Development of a Predictive Model for Agave Prices Employing Environmental, Economic, and Social Factors: Towards a Planned Supply Chain for Agave-Tequila Industry

Abstract

:1. Introduction

| Raw Material or Product | Model | Variables of the Model | References |

|---|---|---|---|

| Cereals | Spatial price prediction | Longitude, latitude, precipitation, month, and access to the market. | [18] |

| Corn | Nonlinear autoregressive models: univariate and bivariate neural network | Daily corn cash prices and future corn prices estimation. | [19] |

| Multiple linear regression model | Production, import, outports, and consumption of corn. | [20] | |

| Cotton | Multifactor seasonal model | Daily futures cotton prices | [21] |

| Soybeans | Multifactor seasonal model | Daily futures soybeans prices | [21] |

| Quantile repression radial basis function (QR-RBF) neural network model | The output of domestic soybean, the import volume of soybean, the output of global soybean, the demand of domestic soybean, consumer price index, consumer confidence index, money supply, and port distribution price of imported soybean. | [22] | |

| Olive oil | Autoregressive fractionally integrated moving average model (ARFIMA) and Fuzzy time series (FTS). | Consumption, import, export, and production. | [23] |

| Wheat | Radial basis function model (RBF). | Climatic and meteorological variables | [24] |

| Potato | Multivariate linear regression | Average temperature lowest temperature, daily temperature range, lowest grass temperature, relative humidity, lowest relative humidity, amount of cloud cover, solar radiation, sunshine, average wind velocity, amount of evaporation, ground-surface temperature. | [25] |

| Cocoa bean | Autoregressive integrated moving average (ARIMA) model. | Explanatory variables | [26] |

| Tomato | Seasonal ARIMA (SARIMA) | Weekly and monthly tomato market prices | [27] |

| Backpropagation neural network (BPNN) | Weekly and monthly tomato market prices | [28] | |

| Backpropagation neural network (BPNN) and radial basis function neural network (RBF). | Weekly and monthly tomato market prices | [29] | |

| Garlic | ARIMA-SVM hybrid model | Average monthly wholesale price of garlic | [30] |

2. Materials and Methods

2.1. Data Analysis

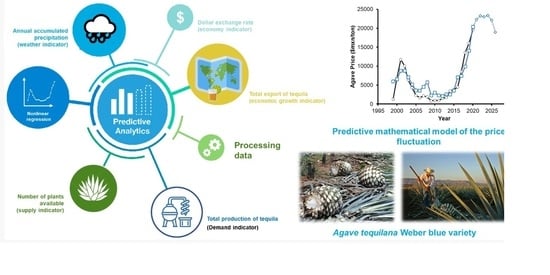

2.2. Information Regarding the Selected Independent Variables

- (I)

- Number of plants available, thousands of ton/year (supply indicator). The data used was retrieved from the databases of the Tequila Regulatory Council (CRT), which has a strict procedure used within this register; as a part of the completion of an application by the farmer for the registration of the cultivation field of new plants, they provide supporting documentation of the plantation that is under review (pre-registration). Afterwards, a field visit is carried out by the department in charge of the CRT, which oversees monitoring and verification that must be fulfilled in the field so that it can be found within the register of authorized producers. This evidence consists of counting the total number of plants, taking photographs of the field, and determining the geographical location of the property. Finally, to maintain a constant verification process, visits are scheduled in which the producer maintains a record of the partial and total sale of his plant inventory. (Supplementary Table S1).

- (II)

- The total production of Tequila, millions of L/year (demand indicator) and the total export of Tequila, millions of L/year (growth indicator). The data of total production and export of Tequila were retrieved from public information that the CRT updates periodically. The collection of these data consists of a rigorous criterion in which weekly reports that each company registers and authorizes for Tequila production are submitted to the CRT. It is important to note that in addition to this, the CRT has a verification department responsible for carrying out unannounced audits to corroborate the information reported by each company and guarantee the quality in each one of the stages of the Tequila production process. (Supplementary Table S1).

