Fractional Derivatives for Economic Growth Modelling of the Group of Twenty: Application to Prediction

Abstract

:1. Introduction

2. Preliminaries

2.1. The G20

2.2. Fractional Calculus in Economic Modelling

3. Methodology

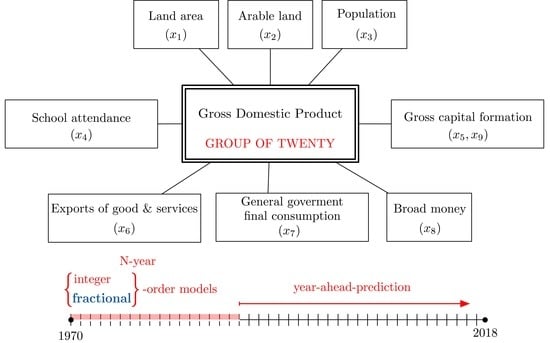

3.1. GDP Models

- : GDP, in 2010 US$;

- : weights, constant in time, for each of the input variables ;

- : first year considered—1970 in this case;

- : inputs of the model, viz.:

- : land area, in km2—measures the natural resources available;

- : arable land, in km2—measures of the quality of the natural resources;

- : population—measures the human resources available;

- : school attendance, in years—measures the quality of human resources;

- : gross capital formation (GCF), in 2010 US$—measures manufactured resources (the model considers the accumulated manufactured resources);

- : exports of goods and services, in 2010 US$—measures external impacts on the economy;

- : general government final consumption expenditure (GGFCE), in 2010 US$—measures budgetary impacts on the economy;

- : broad money (M3), in 2010 US$—measures monetary impacts on the economy (the model considers the variation of monetary impacts);

- : variation of , in 2010 US$—the variation of GCF measures the impact of investment on the economy.

3.2. Optimizing and Assessing Performance

- The mean absolute deviation (MAD):

- The coefficient of determination ():where is the mean of the GDP.

- The t-values and p-values for each variable.

3.3. Models Found from Data for Different Numbers of Years

4. Results

4.1. Models for the 1970–2018 Period

4.2. Models for N–Year Period

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Data Sources

- As in [4], variables for the EUU were the sum of the figures for its member states in each year. The only exception was , addressed below.

- The source for the GDP, , , , , , and was [27].

- Variable was available until 2016 only. It was assumed that . For Belgium and Luxemburg, which are member-states of the EUU, there is no data until 2000. Thus, was assumed constant until that year. This approximation corresponds, in the worst case, to an error in of 1.9% for the EUU during those years.

- The source for and for DEU until 1990 was [29]. In the same period, figures for were reduced in the same proportion.

- The source for was [30] until 2010. Figures are available with a 5-year period only, and were interpolated with a third-order spline. The figure for 2010 was extended into the future, using the increase rate of the figures in [31], also interpolated with a third-order spline. However, Figures for the following member-states of the EUU are not found in [30]: Croatia, Estonia, Latvia, Lithuania, Slovenia, Slovak Republic. The source for for these states was [27]. The EUU figure for is a weighted average of the figures for the member states in each year. The weight is the share of each state in .

- Figures for , , and for JPN and USA for 2018 are those of 2017, updated with the yearly growth rate of the index in [32].

- The source for for ARG, AUS, BRA, IDN, IDN, JPN, MEX, ZAF, GBR, and USA was [27].

- The source for for DEU, FRA, ITA and other states of the EUU until 2015 was [33]. Figures were converted to 2010 US$ using the price index in [27]. In the 2016–2018 period, the figure for 2015 was updated with the growth rate in [34,35,36] for DEU, FRA, and ITA, respectively. However, figures for for Luxembourg and Romania in [33] are only available until 2011 and 2013, respectively. The figure for the last year was updated with the growth rate of [27].

