Reactive Power Optimization and Price Management in Microgrid Enabled with Blockchain

Abstract

:1. Introduction

- Electricity generation and transmission must be achieved in a cost-effective manner.

- Retrieving the energy consumption using automotive equipment from the consumers in order to monitor and control the billing costs [1].

- Incorporating the renewable energy sources [2] into the existing system and thus reducing the greenhouse gas emissions.

- Providing customers with the efficient, uninterrupted, and secure power service.

- Supporting usage of electric vehicles to reduce the vehicle’s dependence on fuel.

Blockchain Technology

- Multiple parties are involved in energy trading;

- No trusted authority;

- System requires transparency among the producers and consumers;

- Decentralized operation;

- Information once added in the ledger is immutable.

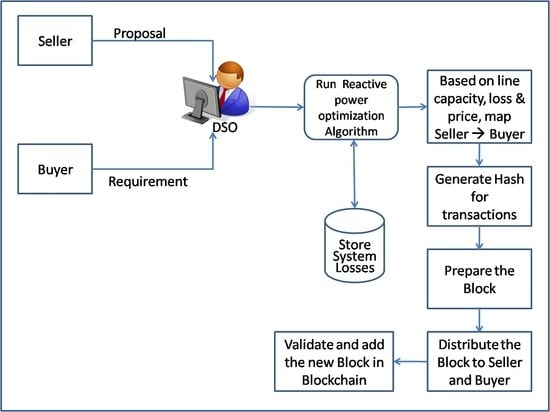

- Power loss is calculated towards each energy transaction using self-balanced differential evolution algorithm (SBDE) optimization algorithm;

- Reactive power at the regulator nodes are optimized, estimated, and priced;

- Transactions such as seller and buyer proposals, losses and seller to buyer mapping are added in the immutable ledger in the blockchain network.

2. Literature Review

2.1. Reactive Power Pricing

2.2. Peer-To-Peer Energy Trading Using Blockchain

3. Proposed Blockchain-Enabled Microgrid Architecture

- For each transaction, calculate the power loss;

- Estimation and remuneration of the amount of reactive power which are necessary at the regulator nodes;

- Use of smart contracts to automatically regulate the transactions between the producers, consumers, and prosumer nodes;

- The writing of active and reactive power transactions in a blockchain.

4. Energy Blockchain

4.1. Consortium Blockchain

4.2. Blockchain Structure

4.3. Process of Energy Trading Using Blockchain

5. Optimal Reactive Power Dispatch

5.1. Self-Balanced Differential Evolution (SBDE)

5.1.1. Initialization

5.1.2. Mutation

5.1.3. Cross Over

5.1.4. Selection

5.2. Cost of Reactive Power Providers

5.3. Static VAr Compensator (SVC)

6. Results and Discussion

- The load 7 acts as a buyer for the power of 100 MW. It can get the power from either generator 1, 2, or 3. DSO matches the best seller for this buyer such that the total system losses should be minimum. Based on the algorithm, it is found that bus 3 acts as a seller bus to meet the load at bus7. The percentage increase in system losses will be 0.53. When generators 1 and 2 act as a seller, the percentage increase in loss will be more.

- From Table 5, it can be found that bus 2 should act as seller bus for load bus 5. The percentage increase in system losses for this case is 5.83. The remaining generators 1 and 3 reduce the system losses; but, the overloading of transmission line comes into the picture. The line flowing from bus 1 to bus 4 gets overloaded when bus 1 acts as seller bus for load 5. When bus 3 acts as seller bus, the transmission line from bus 3 to bus 6 was overloaded. Therefore, the DSO analyzes all the possible cases and identifies the best seller to meet the demand at bus 5.

