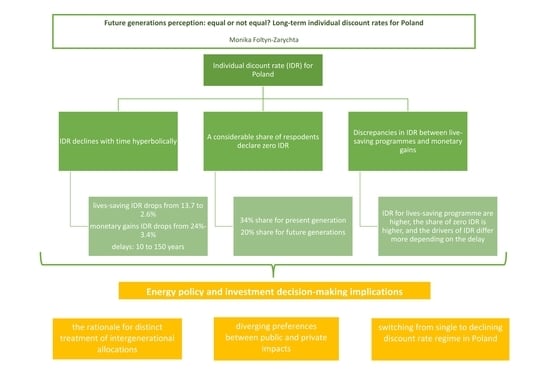

Future-Generation Perception: Equal or Not Equal? Long-Term Individual Discount Rates for Poland

Abstract

:1. Introduction

1.1. Energy Policy Investments—The Longevity and Heterogeneity of Impacts and the Ethical Implications

1.2. Long-Term Discounting

1.3. The Aim of the Paper

2. Materials and Methods

2.1. Respondents’ Socioeconomic Characteristics and Attitude

2.2. Valuation Scenarios—Transforming Bids into Discount Rates for Lives and Monetary Gains

2.3. Investigating the IDR Values and Its Drivers—The Conceptual Framework of the Research

3. Results

3.1. An Overview of Individual Discount Rate Values

3.2. The Drivers of Individual Discount Rates: The Public-Private Domain and Short and Long-Term Discrepancies

4. Discussion

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Characteristic | n | Share (%) |

|---|---|---|

| Gender | ||

| Male | 226 | 45.0 |

| Female | 276 | 55.0 |

| Age | ||

| Up to 25 | 101 | 20.1 |

| 25–35 | 111 | 22.1 |

| 35–45 | 107 | 21.3 |

| 45–55 | 90 | 17.9 |

| 55–65 | 59 | 11.8 |

| More than 65 | 34 | 6.8 |

| Education | ||

| Primary school | 2 | 0.4 |

| Vocational school | 27 | 5.4 |

| High school | 250 | 49.8 |

| University degree | 223 | 44.4 |

| Income per household member | ||

| Up to 500 PLN | 9 | 1.8 |

| 500–1000 PLN | 73 | 14.5 |

| 1001–2000 PLN | 183 | 36.5 |

| 2001–3000 PLN | 118 | 23.5 |

| 3001–4000 PLN | 67 | 13.3 |

| 4001–5000 PLN | 18 | 3.6 |

| More than 5000 PLN | 34 | 6.8 |

| No of household members | ||

| 1 | 52 | 10.4 |

| 2 | 108 | 21.5 |

| 3 | 162 | 32.3 |

| 4 | 132 | 26.3 |

| 5 | 32 | 6.4 |

| 6 | 12 | 2.4 |

| 7 and more | 4 | 0.8 |

| Dependent children present | ||

| Yes | 149 | 31.6 |

| No | 322 | 68.4 |

References

- Ramsey, F.P. A Mathematical Theory of Saving. Econ. J. 1928, 38, 543–559. [Google Scholar] [CrossRef]

- Guide to Cost-Benefit Analysis of Investment Projects. Economic Appraisal Tool for Cohesion Policy 2014–2020; European Commission: Brussels, Belgium, 2015.

- Maselli, G.; Nesticò, A. The Role of Discounting in Energy Policy Investments. Energies 2021, 14, 6055. [Google Scholar] [CrossRef]

- Eurostat. Available online: https://ec.europa.eu/eurostat (accessed on 2 November 2021).

- Global Carbon Atlas. Available online: http://www.globalcarbonatlas.org/en/content/welcome-carbon-atlas (accessed on 8 December 2020).

- Polityka Energetyczna Polski Do Roku 2040; Ministry of Climate and Environment: Warsaw, Poland, 2021.

- Regulation (EU) 2021/1119 of the European Parliament and of the Council of 30 June 2021 Establishing the Framework for Achieving Climate Neutrality and Amending Regulations (EC) No 401/2009 and (EU) 2018/1999 (‘European Climate Law’). Available online: https://eur-lex.europa.eu/eli/reg/2021/1119/oj (accessed on 1 December 2021).

- Wkład Polskiego Sektora Energetycznego w Realizację Globalnej Polityki Klimatycznej; Polish Electricity Association: Warsaw, Poland, 2018.