References

- Tejado, I.; Valério, D.; Pérez, E.; Valério, N. Fractional calculus in economic growth modelling. The Spanish and Portuguese cases. Int. J. Dyn. Control 2017, 5, 208–222. [Google Scholar] [CrossRef]

- Tejado, I.; Valério, D.; Pérez, E.; Valério, N. Fractional calculus in economic growth modelling: The economies of France and Italy. In Proceedings of the International Conference on Fractional Differentiation and Its Applications, Novi Sad, Serbia, 18–20 July 2016. [Google Scholar]

- Tejado, I.; Pérez, E.; Valério, D. Economic growth in the European Union modelled with fractional derivatives: First results. Bull. Pol. Acad. Sci.-Tech. Sci. 2018, 66, 455–465. [Google Scholar]

- Tejado, I.; Pérez, E.; Valério, D. Fractional calculus in economic growth modelling of the Group of Seven. Fract. Calc. Appl. Anal. 2019, 22, 139–157. [Google Scholar] [CrossRef]

- Ming, H.; Wang, J.R.; Feckan, M. The Application of Fractional Calculus in Chinese Economic Growth Models. Mathematics 2019, 7, 665. [Google Scholar] [CrossRef] [Green Version]

- Tarasov, V.E. On history of mathematical economics: Application of fractional calculus. Mathematics 2019, 7, 509. [Google Scholar] [CrossRef] [Green Version]

- Tarasova, V.V.; Tarasov, V.E. Economic interpretation of fractional derivatives. Progr. Fract. Differ. Appl. 2017, 3, 1–6. [Google Scholar] [CrossRef]

- Hu, Z.; Tu, X. A new discrete economic model involving generalized fractal derivative. Adv. Differ. Equ. 2015, 65. [Google Scholar] [CrossRef]

- Petrás, I.; Podlubny, I. State space description of national economies: The V4 countries. Comput. Stat. Data Anal. 2007, 52, 1223–1233. [Google Scholar] [CrossRef] [Green Version]

- Skovranek, T.; Podlubny, I.; Petrás, I. Modeling of the national economies in state-space: A fractional calculus approach. Econ. Model. 2012, 29, 1322–1327. [Google Scholar] [CrossRef]

- Yue, Y.; He, L.; Liu, G. Modeling and application of a new nonlinear fractional financial model. J. Appl. Math. 2013, 325050. [Google Scholar] [CrossRef]

- Xu, Y.; He, Z. Synchronization of variable-order fractional financial system via active control method. Cent. Eur. J. Phys. 2013, 11, 824–835. [Google Scholar] [CrossRef] [Green Version]

- Tenreiro Machado, J.A.; Mata, M.E. Pseudo phase plane and fractional calculus modeling of western global economic downturn. Commun. Nonlinear Sci. Numer. Simul. 2015, 22, 396–406. [Google Scholar] [CrossRef] [Green Version]

- Tenreiro Machado, J.A.; Mata, M.E.; Lopes, A.M. Fractional state space analysis of economic systems. Entropy 2015, 17, 5402–5421. [Google Scholar] [CrossRef] [Green Version]

- Tarasov, V.E. Long and short memory in economics: Fractional-order difference and differentiation. IRA-Int. J. Manag. Soc. Sci. 2016, 5, 327–334. [Google Scholar] [CrossRef] [Green Version]

- Tarasova, V.V.; Tarasov, V.E. Exact discretization of an economic accelerator and multiplier with memory. Fractal Fract. 2017, 1, 6. [Google Scholar] [CrossRef]

- Caputo, M.; Carcione, J.M.; Botelho, M.A.B. Modeling extreme-event precursors with the fractional diffusion equation. Fract. Calc. Appl. Anal. 2015, 18, 208–222. [Google Scholar] [CrossRef]

- Scalas, E.; Gorenflo, R.; Mainardi, F. Fractional calculus and continuous-time finance. Physica A 2000, 284, 376–384. [Google Scholar] [CrossRef] [Green Version]

- Aguilar, J.-P.; Korbel, J.; Luchko, Y. Applications of the fractional diffusion equation to option pricing and risk calculations. Mathematics 2019, 7, 796. [Google Scholar] [CrossRef] [Green Version]

- Denison, E.F. Why Growth Rates Differ: Postwar Experience in Nine Western Countries; Brookings Institution: Washington, DC, USA, 1967; ISBN 9780815718055. [Google Scholar]

