Corporate Governance and Financial Performance: The Interplay of Board Gender Diversity and Intellectual Capital

Abstract

:1. Introduction

2. Literature Review and Hypotheses Development

2.1. BGD and Financial Firm Performance Hypothesis

2.2. BGD and Intellectual Capital Efficiency Hypothesis

2.3. Intellectual Capital Efficiency and Firm Performance Hypothesis

3. Research Methods

3.1. Sample Selection and Data Sources

3.2. Regression Variables

3.3. Empirical Specifications

4. Analysis and Findings

4.1. Descriptive Analysis and Findings

4.2. Inferential Analysis and Findings

4.2.1. The Impact of Board Gender Diversity on Firm Performance: Main Evidence

4.2.2. The Impact of Board Gender Diversity on Firm Performance: Robustness Checks

4.2.3. Alternative Proxies for Firm Performance and Board Gender Diversity

4.2.4. Addressing Endogeneity Concerns

4.2.5. Other Robustness Checks: Alternative Sample Compositions

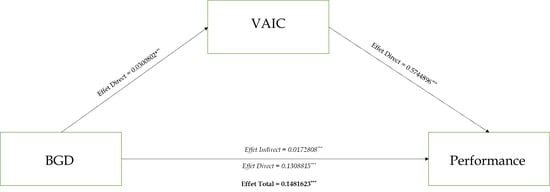

4.3. Board Gender Diversity and Performance: The Mediating Role of Intellectual Capital Efficiency

4.3.1. The Impact of Gender Diversity on Intellectual Capital Efficiency

4.3.2. The Impact of Intellectual Capital Efficiency on Firm Performance

4.3.3. The Mediating Role of Intellectual Capital Efficiency

5. Discussion and Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Variable | Expected Sign | Description | Source |

|---|---|---|---|

| ROA | Return on assets (profitability ratio) calculated as “the ratio of earnings before interest, taxes, depreciation and amortization (EBITDA) to total assets.” | Authors’ calculation based on data from Worldscope | |

| BGD | ? | Percentage of women on the board. | Asset4 ESG |

| CEE | + | Physical capital efficiency measured as the “Value added/capital employed” (where capital employed is the total firms’ capital). | Authors’ calculation based on data from Worldscope |

| HCE | + | Human capital efficiency measured as “Value added/total personnel cost”. | As above |

| SCE | + | Innovation capital efficiency measured as “Value added/structural capital” (structural capital is R&D). | As above |

| VAIC | + | Value-added intellectual. Coefficient Human capital efficiency plus structural capital efficiency plus financial capital efficiency. | As above |

| Size | + | Firm size calculated as the natural log of the total assets in millions of US dollars. | As above |

| Leverage | _ | The firm leverage, which is calculated as “the ratio of total debts to total assets”. | As above |

| Gov | + | The governance quality rating of the company. | Asset4 ESG |

| CEO duality | _ | Dummy variable that takes the value 1 if the CEO is the Chairman person; 0 otherwise. | Asset4 ESG |

| Held Shares | ? | Represents shares held by insiders. In Worldscope, “Closely held shares comprise (1) shares held by insiders, including senior corporate officers, directors, and their immediate families, (2) shares held in trusts, (3) shares held by another corporation (except shares held in a fiduciary capacity by financial institutions), (4) shares held by pension/benefit plans, and (5) shares held by individuals who hold 5% or more of shares outstanding”. | Worldscope |

| CAPEX | + | The ratio of capital expenditures to total assets. | Authors’ calculation based on data from Worldscope |

| Age | + | The firm age. | As above |

| Z-Score | + | “Altman’s (1968) Z-score = 6.56 × (working capital/total assets) + 3.26 × (retained earnings/total assets) + 6.72 × (earnings before interest and taxes/total assets) + 1.05 × (book value of firm/book value of total liabilities)”. | As above |

| GDP | + | The GDP growth. | IMD World Competitiveness Center Database |

| Policy Board Diversity | + | Dummy variable that takes the value 1 if the company has a policy regarding the gender diversity of its board; 0 otherwise. | Asset4 ESG |

| ExMemGD (%) | + | “Percentage of female executive members”. | Asset4 ESG |

| BCulD (%) | + | “The percentage of board members that have a cultural background different from the location of the corporation headquarters”. | Asset4 ESG |

| ExCulD | + | “Percentage of senior executives that have a cultural background different from the location of the corporation headquarters”. | Asset4 ESG |

| WomMangScore | + | “The percentage of women managers to the total number of managers.” | Asset4 ESG |

| SECRules | ? | Dummy variable that takes the value 1 if the specific year is part of the period when the SEC rule on board-gender policy disclosure is effective (2010–2020); 0 otherwise. | Worldscope |

| BoardSize | + | “The total number of board members at the end of the fiscal year”. | Asset4 ESG |

| Loss | _ | Dummy variable that takes the value 1 if net income before extraordinary items is negative in the current and prior fiscal year; 0 otherwise. | Authors’ calculation based on data from Worldscope |

| Beta | + | Risk measure. | Worldscope |

| Inflation | _ | The annual rate of inflation for the prior fiscal year. | IMD World Competitiveness Center Database |

| ROS | Return on sales (operating profit) measured as “the ratio of earnings before interest and taxes (EBIT) to net sales”. | Authors’ calculation based on data from Worldscope | |

| ROE | Return on equity ratio calculated as the ratio of net income by its shareholder’s equity. | As above | |

| TobinQ | “TobinQ calculated as the book value of total assets plus the market value of equity minus the book value of equity divided by total assets”. | As above |