- (III)

- Dollar exchange rate, MXN (economy indicator). The dollar exchange rate data were retrieved from the official reports published by the Bank of Mexico (Banxico) through its Economic Information System website located within the exchange rate and historical results in the average exchange rate of Mexican pesos to United States of America dollar. (Supplementary Table S1).

- (IV)

- Annual accumulated precipitation, mm (weather indicator). The annual accumulated precipitation data for the state of Jalisco, Mexico, were obtained from the databases of the National Water Commission (CONAGUA), an administrative agency whose structure is the National Meteorological Service. Historical data are expressed in “mm”, which corresponds to 1 L m−2. (Supplementary Table S1).

2.3. Statistical Analysis: Multivariate Predictive Model

2.4. Model Fit Quality Indicators

3. Results and Discussion

3.1. Risk Analysis of the Supply Chain of the Tequila Industry to Satisfy Current Demand

3.2. Information Description: Risk Factor Analysis “Raw Material Supply”

3.3. Predictive Model Proposal

3.4. Fit Quality of the Model

| Year | Real Price MNX/Ton | Predicted Price MNX/Ton | Residuals | Standardized Residuals |

|---|---|---|---|---|

| 1999 | 1232.96 | 6196.49 | 2321.03 | 1.47 |

| 2000 | 6926.64 | 6667.79 | −1353.10 | −0.86 |

| 2001 | 11,731.55 | 9071.88 | −2447.33 | −1.55 |

| 2002 | 10,039.68 | 9492.86 | −794.54 | −0.50 |

| 2003 | 6310.24 | 7766.85 | 194.76 | 0.12 |

| 2004 | 4277.80 | 6562.61 | 470.28 | 0.30 |

| 2005 | 2295.51 | 4485.90 | −163.19 | −0.10 |

| 2006 | 1681.55 | 4828.56 | 626.48 | 0.40 |

| 2007 | 2121.12 | 5724.58 | 1202.47 | 0.76 |

| 2008 | 1886.75 | 6693.65 | 2342.18 | 1.48 |

| 2009 | 858.19 | 3220.42 | −382.19 | −0.24 |

| 2010 | 979.68 | 4531.76 | 840.70 | 0.53 |

| 2011 | 913.63 | 2678.00 | −964.97 | −0.61 |

| 2012 | 1470.03 | 2809.74 | −1238.33 | −0.78 |

| 2013 | 1754.47 | 3961.62 | −293.54 | −0.19 |

| 2014 | 3447.14 | 3926.71 | −1560.84 | −0.99 |

| 2015 | 3778.54 | 4618.95 | −1109.89 | −0.70 |

| 2016 | 4470.78 | 7810.69 | 1577.86 | 1.00 |

| 2017 | 8518.73 | 8179.13 | −1000.91 | −0.63 |

| 2018 | 13,563.44 | 10,567.02 | −2285.93 | −1.45 |

| 2019 | 16,039.45 | 15,148.60 | 492.93 | 0.31 |

| 2020 | 19,618.31 | 20,787.43 | 3526.09 | 2.23 |

3.5. Proposals for a Smart Agronomic Production

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Rulfo-Vilchis, F.O.; Pérez-Domínguez, J.F.; del Real Laborde, J.I.; Byerly-Murphy, K.F. Conocimiento y Prácticas Agronómicas para la Producción de Agave tequilana Weber en la Zona de Denominación de Origen del Tequila; Del Real-Laborde, J.I., Peréz-Dominguez, J.F., Eds.; Instituo Nacional de Investigaciones Forestales, Agrícolas y Pecuarias, Centro de Investigación Regional del Pacífico Centro: Tepatitlán de Morelos, Mexico, 2007; ISBN 978-968-800-726-6.

