Empirical Evidence of a Changing Operating Cost Structure and Its Impact on Banks’ Operating Profit: The Case of Germany

Abstract

:1. Introduction

2. Thematic Classification and Hypothesis Development

2.1. The German Banking Market

- Represents the interests of the cooperative financial network at both national and international levels;

- Coordinates and develops the joint strategy within the network;

- Advises and supports their members on legal, taxation, and business management issues;

- Informs their members about the latest developments in the economy, politics, and banking;

- Provides the cooperative financial network protection scheme, Germany’s oldest deposit guarantee fund for banks that is run by the BVR (National Association of German Cooperative Banks 2019).

2.2. Personnel Development in German Banking

2.3. Hypotheses Development

3. Theoretical Framework—Interlinkages of Personnel Costs in Bank’s Income Statement

3.1. Bank Income Statement

- (1)

- IAS 1–Presentation of Financial Statements,

- (2)

- IFRS 7–Financial Instruments: Disclosures, and

- (3)

- RechKredV–Ordinance on the Accounting of Credit Institutions and Financial Services Institutions.

3.2. Mathematical Calculation of Operating Profit

- is operating profit,

- is staff expenses,

- is other administrative expenses,

- is other operating expenses,

- is net operating revenues, and

- is total operating expenses with .

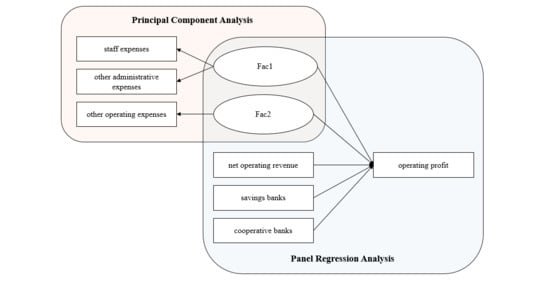

4. Methodology

4.1. Data

4.2. Mathematical Approach and Calculation

- is the z-value of a person i on an item m,

- factor value of person i to factor 1,

- loading of items m to factor 1,

- factor value of person i to factor j,

- loading of items m to factor j,

- number of factors, and

- error component that cannot be explained by the extracted factors.

5. Results

5.1. Statistical Interpretation

5.2. Hypothesis Verification

6. Conclusions

Funding

Conflicts of Interest

Appendix A

| Income Statement | |

| 1. | + Interest on loans |

| 2. | + Interest on bank deposits |

| 3. | + Interest and preferred stock dividends on securities (AFS and HtM) |

| 4. | + Other interest income |

| 5. | = Total interest received |

| 6. | − Interest on customer deposits |

| 7. | − Interest on debt securities |

| 8. | − Interest on bank deposits |

| 9. | − Other interest expenses |

| 10. | = Total interest paid |

| 11. | = Net interest income |

| 12. | + Fee and commission income |

| 13. | − Fee and commission expense |

| 14. | = Net fee and commission income |

| 15. | + Net trading income on securities and derivatives |

| 16 | +/− Net gains and losses on assets & liabilities at fair value through P&L |

| 17. | +/− Net gains and losses on other securities |

| 18. | =Total net trading income and fair value gains and losses |

| 19. | + Net insurance income |

| 20. | + Dividend income: common stock |

| 21. | +/− Net gains and losses on real estate |

| 22. | + Other operating income |

| 23. | = Operating revenues |

| 24. | − Impairment on loans and advances |

| 25. | − Impairment on other assets |

| 26. | = Total Impairment charges |

| 27. | = Net operating revenues |

| 28. | − Staff expenses |

| 29. | − Other administrative expenses |

| 30. | − Other operating expenses |

| 31. | = Total operating expenses |

| 32. | = Operating profit |

| 33. | +/− Equity accounted share of profits of associates and joint ventures |

| 34. | + Non-operating income |

| 35. | − Non-operating expenses |

| 36. | +/− Profit/(loss) on acquisition and disposal of subsidiaries |

| 37. | = Profit before tax |

| 38. | − Income tax expense |

| 39. | +/− Net profit/(loss) for the year from discontinued operations |

| 40. | = Net income |

| 41. | − Dividend paid |

| 42. | = Retained Income |

| Source: Lüdenbach et al. (2019, p. 132). | |

Appendix B

Appendix B.1. Staff Expenses (Lüdenbach et al. 2019, p. 111)