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Kasperowicz, R.; Štreimikienė, D. Economic Growth and Energy Consumption: Comparative Analysis of V4 and the “Old” EU Countries. J. Int. Stud. 2016, 9, 181–194. [Google Scholar] [CrossRef]

- Yu, Y.; Guo, Y.; Min, W.; Zeng, F. Trusted Transactions In micro-Grid Based on Blockchain. Energies 2019, 12, 1952. [Google Scholar] [CrossRef] [Green Version]

- Hirst, E.; Kirby, B. Costs for Electric-Power Ancillary Services. Electr. J. 1996, 9, 26–30. [Google Scholar] [CrossRef]

- Andrzejewski, M.; Dunal, P.; Popławski, Ł. Impact of Changes in Coal Prices and CO2 Allowances on Power Prices in Selected European Union Countries—Correlation Analysis in the Short-Term Perspective. Acta Montan. Slovaca 2019, 24, 53–62. [Google Scholar]

- Haseeb, M.; Kot, S.; Iqbal Hussain, H.; Kamarudin, F. The Natural Resources Curse-Economic Growth Hypotheses: Quantile–on–Quantile Evidence from Top Asian Economies. J. Clean. Prod. 2021, 279, 123596. [Google Scholar] [CrossRef]

- Shindina, T.; Streimikis, J.; Sukhareva, Y.; Nawrot, Ł. Social and Economic Properties of the Energy Markets. Econ. Sociol. 2018, 11, 334–344. [Google Scholar] [CrossRef]

- Hermann, M.; Pentek, T.; Otto, B. Design principles for industrie 4.0 scenarios. In Proceedings of the 2016 IEEE 49th Hawaii International Conference on System Sciences (HICSS), Koloa, HI, USA, 5–8 January 2016; pp. 3928–3937. [Google Scholar] [CrossRef] [Green Version]

- Kornmesser, S. Theoretizität Im Logischen Empirismus Und Im Strukturalismus-Erläutert Am Fallbeispiel Des Neurobiologischen Konstruktivismus. J. Gen. Philos. Sci. 2008, 39, 53–67. [Google Scholar] [CrossRef]

- Szetela, B.; Mentel, G.; Mentel, U.; Bilan, Y. Directional Movement Distribution in the Bitcoin Markets. Eng. Econ. 2020, 31, 188–196. [Google Scholar] [CrossRef]

- Sander, F.; Semeijn, J.; Mahr, D. The Acceptance of Blockchain Technology in Meat Traceability and Transparency. Br. Food J. 2018, 120, 2066–2079. [Google Scholar] [CrossRef] [Green Version]

- Petersen, O.; Jansson, F. Blockchain Technology in Supply Chain Traceability Systems: Developing a Framework for Evaluating the Applicability. Master’s Thesis, Industrial Engineering and Management, Lund University, Lund, Sweden, 2017; pp. 1–86. [Google Scholar]

- Kot, S.; Goldbach, I.R.; Ślusarczyk, B. Supply Chain Management in SMES—Polish and Romanian Approach. Econ. Sociol. 2018, 14, 142. [Google Scholar] [CrossRef]

- Popovic, T.; Kraslawski, A.; Barbosa-Póvoa, A.; Carvalho, A. Quantitative Indicators for Social Sustainability Assessment of Society and Product Responsibility Aspects in Supply Chains. J. Int. Stud. 2017. [Google Scholar] [CrossRef] [PubMed]

- Liu, C.; Xiao, Y.; Javangula, V.; Hu, Q.; Wang, S.; Cheng, X. NormaChain: A Blockchain-Based Normalized Autonomous Transaction Settlement System for IoT-Based e-Commerce. IEEE Internet Things J. 2019, 6, 4680–4693. [Google Scholar] [CrossRef]

- Lahkani, M.J.; Wang, S.; Urbański, M.; Egorova, M. Sustainable B2B E-Commerce and Blockchain-Based Supply Chain Finance. Sustainability 2020, 12, 3968. [Google Scholar] [CrossRef]

- Knezevic, D. Impact of Blockchain Technology Platform in Changing the Financial Sector and Other Industries. Montenegrin J. Econ. 2018, 14, 109–120. [Google Scholar] [CrossRef]

- Bressmann, T. Self-Inflicted Cosmetic Tongue Split: A Case Report. J. Can. Dent. Assoc. 2004, 70, 156–157. [Google Scholar]

