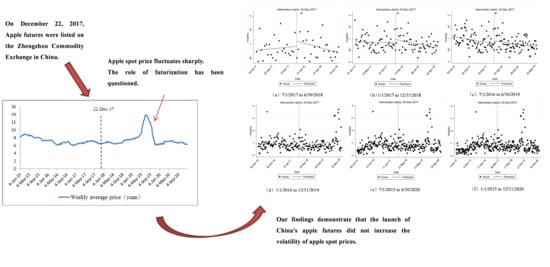

Is Futurization the Culprit for the Violent Fluctuation in China’s Apple Spot Price?

Abstract

:1. Introduction

2. Literature Review

3. Methods

3.1. Data

3.2. Analysis

4. Results

4.1. Descriptive Statistics

4.2. Result of ITSA

4.3. Result of GARCH

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Working, H. New concepts concerning futures markets and prices. Am. Econ. Rev. 1962, 52, 431–459. [Google Scholar]

- Silber, W.L. Innovation, competition, and new contract design in futures markets. J. Futures Mark. 1981, 1, 123–155. [Google Scholar] [CrossRef]

- Garbade, K.D.; Silber, W.L. Price Movements and Price Discovery in Futures and Cash Markets. Rev. Econ. Stat. 1983, 65, 289. [Google Scholar] [CrossRef]

- Friedman, M.; Friedman, M. Essays in Positive Economics; University of Chicago Press: Chicago, IL, USA, 1953. [Google Scholar]

- Yang, X.B. Thirty Years of Futures Market Has Significantly Enhanced Its Function of Serving the Real Economy. Xinhuanet. Available online: http://www.xinhuanet.com/fortune/2020-12/21/c_1126888441.htm (accessed on 21 December 2020). (In Chinese).

- Ji, W.R. Products and the sustainable development of the futures market. China Mark. 2005, 19, 56–57. (In Chinese) [Google Scholar]

- Guo, C.G.; Xiong, X.P.; Sun, R.T. Market Activity and Influencing Factors of New Listed Futures Products: A Perspective of Apple Futures. Financ. Theory Pract. 2020, 10, 98–105. (In Chinese) [Google Scholar]

- Wang, H.H.; Ke, B. Efficiency tests of agricultural commodity futures markets in China. Aust. J. Agric. Resour. Econ. 2005, 49, 125–141. [Google Scholar] [CrossRef] [Green Version]

- Working, H. Price Effects of Futures Trading. Food Res. Inst. Stud. 1960, 1, 3–31. [Google Scholar]

- Gray, R.W. Onions Revisited. Am. J. Agric. Econ. 1963, 45, 273–276. [Google Scholar] [CrossRef]

- Taylor, G.S.; Leuthold, R.M. The Influence of Futures Trading on Cash Cattle Price Variations. Food Res. Inst. Stud. 1974, 13, 29–35. [Google Scholar]

- Pang, Z.Y.; Liu, L. Can Agricultural Product Price Fluctuation be stabilized by Future Market: Empirical Study Based on Discrete Wavelet Transform and GARCH Model. J. Financ. Res. 2013, 11, 126–139. (In Chinese) [Google Scholar]

- Tang, K.; Xiong, W. Index Investment and the Financialization of Commodities. Financ. Anal. J. 2012, 68, 54–74. [Google Scholar] [CrossRef]

- Basak, S.; Pavlova, A. A Model of Financialization of Commodities. J. Financ. 2016, 71, 1511–1556. [Google Scholar] [CrossRef]

- Zhang, C.S. The logic and reflection of financialization. Econ. Res. J. 2019, 54, 4–20. (In Chinese) [Google Scholar]

- Kawai, M. Price Volatility of Storable Commodities under Rational Expectations in Spot and Futures Markets. Int. Econ. Rev. 1983, 24, 435. [Google Scholar] [CrossRef]

- Newbery, D.M. When Do Futures Destabilize Spot Prices? Int. Econ. Rev. 1987, 28, 291. [Google Scholar] [CrossRef]

- Yang, J.; Balyeat, R.B.; Leatham, D.J. Futures Trading Activity and Commodity Cash Price Volatility. J. Bus. Financ. Account. 2005, 32, 297–323. [Google Scholar] [CrossRef] [Green Version]

- Data Source: Zhengzhou Commodity Exchange “Historical Market Data” Data. Available online: http://www.czce.com.cn/cn/jysj/lshqxz/H770319index_1.htm (accessed on 30 December 2020). (In Chinese).

