Environmental Accounting Information Disclosure Driving Factors: The Case of Listed Firms in China

Abstract

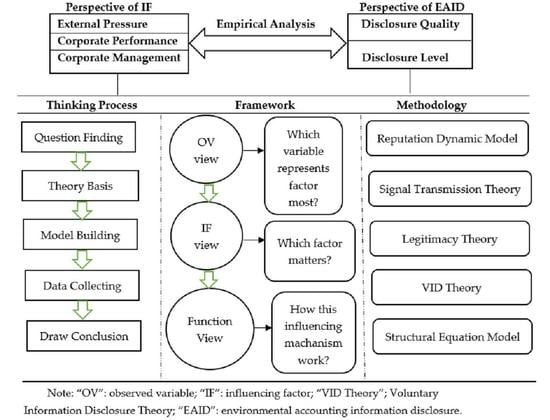

:1. Introduction

2. Theoretical Analysis and Research Hypothesis

2.1. Reputation Dynamic Model

2.2. Legitimacy Theory

2.3. Signal Transmission Theory

2.4. Voluntary Information Disclosure Theory

3. Materials and Methods

3.1. Sample Selection

- Samples with incomplete data for 3 years were excluded;

- Samples with negative net worth were excluded;

- In order to avoid abnormal extreme values, ST company samples were excluded;

- The business model, reporting structure and major accounting items of the financial industry are different from those of other industries, so we excluded financial corporation samples.

3.2. Variable Definitions

3.2.1. Explained Variables

- (I).

- Projects directly related to economic factors;

- (II).

- Projects related to environmental litigation;

- (III).

- Pollution reduction projects;

- (IV).

- Other environment-related projects that do not fall into any of the above categories.

3.2.2. Explanatory Variables

3.3. Table of Observation Variable Definitions

4. Results

4.1. Descriptive Statistics

Descriptive Statistics of Initial Data

4.2. Correlation Analysis

4.3. SEM Model and Analysis

- ①

- External pressure → J-F coefficient;

- ②

- Business performance → Earnings per share;

- ③

- Corporate governance → Ownership concentration.

4.3.1. Interpretation of Coefficients between Observed Variables and Latent Variables

4.3.2. Interpretation of Results between Latent Variables and Explained Variables

4.3.3. Fit Degree Analysis and Hypothesis Testing

4.4. Collinearity Diagnostics

4.5. Robustness Test

4.6. Additional Finding

5. Conclusions

6. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wang, X.; Xu, X.; Wang, C. Public Pressure, Social Reputation, Internal Governance and Corporate Environmental accounting information disclosure: Evidence from Listed Manufacturing Companies in China. Nankai Bus. Rev. Int. 2013, 16, 82–91. [Google Scholar]

- Brown, N.; Deegan, C. The Public Disclosure of Environmental Performance Information: A Dual Test of Media Agenda Setting Theory and Legitimacy Theory. Account. Bus. Res. 1998, 29, 21–41. [Google Scholar] [CrossRef]

- Cormier, D.; Magnan, M.; Velthoven, B.V. Environmental disclosure quality in large German companies: Economic incentives, public pressures or institutional conditions? Eur. Account. Rev. 2005, 14, 3–39. [Google Scholar] [CrossRef]

- Cormier, D.; Ledoux, M.J.; Magnan, M. The Disclosures on Social and Environmental Disclosures for Investors. Manag. Decis. 2011, 49, 1276–1304. [Google Scholar] [CrossRef] [Green Version]

- Shen, H.; Feng, J. Supervision by Public Opinion, Government Supervision and Enterprise Environmental accounting information disclosure. Chin. Account. Res. 2012, 2, 72–78, 97. [Google Scholar]

- Xiao, H.; Zhang, G.; Li, J. System Pressure, Executives and the Company Environment Information Disclosure. J. Econ. Manag. 2016, 38, 168–180. [Google Scholar]

- Zhang, X.; Ma, M.; Chen, J. External Pressure to the Enterprise Environment Information Disclosure Regulation Effect. J. Soft Sci. 2016, 30, 74–78. [Google Scholar]

