3.1. Municipal Development

The methodological path adopted consists of proposing two models of municipal development. One of them is based on the prevailing concepts in the literature, in which predominantly economic aspects stand out: the Purely Economic Development Model. The other, in contrast, proposes that economic development should be extended to the whole of society, in the pursuit of intergenerational equity: the Socioeconomic Development Model.

The measurement of municipal development measurement based on the IFDM-Firjan Municipal Development Index is proposed as an indicator of socioeconomic development. In this regard, IFDM seeks to represent how municipalities operate in three dimensions: employment and income; education, and health. IFDM measures aspects related to municipal government performance. Furthermore, it has annual periodicity, which makes evolution monitoring easier, and allows equal use to be made with other important, annual periodicity indicators within the scope of this research. In addition, IFDM suits the purposes of this research better than the other indicators, which, despite serving the same purpose, do not have annual periodicity, do not strictly address municipal aspects, and predominantly cover economic dimensions [

34].

The IFDM is in line with the United Nations (UN) position that development indicators address not only economic aspects [

35]. Moreover, it uses statistical tests to confirm theoretical hypotheses and to evaluate index weight structures, and follows international standards regarding variables and on how to measure them to ensure that the role of the municipality is being effectively measured. IFDM addresses equally well-established areas of human development, namely Employment and Income, Education, and Health [

36].

Employment and Income represents both the economic environment and the structural characteristics of the labor market (

Table 1).

Regarding Education, it was designed to represent the provision of early childhood education and the quality of education provided in elementary school (

Table 2).

The Health area focuses on basic health, which is the municipal government’s obligation (

Table 3).

Therefore, the IFDM of a municipality consolidates local socioeconomic development levels through the simple average of the results obtained in each of the three highlighted areas. Their final value ranges from zero to one.

Regarding their use, [

37] used development and public expenditure indicators to measure the public efficiency of welfare. Their conclusions showed that IFDM plays an important role in public service evaluations. The authors of [

38] note that IFDM represents a reference for updating municipal socioeconomic development. The authors emphasize the efficiency of IFDM in municipal management evaluations regarding plotting development trajectories.

In addition, this research proposes the public savings variable as a possible measure to guarantee social welfare for future generations [

39,

40]. Since oil is a nonrenewable resource and is associated with a cost-dependent income [

41], public savings emerge as a possibility to help the municipal government manage oil exploration and, thus, foster the implementation of a more diverse local economy, reduce oil activity dependency, make its consumption sustainable over time, and ensure intergenerational equity [

6]. There is legislation in Brazil that subordinates the transfer of royalties to municipalities. Public savings are a necessity, especially in Brazil, where municipal governments have not yet properly applied revenues from oil exploration to socioeconomic development [

42].

Public savings are explanatory of IFDM in the model proposed in this research. In fact, the incorporation of the public savings variable into the analysis seeks to ensure intergenerational equity, as it is the Government’s role to provide society and the local economy with equity [

8].

Finally, this research seeks to contribute to advancing studies in the investigated area by proposing to analyze municipalities, instead of countries, as previous studies on this theme have traditionally done. It should be noted that people live in municipalities and that this is where the government needs to ensure adequate conditions for society and the economy to develop. It should also be noted that Brazilian municipalities have been receiving more and more responsibilities while, contradictorily, revenues have not increased at the same rate. This, in turn, indicates the need for better public management by municipal governments [

43].

This research investigated municipalities, rather than countries, as has frequently been studied, as the authors understand that broader national data tend to be less representative. Moreover, aggregating local data naturally increases data heterogeneity because of the increasing deviation between those data. This results from the geographic, economic, cultural, social, and political conditions which are inherent to municipal local realities.

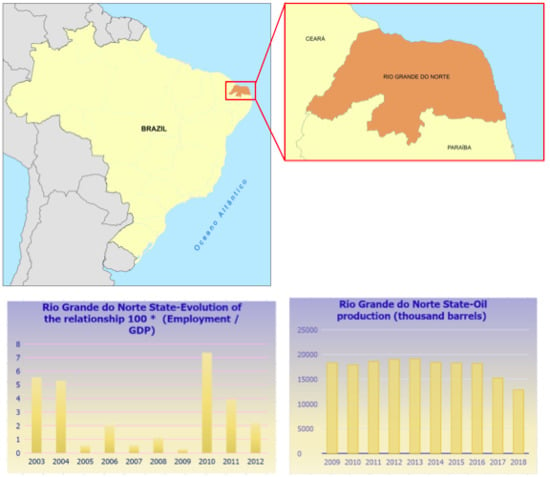

Finally, it should be noted that the present research will focus on the oil producing municipalities of the state of Rio Grande do Norte, the largest onshore producer in Brazil for the past 20 years [

44,

45].

3.2. Analysis Technique

The analysis technique used is panel regression, which, according to the author of [

33], presents objective procedures which are based on statistical tests to ensure the consistency of the analysis and to combine both temporal and local series data. The author also recommend the use of pooled analysis, fixed effects, and random effects models. He points out the necessity of running diagnostic tests to make sure that the most consistent and suitable analysis model is chosen.

