1. Introduction

In recent years, the literature on emissions trading regulation has expanded rapidly. This is due to the awareness relating to environmental change and a sustainable future gaining more attention worldwide. The global debates on climate change and mitigation strategies have led policymakers to address the government concerns about promulgating and implementing regulations to overcome the challenges of mitigating carbon emissions [

1] and be more resilient in overcoming climate impacts. Malaysia has ratified the United Nations Framework Convention on Climate Change (UNFCCC) under the Kyoto Protocol since 2002. Malaysia’s commitment to the carbon market is also closely related to, and affected by, overall climate change policy developments. Since the Paris Agreement in 2015, the UNFCCC has annually improved the climate policy standard, which also directs the international carbon market.

The carbon trading implementation review has changed drastically post-Kyoto and has developed into the new sustainable development mechanism (SDM) and sustainable development goals (SDGs). The United Nations (UN) SDGs have set out a vision for future sustainability principles and Malaysia is one of the countries that has committed to engage in their implementation. Malaysia’s national economic development policies, which were put into practice more than forty years ago, reflected several UN SDGs even before the introduction of the initiative in 2016 [

2]. For example, the ambitious goals and targets that Malaysia set have been indicated through sustainable and systematic efforts by putting into practice the mechanism for the SDGs. Despite the desired sustainable goals, the palm oil industry in Malaysia plays a significant role in influencing growth towards trade and industry globalization business environments [

3]. Moreover, Malaysia has acted on various strategies to invest in sustainability projects, as well as complying with sustainable practices in the palm oil business.

The clean development mechanism (CDM) is one example of a carbon trading project. The mechanism involves value-added investments that can generate carbon credits from environmental projects that have a monetary value. It is reviewed under the UN SDGs initiatives and its main aims are, first, to achieve sustainable development and productive environmental practices for present and future generations; second, to conserve the country’s uniqueness and diverse cultural and natural heritage with effective participation by all sectors of society; third, to achieve sustainable living and strategies in sustainable production [

4,

5]. The CDM serves not only as an instrument to fight climate change issues but also as an important tool to achieve rapid economic growth for sustainable development and a strategy that can provide a constant source of business opportunities for corporations. CDM is designed to support foreign direct investment and clean technology transfers, leading to a reduction in greenhouse gas (GHG) emissions.

The palm oil industry in Malaysia has taken the necessary steps to respond to technological advancements as well as having carried out research. The growing upstream sector has had a rising impact on the whole value chain [

6]. Based on various studies, as indicated, the carbon market plays a distinct role in bringing together various concerns across the globe and growth between developed countries and underdeveloped nations, reflecting opportunities that might result in a win-win situation and the achievement of the carbon market instrument [

7,

8]. However, few studies have been conducted to understand the challenges that have led to a decrease in carbon trading implementation in Malaysia. Furthermore, carbon trading ought to result in sustainable development and lead to benefits, such as investment, technology transfers, poverty relief, development of rural areas, and the provision of new opportunities for developing expertise and knowledge [

9,

10], more so in developing nations, but there has been a lack of further research indicating the impact of carbon trading on sustainable development.

A number of lessons can be learned from the CDM experience in the new policy framework’s development. As in

Figure 1, Malaysia is one of the biggest palm oil producers in the world, thus, the review of the findings suggests that the government needs to view the role played by the markets in a new way. The policy formulated must not simply be a repetition of past practices and must also be given time to make proper contributions to achieve the projects’ goals. In other words, there must be a shift from offsetting and there should be greater concentration to be issued for financial verification, as well as an integration of human rights, public consultations, and transparency, as the mechanism’s core principles. This mitigation action on emission reduction will provide useful recommendations that can facilitate the achievement of an efficient and robust SDM in the future.

In analyzing the possible future of palm oil sustainability and carbon trading, the significant benefits for the development in rural areas and biodiversity need to be examined in order to identify the projects’ challenges and their sustainable development impact. The challenges and factors that have previously confused palm oil producers have continued to concern the palm oil industry in recent years. Despite this challenge, the engagement level and follow-up actions have continued to rise. However, with the European Union’s (EU) threat of banning palm oil use in biofuels being perceived as trade discrimination, the carbon trading scheme appears to have an uncertain future.