- Program Polskiej Energetyki Jądrowej. Available online: https://www.gov.pl/web/polski-atom/program-polskiej-energetyki-jadrowej-2020-r (accessed on 2 November 2021).

- Sosiński, D. Zarządzanie Ryzykiem w Projektach Inwestycyjnych Zorientowanych Na Wytwarzanie Energii Odnawialnej. In Ryzyko Inwestowania w Polskim Sektorze Energetyki Odnawialnej; Kasiewicz, S., Ed.; CeDeWu: Warszawa, Poland, 2012. [Google Scholar]

- Blanco, M.I. The Economics of Wind Energy. Renew. Sustain. Energy Rev. 2009, 13, 1372–1382. [Google Scholar] [CrossRef]

- Raugei, M.; Fullana-i-Palmer, P.; Fthenakis, V. The Energy Return on Energy Investment (EROI) of Photovoltaics: Methodology and Comparisons with Fossil Fuel Life Cycles. Energy Policy 2012, 45, 576–582. [Google Scholar] [CrossRef] [Green Version]

- Rogowski, W.; Rak, P. Zarządzanie Ryzykiem w Projektach Budowy i Eksploatacji Hydroelektrowni. In Ryzyko Inwestowania W Polskim Sektorze Energetyki Odnawialnej; Kasiewicz, S., Ed.; CeDeWu: Warszawa, Poland, 2012. [Google Scholar]

- Atlason, R.S.; Unnthorsson, R. Energy Return on Investment of Hydroelectric Power Generation Calculated Using a Standardised Methodology. Renew. Energy 2014, 66, 364–370. [Google Scholar] [CrossRef]

- Stern, N. The Economics of Climate Change: The Stern Review; Cambridge University Press: Cambridge, UK, 2007; ISBN 978-0-521-70080-1. [Google Scholar]

- Tol, R.S.J. Equitable Cost-Benefit Analysis of Climate Change Policies. Ecol. Econ. 2001, 36, 71–85. [Google Scholar] [CrossRef]

- Groom, B.; Hepburn, C.; Koundouri, P.; Smale, R.; Pearce, D. A Social Time Preference Rate for Use in Long-Term Discounting. Available online: https://www.oxera.com/insights/reports/a-social-time-preference-for-use-in-long-term-discounting/ (accessed on 2 November 2021).

- Newell, R.; Pizer, W. Discounting the Benefits of Future Climate Change Mitigation; Center on Global Climate Change: Washington, DC, USA, 2001. [Google Scholar]

- Moore, M.A.; Boardman, A.E.; Vining, A.R.; Weimer, D.L.; Greenberg, D.H. “Just Give Me a Number!” Practical Values for the Social Discount Rate. J. Policy Anal. Manag. 2004, 23, 789–812. [Google Scholar] [CrossRef]

- Anthoff, D.; Tol, R.S.J.; Yohe, G.W. Discounting for Climate Change. Economics 2009, 3, 20090024. [Google Scholar] [CrossRef] [Green Version]

- Jansen, J.; Bakker, S. Social Cost-Benefit Analysis of Climate Change Mitigation Options in a European Context; ECN-E-06-059; Energy research Centre of the Netherlands ECN: The Hague, The Netherlands, 2006. [Google Scholar]

- Ilg, P.; Gabbert, S.; Weikard, H. Nuclear Waste Management under Approaching Disaster: A Comparison of Decommissioning Strategies for the German Repository Asse II. Risk Anal. 2017, 37, 1213–1232. [Google Scholar] [CrossRef]

- Page, E.A. Climate Change, Justice and Future Generations; Edward Elgar Publishing: Cheltenham, UK, 2006; ISBN 978-1-84542-471-8. [Google Scholar]

- Markandya, A. Equity and Distributional Implications of Climate Change. World Dev. 2011, 39, 1051–1060. [Google Scholar] [CrossRef]

- Taebi, B. Intergenerational Risks of Nuclear Energy. In Handbook of Risk Theory Epistemology, Decision Theory, Ethics, and Social Implications of Risk; Roeser, S., Hillerbrand, R., Sandin, P., Peterson, M., Eds.; Springer: Dordrecht, The Netherlands; Heidelberg, Germany; London, UK; New York, NY, USA, 2012; pp. 295–318. [Google Scholar]

- Principles of Radioactive Waste Management Safety Fundamentals; Safety Series; International Atomic Energy Agency: Vienna, Austria, 1995; ISBN 92-0-103595-0.

