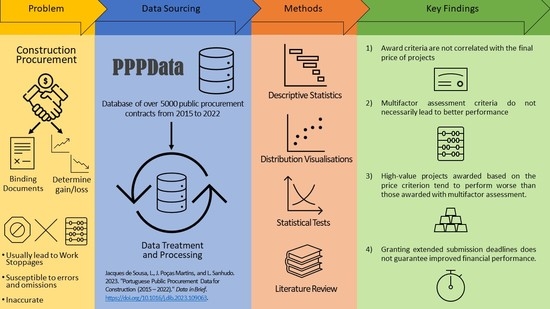

Statistical Descriptive Analysis of Portuguese Public Procurement Data from 2015 to 2022

Abstract

:1. Introduction

2. Research Approach

2.1. Data Variables

2.2. Publication and Close Year

2.3. Region

2.4. Submission and Execution Deadlines

2.5. Award Criteria

2.6. Price Variables

- Small-value projects (IP less than EUR 250 k/USD 272 k);

- Intermediate-value projects (IP greater than EUR 250 k/USD 272 k and less than EUR 1 M/USD 1.1 M);

- High-value projects (IP greater than EUR 1 M/USD 1.1 M).

2.7. Performance

- Price Compliance: contracts in which the ratio between the EP and the IP was above 105%;

- Price Spill: contracts in which the ratio between the EP and the IP was 95% and 105%;

- Price Savings: contract in which the ratio between the EP and the IP was below 95%.

3. Association and Relationships between Contract Characteristics

3.1. Publication and Close Year

3.2. Submission and Execution Deadline Effects on Performance

3.3. Region Relationship between IP Class, Award Criteria, and Performance

3.4. Association between Award Criteria and IP Class

3.5. Association between Award Criteria and Performance

3.6. Association between IP Class and Performance

3.7. Association between Criterium Class and Performance

4. Analysis Per IP Class of Projects

- Is there any criterion that performs better when a project is small/high in value?

- Is there any weight of the price factor that performs better when the project has a smaller/higher value?

5. Discussion

6. Conclusions

- Overall, the performance of construction projects in Portugal during the studied timeframe was positive.

- Award criteria are generally not correlated with the final price of projects.

- Multifactor assessment criteria do not necessarily lead to better performance compared to projects awarded solely based on the price factor.

- High-value (i.e., above USD 1.1 million) projects exclusively awarded based on the price award criterion tend to perform worse than those awarded with multifactor assessment.

- Contract execution is concentrated in coastal areas and major cities of Portugal.

- There has been, in general, an increase in the number of contracts submitted to PB.

- Granting extended submission deadlines does not guarantee improved financial performance of construction projects.

- Errors and omissions in construction reporting are prevalent, leading to information scarcity in public tender repositories.

- Public procurement data repositories play a crucial role in summarising and providing insights into project results.

- Error mitigation tools and increased awareness of data submission accuracy are necessary for public procurement repositories.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- DRE. Código dos Constratos Públicos (CCP)—Consolidated with the Amendment Introduced by Decree-Law no. 78/2022 of 7 November 2008; IMPIC: Rebecq, Belgium, 2008.

- IMPIC. Anual Public Procurement in Portugal. 2019. Available online: https://www.impic.pt/impic/assets/misc/relatorios_dados_estatisticos/RelContratosPublicos_2019_EN.pdf (accessed on 1 April 2023).

- Muriro, A.; Wood, G. A comparative analysis of procurement methods used on competitively tendered office projects in the UK. In Proceedings of the COBRA 2010—Construction, Building and Real Estate Research Conference of the Royal Institution of Chartered Surveyors, Paris, France, 2–3 September 2010. [Google Scholar]

- Yi, C.-Y.; Gwak, H.-S.; Kim, B.-S.; Lee, D.-E. Stochastic Multi-variate Performance Trade-off Method for Technical Tender Evaluation. KSCE J. Civ. Eng. 2018, 22, 4240–4253. [Google Scholar] [CrossRef]

- Carbonara, N.; Pellegrino, R. The role of public private partnerships in fostering innovation. Constr. Manag. Econ. 2020, 38, 140–156. [Google Scholar] [CrossRef]

- Kerridge, S.; Halaris, C. SupplyPoint: An integrated system supporting E-business in the Construction Sector. In Proceedings of the First IFIP Conference on E-Commerce, E-Business, E-Government (I3E 2001), Zürich, Switzerland, 3–5 October 2001. [Google Scholar]

- Chen, D.; Hajderanj, L.; Fiske, J. Towards automated cost analysis, benchmarking and estimating in construction: A machine learning approach. In Proceedings of the 13th Multi Conference on Computer Science and Information Systems, Porto, Portugal, 16–19 July 2019. [Google Scholar]

