.47 | 20 | 10 | 0.74 | 0.80 | 1.17 | 0.74 |

| TAT | 0.74 | 0.59 | 1.46 | 29 | 0.16 | 20 | 11 | 0.30 | 0.19 | 2.44 | 0.15 |

| ETL | 0.26 | 0.22 | 0.62 | 27 | 0.54 | 18 | 11 | 0.19 | 0.09 | 4.05 | 0.03 |

| DSI | 30 | 29 | 0.05 | 30 | 0.96 | 21 | 11 | 20.01 | 22.29 | 1.24 | 0.65 |

| ETA | 0.11 | 0.07 | 1.66 | 28 | 0.11 | 19 | 11 | 0.08 | 0.03 | 6.93 | 0.00 |

| CFA | 1.12 | 1.07 | 0.54 | 30 | 0.59 | 21 | 11 | 0.30 | 0.17 | 2.91 | 0.09 |

| CaR | 0.71 | 0.78 | -0.33 | 28 | 0.74 | 20 | 10 | 0.53 | 0.68 | 1.63 | 0.35 |

| ETS | 0.14 | 0.12 | 0.63 | 29 | 0.53 | 20 | 11 | 0.12 | 0.05 | 5.32 | 0.01 |

| DSO | 49 | 43 | 0.82 | 29 | 0.42 | 20 | 11 | 21.17 | 17.84 | 1.41 | 0.59 |

| QR | 1.08 | 1.04 | 0.17 | 28 | 0.87 | 20 | 10 | 0.63 | 0.63 | 1.00 | 0.94 |

| ROE | 0.13 | 0.07 | 1.92 | 27 | 0.07 | 18 | 11 | 0.10 | 0.04 | 5.18 | 0.01 |

| DPO | 81 | 90 | −0.66 | 28 | 0.52 | 20 | 10 | 38.43 | 33.54 | 1.31 | 0.70 |

| LTA | 5.46 | 6.28 | −3.07 | 30 | 0.00 | 21 | 11 | 0.43 | 1.07 | 6.29 | 0.00 |

| Ratio | M 0 | M 1 | t-Value | df | p | Valid N 0 | Valid N 1 | Std. Dev. 0 | Std. Dev. 1 | F-ratio Variances | p Variances |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 0.07 | 0.04 | 1.56 | 29 | 0.13 | 21 | 10 | 0.05 | 0.04 | 1.98 | 0.29 |

