The Emerging Electric Vehicle and Battery Industry in Indonesia: Actions around the Nickel Ore Export Ban and a SWOT Analysis

Abstract

:1. Introduction

2. Materials and Methods

3. Results and Discussion

3.1. Literature Reviews from the Media, Academic Journals, and Records of Official Government Regulations

3.2. Seminar and Interviews with the Battery and EV Experts and Stakeholders

3.2.1. Insights from the Government

3.2.2. Insights from the Battery Industry

3.2.3. Insights from the EV Industry

3.2.4. Insights from the End-Users

3.3. SWOT Analysis

4. Conclusions

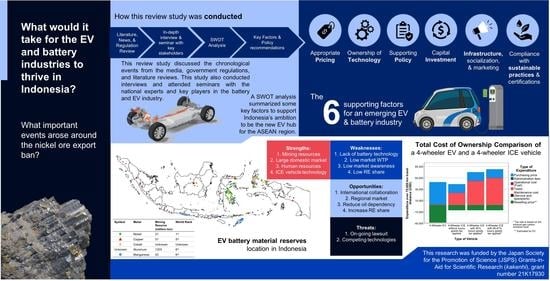

- Other emerging Asian countries with the similar ambitions to develop their EV industries (e.g., Thailand) or shift their ICE markets to EV may also find the six supporting factors (Figure 9) useful. The six factors (price, technology, policy, investment, infrastructure, and sustainable practices) are interrelated. For example, a price appropriate to the domestic and regional purchasing power may be achieved through product diversification, exercising various tax or policy instruments to boost EV price competitiveness in the market, and finally, supporting infrastructure and ensuring sustainable practices that may gain consumers’ and investors’ confidence to support the EV and battery industry.

- The SWOT analysis results of this study highlighted the international collaboration opportunities in both the manufacturing sector and the market sector of the EV and battery industry.

- To find strategies to reduce the costs of the EV battery production through diversification of material selections, manufacturing technology, and process efficiency improvement techniques.

- Exploration of ways to commercialize EVs in the emerging countries.

- Analysis of the effects of the various tax policies on the EV market behavior.

- Examination of the reselling price of used EVs and other topics related to reusing, refurbishing, and recycling EVs in the emerging countries.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- UNEP. Transport|UNEP—UN Environment Programme. 2021. Available online: https://www.unep.org/explore-topics/energy/what-we-do/transport (accessed on 21 October 2021).

- Bieker, G. A Global Comparison of the Life-Cycle Greenhouse Gas Emissions of Combustion Engine and Electric Passenger Cars; The International Council on Clean Transportation: Washington, DC, USA, 2021. [Google Scholar]

- World Economic Forum. A Vision for A Sustainable Battery Value Chain in 2030 Unlocking the Full Potential to Power Sustainable Development and Climate Change Mitigation; WEF: Geneva, Switzerland, 2019. [Google Scholar]

- Faber, B.; Krause, B.; La, D.; Faber, B.; Krause, B. Artisanal Mining, Livelihoods, and Child Labor in the Cobalt Supply Chain of the Democratic Republic of Congo; Center for Effective Global Action: Berkeley, CA, USA, 2017. [Google Scholar]

- Zhao, X.; Dunlap, R.A.; Obrovac, M.N. Alloy negative electrodes for Li-ion batteries. J. Electrochem. Soc. 2014, 161, A1976–A1980. [Google Scholar] [CrossRef]

- Nitta, N.; Wu, F.; Lee, J.T.; Yushin, G. Li-ion battery materials: Present and future. Mater. Today 2015, 18, 252–264. [Google Scholar] [CrossRef]

- Wu, E. Cathode and Precursor Materials: Can Success in the Chinese LFP Battery Market be Mimicked in the European and North American EV Markets? 2021. Available online: https://roskill.com/news/ (accessed on 5 August 2021).

- Greencarcongress. CATL to Build New $ 280M, 80 Tpy LFP Cathode Materials Plant in China; BioAge Group: Ricnmond, CA, USA, 2021; Volume 2021. [Google Scholar]

- Fraser, J.; Anderson, J.; Lazuen, J.; Lu, Y.; Heathman, O.; Brewster, N.; Bedder, J.; Masson, O. Study on Future Demand and Supply Security of Nickel for Electric Vehicle Batteries; Publication Office of the European Union: Luxembourg, 2021. [Google Scholar]

- Statista. Nickel Production Top Countries 2020|Statista. In Nickel Production Top Countries 2020; Statista: New York, NY, USA, 2020; Available online: https://www.statista.com/statistics/264642/nickel-mine-production-by-country/ (accessed on 4 August 2021).