- Gardiner, S.M. A Perfect Moral Storm: Climate Change, Intergenerational Ethics and the Problem of Moral Corruption. Environ. Values 2006, 15, 397–413. [Google Scholar] [CrossRef] [Green Version]

- Caney, S. Climate Change, Intergenerational Equity and the Social Discount Rate. Politics Philos. Econ. 2014, 13, 320–342. [Google Scholar] [CrossRef]

- Foltyn-Zarychta, M. Ocena Inwestycji Międzypokoleniowych—Kryteria Etyczne w Ekonomicznej Ocenie Efektywności Projektów Inwestycyjnych; C.H. Beck: Warszawa, Poland, 2018. [Google Scholar]

- Arrow, K.J.; Cropper, M.L.; Gollier, C.; Groom, B.; Heal, G.M.; Newell, R.G.; Nordhaus, W.D.; Pindyck, R.S.; Pizer, W.A.; Portney, P.R.; et al. Should Governments Use a Declining Discount Rate in Project Analysis? Rev. Environ. Econ. Policy 2014, 8, 145–163. [Google Scholar] [CrossRef] [Green Version]

- The Green Book Central Government Guidance on Appraisal and Evaluation 2020; HM Treasury: London, UK, 2020.

- Economic Appraisal Vademecum 2021–2027—General Principles and Sector Applications; European Commission: Brussels, Belgium, 2021.

- Evans, D.J.; Sezer, H. Social Discount Rates for Member Countries of the European Union. J. Econ. Stud. 2005, 32, 47–59. [Google Scholar] [CrossRef]

- Florio, M.; Sirtori, E. The Social Cost of Capital: Recent Estimates for the EU Countries; CSIL Centre for Industrial Studies: Milano, Italy, 2013. [Google Scholar]

- Seçilmiş, E.; Akbulut, H. Social Discount Rates for Six Transition Countries. Ekon. Čas. 2019, 67, 629–646. [Google Scholar]

- Foltyn-Zarychta, M.; Buła, R.; Pera, K. Discounting for Energy Transition Policies—Estimation of the Social Discount Rate for Poland. Energies 2021, 14, 741. [Google Scholar] [CrossRef]

- Ustawa z Dnia 11 Stycznia 2018 r. o Elektromobilności i Paliwach Alternatywnych. Available online: https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20180000317 (accessed on 5 November 2021).

- Foltyn-Zarychta, M.; Marcinek, K.; Tomecki, M. Metodyczne Dylematy Oceny Inwestowania w Elektromobilność 2021. In Modern Challenges for Real Estate Manadement. The Conference, 20–21 September 2021, Kraków, Poland; Cracow University of Economics: Kraków, Poland, 2021. [Google Scholar]

- Przegląd Przepisów na Potrzeby Etapu 4. (2021–2030). Available online: https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets/revision-phase-4-2021-2030_pl (accessed on 2 November 2021).

- Lemken, D.; Zühlsdorf, A.; Spiller, A. Improving Consumers’ Understanding and Use of Carbon Footprint Labels on Food: Proposal for a Climate Score Label. EuroChoices 2021, 20, 23–29. [Google Scholar] [CrossRef]

- Weitzman, M.L. Why the Far-Distant Future Should Be Discounted at Its Lowest Possible Rate. J. Environ. Econ. Manag. 1998, 36, 201–208. [Google Scholar] [CrossRef] [Green Version]

- Gollier, C. Time Horizon and the Discount Rate. J. Econ. Theory 2002, 107, 463–473. [Google Scholar] [CrossRef] [Green Version]

- Lucas, R.E., Jr. Asset Prices in an Exchange Economy. Econom. J. Econom. Soc. 1978, 46, 1429–1445. [Google Scholar] [CrossRef]

- Gollier, C. Evaluation of Long-Dated Investments under Uncertain Growth Trend, Volatility and Catastrophes. CESIFO Working Paper No. 4052. December 2012. Available online: https://econpapers.repec.org/scripts/redir.pf?u=https%3A%2F%2Fwww.cesifo.org%2FDocDL%2Fcesifo1_wp4052.pdf;h=repec:ces:ceswps:_4052 (accessed on 1 December 2021).