- Di Silvestre, M.L.; Gallo, P.; Ippolito, M.G.; Sanseverino, E.R.; Zizzo, G. A Technical Approach to the Energy Blockchain in Microgrids. IEEE Trans. Ind. Inform. 2018, 14, 4792–4803. [Google Scholar] [CrossRef] [Green Version]

- Saad, M.; Spaulding, J.; Njilla, L.; Kamhoua, C.; Shetty, S.; Nyang, D.H.; Mohaisen, D. Exploring the Attack Surface of Blockchain: A Comprehensive Survey. IEEE Commun. Surv. Tutorials 2020, 22, 1977–2008. [Google Scholar] [CrossRef]

- Wang, W.; Hoang, D.T.; Hu, P.; Xiong, Z.; Niyato, D.; Wang, P.; Wen, Y.; Kim, D.I. A Survey on Consensus Mechanisms and Mining Strategy Management in Blockchain Networks. IEEE Access 2019, 7, 22328–22370. [Google Scholar] [CrossRef]

- Han, D.; Zhang, C.; Ping, J.; Yan, Z. Smart Contract Architecture for Decentralized Energy Trading and Management Based on Blockchains. Energy 2020, 199. [Google Scholar] [CrossRef]

- Sharma, H.; Bansal, J.C.; Arya, K.V. Self Balanced Differential Evolution. J. Comput. Sci. 2014, 5, 312–323. [Google Scholar] [CrossRef]

- Oureilidis, K.; Malamaki, K.N.; Gallos, K.; Tsitsimelis, A.; Dikaiakos, C.; Gkavanoudis, S.; Cvetkovic, M.; Mauricio, J.M.; Ortega, J.M.M.; Ramos, J.L.M.; et al. Ancillary Services Market Design in Distribution Networks: Review and Identification of Barriers. Energies 2020, 13, 917. [Google Scholar] [CrossRef] [Green Version]

- Parida, S.K.; Singh, S.N.; Srivastava, S.C. Reactive Power Cost Allocation by Using a Value-Based Approach. IET Gener. Transm. Distrib. 2009, 3, 872–884. [Google Scholar] [CrossRef]

- Bhattacharya, K.; Zhong, J. Reactive Power as an Ancillary Service. IEEE Trans. Power Syst. 2001, 16, 294–300. [Google Scholar] [CrossRef]

- Da Silva, E.L.; Hedgecock, J.J.; Mello, J.C.; Luz, J.C. Practical Cost-Based Approach for the Voltage Ancillary Service. Proc. IEEE Power Eng. Soc. Transm. Distrib. Conf. 2002, 1, 46. [Google Scholar] [CrossRef]

- Chicco, G.; Gross, G. Competitive Acquisition of Prioritizable Capacity-Based Ancillary Services. IEEE Trans. Power Syst. 2004, 19, 569–576. [Google Scholar] [CrossRef]

- Ebeed, M.; Alhejji, A.; Kamel, S.; Jurado, F. Solving the Optimal Reactive Power Dispatch Using Marine Predators Algorithm Considering the Uncertainties in Load and Wind-Solar Generation Systems. Energies 2020, 13, 4316. [Google Scholar] [CrossRef]

- Muthukumar, R.; Balamurugan, P. A Novel Power Optimized Hybrid Renewable Energy System Using Neural Computing and Bee Algorithm. Automatika 2019, 60, 332–339. [Google Scholar] [CrossRef] [Green Version]

- Li, Z.; Kang, J.; Yu, R.; Ye, D.; Deng, Q.; Zhang, Y. Consortium Blockchain for Secure Energy Trading in Industrial Internet of Things. IEEE Trans. Ind. Inform. 2018, 14, 3690–3700. [Google Scholar] [CrossRef] [Green Version]

- Lüth, A.; Zepter, J.M.; Crespo del Granado, P.; Egging, R. Local Electricity Market Designs for Peer-to-Peer Trading: The Role of Battery Flexibility. Appl. Energy 2018, 229, 1233–1243. [Google Scholar] [CrossRef] [Green Version]