- Martin, J.L.N. E-Bidding for Building Contracts in the UK. AACE Int. Trans. 2007, RICS.02.1–RICS.02.4. [Google Scholar]

- Jacques de Sousa, L.; Martins, J.P.; Baptista, J.S.; Sanhudo, L.; Mêda, P. Algoritmos de classificação de texto na automatização dos processos orçamentação. In Proceedings of the 4° Congresso Português de Building Information Modelling, Braga, Portugal, 4–6 May 2022. [Google Scholar]

- Dogan, A.; Birant, D. Machine learning and data mining in manufacturing. Expert Syst. Appl. 2021, 166, 114060. [Google Scholar] [CrossRef]

- Munawar, H.S.; Ullah, F.; Qayyum, S.; Shahzad, D. Big Data in Construction: Current Applications and Future Opportunities. Big Data Cogn. Comput. 2022, 6, 18. [Google Scholar] [CrossRef]

- Aibinu, A.A.; Al-Lawati, A.M. Using PLS-SEM technique to model construction organisations’ willingness to participate in e-bidding. Autom. Constr. 2010, 19, 714–724. [Google Scholar] [CrossRef]

- IMPIC. Portal Base. 2022. Available online: https://www.base.gov.pt (accessed on 1 April 2023).

- DRE. Diário da Républica Electónico. 2022. Available online: https://dre.pt/dre/home (accessed on 1 April 2023).

- Jacques de Sousa, L.; Martins, J.P.; Sanhudo, L. Portuguese Public Procurement Data for Construction (2015–2022). Data Brief 2023, 48, 109063. [Google Scholar] [CrossRef] [PubMed]

- Umar, T.; Egbu, C. Causes of construction accidents in Oman. Middle East J. Manag. 2017, 5, 21–33. [Google Scholar] [CrossRef]

- Umar, T. Key factors influencing the implementation of three-dimensional printing in construction. Proc. Inst. Civ. Eng. Manag. Procure. Law 2021, 174, 104–117. [Google Scholar] [CrossRef]

- Bryman, A. Social Research Methods, 5th ed.; Oxford University Press: London, UK, 2016. [Google Scholar]

- Jacques de Sousa, L.; Martins, J.P.; Sanhudo, L. Base de Dados: Contratação Pública em Portugal Entre 2015 e 2022; Universidade do Minho: Gimaraes, Portugal, 2022. [Google Scholar]

- Gabinete de Estratégia e Estudos. Principais Indicadores Económicos de Portugal. 2023. Available online: https://www.gee.gov.pt/pt/publicacoes/indicadores-e-estatisticas/principais-indicadores-economicos-de-portugal (accessed on 15 May 2023).

- Infraestruturas de Portugal. Relatório de Contas. 2015. Available online: https://www.infraestruturasdeportugal.pt/sites/default/files/inline-files/Relat%C3%B3rio%20e%20Contas%20Separadas%202015%20%E2%80%93%20vers%C3%A3o%20corrigida.pdf (accessed on 15 May 2023).

- Infraestruturas de Portugal. Relatório de Contas. 2021. Available online: https://www.infraestruturasdeportugal.pt/pdfs/RC_IP_2021.pdf (accessed on 15 May 2023).

- Leontie, V.; Maha, L.-G.; Stoian, I.C. COVID-19 Pandemic and Its Effects on the Usage of Information Technologies in the Construction Industry: The Case of Romania. Buildings 2022, 12, 166. [Google Scholar] [CrossRef]

- Faria, B.S.; Simões, A.C.; Rodrigues, J.C. Impact of Governmental Support for the Implementation of Industry 4.0 in Portugal. In Innovations in Industrial Engineering, Proceedings of the International Conference Innovation in Engineering, Minho, Portugal, 28–30 June 2022; Lecture Notes in Mechanical Engineering; Springer: Cham, Switzerland, 2022; pp. 108–120. [Google Scholar]

- Picas, S.; Reis, P.; Pinto, A.; Abrantes, J.L. Does tax, financial, and government incentives impact long-term Portuguese SMEs’ sustainable company performance? Sustainability 2021, 13, 11866. [Google Scholar] [CrossRef]

- Ferreira FE, M.; Catarino, J.R. European territorial development and the place based approach: The budgetary dimension of Portugal 2020. Rev. Iberoam. J. Dev. Stud. 2018, 7, 114–136. [Google Scholar] [CrossRef]

- Governo da República Portuguesa. Há Uma Clara Correlação Entre a Maior Centralização e o Menor Desenvolvimento. 2019. Available online: https://www.portugal.gov.pt/pt/gc21/comunicacao/noticia?i=ha-uma-clara-correlacao-entre-a-maior-centralizacao-e-o-menor-desenvolvimento (accessed on 15 May 2023).