- Cherbonnier, F.; Gollier, C. Risk-Adjusted Social Discount Rates. Energy J. 2022, 43. [Google Scholar] [CrossRef]

- IPCC. Climate Change 2014: Mitigation of Climate Change; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2014; ISBN 978-1-107-05821-7. [Google Scholar]

- Moore, M.A.; Vining, A.R. The Social Rate of Time Preference and the Social Discount Rate; Mercatus Center at George Mason University: Arlington, VA, USA, 2018. [Google Scholar]

- Burgess, D.F.; Zerbe, R.O. Appropriate Discounting for Benefit-Cost Analysis. J. Benefit-Cost Anal. 2011, 2. [Google Scholar] [CrossRef]

- Spackman, M. Social Discounting and the Cost of Public Funds: A Practitioner’s Perspective. J. Benefit-Cost Anal. 2020, 11, 244–271. [Google Scholar] [CrossRef]

- Berrens, R.P.; Bohara, A.K.; Jenkins-Smith, H.C.; Silva, C.L.; Weimer, D.L. Information and Effort in Contingent Valuation Surveys: Application to Global Climate Change Using National Internet Samples. J. Environ. Econ. Manag. 2004, 47, 331–363. [Google Scholar] [CrossRef]

- Luckert, M.K.; Adamowicz, W.L. Empirical Measures of Factors Affecting Social Rates of Discount. Environ. Resour. Econ. 1993, 3, 1–21. [Google Scholar] [CrossRef]

- Chapman, G.B. Time Preferences for the Very Long Term. Time Judgement Decis. Mak. 2001, 108, 95–116. [Google Scholar] [CrossRef]

- Frederick, S. Measuring Intergenerational Time Preference: Are Future Lives Valued Less? J. Risk Uncertain. 2003, 26, 39–53. [Google Scholar] [CrossRef]

- Cropper, M.L.; Aydede, S.K.; Portney, P.R. Preferences for Life Saving Programs: How the Public Discounts Time and Age. J. Risk Uncertain. 1994, 8, 243–265. [Google Scholar] [CrossRef]

- Wang, H.; He, J. Implicit Individual Discount Rate in China: A Contingent Valuation Study. J. Environ. Manag. 2018, 210, 51–70. [Google Scholar] [CrossRef] [PubMed]

- Weitzman, M.L. Gamma Discounting. Am. Econ. Rev. 2001, 91, 260–271. [Google Scholar] [CrossRef]

- Almansa, C.; Martínez-Paz, J.M. What Weight Should Be Assigned to Future Environmental Impacts? A Probabilistic Cost Benefit Analysis Using Recent Advances on Discounting. Sci. Total Environ. 2011, 409, 1305–1314. [Google Scholar] [CrossRef]

- Drupp, M.A.; Freeman, M.C.; Groom, B.; Nesje, F. Discounting Disentangled. Am. Econ. J. Econ. Policy 2018, 10, 109–134. [Google Scholar] [CrossRef] [Green Version]

- Meerding, W.J.; Bonsel, G.J.; Brouwer, W.B.; Stuifbergen, M.C.; Essink-Bot, M. Social Time Preferences for Health and Money Elicited with a Choice Experiment. Value Health 2010, 13, 368–374. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Howard, G. Discounting for Personal and Social Payments: Patience for Others, Impatience for Ourselves. J. Environ. Econ. Manag. 2013, 66, 583–597. [Google Scholar] [CrossRef]

- Howard, G.; Whitehead, J.C.; Hochard, J. Estimating Discount Rates Using Referendum-Style Choice Experiments: An Analysis of Multiple Methodologies. J. Environ. Econ. Manag. 2021, 105, 102399. [Google Scholar] [CrossRef]

- Ubfal, D. How General Are Time Preferences? Eliciting Good-Specific Discount Rates. J. Dev. Econ. 2016, 118, 150–170. [Google Scholar] [CrossRef] [Green Version]

- Robberstad, B. Estimation of Private and Social Time Preferences for Health in Northern Tanzania. Build. Trust Value Health Syst. Low- Middle- Income Ctries. 2005, 61, 1597–1607. [Google Scholar] [CrossRef]