Appendix B.2. Other Administrative Expenses

Appendix B.3. Other Operating Expenses (Lüdenbach et al. 2019, p. 110)

Appendix B.4. Total Operating Expenses

Appendix B.5. Net Operating Revenues

Appendix B.6. Operating Profit

References

- Abosede, Julius, Benneth Eze, and Motunrayo Sowunmi. 2018. Human Resource Management and Banks’ Performance in Nigeria. Journal of Varna University of Economics 62: 117–30. [Google Scholar]

- AGVBanken. 2018. Beschäftigte im Kreditgewerbe. Available online: https://www.agvbanken.de/AGVBanken/Statistik/2018_Statistik_Beschaeftigte.pdf (accessed on 9 April 2019).

- Bacher, Johann, and Hans-Georg Wolf. 2010. Hauptkomponentenanalyse und explorative Faktorenanalyse. In Handbuch der sozialwissenschaftlichen Datenanalyse. Edited by Christof Wolf and Henning Best. Wiesbaden: Verlag für Sozialwissenschaften, Springer Fachmedien, p. 1098. [Google Scholar]

- Barari, Mojtaba, and Olivier Furrer. 2018. The Customer Experience Ecosystem in Two Cultural Contexts. Journal of Financial Services Marketing 23: 234–43. [Google Scholar] [CrossRef]

- Blount, Yvette, Tanya Castleman, and Paula MC Swatman. 2003. E-Commerce and Human Resource Management: Theoretical Approaches and Issues for the Banking Industry. In Seeking Success in E-Business. Edited by Andersen Kim Viborg, Steve Elliot, Paula Swatman and Eileen Trauth. Boston: Springer, pp. 485–501. [Google Scholar]

- Bühner, Markus. 2010. Einführung in die Test- und Fragebogenkonstruktion, 3rd ed. London: Pearson Studium. [Google Scholar]

- Musikindustrie Bundesverband. 2017. Musikindustrie in Zahlen 2016. Berlin: Bundesverband Musikindustrie. [Google Scholar]

- Bureau van Dijk/BankFocus. 2019. Database. Available online: https://banks.bvdinfo.com/ (accessed on 21 June 2019).

- Chai, Boddy Boon-Hui, Tan Pek See, and Goh Shong. 2016. Banking Services that Influence the Bank Performance. Procedia Social and Behavioral Sciences 224: 401–7. [Google Scholar] [CrossRef] [Green Version]

- Chang, Yen-Ling, and Daniel A. Talley. 2017. Bank Risk in a Decade of Low Interest Rates. Journal of Economics and Finance 41: 505–28. [Google Scholar] [CrossRef]

- Chen, Jian, and Roger Strange. 2005. The Determinants of Capital Structure: Evidence from Chinese Listed Companies. RePEc 38: 11–35. [Google Scholar] [CrossRef]

- Christensen, Clayton M., and Joseph L. Bower. 1996. Customer Power, Strategic Investment, and the Failure of Leading Firms. Strategic Management Journal 17: 197–218. [Google Scholar] [CrossRef]

- Clark, Tim, Alexander Osterwalder, and Yves Pigneur. 2012. Business Model You: Dein Leben—Deine Karriere—Dein Spiel. Frankfurt am Main: Campus Verlag. [Google Scholar]

- Deutsche Bundesbank. 2000. Bankenstatistik Januar 2000. Available online: https://www.bundesbank.de/resource/blob/693554/405d1c0ad7d644188e4d88560a8510e4/mL/2000-01-bankenstatistik-data.pdf (accessed on 9 April 2019).