- Orozco Martínez, J.L. Panorámica actual de la industria tequilera. In Manual del Técnico Tequilero; Consejo Regulador del Tequila: Guadalajara, Mexico, 2019; pp. 7–39. [Google Scholar]

- Acosta-Salazar, E.; Fonseca-Aguiñaga, R.; Warren-Vega, W.M.; Zárate-Guzmán, A.I.; Zárate-Navarro, M.A.; Romero-Cano, L.A.; Campos-Rodríguez, A. Effect of Age of Agave tequilana Weber Blue Variety on Quality and Authenticity Parameters for the Tequila 100% Agave Silver Class: Evaluation at the Industrial Scale Level. Foods 2021, 10, 3103. [Google Scholar] [CrossRef] [PubMed]

- Bowen, S.; Gerritsen, P.R.W. Reverse leasing and power dynamics among blue agave farmers in western Mexico. Agric. Hum. Values 2007, 24, 473–488. [Google Scholar] [CrossRef]

- Rodríguez Gómez, G. La denominación de origen del Tequila: Pugnas de poder y la construcción de la especificidad sociocultural del agave azul. Nueva Antropol. 2007, 20, 141–171. [Google Scholar]

- Luna-Zamora, R. Tequilandia: Un Acercamiento a la Bioeconomía del Tequila y del Mezcal, 2nd ed.; Universidad de Guadalajara Centro Universitario de Ciencias Sociales y Humanidades: Guadalajara, Mexico, 2019; ISBN 978-607-547-487-8. [Google Scholar]

- Luna-Zamora, R. La Construcción Cultural y Economica del Tequila, 1st ed.; Prometeo Editores S.A. de C.V: Guadalajara, Mexico, 2015; ISBN 978-607-8336-84-5. [Google Scholar]

- Vázquez-Elorza, A.; Sánchez-Osorio, E.; Pérez-Ramírez, M.; Contreras-Medina, D.; Pardo-Núñez, J.; Figueroa-Galván, N.; Gallardo-Valdez, J. Perspectivas sociales, históricas y económicas del agave en Mexico: Una mirada a sus problemáticas, producción, aprovechamiento y consumo. Panorama del aprovechamiento de los agaves en Mexico. In Panorama del Aprovechamiento de los Agaves en México; Agared-Red Temática Mexicana Aprovechamiento Integral Sustentable y Biotecnología de los Agaves: Guadalajara, Mexico, 2017; pp. 249–293. ISBN 978-607-97548-5-3. [Google Scholar]

- Romo, P. Aumenta 200% Precio de Agave: Prevén Escasez Durante el 2018 y Parte del 2019. Available online: https://www.eleconomista.com.mx/estados/Aumenta-200-precio-de-agave-20171214-0026.html (accessed on 3 February 2022).

- Rodríguez, A. ¿Alguien Dijo “Caballitos”? Precio del Tequila Aumenta 23% por Costos Elevados de Agave y Alta Demanda. Available online: https://www.elfinanciero.com.mx/empresas/alguien-dijo-caballitos-precio-del-Tequila-aumentan-23-por-escasez-de-agave/ (accessed on 3 February 2022).

- Bowen, S. Las indicaciones geográficas, la globalización y el desarrollo territorial: El caso del Tequila. Agroalimentaria 2012, 18, 91–103. [Google Scholar]

- Trigo, N.A. Se Dispara el Precio del Agave. Available online: https://www.ntrguadalajara.com/post.php?id_nota=65770 (accessed on 3 February 2022).

- Bazen, S.; Cardebat, J.M. Forecasting Bordeaux wine prices using state-space methods. Appl. Econ. 2018, 50, 5108–5119. [Google Scholar] [CrossRef] [Green Version]

- Paroissien, E. Forecasting bulk prices of Bordeaux wines using leading indicators. Int. J. Forecast. 2020, 36, 292–309. [Google Scholar] [CrossRef]

- Jones, G.V.; Storchmann, K.H. Wine market prices and investment under uncertainty: An econometric model for Bordeaux Crus Classes. Agric. Econ. 2001, 26, 115–133. [Google Scholar] [CrossRef]

- Fernandez-Olmos, M.; Rosell-Martinez, J.; Espitia-Escuer, M.A. Vertical Integration in the Wine Industry: A Transaction Costs Analysis on the Rioja DOCa. Agribusiness 2009, 25, 231–250. [Google Scholar] [CrossRef]