- Bloomberg, N.E.F. Battery Metals Outlook. 2021. Available online: https://spotlight.bloomberg.com/story/battery-metals-outlook/page/1 (accessed on 5 August 2021).

- Li, A. Analysis on the current situation and future outlook of coal market in Indonesia. E3S Web Conf. 2020, 214, 1–5. [Google Scholar] [CrossRef]

- ESDM. Peraturan Menteri Energi Dan Sumber Daya Mineral Republik Indonesia Nomor 11 Tahun 2020. 2020. Available online: https://peraturan.bpk.go.id/Home/Details/142182/permen-esdm-no-11-tahun-2020 (accessed on 17 August 2021).

- Widiatedja, I.G.N.P. Indonesia’s export ban on nickel ore: Does it violate the World Trade Organization (WTO) rules? J. World Trade 2021, 55, 667–696. [Google Scholar]

- Nikkei Asia. Nickel-Rich Indonesia Draws Global Suppliers of EV Battery Materials—Nikkei Asia. 2021. Available online: https://asia.nikkei.com/Business/Markets/Commodities/Nickel-rich-Indonesia-draws-global-suppliers-of-EV-battery-materials (accessed on 27 June 2021).

- Hyundai Motor Group and LG Energy Solution Signed MoU with Indonesian Government to Establish EV Battery Cell Plant. 2021. Available online: https://www.hyundai.com/worldwide/en/company/newsroom/hyundai-motor-group-and-lg-energy-solution-sign-mou-with-indonesian-government-to-establish-ev-battery-cell-plant-0000016697 (accessed on 5 August 2021).

- Automotive Industry Portal MarkLines ASEAN: Thailand and Indonesia Building EV and Battery Production Facilities—MarkLines Automotive Industry Portal. 2021. Available online: https://www.marklines.com/en/report/rep2162_202106 (accessed on 9 September 2021).

- Asad, H. Ford, VW and Tesla are Investing in LFP Battery Technology for EV; Environment + Energy LEADER: Fort Collins, CO, USA, 2021; Available online: https://www.environmentalleader.com/2021/08/ford-vw-tesla-lean-in-to-lfp-battery-technology-for-evs/ (accessed on 17 August 2021).

- Lambert, F. Elon Musk Says Tesla is Shifting More Electric Cars to LFP Batteries over Nickel Supply Concerns—Electrek. 2021. Available online: https://electrek.co/2021/02/26/elon-musk-tesla-shifting-more-electric-cars-lfp-batteries-nickel-supply-concerns/ (accessed on 17 August 2021).

- Alvarez, S. Tesla’s Shift to LFP Cells for Megapack Batteries Heralds an Energy Storage Revolution. 2021. Available online: https://www.teslarati.com/tesla-lfp-megapack-batteries-disruption/ (accessed on 17 August 2021).

- Government of Indonesia. Undang-Undang Nomor 3 Tahun 2020 Tentang Perubahan Atas Undang-Undang Nomor 4 Tahun 2009 Tentang Pertambangan Mineral dan Batubara [JDIH BPK RI]; Government of Indonesia: Jakarta Pusat, Indonesia, 2009.

- Home, A. COLUMN-Nickel’s Perfect Bull Storm as Indonesia Bans Exports Again: Andy Home. In Reuters; Reuters: London, UK, 2019; Available online: https://finance.yahoo.com/news/column-nickels-perfect-bull-storm-122148475.html (accessed on 18 August 2021).

- Idris, M. Kronologi Larangan Ekspor Bijih Nikel yang Berujung Gugatan Uni Eropa. 2021. Available online: https://money.kompas.com/read/2021/01/18/170109026/kronologi-larangan-ekspor-bijih-nikel-yang-berujung-gugatan-uni-eropa?page=all (accessed on 18 August 2021).

- Centre for Energy and Mining Law Studies. Why does Indonesia’s Nickel Export Ban Upset the EU?|PUSHEP. In Pushep; Centre for Energy and Mining Law Studies: Jakarta, Indonesia, 2021; Available online: https://pushep.or.id/why-does-indonesias-nickel-export-ban-upset-the-eu/ (accessed on 18 August 2021).

