1. Introduction

The rise of e-commerce has brought benefits to consumers. However, in recent years, the transaction volume of e-commerce has declined all over the word, and the development of e-commerce has met unprecedented challenges. Thus, finding a new way to achieve further growth is of great importance for e-commerce. In response to this situation, a concept of “New Retail” was proposed in 2016 by Alibaba, the biggest e-commerce company in China. The “New Retail” concept is to establish an offline channel and integrate it with the online channel and is an integration of online and offline channels [

1,

2]. The two channels complement each other in three aspects: (1) touching the intangible online products in offline physical stores, (2) solving the unbalanced competitiveness problems by setting the different prices in online and offline channels [

3], (3) delivering the online orders from nearby offline stores to speed up the deliveries. Experiencing the products offline eliminates new retail firm’s products value uncertainty [

4]. Consumers can decide which channel to buy from within the same company based on their own circumstances, they can buy offline directly when the offline stores are nearby, or they can choose to buy online and wait a short time for the deliveries to come. In fact, the price difference between online and offline is the delivery costs. One typical example of new retail is JD.com and Yonghui Supermarket; JD.com supports Yonghui Supermarket in establishing a new retail mode and transforms parts of the supermarkets into its offline channel named “Super Species”. Consumers can buy fresh products directly from JD.com’s offline stores, which are closer to consumers, or buy them from the supermarket APP and wait for the deliveries from the offline stores. The excellent purchasing experience will definitely change the consumers’ purchasing behaviors and bring benefits to the new retail firms.

With the development of new retail centering on consumer experience [

5], people pay more attention to the demand of consumers for products and services. With the higher demand for freshness, the demand for fresh products changes obviously with time during the shelf life. Shortening the delivery time of fresh products has become one of the effective ways to facilitate consumers and improve the supply chain’s competitiveness [

6]. At present, there are e-commerce platforms that encourage consumer demand through early delivery. Although consumer demand has been boosted by the promise of “two-hour delivery” and “self-service offered the next day”, it puts pressure on offline stores. Establishing a fair competitive environment and improving the overall profits of the two channels are the main problems faced by the new retail [

7]. In this paper, delivery time is introduced to improve the competitiveness of offline channels; that is, the new retail firms not only provide early delivery for online channels, but also for offline channels. Shortening the delivery time to the offline stores allows consumers to buy the freshest products offline, which affects consumers’ channel choice.

Accordingly, considering the early delivery of the new retail firms, designing an effective cooperation contract to study the coordination of the new retail fresh products supply chain is crucial for both the offline stores and the new retail firms.

This paper designs an incentive contract for coordinating the supply chain system to promote the new retail development. First, the time-dependent demand functions of the two channels are established. Then, the non-cooperative model, the cooperative model, and the comparison between the optimal decisions of the two models are analyzed. Accordingly, a two-part tariff contract is employed to improve the profit. Moreover, the computational studies are conducted to verify the availability of the contract and the accuracy of theoretical studies. Overall, this paper provides an incentive strategy to coordinate the supply chain and establishes a fair competitive environment for online and offline channels. The results of this paper provide valuable insights into the development of new retail in e-commerce. Therefore, the main contributions of this paper can be enumerated as follows:

The demand is characterized by the fresh products’ time-varying demand characteristics and is affected by the delivery time of the new retail firms so that the fresh products’ demand forecasting can be closer to the actual demand;

Taking the early delivery directly as the new retail firms’ effort level, the research results can provide an intuitive decision-making reference for the New Retail mode of fresh products;

A fair competition environment is established for online and offline channels, promoting the high integration of the two channels under the new retail.

The rest of this paper is organized as follows:

Section 2 reviews some relevant studies from the literature.

Section 3 describes the problems and assumptions. In

Section 4, Stackelberg game models are constructed, and the comparison of models is analyzed.

Section 5 proposes an incentive mechanism to coordinate the supply chain.