- Deutsche Bundesbank. 2009. Bankenstatistik Januar 2009. Available online: https://www.bundesbank.de/resource/blob/693772/905def9c5a9a3886203acddaaed3942f/mL/2009-01-bankenstatistik-data.pdf (accessed on 9 April 2019).

- Deutsche Bundesbank. 2011. Bankenstatistik Januar 2011. Available online: https://www.bundesbank.de/resource/blob/693816/8d4eb4607ad6239c5522a84245f47a1b/mL/2011-01-bankenstatistik-data.pdf (accessed on 11 September 2019).

- Deutsche Bundesbank. 2015. Bankenstatistik Januar 2015. Available online: https://www.bundesbank.de/resource/blob/693922/a24868217d3ad9478b920930e2226987/mL/2015-01-bankenstatistik-data.pdf (accessed on 9 April 2019).

- Deutsche Bundesbank. 2016a. Bankenstatistik August 2016. Available online: https://www.bundesbank.de/resource/blob/693956/6ce4c02bbe9db94ce617df561f5b6cac/mL/2016-08-bankenstatistik-data.pdf (accessed on 11 September 2019).

- Deutsche Bundesbank. 2016b. Bankenstatistik Januar 2016. Available online: https://www.bundesbank.de/resource/blob/693932/28e421937f44e7c19fee43daf9266b0b/mL/2016-01-bankenstatistik-data.pdf (accessed on 9 April 2019).

- Deutsche Bundesbank. 2018. Bankenstatistik Januar 2018. Available online: https://www.bundesbank.de/resource/blob/693982/7b3c771cecbc6b44934c408310bbb35f/mL/2018-01-bankenstatistik-data.pdf (accessed on 9 April 2019).

- Deutsche Bundesbank. 2019. Bankenstatistik Januar 2019. Available online: https://www.bundesbank.de/resource/blob/773438/048ad3c478cd071493582c25ca847a8a/mL/2019-01-bankenstatistik-data.pdf (accessed on 9 April 2019).

- Dhar, Sujoy. 2011. Human Resource Management in Bank: Its Scope and Challenges. New York: FINSIGHTS, vol. 4. [Google Scholar]

- Diener, Florian, and Miroslav Špaček. 2020. The Role of ‘Digitalization’ in German Sustainability Bank Reporting. International Journal of Financial Studies 8: 16. [Google Scholar] [CrossRef] [Green Version]

- Dolata, Ulrich. 2008. Das Internet und die Transformation der Musikindustrie. Berliner Journal für Soziologie 3: 344–69. [Google Scholar] [CrossRef] [Green Version]

- Fernandes, Teresa, and Teresa Pinto. 2019. Relationship quality determinants and outcomes in retail banking services: The role of customer experience. Journal of Retailing and Consumer Services 50: 30–41. [Google Scholar] [CrossRef]

- Gabler Business Dictionary. 2019. Sparkassen. Available online: https://wirtschaftslexikon.gabler.de/definition/sparkassen-45093 (accessed on 7 April 2019).

- Grigore, Maria Zenovia, and Viorica Mirela Ştefan-Duicu. 2013. Agency Theory and Optimal Capital Structure. Challenges of the Knowledge Society 3: 862–68. [Google Scholar]

- Johnson, Mark W., Clayton M. Christensen, and Henning Kagermann. 2008. Reinventing Your Business Model. Harvard Business Review 86: 59–68. [Google Scholar]

- Kessler, Harald. 2019. Aktuelle IFRS-Texte 2018/2019: Deutsch—Englisch. IFRS, IFRIC, IAS, SIC, 1st ed. München: C.H.Beck. [Google Scholar]

- Kozak, Sylwester. 2016. Do low interest rates mean low earnings for banks? Acta Scientiarum Polonorum Oeconomia 15: 41–49. [Google Scholar]

- Kozak, Sylwester. 2018. Low Interest Rates and Changes in the Banking Income Structure in EU Countries. Annales Universitatis Mariae Curie-Skłodowska, sectio H Oeconomia 52: 97–107. [Google Scholar] [CrossRef] [Green Version]

