1. Introduction

Where past economic development efforts focused on attracting new industries to create jobs, economists now recognize the value of import substitution as a possible method for developing regional economies [

1]. The “Buy Local” movement is one key embodiment of import substitution, as increasing purchases within one’s own region reduces leakages within an economic value chain, while simultaneously increasing producer surplus [

2]. Corresponding with the entry of a younger generation of consumers, the notion of “consumer-driven growth” has also entered the economic development lexicon [

3,

4]. Consumer-driven growth is increasingly important, as many consumers desire a proliferation of high-status options [

5]. The economic theories of import substitution and consumer-driven growth converge perfectly in the craft beer value chain. Many consumers are willing to pay higher prices for more unique craft beer varieties, signaling that state governments might create a business climate that is conducive to economic growth via the beer value chain [

6]. This is especially important as governments have sweeping power to regulate the production, importation and sale of beer [

7].

It follows that policymakers would benefit from understanding the economic contributions of the craft beer value chain. Sometimes state legislation can impede the formation of local and regional breweries, thereby impeding its entrepreneurial activity [

6,

8]. In response to increased consumer interests in craft beer, many states have recently provided further opportunities for the growth of local and regional craft beer by restructuring their beer laws [

9]. A thriving local craft beer industry can contribute to local and regional economic development [

10]. It is in this light that we assess the economic contributions of Michigan’s growing beer sector.

This article provides an estimate of the economic impacts associated with a regionally exclusive beer value chain, largely made up by craft beer. The Michigan beer value chain makes an ideal case study for our analysis as it ranks fourth in the nation in terms of craft breweries and 11th overall in terms of craft beer production [

11]. What started as three microbreweries in the state in 1993 has now grown to over 330, with expectations for future growth. Michigan’s long history of beer production includes a similar history in the production of key inputs, including malting barley and hops [

12]. In response to brewery demand, Michigan agricultural producers have been rapidly increasing the amount of farmed malting barley and hop acres, where Michigan is developing a regional reputation for quality beer inputs. Specifically, hops grown in Michigan have clear attributes that differentiate varieties from those grown in other hop producing states, namely Washington, Idaho, and Oregon. Michigan’s brewers are interested in sourcing barley and hops from local sources and generating a genuinely Michigan made product [

12]. In addition, a cadre of specialty malt producers has developed to help meet in-state demand. In addition to yeast harvesting and cultivation, wheat and rye are also grown in Michigan, which provides additional potential for a nearly complete local agricultural supply chain for beer production.

We contribute to the literature in two ways. First, we fill a gap in the economic development literature by generating an estimate of the economic contributions of a local food system that might be accessible to all states. By focusing on the beer value chain, we contribute to the literature in a second way. The craft beer market has been identified as a vehicle for economic development, but studies on the value chain economic contributions of state-level beer production are lacking. The remainder of this article is organized as follows: First, we provide a brief background of the beer value chain. Second, we describe the conceptual framework of input-output analysis, which utilizes a sequence of interlinking production functions to estimate the total (direct, indirect and induced) economic impacts of the beer value chain in Michigan. Following the conceptual framework, we explain our application of input-output analysis to the Michigan beer value chain. We then describe the results of our model, which suggest that the beer value chain contributed nearly $500 million to the Gross State Product in 2016. The final section concludes with a discussion of the implications and limitations of the current study.

1.1. Background

The industrial organization of the U.S. beer industry has an incredible history [

13]. In 1873, 4131 breweries operated in the United States. Industry consolidation reduced the number of breweries to 100 in 1978, operated by only 50 firms, as brewers tended toward flavors with the broadest consumer appeal [

14]. This developed a marketplace where brand loyalty is fierce even though most consumers cannot distinguish between leading brands [

15]. The beer market changed significantly in 1979 when changes in federal laws freed states to allow for homebrewing [

13]. Over the next few decades, many of those hobbyists set out to commercialize their homebrews, planting the seeds of a burgeoning craft beer market [

16].