- Lucas, R.E. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Maddison, A. Explaining the economic performance of nations, 1820–1989. In Convergence of Productivity: Cross-National Studies and Historical Evidence; Baumol, W.J., Nelson, R.R., Wolff, E.N., Eds.; Oxford University Press, Inc.: Oxford, UK, 1994; pp. 20–61. [Google Scholar]

- Van den Berg, H. Economic Growth and Development; World Scientific Publishing Co. Pte. Ltd.: Singapore, 2017; ISBN 978-981-4733-33-5. [Google Scholar]

- Valério, D.; Sá da Costa, J. Introduction to single-input, single-output fractional control. IET Control Theory Appl. 2011, 5, 1033–1057. [Google Scholar] [CrossRef]

- Wang, S.; He, S.; Yousefpour, A.; Jahanshahi, H.; Repnik, R.; Perc, M. Chaos and complexity in a fractional-order financial system with time delays. Chaos Solitons Fractals 2019, 109521. [Google Scholar] [CrossRef]

- Tejado, I.; Pérez, E.; Valério, D. Results for Predictions of the Future Evolution of the GDP for the G20 Group. 2019. Available online: https://github.com/UExtremadura/Economic/blob/master/G20Results_Tejado_et_al2019.rar (accessed on 16 December 2019).

- The World Bank. World Bank Database. 2019. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 19 August 2019).

- Tejado, I.; Pérez, E.; Valério, D. Economic Data for the G20 Group. 2019. Available online: https://github.com/UExtremadura/Economic/blob/master/G20Data_Tejado_et_al_Mathematics19.xls (accessed on 16 December 2019).

- West Germany. 2018. Available online: https://en.wikipedia.org/wiki/West_Germany (accessed on 29 August 2018).

- Lee, J.W.; Lee, H. Lee and Lee Long-run Education Dataset, Lee–Lee Database Version 2.2. 2018. Available online: http://www.barrolee.com/Lee_Lee_LRdata_dn.htm (accessed on 29 August 2019).

- Wittgenstein Centre for Demography and Global Human Capital. Wittgenstein Centre Data Explorer Version 2.0. 2018. Available online: http://dataexplorer.wittgensteincentre.org/wcde-v2/ (accessed on 19 August 2019).

- OECD. OECDiLibrary. 2019. Available online: http://dx.doi.org/10.1787/1036a2cf-en (accessed on 10 September 2019).

- Federal Reserve Bank of St. Louis. Federal Reserve Economic Data. 2019. Available online: https://fred.stlouisfed.org/ (accessed on 10 September 2019).

- The Global Economy. Economic Indicators for Over 200 Countries: Germany. 2019. Available online: https://www.theglobaleconomy.com/Germany/money_supply/ (accessed on 12 September 2019).

- The Global Economy. Economic Indicators for Over 200 Countries: France. 2019. Available online: https://www.theglobaleconomy.com/France/money_supply/ (accessed on 12 September 2019).

- The Global Economy. Economic Indicators for Over 200 Countries: Italy. 2019. Available online: https://www.theglobaleconomy.com/Italy/money_supply/ (accessed on 12 September 2019).

| Argentina | Australia | ||||||

| Index/Statistic | Variable | Integer | Integer | Fractional | Integer | Integer | Fractional |

| (1) | (2) | (3) | (1) | (2) | (3) | ||

| MSE () | 8.355 | 17.475 | 7.423 | 17.608 | 27.232 | 6.235 | |

| 0.9906 | 0.9802 | 0.9916 | 0.9984 | 0.9975 | 0.9994 | ||

| MAD () | 7.761 | 10.101 | 7.614 | 10.208 | 11.986 | 5.467 | |

| t-values | |||||||

| 2.154 | − | − | 1.124 | − | − | ||

| 2.065 | − | − | − | − | |||

| 2.193 | 1.316 | ||||||

| 1.694 | |||||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| AIC () | |||||||

| w (%) | 0 | 0 | 0 | ||||

| Brazil | Canada | ||||||

| Index/Statistic | Variable | Integer | Integer | Fractional | Integer | Integer | Fractional |

| (1) | (2) | (3) | (1) | (2) | (3) | ||

| MSE () | |||||||

| MAD () | |||||||

| t-values | |||||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| AIC () | |||||||