Section 6 provides computational studies to verify the accuracy of theoretical studies. Finally, regarding the discussion section of the paper, new retail management implications and future research directions are highlighted in

Section 7. All proofs are provided in

Appendix A.

2. Literature Review

The new retail is an integration of online and offline channels. In the dual-channel studies, scholars have studied the competition between the manufacturers and its independent retailers. Pi et al. [

8] introduce the concept of channel discrepancy, point out that a higher level of channel discrepancy induces higher prices, and the prices of the offline channel and online channel are always different. Liu et al. [

9] find that the manufacturer should set the same online sale prices and wholesale prices in the decentralized dual-channel supply chain; meanwhile, its online pricing influences the retailers’ pricing. Other aspects, e.g., channel strategy [

10,

11], sales effort [

12,

13], and service effort [

14,

15], are also studied. The concept of new retail in our paper focuses on the cooperation and competition of online and offline channels. The new retail provides different online and offline pricing, and is also an upgrade to the dual-channel. Omni-channel management is also broadly studied, the goal of which is to provide all available channels to consumers without barriers. Li et al. [

16] construct an omni-channel tourism supply chain and provide managerial insights for tourism practitioners to rationally operate tourism supply chain. Liu et al. [

17] find a reasonable inventory management strategy in an omni-channel supply chain. Wang et al. [

18] provide decision basis for enterprises and platform managers on social media channel selection, social media advertising pricing and cooperation mode selection in an omni-channel. Unlike the concept of omni-channel, the new retail does not consider all the available channels, but it is an improvement of the omni-channel in the consumer experience. Accordingly, our work shows the price strategy under non-cooperative and cooperative models between the new retail firm and the offline store and analyzes the profits of each supply chain members.

The popularity of fresh products in e-commerce increases the consumers’ demand. Although fresh products like fruit, flowers, milk, and vegetables will maintain their original characteristics and functions for a while, they deteriorate after a while. These products are defined as non-instantaneous deteriorating items [

19,

20], and their demand is declining exponentially over time; there is a literature stream studying the fresh products’ demand. Ketzenberg et al. [

21] base their study on the premise that demand is stochastic and price sensitive, and they explore the value of data sharing in a two-echelon fresh products’ supply chain. Gao et al. [

22] study a fresh agricultural products’ supply chain, in which the demand depends on the freshness-keeping effort. Xu et al. [

23] investigate a dual-channel supply chain and find that the cost-sharing contract can still achieve the coordination when delivery time sensitivity is relatively high. Noori-Daryan et al. [

24] show that the customer acceptance of the online channel is greater than that of the traditional channel and is affected by the delivery lead time. Other aspects, e.g., inventory strategy [

25,

26], consumer behavior [

27,

28,

29], and fairness concern [

30,

31], are also studied. Our work focuses on time and price dependent demand; the time refers to the new retail firm’s delivery time.

Most studies on the coordination of the dual-channel supply chain focuses on the coordination between manufacturers and traditional retailers; the coordination between manufacturers and their independent retailers is hardly studied. Zheng et al. [

32] investigate the closed-loop supply chain, which consists of manufacturers and traditional retailers, and design a revenue sharing mechanism to coordinate the supply chain. Mahdi et al. [

33] propose a disruption-based two-part tariff contract to achieve channel coordination. Zheng et al. [

34] construct a universal price discount contract to coordinate the dual-channel supply chain. Aslani et al. [

35] analyze the coordination of pricing and product greenness in a dual-channel supply chain and propose a transshipment contract to coordinate pricing and greening decisions in the dual-channel supply chain. Other aspects, e.g., cost sharing contract [

36,

37], cost-sharing–revenue-sharing hybrid contract [

38,

39], buy-back contract [

40], and wholesale price contract [

41], are also studied. The new retail focuses on the high integration of online and offline channels. Our work attempts to coordinate the new retail firm with the offline retailer via a two-part tariff contract and promotes the development of the new retail.