The Brewers Association defines craft breweries as independently owned and producing less than 6 million barrels a year [

17]. They further define Microbreweries as producing less than 15,000 barrels a year, with at least 75 percent of sales off-premise—though Michigan law defines microbreweries as those producing less than 60,000 barrels per year. Brewpubs sell more than 25 percent or more of its beer on site. Today, over 7000 breweries operate in the U.S., but market share is still concentrated with a few national firms. There are about 15.5 breweries per million residents today compared to 96.1 per million in 1873. The six largest firms make up about 84.5 percent of the total market of beer sales, led by Anheuser-Busch InBev, with 40.2 percent of the market [

18]. Craft beer consumers largely fall into one of five categories: Traditional beer drinkers, mavens, locavores, premium beer drinkers and uninformed beer drinkers [

19].

Brewers compete in one of three markets: (1) Local, (2) regional or (3) national. As most brewers start out small and with a local footprint, they start out in a local market. Upon developing a following in their local market and depending on the span of this market, some expand regionally and sell outside of the state. Reaching this level requires a level of distribution resources that are usually reserved for the top tier national brands. However, the obstacles to reaching new markets are getting smaller through information technologies and wholesalers that can take a product to a national market with little up-front costs to the brewer. Conversely, a brand can reach a national audience through acquisition by a national supplier. Acquisitions have become common in the craft beverage industry, although beer labeling is not always clear about the transition of ownership. This is due in large part to the value beer drinkers place on independently owned breweries [

20]. For a more thorough discussion of mergers and acquisitions in the U.S. beer market, see Howard [

21].

1.2. Conceptual Framework

Input-output (I-O) models have become staple economic impact models for regional analysis and are often used in generating economic impact estimates of publicly-funded projects [

22,

23]. Because I-O models trace transactions across industries and institutions, they are instrumental in understanding how changes in one sector of a region’s economy can affect all other economic sectors within the region [

24]. They have been especially popular in estimating the economic impacts of local food systems [

25,

26,

27,

28,

29,

30]. Their applicability to a myriad of questions has resulted in I-O models being the most applied economic modeling approach used in economic analysis [

31].

Input-output models generalize linear transactions in a set of multipliers that capture the full extent of transactions associated with any changes in the level of production in an industry. Mathematically, the total effect of this change can be specified as:

The I-O model takes changes in demand (the “direct” effect) and relates them to overall economic impact (the “total” effect) through a set of mathematical equations. The indirect effect is the value of secondary inter-industry transactions in response to direct effects. The “induced” effect is the value of transactions resulting from changes in income in response to direct effects. Because the relationships are linear, the direct, indirect and induced effects can be specified as multiples of the direct effect, so Equation (1) can be restated as:

where

k1 and

k2 are greater than or equal to zero and represent the multiplicative response of indirect and induced transactions, respectively. For simplicity, we restate Equation (2) as:

where

k = (1 +

k1 +

k2). Equation (2) suggests that the economy-wide impact, the total effect, is some multiple of the direct effect, where the multiplier takes a positive value that is equal to or greater than one. Consider the minimum value the multiplier can take: One. This value reflects the intuitive result that if the economy’s output of agricultural products expands by

$1 million dollars, for example, the economy will expand at least by

$1 million dollars. If the indirect and induced effects are not equal to zero (i.e., not imported), this

$1 million increase in output will spur other industries to expand their output of goods and services and will generate household income that will be applied to the purchase of goods and services in the economy, generating a total economic impact greater than the initial

$1 million expansion. It follows that the economic multiplier is specified as a ratio of the total to direct effects. Rearranging Equation (3) provides:

where the multiplier,

k, encompasses all the direct, indirect and induced effects for a given industry and denotes the impact of a change in direct effects on the total economic system. Each industry in a region is characterized by its own value of multiplier

k. Industries with expansive localized production chains will tend to have higher multipliers than industries that rely on suppliers outside of the modeling region. When there is adequate supply within the region, the region has more potential to retain the total effects of the industry. However, when producers depend on supplies outside the region, leakage occurs, and part of the total effect is lost.