- OECD. Key Data on Local and Regional Governments in the European Union (Brochure). 2018. Available online: www.oecd.org/regional/regional-policy (accessed on 15 May 2023).

- CID. Comissão Independente para a Descentralização—Volume I—Relatório. 2019. Available online: https://www.parlamento.pt/Documents/2019/julho/descentralizacao/Relatorio-Final-descentralizacao.pdf (accessed on 15 May 2023).

- OECD. Decentralisation and Regionalisation in Portugal. 2020. Available online: https://www.oecd-ilibrary.org/content/publication/fea62108-en (accessed on 15 May 2023).

- EU. Directive 2014/24/EU of the European Parliament and of the Council of 26 February 2014 on Public Procurement and Repealing Directive 2004/18/EC Text with EEA Relevance. 2014. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32014L0024 (accessed on 15 May 2023).

- DRE. Law 41 2015, Regulated by Ordinance 212/2022 Diário da República, 1.ª Série; Diário da República: Lisbon, Portugal, 2022.

- Hanák, T.; Drozdová, A.; Marović, I. Bidding Strategy in Construction Public Procurement: A Contractor’s Perspective. Buildings 2021, 11, 47. [Google Scholar] [CrossRef]

- Fry, T.D.; Leitch, R.A.; Philipoom, P.R.; Tian, Y. Empirical Analysis of Cost Estimation Accuracy in Procurement Auctions. Int. J. Bus. Manag. 2016, 11, 1. [Google Scholar] [CrossRef] [Green Version]

- Bergman, M.A.; Lundberg, S. Tender evaluation and supplier selection methods in public procurement. J. Purch. Supply Manag. 2013, 19, 73–83. [Google Scholar] [CrossRef]

- Lehtonen, J.-M.; Virtanen, K. Choosing the most economically advantageous tender using a multi-criteria decision analysis approach. J. Public Procure. 2022, 22, 164–179. [Google Scholar] [CrossRef]

- Plebankiewicz, E.; Kozik, R. The transformation of the tender evaluation process in public procurement in Poland. IOP Conf. Ser. Mater. Sci. Eng. 2017, 251, 012042. [Google Scholar] [CrossRef]

| Variable Group | Variable Name | Brief Description | Variable Classes |

|---|---|---|---|

| 1. Publication and close year | Publication Year | Year of publication in PB | - |

| Close Year | Year of closure in PB | - | |

| 2. Region | Region | Place of execution of the project | - |

| 3. Deadlines | Execution Deadline | Deadline for completion of the project | - |

| Submission Deadline | Deadline for the acceptance of tender applications (bids) | - | |

| 4. Award criteria | Criterium | Award criteria used to select the winner of the tender as stated in the tender documents | Missing, i.e., no specific criteria are described |

| Multifactor assessment | |||

| price | |||

| Criterium Class | Weight given to the price factor in the award criteria in percentages | [0–40] | |

| ]40–70] | |||

| ]70–95] | |||

| ]95–100] | |||

| 5. Price variables | Base Tender Price | Maximum amount which the client is willing to pay for the execution of the project | - |

| Initial Price | Initial contractually agreed price | - | |

| Initial Price Class | Class given to the IP to grade the contracts | IP < 250 k €/272 k $ | |

| 250 k < IP < 1 M € | |||

| IP > 1 M €/1.1 M $ | |||

| Effective Price | Actual price at the end of the project | - | |

| 6. Performance | Price Difference | Difference between the effective and initial prices | - |

| Price Proportion | Proportion between the EP and IP ((EP/IP) × 100%) | - | |

| Performance Class | Class given to the result of the project | Price spill: EP/IP > = 105% | |

| Price compliance: 95% < EP/IP < 105% | |||

| Price savings: EP/IP = <95% |

| Price Weight in All Contracts with Award Criteria (%) | |||||||||

| N | Mean | Median | Mode | Minimum | Maximum | Std. Deviation | Quartiles | ||

| 25 | 50 | 75 | |||||||

| 3602 | 85.1 | 100.0 | 100 | 5 | 100 | 21.6 | 60.0 | 100.0 | 100.0 |

| Price Weight in Contracts with Multifactor Classification (%) | |||||||||

| N | Mean | Median | Mode | Minimum | Maximum | Std. Deviation | Quartiles | ||

| 25 | 50 | 75 | |||||||

| 1281 | 58.2 | 60 | 60 | 5 | 100 | 13.7 | 50 | 60 | 70 |

| Base Tender Price (EUR/USD) | IP (EUR/USD) | EP (EUR/USD) | ||

|---|---|---|---|---|

| N | Valid | 5125 | 5172 | 5172 |

| Missing | 47 | 0 | 0 | |

| Mean | 842,285/917,610 | 633,707/690,379 | 634,318/691,045 | |

| Median | 334,000/363,870 | 270,106/294,262 | 271,389/295,659 | |

| Standard Deviation | 2,695,513/2,936,573 | 2,066,590/2,251,405 | 2,062,120/2,246,535 | |