- Wei, S.G.; Shen, N.; Xu, X.R.; Zeng, Y.X. Crazy Apple: 120 Tons of Deliverables Stir up the 200 Billion Spot Market. Securities Times. Available online: http://news.stcn.com/2018/0521/14255834.shtml (accessed on 12 May 2018). (In Chinese).

- Ye, Q. Apple Futures Are Crazy! Soaring 70% in 4 Months, Private Equity Speculation by Reducing Production? China Times. Available online: https://kknews.cc/zh-my/finance/aprp94g.html (accessed on 13 August 2018). (In Chinese).

- Chen, Z. Ignoring the Zheng Stock Exchange’s Risk Warning, Hot Money “Willful” Pushes up Apple and Red Date Futures. 21st Century Business Herald. Available online: https://m.21jingji.com/article/20190517/73e1af9dd641dfe8d8b5fa36c37b9859.html (accessed on 17 May 2019). (In Chinese).

- Dong, P. Fruit Futures Rose Again and Again: The “Researchers” Were Beaten up, and They Lost Nearly 200 Million Yuan in Short-Selling against the Market. 21st Century Business Herald. Available online: https://www.yicai.com/news/100216204.html (accessed on 7 June 2019). (In Chinese).

- Masters, M.W. Testimony before the Committee on Homeland Security and Governmental Affairs; US Senate: Washington, DC, USA, 2008.

- Ouyang, R.; Zhang, X. Financialization of agricultural commodities: Evidence from China. Econ. Model. 2020, 85, 381–389. [Google Scholar] [CrossRef]

- Johan, D.J.; Joep, S.; Jan, T. The Effect of Futures Markets on the Stability of Commodity Prices. Tinbergen Inst. Discuss. Pap. 2019, 28. [Google Scholar] [CrossRef] [Green Version]

- Sobti, N. Does Ban on Futures trading (de)stabilise spot volatility? Evidence from Indian Agriculture Commodity Market. South Asian J. Bus. Stud. 2019, 9, 145–166. [Google Scholar] [CrossRef]

- Bohl, M.T.; Siklos, P.L.; Stefan, M.; Wellenreuther, C. Price discovery in agricultural commodity markets: Do speculators contribute? J. Commod. Mark. 2020, 18, 100092. [Google Scholar] [CrossRef] [Green Version]

- Johnson, A.C. Effects of Futures Trading on Price Performance in the Cash Onion Market, 1930–1968; United States Department of Agriculture, Economic Research Service: Washington, DC, USA, 1973.

- Powers, M.J. Does futures trading reduce price fluctuations in the cash markets? In The Economics of Futures Trading; Palgrave Macmillan: London, UK, 1976; pp. 217–224. [Google Scholar]

- Netz, J.S. The Effect of Futures Markets and Corners on Storage and Spot Price Variability. Am. J. Agric. Econ. 1995, 77, 182–193. [Google Scholar] [CrossRef]

- Morgan, C.W. Futures Markets and Spot Price Volatility: A Case Study. J. Agric. Econ. 2008, 50, 247–257. [Google Scholar] [CrossRef]

- Dimpfl, T.; Flad, M.; Jung, R.C. Price discovery in agricultural commodity markets in the presence of futures speculation. J. Commod. Mark. 2017, 5, 50–62. [Google Scholar] [CrossRef]

- Bohl, M.T.; Stephan, P.M. Does Futures Speculation Destabilize Spot Prices? New Evidence for Commodity Markets. J. Agric. Appl. Econ. 2013, 45, 595–616. [Google Scholar] [CrossRef] [Green Version]

- Tang, J.R.; Deng, Q.; Wang, R. Relationship Between International Bulk Commodity Futures Price and Chinese Agricultural Products Wholesale Market Price. Financ. Trade Econ. 2012, 6, 131–137. (In Chinese) [Google Scholar]

- Lu, H.M.; Jiang, X.Y. Analysis on the Financialization Factors of the Price Fluctuation of National Agricultural Products—An Empirical Study Based on SVAR Model. J. Agrotech. Econ. 2013, 2, 51–58. (In Chinese) [Google Scholar]

- Yang, C.H.; Liu, X.H.; Wei, Z.X. Information Transmission Effect between Agricultural Commodity Futures Market and Spot Market in China. Syst. Eng. 2011, 29, 10–15. (In Chinese) [Google Scholar]

- Hou, J.L. Research on the relationship between agricultural product futures prices and spot prices. Econ. Rev. J. 2014, 4, 70–74. (In Chinese) [Google Scholar]