- Gouel, C. Agricultural price instability: A survey of competing explanations and remedies. J. Econ. Surv. 2012, 26, 129–156. [Google Scholar] [CrossRef] [Green Version]

- Cedrez, C.B.; Chamberlin, J.; Hijmans, R.J. Seasonal, annual, and spatial variation in cereal prices in Sub-Saharan Africa. Glob. Food Secur. Policy Econ. Environ. 2020, 26, 100438. [Google Scholar] [CrossRef]

- Xu, X.J.; Zhang, Y. Corn cash price forecasting with neural networks. Comput. Electron. Agric. 2021, 184, 106120. [Google Scholar] [CrossRef]

- Ge, Y.; Wu, H.X. Prediction of corn price fluctuation based on multiple linear regression analysis model under big data. Neural Comput. Appl. 2020, 32, 16843–16855. [Google Scholar] [CrossRef]

- Schneider, L.; Tavin, B. Seasonal volatility in agricultural markets: Modelling and empirical investigations. Ann. Oper. Res. 2021, 1, 52. [Google Scholar] [CrossRef]

- Zhang, D.Q.; Zang, G.M.; Li, J.; Ma, K.P.; Liu, H. Prediction of soybean price in China using QR-RBF neural network model. Comput. Electron. Agric. 2018, 154, 10–17. [Google Scholar] [CrossRef]

- Fatih, C.; Charfeddine, L.; Mishra, P. Modeling and Forecasting Olive Oil Price Using Fuzzy Time Series and a Fractional Integrated Stochastic Process. Middle East J. Sci. Res. 2020, 28, 322–336. [Google Scholar] [CrossRef]

- Rocha, H.; Dias, J.M. Early prediction of durum wheat yield in Spain using radial basis functions interpolation models based on agroclimatic data. Comput. Electron. Agric. 2019, 157, 427–435. [Google Scholar] [CrossRef]

- Gu, Y.H.; Yoo, S.J.; Park, C.J.; Kim, Y.H.; Park, S.K.; Kim, J.S.; Lim, J.H. BLITE-SVR: New forecasting model for late blight on potato using support-vector regression. Comput. Electron. Agric. 2016, 130, 169–176. [Google Scholar] [CrossRef]

- Kamu, A.; Ahmed, A.; Yusoff, R. Forecasting Cocoa Bean Prices Using Univariate Time Series Models. J. Arts Sci. Commer. 2010, 1, 71. [Google Scholar]

- Yercan, M.; Adanacioglu, H. An analysis of tomato prices at wholesale level in Turkey: An application of SARIMA model. Custos E Agronegocio 2012, 8, 52–75. [Google Scholar]

- Nasira, G.M.; Hemageetha, N. Vegetable price prediction using data mining classification technique. In Proceedings of the International Conference on Pattern Recognition, Informatics and Medical Engineering, Salem, India, 21–23 March 2012; pp. 99–102. [Google Scholar]

- Hemageetha, N.; Nasira, G.M. Radial basis function model for vegetable price prediction. In Proceedings of the 2013 International Conference on Pattern Recognition, Informatics and Mobile Engineering, Salem, India, 21–22 February 2013; pp. 424–428. [Google Scholar]

- Wang, B.; Liu, P.; Chao, Z.; Junmei, W.; Chen, W.; Cao, N.; O’Hare, G.; Wen, F. Research on Hybrid Model of Garlic Short-term Price Forecasting based on Big Data. Comput. Mater. Contin. 2018, 57, 283–296. [Google Scholar] [CrossRef]

- Satten, G.A.; Kupper, L.L. Sample size determination for pair-matched case-control studies where the goal is interval estimation of the odds ratio. J. Clin. Epidemiol. 1990, 43, 55–59. [Google Scholar] [CrossRef]

- Peisheng, L.; Youhui, X.; Dunxi, Y.; Xuexin, S. Prediction of grindability with multivariable regression and neural network in Chinese coal. Fuel 2005, 84, 2384–2388. [Google Scholar] [CrossRef]