- He, Y.; Li, H.; Cheng, X.; Liu, Y.; Yang, C.; Sun, L. A Blockchain Based Truthful Incentive Mechanism for Distributed P2P Applications. IEEE Access 2018, 6, 27324–27335. [Google Scholar] [CrossRef]

- Son, Y.B.; Im, J.H.; Kwon, H.Y.; Jeon, S.Y.; Lee, M.K. Privacy-Preserving Peer-to-Peer Energy Trading in Blockchain-Enabled Smart Grids Using Functional Encryption. Energies 2020, 16, 1321. [Google Scholar] [CrossRef] [Green Version]

- Monroe, J.G.; Hansen, P.; Sorell, M.; Berglund, E.Z. Agent-Based Model of a Blockchain Enabled Peer-to-Peer Energy Market: Application for a Neighborhood Trial in Perth, Australia. Smart Cities 2020, 3, 53. [Google Scholar] [CrossRef]

- Power Ledger. Available online: https://www.powerledger.io/ (accessed on 5 October 2020).

- Energy, L. Available online: https://lo3energy.com/ (accessed on 5 October 2020).

- Microgrid, B. Available online: https://www.brooklyn.energy/ (accessed on 5 October 2020).

- Wielki, J. The impact of the internet of things concept development on changes in the operations of modern enterprises. Polish J. Manag. Stud. 2017, 15, 262–275. [Google Scholar] [CrossRef]

- Zimmerman, R.D.; Murillo-Sánchez, C.E.; Gan, D. Matpower (PSERC). Available online: http://www.pserc.cornell.edu/matpower (accessed on 21 October 2020).

- Afonasova, M.A.; Panfilova, E.E.; Galichkina, M.A.; Ślusarczyk, B. Digitalization in Economy and Innovation: The Effect on Social and Economic Processes. Polish J. Manag. Stud. 2019, 19, 22–32. [Google Scholar] [CrossRef]

- Ključnikov, A.; Civelek, M.; Vozňáková, I. Can Discounts Expand Local and Digital Currency Awareness of Individuals Depending on Their Characteristics? Oeconomia Copernic. 2020, 11, 239–266. [Google Scholar] [CrossRef]

- Di Silvestre, M.L.; Gallo, P.; Ippolito, M.G.; Musca, R.; Riva Sanseverino, E.; Tran, Q.T.T.; Zizzo, G. Ancillary Services in the Energy Blockchain for Microgrids. IEEE Trans. Ind. Appl. 2019, 55, 7310–7319. [Google Scholar] [CrossRef]

- Danalakshmi, D.; Kannan, S.; Thiruppathy Kesavan, V. Reactive Power Pricing Using Cloud Service Considering Wind Energy. Cluster Comput. 2018, 21, 767–777. [Google Scholar] [CrossRef]

- De, M.; Goswami, S.K. Reactive Power Cost Allocation by Power Tracing Based Method. In Energy Conversion and Management; Elsevier: Belton, TX, USA, 2012; Volume 64, pp. 43–51. [Google Scholar] [CrossRef]

- Tiwari, A.; Ajjarapu, V. Reactive Power Cost Allocation Based On Modified Power Flow Tracing Methodology. In Proceedings of the 2007 IEEE Power Engineering Society General Meeting, Tampa, FL, USA, 24–28 June 2007; pp. 1–7. [Google Scholar] [CrossRef]

- Duman, S.; Sönmez, Y.; Güvenç, U.; Yörükeren, N. Optimal Reactive Power Dispatch Using a Gravitational Search Algorithm. IET Gener. Transm. Distrib. 2012, 6, 563–576. [Google Scholar] [CrossRef]