- Li, J.D.; Li, X.D. Financialization in Price Fluctuation of Chinese Small-scale Agricultural Commodities—An Empirical Study Based on the Price Data of Garlic and Mung Bean. J. Agrotech. Econ. 2018, 8, 98–111. (In Chinese) [Google Scholar]

- Lin, H.B.; Yang, L. New Evidence of Futures Price Discovery in Agricultural Products—An Analysis Based on the Fixed Eff ect and Tool Variable on Egg Futures. Collect. Essays Financ. Econ. 2017, 12, 54–61. (In Chinese) [Google Scholar]

- Crain, S.J.; Lee, J.H. Volatility in Wheat Spot and Futures Markets, 1950–1993: Government Farm Programs, Seasonality, and Causality. J. Financ. 1996, 51, 325–343. [Google Scholar] [CrossRef]

- Foucault, T.; Sraer, D.; Thesmar, D.J. Individual investors and volatility. J. Financ. 2011, 66, 1369–1406. [Google Scholar] [CrossRef]

- Grimshaw, J.; Campbell, M.; Eccles, M.; Steen, N. Experimental and quasi-experimental designs for evaluating guideline implementation strategies. Fam. Pract. 2000, 17, S11–S16. [Google Scholar] [CrossRef] [PubMed]

- Wagner, A.K.; Soumerai, S.B.; Zhang, F.; Ross-Degnan, D. Segmented regression analysis of interrupted time series studies in medication use research. J. Clin. Pharm. Ther. 2002, 27, 299–309. [Google Scholar] [CrossRef] [PubMed]

- Harris, A.D.; McGregor, J.C.; Perencevich, E.N.; Furuno, J.P.; Zhu, M.J.; Peterson, D.E.; Finkelstein, J. The Use and Interpretation of Quasi-Experimental Studies in Medical Informatics. J. Am. Med. Inform. Assoc. 2006, 13, 16–23. [Google Scholar] [CrossRef] [PubMed]

- Linden, A. Conducting Interrupted Time-series Analysis for Single- and Multiple-group Comparisons. Stata J. Promot. Commun. Stat. Stata 2015, 15, 480–500. [Google Scholar] [CrossRef] [Green Version]

- Hartmann, D.P.; Gottman, J.M.; Jones, R.R.; Gardner, W.; Kazdin, A.E.; Vaught, R.S. Interrupted time-series analysis and its application to behavioral data. J. Appl. Behav. Anal. 1980, 13, 543–559. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Muller, A. Florida’s Motorcycle Helmet Law Repeal and Fatality Rates. Am. J. Public Health 2004, 94, 556–558. [Google Scholar] [CrossRef] [PubMed]

- O’Donnell, A.; Anderson, P.; Jané-Llopis, E.; Manthey, J.; Kaner, E.; Rehm, J. Immediate impact of minimum unit pricing on alcohol purchases in Scotland: Controlled interrupted time series analysis for 2015-18. BMJ 2019, 366, l5274. [Google Scholar] [CrossRef] [Green Version]

- Briesacher, B.A.; Soumerai, S.B.; Zhang, F.; Toh, S.; Andrade, S.E.; Wagner, J.L.; Shoaibi, A.; Gurwitz, J.H. A critical review of methods to evaluate the impact of FDA regulatory actions. Pharmacoepidemiol. Drug Saf. 2013, 22, 986–994. [Google Scholar] [CrossRef] [Green Version]

- Ramsay, C.R.; Matowe, L.; Grilli, R.; Grimshaw, J.M.; Thomas, R.E. Interrupted time series designs in health technology assessment: Lessons from two systematic reviews of behavior change strategies. Int. J. Technol. Assess. Health Care 2003, 19, 613–623. [Google Scholar] [CrossRef] [Green Version]

- Bollerslev, T. Generalized autoregressive conditional heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef] [Green Version]

- Engle, R.F. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econom. J. Econom. Soc. 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Hansen, P.R.; Lunde, A. A forecast comparison of volatility models: Does anything beat a GARCH (1, 1)? J. Appl. Econom. 2005, 20, 873–889. [Google Scholar] [CrossRef] [Green Version]

- Kristjanpoller, W.; Minutolo, M.C. Gold price volatility: A forecasting approach using the Artificial Neural Network–GARCH model. Expert Syst. Appl. 2015, 42, 7245–7251. [Google Scholar] [CrossRef]

- Choudhry, T. Day of the week effect in emerging Asian stock markets: Evidence from the GARCH model. Appl. Financ. Econ. 2000, 10, 235–242. [Google Scholar] [CrossRef]