- Al-Tuwaijri, S.A.; Christensen, T.E.; Hughes, K.E. The Relations among Environmental Disclosure, Environmental Performance and Economic Performance: A Simultaneous Equations Approach. Account. Organ. Soc. 2004, 29, 447–471. [Google Scholar] [CrossRef]

- Anderson, J.C.; Frankle, A.W. Voluntary Social Reporting: An Iso-beta Portfolio analysis. Account. Rev. 1980, 3, 467–479. [Google Scholar]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the Relation between Environmental Performance and Environmental Disclosure: An Empirical Analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Tang, Y.; Chen, Z.; Liu, X.; Li, W. An Empirical Study on Environmental accounting information disclosure of Listed Companies in China and Its Influencing Factors. Manag. World 2006, 1, 158–159. [Google Scholar]

- Yang, Y.; Yang, F.; Zhao, X. The impact of the quality of environmental accounting information disclosure on financial performance: The moderating effect of internal and external stakeholders. Environ. Sci. Pollut. Res. 2022, 29, 68796–68814. [Google Scholar] [CrossRef] [PubMed]

- Donnelly, R.; Lynch, C. The Ownership Structure of UK Firms and The Informativeness of Accounting Earnings. Account. Bus. Res. 2002, 32, 245–257. [Google Scholar] [CrossRef]

- Gao, M.; Ma, S. An Empirical Analysis of The Relationship Between Independent Director System and Corporate Performance—Also on the Institutional Environment of Effective Exercise of Independent Directors in China. Nankai Bus. Rev. Int. 2002, 2, 64–68. [Google Scholar]

- Guenther, E.; Endrikat, J.; Guenther, T.W. Environmental management control systems: A conceptualization and a review of the empirical evidence. J. Clean. Prod. 2016, 136, 147–171. [Google Scholar] [CrossRef]

- Liu, X.; Xu, H.; Lu, M. Do auditors respond to stringent environmental regulation? Evidence from China’s new environmental protection law. Econ. Model. 2021, 96, 54–67. [Google Scholar] [CrossRef]

- Liu, Z.; Bai, Y. The impact of ownership structure and environmental supervision on the environmental accounting information disclosure quality of high-polluting enterprises in China. Environ. Sci. Pollut. Res. 2022, 29, 21348–21364. [Google Scholar] [CrossRef] [PubMed]

- Hu, J.; Wu, D. The Riddle of Equity Structure and Corporate Performance. Dongyue Rev. 2020, 9, 97–113. [Google Scholar]

- Lang, L.H.P.; Stulz, R.M.; Tobin’s, Q. Corporate Diversification and Form Performance. J. Political Econ. 1994, 102, 1248–1280. [Google Scholar]

- Du, Y.; Jia, L. A New Approach to Management Research. Manag. World 2017, 6, 155–167. [Google Scholar]

- Formbrun, C.; Shanley, M. What’s in a Name? Reputation Building and Corporate Strategy. Acad. Manag. J. 1990, 33, 233–258. [Google Scholar] [CrossRef]

- Li, C. Environmental Responsibility, Organizational Change and Environmental accounting information Disclosure: A Normative Research Framework Based on Legitimacy Theory. Econ. Manag. Res. 2010, 5, 117–123. [Google Scholar]

- Patten, D.M. The relation between environmental performance and environmental disclosure: A research note. Account. Organ. Soc. 2002, 27, 763–773. [Google Scholar] [CrossRef]

- Spence, A.M. Job Market Signaling. Q. J. Econ. 1973, 3, 355–374. [Google Scholar] [CrossRef]

- Meek, G.K.; Roberts, C.B.; Gray, S.J. Factors Influencing Voluntary Annual Report Disclosures By, U.S. U.K. and Continental European Multinational Corporations. J. Int. Bus. Stud. 1995, 26, 555–572. [Google Scholar] [CrossRef]

- Niu, J.; Wu, C.; Li, S. Institutional Investors Type Characteristics and Voluntary Information Disclosure, Equity. J. Manag. Rev. 2013, 25, 48–59. [Google Scholar]