- Lee, Chien-Chiang, Chih-Wei Wang, and Shan-Ju Ho. 2020. Financial Innovation and Bank Performance: The Role of Institutional Environments. The North American Journal of Economics and Finance 53: 101195. [Google Scholar] [CrossRef]

- Lüdenbach, Norbert, Wolf-Dieter Hoffmann, and Jens Freiberg. 2019. Haufe IFRS-Kommentar plus Onlinezugang: Das Standardwerk bereits in der 17. Auflage (Haufe Fachbuch), 17th ed. Haufe: Freiburg, München and Stuttgart. [Google Scholar]

- Maiya, Rajashekara. 2017. How to be a truly digital bank. Journal of Digital Banking 1: 338–48. [Google Scholar]

- Mirković, Vladimir, Jelena Lukić, and Vesna Martin. 2019. Reshaping Banking Industry through Digital Transformation. In Finiz—Digitization and Smart Financial Reporting. Belgrade: Singidunum University. [Google Scholar]

- Mohan, Devie. 2015. How banks and FinTech startups are partnering for faster innovation. Journal of Digital Banking 1: 12–21. [Google Scholar]

- Mphil, Abdul Hameed, Muhammad Ramzan, Hafiz M. Kashif Zubair, Ghazanfar Ali, and Muhammad Arslan. 2014. Impact of Compensation on Employee Performance (Empirical Evidence from Banking Sector of Pakistan). International Journal of Business and Social Science 5: 302–9. [Google Scholar]

- Mukherjee, Avinandan, Prithwiraj Nath, and Manabendranath Pal. 2003. Resource, service quality and performance triad: a framework for measuring efficiency of banking services. Journal of the Operational Research Society 54: 723–35. [Google Scholar] [CrossRef]

- National Association of German Cooperative Banks. 2019. National Association of German Cooperative Banks. Available online: https://www.bvr.de/p.nsf/index.xsp (accessed on 24 March 2019).

- Null, Nancy R. Lackey, Marjorie A. Pett, and John Sullivan. 2003. Making Sense of Factor Analysis: The Use of Factor Analysis for Instrument Development in Health Care Research. New Edition. Newsbury Park: SAGE Publications, Inc. [Google Scholar]

- Nunnally, Jum C., and Ira H. Bernstein. 2017. Psychometric Theory, 3rd ed. New York: McGraw-Hill. [Google Scholar]

- Ojeleye, Yinka Calvin. 2017. The Impact of Remuneration on Employees’ Performance (A Study of Abul Gusau Polytechnic, Talata-Mafara and Sate College of Education Maru, Zamfara State). Arabian Journal of Business and Management Review 4: 34–43. [Google Scholar]

- Omarini, Anna. 2019. Banks and Banking: Digital Transformation and the Hype of Fintech. Business Impact, New Frameworks and Managerial Implications. New York: McGraw-Hill Education. [Google Scholar]

- Ortaköy, Selman, and Zehra Özsürünç. 2019. The Effect of Digital Channel Migration, Automation and Centralization on the Efficiency of Operational Staff of Bank Branches. Procedia Computer Science 158: 938–46. [Google Scholar] [CrossRef]

- Osterwalder, Alexander, and Yves Pigneur. 2010. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers, 1st ed. Hoboken: Wiley. [Google Scholar]

- Phan, Dinh, Paresh Kumar Narayan, R. Eki Rahman, and Akhis R. Hutabarat. 2020. Do financial technology firms influence bank performance? Pacific-Basin Finance Journal 62: 101210. [Google Scholar] [CrossRef]

- Pillai, Rajani H., R. Vedapradha, Candida Smitha, and A. Suriya Kumari. 2019. Footprints of Human Resource in Banking Sector. Journal of Human Resource and Sustainability Studies 7: 388–96. [Google Scholar] [CrossRef] [Green Version]