- Purwaningsih, A. Konsultasi di WTO: Eropa dan Indonesia Gagal Capai Titik Temu Soal Larangan Ekspor Bijih Nikel|DUNIA: Informasi Terkini Dari Berbagai Penjuru Dunia|DW|13.02.2021. In Deutsche Welle Indonesia; Deutsche Welle: Indonesia, 2021; Available online: https://www.dw.com/id/di-balik-kekisruhan-larangan-ekspor-bijih-nikel/a-56521023 (accessed on 17 August 2021).

- APBI-ICMA Kebijakan Larangan Ekspor Nikel, Siapa yang Lebih Diuntungkan?|APBI-ICMA. In APBI-ICMA; Indonesian Coal Mining Association: Jakarta, Indonesia, 2019; Available online: http://www.apbi-icma.org/news/1778/ (accessed on 18 August 2021).

- Sandi, F. Siap Tempur Lawan Eropa Soal Nikel, Mendag: Mereka Ketakutan! In CNBC Indonesia; CNBC Indonesia: Indonesia, 2021; Available online: https://www.cnbcindonesia.com/news/20210127175840-4-219215/siap-tempur-lawan-eropa-soal-nikel-mendag-mereka-ketakutan (accessed on 18 August 2021).

- Artha Uly, Y. Semakin Panas, RI Siap Hadapi Gugatan Uni Eropa Soal Ekspor Nikel di WTO, Kompas, Indonesia. 2021. Available online: https://money.kompas.com/read/2021/02/26/201624726/semakin-panas-ri-siap-hadapi-gugatan-uni-eropa-soal-ekspor-nikel-di-wto?page=all (accessed on 18 August 2021).

- Harsono, N. ‘No Compromise on Nickel Ban’: Ministry Puts Foot down on Nickel Price Floor—Business—The Jakarta Post; The Jakarta Post: Indonesia, 2020; Available online: https://www.thejakartapost.com/news/2020/07/27/no-compromise-on-nickel-ban-ministry-puts-foot-down-on-nickel-price-floor.html (accessed on 18 August 2021).

- Reuters Indonesia President Defends Nickel Export Curbs after EU Complaint at WTO. In Yahoo Finance; Yahoo: Indonesia, 2019; Available online: https://finance.yahoo.com/news/indonesia-president-defends-nickel-export-065256064.html (accessed on 18 August 2021).

- Sappor, J. COVID19—Turns Indonesian Ore Export Ban into Curse for Nickel Market|S&P Global Market Intelligence. In S&P Global; S&P Global Market Intelligence: USA, 2020; Available online: https://www.spglobal.com/marketintelligence/en/news-insights/research/covid19-turns-indonesian-ore-export-ban-into-curse-for-nickel-market (accessed on 18 August 2021).

- Karunia, A.M. Pabrik Smelter Nikel di Konawe Dibakar Buruh, Menperin Dorong Penyelesaian Dengan Dialog; Kompas: Jakarta, Indonesia, 2020; Available online: https://money.kompas.com/read/2020/12/16/055536126/pabrik-smelter-nikel-di-konawe-dibakar-buruh-menperin-dorong-penyelesaian (accessed on 17 August 2021).

- Fauziah, F. Untung-Rugi Kebijakan Melarang Ekspor Bijih Nikel; Alinea.id: Indonesia, 2019; Available online: https://www.alinea.id/bisnis/untung-rugi-kebijakan-melarang-ekspor-bijih-nikel-b1XmD9ntt (accessed on 18 August 2021).

- METI. Nov 11, 2020—Japan’s 2050 Carbon Neutral Goal|METI Ministry of Economy, Trade and Industry; Ministry of Economy, Trade, and Industry: Tokyo, Japan, 2020.

- World Bank Population. Total—Indonesia|Data. In Population, Total—Indonesia; World Bank: Washington, DC, USA, 2020; Available online: https://data.worldbank.org/indicator/SP.POP.TOTL?locations=ID (accessed on 24 August 2021).