Appendix B

| Steps | Tasks | Outcomes |

|---|---|---|

| Step 1: | Obtain board gender diversity information from Asset4 ESG database for all American and Canadian public firms. As a first filter, we only keep firms that have adopted board gender policy. | 27,053 firm-year observations covering the period from 2002 to 2021 (23,522 observations about 3556 American firms and 3532 observations about 454 Canadian firms) |

| Step 2: | Collect performance and other financial data: Match board gender diversity data with financial data from Worldscope database. | 15,986 firm-year observations covering the period from 2002 to 2020 (14,362 observations about 3556 American firms and 1823 observations about 452 Canadian firms). |

| Step 3: | Collect macroeconomic data: Match board gender diversity and financial data with economic indicators from IMD World Competitiveness Center database. | Main sample: 14,382 firm-year observations covering the period from 2002 to 2020 (13,106 observations about 3556 American firms and 1276 observations about 452 Canadian firms). |

| Step 4: | Collect and manual calculation of intellectual data: Match our main sample with intellectual data (VAIC). | 3425 firm-year observations covering the period from 2002 to 2020 (2570 observations about 3556 American firms and 855 observations about 452 Canadian firms). |

References

- Matsa, D.A.; Miller, A.R. A female style in corporate leadership? Evidence from quotas. Am. Econ. J. Appl. Econ. 2013, 5, 136–169. [Google Scholar] [CrossRef] [Green Version]

- Ahern, K.R.; Dittmar, A.K. The changing of the boards: The impact on firm valuation of mandated female board representation. Q. J. Econ. 2012, 127, 137–197. [Google Scholar] [CrossRef]

- Adams, R.B.; Kirchmaier, T. Women on boards in finance and STEM industries. Am. Econ. Rev. 2016, 106, 277–281. [Google Scholar] [CrossRef] [Green Version]

- Farag, H.; Mallin, C. Board diversity and financial fragility: Evidence from European banks. Int. Rev. Financ. Anal. 2017, 49, 98–112. [Google Scholar] [CrossRef] [Green Version]

- Tyrowicz, J.; Terjesen, S.; Mazurek, J. All on board? New evidence on board gender diversity from a large panel of European firms. Eur. Manag. J. 2020, 38, 634–645. [Google Scholar] [CrossRef] [Green Version]

- Cohen, S.; Kaimenakis, N. Intellectual Capital and Corporate Performance in Knowledge–intensive SMEs. Learn. Organ. 2007, 14, 241–262. [Google Scholar] [CrossRef]

- Adams, R.; Ferreira, D. Women in the boardroom and their impact on governance and performance. J. Financ. Econ. 2009, 94, 291–309. [Google Scholar] [CrossRef] [Green Version]

- Li, Y.; Zhang, X. Impact of board gender composition on corporate debt maturity structures. Eur. Financ. Manag. 2019, 25, 1286–1320. [Google Scholar] [CrossRef]

- Carter, D.A.; D’Souza, F.; Simkins, B.J.; Simpson, W.G. The gender and ethnic diversity of US boards and board committees and firm financial performance. Corp. Gov. Int. Rev. 2010, 18, 396–414. [Google Scholar] [CrossRef]

- Chen, S.; Ni, X.; Tong, J.Y. Gender diversity in the boardroom and risk management: A case of R&D investment. J. Bus. Ethics 2016, 136, 599–621. [Google Scholar] [CrossRef]

- Shleifer, A.; Vishny, R.W.A. Survey of Corporate Governance. J. Financ. 1997, 52, 737–783. [Google Scholar] [CrossRef]

- Anderson, R.C.; Mansi, S.A.; Reeb, D.M. Board characteristics, accounting report integrity, and the cost of debt. J. Account. Econ. 2004, 37, 315–342. [Google Scholar] [CrossRef]

- Adjaoud, F.; Zeghal, D.; Andaleeb, S. The Effect of Board’s Quality on Performance: A study of Canadian firms. Corp. Gov. 2007, 15, 623–635. [Google Scholar] [CrossRef]

- Hermalin, B.E.; Weisbach, M.S. Boards of directors as an endogenously determined institution: A survey of the economic literature. Econ. Policy Rev. 2003, 9, 7–26. [Google Scholar] [CrossRef]

- Anifowose, M.; Abdul Rashid, H.M.; Annuar, H.A.; Ibrahim, H. Intellectual capital efficiency and corporate book value: Evidence from Nigerian economy. J. Intellect. Cap. 2018, 19, 644–668. [Google Scholar] [CrossRef] [Green Version]

- Chen, M.-C.; Cheng, S.-J.; Hwang, Y. An empirical investigation of the relationship between intellectual capital and firms’ market value and financial performance. J. Intellect. Cap. 2005, 6, 159–176. [Google Scholar] [CrossRef]

- Sardo, F.; Serrasqueiro, Z. A European empirical study of the relationship between firms’ intellectual capital, financial performance and market value. J. Intellect. Cap. 2017, 18, 771–788. [Google Scholar] [CrossRef]

- Scafarto, V.; Ricci, F.; Scafarto, F. Intellectual capital and firm performance in the global agribusiness industry: The moderating role of human capital. J. Intellect. Cap. 2016, 17, 530–552. [Google Scholar] [CrossRef]

- Galia, F.; Zenou, E.; Ingham, M. Board composition and environmental innovation: Does gender diversity matter? Int. J. Entrep. Small Bus. 2015, 24, 117–141. [Google Scholar] [CrossRef]

- Garcia-Meca, E.; Garcia-Sanchez, I.M.; Martinez-Ferrero, J. Board diversity and its effects on bank performance: An international analysis. J. Bank. Financ. 2015, 53, 202–214. [Google Scholar] [CrossRef]