- Stevens, T.H.; DeCoteau, N.E.; Willis, C.E. Sensitivity of Contingent Valuation to Alternative Payment Schedules. Land Econ. 1997, 73, 140–148. [Google Scholar] [CrossRef]

- Egan, K.J.; Corrigan, J.R.; Dwyer, D.F. Three Reasons to Use Annual Payments in Contingent Valuation Surveys: Convergent Validity, Discount Rates, and Mental Accounting. J. Environ. Econ. Manag. 2015, 72, 123–136. [Google Scholar] [CrossRef]

- Frederick, S.; Loewenstein, G.; O’Donoghue, T. Time Discounting and Time Preference: A Critical Review. J. Econ. Lit. 2002, 40, 351–401. [Google Scholar] [CrossRef]

- Loewenstein, G.; Prelec, D. Anomalies in Intertemporal Choice: Evidence and an Interpretation. Q. J. Econ. 1992, 107, 573–597. [Google Scholar] [CrossRef]

- Venkatachalam, L. The Contingent Valuation Method: A Review. Environ. Impact Assess. Rev. 2004, 24, 89–124. [Google Scholar] [CrossRef]

- Tukey, J.W. Exploratory Data Analysis; Addison-Wesley Series in Behavioral Sciences; Addison-Wesley Pub. Co.: Boston, MA, USA, 1977. [Google Scholar]

- GUS—Bank Danych Lokalnych. Available online: https://bdl.stat.gov.pl/BDL/start (accessed on 2 November 2021).

- Joshi, A.; Kale, S.; Chandel, S.; Pal, D.K. Likert Scale: Explored and Explained. Br. J. Appl. Sci. Technol. 2015, 7, 396. [Google Scholar] [CrossRef]

- Rodríguez, E.M.M.; Lacaze, M.V.; Lupín, B. Contingent Valuation of Consumers’ Willingness-to-Pay for Organic Food in Argentina. In Proceedings of the 12th Congress of the European Association of Agricultural Economists—EAAE, Ghent, Belgium, 26–29 August 2008. [Google Scholar]

- Cavanaugh, J.E.; Neath, A.A. The Akaike Information Criterion: Background, Derivation, Properties, Application, Interpretation, and Refinements. Wiley Interdiscip. Rev. Comput. Stat. 2019, 11, e1460. [Google Scholar] [CrossRef]

- Kim, S.-I.; Haab, T.C. Temporal Insensitivity of Willingness to Pay and Implied Discount Rates. Resour. Energy Econ. 2009, 31, 89–102. [Google Scholar] [CrossRef] [Green Version]

- Hardisty, D.J.; Weber, E.U. Discounting Future Green: Money Versus the Environment. J. Exp. Psychol. Gen. 2009, 138, 329–340. [Google Scholar] [CrossRef]

- Jørgensen, S.L.; Olsen, S.B.; Ladenburg, J.; Martinsen, L.; Svenningsen, S.R.; Hasler, B. Spatially Induced Disparities in Users’ and Non-Users’ WTP for Water Quality Improvements—Testing the Effect of Multiple Substitutes and Distance Decay. Land Use 2013, 92, 58–66. [Google Scholar] [CrossRef]

- Breuer, W.; Müller, T.; Sachsenhausen, E. The Determinants of Discounting in Intergenerational Decision-Making; Social Science Research Network: Rochester, NY, USA, 2021. [Google Scholar]

- Berry, M.S.; Nickerson, N.P.; Odum, A.L. Delay Discounting as an Index of Sustainable Behavior: Devaluation of Future Air Quality and Implications for Public Health. Int. J. Environ. Res. Public Health 2017, 14, 997. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Moser, C.; Stauffacher, M.; Smieszek, T.; Seidl, R.; Krütli, P.; Scholz, R.W. Psychological Factors in Discounting Negative Impacts of Nuclear Waste. J. Environ. Psychol. 2013, 35, 121–131. [Google Scholar] [CrossRef]

- Lewinsohn-Zamir, D. Consumer Preferences, Citizen Preferences, and the Provision of Public Goods. Yale Law J. 1998, 108, 377–406. [Google Scholar] [CrossRef]

- Foltyn-Zarychta, M. The Dilemmas of Public vs. Private Goods Discounting for Long-Term Investment Appraisal: The Puzzle of Citizen and Consumer Approaches to Valuation. Folia Oecon. Stetin. 2020, 20, 114–133. [Google Scholar] [CrossRef]