- Bawazier, T. Industri baterai & kendaraan listrik indonesia. In Quo Vadis Industri Baterai dan Kendaraan Listrik Indonesia; Forum Energizing Indonesia: Jakarta, Indonesia, 2021. [Google Scholar]

- President of Republic of Indonesia. Peraturan Presiden No. 55 Tahun 2019 Tentang Percepatan Program Kendaraan Bermotor Listrik Berbasis Baterai (Battery Electric Vehicle) Untuk Transportasi Jalan; President of Republic of Indonesia: Jakarta Pusat, Indonesia, 2019. [Google Scholar]

- Ministry of Industry. Peraturan Menteri Perindustrian Nomor 27 Tahun 2020 Tentang Spesifikasi, Peta Jalan Pengembangan, dan Ketentuan Penghitungan Tingkat Komponen Dalam Negeri Kendaraan Bermotor Dalam Negeri Kendaraan Bermotor Listrik Berbasis Baterai Battery Electric Vehicle; Ministry of Industry: Jakarta Pusat, Indonesia, 2020.

- Deutsche Welle Indonesia. Eropa dan RI Gagal Capai Titik Temu Soal Larangan Ekspor Bijih Nikel. 2021. Available online: https://news.detik.com/dw/d-5372935/eropa-dan-ri-gagal-capai-titik-temu-soal-larangan-ekspor-bijih-nikel (accessed on 18 August 2021).

- Government of Indonesia. Peraturan Pemerintah Republik Indonesia Nomor 24 Tahun 2010 Tentang Penggunaan Kawasan Hutan; Government of Indonesia: Jakarta Pusat, Indonesia, 2010.

- Government of Indonesia. Peraturan Pemerintah Republik Indonesia Nomor 1 Tahun 2014 Tentang Perubahan Kedua Atas Peraturan Pemerintah Nomor 23 Tahun 2010 Tentang Pelaksanaan Kegiatan Usaha Pertambangan Mineral Dan Batubara; Government of Indonesia: Jakarta Pusat, Indonesia, 2014.

- Ministry of Energy and Mineral Resources. Peraturan Menteri Energi dan Sumber Daya Mineral Nomor 1 Tahun 2014 Tentang Peningkatan Nilai Tambah Mineral Melalui Kegiatan Pengolahan Dan Pemurnian Mineral Di Dalam Negeri; Ministry of Energy and Mineral Resources: Jakarta Pusat, Indonesia, 2014.

- Government of Indonesia. Peraturan Pemerintah Nomor 1 Tahun 2017 Tentang Perubahan Keempat atas Peraturan Pemerintah Nomor 23 Tahun 2010 Tentang Pelaksanaan Kegiatan Usaha Pertambangan Mineral dan Batubara; Government of Indonesia: Jakarta Pusat, Indonesia, 2017.

- Ministry of Energy and Mineral Resources. Peraturan Menteri Energi dan Sumber Daya Mineral No. 25 Tahun 2018 Tentang Pengusahaan Pertambangan Mineral Dan Batubara; Ministry of Energy and Mineral Resources: Jakarta Pusat, Indonesia, 2018. [Google Scholar]

- Government of Indonesia. Peraturan Pemerintah Republik Indonesia Nomor 73 Tahun 2019 Tentang Barang Kena Pajak yang Tergolong Mewah Berupa Kendaraan Bermotor yang Dikenai Pajak Penjualan atas Barang Mewah; Government of Indonesia: Jakarta Pusat, Indonesia, 2019. [Google Scholar]

- Ministry of Transportation. Peraturan Menteri Perhubungan Nomor 45 Tahun 2020 Tentang Kendaraan Tertentu Dengan Menggunakan Penggerak Motor Listrik; Ministry of Transportation: Jakarta Pusat, Indonesia, 2020.

- Government of Indonesia. Undang-Undang Republic Indonesia Nomor 4 Tahun 2009 Tentang Tentang Pertambangan Mineral dan Batubara; Government of Indonesia: Jakarta Pusat, Indonesia, 2009. [Google Scholar]

- Ministry of Energy and Mineral Resources. Peraturan Menteri Energi dan Sumber Daya Mineral Nomor 13 Tahun 2020 Tentang Penyediaan Infrastruktur Pengisian Listrik Untuk Kendaraan Bermotor Listrik Berbasis Baterai; Ministry of Energy and Mineral Resources: Jakarta Pusat, Indonesia, 2020.