- Nguyen, H.; Faff, R. Impact of board size and board diversity on firm value: Australian evidence. Corp. Ownersh. Control 2012, 4, 24–32. [Google Scholar] [CrossRef] [Green Version]

- Singh, V.; Vinnicombe, S.; Johnson, P. Women directors on top UK boards. Corp. Gov. Int. Rev. 2001, 9, 206–216. [Google Scholar] [CrossRef]

- Campbell, K.; Minguez-Vera, A. Female board appointments and firm valuation: Short and long-term effects. J. Manag. Gov. 2010, 14, 37–59. [Google Scholar] [CrossRef]

- Darmadi, S. Board diversity and firm performance: The Indonesian evidence. Corp. Ownersh. Control 2011, 8, 450–466. [Google Scholar] [CrossRef]

- Minguez-Vera, A.; Martin, A. Gender and management on Spanish SMEs: An empirical analysis. Int. J. Hum. Resour. Manag. 2011, 22, 2852–2873. [Google Scholar] [CrossRef]

- Bøhren, Ø.; Strøm, R.Ø. Governance and politics: Regulating independence and diversity in the boardroom. J. Bus. Financ. Account. 2010, 37, 1281–1308. [Google Scholar] [CrossRef] [Green Version]

- Rose, C. Does female board representation influence firm performance? The Danish evidence. Corp. Gov. Int. Rev. 2007, 15, 404–413. [Google Scholar] [CrossRef]

- Shrader, C.; Blackburn, V.; Iles, P. Women in management and firm financial performance: An exploratory study. J. Manag. Issues 1997, 9, 355–372. [Google Scholar]

- Carter, D.A.; Simkins, B.J.; Simpson, W.G. Corporate governance, board diversity, and firm value. Financ. Rev. 2003, 38, 33–53. [Google Scholar] [CrossRef]

- Nguyen, T.; Locke, S.; Reddy, K. Does boardroom gender diversity matter? Evidence from a transitional economy. Int. Rev. Econ. Financ. 2015, 37, 184–202. [Google Scholar] [CrossRef]

- Ouni, Z.; Ben Mansour, M.; Arfaoui, S. Board/Executive Gender Diversity and Firm Financial Performance in Canada: The Mediating Role of Environmental, Social, and Governance (ESG) Orientation. Sustainability 2020, 12, 8386. [Google Scholar] [CrossRef]

- Jensen, M.; Meckling, W. Theory of the firm: Managerial behaviour, agency cost, and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Abou-El-Sood, H. Board gender diversity, power, and bank risk taking. Int. Rev. Financ. Anal. 2021, 75, 101733. [Google Scholar] [CrossRef]

- Mavridis, D. The Intellectual Capital Performance of the Japanese Banking Sector. J. Intellect. Cap. 2004, 5, 92–115. [Google Scholar] [CrossRef]

- Bontis, N.; Chong Keow, W.C.; Richardson, S. Intellectual Capital and Business Performance in Malaysian Industries. J. Intellect. Cap. 2000, 1, 85–100. [Google Scholar] [CrossRef] [Green Version]

- Shiu, H.-J. The Application of the Value Added Intellectual Coefficient to Measure Corporate Performance: Evidence from Technological Firms. Int. J. Manag. 2006, 23, 356–365. [Google Scholar] [CrossRef]

- Wei Kiong Ting, I.; Hooi Lean, H. Intellectual capital performance of financial institutions in Malaysia. J. Intellect. Cap. 2009, 10, 588–599. [Google Scholar] [CrossRef]

- Firer, S.; Williams, S.M. Intellectual capital and traditional measures of corporate performance. J. Intellect. Cap. 2003, 4, 348–360. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Certo, S.T.; Lester, R.H.; Dalton, C.M.; Dalton, D.R. Top management teams, strategy and financial performance: A meta-analytic examination. J. Manag. Stud. 2006, 43, 813–839. [Google Scholar] [CrossRef]

- Talke, K.; Salomo, S.; Rost, K. How top management team diversity affects innovativeness and performance via the strategic choice to focus on innovation fields. Res. Policy 2010, 39, 907–918. [Google Scholar] [CrossRef]

- Doldor, E.; Vinnicombe, S.; Gaughan, M.; Sealy, R. Gender diversity on boards: The appointment process and the role of executive search firms. In Equality and Human Rights Commission Research Report; Cranfield University: Manchester, UK, 2012; Volume 85. [Google Scholar]

- Low, D.C.; Roberts, H.; Whiting, R.H. Board gender diversity and firm performance: Empirical evidence from Hong Kong, South Korea, Malaysia and Singapore. Pac.-Basin Financ. J. 2015, 35, 381–401. [Google Scholar] [CrossRef]

- Broadbridge, A.; Hearn, J.; Huse, M.; Grethe Solberg, A. Gender-related boardroom dynamics: How Scandinavian women make and can make contributions on corporate boards. Women Manag. Rev. 2006, 21, 113–130. [Google Scholar] [CrossRef]

- Kravitz, D.A. More women in the workplace: Is there a payoff in firm performance? Acad. Manag. Exec. 2003, 17, 148–149. [Google Scholar] [CrossRef] [Green Version]

- Krishnan, H.A.; Park, D. A few good women—On top management teams. J. Bus. Res. 2005, 58, 1712–1720. [Google Scholar] [CrossRef]

- Dezsö, C.L.; Ross, D.G. Does female representation in top management improve firm performance? A panel data investigation. Strateg. Manag. J. 2012, 33, 1072–1089. [Google Scholar] [CrossRef] [Green Version]

- Daily, C.M.; Certo, S.T.; Dalton, D.R. A decade of corporate women: Some progress in the boardroom, none in the executive suite. Strateg. Manag. J. 1999, 20, 93–99. [Google Scholar] [CrossRef]