| DR | 0.40 | 0.31 | 1.33 | 30 | 0.19 | 22 | 10 | 0.19 | 0.14 | 1.81 | 0.36 |

| SWC | 0.13 | 0.06 | 1.18 | 30 | 0.25 | 22 | 10 | 0.16 | 0.08 | 3.83 | 0.04 |

| CR | 2.17 | 1.52 | 1.19 | 30 | 0.24 | 22 | 10 | 1.66 | 0.62 | 7.26 | 0.00 |

| TAT | 0.65 | 0.55 | 1.13 | 29 | 0.27 | 21 | 10 | 0.26 | 0.15 | 2.90 | 0.10 |

| ETL | 0.29 | 0.25 | 0.72 | 29 | 0.48 | 21 | 10 | 0.19 | 0.12 | 2.56 | 0.15 |

| DSI | 48 | 26 | 1.77 | 30 | 0.09 | 22 | 10 | 35.46 | 17.80 | 3.97 | 0.04 |

| ETA | 0.11 | 0.07 | 1.68 | 30 | 0.10 | 22 | 10 | 0.08 | 0.05 | 2.59 | 0.14 |

| CFA | 1.21 | 1.03 | 1.72 | 30 | 0.10 | 22 | 10 | 0.30 | 0.21 | 2.13 | 0.24 |

| CaR | 0.82 | 0.75 | 0.21 | 29 | 0.84 | 21 | 10 | 1.07 | 0.59 | 3.28 | 0.07 |

| ETS | 0.16 | 0.14 | 0.63 | 29 | 0.53 | 21 | 10 | 0.09 | 0.10 | 1.13 | 0.78 |

| DSO | 56 | 47 | 1.23 | 30 | 0.23 | 22 | 10 | 22.90 | 9.88 | 5.37 | 0.01 |

| QR | 1.51 | 1.02 | 1.01 | 30 | 0.32 | 22 | 10 | 1.50 | 0.55 | 7.54 | 0.00 |

| ROE | 0.14 | 0.07 | 1.71 | 30 | 0.10 | 22 | 10 | 0.12 | 0.08 | 2.62 | 0.14 |

| DPO | 100 | 103 | −0.16 | 30 | 0.88 | 22 | 10 | 51.30 | 31.84 | 2.60 | 0.14 |

| LTA | 5.56 | 6.35 | −2.86 | 30 | 0.01 | 22 | 10 | 0.48 | 1.09 | 5.07 | 0.00 |

| Ratio | M 0 | M 1 | t-Value | df | p | Valid N 0 | Valid N 1 | Std. Dev. 0 | Std. Dev. 1 | F-ratio Variances | p Variances |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 0.10 | 0.03 | 2.67 | 28 | 0.01 | 20 | 10 | 0.07 | 0.03 | 7.36 | 0.00 |

| DR | 0.39 | 0.35 | 0.58 | 28 | 0.57 | 20 | 10 | 0.18 | 0.17 | 1.11 | 0.92 |

| SWC | 0.13 | 0.05 | 1.27 | 28 | 0.21 | 20 | 10 | 0.19 | 0.09 | 4.46 | 0.03 |

| CR | 1.46 | 1.39 | 0.27 | 24 | 0.79 | 16 | 10 | 0.60 | 0.65 | 1.16 | 0.77 |

| TAT | 0.86 | 0.66 | 1.57 | 28 | 0.13 | 20 | 10 | 0.38 | 0.22 | 3.08 | 0.09 |

| ETL | 0.29 | 0.20 | 1.15 | 27 | 0.26 | 19 | 10 | 0.20 | 0.19 | 1.05 | 0.98 |

| DSI | 33 | 25 | 0.84 | 28 | 0.41 | 20 | 10 | 26.00 | 22.54 | 1.33 | 0.68 |

| ETA | 0.11 | 0.05 | 2.31 | 27 | 0.03 | 19 | 10 | 0.07 | 0.04 | 3.05 | 0.09 |

| CFA | 1.10 | 1.01 | 1.28 | 26 | 0.21 | 18 | 10 | 0.16 | 0.19 | 1.47 | 0.48 |

| CaR | 0.49 | 0.66 | −0.79 | 24 | 0.44 | 16 | 10 | 0.49 | 0.60 | 1.47 | 0.49 |

| ETS | 0.13 | 0.08 | 1.56 | 27 | 0.13 | 19 | 10 | 0.08 | 0.07 | 1.33 | 0.68 |

| DSO | 45 | 42 | 0.34 | 27 | 0.74 | 19 | 10 | 20.54 | 10.75 | 3.65 | 0.05 |

| QR | 1.33 | 0.90 | 1.06 | 27 | 0.30 | 19 | 10 | 1.21 | 0.59 | 4.31 | 0.03 |

| ROE | 0.17 | 0.05 | 2.72 | 28 | 0.01 | 20 | 10 | 0.13 | 0.05 | 7.21 | 0.00 |

| DPO | 77 | 96 | −1.29 | 28 | 0.21 | 20 | 10 | 39.01 | 38.97 | 1.00 | 1.00 |

| LTA | 5.47 | 6.30 | −2.99 | 28 | 0.01 | 20 | 10 | 0.44 | 1.10 | 6.38 | 0.00 |

References

- Aslani, A.; Mohaghar, A. Business structure in renewable energy industry: Key areas. Renew. Sustain. Energy Rev. 2013, 27, 569–575. [Google Scholar] [CrossRef]

- Doumpos, M.; Andriosopoulos, K.; Galariotis, E.; Makridou, G.; Zopounidis, C. Corporate failure prediction in the European energy sector: A multicriteria approach and the effect of country characteristics. Eur. J. Oper. Res. 2017, 262, 347–360. [Google Scholar] [CrossRef]

- The International Energy Agency. Available online: https://www.iea.org/statistics (accessed on 14 August 2019).