All versions of I-O models require several common restrictive assumptions. First, the model imposes constant returns to scale, such that a doubling of output requires a doubling of all inputs. Second, technology is fixed with no substitution. Combined, these two assumptions mean an increase in industry output requires an equal and proportionate increase in all inputs. Additionally, supply is assumed to be perfectly elastic such that there are no supply constraints. This final assumption also asserts that all prices are fixed, such that an increase in demand for any commodity will not result in a price change for that industry. Input-output models have been criticized on the grounds that some of these assumptions are overly restrictive and that the magnitude of the bias generated by these assumptions is greater when the industry direct effects are larger, relative the overall size of the industry [

32]. Despite this criticism, I-O models have become a standard by which economic impact assessment is generated.

2. Methods

We used a value chain assessment to estimate the economic contribution of the beer value chain in Michigan. A contribution analysis is similar to an economic impact assessment [

33], but asserting an economic impact to an industry’s presence posits some challenges. In an economic impact assessment, the generally accepted counterfactual state is that not all direct expenditures will exist in the absence of the measured industry or business. This assumption may be applicable for assessing the economic impact of a new factory that exports to other regions but is overly restrictive for assessing the economics of a visceral industry. For example, when measuring the economic impact of a new automobile panel stamping plant, it may make sense to assume that the transactions arising from that plant would not exist in the local economy in the absence of the plant. However, when measuring the economic impact of a dispersed industry like beer production, it is very likely that many of the transactions arising from the value chain would exist in the absence of beer production. Consumers will still buy beer, but it would be imported to the region. Farmers would still produce cash crops, but it would likely not be barley for malting. Rather than asserting that the value of all associated transactions would cease to exist, as in an economic impact assessment, an economic contribution study is silent on the counterfactual state of the economy in the absence of the measured industry. The associated contribution estimates suggest the extent to which the industry contributes to the overall size of the economy.

We used the IMPLAN Pro 3.1 economic input-output modeling software with the Michigan transactions data in this assessment. The IMPLAN Pro model is widely used in economic impact and industry contribution simulations and has become a standard resource for regional economists [

27]. A Michigan-calibrated IMPLAN economic impact assessment model was used to estimate the contributions that would arise through secondary transactions. Of the commercial input-output models used in economic simulations, IMPLAN is one of the most referenced in the literature. Transactions are adopted from the Bureau of Economic Analysis’s benchmark input-output tables, meaning that it traces transactions across industries, households and government units and uses these measures to estimate secondary transactions arising from a given set of industry transactions [

34]. In this assessment, industry transactions include the set of estimated transactions along the value chain for producing Michigan beer. Secondary transactions are those transactions not directly made by industries making up the Michigan supply chain, but rather are generated for the provisions of intermediate goods and services inputs into the supply chain as indirect effects, and expenditures from earnings by workers, proprietors and government (through fees and taxes) as induced effects. The total contributions, estimated as the sum of direct and secondary effects, generally exceed the initial infusion of economic activity, generating what is commonly referred to as a multiplier effect. That is, once accounting for secondary transactions, the total contribution is larger than the direct value of economic activities along the value chain, as predicated by economic theory [

35].

The IMPLAN model is driven by the dollar value of transactions, and therefore, the resulting contributions were measured in the value of total transactions. However, estimates of employment, labor income and contributions to gross state product were made via fixed ratios to industry output. The fixed ratios are industry averages. While IMPLAN provides a high degree of industry granularity, with 528 distinct industries, barley and hops production is included in industry aggregates of grain farming and fruit farming, respectively. Additionally, brewpubs are represented in the full-service restaurants industry. Only breweries are uniquely categorized within the 528 distinct industry categories. Hence, industry aggregates may not be suitably representative of the actual transactions associated with Michigan brewing. Consequently, we modified the industry purchases, as described by Miller [

12], to better represent the industries under this study.

The direct economic contribution of Michigan’s brewing industry is measured through brewing activities, including the transportation costs of the final output. However, in a separate measure, we included the economic contribution beyond brewing to include retail and food accommodation sales of Michigan-brewed beer as a separate measure, netting out the production of the beer sales in our final estimates. In this, we recognize two downstream channels from brewing by which economic value is generated.