- Campbell, K.; Mínguez-Vera, A. Gender diversity in the boardroom and firm financial performance. J. Bus. Ethics 2008, 83, 435–451. [Google Scholar] [CrossRef]

- Boudreau, J.W.; Ramstad, P.M. Beyond HR: The New Science of Human Capital; Harvard Business School Press: Boston, MA, USA, 2007; 258p. [Google Scholar]

- Walters, D. A business model for the new economy. Int. J. Phys. Distrib. Logist. Manag. 2004, 34, 346–357. [Google Scholar] [CrossRef]

- Vergauwen, P.; Bollen, L.; Oirbans, E. Intellectual capital disclosure and intangible value drivers: An empirical study. Manag. Decis. 2007, 45, 1163–1180. [Google Scholar] [CrossRef] [Green Version]

- Bollen, L.; Vergauwen, P.; Schnieders, S. Linking Intellectual Capital and Intellectual Property to Company Performance. Manag. Decis. 2005, 43, 1161–1185. [Google Scholar] [CrossRef]

- Appuhami, R. The Impact of Intellectual Capital on Investors’ Capital Gains on Shares: An Empirical Investigation of Thai Banking, Finance & Insurance Sector. Int. Manag. Rev. 2007, 3, 14–25. [Google Scholar]

- Chan, K.H. Impact of intellectual capital on organisational performance. An empirical study of companies in the Hang Seng Index (Part 2). Learn. Organ. 2009, 16, 22–39. [Google Scholar] [CrossRef]

- Ghouma, H.; Ben-Nasr, H.; Yan, R. Corporate governance and cost of debt financing: Empirical evidence from Canada. Q. Rev. Econ. Financ. 2018, 67, 138–148. [Google Scholar] [CrossRef]

- Adjaoud, F.; Ben-Amar, W. Corporate governance and dividend policy: Shareholders’ protection or expropriation? J. Bus. Financ. Account. 2010, 37, 648–667. [Google Scholar] [CrossRef]

- Broshko, E.B.; Li, K. Playing by the rules: Comparing principles-based and rules-based corporate governance in Canada and the U.S. Can. Invest. Rev. 2006, 19, 18–25. [Google Scholar]

- Liu, Y.; Wei, Z.; Xie, F. Do women directors improve firm performance in China? J. Corp. Financ. 2014, 28, 169–184. [Google Scholar] [CrossRef]

- Ho, C.A.; Williams, S.M. International comparative analysis of the association between board structure and the efficiency of value added by a firm from its physical capital and intellectual capital resources. Int. J. Account. 2003, 38, 465–491. [Google Scholar] [CrossRef]

- Nadeem, M.; Farooq, M.B.; Ahmed, A. Does female representation on corporate boards improve intellectual capital efficiency? J. Intellect. Cap. 2019, 20, 680–700. [Google Scholar] [CrossRef]

- Cenciarelli, V.G.; Greco, G.; Allegrini, M. Does intellectual capital help predict bankruptcy? J. Intellect. Cap. 2018, 19, 321–337. [Google Scholar] [CrossRef]

- Petersen, M. Estimating standard errors in finance panel datasets: Comparing approaches. Rev. Financ. Stud. 2009, 22, 435–480. [Google Scholar] [CrossRef] [Green Version]

- Thompson, S.B. Simple formulas for standard errors that cluster by both firm and time. J. Financ. Econ. 2011, 99, 1–10. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173–1194. [Google Scholar] [CrossRef]

- Mohsni, S.; Otchere, I.; Shahriar, S. Board gender diversity, firm performance and risk-taking in developing countries: The moderating effect of culture. J. Int. Financ. Mark. Inst. Money 2021, 73, 101360. [Google Scholar] [CrossRef]

- Triana, M.; Miller, T.; Trzebiatowski, T. The double-edged nature of board gender diversity: Diversity, firm performance, and the power of women directors as predictors of strategic change. Organ. Sci. 2014, 25, 609–632. [Google Scholar] [CrossRef]

- Bortolotti, B.; Fotak, V.; Megginson, W.L. The Sovereign Wealth Fund Discount: Evidence from Public Equity Investments. Rev. Financ. Stud. 2015, 28, 2993–3035. [Google Scholar] [CrossRef] [Green Version]

- Fernandes, N. The Impact of Sovereign Wealth Funds on Corporate Value and Performance. J. Appl. Corp. Financ. 2014, 26, 76–84. [Google Scholar]

- Imbens, G.; Wooldridge, J. Recent developments in the econometrics of program evaluation. J. Econ. Lit. 2009, 47, 5–86. [Google Scholar] [CrossRef] [Green Version]

- Clarke, M.; Seng, D.; Whiting, R.H. Intellectual capital and firm performance in Australia. J. Intellect. Cap. 2011, 12, 505–530. [Google Scholar] [CrossRef]