- Mill, A.G.; van Rensburg, T.M.; Hynes, S.; Dooley, C. Preferences for Multiple Use Forest Management in Ireland: Citizen and Consumer Perpectives. Ecol. Econ. 2007, 60, 642–653. [Google Scholar] [CrossRef]

- Ari, I.; Koc, M. Philanthropic-Crowdfunding-Partnership: A Proof-of-Concept Study for Sustainable Financing in Low-Carbon Energy Transitions. Energy 2021, 222, 119925. [Google Scholar] [CrossRef]

| Statistics | Delay | ||||

|---|---|---|---|---|---|

| 10 | 30 | 90 | 150 | All Delays | |

| Lives saved | |||||

| n | 468 | 466 | 467 | 467 | 1868 |

| Mean | 13.7% | 7.5% | 3.5% | 2.6% | 6.8% |

| Median | 7.7% | 5.5% | 2.6% | 2.0% | 3.4% |

| Modal | 0.0% | 0% | 0% | 0% | 0% |

| SD | 16.9% | 7.4% | 3.3% | 2.4% | 10.4% |

| Skewness | 1.56 | 1.23 | 1.16 | 1.05 | 3.12 |

| Monetary gains | |||||

| n | 471 | 471 | 471 | 471 | 1884 |

| Mean | 24.0% | 11.2% | 4.9% | 3.4% | 10.9% |

| Median | 25.6% | 11.7% | 5.1% | 3.4% | 5.7% |

| Modal | 25.6% | 11.7% | 5.1% | 3.4% | 0.0% |

| SD | 17.5% | 6.9% | 2.7% | 2.0% | 12.5% |

| Skewness | 0.60 | 0.38 | 0.21 | 0.34 | 2.14 |

| DR Value | Delay | ||||

|---|---|---|---|---|---|

| 10 | 30 | 90 | 150 | All Delays | |

| Lives | |||||

| negative | 3.8% | 2.8% | 2.1% | 1.7% | 2.6% |

| zero | 34.0% | 21.2% | 21.8% | 20.8% | 24.5% |

| positive | 62.2% | 76.0% | 76.0% | 77.5% | 72.9% |

| Monetary gains | |||||

| negative | 0.2% | 0.8% | 0.0% | 0.0% | 0.3% |

| zero | 14.2% | 8.7% | 9.3% | 8.9% | 10.3% |

| positive | 85.6% | 90.4% | 90.7% | 91.1% | 89.4% |

| Variable | LS | MG |

|---|---|---|

| Intercept | −0.04 | 1.12 |

| (0.94) | (0.13) | |

| FGI | 0.06 | 0.09 |

| (0.49) | (0.44) | |

| EPI | 0.16 ** | 0.03 |

| (0.02) | (0.79) | |

| LSI | 0.05 | −0.05 |

| (0.53) | (0.67) | |

| CHF | −0.16 *** | 0.15 * |

| (0.01) | (0.10) | |

| D | 0.00 *** | 0.00 ** |

| (0.00) | (0.02) | |

| MALE | 0.11 ** | −0.04 |

| (0.05) | (0.67) | |

| YNG | 0.15 *** | 0.36 *** |

| (0.01) | (0.00) | |

| NO_UD | 0.06 | −0.17 ** |

| (0.25) | (0.04) | |

| LOW_INC | 0.25 *** | −0.21 ** |

| (0.00) | (0.01) | |

| S_HH | −0.23 *** | −0.57 *** |

| (0.00) | (0.00) | |

| N_CHILD | 0.20 *** | 0.19 * |

| (0.00) | (0.05) | |

| Scale | 1 | 1 |

| (0.00) | (0.00) | |

| AIC | 2117.16 | 1215.15 |

| BIC | 2183.53 | 1281.62 |

| Variable | LS10 | LS30 | LS90 | LS150 |

|---|---|---|---|---|

| Intercept | −0.78 | 0.50 | 0.59 | 0.93 |

| (0.39) | (0.63) | (0.58) | (0.38) | |

| FGI | 0.1 | 0.02 | 0.05 | 0.05 |

| (0.50) | (0.90) | (0.76) | (0.75) | |

| EPI | 0.13 | 0.12 | 0.20 | 0.22 |

| (0.32) | (0.42) | (0.18) | (0.13) | |

| LSI | 0.22 | 0.07 | 0.01 | −0.12 |

| (0.17) | (0.68) | (0.98) | (0.51) | |

| CHF | −0.25 ** | −0.11 | −0.18 | −0.12 |