- Gallant. Nonlinear Regression. Am. Stat. 1975, 29, 73–81. [Google Scholar] [CrossRef]

- Peck, C.C.; Beal, S.L.; Sheiner, L.B.; Nichols, A.I. Extended least squares nonlinear regression: A possible solution to the “choice of weights” problem in analysis of individual pharmacokinetic data. J. Pharmacokinet. Biopharm. 1984, 12, 545–558. [Google Scholar] [CrossRef]

- Yagiz, S.; Sezer, E.A.; Gokceoglu, C. Artificial neural networks and nonlinear regression techniques to assess the influence of slake durability cycles on the prediction of uniaxial compressive strength and modulus of elasticity for carbonate rocks. Int. J. Numer. Anal. Methods Geomech. 2012, 36, 1636–1650. [Google Scholar] [CrossRef]

- Smyth, G.K. Nonlinear Regression. In Encyclopedia of Environmetrics; John Wiley & Sons, Ltd.: Hoboken, NJ, USA, 2001. [Google Scholar]

- Srivastava, A.K.; Srivastava, V.K.; Ullah, A. The coefficient of determination and its adjusted version in linear regression models. Econom. Rev. 1995, 14, 229–240. [Google Scholar] [CrossRef]

- Yang, Y. Prediction and analysis of aero-material consumption based on multivariate linear regression model. In Proceedings of the 2018 IEEE 3rd International Conference on Cloud Computing and Big Data Analysis (ICCCBDA), Chengdu, China, 20–22 April 2018; pp. 628–632. [Google Scholar]

- Núñez, H.M.; Rodríguez, L.F.; Khanna, M. Agave for Tequila and biofuels: An economic assessment and potential opportunities. GCB Bioenergy Bioprod. A Sustain. Bioecon. 2011, 3, 43–57. [Google Scholar] [CrossRef]

- Redacción, L. Afectan Lluvias en Jalisco 65 Mil Hectáreas–Proceso. Available online: https://www.proceso.com.mx/nacional/2003/9/13/afectan-lluvias-en-jalisco-65-mil-hectareas-79014.html (accessed on 4 March 2022).

- Tlapal Bolaños, B.; González Hernández, H.; Zavaleta Mejía, E.; Sánchez García, P.; Mora Aguilera, G.; Nava Díaz, C.; Del Real Laborde, J.I.; Rubio Cortes, R. Colonización de Trichoderma y Bacillus en Plántulas de Agave tequilana Weber, var. Azul y el Efecto Sobre la Fisiología de la Planta y Densidad de Fusarium. Rev. Mex. Fitopatol. 2014, 32, 62–74. [Google Scholar]

- Altuzar, A.; Malo, E.A.; Gonzalez-Hernandez, H.; Rojas, J.C. Electrophysiological and behavioural responses of Scyphophorus acupunctatus (Col., Curculionidae) to Agave tequilana volatiles. J. Appl. Entomol. 2007, 131, 121–127. [Google Scholar] [CrossRef]

- Ruiz-Montiel, C.; García-Coapio, G.; Rojas, J.C.; Malo, E.A.; Cruz-López, L.; Del Real, I.; González-Hernández, H. Aggregation pheromone of the agave weevil, Scyphophorus acupunctatus. Entomol. Exp. Appl. 2008, 127, 207–217. [Google Scholar] [CrossRef]

- Flores, D.; González-Hernández, I.; Lozano, R.; Vazquez-Nicolas, J.M.; Hernandez Toral, J.L. Automated Agave Detection and Counting Using a Convolutional Neural Network and Unmanned Aerial Systems. Drones 2021, 5, 4. [Google Scholar] [CrossRef]

- Casas, R. Between traditions and modernity: Technological strategies at three Tequila firms. Technol. Soc. 2006, 28, 407–419. [Google Scholar] [CrossRef]