- Ministry of Domestic Affairs. Peraturan Menteri Dalam Negeri No. 8 Tahun 2020 Tentang Penghitungan Dasar Pengenaan Pajak Kendaraan Bermotor Dan Bea Balik Nama Kendaraan Bermotor; Ministry of Domestic Affairs: Jakarta Pusat, Indonesia, 2020.

- Artha Uly, Y. Ada Larangan Ekspor Bijih Nikel, Konsumsi Listrik Sulawesi Bisa Naik 3 Kali Lipat; Kompas: Jakarta, Indonesia, 2021. [Google Scholar]

- Cori, D. Menyoal Kebijakan Hilirasi Nikel. 2021. Available online: https://investor.id/opinion/menyoal-kebijakan-hilirasi-nikel (accessed on 17 August 2021).

- Sulaeman. Rasio Kepemilikan Mobil di Indonesia 99 Unit Per 1.000 Orang. 2021. Available online: https://www.liputan6.com/bisnis/read/4578268/rasio-kepemilikan-mobil-di-indonesia-99-unit-per-1000-orang-potensi-industri-otomotif (accessed on 18 September 2021).

- World Bank. GDP Per Capita (Current US$)|Data; World Bank: Washington, DC, USA, 2020; Available online: https://data.worldbank.org/indicator/NY.GDP.PCAP.CD (accessed on 24 August 2021).

- World Bank. GDP Per Capita (Current US$)—European Union|Data; World Bank: Washington, DC, USA, 2020; Available online: https://data.worldbank.org/indicator/NY.GDP.PCAP.CD?locations=EU (accessed on 24 August 2021).

- Japan GDP Per Capita. GDP Per Capita (Current US$)—Japan|Data. 2019. Available online: https://data.worldbank.org/indicator/NY.GDP.PCAP.CD?locations=JP (accessed on 24 August 2021).

- Maskur, F. DP Kredit 0 Persen, Ini Daftar Mobil Listrik Baterai Lulus Uji Tipe; Bisnis.com. 2020. Available online: https://otomotif.bisnis.com/read/20201001/275/1299533/dp-kredit-0-persen-ini-daftar-mobil-listrik-baterai-lulus-uji-tipe (accessed on 18 September 2021).

- CNN Indonesia. OJK Permudah Kredit Untuk Pelaku Industri Kendaraan Listrik. 2020. Available online: https://www.cnnindonesia.com/ekonomi/20200904135821-78-542804/ojk-permudah-kredit-untuk-pelaku-industri-kendaraan-listrik (accessed on 18 September 2021).

- Government of Indonesia. Peraturan Pemerintah No. 45 Tahun 2019 Tentang Penghitungan Penghasilan Kena Pajak dan Pelunasan Pajak Penghasilan Dalam Tahun Berjalan; Government of Indonesia: Jakarta Pusat, Indonesia, 2019.

- Mo, J.Y.; Jeon, W. The impact of electric vehicle demand and battery recycling on price dynamics of lithium-ion battery cathode materials: A Vector Error Correction Model (VECM) analysis. Sustainability 2018, 10, 2870. [Google Scholar] [CrossRef] [Green Version]

- BNEF. Battery Pack Prices Cited Below $100/kWh for the First Time in 2020, While Market Average Sits at $137/kWh|BloombergNEF. 2020. Available online: https://about.bnef.com/blog/battery-pack-prices-cited-below-100-kwh-for-the-first-time-in-2020-while-market-average-sits-at-137-kwh/ (accessed on 24 August 2021).

- Economist. Lithium Battery Costs Have Fallen by 98% in Three Decades|The Economist. In Lithium Battery Costs Have Fallen by 98% in Three Decades; Economist: London, UK, 2021; Available online: https://www.economist.com/graphic-detail/2021/03/31/lithium-battery-costs-have-fallen-by-98-in-three-decades (accessed on 24 August 2021).

- Tsiropoulos, I.; Tarvydas, D.; Lebedeva, N. Li-ion Batteries for Mobility and Stationary Storage Applications; Publications Office of the European Union: Luxembourg, 2018. [Google Scholar]

- Nugroho, T. Rencana Pengembangan Ekosistem EV Battery Indonesia. In Quo Vadis Industri Baterai dan Kendaraan Listrik Indonesia; Forum Energizing Indonesia: Jakarta, Indonesia, 2021. [Google Scholar]

- Central Government of Indonesia. PP No. 79 Tahun 2014 Tentang Kebijakan Energi Nasional [JDIH BPK RI]. In National Energy Regulation; Central Government of Indonesia: Indonesia, 2014. Available online: https://peraturan.bpk.go.id/Home/Details/5523/pp-no-79-tahun-2014 (accessed on 9 September 2021).

