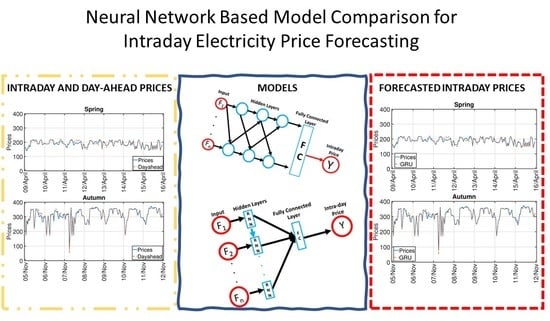

Neural Network Based Model Comparison for Intraday Electricity Price Forecasting

Abstract

:1. Introduction

1.1. Intraday Electricity Market

1.2. Intraday Electricity Price Forecasting

1.3. Contributions

2. Data

3. Methods

3.1. Naive Method

3.2. Multivariate Linear Regression

3.3. Lasso Regression

3.4. Artificial Neural Networks

3.5. Recurrent Neural Networks

3.6. Long Short Term Memory

3.7. Gated Recurrent Units

3.8. Implementation Details

3.9. Evaluation Metrics

4. Results

4.1. Price Prediction on Actual Values

4.2. Price Prediction on Spread Values

4.3. Seasonal Prediction Results

4.4. Diebold-Mariano Tests

5. Discussion

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Bunn, D.W. Forecasting loads and prices in competitive power markets. Proc. IEEE 2000, 88, 163–169. [Google Scholar] [CrossRef]

- Nogales, F.J.; Contreras, J.; Conejo, A.J.; Espinola, R. Forecasting next-day electricity prices by time series models. IEEE Trans. Power Syst. 2002, 17, 342–348. [Google Scholar] [CrossRef]

- Shahidehpour, M.; Yamin, H.; Li, Z. Market Operations in Electric Power Systems; IEEE: New York, NY, USA, 2002. [Google Scholar]

- Contreras, J.; Espinola, R.; Nogales, F.J.; Conejo, A.J. ARIMA models to predict next-day electricity prices. IEEE Trans. Power Syst. 2003, 18, 1014–1020. [Google Scholar] [CrossRef]

- Cuaresma, J.C.; Hlouskova, J.; Kossmeier, S.; Obersteiner, M. Forecasting electricity spot-prices using linear univariate time-series models. Appl. Energy 2004, 77, 87–106. [Google Scholar] [CrossRef]

- Aggarwal, S.K.; Saini, L.M.; Kumar, A. Electricity price forecasting in deregulated markets: A review and evaluation. Int. J. Electr. Power Energy Syst. 2009, 31, 13–22. [Google Scholar] [CrossRef]

- Weron, R. Electricity price forecasting: A review of the state-of-the-art with a look into the future. Int. J. Forecast. 2014, 30, 1030–1081. [Google Scholar] [CrossRef]

- Nowotarski, J.; Weron, R. Recent advances in electricity price forecasting: A review of probabilistic forecasting. Renew. Sustain. Energy Rev. 2018, 81, 1548–1568. [Google Scholar] [CrossRef]

- Ziel, F.; Steinert, R. Electricity price forecasting using sale and purchase curves: The X-Model. Energy Econ. 2016, 59, 435–454. [Google Scholar] [CrossRef]

- Howison, S.; Coulon, M. Stochastic behavior of the electricity bid stack: From fundamental drivers to power prices. J. Energy Mark. 2009, 2, 29–69. [Google Scholar] [CrossRef]

- Carmona, R.; Coulon, M. A survey of commodity markets and structural models for electricity prices. In Quantitative Energy Finance; Springer: Berlin/Heidelberg, Germany, 2014; pp. 41–83. [Google Scholar]

- Shrivastava, N.A.; Panigrahi, B.K. A hybrid wavelet-ELM based short term price forecasting for electricity markets. Int. J. Electr. Power Energy Syst. 2014, 55, 41–50. [Google Scholar] [CrossRef]

- Uniejewski, B.; Marcjasz, G.; Weron, R. Understanding intraday electricity markets: Variable selection and very short-term price forecasting using LASSO. Int. J. Forecast. 2019, 35, 1533–1547. [Google Scholar] [CrossRef]