- Waleckx, E.; Mateos-Diaz, J.C.; Gschaedler, A.; Colonna-Ceccaldi, B.; Brin, N.; García-Quezada, G.; Villanueva-Rodríguez, S.; Monsan, P. Use of inulinases to improve fermentable carbohydrate recovery during Tequila production. Food Chem. 2011, 124, 1533–1542. [Google Scholar] [CrossRef]

- Mirna, E.-E.; Mariela, R.-P.; Daniel, P.L.; Rogelio, P.-R. Innovation in Continuous Rectification for Tequila Production. Processes 2019, 7, 283. [Google Scholar] [CrossRef] [Green Version]

- Cortés, G.H.; Octavio, J.; Rodríguez, V.; López, E.J.H.; María, D.; Montaño, D.; García, Y.G.; Buendía, H.B.E.; Córdova, J. Improvement on the productivity of continuous Tequila fermentation by Saccharomyces cerevisiae of Agave tequilana juice with supplementation of yeast extract and aeration. AMB Express 2016, 1, 12. [Google Scholar] [CrossRef] [Green Version]

- Warren-Vega, W.M.; Fonseca-Aguiñaga, R.; González-Gutiérrez, L.V.; Carrasco-Marín, F.; Zárate-Guzmán, A.I.; Romero-Cano, L.A. Chemical characterization of Tequila maturation process and their connection with the physicochemical properties of the cask. J. Food Compos. Anal. 2021, 98, 103804. [Google Scholar] [CrossRef]

- Mere, F. The Future Of North American Market Integration: The Mexican Perspective. In Agricultural Outlook Forum; United States Department of Agriculture: Washington, DC, USA, 2005; p. 32882. [Google Scholar] [CrossRef]

- González Nieves, B. Introducción a la comercialización de Tequila. In Manual del Técnico Tequilero; Consejo Regulador del Tequila: Guadalajara, Mexico, 2019; pp. 623–637. [Google Scholar]

- Lecat, B.; Brouard, J.; Chapuis, C. Fraud and counterfeit wines in France: An overview and perspectives. Br. Food J. 2017, 119, 84–104. [Google Scholar] [CrossRef]

- Kotelnikova, Z. Explaining Counterfeit Alcohol Purchases in Russia. Alcohol. Clin. Exp. Res. 2017, 41, 810–819. [Google Scholar] [CrossRef]

- Chapa, S.; Minor, M.S.; Maldonado, C. Product Category and Origin Effects on Consumer Responses to Counterfeits. J. Int. Consum. Mark. 2006, 18, 79–99. [Google Scholar] [CrossRef]

- Aylott, R.; Aylott, I. Investigation and occurrence of counterfeit distilled spirits. In Whisky and Other Spirits, 3rd ed.; Russell, I., Stewart, G.G., Kellershohn, J.B.T.-W., Eds.; Academic Press: Cambridge, MA, USA, 2022; pp. 363–386. ISBN 978-0-12-822076-4. [Google Scholar]

- Gayialis, S.P.; Kechagias, E.P.; Konstantakopoulos, G.D.; Papadopoulos, G.A.; Tatsiopoulos, I.P. An Approach for Creating a Blockchain Platform for Labeling and Tracing Wines and Spirits. In Advances in Production Management Systems. Artificial Intelligence for Sustainable and Resilient Production Systems, Proceedings of the APMS 2021. IFIP Advances in Information and Communication Technology, Nantes, France, 5–9 September 2021; Dolgui, A., Bernard, A., Lemoine, D., von Cieminski, G., Romero, D., Eds.; Springer: Cham, Switzerland, 2021; pp. 81–89. [Google Scholar]

- Aguilar-Cisneros, B.O.; López, M.G.; Richling, E.; Heckel, F.; Schreier, P. Tequila authenticity assessment by headspace SPME-HRGC-IRMS analysis of 13C/12C and 18O/16O ratios of ethanol. J. Agric. Food Chem. 2002, 50, 7520–7523. [Google Scholar] [CrossRef]

- Fonseca-Aguiñaga, R.; Gómez-Ruiz, H.; Miguel-Cruz, F.; Romero-Cano, L.A. Analytical characterization of Tequila (silver class) using stable isotope analyses of C, O and atomic absorption as additional criteria to determine authenticity of beverage. Food Control 2020, 112, 107161. [Google Scholar] [CrossRef]