- Ress, Ray. 1974. A Reconsideration of the Expense Preference Theory of the Firm. Economica 41: 295–307. [Google Scholar] [CrossRef]

- Sollanek, Achim, and Pascal Hansen. 2012. Bankbilanzen nach IFRS—Betriebliche Mitbestimmung und betriebliche Handlungshilfen. Dusseldorf: Hans-Böckler-Stiftung. [Google Scholar]

- Sparkassengesetz. 2015. Gesetz über die öffentlichen Sparkassen (Sparkassengesetz—SpkG)1) In der Fassung der Bekanntmachung vom 1. Oktober 1956 (BayRS II S. 476) BayRS 2025-1-I. Available online: http://www.gesetze-bayern.de/(X(1)S(vhg40px220nampsnhbaoqu0u))/Content/Document/BaySpkG/true?AspxAutoDetectCookieSupport=1 (accessed on 7 April 2019).

- Vernimmen, Pierre, Pascal Quiry, Maurizio Dallocchio, Yann Le Fur, and Antonio Salvi. 2017. Corporate Finance: Theory and Practice, 5th ed. Hoboken: Wiley. [Google Scholar]

- Vives, Xavier. 2019. Digital Disruption in Banking. Annual Review of Financial Economics 11: 243–72. [Google Scholar] [CrossRef]

- Werwatz, Axel, and Stefan Mangelsdorf. 2019. Einführung in die Methode der Panelregression. Available online: https://www.forschungsdatenzentrum.de/sites/default/files/2018-08/nachwuchsworkshop_2009_vortrag_werwatz.pdf (accessed on 12 December 2019).

- Williamson, Oliver E. 1963. Managerial Discretion and Business Behavior. The American Economic Review 53: 1032–57. [Google Scholar]

| 1 | ‘A business model […] consists of four interlocking elements that, taken together, create and deliver value. The most important […], by far, is the first (Johnson et al. 2008).’ Elements: Customer value proposition, profit formula, key resources, and key processes. |

| 2 | In accounting, differences exist between these terms. When an enterprise purchases a service or product, it incurs an expense. As soon as the company receives a vendor invoice, it is posted and becomes an expense. An expense is a payment or cash outflow. Costs are associated with expenses, but they’re associated with a specific period. Accountants use the word expense when costs are spent on a company’s revenue-generating activities. |

| 3 | Further detailed explanations of the variables are given in Appendix B. |

| Bank Branches | 1997 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | CAGR 3 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Savings bank sector 1 | 19.8 | 14.2 | 13.9 | 13.7 | 13.5 | 13.2 | 12.8 | 12.3 | 11.4 | 10.6 | −3.09% |

| Cooperative sector 2 | 19.2 | 13.3 | 13.2 | 13.1 | 12.9 | 12.6 | 12.3 | 11.9 | 11.1 | 10.4 | −3.04% |

| Private banks and building societies | 27.2 | 13.2 | 12.8 | 12.7 | 11.6 | 12.1 | 11.9 | 11.6 | 11.1 | 10.7 | −4.56% |

| Other banks | 0.6 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | −3.03% |

| ∑ | 66.8 | 41 | 40.2 | 39.8 | 38.3 | 38.2 | 37.3 | 36 | 33.9 | 32 | −3.62% |

| Employees | 1997 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | CAGR 3 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Savings bank sector | 288.4 | 249.6 | 248.2 | 246 | 245 | 244 | 240.1 | 233.7 | 224.7 | 216.1 | −1.43% |

| Cooperative sector | 182.1 | 164 | 163.4 | 163.9 | 165.6 | 166.1 | 165.1 | 161.8 | 157.3 | 152.3 | −0.89% |

| Private banks and building societies | 246 | 192.9 | 189.7 | 187.2 | 183.1 | 180.8 | 180.9 | 178.6 | 175.5 | 167.5 | −1.90% |

| Other banks | 51.7 | 56.6 | 56.5 | 56.6 | 55.4 | 54.7 | 54 | 53.1 | 51.6 | 50.4 | −0.13% |