- The National Renewable Energy Action Plan of Czech. Republic, Estonia, Hungary, Lithuania, Latvia, Poland, Slovakia and Slovenia. Available online: http://ec.europa.eu/energy/renewables (accessed on 14 August 2019).

- Trück, S.; Weron, R. Convenience yields and risk premiums in the EU-ETS—Evidence from the Kyoto commitment period. J. Futures Mark. 2016, 36, 587–611. [Google Scholar] [CrossRef]

- Bohl, M.T.; Kaufmann, P.; Stephan, P.M. From hero to zero: Evidence of performance reversal and speculative bubbles in German renewable energy stocks. Energy Econ. 2013, 37, 40–51. [Google Scholar] [CrossRef] [Green Version]

- Henriques, I.; Sadorsky, P. Oil prices and the stock prices of alternative energy companies. Energy Econ. 2008, 30, 998–1010. [Google Scholar] [CrossRef]

- Inchauspe, J.; Ripple, R.D.; Truck, S. The dynamics of returns on renewable energy companies: A state-space approach. Energy Econ. 2015, 48, 325–335. [Google Scholar] [CrossRef]

- Kumar, S.; Managi, S.; Matsuda, A. Stock prices of clean energy firms, oil and carbon markets: A vector autoregressive analysis. Energy Econ. 2012, 34, 215–226. [Google Scholar] [CrossRef]

- Managi, S.; Okimoto, T. Does the price of oil interact with clean energy prices in the stock market? Japan World Econ. 2013, 27, 1–9. [Google Scholar] [CrossRef] [Green Version]

- Maryniak, P.; Trück, S.; Weron, R. Carbon pricing and electricity markets—The case of the Australian Clean Energy Bill. Energy Econ. 2019, 79, 45–58. [Google Scholar] [CrossRef]

- Capece, G.; Cricelli, L.; Di Pillo, F.; Levialdi, N. A cluster analysis study based on profitability and financial indicators in the Italian gas retail market. Energy Policy 2010, 38, 3394–3402. [Google Scholar] [CrossRef]

- Capece, G.; Cricelli, L.; Di Pillo, F.; Levialdi, N. New regulatory policies in Italy: Impact on financial results, on liquidity and profitability of natural gas retail companies. Util. Policy 2012, 23, 90–98. [Google Scholar] [CrossRef]

- Halkos, G.E.; Tzeremes, N.G. Analyzing the Greek renewable energy sector: A Data Envelopment Analysis approach. Renew. Sustain. Energy Rev. 2012, 16, 2884–2893. [Google Scholar] [CrossRef]

- Paun, D. Sustainability and financial performance of companies in the energy sector in Romania. Sustainability 2017, 9, 1722. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Does it really pay to be green? Determinants and consequences of proactive environmental strategies. J. Account. Public Policy 2011, 30, 122–144. [Google Scholar] [CrossRef]

- Ruggiero, S.; Lehkonen, H. Renewable energy growth and the financial performance of electric utilities: A panel data study. J. Clean. Prod. 2017, 142, 3676–3688. [Google Scholar] [CrossRef] [Green Version]

- Sueyoshi, T.; Goto, M. Can environmental investment and expenditure enhance financial performance of US electric utility firms under the Clean Air Act amendment of 1990? Energy Policy 2009, 37, 4819–4826. [Google Scholar] [CrossRef]

- Telle, K. “It pays to be green”—A premature conclusion? Environ. Resour. Econ. 2006, 35, 195–220. [Google Scholar] [CrossRef]

- Pätäri, S.; Arminen, H.; Tuppura, A.; Jantunen, A. Competitive and responsible? The relationship between corporate social and financial performance in the energy sector. Renew. Sustain. Energy Rev. 2014, 37, 142–154. [Google Scholar] [CrossRef]