- Mahon, J.F.; Wartick, S.L. Dealing with Stakeholders: How Reputation, Credibility and Framing Influence the Game. Corp. Reput. Rev. 2003, 6, 19–35. [Google Scholar] [CrossRef]

- Brammer, S.J.; Pavelin, S. Corporate reputation and social performance: The importance of fit. J. Manag. Stud. 2006, 43, 435–455. [Google Scholar] [CrossRef]

- Mia, P.; Rana, T.; Ferdous, L.T. Government Reform, Regulatory Change and Carbon Disclosure: Evidence from Australia. Sustainability 2021, 13, 13282. [Google Scholar] [CrossRef]

- Xu, J. Relationship between controlling shareholders’ participation in share pledging and accounting conservatism in China. Aust. Account. Rev. 2021, 31, 9–21. [Google Scholar] [CrossRef]

- Wiseman, J. An evaluation of environmental disclosures made in corporate annual reports. Account. Organ. Soc. 1982, 7, 53–63. [Google Scholar] [CrossRef]

- Cormier, D.; Magnan, M. Environmental reporting management: A continental European perspective. J. Account. Public Pol. 2003, 22, 43–62. [Google Scholar] [CrossRef]

- Janis, I.L.; Fadner, R. The coefficient of Imbalance. In Language of Politics; Lasswell, H., Leites, N., Eds.; MIT Press: Cambridge, MA, USA, 1965; pp. 153–169. [Google Scholar]

- Du, Y.; Liu, L. Ownership Structure and Corporate Governance Efficiency: An empirical analysis of Chinese Listed Companies. Manag. World 2002, 11, 124–133. [Google Scholar]

- Xu, L.; Xin, Y.; Chen, G. The Influence of Ownership Concentration and Ownership Balance on Corporate Performance. J. Econ. Res. 2006, 1, 90–100. [Google Scholar]

- Smith, A.J. Corporate ownership structure and performance: The case of management buyouts. J. Financ. Econ. 1990, 27, 143–164. [Google Scholar] [CrossRef]

- Aerts, W.; Cormier, D.; Magnan, M. Corporate environmental disclosure, financial markets and the media: An international perspective. Ecol. Econ. 2008, 64, 643–659. [Google Scholar] [CrossRef]

- Cho, C.H.; Patten, D.M. The role of environmental disclosures as tools of legitimacy: A research note. Account. Org. Soc. 2007, 32, 639–647. [Google Scholar] [CrossRef]

- Blanco, E.; Rey-Maquieira, J.; Lozano, J. The economic impacts of voluntary environmental performance of firms: A critical review. J. Econ. Surv. 2009, 23, 462–502. [Google Scholar] [CrossRef]

- Fairfield, P.M.; Yohn, T.L. Using asset turnover and profit margin to forecast changes in profitability. Rev. Account. Stud. 2001, 6, 371–385. [Google Scholar] [CrossRef]

- Fan, J.P.H.; Wong, T.J. Corporate ownership structure and the informativeness of accounting earnings in East Asia. J. Account. Econ. 2002, 33, 401–425. [Google Scholar] [CrossRef] [Green Version]

- Huang, J.; Zhou, C.N. Empirical Study on The Impact of Ownership Structure and Management Behavior on Environmental accounting information disclosure: Empirical Evidence from Shanghai Heavy Pollution Industry. China Soft Sci. 2012, 1, 133–143. [Google Scholar]

- Barnea, A.; Rubin, A. Corporate social responsibility as a conflict between shareholders. J. Bus. Ethics. 2010, 97, 71–86. [Google Scholar] [CrossRef]

- Ioannou, I.; Serafeim, G. The impact of corporate social responsibility on investment recommendations: Analysts’ perceptions and shifting institutional logics. Strateg. Manag. J. 2015, 36, 1053–1081. [Google Scholar] [CrossRef] [Green Version]

- Xue, J.; He, Y.; Liu, M.; Tang, Y.; Xu, H. Incentives for Corporate Environmental Information Disclosure in China: Public Media Pressure, Local Government Supervision and Interactive Effects. Sustainability 2021, 13, 10016. [Google Scholar] [CrossRef]