| Panel A: Sample Distribution by Target Country | |||

| Nation | Freq. | Percent | Cum. |

| Canada | 1276 | 8.87 | 8.87 |

| United States of America | 13,106 | 91.13 | 100.00 |

| Total | 14,382 | 100.00 | |

| Panel B: Sample Distribution by Target Industry | |||

| Industry Group Name | Freq. | Percent | Cum. |

| Aerospace | 72 | 0.50 | 0.50 |

| Apparel | 124 | 0.86 | 1.36 |

| Automotive | 214 | 1.49 | 2.85 |

| Beverages | 108 | 0.75 | 3.60 |

| Chemicals | 458 | 3.18 | 6.79 |

| Construction | 459 | 3.19 | 9.98 |

| Diversified | 243 | 1.69 | 11.67 |

| Drugs, cosmetics and health care | 1308 | 9.09 | 20.76 |

| Electrical | 230 | 1.60 | 22.36 |

| Electronics | 1852 | 12.88 | 35.24 |

| Financial | 962 | 6.69 | 41.93 |

| Food | 357 | 2.48 | 44.41 |

| Machinery and equipment | 537 | 3.73 | 48.14 |

| Metal producers | 482 | 3.35 | 51.49 |

| Metal product manufacturers | 243 | 1.69 | 53.18 |

| Miscellaneous | 2824 | 19.64 | 72.82 |

| Oil, gas, coal and related services | 849 | 5.90 | 78.72 |

| Paper | 160 | 1.11 | 79.84 |

| Printing and publishing | 149 | 1.04 | 80.87 |

| Recreation | 507 | 3.53 | 84.40 |

| Retailers | 800 | 5.56 | 89.96 |

| Textiles | 65 | 0.45 | 90.41 |

| Tobacco | 19 | 0.13 | 90.54 |

| Transportation | 435 | 3.02 | 93.57 |

| Utilities | 925 | 6.43 | 100.00 |

| Total | 14,382 | 100.00 | |

| Panel C: Sample Distribution by Year | |||

| Year | Freq. | Percent | Cum. |

| 2002 | 184 | 1.28 | 1.28 |

| 2003 | 189 | 1.31 | 2.59 |

| 2004 | 288 | 2.00 | 4.60 |

| 2005 | 354 | 2.46 | 7.06 |

| 2006 | 344 | 2.39 | 9.45 |

| 2007 | 378 | 2.63 | 12.08 |

| 2008 | 504 | 3.50 | 15.58 |

| 2011 | 693 | 4.82 | 20.40 |

| 2012 | 702 | 4.88 | 25.28 |

| 2013 | 704 | 4.90 | 30.18 |

| 2014 | 748 | 5.20 | 35.38 |

| 2015 | 1137 | 7.91 | 43.28 |

| 2016 | 1456 | 10.12 | 53.41 |

| 2017 | 1831 | 12.73 | 66.14 |

| 2018 | 2135 | 14.84 | 80.98 |

| 2019 | 2351 | 16.35 | 97.33 |

| 2020 | 384 | 2.67 | 100.00 |

| Total | 14,382 | 100.00 | |

| Mean | Median | SD | Min | Max | |

|---|---|---|---|---|---|

| ROA | 2.872 | 5.270 | 14.673 | −75.820 | 31.840 |

| BGD | 16.372 | 15.385 | 10.947 | 0.000 | 50.000 |

| Gov | 48.867 | 49.589 | 22.052 | 3.654 | 91.386 |

| CEO duality | 0.976 | 1.000 | 0.153 | 0.000 | 1.000 |

| Held Shares | 11.306 | 3.100 | 16.826 | 0.000 | 99.640 |

| CAPEX | 0.052 | 0.036 | 0.053 | 0.000 | 0.299 |

| Leverage | 2.214 | 1.300 | 3.618 | 0.001 | 49.787 |

| Age | 28.084 | 20.000 | 26.737 | 0.000 | 119.000 |

| Z-Score | 4.298 | 3.002 | 5.516 | −7.495 | 38.182 |

| Size | 21.892 | 21.938 | 1.720 | 17.250 | 26.906 |

| GDP | 0.153 | 0.231 | 0.349 | −2.438 | 0.766 |

| SEC | 4.370 | 3.022 | 4.974 | −3.359 | 18.776 |

| CEE | 0.348 | 0.249 | 0.414 | −0.653 | 1.955 |

| HCE | 3.435 | 1.926 | 4.112 | −2.855 | 18.064 |

| VAIC | 4.541 | 2.644 | 5.542 | −4.011 | 22.634 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) ROA | 1.000 | ||||||||||

| (2) BGD | 0.076 *** | 1.000 | |||||||||

| (3) Gov | 0.186 *** | 0.309 *** | 1.000 | ||||||||

| (4) CEO duality | −0.022 *** | 0.027 *** | 0.031 *** | 1.000 | |||||||

| (5) Held Shares | −0.086 *** | −0.147 *** | −0.298 *** | −0.087 *** | 1.000 | ||||||

| (6) CAPEX | 0.029 *** | −0.096 *** | 0.028 *** | −0.014 * | 0.034 *** | 1.000 | |||||

| (7) Leverage | 0.000 | 0.046 *** | 0.013 * | −0.018 ** | 0.011 | −0.016 * | 1.000 | ||||

| (8) Age | 0.158 *** | 0.144 *** | 0.156 *** | 0.032 *** | −0.084 *** | −0.071 *** | 0.011 | 1.000 | |||

| (9) Z-Score | 0.125 *** | −0.044 *** | −0.085 *** | 0.005 | 0.065 *** | −0.050 *** | −0.194 *** | −0.022 *** | 1.000 | ||

| (10) Size | 0.344 *** | 0.205 *** | 0.351 *** | 0.019 ** | −0.226 *** | 0.043 *** | 0.148 *** | 0.195 *** | −0.235 *** | 1.000 | |

| (11) GDP | −0.022 *** | 0.056 *** | −0.004 | −0.007 | 0.016 * | −0.014 * | −0.007 | −0.026 *** | 0.012 | −0.056 *** | 1.000 |

| Panel A: ROA Mean—Comparisons Test | Panel B: ROA Mean—Comparisons Test Using Propensity Score Matching | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Group | N | Mean | t-Statistic | Sig. [Pr(T < t)] | Group | N | Difference: (1)–(2) | t-Statistic | Sig. [Pr(T < t)] |