The paper aims is to discover the challenges that have led to the conundrum of carbon trading projects and whether the palm oil companies that have engaged with carbon trading have achieved sustainable development from the projects. This research is intended to facilitate an incisive understanding of future development in palm oil companies in Malaysia to ensure a better standard of practices relating to climate change mitigation strategies and would contribute to the SDGs and national development. In addition, based on the qualitative research in this study and the analysis of the palm oil companies that are engaged with carbon trading in Malaysia, this research unpicks the carbon trading policy towards developing better strategies to allow palm oil to meet the sustainability goals.

2. Literature Review

2.1. Carbon Trading in Malaysia

The biomass renewable energy (RE) project’s implementation in the carbon market is a cooperative mechanism that depicts high innovation under the bioenergy policy agenda. The implementation is planned with the intention of providing aid to developing countries to achieve sustainable development and to comply with climate change mitigation strategies [

1]. The implementation is also aimed at assisting the developed world to comply with their commitment to reducing GHG emissions [

12] and provide new opportunities in investments, technology transfer, building skills, and knowledge to create a sustainable future in Malaysia.

The CDM project activities have become one of the mitigation and emission reduction strategies in Malaysia and other countries in Southeast Asian regions, such as Singapore, Thailand, Indonesia, and the Philippines [

12]. These countries are also engaged in carbon emission policies relating to the SDG standard and are focused not only on the energy sector but also on the agricultural and forestry sectors. In the Association of Southeast Asian Nations (ASEAN) countries, the CDM has been very successful in engaging with RE project application and GHG reduction [

13]. As the carbon trading mechanism can be employed in separate projects, its effectiveness in encouraging RE use in developing nations, particularly in Asia, has a great potential impact on the energy industry.

In the palm oil industry, the Malaysia Palm Oil Board (MPOB) has continually prioritized research and development (R&D) to enhance sustainability in relation to palm oil. Moreover, the issues related to sustainability and productivity are core elements of consideration for the MPOB, consisting of various strategies to maximize the connection between economic development and environmental sustainability. Hence, the palm oil industry’s future growth is based on a sustainable framework and the adoption of innovative technologies.

Malaysia’s government has put considerable efforts into RE’s development in the palm oil industry and into finding an alternative approach through various support and promotion programs to address the new carbon pricing instruments. The Nationally Appropriate Mitigation Actions (NAMAs) is one of the alternatives for supporting the CDM activities’ continuity. Malaysia’s palm oil industry has endeavored to implement projects that are relevant to RE production, such as RE supply, biofuel, biomass, biodiesel, and other bio-related production [

14]. RE is known as the most adaptable type of low carbon and sustainable power source because it can contribute towards long-term emission reduction within the energy usage of electricity, transportation, and energy intensity [

15]. The ratification in the UNFCCC discusses and implements the strategy for reducing carbon emissions [

16] and one of the strategies noted was to have businesses innovate and invest in carbon trading projects that can be applied in the country’s palm oil industry.

2.2. CDM in the Palm Oil Industry

As [

17] mentions, the palm oil industry in Malaysia has great potential to be engaged in carbon trading projects. The amount of biomass and palm oil production has been noted to increase from time to time [

18] and, therefore, it assumes a strategic role in enhancing RE consumption and delivering a sustainable future. The RE production from palm oil mill effluent (POME), biomass, composting, and bioenergy residues can prove beneficial for different sectors in moving forward to a new market mechanism. This goal is one of the directions for carbon trading project implementation.

As of 2015, there were registered CDM projects with a total investment of approximately USD1,530 million in certified emission reductions (CER) transactions and holdings in Malaysia’s pending account, with 2,789,528 CER [

5]. The biomass production accounted for 80.1% of Malaysia’s CDM pipeline or 76.9% of all registered projects [

14]. The data on the CDM project undertakings in Malaysia shows a massive biomass production volume from milling and plantation activity [

19]. The data for 2015 indicates that project activities involved processing oil palm excesses, biofuel, biomass, methane capture, and co-composting using either solid or liquid waste collectively.

Table 1 provides a breakdown of the projects’ undertakings and their distribution in the palm oil industry according to project type.