- Cao, Y.; Feng, Z.; Lu, M.; Shan, Y. Tax avoidance and firm risk: Evidence from China. Account. Financ. 2021, 61, 4967–5000. [Google Scholar] [CrossRef]

- Hu, D.; Huang, Y.; Zhong, C. Does Environmental information disclosure affect the sustainable development of enterprises: The role of green innovation. Sustainability 2021, 13, 11064. [Google Scholar] [CrossRef]

- Nguyen, T.H.; Vu, Q.T.; Nguyen, D.M.; Le, H.L. Factors influencing corporate social responsibility disclosure and its impact on financial performance: The case of Vietnam. Sustainability 2021, 13, 8197. [Google Scholar] [CrossRef]

- Wang, S.; Wang, H.; Wang, J.; Yang, F. Does Environmental accounting information disclosure Contribute to Improve Firm Financial Performance? An Examination of the Underlying Mechanism. Sci. Total Environ. 2020, 714, 136855. [Google Scholar] [CrossRef]

- Liang, Q.; Li, Q.; Lu, M.; Shan, Y. Industry and geographic peer effects on corporate tax avoidance: Evidence from China. Pac. Basin Financ. J. 2021, 67, 101545. [Google Scholar] [CrossRef]

- Bergstresser, D.; Philippon, T. CEO incentives and earnings management. J. Financ. Econ. 2006, 80, 511–529. [Google Scholar] [CrossRef] [Green Version]

- Li, M.; Cao, Y.; Lu, M.; Wang, H. Political uncertainty and allocation of decision rights among business groups: Evidence from the replacement of municipal officials. Pac. Basin Financ. J. 2021, 67, 101541. [Google Scholar] [CrossRef]

- Wang, X.; Jiang, H.; Lu, M. Does the reporting location of other comprehensive income matter? The investor’s perspective. Aust. Account. Rev. 2019, 29, 546–555. [Google Scholar] [CrossRef]

- Zhou, D.; Bai, M.; Liang, X.; Qin, Y. The Early-life Political Event Experience of the Chair of the Board and the Firm’s Innovation Decision. Aust. Account. Rev. 2021, 31, 186–212. [Google Scholar] [CrossRef]

- Zhai, H.; Lu, M.; Shan, Y.; Liu, Q.; Zhao, Y. Key audit matters and stock price synchronicity: Evidence from a quasi-natural experiment in China. Int. Rev. Financ. Anal. 2021, 75, 101747. [Google Scholar] [CrossRef]

| Information Classification | Examples of Containing Information | Scoring Standards |

|---|---|---|

| Overall environment management information | Annual Environmental Investment | The scoring standards of corporate disclosure level are as follows: Mention: 1 point Not mentioned: 0 point Cumulative score of corporate disclosure level = Cumulative sum of the four projects |

| Pollution prevention information | Identification and measurement of discharge pollution and waste, and measures to control pollution sources | |

| Information on sustainable resource use | Measure, record and report water usage | |

| Information on climate change mitigation and adaptation | Greenhouse gas reduction measures |

| Category | Disclosure of Project Contents | Supposed the Standard |

|---|---|---|

| Environmental Management Information | Resource consumption information | The scoring standards of corporate disclosure are as follows: Quantitative, precisely monetized information—3 points; Qualitative, specific non-monetized information—2 points; General mention of information—1 point; Not mentioned—0 point. Corporate environmental accounting information disclosure score = cumulative score of nine items. |

| ISO environmental system certification information | ||

| Emergency environmental accidents, environmental illegal incidents, environmental petition cases | ||

| Environmental performance information | Measures to improve (or remedy) the ecological environment | |

| Pollutant discharge and emission reduction treatment | ||

| Environmental investment, loans and related technology research and development | ||

| Environmental responsibility information | Implementation of cleaner production | |

| Environmental protection objectives, concepts and management systems | ||

| Environmental emergency response mechanism |

| Variable Types | Latent Variables | Observation Variable | Variable Definitions | Literature Sources |