- Aragó, V.; Nieto, L. Heteroskedasticity in the returns of the main world stock exchange indices: Volume versus GARCH effects. J. Int. Financ. Mark. Inst. Money 2005, 15, 271–284. [Google Scholar] [CrossRef]

- Engle, R. GARCH 101: The Use of ARCH/GARCH Models in Applied Econometrics. J. Econ. Perspect. 2001, 15, 157–168. [Google Scholar] [CrossRef] [Green Version]

- Durbin, J.; Watson, G. Testing for Serial Correlation in Least Squares Regression. II. Biometrika 1951, 38, 159–177. [Google Scholar] [CrossRef] [PubMed]

- de Souza, S.V.C.; Junqueira, R.G. A procedure to assess linearity by ordinary least squares method. Anal. Chim. Acta 2005, 552, 25–35. [Google Scholar] [CrossRef]

- Katsiampa, P. Volatility estimation for Bitcoin: A comparison of GARCH models. Econ. Lett. 2017, 158, 3–6. [Google Scholar] [CrossRef] [Green Version]

- Angabini, A.; Wasiuzzaman, S. GARCH Models and the Financial Crisis-A Study of the Malaysian. Int. J. Appl. Econ. Financ. 2011, 3, 226–236. [Google Scholar]

- Antonic, B.; Jancikova, S.; Dordevic, D.; Tremlova, B. Apple pomace as food fortification ingredient: A systematic review and metafanalysis. J. Food Sci. 2020, 85, 2977–2985. [Google Scholar] [CrossRef] [PubMed]

- Chinese Ministry of Commerce. China Is about to Become the World’s Largest Consumer Goods Retail Market. Available online: http://www.mofcom.gov.cn/article/i/jyjl/e/202012/20201203019373.shtml (accessed on 1 December 2020). (In Chinese)

- Roache, S.K. China’s Impact on World Commodity Markets. IMF Work. Pap. 2012, 12, 115. [Google Scholar]

- Lin, B.; Xu, B. How to effectively stabilize China’s commodity price fluctuations? Energy Econ. 2019, 84, 104544. [Google Scholar] [CrossRef]

- Miao, H.; Ramchander, S.; Zumwalt, J.K. S&P 500 index—Futures price jumps and macroeconomic news. J. Futures Mark. 2014, 34, 980–1001. [Google Scholar]

- Hirshleifer, D. Hedging pressure and futures price movements in a general equilibrium model. Econom. J. Econom. Soc. 1990, 58, 411–428. [Google Scholar] [CrossRef]

- Timmer, C.P. Food security, structural transformation, markets and government policy. Asia Pac. Policy Stud. 2017, 4, 4–19. [Google Scholar] [CrossRef]

- Timmer, C.P.; Akkus, S. The structural transformation as a pathway out of poverty: Analytics, empirics and politics. Cent. Glob. Dev. Work. Pap. 2008, 150. [Google Scholar] [CrossRef] [Green Version]

| Period | Apple’s Spot Price | Apple’s Spot Price Volatility | ||||||

|---|---|---|---|---|---|---|---|---|

| Mean | Std. Dev. | Min | Max | Mean | Std. Dev. | Min | Max | |

| 1 July 2017 to 30 June 2018 | 6.7288 | 0.2944 | 6.1000 | 7.5000 | 0.0881 | 0.0383 | 0.0380 | 0.2106 |

| 1 January 2017 to 31 December 2018 | 6.8315 | 0.3769 | 6.0819 | 7.8700 | 0.0821 | 0.0349 | 0.0188 | 0.2106 |

| 1 July 2016 to 30 June 2019 | 7.2126 | 1.3231 | 5.6059 | 14.2300 | 0.0852 | 0.0348 | 0.0188 | 0.2106 |

| 1 January 2016 to 31 December 2019 | 7.4163 | 1.7392 | 4.5500 | 14.2800 | 0.0928 | 0.0556 | 0.0145 | 0.3743 |

| 1 July 2015 to 30 June 2020 | 7.3979 | 1.5859 | 4.5500 | 14.2800 | 0.0863 | 0.0532 | 0.0101 | 0.3743 |

| 1 January 2015 to 31 December 2020 | 7.4334 | 1.5134 | 4.5500 | 14.2800 | 0.0810 | 0.0510 | 0.0101 | 0.3743 |

| Period | D. W. Statistic | Level Change | Slope before Change | Slope Change | N |