We assumed brewery sales follow two channels to consumption: Onsite consumption, which includes own- and third-party sales, or through off-premise retail sales. For on-premise consumption, own sales command higher seller margins per unit of sale since sales are not required to pass through the three-tier trade system [

36], entailing a licensed wholesale distributor. All off-premise consumption is channeled through the three-tier trade system, entailing the wholesale and retail trade sectors. Only margins earned at the point of sale are captured, and those through food and drinking places account only for beer sales components. Beer that is brewed and distributed in Michigan generates value all the way to final sale for consumption, while beer that is brewed in Michigan and shipped out of state stops contributing value for the state at the state borders. The structural relationship of the modeling frame is represented in

Figure 1, where exports along the value chain are implied along the value chain, as that share that does traverse downstream along the instate value chain.

2.1. Calculating Direct Contributions

Because all but one of Michigan’s breweries were classified as craft breweries in 2016, and because the Brewers Association (BA) tracks commercial craft beer production, estimates of the production of craft beer by volume were provided by the BA statistics to be 846,029 barrels [

11]. The volume of production from the one non-craft beer brewery was added to get the total volume of beer produced in-state. This beer may be packaged in barrel form for draft sales or may be packaged in bottles and cans. Using national statistics, about 61 percent of beer purchases are in the form of kegs, while the remaining 39 percent is sold by the bottle or can [

37]. Additionally, the market research firm Mintel provides an estimate of where consumers purchase beer based on household surveys, showing that 79 percent of beer is consumed away from home [

18]. Applying estimated sales values to volume allowed us to isolate estimates of the economic contributions of on-premise and off-premise sales channels. Assuming equitable combinations of inputs, except for beer packaging, in the brewing process and all associated agricultural inputs, the remainder of the up-stream value chain can be estimated in the aggregate based on the volume of in-state production.

Through discussions with growers and maltsters, it was determined that malting barley production largely follows standard winter and spring grain production processes, by which the IMPLAN software is readily sufficient for estimating. Similarly, as craft beer production differs from that of national brands, which are largely represented in the IMPLAN transactions table, the standard IMPLAN production function for beer brewing was modified to account for added barley and hops. More specifically, while barley use per barrel of beer is typically higher for craft beer over conventional beers [

12], much of this represents a substitution of rice for barley. However, rice and barley are grouped into a single category in IMPLAN under the category of grain farming. Since barley is produced in-state while rice is not, the substitution of barley for rice represents a reduction of the intermediate imports of rice, which is not grown in Michigan, with more barley, which is grown instate. Additionally, separate accounting for wheat beers is not necessary in the IMPLAN software, as wheat and barley represent similar inputs by volume [

12] under IMPLAN’s grain farming sector. As both malting wheat and barley are grown in Michigan, substituting barley with wheat does not represent a shift in import shares. Finally, hop use is also heavier in craft beer, but as hops make up a minute input by volume, the overall change of hop shares in the baseline production function is minute. Hops are vegetables and therefore reflect added vegetable inputs into the production process, which falls into the IMPLAN category “vegetables and melon farming”.

Under this approach, estimates exclude the contribution of imported beers into the state, where imports include domestic and foreign beers produced outside of but imported into Michigan. Hence, the estimated contributions reflect that of the beer production value chain in Michigan, but not the entirety of the economic contribution of the beer industry as a whole. One can argue that food sales through brewpubs should be included in economic contribution estimates, as food sales complement beer sales from these venues. Rather than asserting that food sold through brewpubs contributes to Michigan’s beer value chain, we opted to separate the two and focus only on contributions directly arising from the production and sale of Michigan-produced beer. To be sure, on-premise sales can accrue through food and drinking establishments, but may also entail hotels, casinos, sporting and community event venues, and other recreation outlets, outside of food and drinking establishments where beer is typically sold. However, we modelled on-premise sales as if taking place in food and drinking establishments, as the underlying production functions likely better represent the actual food and drink value chains of these alternative venues. This is also a simplifying assumption, freeing us from sorting out the values of different on-premise venues that beer is sold through.

As IMPLAN is driven on sales values, not volume of production, we must convert the volume of production into actual sales values. To do this, we broke out volume into three categories: (1) On-premise drafts, (2) on-premise bottled/canned and (3) off-premise bottled/canned. Each were assigned an average price per volume, as described below. Because the IMPLAN production function for brewing beer is dominated by larger, national brand processors, the production functions were modified based on industry interviews discussed by Miller [

38]. These modifications emphasize deeper ties to local supply chains of barley and hops and deemphasize rice imports through modified regional purchase coefficients. Similarly, the trade sector retail and wholesale shares of local supply from breweries is increased, as well as that for food sector inputs.