- Wentker, M.; Greenwood, M.; Leker, J. A bottom-up approach to Lithium-ion battery cost modeling with a focus on cathode active materials. Energies 2019, 12, 504. [Google Scholar] [CrossRef] [Green Version]

- IEA. Southeast Asia Energy Outlook 2019; IEA: Paris, France, 2019. [Google Scholar]

- Peplow, L.; Eardley, C. Electric Cars: Calculating the Total Cost of Ownership for Consumers; Element Energy Limited: Cambridge, UK, 2021. [Google Scholar]

- Deloitte. 2019 Global Automotive Consumer Study|Deloitte|Automotive, Connectivity; Deloitte: London, UK, 2019. [Google Scholar]

- Samyarto. Quo Vadis—Industri Baterai & Kendaraan Listrik Di Indonesia. In Quo Vadis Industri Baterai dan Kendaraan Listrik Indonesia; Forum Energizing Indonesia: Jakarta, Indonesia, 2021. [Google Scholar]

- Gogoro. Gogoro Network® Battery Swapping Platform—Gogoro. 2021. Available online: https://www.gogoro.com/gogoro-network/ (accessed on 31 August 2021).

- CNESA. BAIC BJEV Announces ‘Optimus Prime Plan’ Combining Battery Swapping, Energy Storage, and Solar Models. In China Energy Storage Alliance; CNESA: Beijing, China, 2017. [Google Scholar]

- Hyatt, K. China approves national EV battery swap standards, report says. In Road Show by CNET; CNET: San Francisco, CA, USA, 2021. [Google Scholar]

- Ather. Ather Energy—Building Fast and Intelligent Electric Scooters in India. 2021. Available online: https://www.atherenergy.com/grid (accessed on 31 August 2021).

- Ministry of Energy and Mineral Resources Coal and Minerals. Coal and Mineral Reserves in Indonesia; Ministry of Energy and Mineral Resources Coal and Minerals: Jakarta Pusat, Indonesia, 2021.

- Questera, N.; QUEST Motors-PT Ide Inovatif Bangsa, Jakarta, Indonesia. Personal communication, 2021.

- Croce, A.I.; Musolino, G.; Rindone, C.; Vitetta, A. Energy consumption of electric vehicles: Models’ estimation using big data (FCD). Transp. Res. Procedia 2020, 47, 211–218. [Google Scholar] [CrossRef]

- Kompas. Harga Motor Listrik Gesits Naik Per Juni. In Otomotif; Kompas: Jakarta, Indonesia, 2021; Available online: https://otomotif.kompas.com/read/2021/06/14/131200615/harga-motor-listrik-gesits-naik-per-juni-2021 (accessed on 14 September 2021).

- Astra-Honda. Sepeda Motor Honda Terbaru|PT Astra Honda Motor. In Price List; Astra-Honda: Indonesia, 2021; Available online: https://www.astra-honda.com/product/price-list (accessed on 14 September 2021).

- Kumparan, O.T.O. Biaya Servis Honda BeAT Selama 2 Tahun Pemakaian|Kumparan.Com. In Otomotif; KumparanOTO: Indonesia, 2021; Available online: https://kumparan.com/kumparanoto/biaya-servis-honda-beat-selama-2-tahun-pemakaian-1uzRHWlM2Wa (accessed on 14 September 2021).

- Muzaki, A. Harga Motor Listrik Gesits, Review, Spesifikasi, dan Simulasi Kredit Juni 2021; Otosia.com, Indonesia. 2021. Available online: https://www.otosia.com/berita/harga-motor-listrik-gesits-kln.html (accessed on 26 October 2021).

- Kosasih, D.T. Garansi 3 Tahun, Berapa Harga Baterai Motor Listrik Gesits?—Otomotif Liputan6.Com; Liputan6: Indonesia, 2019; Available online: https://www.liputan6.com/otomotif/read/4053391/garansi-3-tahun-berapa-harga-baterai-motor-listrik-gesits (accessed on 26 October 2021).