| (1) Policy Board Diversity = 0 | 2377 | −12.32 | −22.69 | 0.000 | (1) Treatment group | 7204 | 13.39 | 11.59 | 0.000 |

| (2) Policy Board Diversity = 1 | 7563 | 2.857 | (2) Control group | 2313 | |||||

| Combined | 9940 | −0.774 | |||||||

| Difference: (1)–(2) | −15.18 | ||||||||

| (1) Dep Var: ROA | (2) Dep Var: ROA | (3) Dep Var: ROA | (4) Dep Var: ROA | (5) Dep Var: ROE | (6)DepVar: Tobin-Q | (7) Dep Var: ROS | (8) DepVar: ROA | (9) Dep Var: ROA | |

|---|---|---|---|---|---|---|---|---|---|

| BGD | 0.176 *** | 0.025 *** | 0.024 ** | 0.013 *** | 0.149 *** | 0.032 *** | 0.006 *** | ||

| (6.023) | (2.63) | (2.134) | (13.157) | (6.331) | (17.602) | (13.133) | |||

| ExMemGD (%) | 0.089 *** | ||||||||

| (8.583) | |||||||||

| WomMangScore | 0.019 ** | ||||||||

| (20.334) | |||||||||

| Gov | 0.051 *** | 0.053 *** | −0.008 *** | 0.121 *** | −0.002 | 0.001 *** | 0.069 *** | 0.004 | |

| (10.056) | (7.994) | (−6.121) | (9.6) | (−1.124) | (6.785) | (7.249) | (0.484) | ||

| CEO duality | −3.013 *** | −3.219 *** | −0.248 | −7.483 *** | −0.135 ** | −0.46 *** | −4.342 *** | −2.91 *** | |

| (−7.106) | (−9.319) | (−1.067) | (−10.607) | (−2.239) | (−3.409) | (−12.229) | (−3.235) | ||

| Held Shares | 0.006 | 0.009 | −0.047 ** | −0.041 * | 0 | 0 | 0.001 | −0.014 | |

| (0.875) | (1.168) | (−3.352) | (−1.72) | (0.266) | (0.599) | (0.171) | (−0.569) | ||

| CAPEX | 4.997 | 4.734 | 11.577 ** | −9.801 | −0.026 | 0.351 *** | 8.041 ** | −25.845 *** | |

| (1.587) | (1.463) | (3.552) | (−1.325) | (−0.204) | (6.334) | (2.574) | (−4.544) | ||

| Leverage | −0.013 | −0.012 | 0.14 *** | 0.895 ** | 0.024 *** | −0.005 *** | −0.107 *** | 0.206 *** | |

| (−0.604) | (−0.415) | (15.43) | (2.211) | (5.85) | (−4.29) | (−4.8) | (10.145) | ||

| Age | 0.043 *** | 0.046 *** | 0.299 *** | 0.122 *** | −0.002 | 0.001 *** | 0.047 *** | 0.016 *** | |

| (11.281) | (12.215) | (44.28) | (11.95) | (−1.007) | (6.925) | (14.602) | (3.799) | ||

| Z-Score | 0.559 *** | 0.556 *** | 0.236 *** | 1.463 *** | 0.156 *** | 0.009 *** | 0.553 *** | 1.121 *** | |

| (13.48) | (19.52) | (34.016) | (18.976) | (13.549) | (4.243) | (19.44) | (14.749) | ||

| Size | 2.605 *** | 2.754 *** | −1.567 *** | 6.084 *** | −0.149 *** | 0.078 *** | 2.816 *** | 0.691 *** | |

| (29.057) | (35.257) | (−26.499) | (26.172) | (−8.707) | (30.679) | (27.651) | (6.613) | ||

| GDP | −0.728 | 1.206*** | −1.468 | 0.557 *** | −0.005 | −0.109 | −1.019 | ||

| (−1.155) | (6.455) | (−1.361) | (11.158) | (−0.302) | (−0.325) | (−1.049) | |||

| _cons | 2.601 *** | −55.768 *** | −58.89 *** | −12.212 *** | −131.631 *** | 4.849 *** | −1.934 *** | −60.262 *** | −7.52 *** |

| (8.752) | (−22.312) | (−30.753) | (−7.306) | (−17.971) | (12.512) | (−36.243) | (−15.557) | (−9.061) | |

| Observations | 23,200 | 15,986 | 14,382 | 14,382 | 14,300 | 4759 | 12,118 | 13,190 | 1963 |

| Adj R2 | 0.079 | 0.198 | 0.201 | 0.726 | 0.168 | 0.307 | 0.155 | 0.224 | 0.278 |

| Sig. | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) |

| Year Fixed Effect | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Industry Fixed Effects | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Country Fixed Effects | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Firm Fixed Effects | NO | NO | NO | YES | NO | NO | NO | NO | NO |

| (1) | (2) | (3) | Instrumental Variables (2sls) | (6) | (7) | (8) | (9) | (10) | ||

|---|---|---|---|---|---|---|---|---|---|---|

| Loss | Beta | Inflation | First Stage DepVar: BGD | Second Stage DepVar: ROA | GMM | PMS Regression | DID Estimation | Excluding USA | Excluding 2016–2018 Period | |