- Arslan-Ayaydin, Ö.; Thewissen, J. The financial reward for environmental performance in the energy sector. Energy Environ. 2016, 27, 389–413. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. Data envelopment analysis for environmental assessment: Comparison between public and private ownership in petroleum industry. Eur. J. Oper. Res. 2012, 216, 668–678. [Google Scholar] [CrossRef]

- Jamasb, T.; Pollitt, M.; Triebs, T. Productivity and efficiency of US gas transmission companies: A European regulatory perspective. Energy Policy 2008, 36, 3398–3412. [Google Scholar] [CrossRef] [Green Version]

- Bobinaite, V. Financial sustainability of wind electricity sectors in the Baltic States. Renew. Sustain. Energy Rev. 2015, 47, 794–815. [Google Scholar] [CrossRef]

- Zięba, M.; Tomczak, S.K.; Tomczak, J.M. Ensemble boosted trees with synthetic features generation in application to bankruptcy prediction. Expert Syst. Appl. 2016, 58, 93–101. [Google Scholar] [CrossRef]

- Altman, E.I.; Iwanicz-Drozdowska, M.; Laitinen, E.K.; Suvas, A. Financial distress prediction in an international context: A review and empirical analysis of Altman’s Z-score model. J. Int. Financ. Manag. Account. 2017, 28, 131–171. [Google Scholar] [CrossRef]

- Altman, E.I.; Hotchkiss, E. Corporate Financial Distress and Bankruptcy, 3rd ed.; John Wiley & Sons: Hoboken, NJ, USA, 2006. [Google Scholar]

- Ward, J.H., Jr. Hierarchical grouping to optimize an objective function. J. Am. Stat. Assoc. 1963, 58, 236–244. [Google Scholar] [CrossRef]

- Anderberg, M.R. Cluster Analysis for Applications; Academic Press: New York, NY, USA, 1973. [Google Scholar]

- Everitt, B.S.; Landau, S.; Leese, M. Cluster Analysis; Arnold: London, UK, 2001. [Google Scholar]

- Kaufman, L.; Rousseeuw, P.J. Finding Groups in Data: An Introduction to Cluster Analysis; John Wiley & Sons: New York, NY, USA, 1990. [Google Scholar]

- Tryon, R.C.; Bailey, D.E. Cluster Analysis; McGraw Hill: New York, NY, USA, 1970. [Google Scholar]

| No. | Country | Company | Industry (NAICS) |

|---|---|---|---|

| 1 | Czech Republic | Alpiq Generation (CZ) s.r.o. | Fossil Fuel Electric Power Generation (221,112) |

| 2 | Hungary | Alteo Nyrt. | Wind Electric Power Generation (221,115); Fossil Fuel Electric Power Generation (221,112) |

| 3 | Slovakia | Bratislavska teplarenska, a.s. | Fossil Fuel Electric Power Generation (221,112) |

| 4 | Hungary | Budapesti Eromu Zrt. | Fossil Fuel Electric Power Generation (221,112) |

| 5 | Slovakia | Bytkomfort, s.r.o. | Biomass Electric Power Generation (221,117); Fossil Fuel Electric Power Generation (221,112) |

| 6 | Poland | Cez Skawina S.A. | Fossil Fuel Electric Power Generation (221,112) |

| 7 | Hungary | Dunamenti Eromu Zrt. | Fossil Fuel Electric Power Generation (221,112) |

| 8 | Poland | Elektrocieplownia Chorzow Elcho Sp. z o.o. | Fossil Fuel Electric Power Generation (221,112) |

| 9 | Poland | Elektrocieplownia Zielona Gora S.A. | Fossil Fuel Electric Power Generation (221,112) |

| 10 | Poland | Elektrownia Stalowa Wola S.A. | Fossil Fuel Electric Power Generation (221,112) |

| 11 | Poland | Enea S.A. | Electric Power Generation (22,111) |

| 12 | Poland | Enea Wytwarzanie Sp. z o.o. | Fossil Fuel Electric Power Generation (221,112) |

| 13 | Estonia | Enefit Energiatootmine AS | Wind Electric Power Generation (221,115); Fossil Fuel Electric Power Generation (221,112) |