- Umah, A. Murah! Ini Perbandingan Ongkos Charging Mobil Listrik vs BBM; CNBCl Indonesia. 2021. Available online: https://www.cnbcindonesia.com/news/20210104153420-4-213393/murah-ini-perbandingan-ongkos-charging-mobil-listrik-vs-bbm (accessed on 26 October 2021).

- Central Government. PP No. 74 Tahun 2021 Tentang Perubahan atas Peraturan Pemerintah Nomor 73 Tahun 2019 Tentang Barang Kena Pajak Yang Tergolong Mewah Berupa Kendaraan Bermotor yang Dikenai Pajak Penjualan atas Barang Mewah [JDIH BPK RI]; Central Government: Indonesia, 2021. Available online: https://peraturan.bpk.go.id/Home/Details/171112/pp-no-74-tahun-2021 (accessed on 26 October 2021).

- Herdianto, R. Biaya Servis Nissan Livina Baru, dari 10.000 km sampai 100.000 Km; Grido.com, Indonesia. 2019. Available online: https://www.gridoto.com/read/221670123/biaya-servis-nissan-livina-baru-dari-10000-km-sampai-100000-km?page=all (accessed on 27 October 2021).

- Kencana, M.R.B. Sri Mulyani Terbitkan Aturan Baru Pajak PPnBM Mobil dan Motor, Cek Lengkapnya—Bisnis Liputan6.Com; Liputan6: Indonesia, 2021; Available online: https://www.liputan6.com/bisnis/read/4689711/sri-mulyani-terbitkan-aturan-baru-pajak-ppnbm-mobil-dan-motor-cek-lengkapnya (accessed on 27 October 2021).

- Satria, G. Servis Motor Listrik Gesits, Apa Saja yang Mesti Diganti? Kompas: Jakarta, Indonesia, 2020. [Google Scholar]

- Nugrahadi, A. Ini Biaya Resmi Urus Balik Nama Kendaraan di Jakarta; Kompas: Jakarta, Indonesia, 2021; Available online: https://otomotif.kompas.com/read/2021/03/29/151200415/ini-biaya-resmi-urus-balik-nama-kendaraan-di-jakarta (accessed on 26 October 2021).

- Nayazri, G.M. Ini Biaya Sevice Rutin Mercedes-Benz—GridOto.Com; Otomania: Indonesia, 2015; Available online: https://otomania.gridoto.com/read/241170162/ini-biaya-sevice-rutin-mercedes-benz (accessed on 26 October 2021).

- Rahadiansyah, R. Murah Banget, Cuma Segini Biaya Perawatan Mobil Listrik; detik.com, Indonesia. 2020. Available online: https://oto.detik.com/mobil/d-5252995/murah-banget-cuma-segini-biaya-perawatan-mobil-listrik (accessed on 26 October 2021).

- Wisnugroho, J.; PT. Hardtmann Mekatroniske Indonesia, Jakarta, Indonesia. Personal communication, 2021.

- Hidayat, F. Setiap Lima Tahun, Konsumen di Indonesia Ganti Mobil Baru. In Berita Satu; Berita Satu: Indonesia, 2015; Available online: https://www.beritasatu.com/otomotif/299441/setiap-lima-tahun-konsumen-di-indonesia-ganti-mobil-baru (accessed on 26 October 2021).

- Hyundai Indonesia. Pricelist|Hyundai Mobil Indonesia. In Price List; Hyundai Indonesia: Indonesia, 2021; Available online: http://hyundaimobil.co.id/pricelist (accessed on 9 September 2021).

- Lim, B.; Kim, H.S.; Park, J. Implicit interpretation of indonesian export bans on LME nickel prices: Evidence from the announcement effect. Risks 2021, 9, 93. [Google Scholar] [CrossRef]

- Situmorang, H. The effect of the ban on nickel exports on the economic profitability of PT vale Indonesia, Tbk from 2015—June. Fundam. Manag. J. 2021, 6, 73–82. [Google Scholar]

- Marciano, I. Strengthening the Development of Electric Vehicle Ecosystem in Indonesia, IESR Compare with the United States, Norway, and China—IESR; IESR: Jakarta, Indonesia, 2021. [Google Scholar]

- Times. Times Car Sharing. 2021. Available online: https://share.timescar.jp/ (accessed on 15 September 2021).