- Fonseca-Aguiñaga, R.; Warren-Vega, W.M.; Miguel-Cruz, F.; Romero-Cano, L.A. Isotopic Characterization of 100% Agave Tequila (Silver, Aged and Extra-Aged Class) for Its Use as an Additional Parameter in the Determination of the Authenticity of the Beverage Maturation Time. Molecules 2021, 26, 1719. [Google Scholar] [CrossRef] [PubMed]

- Diario Oficial de la Federación. Acuerdo por el que se Establece la Campaña y las Medidas Fitosanitarias que Deberán Aplicarse para el Control y en su Caso Erradicación del Picudo del Agave, así como Disminuir el Daño de las Enfermedades Asociadas a Dicha Plaga en la Zona Denominación de Origen; Secretaría de Gobernación: Mexico City, Mexico, 2013.

- Dirección General de Sanidad Vegetal. Manual Operativo de la Campaña contra Plagas Reglamentadas del Agave; Secretaria de Agricultura y Desarrollo Rural: Mexico City, Mexico, 2017. Available online: https://www.gob.mx/cms/uploads/attachment/file/625684/Estrategia_Operativa_campa_a_contra_plagas_reglamentadas_del_agave.pdf (accessed on 12 March 2022).

- Forbes China Reconoce Denominación de Origen del Tequila. Available online: https://www.forbes.com.mx/china-reconoce-denominacion-de-origen-del-Tequila/ (accessed on 6 February 2022).

- Álvarez-Díaz, J. Mexico Empieza a Vender en China su Bebida Estrella: Tequila de 100% de Agave. Available online: https://www.expansion.com/agencia/efe/2013/09/13/18734127.html (accessed on 12 March 2022).

- Kuroiwa, I.; Kuwamori, H. Impact of the US Economic Crisis on East Asian Economies: Production Networks and Triangular Trade through Chinese Mainland. China World Econ. 2011, 19, 1–18. [Google Scholar] [CrossRef]

- Bowen, S.; Zapata, A.V. Designations of origin and socioeconomic and ecological sustainability: The case of Tequila in Mexico. Cah. Agric. 2008, 17, 552–560. [Google Scholar] [CrossRef]

- Montgomery, D.C. Apéndice IV: Puntos porcentuales de la distribución F. In Diseño Y Análisis De Experimentos/Design and Analysis of Experiments (Spanish Edition); Translation ed.; Editorial Limusa S.A. De C.V: Guadalajara, Mexico, 2005; p. 543. ISBN 9681861566. [Google Scholar]

- Ruiz-Corral, J.A. Requerimientos agroecologicos y potencial productivo del agave Agave tequilana Weber en Mexico. In Conocimiento y Prácticas Agronómicas para la Producción de Agave tequilana Weber en la Zona de Denominación de Origen del Tequila; Rulfo-Vilchis, F.O., Pérez-Domínguez, J.F., del Real Laborde, J.I., Byerly-Murphy, K.F., Eds.; Instituto Nacional de Investigaciones Forestales, Agrícolas y Pecuarias. Centro de Investigación Regional del Pacífico Centro: Tepatitlán de Morelos, Mexico, 2007; pp. 11–36. ISBN 978-968-800-726-6. [Google Scholar]

- Gómez-Arriola, I. Tequila De la AntiguaTaberna Artesanal a una Industria de Alcance Global, 1st ed.; Casados-Arregoita, J., González-García, F.J., Orendáin-Giovannini, E., Rivial-León, R., Soltero-Jimenez, F.J., Cañedo-Sandoval, G., Eds.; Cámara Nacional de la Industria Tequilera: Guadalajara, Mexico, 2012; ISBN 9786079581800.