| Coefficient of Variation | 320% | 326% | 325% | |

| Minimum | 7750/8443 | 3053/3326 | 3053/3326 | |

| Maximum | 110 M/120 M | 88,099,874/95,978,646 | 88,099,874/95,978,646 | |

| Quartiles | 25 | 200,613/218,554 | 167,727/182,727 | 166,009/180,855 |

| 50 | 334,000/363,870 | 270,106/294,262 | 271,389/295,659 | |

| 75 | 675,000/735,365 | 517,392/563,662 | 519,079/565,500 | |

| Small Value | Intermediate Value | High Value | Total | |

|---|---|---|---|---|

| Frequency | 2406 | 2204 | 562 | 5172 |

| Percentage | 46.5 | 42.6 | 10.9 | 100.0 |

| Price Proportion (%) | Price Difference (EUR/USD) | ||

|---|---|---|---|

| N | Valid | 5172 | 5172 |

| Missing | 0 | 0 | |

| Mean | 100.2 | −611.1/−666 | |

| Median | 100 | 0 | |

| Standard Deviation | 9.4 | 87,125.1/94,868.8 | |

| Minimum | 10.3 | −2,021,789.5/2,201,486.2 | |

| Maximum | 279.7 | 1,824,950.9/1,987,152.5 | |

| Quartiles | 25 | 98.6 | −3878.1/−4222.8 |

| 50 | 100 | 0 | |

| 75 | 101.8 | 4493.6/4893.0 | |

| IP Class | Performance Class | Award Criteria | Criterium Class | |||||

|---|---|---|---|---|---|---|---|---|

| Missing | Price | Multifactor Assessment | [0; 40] | ]40; 70] | ]70; 95] | ]95; 100] | ||

| Small value | Slip | 13.3 | 16.0 | 19.2 | 10.4 | 22.4 | 17.6 | 16.0 |

| Compliance | 73.4 | 71.0 | 71.4 | 81.8 | 69.0 | 70.2 | 71.0 | |

| Saving | 13.3 | 13.0 | 9.4 | 7.8 | 8.5 | 12.2 | 13.0 | |

| Intermediate value | Slip | 14.8 | 18.5 | 17.2 | 11.6 | 21.0 | 14.3 | 18.5 |

| Compliance | 67.5 | 68.0 | 71.0 | 75.2 | 66.4 | 76.4 | 68.0 | |

| Saving | 17.6 | 13.5 | 11.8 | 13.2 | 12.6 | 9.3 | 13.5 | |

| High value | Slip | 12.4 | 27.3 | 16.9 | 12.9 | 16.1 | 25.0 | 27.3 |

| Compliance | 75.6 | 66.7 | 68.2 | 80.6 | 63.4 | 70.8 | 66.7 | |

| Saving | 12.1 | 6.1 | 14.9 | 6.5 | 20.4 | 4.2 | 6.1 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jacques de Sousa, L.; Simões, M.L.; Poças Martins, J.; Sanhudo, L.; Moreira da Costa, J. Statistical Descriptive Analysis of Portuguese Public Procurement Data from 2015 to 2022. CivilEng 2023, 4, 808-826. https://doi.org/10.3390/civileng4030045

Jacques de Sousa L, Simões ML, Poças Martins J, Sanhudo L, Moreira da Costa J. Statistical Descriptive Analysis of Portuguese Public Procurement Data from 2015 to 2022. CivilEng. 2023; 4(3):808-826. https://doi.org/10.3390/civileng4030045

Chicago/Turabian StyleJacques de Sousa, Luís, Maria Lurdes Simões, João Poças Martins, Luís Sanhudo, and Jorge Moreira da Costa. 2023. "Statistical Descriptive Analysis of Portuguese Public Procurement Data from 2015 to 2022" CivilEng 4, no. 3: 808-826. https://doi.org/10.3390/civileng4030045

APA StyleJacques de Sousa, L., Simões, M. L., Poças Martins, J., Sanhudo, L., & Moreira da Costa, J. (2023). Statistical Descriptive Analysis of Portuguese Public Procurement Data from 2015 to 2022. CivilEng, 4(3), 808-826. https://doi.org/10.3390/civileng4030045