| w (%) | 0 | 0 | 0 | ||||

| European Union | France | ||||||

| Index/Statistic | Variable | Integer | Integer | Fractional | Integer | Integer | Fractional |

| (1) | (2) | (3) | (1) | (2) | (3) | ||

| MSE () | |||||||

| MAD () | |||||||

| t-values | |||||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| AIC () | |||||||

| w (%) | 0 | 0 | |||||

| Germany | India | ||||||

| Index/Statistic | Variable | Integer | Integer | Fractional | Integer | Integer | Fractional |

| (1) | (2) | (3) | (1) | (2) | (3) | ||

| MSE () | |||||||

| MAD () | |||||||

| t-values | |||||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| AIC () | |||||||

| w (%) | 0 | 0 | 0 | 0 | |||

| Indonesia | Italy | ||||||

| Index/Statistic | Variable | Integer | Integer | Fractional | Integer | Integer | Fractional |

| (1) | (2) | (3) | (1) | (2) | (3) | ||

| MSE () | |||||||

| MAD () | |||||||

| t-values | |||||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| AIC () | |||||||

| w (%) | 0 | 0 | 0 | ||||

| Japan | Mexico | ||||||

| Index/Statistic | Variable | Integer | Integer | Fractional | Integer | Integer | Fractional |

| (1) | (2) | (3) | (1) | (2) | (3) | ||

| MSE () | |||||||

| MAD () | |||||||

| t-values | |||||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| AIC () | |||||||

| w (%) | 0 | 0 | 0 | 0 | |||

| South Africa | Korea | ||||||

| Index/Statistic | Variable | Integer | Integer | Fractional | Integer | Integer | Fractional |

| (1) | (2) | (3) | (1) | (2) | (3) | ||

| MSE () | |||||||

| MAD () | |||||||

| t-values | |||||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| AIC () | |||||||

| w (%) | 0 | 0 | 0 | ||||

| United Kingdom | United States of America | ||||||

| Index/Statistic | Variable | Integer | Integer | Fractional | Integer | Integer | Fractional |

| (1) | (2) | (3) | (1) | (2) | (3) | ||

| MSE () | |||||||

| MAD () | |||||||

| t-values | |||||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| − | − | − | − | ||||

| AIC () | |||||||

| w (%) | 0 | 0 | |||||

| Argentina | ✓ | ||||||||

| Australia | ✓ | ✓ | ✓ | ||||||

| Brazil | ✓ | ✓ | |||||||

| Canada | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| European Union | ✓ | ✓ | ✓ | ||||||

| France | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| Germany | ✓ | ✓ | ✓ | ✓ | |||||

| India | ✓ | ✓ | ✓ | ||||||

| Indonesia | ✓ | ✓ | |||||||

| Italy | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Japan | ✓ | ✓ | |||||||

| Mexico | ✓ | ✓ | |||||||

| South Africa | ✓ | ✓ | ✓ | ✓ | |||||

| Korea | ✓ | ✓ | |||||||

| United Kingdom | ✓ | ✓ | ✓ | ✓ | |||||

| United States of America | ✓ | ✓ | ✓ | ✓ |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tejado, I.; Pérez, E.; Valério, D. Fractional Derivatives for Economic Growth Modelling of the Group of Twenty: Application to Prediction. Mathematics 2020, 8, 50. https://doi.org/10.3390/math8010050

Tejado I, Pérez E, Valério D. Fractional Derivatives for Economic Growth Modelling of the Group of Twenty: Application to Prediction. Mathematics. 2020; 8(1):50. https://doi.org/10.3390/math8010050

Chicago/Turabian StyleTejado, Inés, Emiliano Pérez, and Duarte Valério. 2020. "Fractional Derivatives for Economic Growth Modelling of the Group of Twenty: Application to Prediction" Mathematics 8, no. 1: 50. https://doi.org/10.3390/math8010050

APA StyleTejado, I., Pérez, E., & Valério, D. (2020). Fractional Derivatives for Economic Growth Modelling of the Group of Twenty: Application to Prediction. Mathematics, 8(1), 50. https://doi.org/10.3390/math8010050