- Ziel, F. Forecasting electricity spot prices using lasso: On capturing the autoregressive intraday structure. IEEE Trans. Power Syst. 2016, 31, 4977–4987. [Google Scholar] [CrossRef]

- Shafie-khah, M.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K. Price forecasting of day-ahead electricity markets using a hybrid forecast method. Energy Convers. Manag. 2011, 52, 2165–2169. [Google Scholar] [CrossRef]

- Amjady, N.; Keynia, F. Day-ahead price forecasting of electricity markets by a new feature selection algorithm and cascaded neural network technique. Energy Convers. Manag. 2009, 50, 2976–2982. [Google Scholar] [CrossRef]

- Du, P.; Wang, J.; Yang, W.; Niu, T. Multi-step ahead forecasting in electrical power system using a hybrid forecasting system. Renew. Energy 2018, 122, 533–550. [Google Scholar] [CrossRef]

- Yang, Z.; Ce, L.; Lian, L. Electricity price forecasting by a hybrid model, combining wavelet transform, ARMA and kernel-based extreme learning machine methods. Appl. Energy 2017, 190, 291–305. [Google Scholar] [CrossRef]

- Yang, W.; Wang, J.; Niu, T.; Du, P. A hybrid forecasting system based on a dual decomposition strategy and multi-objective optimization for electricity price forecasting. Appl. Energy 2019, 235, 1205–1225. [Google Scholar] [CrossRef]

- Ugurlu, U.; Oksuz, I.; Tas, O. Electricity Price Forecasting Using Recurrent Neural Networks. Energies 2018, 11, 1255. [Google Scholar] [CrossRef]

- Lago, J.; Ridder, F.D.; Schutter, B.D. Forecasting spot electricity prices: Deep learning approaches and empirical comparison of traditional algorithms. Appl. Energy 2018, 221, 386–405. [Google Scholar] [CrossRef]

- Kuo, P.H.; Huang, C.J. An Electricity Price Forecasting Model by Hybrid Structured Deep Neural Networks. Sustainability 2018, 10, 1280. [Google Scholar] [CrossRef]

- Zahid, M.; Ahmed, F.; Javaid, N.; Abbasi, R.A.; Kazmi, Z.; Syeda, H.; Javaid, A.; Bilal, M.; Akbar, M.; Ilahi, M. Electricity price and load forecasting using enhanced convolutional neural network and enhanced support vector regression in smart grids. Electronics 2019, 8, 122. [Google Scholar] [CrossRef]

- Kiesel, R.; Paraschiv, F. Econometric analysis of 15-minute intraday electricity prices. Energy Econ. 2017, 64, 77–90. [Google Scholar] [CrossRef]

- Ozyildirim, C.; Beyazit, M.F. Forecasting and Modelling of Electricity Prices by Radial Basis Functions: Turkish Electricity Market Experiment. İktisat İşletme Ve Finans 2014, 29, 31–54. [Google Scholar] [CrossRef]

- Ugurlu, U.; Tas, O.; Gunduz, U. Performance of Electricity Price Forecasting Models: Evidence from Turkey. Emerg. Mark. Financ. Trade 2018, 54, 1720–1739. [Google Scholar] [CrossRef]

- Wolff, G.; Feuerriegel, S. Short-term dynamics of day-ahead and intraday electricity prices. Int. J. Energy Sect. Manag. 2017, 11, 557–573. [Google Scholar] [CrossRef]

- Pape, C.; Hagemann, S.; Weber, C. Are fundamentals enough? Explaining price variations in the German day-ahead and intraday power market. Energy Econ. 2016, 54, 376–387. [Google Scholar] [CrossRef]

- Hagemann, S. Price determinants in the German intraday market for electricity: An empirical analysis. J. Energy Mark. 2015, 8, 21–45. [Google Scholar] [CrossRef]

- Kulakov, S.; Ziel, F. The impact of renewable energy forecasts on intraday electricity prices. arXiv 2019, arXiv:1903.09641. [Google Scholar]

- Goodarzi, S.; Perera, H.N.; Bunn, D. The impact of renewable energy forecast errors on imbalance volumes and electricity spot prices. Energy Policy 2019, 134, 110827. [Google Scholar] [CrossRef]