Moreover, the above literature shows that reasonable price strategies and incentive schemes can coordinate the competition and cooperation between the two channels. The demand for fresh products is declining exponentially over time. Scholars have presented several ways to improve the freshness level [

42,

43]. Due to the new retail as a new concept, there is a dearth of research investigating the coordination of new retail fresh products’ supply chain. Hence, we explore the decision-making and coordination of the new retail firms and offline stores and attempt to compensate for the new retail research area.

3. Problem Description and Assumptions

The new retail focuses on consumers’ shopping experience. Early delivery of fresh products can provide consumers with fresher products and expand the demand for products at the same time. This paper takes a new retail fresh product supply chain as the research object, including a new retail firm

and an offline store

. The new retail firm establishes an offline channel and integrates it with the online channel and determines the delivery time. In this system, the new retail firm and the offline store sell products under a wholesale price contract; that is, the former sells products to the offline store at wholesale price

, and the latter sells products to customers at price

. At the same time, the new retail firm sells products to customers on the e-commerce platform at price

. Consumers can buy offline directly when the offline store is nearby, or they can choose to buy online and wait the deliveries to come from the offline store. Meanwhile, there is not only cooperation, but also competition between the new retail firm and the offline store; they compete with each other on prices.

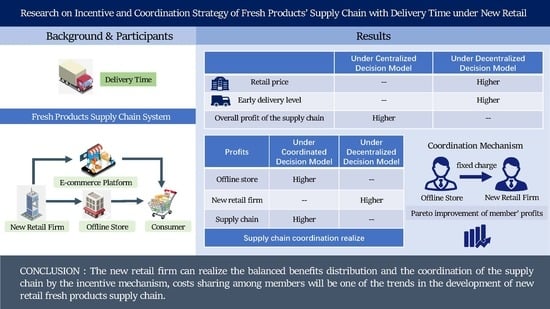

Figure 1 shows the new retail fresh products’ supply chain system.

Due to the perishability of fresh products, their demand varies with time. As consumers’ demand for freshness is getting higher and higher, the demand satisfies the following time-varying relation during the shelf life [

44,

45]:

where

is the shelf life, and

is a time-dependent parameter of demand. It can be seen that the demand decreases exponentially with time. Thus, the new retail firm can advance the delivery time to improve the demand. For the sake of convenience, this paper assumes the following relation:

where

is the new retail firm’s early delivery level, and

is the advanced time. At the same time, this paper considers the following hypotheses:

Hypothesis 1. The new retail firm sells the products to customers on an e-commerce platform, and the decisions of the new retail firm (like pricing, product delivery time) are displayed on the e-commerce platform; this constitutes the online channel for the new retail firm.

Hypothesis 2. This paper considers the delivery costs and adds the delivery charges to the two channel’s final prices; that is, the margin between the two channels’ prices is the delivery charge.

Hypothesis 3. The new retail firm’s early delivery has the same impact on the demand of online and offline channels, and the new retail firm shortens the products’ delivery time to the offline store and consumers to ensure that consumers get the same freshness of products when they buy online or offline. This paper focuses on the new retail firm’s transportation link to verify the fresh products’ time-varying demand.

Hypothesis 4. The new retail firm can meet the consumers’ requirements without out-of-stock and stock-up situations.

4. Constructing and Solving the Model

The new retail firm’s early delivery can promote demand. The time that the new retail firm transported the fresh products to the offline store through the offline channel (the time that the customer to the offline store was ignored) or to the end customer through the online channel was denoted by

. The following multiplicative functions [

46] were employed to express the dual-channel market demand:

where

was the degree of early delivery impact on demand,

was the offline channel market share, and

was the consumers’ price sensitivity coefficient. The longer the early delivery was, the greater the early delivery costs would be taken by the new retail firm. Therefore, the early delivery cost function was set as

, where

was the early delivery costs and

was a cost coefficient.