The CDM projects’ status in Malaysia has been given due consideration due to the sharp decline in the carbon market following uncertainty in the future global carbon market [

14]. According to the data by the Ministry of Natural Resources and Environment (MNRE) [

14], 35.8% of Malaysia’s RE-based CDM project pipelines are from biomass energy. Most of the palm oil mills generated biomass by capturing methane gas from POME treatment and used it as a fuel source for generating electrical and thermal energy for either on or off-site consumption. The Palm Oil National Key Economic Areas (NKEAs) plan, for instance, targets achieving 100% compliance by all the mills that have implemented biogas recovery projects by 2020. Moreover, this initiative has put in place a policy designed to re-operationalization all CDM methane avoidance projects in the palm oil sector [

14]. In addition, the relevant public policies, including the National Renewable Energy Policy Action Plan (2010) and the Economic Transformation Programme (ETP), are focused on enhancing the utilization of local renewable energy sources as a way of contributing towards the security of the nationwide supply of electricity and to sustainable socio-economic development.

According to the 2015 Malaysian government report [

20], the nationally determined mitigation contributions (NDCs) demonstrate the government’s commitments to minimize the intensity of GHG emissions by 45% by 2030 relative to the intensity of emission of gross domestic product (GDP) in 2005. The amount of GHG emissions is made up of 35% on a non-restricted basis and an additional 10% as the condition upon proof of payment of climate funding, transfer of technology, and capacity building from developed countries [

20]. As indicated in

Table 2, the biennial report [

21] made available by the MNRE gives a summary of the reduction of emissions as of 2013 and possible emission reduction in 2020. The comparison in emission reductions between 2013 and 2020 shows a huge reduction in emissions with the palm oil industry mitigation action. The statistics suggest that specific mitigation actions have been put in place to ensure the nation meets it’s target in the NDCs report to the UNFCCC.

With the potential development in carbon trading projects, the CDM projects’ CER in Malaysia have contributed a total of 9,844,435 CER issued as of April 2015 [

14]. However, the CER oversupply has reduced its price and it is unable to meet the high transaction costs incurred in verification. As discussed in the Conference of Parties 21 (COP 21) in Paris, carbon trading projects require longer-term outcomes to ensure optimal growth in sustainability; hence, developing countries can grow economically and achieve their respective emission targets with a low economic cost. Other studies have focused on how well carbon trading projects function; however, the numerous prospects for initiating CDM project activities in the palm oil industry will demonstrate significant achievements in the future [

13]. Furthermore, the subsidies provided for the CDM’s financial allocation have received criticism from many organizations who have contended that the allocation has been subject to unethical and unsuitable implementation in reducing carbon emissions. Based on various sources and the detailed exploration by the Standards and Industrial Research Institute of Malaysia (SIRIM) and the Malaysian Palm Oil Council (MPOC) [

22], the slow-moving carbon trading and engagement in Malaysia within the palm oil industry is because of the lack of knowledge and uncertain development within the carbon market and trading opportunities [

23,

24], which have led to various questions and dilemmas in the carbon market system involving the palm oil industry in Malaysia. However, as presented in

Table 3 below, the total CER issued are higher within the palm oil industry. The development towards the SDGs aims to enhance renewable energy development in Malaysia and would bring material and positive outcomes to the palm oil industry [

14].

3. Research Methodology

As described above, this study focuses on capturing the outlook of critical factors in carbon trading implementation in the palm oil industry. The issues of carbon trading challenges are crucial yet problematic. As such, a qualitative study was conducted to understand these issues, adopting one-to-one interviews and discussions. This methodology developed as a qualitative approach and a connecting strategy for scientific research and local knowledge [

25].

3.1. Data Collection

As identified by [

26], the quantity of data that can be utilized that is gathered from the interviewees and the number of participants required for the interviews has a converse relationship. The criterion for selection for the interviewees was purposive suitable sampling. After the selection of the various experts in carbon trading in the palm oil industry, information seeking the prospective interviewees’ permission to engage in semi-structured interviews was channeled through email or telephone messages. As highlighted above, due to the limitations in some carbon trading experts, a small number of them were interested in taking part in a follow-up study via an interview. The researcher deliberately included carbon trading firms in the palm oil industry to accomplish the research objectives in terms of size and segment.