- Gürtler, M.; Paulsen, T. The effect of wind and solar power forecasts on day-ahead and intraday electricity prices in Germany. Energy Econ. 2018, 75, 150–162. [Google Scholar] [CrossRef]

- Ziel, F. Modeling the impact of wind and solar power forecasting errors on intraday electricity prices. In Proceedings of the 2017 14th International Conference on the European Energy Market (EEM), Dresden, Germany, 6–9 June 2017. [Google Scholar] [CrossRef]

- Garnier, E.; Madlener, R. Balancing Forecast Errors in Continuous-Trade Intraday Markets. Energy Syst. 2015, 6, 361–388. [Google Scholar] [CrossRef]

- Ciarreta, A.; Muniain, P.; Zarraga, A. Modeling and forecasting realized volatility in German-Austrian continuous intraday electricity prices. J. Forecast. 2017, 36, 680–690. [Google Scholar] [CrossRef]

- Kath, C.; Ziel, F. The value of forecasts: Quantifying the economic gains of accurate quarter-hourly electricity price forecasts. Energy Econ. 2018, 76, 411–423. [Google Scholar] [CrossRef] [Green Version]

- Shinde, P.; Amelin, M. A Literature Review of Intraday Electricity Markets and Prices. In Proceedings of the 2019 IEEE Milan PowerTech, Milan, Italy, 23–27 June 2019; pp. 1–5. [Google Scholar]

- Monteiro, C.; Ramirez-Rosado, I.; Fernandez-Jimenez, L.; Conde, P. Short-Term Price Forecasting Models Based on Artificial Neural Networks for Intraday Sessions in the Iberian Electricity Market. Energies 2016, 9, 721. [Google Scholar] [CrossRef]

- Andrade, J.; Filipe, J.; Reis, M.; Bessa, R. Probabilistic Price Forecasting for Day-Ahead and Intraday Markets: Beyond the Statistical Model. Sustainability 2017, 9, 1990. [Google Scholar] [CrossRef] [Green Version]

- Maciejowska, K.; Nitka, W.; Weron, T. Day-Ahead vs. Intraday—Forecasting the Price Spread to Maximize Economic Benefits. Energies 2019, 12, 631. [Google Scholar] [CrossRef] [Green Version]

- Mohammadi-Ivatloo, B.; Zareipour, H.; Ehsan, M.; Amjady, N. Economic impact of price forecasting inaccuracies on self-scheduling of generation companies. Electr. Power Syst. Res. 2011, 81, 617–624. [Google Scholar] [CrossRef]

- Mathaba, T.; Xia, X.; Zhang, J. Analysing the economic benefit of electricity price forecast in industrial load scheduling. Electr. Power Syst. Res. 2014, 116, 158–165. [Google Scholar] [CrossRef]

- Narajewski, M.; Ziel, F. Econometric modelling and forecasting of intradayelectricity prices. J. Commod. Mark. 2019. [Google Scholar] [CrossRef] [Green Version]

- Diebold, F.X.; Mariano, R.S. Comparing Predictive Accuracy. J. Bus. Econ. Stat. 1995, 13, 253–263. [Google Scholar] [CrossRef]

- EPIAS (Epias Transparency Platform). Available online: https://seffaflik.epias.com.tr/transparency (accessed on 23 July 2019).

- Ziel, F.; Steinert, R.; Husmann, S. Forecasting day ahead electricity spot prices: The impact of the EXAA to other European electricity markets. Energy Econ. 2015, 51, 430–444. [Google Scholar] [CrossRef] [Green Version]

- Tibshirani, R. Regression shrinkage and selection via the lasso. J. R. Stat. Soc. Ser. B Methodol. 1996, 58, 267–288. [Google Scholar] [CrossRef]

- Ludwig, N.; Feuerriegel, S.; Neumann, D. Putting Big Data analytics to work: Feature selection for forecasting electricity prices using the LASSO and random forests. J. Decis. Syst. 2015, 24, 19–36. [Google Scholar] [CrossRef]