4.1. Optimal Decisions in a Decentralized System: Non-Cooperative Model

In the decentralized system, the new retail firm and the offline store take self-interest maximization as the goal; that is, although the offline store belongs to the new retail firm, the offline store can make independent decisions according to the local economic situation. At this point, the offline store can be regarded as a separate entity. In this system, the new retail firm took the supply chain leader and prioritized deciding the product’s wholesale price and the electronic selling price and determined the early delivery level. The offline store, as a follower, determined its optimal retail price. The profit functions of the offline store and the new retail firm were as follows:

The second derivative of (5) was obtained as:

Thus,

was a concave function of

. By setting the first derivative of

to zero, the response price of the offline store was obtained as:

Putting (8) into (6) and taking the second derivative of (6) gave the following Hessian Matrix:

Since the Hessian Matrix was negative semidefinite,

was a concave function of

. By taking the first derivative of

and setting it to zero, the optimal early delivery, the optimal retail price, and the optimal electronic selling price under decentralized decision were obtained as:

Thus, the optimal response price of the offline store was:

According to (10), the optimal early delivery of the new retail firm under decentralized decision was positively related to the market share

. By putting the equilibrium solutions into the demand functions, we calculated:

Accordingly, the total profits of the offline store, the new retail firm, and the supply chain were obtained as follows:

4.2. Optimal Decisions in a Centralized System: Cooperative Model

In the centralized system, the new retail firm and the offline store are regarded as a whole to evaluate the overall profit of the supply chain. That is, the offline store needs to consider the benefits of the new retail firm when making decisions, which requires joint decision-making with the new retail firm to maximize the profit of the entire supply chain system. The overall profit function of the fresh products’ supply chain was as follows:

Taking the second derivative of (19) gave the following Hessian Matrix:

Since the Hessian Matrix was negative semidefinite,

was a concave function of

. By taking the first derivative of

and setting it to zero, the optimal early delivery, the optimal retail price, and the optimal electronic selling price under centralized decision were calculated as:

From (21), the new retail firm’s early delivery had nothing to do with the market share

of the offline channel in the centralized decision. By putting the optimal solutions into functions (3)~(4), the satisfactory solutions of demand under a centralized decision was obtained as follows:

Therefore, the overall profit of the fresh products supply chain under a centralized decision was as follows:

4.3. Comparison of Centralized and Decentralized Decision Models

By comparing the optimal pricing strategies, the optimal early delivery level, and the maximum profit of the whole supply chain under the two decision models, the following propositions were obtained (see

Appendix A for proof):

Proposition 1. The optimal price under decentralized decision is higher than that under centralized decision,.

Proposition 2. The optimal early delivery is different under the two decision models,

.

Proposition 3. The overall profit of the supply chain under centralized decision model is higher than that under decentralized decision model, .

Although the centralized model was the most efficient one, it was hardly achievable in real-life situations. In order to improve the overall profit of the supply chain under the decentralized decision model and finally achieve the goal of new retail supply chain coordination, the centralized system was employed as the benchmark case. In addition, to improve the decentralized system, a two-part tariff contract model was established to study the coordination, and the results were compared with the optimal solutions under the decentralized decision model to verify the feasibility of the contract.

5. Two-Part Tariff Contract: Cooperative and Coordinated Model

In order to achieve the coordination of new retail fresh products supply chain, the new retail firm and the offline store can adopt a two-part tariff contract; that is, after charging the offline store fixed charges, the new retail firm determines the wholesale price according to the demand for fresh products. Here, the fixed charges can be regarded as the joining fees of the offline store, and the offline store pays the fixed charges to encourage the new retail firm to make the early delivery.

Proposition 4. When

, the overall profit of the supply chain increases to the level of the centralized decision model, and the fresh products supply chain achieves coordination. At this point, the profits of the offline store and the new retail firm are given by (as evidenced in Appendix A): Proposition 5. Under the two-part tariff contract, the fresh products supply chain can achieve Pareto improvement when the fixed charge varies in the range . As the main leader, the new retail firm adjusts the fixed charges to realize the balanced distribution of the members’ profits.