In particular, the interview questions explored the respondents’ perception of the challenges and dilemmas that could affect the carbon trading implementation growth. The data collected was based on literature reviews, current status, growth, challenges and trends, and government and private sector reports were considered as the secondary data collection process determinants. The primary interview data collection was proposed in this study to provide an explanation of how the respondents replied to the carbon trading project issues in the palm oil context. Semi-structured interviews were conducted and they offered a more in-depth understanding of the focus subject. These interviews were directed by the researcher and were digitally recorded after the interviewees gave their verbal agreement. Furthermore, the researcher took notes required at the time of interview.

A total of seven company representatives were interviewed for data collection for this study. The sampling frame was drawn from the UNFCCC database, totalling 49 palm oil companies in Malaysia. The interviews were conducted with professionals among carbon trading experts and institutional theory was adopted to structure the interview questions. This theory informs the combination of deductive and inductive logic. The analyzed data was compared and developed further based on the data collected from the interviews. The researcher applied thematic analysis for the purpose of identifying a variety of restricted themes under every category, which could adequately reflect the data that has been collected. Thematic analysis is the qualitative data encoding procedure under a variety of themes. The two main ways through which themes can be identified in the thematic analysis include the inductive and deductive methods [

27]. The inductive method is strongly linked with the data itself during the process of identification [

28], while the deductive method entails the use of themes that are guided by the theoretical or analytical interest in the area, as well as a more explicitly analyst-driven approach.

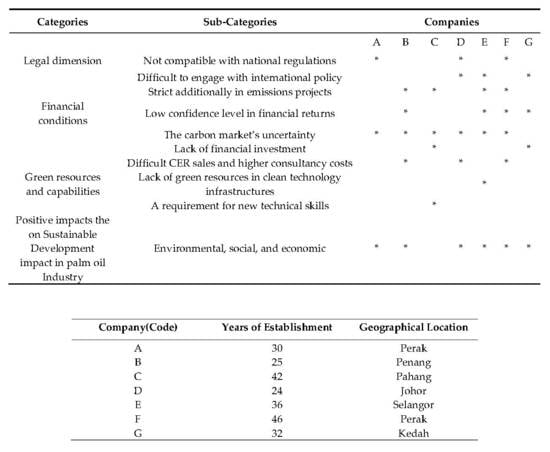

In the current research, an investigation of four main categories was carried out, namely the legal dimension, the financial conditions, the green resources and capabilities and the positive impacts on SDM. Under each group, a few themes were generated inductively based on the raw information obtained from the subjects. A compilation of the identified themes is available in the research findings section.

3.2. Data Analysis

In this paper, the focus on the palm oil companies is according to the detailed content development and data analysis information presented in the companies’ sustainability reports or other equivalent corporate publications. The following sections introduce and discuss the analysis of the respective evaluation forms from the supplementary literature reviews, desktop reviews, and interviews.

Table 4 shows the profile of the firms that took part in the data collection, consisting of the distribution in years of establishment, location, and the respondents/interviewees’ positions as representatives of Malaysian palm oil companies.

A transcription of the interviews was then carried out and the coded data was further analyzed through the thematic analysis. As illustrated by [

29], qualitative analysis is often conducted through reviewing the subjects’ answers to every question and then carrying out a selection of the most relevant parts to the question asked. The participants had expressed various conditions that are perceived to be significant in facilitating their views on carbon trading based on the experiences they have. The factors were grouped into four broad themes and were subsequently mapped to the four forms of assessment for pressure from institutions that were anticipated in this research.

Table 5 below presents the four themes and their relevant descriptions.

This study has explored the positive impacts of CDM implementation within palm oil companies in Malaysia. Its findings have supported the significant factors on the legal dimensions, financial conditions, green resources, and capabilities, and highlighted the more important criteria that could encourage the palm oil industry to implement CDM, which has positive impacts on sustainable development. Based on the follow-up interviews’ exploratory investigation, some palm oil companies have confirmed that the majority of Malaysian palm oil producers have considered implementing CDM as their future option in relation to sustainability and can engage in long-term investment. However, there are some limitations in relation to its achievement as the future carbon market development has an effect on global policy and, at some points, education, skills, technology, and cost factors interfere with the decisions.

4. Discussion

This section aims to discuss the results obtained in this work and to describe the main contribution of this research. As can be observed in

Table 5, many of the factors show the challenges and crucial factors in carbon trading projects within the palm oil industry in Malaysia. Elaborating on these crucial factors is important in addressing the developed research is necessary to verify the challenges of carbon trading implementation.