| BGD | 0.021 ** | 0.07 ** | 0.024 ** | 0.470 *** | 0.306 *** | 0.095 *** | 0.067 *** | |||

| (2.497) | (2.572) | (2.087) | (0.000) | (0.001) | (7.572) | (3.319) | ||||

| Additional Controls | −17.83 *** | −2.363 *** | −1.039 *** | |||||||

| (−25.568) | (−5.579) | (−3.386) | ||||||||

| SECRules | 1.984 *** | |||||||||

| (0.000) | ||||||||||

| BoardSize | 0.943 *** | |||||||||

| (0.000) | ||||||||||

| LagROA | 0.0459 *** | |||||||||

| (0.002) | ||||||||||

| LagSize | 0.000 | |||||||||

| (1.000) | ||||||||||

| Policy Board Diversity | 10.52 *** | 3.01 *** | ||||||||

| (0.000) | (0.000) | |||||||||

| SECRules | 0.849 *** | |||||||||

| (0.000) | ||||||||||

| Policy Board Diversity × SECRules | 2.154 *** | |||||||||

| (0.000) | ||||||||||

| Gov | 0.022 *** | 0.078 *** | 0.053 *** | 0.00744 | 0.00416 | 0.0409 *** | 0.015 *** | 0.017 ** | ||

| (4.216) | (17.015) | (7.17) | (0.538) | (0.727) | (0.001) | (3.934) | (2.439) | |||

| CEO duality | −2.65 *** | −3.285 *** | −3.215 *** | −3.764 *** | −2.223 *** | −8.555 *** | −2.613 *** | −1.771 *** | ||

| (−5.52) | (−5.599) | (−9.761) | (0.000) | (0.006) | (0.000) | (−9.392) | (−3.4) | |||

| Held Shares | 0.021 *** | 0.026 *** | 0.009 | 0.0300 *** | 0.0191 * | 0.0658 *** | −0.001 *** | −0.015 * | ||

| (4.379) | (2.87) | (1.087) | (0.003) | (0.060) | (0.000) | (−8.753) | (−1.808) | |||

| CAPEX | 2.517 | 20.846 *** | 4.72 | 11.58*** | 0.812 | 0.000 | −11.21 *** | −4.776 ** | ||

| (1.037) | (8.83) | (1.43) | (0.000) | (0.788) | (1.000) | (−2.199) | (−2.289) | |||

| Leverage | 0.07 ** | 0.075 | −0.012 | −0.0266 | 0.133 *** | 0.000 | 0.031*** | 0.025 | ||

| (2.377) | (1.007) | (−0.353) | (0.534) | (0.003) | (1.000) | (1.614) | (0.646) | |||

| Age | 0.01 *** | 0.069 ** | 0.046 *** | 0.0320 *** | 0.0224 *** | 0.101 *** | 0.03 *** | 0.019 *** | ||

| (3.719) | (1.989) | (12.931) | (0.000) | (0.000) | (0.000) | (5.413) | (8.977) | |||

| Z-Score | 0.515 *** | 0.213 *** | 0.556 *** | 0.537 *** | 0.754 *** | 0.955 *** | 0.443 *** | 0.58 *** | ||

| (19.747) | (7.491) | (21.134) | (0.000) | (0.000) | (0.000) | (3.904) | (8.681) | |||

| Size | 2.059 *** | 4.544 *** | 2.754 *** | 2.334 *** | 0.820 *** | 7.538 *** | 1.03 *** | 0.841 *** | ||

| (24.119) | (24.033) | (35.391) | (0.000) | (0.000) | (0.000) | (3.370) | (4.726) | |||

| GDP | −0.93 | −2.773 *** | −0.953 | 22.96 *** | 8.786 * | −1.487 | 0 | 0.767 *** | ||

| (−1.499) | (−3.464) | (−1.424) | (0.000) | (0.082) | (0.567) | (0) | (10.747) | |||

| _cons | −42.064 *** | −96.889 *** | −60.426 *** | −0.869 | −60.52 *** | −21.43 *** | −159.8 *** | 0.487 ** | −11.974 *** | −11.424 *** |

| (−24.198) | (−32.739) | (−32.939) | (0.614) | (0.000) | (0.000) | (0.000) | (0.048) | (−2.265) | (−3.28) | |

| Observations | 14,382 | 4373 | 14,382 | 21,703 | 13,081 | 13,081 | 2146 | 917 | 1276 | 6609 |

| Adj R * | 0.324 | 0.254 | 0.201 | 0.152 | 0.212 | 0.112 | 0.279 | 0.240 | 0.132 | 0.132 |

| Sig. | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) |

| Year Fixed Effects | YES | YES | YES | YES | YES | YES | YES | NO | YES | YES |

| Industry Fixed Effects | YES | YES | YES | YES | YES | YES | YES | NO | YES | YES |

| Country Fixed Effects | YES | YES | YES | YES | YES | YES | YES | NO | YES | YES |

| (1): Dep Var: VAIC | (2): Dep Var: ROA | (3): Dep Var: ROA | (4): Dep Var: ROA | (5): Dep Var: ROA | |

|---|---|---|---|---|---|

| Indp Var: BGD | Indp Var: VAIC | Indp Var: SEC | Indp Var: CEE | Indp Var: HCE | |