2.2. Estimating Final Sales Direct Effects

Estimates of direct effects start at the brewery level, where estimates exist for the total volume of beer produced in the state. Production direct effects are dollar-values based on the volume of beer produced in Michigan. Total volume of brewery sales comes from the Brewers Association’s 2016 estimate for Michigan [

11]. However, since the Brewers Association only tracks craft beer sales, and because Michigan’s Founders Brewery does not fall into the Brewers’ Association definition of craft beer, estimates for the Founders Brewery production must be added to the total in-state brewery output. Estimates for Founders Brewery production in 2016 were based on direct contact with the brewery [

39]. Accordingly, the in-state production of beer totaled 846,688 barrels.

Generating sale values requires breaking out production between keg sales and bottle/can sales, as the average selling prices of beer depends on the packaging. We assume producer prices of $110.00 per keg (1/2 barrel) and $4.62 per six-pack of bottled or canned beer. With 61 percent of the beer produced going to kegs, keg sales total $113,626,000. Alternatively, estimated brewery bottle/can sales totaled $83,906,000. Taken together, the value of beer sales totaled $197,532,000.

Estimating the downstream contributions of wholesalers, retailers and food services requires the application of estimates of margins earned. To simplify the estimates, we assumed that all keg sales go to on-premise consumption venues, represented by IMPLAN’s full-service restaurants sector. Through industry interviews, Miller [

12,

38] provided estimates of sales margins, which have been reproduced in

Table 1. In

Table 1, brewer’s prices represent the sale price brewers earn per keg or 6-pack, sold through the three-tier system of a wholesaler distributor. Wholesale margins are the added value attributed to wholesalers and the entailed shipping costs. Retail margins are only applied to off-premise sales by assumption and represent that which is earned by the retailer, while food service margins, which tend to be about four times the wholesale price, is that which is earned by food service providers. By assumption, the brewer operating its own brewpub can earn food service prices. Summing the column provides the estimated consumer prices. While not shown, the estimated sales prices were

$4.79 per pint of draught beer,

$1.75 per bottle/can for off-premise consumption and

$4.83 per bottle/can for on-premise consumption.

Next, the total volume sold through the value chain must be estimated based on the estimated volume of Michigan’s production. First, we estimated the total volume and value of sales based on production. From which, we applied estimates of the share that remained in Michigan for final consumption. The share of beer that is sold out of state does not contribute to downstream economic impacts but increases brewery production contributions.

Table 2 shows the estimated volume and sales revenues by sales channel, based on the volume of in-state beer production. As discussed above, 61 percent of volume goes to kegs, while 39 percent goes to bottles and cans. A simplifying assumption asserts that all keg production is sold through on-premise drinking establishments. Of the bottle/can-packaged volume, Mintel estimates indicate that consumers purchase 48 percent of beer for on-premise consumption and 52 percent for off-premise. Applying the prices above determines total expenditures, where brewers’ earnings through keg sales topped out at

$113,626,000, while that for bottled/canned production was

$83,906,000. These estimates are based on the volume of production at the brewery and therefore do not account for exports.

3. Results

The final estimates of the economic contribution of beer sales net out in-state production exported out of Michigan. The most current IMPLAN data for Michigan at the time of this study was 2013. We used IMPLAN regional purchase coefficients for Michigan [

34] to estimate the share of beer produced in Michigan that stays in Michigan. The IMPLAN software estimates regional trade flows using a constrained gravity model that combines trade flow data with economic intensity and is believed to be a superior approach for measuring trade flows across regions by commodity. The reference data for Michigan suggests that about 52.7 percent of Michigan’s beer production remains in-state. While the underlying trade flow estimates were made three years prior to this 2016 data assessment, we have no impression that this share is either increasing or decreasing. While consumers of the growing craft beer segment express a preference for locally-sourced beers [

40], Michigan producers have indicated an increase in exporting activities [

12]. Hence, the final estimates of economic contributions used 52.7 percent as the basis of volume that remains in state. This rate was applied to all channels of sales, which is consistent with the input-output literature for applying regional purchase coefficients [

41].