- Wasserman, P.D.; Schwartz, T. Neural networks. II. What are they and why is everybody so interested in them now? IEEE Expert 1988, 3, 10–15. [Google Scholar] [CrossRef]

- Hochreiter, S.; Schmidhuber, J. Long short-term memory. Neural Comput. 1997, 9, 1735–1780. [Google Scholar] [CrossRef]

- Cho, K.; Van Merriënboer, B.; Bahdanau, D.; Bengio, Y. On the properties of neural machine translation: Encoder-decoder approaches. arXiv 2014, arXiv:1409.1259. [Google Scholar]

| Symbol | Feature | Availability |

|---|---|---|

| F1 | Day-ahead price | from 14:00 previous day |

| F2 | Balancing market price | 3 hours in advance |

| F3 | Forecast Renewables/Total generation | from 18:00 previous day |

| F4 | Forecast demand/supply | from 18:00 previous day |

| F5 | Trade Value (day-ahead market) | from 14:00 previous day |

| Hours | Mean | Standard Deviation | Upper Bound | Lower Bound | Median |

|---|---|---|---|---|---|

| 0 | 235.07 | 71.33 | 357.80 | 4.56 | 212.91 |

| 1 | 234.26 | 65.75 | 355.49 | 4.77 | 212.25 |

| 2 | 209.52 | 67.80 | 353.28 | 4.55 | 197.15 |

| 3 | 194.49 | 69.96 | 350.68 | 2.31 | 185.39 |

| 4 | 183.64 | 74.21 | 352.22 | 2.26 | 178.62 |

| 5 | 199.76 | 72.32 | 359.08 | 2.31 | 188.32 |

| 6 | 200.59 | 66.17 | 355.73 | 4.28 | 189.16 |

| 7 | 217.80 | 70.22 | 356.21 | 2.53 | 202.65 |

| 8 | 246.42 | 77.17 | 360.19 | 5.33 | 231.12 |

| 9 | 255.72 | 76.72 | 366.31 | 1.98 | 271.16 |

| 10 | 255.63 | 74.02 | 368.89 | 6.40 | 270.64 |

| 11 | 262.78 | 71.43 | 378.24 | 7.45 | 285.49 |

| 12 | 238.53 | 72.44 | 373.48 | 6.52 | 228.45 |

| 13 | 246.58 | 74.72 | 380.13 | 6.60 | 240.49 |

| 14 | 257.72 | 69.81 | 383.39 | 6.79 | 252.14 |

| 15 | 255.95 | 73.34 | 382.91 | 8.34 | 253.54 |

| 16 | 262.11 | 70.48 | 384.86 | 6.86 | 271.63 |

| 17 | 266.48 | 69.77 | 381.15 | 6.43 | 289.57 |

| 18 | 265.48 | 69.61 | 377.28 | 8.99 | 294.91 |

| 19 | 265.71 | 64.32 | 371.88 | 125.06 | 286.45 |

| 20 | 266.99 | 61.23 | 371.34 | 148.6 | 281.09 |

| 21 | 264.68 | 60.37 | 371.31 | 131.14 | 273.23 |

| 22 | 245.97 | 62.62 | 365.46 | 65.41 | 256.59 |

| 23 | 227.45 | 66.03 | 358.42 | 34.72 | 218.72 |

| Hours | Mean | Standard Deviation | Upper Bound | Lower Bound | Median |

|---|---|---|---|---|---|

| 0 | −2.30 | 6.31 | 59.78 | −24.63 | −1.86 |

| 1 | −2.55 | 6.35 | 30.94 | −38.02 | −1.51 |

| 2 | −1.56 | 6.93 | 42.64 | −32.21 | −0.82 |

| 3 | −1.25 | 6.36 | 32.30 | −36.23 | −1.25 |

| 4 | −0.30 | 8.01 | 59.57 | −54.84 | −0.46 |

| 5 | −1.45 | 6.97 | 33.97 | −39.12 | −1.07 |

| 6 | −1.34 | 8.25 | 70.96 | −36.11 | −1.07 |

| 7 | −1.94 | 7.42 | 56.12 | −45.31 | −1.38 |

| 8 | −2.57 | 7.37 | 18.41 | −77.55 | −1.38 |