| 14 | Poland | Energa S.A. | Fossil Fuel Electric Power Generation (221,112); Electric Power Transmission, Control, and Distribution (22,112) |

| 15 | Czech Republic | Energotrans a.s. | Fossil Fuel Electric Power Generation (221,112) |

| 16 | Poland | Kogeneracja S.A. | Fossil Fuel Electric Power Generation (221,112) |

| 17 | Lithuania | Lietuvos elektrine AB | Fossil Fuel Electric Power Generation (221,112) |

| 18 | Hungary | Matrai Eromu Zrt. | Fossil Fuel Electric Power Generation (221,112) |

| 19 | Poland | PGE Elektrownia Opole S.A. | Fossil Fuel Electric Power Generation (221,112) |

| 20 | Poland | PGE Energia Ciepla S.A. | Fossil Fuel Electric Power Generation (221,112) |

| 21 | Poland | PGE S.A. | Biomass Electric Power Generation (221,117); Wind Electric Power Generation (221,115); Fossil Fuel Electric Power Generation (221,112) |

| 22 | Poland | PGE Torun S.A. | Fossil Fuel Electric Power Generation (221,112) |

| 23 | Poland | PGNIG Termika S.A. | Fossil Fuel Electric Power Generation (221,112) |

| 24 | Poland | Polenergia Elektrocieplownia Nowa Sarzyna Sp. z o.o. | Fossil Fuel Electric Power Generation (221,112) |

| 25 | Slovakia | PPC Power, a.s. | Fossil Fuel Electric Power Generation (221,112) |

| 26 | Latvia | Rigas Siltums AS | Fossil Fuel Electric Power Generation (221,112) |

| 27 | Slovakia | Slovenske Elektrarne, a.s. | Solar Electric Power Generation (221,114); Fossil Fuel Electric Power Generation (221,112) |

| 28 | Slovakia | STEFE Banska Bystrica, a.s. | Fossil Fuel Electric Power Generation (221,112) |

| 29 | Poland | Tauron Polska Energia S.A. | Fossil Fuel Electric Power Generation (221,112); Electric Power Transmission, Control, and Distribution (22,112) |

| 30 | Poland | Tauron Wytwarzanie S.A. | Fossil Fuel Electric Power Generation (221,112) |

| 31 | Slovenia | Teb d.o.o. | Solar Electric Power Generation (221,114); Fossil Fuel Electric Power Generation (221,112) |

| 32 | Hungary | Tisza Eromu Kft. | Fossil Fuel Electric Power Generation (221,112) |

| 33 | Poland | Veolia Energia Lodz S.A. | Fossil Fuel Electric Power Generation (221,112) |

| 34 | Poland | Veolia Energia Poznan Zec S.A. | Fossil Fuel Electric Power Generation (221,112) |

| 35 | Hungary | Vertesi Eromu Zrt. | Fossil Fuel Electric Power Generation (221,112) |

| 36 | Poland | Zespol Elektrowni PAK S.A. | Biomass Electric Power Generation (221,117); Fossil Fuel Electric Power Generation (221,112); Electric Power Transmission, Control, and Distribution (22,112) |

| 37 | Slovakia | Zvolenska teplarenska, a.s. | Fossil Fuel Electric Power Generation (221,112) |

| No. | Company | Energy Production from RES in TWh | RES Share in the Structure of Fuels Used to Generate Electricity | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | 2015 | 2016 | 2017 | 2018 | ||

| 1 | Alteo Nyrt. | 0.28 | 0.3 | n.d. | n.d. | 3.40% | 3.40% | n.d. | n.d. |

| 2 | Enefit Energiatootmine AS | 0.36 | 0.38 | 0.4 | n.d. | n.d. | n.d. | n.d. | n.d. |

| 3 | Bytkomfort, s.r.o. | 0.03 | n.d. | n.d. | n.d. | n.d. | n.d. | n.d. | n.d. |

| 4 | Slovenske Elektrarne, a.s. | 4.56 | 4.21 | 4.36 | 3.80 | 12.33% | 11.32% | 10.29% | 9.14% |