4.1. Legal Dimension

The existing CDM framework is seen to be lacking in terms of guidelines for improving sustainability performance [

30]. Most of the CDM projects involved in development or positioning in RE technologies have been criticized for their negative impact on the environment and social fields. Supported by the results in

Table 5 from the palm oil companies, the Malaysian palm oil industry particularly offers a promising platform for CDM projects. However, proper monitoring needs to be performed in order to ensure the projects’ positive impact. Furthermore, a set of sustainability criteria should be developed to promote the achievement of sustainable development and the criteria should reflect the local context in which the projects are carried out. In other words, the effort must be holistic in order to reach an equilibrium state for sustainability.

The legal dimension factor’s results showed that three out of seven respondents indicated “not compatible with national regulations.” In Malaysia, there are no regulations to dictate that the palm oil industry should implement carbon trading. Carbon trading implementation, such as CDM, was made as a result of climate negotiations and, therefore, governments with different views on carbon trading’s commodification influence the outcome [

31].

The analysis of the collected data revealed that the majority of the interviewees on carbon trading implementation in Malaysia considered the “legal dimension” as the crucial factor in implementing carbon trading. As argued by a representative from Company A, the regulatory constraints hinder the implementation of CDM and the development of the carbon market, which indicates the perception of the crucial legal dimension factors in carbon trading implementation (Company A, 2018).

However, Companies B, C, E, and G considered the legal dimension as one of the incentives to meet the sustainable palm oil standard and development in palm oil plantation areas. As stated by [

32], the firms respond to the institutional pressure that emphasizes the importance of the regulatory, normative, and cognitive factors that have affected the firms’ decisions to adopt some environmental practices. Beyond the institutional pressures’ perspective, perhaps more symbolic actions have been a long-standing priority for palm oil companies to provide emission-related investments and to participate in voluntary initiatives that allow them to demonstrate their commitment to the government as core corporate strategy elements on climate change [

33].

The results relating to the “difficulty to engage with international policy” show that Companies D, E, and G have affected the management decisions to continue in CDM projects. The representative from Company E (2018) argued that the project developers and consultants are essentially dependent on each other and, if they don’t comply with each other and there is a problem, then the consultant needs to be changed. This was explained further by the representative from Company G (2017), “There are a lot of problems, and they don’t want to share the loan equally. You are the industrialized country, I am also the industrialized country, the ratio that we want to split is not agreeable.”

There are many arguments that have advocated carbon trading implementation related to the environmental market and policies governance. While governance is important in policy formation, the critical factor on strict additionality in implementing carbon emission projects has contributed to confusion in continuing with the projects. From the findings, “strict additionality in emissions projects” shows that four of the seven palm oil companies agreed with the problem. As stated by representatives from Company B (2018), “Review the entire procedures of the data monitoring, collections and compilation and documentations…once wrong, another problem will start…typical accounting procedures.”

Moreover, when climate change became a big issue, there were two different sorts of arguments that economists used to explain efficient methods for reducing emissions [

34]. Although the world has recognized Malaysia as being ready to replace non-renewable energy with renewable fuels, the implementation of various policies and programs by the Malaysian government has increased the awareness of the important role of RE in sustainable energy systems [

35]. The existing policy, however, appears to not be indicative of such progress.

The ongoing revision from the Malaysian perspective has contributed to the development of a mechanism that complies more sustainably with the palm oil industry. More importantly, the enhancement of carbon market policies has shown a positive impact. This analysis provides links between the legal dimension perspectives with the current Malaysian policies. The challenge of addressing carbon trading stresses the palm oil industry’s potential to contribute to several SDGs, especially for sustainable palm oil, RE, waste management, and water treatment of palm oil waste, which appear to be beneficial for promoting sustainable development.

4.2. Financial Conditions

Carbon trading projects in Malaysia have shown a downturn since 2015 [

14]. Project developers have shown less interest and confidence in this project’s implementation. According to the MNRE Consultancy Report [

14], the issues hampering the continuity is that there has been a lack of demand but an increase in the CER supply. The findings identified that the “low confidence level and uncertainty of the carbon market” has contributed to the growth of financial flows and resources. There is also a low commitment to further investment to continue the current depressed market situation. Nevertheless, the challenge must be met in order to persist with Malaysia’s pledge to voluntarily reduce its emissions by up to 45% by 2030.