- Marciano, I. Developing the Ecosystem of Electric Vehicles in Indonesia—IESR; IESR: Jakarta, Indonesia, 2021. [Google Scholar]

- World Resources Institute. Beijing Low-Emission Zone|WRI Ross Center for Sustainable Cities. In Projects; World Resources Institute: Washington, DC, USA, 2017; Available online: https://wrirosscities.org/our-work/project-city/beijing-low-emission-zone (accessed on 15 September 2021).

- IEA. Global EV Outlook 2020—Analysis—IEA. In Global EV Outlook 2020; IEA: Paris, France, 2020; Available online: https://www.iea.org/reports/global-ev-outlook-2020 (accessed on 15 September 2021).

- Adiatma, J.C.; Marciano, I. The Role of Electric Vehicles in Decarbonizing Indonesia’s Road Transport Sector—IESR; IESR: Jakarta, Indonesia, 2020. [Google Scholar]

| Cell Generation | Cell Chemistry |

|---|---|

| Generation 5 |

|

| Generation 4 |

|

| Generation 3b |

|

| Generation 3a |

|

| Generation 2b |

|

| Generation 2a |

|

| Generation 1 |

|

| Nickel Ore | MHP | NiSO4 | Precursor | Cathode | Battery Cell | |

|---|---|---|---|---|---|---|

| Increased added value (1000 USD/ton Ni) | 1.1 to 1.7 | up to 10 | up to 14 | 25 to 30 | 45 to 55 | 90 to 150 |

| Value-added relative to the ore price | - | 30 to 40 times | 90 to 150 times | |||

| Battery Parts | Brushless DC Motor (BLDC) Parts | Controller Parts | ||

|---|---|---|---|---|

| Imported (as of 2021) | Battery Management System (BMS) | Stator core | Insulation tube B | Mainboard PCB controller |

| Battery cell | Vinalon rope | Insulation tube C | Wire cable + socket connector | |

| Heat shrink black | Rotor core | |||

| Magnet rotor 35 | ||||

| Domestically available | Top cover | Enameled wire | Rear bracket assy | Plastic cover |

| Socket connector | Copper tube | Thermal sensor assy | Heatsink Aluminum | |

| Cover body extrusion | Varnish A | Rear bracket | Component assembly and integration | |

| Plastic bottom cover | Solder bar | Front bracket material | Software & programming | |

| Component assembly | Flux solder | O. ring bracket | ||

| Motor frame | Magnet sensor assy | |||

| Bolts stopper stator | PCB assy | |||

| Cable assy | PCB holder | |||

| Cable seal | Sensor cover | |||

| Cable plate | O. ring sensor cover | |||

| Bold cable plate | Bold sensor cover | |||

| Shaft material | Oil seal | |||

| Rear endplate | Pulley | |||

| Front end plate | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pandyaswargo, A.H.; Wibowo, A.D.; Maghfiroh, M.F.N.; Rezqita, A.; Onoda, H. The Emerging Electric Vehicle and Battery Industry in Indonesia: Actions around the Nickel Ore Export Ban and a SWOT Analysis. Batteries 2021, 7, 80. https://doi.org/10.3390/batteries7040080

Pandyaswargo AH, Wibowo AD, Maghfiroh MFN, Rezqita A, Onoda H. The Emerging Electric Vehicle and Battery Industry in Indonesia: Actions around the Nickel Ore Export Ban and a SWOT Analysis. Batteries. 2021; 7(4):80. https://doi.org/10.3390/batteries7040080

Chicago/Turabian StylePandyaswargo, Andante Hadi, Alan Dwi Wibowo, Meilinda Fitriani Nur Maghfiroh, Arlavinda Rezqita, and Hiroshi Onoda. 2021. "The Emerging Electric Vehicle and Battery Industry in Indonesia: Actions around the Nickel Ore Export Ban and a SWOT Analysis" Batteries 7, no. 4: 80. https://doi.org/10.3390/batteries7040080

APA StylePandyaswargo, A. H., Wibowo, A. D., Maghfiroh, M. F. N., Rezqita, A., & Onoda, H. (2021). The Emerging Electric Vehicle and Battery Industry in Indonesia: Actions around the Nickel Ore Export Ban and a SWOT Analysis. Batteries, 7(4), 80. https://doi.org/10.3390/batteries7040080