By comparing the profits of the offline store and the new retail firm under the coordinated decision model with that of the decentralized decision

model, we could obtain

and

. This meant that the offline store’s profit increased compared with the decentralized decision model. However, since the profit of the new retail firm decreased, the coordination contract should be optimized, as shown in

Appendix A.

When the offline store paid the fixed charge or , the profit of the offline store or the new retail firm was equal to that of the decentralized decision model. Therefore, when the fixed charge was set in the range , the contract could coordinate the fresh products supply chain and optimize the profit of each member of the supply chain.

Under the two-part tariff contract, the new retail firm’s profit was , and the offline store’s profit was .

6. Computational Studies

Computational studies verify the reliability of the above theoretical studies. According to the hypotheses of the parameters, we assumed . In addition, the relevant demand parameters of fresh products were . Then, we analyzed the profits and optimal pricing strategy changes of the dual-channel supply chain and its members.

6.1. Influence of and on Supply Chain Profit and Decision-Making

Since the fixed charges depend on the bargaining power between the new retail firm and the offline store, this paper took the fixed charge to verify the influence of the demand coefficient and the cost coefficient on the profit and pricing of the fresh products supply chain.

As shown in

Figure 2, the overall profit of the supply chain increased with the increase of

and decreased with the increase in

, and the overall profit of the supply chain under the coordinated decision model was higher than that under the decentralized decision model. This confirmed the accuracy of the theoretical proof.

As shown in

Figure 3 and

Figure 4, the profits of the new retail firm and the offline store increased with the increase in

and decreased with the increase in

under both decentralized and coordinated decision models. In addition, the profit of the offline store under the decentralized decision model was less than that under the coordinated decision model. With the increase in the early delivery impact on market demand, the new retail firm was more willing to use early delivery in order to obtain greater profit. Moreover, the high costs would make the new retail firm reduce the early delivery level to maintain its profit. Under the coordination decision, the new retail firm’s profit depended on the offline store’s fixed charges level.

As shown in

Figure 3, under the coordinated decision model, due to the fixed charges paid by the offline store, the profit of the new retail firm was greater than that under the decentralized decision model, and the profit margin after coordination depended on the bargaining power of the new retail firm. Therefore, the new retail firm could reduce the early delivery costs and pursue the whole supply chain and its members’ profits maximization while coordinating the fresh products supply chain.

Figure 5 shows that with the increase in

, the prices decreased under decentralized and coordinated decision models. The greater the early delivery impact on market demand, the lower the prices the new retail firm and the offline store will set for more profits.

Figure 6 shows that with the increase in

, the prices increased under decentralized and coordinated decision models. Thus, the greater the early delivery impact on costs, the higher the prices the new retail firm and the offline store will set to protect their interests and maintain their competitiveness.

Figure 5 and

Figure 6 show that under the decentralized decision model, the retail price was higher than the electronic selling price, but it was the opposite under the coordinated decision model. Accordingly, the profit of the offline store under the decentralized decision model was lower than that under the coordinated decision model.

Figure 5 and

Figure 6 also show that the optimal price under decentralized decision was higher than that under centralized decision, this confirmed the accuracy of proposition 1.

6.2. Influence of and on a Fixed Charge

The offline store paid the fixed charges to the new retail firm, which should not exceed the maximum acceptable range by the offline store. In turn, the offline store could no pay the fixed charges lower than the minimum expected range by the new retail firm.

Figure 7 shows that the fixed charges decreased with the increase in

and increased with the increase in

. This paper studied the influence of demand coefficient

and the cost coefficient

on the value range of fixed charges and provided a reference for the decision-making of fresh products’ supply chain.