|---|---|---|---|---|

| Explanatory variables | External pressure | Loans (Loans) | The sum of the company’s short-term and long-term borrowings; | [37] |

| Proportion of state-owned Shares (SOE) | Total number of state-owned shares/corporations | [1] | ||

| Whether audited by Big Four accounting firm (Big4) | Dummy variables; Assigned 1 if they are, 0 if they are not; | [38] | ||

| Social Public Opinion Pressure Index (J-F) | Janis-fadner coefficient (J-F coefficient) | [4] | ||

| Corporate performance | Earnings per share (EPS) | Net profit/Total number of shares issued; | [39] | |

| Profitability (NPR) | Net profit growth rate = (Current year net profit—last year net profit)/Last year net profit | [5] | ||

| Operating Capacity (TAT) | Total asset turnover = sales revenue/Total assets | [40] | ||

| Financial Leverage (DFL) | Change in earnings per common share/Change in EBIT | [4] | ||

| Corporate governance | Ownership Concentration (Herf5) | The sum of squares of the shareholding ratio of the top five shareholders; | [41] | |

| Equity Balance degree (ERR) | Shareholding ratio of the 2nd–5th largest shareholder/Shareholding of the largest shareholder; | [42] | ||

| Management Shareholding (MH) | Management shareholding/Total shares; | [43] | ||

| Proportion of independent directors (RID) | (Proportion of independent directors) = Number of independent directors/Total number of directors | [44] | ||

| Explained variable | Corporate environmental accounting information disclosure | Management Shareholding (MH) | Management shareholding/Total shares | [1,7,10,31,42,43,44] |

| Equity Balance degree (ERR) | Shareholding ratio of the 2nd–5th largest shareholder/Shareholding of the largest shareholder | |||

| Level of Environmental accounting information disclosure (EDI) | Rankins CSR Ratings Global MCTI Social Responsibility report Rating System 2012 edition | |||

| Quality of Environmental accounting information disclosure (EDQ) | Environmental Scoring Guidelines | |||

| Control variables | Corporate Size (Size) | The natural log of total assets | Ln (Total assets) | |

| Industry Type (Industry) Degree of Debt | The bureau of Statistics publishes industry classifications Asset-liability ratio | Total liabilities/total assets |