| 5 | Teb d.o.o. | 2 × 10−3 | n.d. | n.d. | n.d. | n.d. | n.d. | n.d. | n.d. |

| 6 | Enea S.A. | 0.85 | 0.54 | 1.83 | 2.03 | 16.55% | 19.94% | 17% | 11% |

| 7 | Enea Wytwarzanie Sp. z o.o. | 0.85 | 0.54 | 0.44 | 0.44 | 6.46% | 3.97% | 3% | 2% |

| 8 | Energa S.A. | 1.74 | 1.22 | 1.55 | 1.19 | 41% | 38% | 36% | 31% |

| 9 | PGE S.A. | 2.41 | 2.24 | 2.08 | 1.82 | n.d. | n.d. | 2.13% | n.d. |

| 10 | Tauron Polska Energia S.A. | 1.63 | 1.32 | 1.3 | 0.74 | n.d. | n.d. | n.d. | 11.19% |

| 11 | Tauron Wytwarzanie S.A. | n.d. | n.d. | 1 × 10−4 | n.d. | n.d. | n.d. | n.d. | 1.86% |

| 12 | Zespol Elektrowni PAK S.A. | 0.47 | 0.39 | n.d. | n.d. | n.d. | n.d. | n.d. | n.d. |

| ID | Description | Group |

|---|---|---|

| ROA | net profit/total assets | profitability |

| DR | total liabilities/total assets | debt |

| SWC | working capital/total assets | liquidity |

| CR | current assets/short-term liabilities | liquidity |

| TAT | sales/total assets | turnover |

| ETL | EBIT/total liabilities | debt |

| DSI | (inventory ×365)/sales | turnover |

| ETA | EBIT/total assets | profitability |

| CFA | constant capital/fixed assets | debt |

| CaR | (current assets - inventory - receivables) / short-term liabilities | liquidity |

| ETS | EBIT/sales | profitability |

| DSO | (receivables × 365)/sales | turnover |

| QR | (current assets - inventory)/short-term liabilities | liquidity |

| ROE | net profit/equity | profitability |

| DPO | (short-term liabilities × 365)/sales | turnover |

| LTA | logarithm of total assets | other |

| Ratio | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|---|---|---|

| ROA | no | no | no | no | no | yes | no | no | no | yes |

| DR | no | no | no | no | no | no | no | no | no | no |

| SWC | no | no | no | no | no | no | no | no | no | no |

| CR | no | no | no | no | no | no | no | no | no | no |

| TAT | no | no | no | no | no | no | no | no | no | no |

| ETL | no | no | no | no | no | no | no | no | no | no |

| DSI | no | no | no | no | no | no | no | no | no | no |

| ETA | no | no | no | no | no | no | no | no | no | yes |

| CFA | no | no | no | no | no | no | no | no | no | no |

| CaR | no | no | no | no | yes | yes | no | no | no | no |

| ETS | no | no | no | no | no | no | no | no | no | no |

| DSO | no | no | no | no | no | no | yes | no | no | no |

| QR | no | no | no | no | no | no | no | no | no | no |

| ROE | no | no | no | no | no | no | no | no | no | yes |

| DPO | no | no | no | no | no | no | no | no | no | no |

| LTA | yes | yes | yes | yes | yes | yes | yes | yes | yes | yes |

| Company name | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|---|---|---|

| Alpiq Generation (CZ) | 5.17 | 5.19 | 4.85 | 4.78 | 4.24 | 4.84 | 5.01 | 3.85 | 5.65 | 4.55 |

| Bratislavska teplarenska | 1.71 | 1.62 | 0.67 | 0.10 | −2.23 | 5.02 | 5.23 | 4.68 | 6.94 | 8.87 |

| Budapesti Eromu | 5.84 | 5.47 | −1.87 | 1.26 | 4.81 | 4.28 | −2.62 | 1.92 | 4.84 | 4.39 |

| Cez Skawina | 6.19 | 6.23 | 5.07 | 7.09 | 6.92 | 8.37 | 8.26 | 7.73 | 6.63 | 6.29 |