| (0.03) | (0.38) | (0.16) | (0.37) | |

| MALE | 0.18 * | 0.13 | 0.05 | 0.07 |

| (0.08) | (0.26) | (0.64) | (0.53) | |

| YNG | 0.25 ** | 0.08 | 0.1 | 0.18 |

| (0.02) | (0.50) | (0.41) | (0.12) | |

| NO_UD | 0.02 | 0.01 | 0.14 | 0.09 |

| (0.84) | (0.92) | (0.23) | (0.44) | |

| LOW_INC | 0.30 *** | 0.33 *** | 0.16 | 0.23 * |

| (0.01) | (0.01) | (0.17) | (0.05) | |

| S_HH | −0.18 | −0.24 * | −0.29 ** | −0.23 * |

| (0.13) | (0.07) | (0.03) | (0.09) | |

| N_CHILD | 0.27 ** | 0.23 * | 0.16 | 0.14 |

| (0.02) | (0.09) | (0.26) | (0.31) | |

| Scale | 1 | 1 | 1 | 1 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| AIC | 614.96 | 516.78 | 517.71 | 504.25 |

| BIC | 660.57 | 562.34 | 563.30 | 549.84 |

| Variable | MG10 | MG30 | MG90 | MG150 |

|---|---|---|---|---|

| Intercept | −0.48 | 2.73 * | 2.43 | 1.46 |

| (0.69) | (0.09) | (0.14) | (0.35) | |

| FGI | 0.12 | −0.39 | 0.19 | 0.13 |

| (0.57) | (0.87) | (0.43) | (0.62) | |

| EPI | 0.00 | 0.04 | 0.04 | 0.02 |

| (0.99) | (0.85) | (0.85) | (0.94) | |

| LSI | 0.28 | −0.32 | −0.33 | −0.03 |

| (0.17) | (0.26) | (0.25) | (0.90) | |

| CHF | 0.17 | 0.23 | 0.09 | 0.15 |

| (0.30) | (0.24) | (0.64) | (0.46) | |

| MALE | 0.04 | −0.12 | −0.07 | 0.01 |

| (0.77) | (0.49) | (0.68) | (0.97) | |

| YNG | 0.23 * | 0.49 *** | 0.43 ** | 0.34 ** |

| (0.10) | (0.00) | (0.01) | (0.05) | |

| NO_UD | −0.26 * | −0.05 | −0.11 | −0.23 |

| (0.08) | (0.76) | (0.51) | (0.20) | |

| LOW_INC | −0.19 | −0.21 | −0.21 | −0.22 |

| (0.19) | (0.25) | (0.24) | (0.23) | |

| S_HH | −0.41 *** | −0.65 *** | −0.68 *** | −0.63 *** |

| (0.01) | (0.00) | (0.00) | (0.00) | |

| N_CHILD | 0.19 | 0.26 | 0.26 | 0.01 |

| (0.24) | (0.21) | (0.23) | (0.97) | |

| Scale | 1 | 1 | 1 | 1 |

| (0.00) | (0.00) | (0.00) | (0.00) | |

| AIC | 392.29 | 249.13 | 291.04 | 285.02 |

| BIC | 437.97 | 339.81 | 336.72 | 330.70 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Foltyn-Zarychta, M. Future-Generation Perception: Equal or Not Equal? Long-Term Individual Discount Rates for Poland. Energies 2021, 14, 8218. https://doi.org/10.3390/en14248218

Foltyn-Zarychta M. Future-Generation Perception: Equal or Not Equal? Long-Term Individual Discount Rates for Poland. Energies. 2021; 14(24):8218. https://doi.org/10.3390/en14248218

Chicago/Turabian StyleFoltyn-Zarychta, Monika. 2021. "Future-Generation Perception: Equal or Not Equal? Long-Term Individual Discount Rates for Poland" Energies 14, no. 24: 8218. https://doi.org/10.3390/en14248218

APA StyleFoltyn-Zarychta, M. (2021). Future-Generation Perception: Equal or Not Equal? Long-Term Individual Discount Rates for Poland. Energies, 14(24), 8218. https://doi.org/10.3390/en14248218