| Industry | Sample | Mean | Standard Deviation | Median | Minimum | Maximum |

|---|---|---|---|---|---|---|

| Energy industry | 62 | 210.84 | 13.30 | 178 | 1 | 730 |

| Machinery/technology industry | 69 | 108.97 | 10.77 | 83 | 1 | 436 |

| Electronics industry | 9 | 152.67 | 15.84 | 106 | 7 | 497 |

| Real estate/construction industry | 12 | 117.91 | 11.31 | 131 | 13 | 269 |

| Life service industry | 10 | 102.3 | 10.49 | 100.5 | 1 | 258 |

| Food industry | 11 | 141.8 | 10.25 | 123 | 85 | 234 |

| Pharmaceutical industry | 18 | 124.1 | 11.4 | 100 | 25 | 325 |

| Transportation | 9 | 150.44 | 7.14 | 157 | 51 | 233 |

| Overall average | - | 138.63 | 11.31 | 122.31 | 23 | 372.75 |

| Industry | Sample | Mean | Standard Deviation | Median | Minimum | Maximum |

|---|---|---|---|---|---|---|

| Energy industry | 62 | 79.13 | 5.83 | 78.5 | 3 | 232 |

| Machinery/technology industry | 69 | 44.16 | 11.04 | 37 | 4 | 124 |

| Electronics industry | 9 | 57.67 | 4.47 | 54 | 7 | 150 |

| Real estate/construction industry | 12 | 61.33 | 6.08 | 57.5 | 5 | 153 |

| Life service industry | 10 | 51.7 | 9.90 | 45 | 1 | 125 |

| Food industry | 11 | 59.63 | 8.60 | 60 | 22 | 109 |

| Pharmaceutical industry | 18 | 72.67 | 5.48 | 56 | 15 | 296 |

| Transportation | 9 | 79.11 | 8.77 | 56 | 20 | 152 |

| Overall average | 200 | 63.17 | 7.52 | 55.5 | 9.63 | 167 |

| Variable | N | Minimum | Maximum | Mean | Standard Deviation |

|---|---|---|---|---|---|

| Loans | 200 | 0 | 132,868,500,000 | 4,973,085,898.6 | 12,976,193,546.43 |

| J-F coefficient | 200 | 0.218 | 0.945 | 0.658 | 0.124 |

| Proportion of state-owned equity (SOE) | 200 | 0 | 0.932 | 0.229 | 0.268 |

| Whether audited by “Big Four” (“Big Four”) | 200 | 0 | 5 | 4.76 | 0.791 |

| Net Profit Growth Rate (NPR) | 200 | −16.287 | 378.07 | 2.639 | 27.146 |

| Earnings per share (EPS) | 200 | −1.03 | 2.190 | 0.401 | 0.432 |

| Debt financial leverage (DFL) | 200 | −9.297 | 155.698 | 2.68 | 11.28 |

| Total asset turnover (TAT) | 200 | 0.124 | 2.073 | 0.593 | 0.339 |

| Ratio of independent director (RID) | 200 | 0.038 | 3.03 | 0.730 | 0.605 |

| Management shareholding (MH) | 200 | 0.136 | 0.663 | 0.373 | 0.052 |

| Ownership concentration (Herf5) | 200 | 0 | 60.90 | 8.541 | 15.229 |

| Disclosure quality score (Quality Score) | 200 | 0.003 | 0.718 | 0.192 | 0.132 |

| Disclosure level score (Level Score) | 200 | 1 | 730 | 148.03 | 118.757 |

| Loans | J-F | SOE | Big4 | NPR | EPS | DFL | TAT | ERR | RID | MH | Herf5 | EDQ | EDI | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Loans | 1.000 | 0.243 *** | 0.415 *** | 0.041 | −0.006 | 0.031 | −0.013 | −0.056 | −0.033 | 0.132 ** | −0.185 *** | 0.344 *** | 0.179 *** | 0.235 *** |

| J-F | 0.243 *** | 1.000 | 0.157 | −0.084 | 0.108 | 0.089 | −0.110 | 0.114 | −0.076 | 0.081 | −0.080 | 0.164 | 0.163 | 0.204 |

| SOE | 0.415 *** | 0.154 ** | 1.000 | 0.032 | 0.097 | −0.003 | 0.078 | −0.032 | −0.216 | 0.147 | −0.406 | 0.439 | 0.247 | 0.308 |

| Big4 | 0.041 | −0.083 | 0.031 | 1.000 | 0.024 | −0.026 | 0.022 | 0.041 | −0.091 | 0.195 | −0.124 | 0.066 | 0.097 | 0.086 |

| NPR | −0.006 | 0.108 | 0.097 | 0.024 | 1.000 | 0.021 | −0.009 | −0.013 | 0.014 | −0.032 | −0.024 | 0.014 | 0.137 | 0.046 |

| EPS | 0.031 | 0.087 | −0.002 | −0.026 | 0.021 | 1.000 | −0.200 | 0.123 | 0.066 | 0.021 | 0.040 | 0.221 | 0.139 | 0.238 |

| DFL | −0.013 | −0.110 * | 0.078 | 0.022 | −0.009 | −0.2 *** | 1.000 | −0.017 | −0.040 | −0.037 | −0.060 | −0.085 | −0.041 | −0.031 |

| TAT | −0.056 | 0.118 * | −0.037 | 0.042 | −0.013 | 0.121 ** | −0.018 | 1.000 | −0.102 | −0.015 | 0.005 | 0.187 | 0.236 | 0.150 |

| ERR | −0.033 | −0.077 | −0.215 *** | −0.091 | 0.014 | 0.067 | −0.040 | −0.102 * | 1.000 | −0.109 | 0.310 | −0.510 | −0.140 | −0.162 |

| RID | 0.132 ** | 0.085 | 0.142 ** | 0.196 *** | −0.032 | 0.018 | −0.037 | −0.009 | −0.110 ** | 1.000 | −0.111 | 0.218 | 0.070 | 0.165 |