| ∑ | 768.2 | 663 | 675.7 | 653.6 | 649 | 645.6 | 640.1 | 627.2 | 609.1 | 586.3 | −1.34% |

| Factor 1 | Factor 2 | |

|---|---|---|

| Staff expenses | x | |

| Other administrative expenses | x | |

| Other operating expenses | x |

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | Rotation Sums of Squared Loadings | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1_2013 | 2.337 | 77.888 | 77.888 | 2.337 | 77.888 | 77.888 | 1.921 | 64.03 | 64.03 |

| 2_2013 | 0.647 | 21.581 | 99.469 | 0.647 | 21.581 | 99.469 | 1.063 | 35.439 | 99.469 |

| 3_2013 | 0.016 | 0.531 | 100 | ||||||

| 1_2014 | 2.493 | 83.106 | 83.106 | 2.493 | 83.106 | 83.106 | 1.874 | 62.456 | 62.456 |

| 2_2014 | 0.487 | 16.228 | 99.334 | 0.487 | 16.228 | 99.334 | 1.106 | 36.878 | 99.334 |

| 3_2014 | 0.02 | 0.666 | 100 | ||||||

| 1_2015 | 2.468 | 82.263 | 82.263 | 2.468 | 82.263 | 82.263 | 1.885 | 62.825 | 62.825 |

| 2_2015 | 0.515 | 17.164 | 99.427 | 0.515 | 17.164 | 99.427 | 1.098 | 36.602 | 99.427 |

| 3_2015 | 0.017 | 0.573 | 100 | ||||||

| 1_2016 | 2.582 | 86.053 | 86.053 | 2.582 | 86.053 | 86.053 | 1.845 | 61.511 | 61.511 |

| 2_2016 | 0.401 | 13.382 | 99.435 | 0.401 | 13.382 | 99.435 | 1.138 | 37.923 | 99.435 |

| 3_2016 | 0.017 | 0.565 | 100 | ||||||

| 1_2017 | 2.651 | 88.373 | 88.373 | 2.651 | 88.373 | 88.373 | 1.815 | 60.498 | 60.498 |

| 2_2017 | 0.333 | 11.097 | 99.47 | 0.333 | 11.097 | 99.47 | 1.169 | 38.973 | 99.47 |

| 3_2017 | 0.016 | 0.53 | 100 | ||||||

| Extraction Method: Principal Component Analysis. | |||||||||

| Component | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| F1_2013 | F2_2013 | F1_2014 | F2_2014 | F1_2015 | F2_2015 | F1_2016 | F2_2016 | F1_2017 | F2_2017 | |

| SE | 0.96 | 0.265 | 0.939 | 0.328 | 0.944 | 0.318 | 0.918 | 0.386 | 0.897 | 0.433 |

| OAE | 0.967 | 0.237 | 0.94 | 0.327 | 0.946 | 0.311 | 0.93 | 0.357 | 0.919 | 0.384 |

| OOE | 0.252 | 0.968 | 0.329 | 0.944 | 0.316 | 0.949 | 0.372 | 0.928 | 0.407 | 0.913 |

| Extraction Method: Principal Component Analysis. Rotation Method: Varimax with Kaiser Normalisation. | ||||||||||

| NOR | OP | Fac1 | Fac2 | ||

|---|---|---|---|---|---|

| N | Valid | 6400 | 6400 | 6400 | 6400 |

| Missing | 0 | 0 | 0 | 0 | |

| Mean | 46,574.82 | 10,631.80 | 0.00 | 0.00 | |

| Median | 211,86.50 | 4809.5 | 0.10234 | 0.28 | |

| Mode | 1506.00 a | 1235.00 a | 0.000 a | 0.000 a | |

| Std. Deviation | 147,731.16 | 43,147.22 | 0.999531 | 0.999531 | |

| Minimum | 374.00 | −15,723.00 | −33.150 | −18.02 | |

| Maximum | 4,753,000.00 | 1,601,000.00 | 5.462 | 3.706 | |

| Number of Levels | Covariance Structure | Number of Parameters | Subject Variables | Number of Subjects | ||