For the palm oil companies, one of the barriers to investing in carbon trading projects is the high costs of CER consultation and verification. The weakening of the local currency (consultancy and verification fees are generally quoted in €), paired with the drop in CER value, has made CDM projects a costly endeavor (Company B, 2018).

Furthermore, as highlighted by representatives of Companies E and F, the challenge in the current carbon trading implementation, specifically in the Malaysian palm oil industry, concerns the registration and certification costs. For palm oil producers, GHG reduction projects are implemented to reduce the overall carbon footprint of the palm oil production itself. Hence, the trading of any carbon credits defeats this purpose (from a carbon accounting position) unless it has exceeded sustainability targets (Company F, 2018).

As mentioned, Malaysia has benefited from the investment in GHG emissions reduction projects through the ratification in the UNFCCC. As the representative from Company B (2018) pointed out, “…investment in renewable energy is costly and political support for the adoption of renewable energy has been inconsistent and unfair.” When the regulators removed the subsidies, the carbon market’s inconsistencies caused the carbon prices to fluctuate [

14] and affected the demand for carbon. Therefore, CDM projects can only earn the return on investment (ROI) by continuance to invest in the longer term despite focusing on the uncertainties on the mechanism and other new mechanisms.

The representative from Company C (2017) argued that there was a “lack of financial investment primarily influenced by demand and supply…and low-prices due to low-demand.” As mentioned by [

31], there was a drop in CDM prices because, after Kyoto, the markets were demanding fewer credits and the financial crisis caused problems. The issues of concern are that “difficulty of CER sales are higher in consultancy” generate an additional cost for the project developers. As pointed out by [

36], the cost is related to the environmental projects’ formalization and validation, the monitoring process and the implementation verification process. However, costing and CER sales are dependent on the size of the project and requires a huge investment of the project development. Companies A, C, E, and G disagree on the “difficulty of CER sales and higher consultancy costs” because the credits received met their expectations and satisfied the financial additionality criteria of CDM.

The financial benefits from the sale of carbon credits have been viewed as being potentially positive and economically profitable. Therefore, environmental practices create advantages for palm oil companies to benefit from emissions reduction and reduced energy intensity or by switching to relatively cheaper fuels as part of the operational costs.

4.3. Green Resources and Capabilities

In Malaysia, many options under green technology projects could create significant co-benefits in this country. The strategies are able to address local and regional environmental problems and advance social goals [

37]. For developing countries that might otherwise give priority to their immediate economic and environmental needs, the prospect of significant additional benefits should provide a strong inducement to participate in carbon trading projects.

In this study, the terms of green resources and capabilities have been identified as being able to minimize energy and resource dependence and to make economic trends more sustainable with resource-efficient manufacturing [

38]. In order to meet the growing demand for palm oil in the future, the palm oil producers must co-exist with new skills development and green resources to move towards sustainability.

In theory, irrespective of the allocation of the rights to trade in the carbon market, Malaysia benefits from a transaction that is designed to contribute towards sustainable development. Similar to other foreign investments, the RE projects in Malaysia could promote technology transfer and the adoption of similar strategies and policies for emissions reduction planning. In contrast, green resources and capabilities do not support the “lack of green resources in green technology” and “need new technical skills.”

From the findings, the representative from Company C (2017) stated that “The carbon trading project presents an opportunity for channelling of resources towards projects that are most likely to be accessed for further national sustainable development.” In addition, new skills development is needed to move forward towards sustainability as one of the emerging knowledge and new skills (Company A, 2018). The analysis suggests that, if the management systems and skills development are not well developed, the external pressures on sustainability issues will be relatively weak and unresponsive [

33]. Thus, responding to sustainability-related projects, such as carbon trading, limits a company’s ability to move forward.

Consistent with the findings in this study, carbon trading promotes green resources and capabilities, which were significant in the previous study by [

39]. One of the CDM objectives was to promote green technology and increase local skills and equipment content [

39]. Carbon trading can also provide employment, new knowledge skills and business opportunities in less developed countries (Company B, 2018).

There are high expectations amongst palm oil producers in Malaysia due to the potential of carbon trading to deliver sustainable benefits and its ability to attract foreign investments, technology transfer, and possible contributions to poverty alleviation [

40]. With initiatives in energy sectors and bioenergy production, the palm oil carbon emission projects’ activities have already produced the benefits of sound progress that can contribute to sustainable development. Carbon trading projects can lower the cost of compliance with the emissions reduction initiative projects for developed countries.