| Dunamenti Eromu | 5.57 | 6.04 | 0.72 | −5.93 | 3.22 | 4.86 | 5.32 | 6.41 | 9.19 | 10.53 |

| Elektrocieplownia Chorzow Elcho | - | - | - | - | 7.96 | 7.53 | 8.13 | 6.55 | 8.11 | 5.39 |

| Elektrocieplownia Zielona Gora | 6.68 | 5.80 | 5.81 | 5.37 | 6.74 | 6.26 | 6.29 | 6.40 | 6.02 | 5.41 |

| Elektrownia Stalowa Wola | - | - | - | - | - | - | - | 6.52 | 7.27 | 6.87 |

| Energotrans | 10.20 | 10.62 | 12.18 | 11.88 | 17.89 | 17.75 | 13.19 | 15.98 | 14.20 | 15.00 |

| Kogeneracja | 7.14 | 7.06 | 6.38 | 6.16 | 6.28 | 5.64 | 6.27 | 6.21 | 6.24 | 5.71 |

| Matrai Eromu | 8.65 | 10.35 | 8.34 | 8.52 | 8.73 | 8.52 | 8.76 | 7.55 | 7.12 | 6.67 |

| PGE Elektrownia Opole | - | - | - | - | - | - | 3.04 | 5.04 | 5.70 | 5.64 |

| PGE Energia Ciepla | - | 1.51 | 0.91 | 4.29 | 3.11 | 5.68 | 9.55 | 9.06 | 9.06 | 8.70 |

| PGE Torun | - | - | - | - | - | - | 11.61 | 12.13 | 10.30 | 6.35 |

| PGNIG Termika | - | - | - | - | - | - | - | - | 14.79 | 16.85 |

| Polenergia Elektrocieplownia Nowa Sarzyna | 5.44 | 4.78 | 5.55 | 3.86 | 3.34 | 4.17 | 4.38 | 5.99 | 4.95 | 5.67 |

| PPC Power | - | 0.92 | 0.65 | 8.85 | 19.51 | 3.48 | 6.14 | 5.23 | 3.74 | 15.98 |

| Rigas Siltums | 5.63 | 5.79 | 5.91 | 5.79 | 5.98 | 5.70 | - | - | - | - |

| STEFE Banska Bystrica | 4.45 | 3.76 | 4.35 | 4.59 | 4.67 | 4.85 | 4.95 | 5.15 | 5.10 | 5.10 |

| Tisza Eromu | 4.79 | 5.80 | 10.39 | 10.42 | 8.48 | 7.32 | 0.29 | 6.74 | 6.03 | 4.90 |

| Veolia Energia Lodz | 4.55 | 4.66 | 5.15 | 4.48 | 4.67 | 6.64 | 8.14 | 8.55 | 7.93 | 8.07 |

| Veolia Energia Poznan Zec | - | 5.27 | 5.50 | 4.45 | 4.74 | 5.39 | 4.84 | 6.52 | 6.24 | 5.51 |

| Alteo Nyrt | 6.00 | 5.27 | 5.24 | 4.67 | 3.46 | 3.90 | - | - | - | - |

| Bytkomfort | 8.74 | 7.62 | 8.48 | 7.93 | 7.48 | 7.21 | 5.71 | 7.68 | 6.24 | 6.47 |

| Energa | 5.93 | 5.40 | 6.08 | 6.24 | 5.85 | 6.05 | 6.60 | 6.74 | 7.75 | 8.05 |

| Enefit Energiatootmine | 0.51 | 0.80 | −1.71 | −0.14 | 0.67 | 0.05 | 2.75 | 3.61 | - | - |

| Enea Wytwarzanie | 4.89 | 4.65 | 3.98 | 5.69 | 6.60 | 10.49 | 10.58 | 8.92 | 8.42 | 8.03 |