| MH | −0.185 *** | −0.077 | −0.408 *** | −0.123 ** | −0.024 | 0.038 | −0.060 | 0.008 | 0.310 *** | −0.107 ** | 1.000 | −0.273 | −0.228 | −0.328 |

| Herf5 | 0.344 *** | 0.163 ** | 0.438 *** | 0.066 | 0.014 | 0.221 *** | −0.085 | 0.186 *** | −0.510 *** | 0.217 *** | −0.273 *** | 1.000 | 0.216 | 0.299 |

| EDQ | 0.179 *** | 0.161 ** | 0.248 *** | 0.096 * | 0.137 | 0.140 ** | −0.040 | 0.233 *** | −0.139 ** | 0.068 | −0.228 *** | 0.216 *** | 1.000 | 0.744 |

| EDI | 0.235 *** | 0.199 *** | 0.311 *** | 0.084 | 0.046 | 0.239 *** | −0.030 | 0.144 ** | −0.161 ** | 0.159 ** | −0.330 *** | 0.299 *** | 0.744 *** | 1.000 |

| Estimate | S.E. | C.R. | p Value | |

|---|---|---|---|---|

| External Pressure → SOE | 1.986 | 0.600 | 3.310 | *** |

| External Pressure → “Big Four” | 0.193 | 0.282 | 0.683 | 0.495 |

| External Pressure → Loans | 2.131 | 0.630 | 3.382 | *** |

| External Pressure → J-F coefficient | 1.000 | - | - | - |

| Corporate Performance → DFL | 0.008 | 0.231 | 0.034 | 0.973 |

| Corporate Performance → NPR | 0.054 | 0.232 | 0.231 | 0.817 |

| Corporate Performance → TAT | 0.593 | 0.361 | 1.641 | 0.101 |

| Corporate Performance → EPS | 1.000 | - | - | - |

| Corporate governance → ERR | −1.585 | 0.457 | −3.471 | *** |

| Corporate governance → MH | −0.487 | 0.150 | −3.246 | 0.001 |

| Corporate governance → RID | 0.214 | 0.148 | 1.440 | 0.150 |

| Corporate governance → Herf5 | 1 | − | − | − |

| External Pressure → Quality Score | 1.016 | 0.387 | 2.624 | 0.009 |

| External Pressure → Level Score | 1.396 | 0.457 | 3.055 | 0.002 |

| Corporate Performance → Quality Score | 2.868 | 0.882 | 3.253 | 0.001 |

| Corporate Performance → Level Score | 3.818 | 1.348 | 2.833 | 0.005 |

| Corporate governance → Quality Score | −1.006 | 0.986 | −1.020 | 0.308 |

| Corporate governance → Level Score | −1.392 | 1.339 | −1.039 | 0.299 |

| External Pressure → Corporate governance | 0.195 | 0.217 | 0.895 | 0.371 |

| External Pressure → Herf5 | 1.520 | 0.484 | 3.142 | 0.002 |

| External Pressure → RID | 0.214 | 0.148 | 1.440 | 0.150 |

| Corporate governance → SOE | 0.359 | 0.141 | 2.541 | 0.011 |

| Corporate governance → Corporate Performance | 0.434 | 0.368 | 1.179 | 0.238 |

| Herf5 → EPS | 0.418 | 0.118 | 3.538 | *** |

| SOE → MH | −0.338 | 0.067 | −5.017 | *** |

| Corporate governance → EPS | −1.035 | 0.429 | −2.413 | 0.016 |

| Model | NPAR | CMIN | DF | P | CMIN/DF | RMR |

|---|---|---|---|---|---|---|

| Default Model | 40 | 77.907 | 64 | 0.114 | 1.217 | 0.055 |

| GFI | CFI | RMSEA | IFI | TLI | ||

| 0.949 | 0.969 | 0.033 | 0.971 | 0.956 |

| Fitting Index | CMIN/DF | RMR | RMSEA | GFI | CFI | TLI | P |

|---|---|---|---|---|---|---|---|

| Adapt standard | (1, 3) | <0.08 | <0.05 | >0.9 | >0.9 | >0.9 | >0.05 |

| Model values | 1.217 | 0.055 | 0.033 | 0.949 | 0.969 | 0.956 | 0.114 |

| Category | Observation Variable | VIF | Tolerance |

|---|---|---|---|

| External pressure | Loans | 1.384 | 0.723 |

| J-F coefficient | 1.140 | 0.877 | |