4.4. Sustainability in the Palm Oil Industry

The primary purpose of carbon trading is to reduce overall global carbon emissions. The concept behind carbon trading is simple: if total global emissions are reduced, it does not matter from which country or organization the reduction comes. Thus, this concept will benefit developed nations and organizations by enabling them to purchase CER to meet their NDC targets (Company B, 2018).

Based on the findings for the sustainable development’s positive impact, it is shown that six of the seven palm oil companies have stated a positive sustainable impact. The representative from Company C argued (2017), “In certain countries, there has been criticism that carbon trading does not promote sustainable development because the activities act as an enabler for developed countries to maintain and increase their emission levels as long as they have the means to pay in order to meet their set targets.”

Furthermore, despite the issues associated with carbon trading in the palm oil industry, sustainable palm oil’s evolution [

41] in Malaysia should be perceived as being more effect in contributing ideas to more sustainable reductions in carbon emissions. However, in relation to Malaysia’s economic growth, it can be concluded that the growth of new palm oil estates in the tropical rainforest will soon no longer be achievable [

9].

In the mitigation’s development process, it is vital to consider the quality of the environment. In practice, there exists a significant strain between financial and environmental targets in fulfilling the carbon emissions projects. An ethical concern faced in this industry is that the production of palm oil affects the environment, wildlife, and native communities. Despite the arguments about sustainability issues concerning carbon trading, Malaysia has established policies related to sustainability that ensure economic development and ecological biodiversity. By considering an alternative approach and supplying the economic and technological undertakings, numerous issues could be removed [

5]. Additionally, the resources that are already on-going are more advanced and are using technologies with good practices; however, the resources need to be scaled up and used in other appropriate ways [

42].

The SDGs are influential, long-term prospects that can provide the direction and unlimited framework for businesses driven towards sustainability to release their powers of transforming and developing solutions for the world. In short, the SDGs are driving businesses to become an even stronger force for good. A recent report by [

43] has compared the potential of implementing carbon trading projects and has asserted that most companies are defined by carbon reduction benefits, as well as the social benefits that are associated with the palm oil sector. As discussed, sustainable development benefits the reduction of air and water pollution through the minimized usage of fossil fuel, as well as extending to improving water availability, reducing soil erosion, and the protection of biodiversity. From the perspective of social benefits, many projects would result in employment opportunities in the different regions or income groups that are targeted and would result in local energy self-reliance promotion. The goals of carbon reduction and sustainable development can, therefore, be pursued on a long-term basis.

Carbon trading projects also have an impact on funding channels in achieving economic, social, environmental, and sustainable development targets, including clean water and atmosphere, that sit alongside social development, such as growth in rural areas, creation of job opportunities, alleviation of poverty, and often reduce the reliance on the use of imported fossil fuels [

44]. Alongside green investment opportunities in developing nations, the voluntary carbon trading projects in the palm oil industry also improve climate and future developments, as well as environmental issues within local areas. The prospect of such benefits ought to provide a strong inducement for developing countries that are anxious about immediate economic and social development to engage in palm oil carbon emissions and sustainable future projects.

5. Limitations and Future Research

This paper acknowledges that there are limitations to this study as it focuses only on palm oil producers in Malaysia and the findings illustrate the challenges and sustainable development impact within the palm oil industry. However, these findings are important in determining how palm oil producers will enhance the strategies and future policies in this field. In another context, the alternatives in carbon trading project implementation should be implemented locally and lead to the improvement in future carbon emissions projects.

The second limitation pertains to palm oil producers in the country which have conventionally struggled to come to terms with the ban on biofuels produced using palm oil as well as the deforestation ban phenomena which began in the early part of 2018. For this reason, the number of participants was limited, and the majority of producers rejected the invitation of the interview. Moreover, earlier on in 2019, the trade war that broke out with palm oil producers curtailed the producers’ ability for participation. Furthermore, the involvement in this study was both subjective and voluntary; for this reason, it is difficult to reach the subject matter expert in carbon trading and CDM.