- Jena, R.; Chirantan, S.; Swain, S.; Panda, P. Load flow analysis and optimal allocation of SVC in nine bus power system. In Proceedings of the 2018 Technologies for Smart-City Energy Security and Power (ICSESP), Bhubaneswar, India, 28–30 March 2018; pp. 1–5. [Google Scholar] [CrossRef]

| Role | Activities | Layer |

|---|---|---|

| Consumer | Purchases the energy and consumes it | Physical Link |

| Producer | Produces the energy and sells it | Physical Link |

| Prosumer | Produces as well as consumes the energy (in the energy network, they are considered either as producer or consumer at a time) | Physical Link |

| DSO | Technically manages the reactive power optimization, pricing and distribution of energy, as well as manages the addition of blocks in the blockchain | Commercial |

| ICT node | Third-party/stakeholder who maintains the blockchain, verifies the related activities, and provides user interface to interact with the system | ICT |

| Parameter | SBDE |

|---|---|

| No. of population | 23 |

| Scaling factor | 0.5 |

| Crossover ratio | 0.4 |

| No. of control variables | 7 |

| Maximum number of iterations | 100 |

| Without SVC | With SVC | |

|---|---|---|

| 285.9 $/h | 57.45 $/h | |

| 71.2 $/h | 12.94 $/h | |

| 22.2 $/h | 3.63 $/h |

| Case 1 | Case 2 | ||||||

|---|---|---|---|---|---|---|---|

| Generator 1 ($/h) | Generator 2 ($/h) | Generator 3 ($/h) | Generator 1 ($/h) | Generator 2 ($/h) | Generator 3 ($/h) | Bus 9-SVC ($/h) | |

| Load 5 | 0 | 0 | 11.043 | 7.136 | 0 | 1.84 | 0 |

| Load 7 | 0 | 0 | 9.14 | 0 | 3.01 | 1.79 | 0 |

| Load 9 | 285.9 | 71.2 | 2.007 | 50.304 | 9.94 | 0 | 287 |

| Total | 285.9 | 71.2 | 22.19 | 57.45 | 12.95 | 3.63 | 287 |

| Load 7 as Buyer Bus (t1 and t4) | Load 5 as Buyer Bus (t2 and t4) | ||

|---|---|---|---|

| Seller Bus | % Increase in Losses | Seller Bus | % Increase in Losses |

| 1 | 3.41 | 1 | 1.07 |

| 2 | 1.46 | 2 | 5.83 |

| 3 | 0.53 | 3 | 4.94 |

| Time Instant | Transactions | SBDE Optimization Algorithm | Case 1 | Case 2 |

|---|---|---|---|---|

| Loss (MW) | Loss (MW) | |||

| t1–t2 | tr1 | With | 4.88 | 4.8 |

| Without | 5.02 | 5.02 | ||

| t2–t3 | tr1 | With | 5.1 | 5.03 |

| Without | 5.54 | 5.4 | ||

| tr2 | With | 4.93 | 4.76 | |

| Without | 4.98 | 4.92 | ||

| t3–t4 | tr1 | With | 4.8 | 4.78 |

| Without | 4.7 | 4.62 | ||

| tr2 | With | 4.9 | 4.759 | |

| Without | 5.1 | 4.8 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

D., D.; R., G.; Hariharasudan, A.; Otola, I.; Bilan, Y. Reactive Power Optimization and Price Management in Microgrid Enabled with Blockchain. Energies 2020, 13, 6179. https://doi.org/10.3390/en13236179

D. D, R. G, Hariharasudan A, Otola I, Bilan Y. Reactive Power Optimization and Price Management in Microgrid Enabled with Blockchain. Energies. 2020; 13(23):6179. https://doi.org/10.3390/en13236179

Chicago/Turabian StyleD., Danalakshmi, Gopi R., A. Hariharasudan, Iwona Otola, and Yuriy Bilan. 2020. "Reactive Power Optimization and Price Management in Microgrid Enabled with Blockchain" Energies 13, no. 23: 6179. https://doi.org/10.3390/en13236179

APA StyleD., D., R., G., Hariharasudan, A., Otola, I., & Bilan, Y. (2020). Reactive Power Optimization and Price Management in Microgrid Enabled with Blockchain. Energies, 13(23), 6179. https://doi.org/10.3390/en13236179