| BGD | 0.005 ** | ||||

| (2.529) | |||||

| VAIC | 0.696 *** | ||||

| (11.883) | |||||

| SEC | 1.233 *** | ||||

| (5.999) | |||||

| CEE | 15.291 *** | ||||

| (9.649) | |||||

| HCE | 0.566 *** | ||||

| (8.25) | |||||

| Gov | 0.012 *** | 0.01 | −0.029 *** | −0.004 | 0.01 |

| (6.757) | (0.955) | (−2.769) | (−.273) | (1.04) | |

| CEO duality | −0.013 | −2.841 *** | −2.369 *** | −2.733 *** | −1.788 * |

| (−0.014) | (−2.698) | (−2.712) | (−2.98) | (−1.876) | |

| Held Shares | −0.003 | −0.001 | −0.025 | 0.003 | 0.009 |

| (−0.655) | (−0.05) | (−0.771) | (0.154) | (0.649) | |

| CAPEX | 4.123 *** | −5.375 | 0.973 | −2.919 | −2.709 |

| (3.386) | (−0.935) | (0.271) | (−1.445) | (−0.52) | |

| Leverage | 0.004 | −0.037 | −0.2 *** | −0.335 *** | −0.052 |

| (0.157) | (−0.499) | (−2.802) | (−3.15) | (−0.857) | |

| Age | 0.019 | 0.034 *** | 0.047 *** | 0.023 | 0.026 |

| (1.356) | (3.044) | (6.036) | (1.438) | (1.263) | |

| Z-Score | 0.084 *** | 0.514 *** | 0.36 *** | 0.416 *** | 0.522 *** |

| (5.469) | (3.792) | (5.237) | (4.494) | (5.353) | |

| Size | 0.059 | 2.454 *** | 3.456 *** | 2.603 *** | 1.533 *** |

| (0.705) | (10.05) | (16.204) | (13.675) | (10.364) | |

| GDP | −0.474 *** | −0.847 | −0.036 | −1.037 ** | −2.898 *** |

| (−28.928) | (−1.391) | (−0.019) | (−2.314) | (−3.12) | |

| _cons | 1.763 | −52.743 *** | −78.229 *** | −55.654 *** | −30.295 *** |

| (0.76) | (−6.843) | (−8.954) | (−9.81) | (−7.601) | |

| Observations | 3600 | 3425 | 1333 | 3392 | 2494 |

| Adj R * | 0.033 | 0.245 | 0.341 | 0.353 | 0.191 |

| Sig. | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) |

| Year Fixed Effects | YES | YES | YES | YES | YES |

| Industry Fixed Effects | YES | YES | YES | YES | YES |

| Country Fixed Effects | YES | YES | YES | YES | YES |

| Model 1: SEC | Model 2: CEE | Model 3: HCE | Model 4: VAIC | Model 5:VAIC with Controls | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BGD and ROA | BGD and ROA | BGD and ROA | BGD and ROA | BGD and ROA | |||||||||||

| IE | DE | TE | IE | DE | TE | IE | DE | TE | IE | DE | TE | IE | DE | TE | |

| BGD | 0.052 | 0.19 | 0.242 | 0.077 | 0.076 | 0.154 | 0.007 | 0.020 | 0.028 | 0.01 | 0.145 | 0.155 | 0.017 | 0.13 | 0.148 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.001) | (0.001) | (0.009) | (0.059) | (0.012) | (0.036) | (0.000) | (0.000) | (0.005) | (0.000) | (0.000) | |

| Gov | −0.003 | ||||||||||||||

| (0.751) | |||||||||||||||

| CEO duality | −1.89 | ||||||||||||||

| (0.113) | |||||||||||||||

| Held Shares | −0.009 | ||||||||||||||

| (0.436) | |||||||||||||||

| CAPEX | −4.25 | ||||||||||||||

| 0.469 | |||||||||||||||

| Leverage | −0.112 | ||||||||||||||

| (0.003) | |||||||||||||||

| Age | 0.016 | ||||||||||||||

| (0.018) | |||||||||||||||

| Z-Score | 0.469 | ||||||||||||||

| (0.000) | |||||||||||||||

| Size | 2.448 | ||||||||||||||

| (0.000) | |||||||||||||||

| GDP | −0.000 | ||||||||||||||

| (0.908) | |||||||||||||||

| Observations | 2382 | 7158 | 6002 | 7221 | 3227 | ||||||||||

| Sig. | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | ||||||||||

| Model 1: VAIC | Model 2: VAIC | Model 3: VAIC | Model 4: VAIC | Model 5: VAIC | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BGD and ROE | BGD and Tobin-Q | BGD and ROS | ExMemGD (%) and ROA | WomMangScore and ROA | |||||||||||

| IE | DE | TE | IE | DE | TE | IE | DE | TE | IE | DE | TE | IE | DE | TE | |

| BGD | 0.018 | 0.516 | 0.535 | 0.002 | 0.027 | 0.03 | 0.001 | 0.001 | 0.002 | ||||||

| (0.056) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.043) | (0.000) | (0.003) | |||||||

| ExMemGD (%) | 0.059 | 0.136 | 0.195 | ||||||||||||

| (0.018) | (0.000) | 0.002 | |||||||||||||

| WomMangScore | 0.03 | 0.003 | 0.033 | ||||||||||||

| (0.031) | (0.000) | (0.017) | |||||||||||||

| Observations | 6990 | 886 | 863 | 3071 | 472 | ||||||||||

| Sig. | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | ||||||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ouni, Z.; Ben Mansour, J.; Arfaoui, S. Corporate Governance and Financial Performance: The Interplay of Board Gender Diversity and Intellectual Capital. Sustainability 2022, 14, 15232. https://doi.org/10.3390/su142215232

Ouni Z, Ben Mansour J, Arfaoui S. Corporate Governance and Financial Performance: The Interplay of Board Gender Diversity and Intellectual Capital. Sustainability. 2022; 14(22):15232. https://doi.org/10.3390/su142215232

Chicago/Turabian StyleOuni, Zeineb, Jamal Ben Mansour, and Sana Arfaoui. 2022. "Corporate Governance and Financial Performance: The Interplay of Board Gender Diversity and Intellectual Capital" Sustainability 14, no. 22: 15232. https://doi.org/10.3390/su142215232

APA StyleOuni, Z., Ben Mansour, J., & Arfaoui, S. (2022). Corporate Governance and Financial Performance: The Interplay of Board Gender Diversity and Intellectual Capital. Sustainability, 14(22), 15232. https://doi.org/10.3390/su142215232