It is necessary to broaden the scope of this study to encompass other divergent viewpoints, including economic dimensions, stakeholders’ perspectives, international relations, social responsibility, as well as competitiveness in future research. Finding novelty in other perspectives and industries could also help improve the level of understanding and be in alignment with aspirations relating to Malaysia’s SDGs. This approach could also be used for a quantitative method or mixed methods in future order to gather detail for future studies. Furthermore, studies in the future must undertake research on the energy industry, which could turn out to be one of the most promising sectors to enforce carbon trading as well as contributing toward sustainable development.

Malaysia has been proactive in accelerating the adoption of the 2030 Agenda and SDGs nationally. The country began preparing for the SDGs since 2014 in order to incorporate the SDGs into the national planning framework with a view to reduce the emissions target by 2030. The CDM or carbon trading was the tool that was used previously. Currently, there is no encouragement to continue with the projects and it is just business-as-usual. Through the implementation of carbon trading, Malaysia can maintain its flexibility in adjusting and realigning strategies based on the achievements, challenges, and lessons learned during the previous phase, while also assessing emerging trends and circumstances that may affect the desired development outcomes [

43]. It also provides an opportunity for feedback and greater participation from various stakeholders as they gradually align themselves with the 2030 Agenda as well as the SDGs.

However, the research work for future studies would yield better results with an evaluation and examination of the study model in other industries so that comparisons can be made with the existing research work. Hence, value would be added concerning the insight to find the appropriate enforcement regulations in carbon trading, as well as the completion level and market demand for the local market with carbon trading implementation.

6. Conclusions

In recent years, sustainability has been promoted by the addition of carbon trading as a vital strategy for an agricultural business. Palm oil is one of the biggest traded commodities and has provided many benefits to health, society, the economy, and the environment. Many policies have emerged in Malaysia with regard to achieving the SDGs’ agenda. The palm oil industry’s potential in carbon trading project utilisation in Malaysia could be improved with government encouragement in the carbon market post-2020.

This paper has explored carbon trading implementation challenges in Malaysia that will assist in leading the opinions on problems and solutions for a better transition. In the struggle over palm oil’s sustainability, Malaysia has shown a strong desire to promote itself as a significant palm oil hub in the South-East Asia region, with extra payback from carbon trading implementation. Thus, the government has to play a more active role. The government can improve conditions for local development by providing funding opportunities and policies that could increase carbon trading’s competitiveness. Supportive policies need to be developed to enhance the implementation and investment from the private sector in the agricultural sector, particularly in the palm oil industry. The new trend of business opportunities has accelerated the palm oil sector’s development towards a sustainable future and improved process efficiencies. Despite the challenges to be solved, the on-going R&D into palm oil carbon trading projects are expected to promote a more advanced generation of palm oil bioenergy and biotechnology, where high value-added products and bio-based chemicals are produced, and technology enhancements are provided for the palm oil producers. In this study, carbon trading projects’ positive sustainability impacts have contributed to new intervention in the palm oil industry towards more sustainable production, with improvements in procedures and policies, alongside the SDGs agenda. Through technology transfer and engagement in carbon trading projects, Malaysia might meet its target in reducing the regional temperature to 1.5 degree Celsius, in accordance with the Paris Agreement pledge that the targeted carbon emissions would be reduced.

This paper offers an original contribution to the research field in carbon trading within the palm oil industry. It aims to improve the understanding of palm oil producers and policymakers for future developments in carbon trading and its impact through contributing to a sustainable future with opportunities to drive sustainable development and the climate change mitigation strategies in order to achieve SDGs. By understanding the challenges in carbon trading implementation, this study hopes to further develop and enhance new approaches and to encourage continuous improvement in environmental projects that soon will become the new period of future development. Moreover, the challenges relating to the difficulty in implementing the CDM will help policymakers, practitioners, and other industries to understand and manage future climate mitigation strategies.

The concept of sustainability has pinned a promising outlook for the palm oil industry to continue the development and growth of palm oil use. Despite the challenges with the legal dimension, the financial conditions and the green resources and capabilities, the palm oil industry still shows a significant inflow of investments and has been following Malaysia’s extensive economic growth. Furthermore, Malaysia will be able to utilize its substantial green potential by developing a robust supply network for proper palm oil supply and demand connections in the carbon market. The potential of the mitigation action objectives will enhance the sustainability performance in the palm oil industry in Malaysia, in line with the SDGs.