| Proportion of state-owned equity (SOE) | 1.592 | 0.628 | |

| Whether audited by “Big Four” (Big Four) | 1.076 | 0.929 | |

| Corporate performance | Earnings per share (EPS) | 1.160 | 0.862 |

| Net profit growth rate (NPR) | 1.032 | 0.969 | |

| Total asset turnover (TAT) | 1.093 | 0.915 | |

| Debt financial leverage (DFL) | 1.075 | 0.930 | |

| Corporate governance | Ownership concentration (Herf5) | 2.034 | 0.492 |

| Management shareholdings (MH) | 1.296 | 0.771 | |

| Ratio of independent directors (RID) | 1.104 | 0.905 | |

| Degree of equity balance (ERR) | 1.557 | 0.642 |

| Category | Observation Variable | Normalization Coefficient β | t-Statistic | Significance Level |

|---|---|---|---|---|

| External pressure | Borrowing costs (Loans) | 0.084 | 1.115 | 0.266 |

| J-F coefficient | 0.144 * | 2.075 | 0.039 * | |

| Proportion of state-owned equity (SOE) | 0.239 *** | 3.244 | 0.001 | |

| Whether audited by “Big Four” (Big Four) | 0.098 | 1.451 | 0.148 | |

| Corporate performance | Earnings per share (EPS) | 0.179 ** | 2.545 | 0.012 |

| Net profit growth rate (NPR) | 0.097 | 1.413 | 0.159 | |

| Total asset turnover (TAT) | 0.182 *** | 2.628 | 0.009 | |

| Debt financial leverage (DFL) | 0.002 | 0.030 | 0.976 | |

| Corporate governance | Ownership concentration (Herf5) | 0.213 *** | 2.671 | 0.008 |

| Management shareholdings (MH) | −0.244 *** | −3.446 | 0.001 | |

| Ratio of independent directors (RID) | 0.053 | 0.772 | 0.441 | |

| Degree of equity balance (ERR) | 0.029 | 0.364 | 0.716 |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| QualityS | 0.283428 | 0.018084 | 15.67305 | 0.000 |

| C | 20.34554 | 3.428498 | 5.934243 | 0.000 |

| R-squared | 0.553697 | Mean dependent var | 62.300 | |

| Adjusted R-squared | 0.551443 | S.D. dependent var | 45.23429 | |

| S.E. of regression | 30.29540 | Akaike info criterion | 9.669818 | |

| Sum squared resid | 181726.6 | Schwarz criterion | 9.702802 | |

| Log likelihood | −964.9818 | Hannan-Quinn criter. | 9.683166 | |

| F-statistic | 245.6446 | Durbin-Watson stat | 1.930242 | |

| Prob (F-statistic) | 0.0000 | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ji, M.; Ji, Y.; Dong, S. Environmental Accounting Information Disclosure Driving Factors: The Case of Listed Firms in China. Sustainability 2022, 14, 15797. https://doi.org/10.3390/su142315797

Ji M, Ji Y, Dong S. Environmental Accounting Information Disclosure Driving Factors: The Case of Listed Firms in China. Sustainability. 2022; 14(23):15797. https://doi.org/10.3390/su142315797

Chicago/Turabian StyleJi, Maoli, Yuguang Ji, and Shulan Dong. 2022. "Environmental Accounting Information Disclosure Driving Factors: The Case of Listed Firms in China" Sustainability 14, no. 23: 15797. https://doi.org/10.3390/su142315797

APA StyleJi, M., Ji, Y., & Dong, S. (2022). Environmental Accounting Information Disclosure Driving Factors: The Case of Listed Firms in China. Sustainability, 14(23), 15797. https://doi.org/10.3390/su142315797