3.1. Economic Contribution Estimates

Using the assumptions described above, we estimated the economic contribution of Michigan’s beer production value chain in three parts: (1) Beer brewing, (2) retail for off-premise consumption, and (3) sales for on-premise through food and beverage establishments. The findings for each contribution area are presented below. This is followed by the aggregate gross contribution estimates across the value chain.

3.2. Brewing Activity

Estimates of the contributions of brewing activities entail all the upstream transactions associated with brewing, including the purchase of inputs and services in commercial breweries. Estimates include those contributions from in-state consumption, as well as for exportation out of the state. The estimates also aggregate brewing activities for both on-premise and off-premise sales. Accordingly, we estimate the value of Michigan beer production to be

$197.5 million in 2016. Once accounting for the indirect and induced effects, this and the associated transactions are expected to give rise to

$314.6 million in economy-wide transactions, as shown in

Table 3. These transactions are expected to give rise to some 877 new jobs per year, where 218 are directly employed in the upstream brewing value chain. These jobs support some

$44.3 million in labor income in the state and contribute about

$106.9 million in Gross State Product.

3.3. Off-Premise Consumption Sales

The impacts of sales for off-premise consumption include only those sales that remain in Michigan. The estimates include both retail and wholesale sales, where only margins (markup earned by retailers and wholesalers) are used as a basis of impacts. Because of the nature of the model, the purchases of beer from brewers and wholesalers cannot be easily subtracted from the estimates. Hence, the estimated secondary effects include the expected purchases of beer through conventional channels and may not represent the true expected extent to which final transactions take place. A correction is provided in the aggregate contribution estimates below.

Retail sales margins generate a more moderate level of contribution to the Michigan economy. About

$29.3 million in wholesale and retail margins is generated by Michigan-produced beer, giving rise to some

$53.1 million in transactions throughout the economy (

Table 4). This facilitates about 458 Michigan jobs, where about 294 are directly related to the retail and wholesale efforts of beer distribution. These jobs are expected to bring in about

$19.5 million in annual labor income and contribute about

$33.6 million to the Gross State Product.

3.4. On-Premise Consumption Sales

The final contribution estimates are for sales for on-premise consumption and associated wholesale activities. The value of wholesaling activities differs from that of the prior section only with regards to volume. That is, we do not differentiate wholesale per-unit values between selling to retail and selling to food and drink establishments. However, the per-unit consumer prices at food and drink establishments are much higher than at retail establishments. These higher markups are attributed to the mix of services and attributes the establishment provides, whether it be the mix of food, big-screen TVs, ambiance or sporting facilities. Hence, the values earned are not necessarily driven by the value of the beer consumed, but rather by the mix of products and ambiance afforded by the venue.

Accordingly, we estimate that the contribution of Michigan-brewed beer to food and drink establishments through margins earned and associated wholesaling is

$342.4 million (

Table 5). This drives additional transactions up to

$625.7 million annually. Being more labor intensive, direct employment (including venue and wholesaling) is expected to top out just short of 6511 jobs. Through the multiplier effect, about 8403 jobs are supported with expected total labor income of

$229.9 million, contributing about

$329.1 million to the annual Gross State Product.

3.5. Estimated Gross Contributions

The final task is to combine the contribution estimates into a single set of contribution estimates. The wholesale and retail sales contributions estimated above reflect the share of Michigan-produced beer that remains in state, and only account for the margins earned at each leg. Hence, adding the retail and wholesale margin contributions to that of brewing contributions avoids double counting. When combining the direct effects of sales, we assert that Michigan consumers spent about

$569.17 million on Michigan-produced beer. According to the statistics reporting portal Statistica [

42], per-capita expenditures on beer average about

$229.40 nationally. Given Michigan’s population of 9.951 million in 2016 [

43], our estimates suggest that Michigan’s per capita expenditure on Michigan-produced beer was

$57.19, or about 24.0 percent of the national average total expenditure on beer. A Mintel survey of beer drinkers found that 19 percent of beer drinkers associate with purchasing craft beer [

44]. Our findings’ close proximity suggests an appropriate estimate, while the fact that our findings suggest a higher proportion of sales to craft can be attributed to the higher price points of locally-sourced beers.