|---|---|---|---|---|---|

| 1 July 2017 to 30 June 2018 | 1.9957 | 0.0183 (−0.0236) | 0.0005 (−0.0010) | −0.0021 (−0.0014) | 52 |

| 1 January 2017 to 31 December 2018 | 1.9050 | 0.0162 (−0.0172) | −0.0001 (−0.0004) | −0.0006 (−0.0005) | 105 |

| 1 July 2016 to 30 June 2019 | 1.9950 | 0.0122 (−0.0154) | −0.0004 * (−0.0002) | 0.0001 (−0.0003) | 155 |

| 1 January 2016 to 31 December 2019 | 2.0523 | −0.0266 (−0.0169) | −0.0000 (−0.0002) | 0.0006 (−0.0004) | 207 |

| 1 July 2015 to 30 June 2020 | 2.0944 | −0.0243 * (−0.0138) | 0.0003 *** (−0.0001) | −0.0002 (−0.0002) | 259 |

| 1 January 2015 to 31 December 2020 | 2.1071 | −0.0191 (−0.013) | 0.0004 *** (−0.0001) | −0.0004 *** (−0.007) | 310 |

| Period | White Noise Test | Q Statistical Test | LM Test | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Portmanteau Statistic | p Value | Lag (1) | Lag (2) | Lag (3) | Lag (4) | Lag (5) | Lag (1) | Lag (2) | Lag (3) | |

| 1 July 2017 to 30 June 2018 | 24.633 | 0.216 | 0.157 | 2.429 | 3.637 | 3.638 | 5.084 | 0.146 | 2.251 | 2.839 |

| 1 January 2017 to 31 December 2018 | 56.117 | 0.047 | 0.047 | 1.486 | 1.542 | 3.512 | 3.568 | 0.045 | 1.418 | 1.461 |

| 1 July 2016 to 30 June 2019 | 59.269 | 0.025 | 0.311 | 1.120 | 1.457 | 3.076 | 3.175 | 0.309 | 1.155 | 1.460 |

| 1 January 2016 to 31 December 2019 | 16.757 | 0.999 | 13.116 *** | 18.054 *** | 18.561 *** | 18.571 *** | 18.571 *** | 12.867 *** | 14.649 *** | 14.632 *** |

| 1 July 2015 to 30 June 2020 | 23.469 | 0.983 | 15.941 *** | 22.584 *** | 23.635 *** | 23.643 *** | 23.643 *** | 15.697 *** | 18.256 *** | 18.182 *** |

| 1 January 2015 to 31 December 2020 | 29.148 | 0.898 | 17.447 *** | 26.332 *** | 27.422 *** | 27.473 *** | 27.490 *** | 17.229 *** | 21.261 *** | 21.195 *** |

| Period | Mean Equation Intercept | Impact on Current Volatility | Constant of Variance Equation | Arch (1) | Garch (1) | Influence Level of Futuresization |

|---|---|---|---|---|---|---|

| 1 January 2016 to 31 December 2019 | 0.0583 *** | 0.3337 *** | −8.2159 *** | 0.1000 *** | 0.8184 *** | −0.1777 |

| 1 July 2015 to 30 June 2020 | 0.0494 *** | 0.3914 *** | −8.0506 *** | 0.1158 *** | 0.7672 *** | −0.2010 * |

| 1 January 2015 to 31 December 2020 | 0.0384 *** | 0.4741 *** | −8.3004 *** | 0.1591 *** | 0.7539 *** | −0.2842 ** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xie, L.; Liao, J.; Chen, H.; Yan, X.; Hu, X. Is Futurization the Culprit for the Violent Fluctuation in China’s Apple Spot Price? Agriculture 2021, 11, 342. https://doi.org/10.3390/agriculture11040342

Xie L, Liao J, Chen H, Yan X, Hu X. Is Futurization the Culprit for the Violent Fluctuation in China’s Apple Spot Price? Agriculture. 2021; 11(4):342. https://doi.org/10.3390/agriculture11040342

Chicago/Turabian StyleXie, Lin, Jiahua Liao, Haiting Chen, Xuefei Yan, and Xinyan Hu. 2021. "Is Futurization the Culprit for the Violent Fluctuation in China’s Apple Spot Price?" Agriculture 11, no. 4: 342. https://doi.org/10.3390/agriculture11040342

APA StyleXie, L., Liao, J., Chen, H., Yan, X., & Hu, X. (2021). Is Futurization the Culprit for the Violent Fluctuation in China’s Apple Spot Price? Agriculture, 11(4), 342. https://doi.org/10.3390/agriculture11040342