| Enea | 6.08 | 6.39 | 6.07 | 7.93 | 7.99 | 8.61 | 8.93 | 9.54 | 9.30 | 8.90 |

| PGE | 5.98 | 6.35 | 5.78 | 7.53 | 7.80 | 7.67 | 7.42 | 6.98 | 7.77 | 5.93 |

| Slovenske Elektrarne | - | - | - | - | 3.26 | 3.63 | 3.35 | 2.55 | 2.28 | 1.42 |

| Tauron Polska Energia | 4.73 | 4.37 | 2.77 | 4.99 | 4.79 | 4.97 | 5.05 | 5.64 | 5.12 | 4.62 |

| Tauron Wytwarzanie | 3.26 | 2.97 | −0.37 | 3.97 | 4.81 | 4.96 | 5.35 | 5.85 | - | 5.23 |

| Teb | 8.97 | 15.77 | 29.50 | 20.98 | 23.39 | 17.12 | 15.04 | 20.56 | 13.25 | 11.08 |

| Zespol Elektrowni PAK | 5.53 | 5.11 | 0.89 | 5.33 | 5.90 | 5.89 | 6.85 | 6.44 | 6.77 | 4.27 |

| Year | M 0 | M 1 | t-Value | df | p | Valid N 0 | Valid N 1 | Std. Dev. 0 | Std. Dev. 1 | F-ratio Variances | p Variances |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2017 | 5.62 | 5.17 | 0.56 | 25 | 0.58 | 17 | 10 | 1.91 | 2.14 | 1.25 | 0.66 |

| 2016 | 5.42 | 4.89 | 0.59 | 28 | 0.56 | 20 | 10 | 2.44 | 1.92 | 1.63 | 0.46 |

| 2015 | 4.79 | 3.72 | 0.83 | 28 | 0.41 | 20 | 10 | 3.39 | 3.26 | 1.08 | 0.95 |

| 2014 | 5.96 | 5.42 | 0.50 | 27 | 0.62 | 19 | 10 | 2.93 | 2.39 | 1.50 | 0.54 |

| 2013 | 6.66 | 6.83 | −0.09 | 31 | 0.93 | 21 | 12 | 4.75 | 5.63 | 1.41 | 0.49 |

| 2012 | 6.43 | 6.71 | −0.22 | 31 | 0.83 | 21 | 12 | 3.00 | 4.22 | 1.99 | 0.18 |

| 2011 | 6.19 | 7.06 | −0.68 | 31 | 0.50 | 22 | 11 | 3.45 | 3.48 | 1.02 | 0.93 |

| 2010 | 6.73 | 6.39 | 0.32 | 31 | 0.75 | 23 | 10 | 2.96 | 2.16 | 1.89 | 0.33 |

| 2009 | 6.92 | 7.43 | −0.41 | 31 | 0.68 | 24 | 9 | 3.26 | 3.01 | 1.18 | 0.86 |

| 2008 | 7.42 | 6.40 | 0.79 | 32 | 0.44 | 24 | 10 | 3.69 | 2.74 | 1.81 | 0.36 |

| 2017 | 5.62 | 5.17 | 0.56 | 25 | 0.58 | 17 | 10 | 1.91 | 2.14 | 1.25 | 0.66 |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tomczak, S.K. Comparison of the Financial Standing of Companies Generating Electricity from Renewable Sources and Fossil Fuels: A New Hybrid Approach. Energies 2019, 12, 3856. https://doi.org/10.3390/en12203856

Tomczak SK. Comparison of the Financial Standing of Companies Generating Electricity from Renewable Sources and Fossil Fuels: A New Hybrid Approach. Energies. 2019; 12(20):3856. https://doi.org/10.3390/en12203856

Chicago/Turabian StyleTomczak, Sebastian Klaudiusz. 2019. "Comparison of the Financial Standing of Companies Generating Electricity from Renewable Sources and Fossil Fuels: A New Hybrid Approach" Energies 12, no. 20: 3856. https://doi.org/10.3390/en12203856

APA StyleTomczak, S. K. (2019). Comparison of the Financial Standing of Companies Generating Electricity from Renewable Sources and Fossil Fuels: A New Hybrid Approach. Energies, 12(20), 3856. https://doi.org/10.3390/en12203856