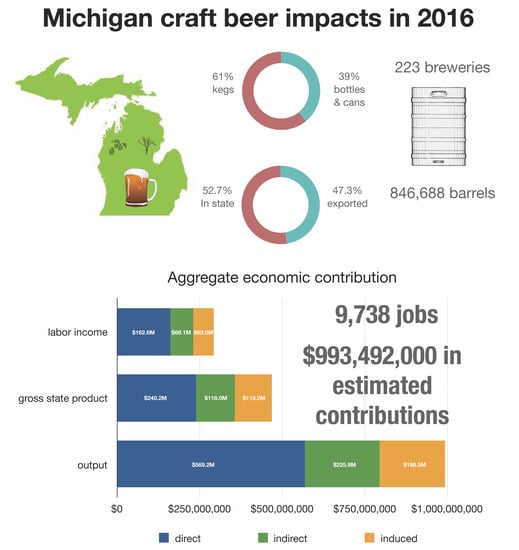

The resulting gross contribution estimates are shown in

Table 6. In this, the expected contribution of Michigan’s craft beer value chain, including the Founders Brewery, totals

$993.5 million, where the direct value chain transactions amount to about

$569.2 million of that value. In total, just over 9700 jobs can be linked back to Michigan-produced beer, where about 7023 are directly tied to brewing, moving, selling and serving beer. The largest bulk of this is in the food and drink service industry. Total labor income is expected to be about

$293.7 million, making up average annual job earnings of around

$30,156. Finally, our estimates suggest that Michigan’s craft beer sector contributes some

$469.5 million to the annual Gross State Product.

4. Conclusions

The U.S. beer industry is undergoing a significant, consumer-driven restructuring as portions of the national alcohol landscape are shifting to localized supply chains. This study estimated the economic contributions of Michigan’s beer industry. The distinction of measuring the economic contribution from economic impacts is important, as an economic impact estimate would assert a change in economic activity in the absence of Michigan’s brewing value chains. Rather than focus on such hypothetical scenarios, our measures detail the contributions of Michigan’s beer production value chains to existing economic activities. Our findings suggest that Michigan-produced beers generate a sizeable contribution to the state economy, contributing just under

$500 million to the annual Gross State Product (a measure of total income generated in the state), or alternatively, 8.4 percent of the value of Michigan’s food and beverage and tobacco products manufacturing sector’s annual Gross State Product [

45].

Some limitations remain. These estimates omit some sources of contribution along Michigan’s beer-production value chain. Namely, Michigan’s agricultural producers of malting grains and hops have found markets outside of Michigan, making raw ingredient inputs an export industry for Michigan. Michigan entrepreneurs are also experimenting with specialty malting operations, with a specific focus on supplying in-state breweries, but with the potential for extending the export options along Michigan’s beer production value chains. Miller [

38] estimates that Michigan’s agricultural inputs and malting operations contributed

$8.9 million in annual transactions in 2016. Much of this value is captured in our estimates, though the value attributed to exports is not. Furthermore, not all states are likely to have as significant an economic impact from their beer value chain, as few states are as well prepared to foster the development of the industry along the extent of the value chain. Michigan is a state with a long history of growing beer inputs such as malting barley and hops, so the potential for economic impact can be relatively large.

The findings of this study highlight the ubiquitous nature of Michigan’s brewing industry from that which is produced for consumption in the state and that which is produced for export to other markets. While largely comprised of small producers, in the aggregate, it comprises a measurably large component of the Michigan economy. Interest in consuming locally-sourced beer and craft beers is increasing and we believe that the industry will continue to grow, relative to the 2016 numbers used in this estimate. There are a surprisingly large number of jobs that can be tied to Michigan-sourced beer, but most of these jobs are tied to the food and drink service sector. While beer production has long been regulated at the federal and state levels, recent changes in federal law have relaxed federal oversight and increased the authority of state regulations over beer production. Recognizing that regulation is a collective choice for managing the affairs of society, regulation without a full understanding of the economic contributions can result in money and opportunities left on the table.