|---|---|---|---|---|---|---|

| Fixed Effects | Intercept | 1 | 1 | |||

| Fac1 | 1 | 1 | ||||

| Fac2 | 1 | 1 | ||||

| zNOR | 1 | 1 | ||||

| Repeated Effects | IndexY | 5 | Identity | 1 | ID | 1298 |

| Total | 9 | 5 | ||||

| Source | Numerator df | Denominator df | F | Sig. |

|---|---|---|---|---|

| Intercept | 1 | 6400 | 67.89 | 0.000 |

| Type | 1 | 6400 | 392.03 | 0.000 |

| Fac1 | 1 | 6400 | 15,589.62 | 0.000 |

| Fac2 | 1 | 6400 | 22,660.30 | 0.000 |

| zNOR | 1 | 6400 | 42,247.69 | 0.000 |

| Parameter | Estimate | Std. Error | df | t | Sig. | 95% Confidence Interval | |

|---|---|---|---|---|---|---|---|

| Lower Bound | Upper Bound | ||||||

| Intercept | −0.044130 | 0.0026 | 6400 | −16.971 | 0.000 | −0.049227 | −0.039032 |

| [Type = CB] | 0.063985 | 0.003232 | 6400 | 19.8 | 0.000 | 0.05765 | 0.070321 |

| [Type = SB] | 0 b | 0 | |||||

| Fac1 | 1.465189 | 0.011735 | 6400 | 124.858 | 0.000 | 1.442185 | 1.488193 |

| Fac2 | 0.832222 | 0.005528 | 6400 | 150.533 | 0.000 | 0.821384 | 0.84306 |

| zNOR | 2.636094 | 0.012825 | 6400 | 205.542 | 0.000 | 2.610953 | 2.661236 |

| Parameter | Estimate | Std. Error | |

|---|---|---|---|

| Repeated Measures | Variance | 0.011482 | 203 |

| Hypothesis | ||

|---|---|---|

| H1 | The reduction of Factor 1 has a positive effect on operating profit. | Confirmed |

| Fac1 = 1.465189 | ||

| H2 | The reduction of Factor 1 has a negative effect on operating profit. | Rejected |

| Fac1 = 1.465189 | ||

| H3 | Factor 1 and Factor 2 have equal effects on operating profit. | Rejected |

| Fac1 = 1.465189/Fac2 = 0.832222 | ||

| H4 | Factor 2 has a positive effect on operating profit. | Confirmed |

| Fac2 = 0.832222 | ||

| H5 | Factor 2 has a negative effect on operating profit. | Rejected |

| Fac2 = 0.832222 | ||

| H6 | Operating profit is not affected by the fact of different business model influences, namely cooperative and savings banks. | Confirmed |

| [Type = CB] = 0.063985 (negligible estimate value)/[Type = SB] = 0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Diener, F. Empirical Evidence of a Changing Operating Cost Structure and Its Impact on Banks’ Operating Profit: The Case of Germany. J. Risk Financial Manag. 2020, 13, 247. https://doi.org/10.3390/jrfm13100247

Diener F. Empirical Evidence of a Changing Operating Cost Structure and Its Impact on Banks’ Operating Profit: The Case of Germany. Journal of Risk and Financial Management. 2020; 13(10):247. https://doi.org/10.3390/jrfm13100247

Chicago/Turabian StyleDiener, Florian. 2020. "Empirical Evidence of a Changing Operating Cost Structure and Its Impact on Banks’ Operating Profit: The Case of Germany" Journal of Risk and Financial Management 13, no. 10: 247. https://doi.org/10.3390/jrfm13100247

APA StyleDiener, F. (2020). Empirical Evidence of a Changing Operating Cost Structure and Its Impact on Banks’ Operating Profit: The Case of Germany. Journal of Risk and Financial Management, 13(10), 247. https://doi.org/10.3390/jrfm13100247