- Beluli, V.M. Smart beer production as a possibility for cyber-attack within the industrial process in automatic control. Procedia Comput. Sci. 2019, 158, 206–213. [Google Scholar] [CrossRef]

- Linko, S.; Linko, P. Developments in Monitoring and Control of Food Processes. Food Bioprod. Process. 1998, 76, 127–137. [Google Scholar] [CrossRef]

- Racz, S.-G.; Breaz, R.-E.; Cioca, L.-I. Evaluating Safety Systems for Machine Tools with Computer Numerical Control using Analytic Hierarchy Process. Safety 2019, 5, 14. [Google Scholar] [CrossRef] [Green Version]

- Formentin, S.; Campi, M.C.; Savaresi, S.M. Virtual Reference Feedback Tuning for industrial PID controllers. IFAC Proc. Vol. 2014, 47, 11275–11280. [Google Scholar] [CrossRef]

- del Real Laborde, J.I. Agave, materia prima del Tequila. In Manual del Técnico Tequilero; Consejo Regulador del Tequila: Guadalajara, Mexico, 2019; pp. 128–157. [Google Scholar]

| Parameters for the Predictive Mathematical Model | |||||

|---|---|---|---|---|---|

| Βij | j = 1 | j = 2 | j = 3 | j = 4 | j = 5 |

| i = 1 | 103.30 | 495.10 | −4.17 × 104 | 247.70 | −138.00 |

| i = 2 | −0.26 | −4.93 | 3526.00 | −0.33 | −3.49 |

| i = 3 | 2.22 × 10−4 | 0.02 | −133.90 | 2.07 × 10−4 | 0.03 |

| i = 4 | 5.62 × 10−8 | 1.58 × 10−5 | 2.03 | 5.08 × 10−8 | 5.13 × 10−5 |

| Parameter μj | |||||

| −2745.00 | −969.70 | 1.83 × 105 | −6.57 × 104 | 3.15 × 104 | |

| Parameter αj | |||||

| 0.44 | 0.05 | 0.45 | 0.50 | 0.05 | |

| Continent | Countries | Liters of Tequila Exports from 2020 | Participation (%) in the Market |

|---|---|---|---|

| America | 31 | 301,367,647.44 | 89.5 |

| Europe | 32 | 24,662,303.48 | 7.3 |

| Asia | 25 | 6,032,626.59 | 1.8 |

| Africa | 7 | 1,619,565.33 | 0.5 |

| Oceania | 2 | 3,217,762.82 | 1.0 |

| Total | 97 | 336,899,905.66 | 100.0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Warren-Vega, W.M.; Aguilar-Hernández, D.E.; Zárate-Guzmán, A.I.; Campos-Rodríguez, A.; Romero-Cano, L.A. Development of a Predictive Model for Agave Prices Employing Environmental, Economic, and Social Factors: Towards a Planned Supply Chain for Agave-Tequila Industry. Foods 2022, 11, 1138. https://doi.org/10.3390/foods11081138

Warren-Vega WM, Aguilar-Hernández DE, Zárate-Guzmán AI, Campos-Rodríguez A, Romero-Cano LA. Development of a Predictive Model for Agave Prices Employing Environmental, Economic, and Social Factors: Towards a Planned Supply Chain for Agave-Tequila Industry. Foods. 2022; 11(8):1138. https://doi.org/10.3390/foods11081138

Chicago/Turabian StyleWarren-Vega, Walter M., David E. Aguilar-Hernández, Ana I. Zárate-Guzmán, Armando Campos-Rodríguez, and Luis A. Romero-Cano. 2022. "Development of a Predictive Model for Agave Prices Employing Environmental, Economic, and Social Factors: Towards a Planned Supply Chain for Agave-Tequila Industry" Foods 11, no. 8: 1138. https://doi.org/10.3390/foods11081138

APA StyleWarren-Vega, W. M., Aguilar-Hernández, D. E., Zárate-Guzmán, A. I., Campos-Rodríguez, A., & Romero-Cano, L. A. (2022). Development of a Predictive Model for Agave Prices Employing Environmental, Economic, and Social Factors: Towards a Planned Supply Chain for Agave-Tequila Industry. Foods, 11(8), 1138. https://doi.org/10.3390/foods11081138