6.3. The Influence of on Supply Chain Profit and Decision-Making

This section studies the influence of the market share

of the offline channel on the optimal decision-making of fresh products supply chain. As shown in

Figure 8, with the increase in

, the overall profits of the supply chain decreased under decentralized and coordinated decision models while the overall profit under the coordinated decision model was higher than that under the decentralized decision model. This meant that under the decentralized decision model, each member of the supply chain pursued self-interest maximization and ignored the overall profit of the supply chain. In other words, the new retail firm should reasonably reduce the market share

of the offline channel to increase the supply chain’s overall profit.

Figure 8 proves that proposition 3 was accurate.

Figure 8 shows that the profit margin of the new retail firm and the offline store under the coordinated decision model was much smaller than that under the decentralized decision model, which indicated that the profit of each supply chain members under the coordinated decision model was distributed equitably, demonstrating the superiority of the coordination contract. At the same time, when a specific value of

was taken, the new retail firm’s profit under the decentralized decision model was higher than that under the coordinated decision model due to the lower fixed charges.

As shown in

Figure 9, as the market share

of the offline channel increased, the electronic selling prices decreased under decentralized and coordinated decision models. The wholesale prices decreased under decentralized decision models and increased under coordinated decision models while the former was smaller than the latter, demonstrating the reasonability of the wholesale price in proposition 4.

7. Conclusions

This paper investigates the coordination problem of the new retail fresh products’ supply chain, considers the time-varying demand of fresh products and the early delivery effort of the new retail firm, analyzes the centralized decision-making model, decentralized decision-making model, by comparing different decision-making models, this paper proposes a two-part tariff contract to coordinate the fresh products’ supply chain and construct the coordinated decision-making model. Finally, the feasibility and validity of the theoretical model are verified by numerical analysis. The results show that in the cooperative model, the overall profits of the supply chain are greater than that in the non-cooperative model, the optimal early delivery level and price is smaller than in the non-cooperative model. The designed contract can realize the coordination of the fresh products’ supply chain. After coordination, the overall profit of the supply chain increased, and the profit of each member increased accordingly. Therefore, although there is not only cooperation, but also competition between the new retail firm and the offline store, this relationship is not completely uncoordinated, and a win–win situation can be achieved through the coordinated contract. The fixed charges depend on the result of the cooperative game between the offline store and the new retail firm; in the cooperative and coordinated model, the offline store pays fixed charges to compensate for the new retail firm’s early delivery costs, but its profit still increase compared with the non-cooperative model. Different from other researches, this paper gives a complete definition of new retail and introduces delivery time to study the cooperation and competition among the fresh products supply chain members, the results of this paper provide valuable insights into the development of new retail in e-commerce. In addition, little research has focused on both new retail and delivery time.

To summarize, the following suggestions for new retail fresh products’ supply chain management are put forward:

- (1)

As the demand for fresh products declines exponentially over time, the market demand for the products decreases over time accordingly; thus, the new retail firms need to shorten the delivery time to keep the freshness of the products. At the same time, the new retail firms can take effective measures to reduce the early delivery costs to improve its profits;

- (2)

Controlling fixed charges and improving the competitiveness of offline stores can achieve a win–win situation for all members and enhance the core competitiveness of the supply chain and the ability to resist risks. However, it is unwise for new retail firms to establish many offline stores at the same time; this will affect the balance between online and offline channels and will cost large quantities of construction costs;

- (3)

Under the two-part tariff contract, the profits of the new retail firms will increase due to the fixed charges, and the extra fixed charges paid to the new retail firms will not affect the increase of the offline stores’ profits but only reduce the increased degree of its profits. It can be seen that new retail firms and offline stores sharing costs and obtaining higher returns will be one of the trends in the development of the new retail fresh products’ supply chain.

This paper only considers the cooperation and competition between the new retail firm and its independent offline store within the new retail environment, but in practice, the new retail has a specific impact on the offline markets, which have not yet transformed into new retail firms. Future research may consider the competition between new retail firms and traditional retail firms and analyze the impact of “new retail” on the traditional retail markets. Meanwhile, the transformation condition of traditional retail firms to new retail firms are also worth investigating.