According to

Figure 1, after specifying the Model, all other activities are objectively defined and evaluated through statistical tests.

Regarding panel regression models, specifically, in the pooled model, all coefficients are constant over time and between individuals. In the fixed effects model, each individual’s intercept may differ, but it does not vary over time, while in the random effects model, each individual’s random intercept is not correlated with explanatory variables [

33].

Regarding diagnostic tests, the first thing to do is choose the most appropriate analysis model [

46]. The tests used for this selection are listed in

Table 4.

Afterwards, the multicollinearity [

47], serial autocorrelation in the error term [

33], and heteroscedasticity [

33] must be diagnosed. Diagnostic tests give more consistency to the chosen model [

46,

48]. In order to obtain such diagnoses, the decision rules from

Table 5 must be considered.

Therefore, panel regression analysis, as shown in

Figure 1 and

Table 4 and

Table 5, consists of a standardized process of objective and automated activities with statistical tests on all activities. This allows an objective analysis to be made of the role of independent variables in the behavior of the dependent variable in space and time [

46,

49].

3.3. Analyzed Development Models

In order to understand the purpose of this research regarding the relationship between oil and development, and the role of municipal government, first, it is necessary to explain how the purely economic model and the socioeconomic development model were outlined.

Figure 2 shows how the municipality prepares and transforms for the inclusion of oil activity. It also reveals the research proposal to investigate the role of municipal government in this context.

Figure 2 shows the political, economic, and social dimensions in municipalities with oil activities, and shows how these activities impact local reality. With the emergence of oil activity, municipalities are affected by the increase in more profitable jobs, the increase in demand for public services, due to the population increase, and the reduction of local economic activities, as local workforces shift to the oil sector.

Such a reality demands that local governments find solutions through public management actions to avoid negative impacts on the local reality and reductions in the quality of public services, while financial revenues increase.

Therefore, this research proposes that municipal governments use financial revenues to build public savings to provide local economies, society, and oil activities with efficient public management, thereby promoting socioeconomic development [

50,

51].

Regarding the variables that comprise the analyzed models, those appropriate for the analysis and whose data are available for all municipalities in all years were selected.

The per capita gross domestic product (GDP) variable is the most commonly used for economic analyses when considering only economic development [

52], and for impact evaluation studies of oil industry royalties on the economy, such as in the studies by [

53,

54].

The per capita expenditure variable represents the way the government spends, since oil-producing municipalities are known for their huge expenditures. The royalty variable represents oil revenue and is added to the municipality’s revenues.

The employment balance variable represents a measurement of the economic activity in oil-dependent locations, where there are many jobs in oil activity and high unemployment in local activities [

55].

The high school distortion rate variable shows the rate of students at that schooling level’s average age who are not attending school. In general, those students drop out of school to work and help maintain their families. So, it is recommended that the government increase the amount of educational opportunities by improving education quality, which would strengthen local reality [

7].

Proper public management can be measured by the public savings variable. This represents a municipal management effort to ensure future investments by changing the economic results from oil royalties into development for the entire local society. Public savings are a concrete means for municipal governments to invest in socioeconomic development over time to ensure intergenerational equity.

A summary of the variables used in this paper will be presented in

Section 3.4.

Finally, it should be noted that socioeconomic development will be expressed in the IFDM variable, as this indicator is better able than the other indicators to measure aspects which are strictly related to the municipal government’s performance, to have an annual frequency, and to allow its equal use with other important indicators within the scope of this survey.

Regarding the development models chosen for this research, two models were analyzed: the purely economic model and the socioeconomic development model.

The first one is reduced to the economic dimension and has no municipal government participation. This model was used to analyze the hypothesis that oil wealth is responsible for development, the importance of royalties for the municipality’s gross domestic product (GDP), and to verify whether this model is significant, according to Equation (1) below.

Model (1) represents what has been analyzed by various authors concerning development in oil-producing economies. In [

53,

54], GDP and oil were used as development dependent variables.

As for the second model proposed in this research, analyses were run on the hypothesis that public management in more cautious municipalities seeks to achieve an investment capacity that can carry out future investments to promote intergenerational equity. Public management is represented by the public savings variable, as it allows municipal governments to carry out public management aimed at improving local public reality. This, in turn, will lead to a better socioeconomic development indicator and function as an attempt to make up for the consumption of natural resources from oil exploration by making future investments in human capital, thereby enhancing local socioeconomic reality. The proposed socioeconomic development indicator is the IFDM.

As for operationalization, the Model will analyze the contribution hypothesis of the research that development is broader than mere economic results, and that it can be expressed in socioeconomic outcomes with the effective participation of the municipal government through public savings to the municipal IFDM. Finally, the socioeconomic model is tested for significance, according to Equation (2) below.

The socioeconomic development model (2) is intended to take a step forward and lead development discussions to another level, i.e., beyond that of merely economic models (1). By using IFDM instead of GDP, model (2) recognizes that development goes beyond the economic aspect and places the emphasis on the role of municipal public management. By using the public savings variable instead of that of expenditure, model (2) recognizes that a municipal financial fund will allow governments to make investments for local socioeconomic development. This, in turn, will foster intergenerational equity.