| 9 | −2.60 | 7.27 | 12.73 | −70.71 | −1.24 |

| 10 | −1.64 | 5.63 | 17.09 | −31.06 | −1.07 |

| 11 | −0.69 | 7.30 | 87.14 | −38.19 | −0.31 |

| 12 | 0.03 | 6.41 | 29.79 | −24.78 | 0.00 |

| 13 | −0.19 | 6.73 | 25.70 | −29.07 | −0.05 |

| 14 | −1.00 | 6.77 | 17.24 | −34.99 | −0.43 |

| 15 | −0.56 | 6.80 | 21.43 | −39.27 | 0.05 |

| 16 | −1.00 | 7.28 | 20.34 | −41.79 | −0.34 |

| 17 | −1.10 | 7.56 | 46.52 | −30.75 | −0.08 |

| 18 | −1.34 | 7.77 | 25.52 | −30.49 | 0.09 |

| 19 | −1.37 | 7.64 | 17.85 | −40.94 | −0.31 |

| 20 | −1.77 | 7.96 | 52.70 | −37.57 | −0.52 |

| 21 | −1.83 | 7.13 | 15.74 | −36.02 | −0.77 |

| 22 | −0.90 | 7.66 | 78.52 | −27.20 | −0.44 |

| 23 | −0.27 | 8.56 | 98.01 | −32.95 | −0.11 |

| Features | Naive | Regression | Lasso | ANN | LSTM | GRU |

|---|---|---|---|---|---|---|

| F1 | 4.736 | 4.908 | 5.472 | 5.153 | 5.153 | 4.719 |

| F1-2 | 4.736 | 4.505 | 4.802 | 4.692 | 4.726 | 4.490 |

| F1-3 | 4.736 | 4.616 | 4.802 | 4.906 | 4.694 | 4.496 |

| F1-4 | 4.736 | 6.118 | 4.802 | 4.796 | 4.487 | 4.407 |

| F1-5 | 4.736 | 5.763 | 4.961 | 4.708 | 4.479 | 4.393 |

| Features | Naive | Regression | Lasso | ANN | LSTM | GRU |

|---|---|---|---|---|---|---|

| F1 | 7.374 | 7.283 | 7.696 | 7.911 | 7.911 | 7.202 |

| F1-2 | 7.374 | 6.884 | 7.047 | 7.379 | 7.416 | 6.912 |

| F1-3 | 7.374 | 6.933 | 7.047 | 7.590 | 7.348 | 7.073 |

| F1-4 | 7.374 | 8.200 | 7.047 | 7.514 | 7.142 | 6.919 |

| F1-5 | 7.374 | 7.952 | 7.214 | 7.033 | 6.895 | 6.857 |

| Features | Naive | Regression | Lasso | ANN | LSTM | GRU |

|---|---|---|---|---|---|---|

| F2-5 | 4.736 | 4.828 | 4.722 | 1.715 | 1.634 | 1.181 |

| F1-5 | 4.736 | 5.763 | 4.926 | 1.668 | 1.325 | 0.978 |

| Features | Naive | Regression | Lasso | ANN | LSTM | GRU |

|---|---|---|---|---|---|---|

| F2-5 | 7.374 | 7.231 | 7.190 | 2.170 | 2.382 | 1.719 |

| F1-5 | 7.374 | 7.952 | 7.182 | 2.323 | 1.785 | 1.302 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oksuz, I.; Ugurlu, U. Neural Network Based Model Comparison for Intraday Electricity Price Forecasting. Energies 2019, 12, 4557. https://doi.org/10.3390/en12234557

Oksuz I, Ugurlu U. Neural Network Based Model Comparison for Intraday Electricity Price Forecasting. Energies. 2019; 12(23):4557. https://doi.org/10.3390/en12234557

Chicago/Turabian StyleOksuz, Ilkay, and Umut Ugurlu. 2019. "Neural Network Based Model Comparison for Intraday Electricity Price Forecasting" Energies 12, no. 23: 4557. https://doi.org/10.3390/en12234557

APA StyleOksuz, I., & Ugurlu, U. (2019). Neural Network Based Model Comparison for Intraday Electricity Price Forecasting. Energies, 12(23), 4557. https://doi.org/10.3390/en12234557