1. Introduction

The Korean government has an environmentally oriented energy policy. This orientation has been embodied in state-run tasks related to energy policy, such as the discovery and development of eco-friendly future energy (Minister of Trade, Industry and Energy of Korea, MOTIE), the creation of pleasant air without particulate matter (PM) (Minister of Environment of Korea, MOE), the transition to safe and clean energy based on the policy of phasing out nuclear power (MOTIE and Nuclear Safety and Security Commission of Korea, NSSC) and the establishment of an effective implementation system for new climate change (MOE).

The generation sector has clearly shifted to follow this policy orientation. The government announced a policy to abolish old coal-fired power plants and to suspend the construction of new coal-fired power plants to reduce both greenhouse gas (GHG) and PM emissions. Safety concerns have prevented an extension of the life of nuclear power plants and cancelled the construction of new nuclear power plants. Additionally, a plan has been established to increase the share of renewable power generation to 20% by 2030. Energy transition policy, which tends to phase out nuclear and coal energy, is implemented as a policy tool. The government uses a quantity ceiling, for example, to shut down old coal power plants in spring. The 8th electricity supply–demand basic plan (the 8th basic plan) included tax reforms to reduce both PM and GHG emissions, but it mostly relied on a quantity ceiling. Although a quantity ceiling is an effective means of ensuring environmental quality, it negatively affects the efficiency of resource allocation, the equity among generation operators, and the stability of the electricity network.

A Pigouvian tax, which internalizes the external costs of the environment in prices, minimizes economic inefficiency by adapting the market mechanism. Pigouvian tax considering environmental externality has long been referred to as a useful measure of reducing the environmental impact connected to energy consumption and production [

1,

2]. This tax generally has policy objectives that change the behavior of economic entities. In resource allocation, indirect tools based on price like Pigouvian tax should be used to induce the exit of low-economic performing and environmental-unfriendly power plants and to incentivize the entry of environmentally friendly and high-efficiency power plants in the electricity market. However, applying a tax base that is less relevant to air pollutant emissions can cause efficiency losses because all emission reduction measures are not equally activated. For example, taxing on electricity consumption would reduce consumption itself and would not provide incentives for higher efficiency or fuel substitution in generation [

1]. A suitable tax system is useful for switching from power generation sources with large emissions to ones with relatively low emissions [

2].

The Korean government applies a high tax rate on energy sources with a high calorific value to reflect their commercial value. As of December 2017, when the 8th basic plan was set, the excise tax on generation fuel was 36 won/kg for bituminous coal and 60 won/kg for liquefied natural gas (LNG). For bituminous coal, a higher tax rate is applied to high-calorific coal (39 won/kg) than to low-calorific coal (33 won/kg). These taxes levied on energy sources run counter to their environmental load [

3,

4].

Tax reform reflecting environmental issues should reduce the share of coal power and increase the share of LNG power, thus decreasing air pollutant and GHG emissions. To compose eco-friendly generation sources, the merit order of coal and LNG generation must be reversed under the cost-based binding pool (CBP) electricity market [

5,

6]. This paper analyzes the tax reform of generation fuel capable of achieving an energy transition, taking into account the Pigouvian tax as a means of reversing the merit order.

Previous studies considered the Pigouvian tax as a measure of reducing GHG emissions and slowing global warming [

1,

2,

6,

7,

8,

9]. These analyzed the impact of an environmental tax on GHG emissions, economy, industry, tax revenue and electricity price. For analysis methods, dynamic CGE, power system operational simulated model, multi-period modelling and optimization framework etc. are used. The cost-effective carbon tax is 1–15 EUR/t-CO

2, and the optimal CO

2 tax rate is 13 EUR/t-CO

2 for environmentally friendly generation mix, according to a simulation of Belgium’s power market [

8]. According to the result of analyzing the impact of carbon tax on the generation mix of Sri Lanka from 2005 to 2050, it lowers the proportion of coal power generation and increases the proportion of biomass and wind power generation [

7]. The analysis for the effect of carbon tax and CO

2 emission targets system applied to the generation mix in China, although both carbon taxes and CO

2 emission targets lead to higher electricity price, showed that two measures replace fossil fuels with renewable energy or energy sources with less GHG emissions [

9]. The estimated results for environmental and economic impacts of charging environmental taxes on electricity in Spain showed that taxing on electricity generated from only coal, oil, and LNG was more advantageous than taxing on all power sources for environmental improvement and economic growth from a tax revenue-neutral point of view [

2].

This study also takes into account Pigouvian taxes reflecting environmental externalities, but levies Pigouvian taxes on primary energy sources to change the merit order and the power mix. Switching to an environmental-friendly generation mix continues to reduce air pollutants and GHGs emissions. Furthermore, taxation on primary energy sources is more effective than taxation on final energy. This is because the final energy taxation only affects the behavior of end-users, but does not affect the composition of power generation suppliers [

8]. Accordingly, in this paper, we estimate the changes in the power generation mix and air pollutant and GHG emissions using excise tax reform scenarios that internalize the external costs of the environment in prices.

This paper is structured as follows: In

Section 2, taxation in Korea’s power generation sector is reviewed. In

Section 3, we briefly explain the commercial economic dispatch model known as M-Core, which is able to simulate the characteristics of Korea’s power system and market. Additionally, the input data for the simulation are described. In

Section 4, excise tax reform scenarios are set, focusing on coal and LNG. In addition, we estimate the transition between coal and LNG generation through the change in the capacity factor and generation share of these two sources based on excise tax adjustments. In

Section 5, conclusions are drawn.

2. Taxation in Korea’s Power Generation Sector

The taxes on the power generation sector are the excise tax and value-added tax (VAT), which are national taxes, and the local resource facility tax, which is a local tax. The charges consist of import and sales surcharges for oil and alternative oil fuels, quality inspection fees, the power industry fund, and the nuclear fund, as well as charges for safety management, nuclear spent fuel management and nuclear safety management.

Table 1 shows the taxes and charges by generation source reflected in the 2018 Tax Act Amendment (applied after 1 April 2019). The base rate of tariffs on energy is 3% of the import price. However, the quota tariff of 2% is applied to LNG for generation only during winter. Uranium, anthracite coal (domestic coal) and bituminous coal are subject to tariff exemptions. As of 2018, the excise tax rate of generation is 36 won/kg for bituminous coal, 60 won/kg for LNG, and 17 won/L for heavy oil. The tax rate for bituminous coal, which emits more GHG and air pollutant emissions, was lower than that of LNG. Uranium, anthracite coal and bituminous coal for combined heat power (CHP) are subject to a tax exemption. The lower flexible tax rate of 42 won/kg is applied to the excise tax on LNG for urban gas and for collective CHP. An education tax is imposed on generation fuels. Thirty percent of the excise tax is imposed on heavy oil as a surtax and not on other fuels. Except for anthracite coal (ad valorem tax), the VAT rate for electricity generation fuels is 10%. The VAT on generation fuels is refunded.

The local resource facility tax is an earmarked tax imposed to protect and develop local resources such as underground resources, marine resources, tourism resources, water resources, and special topographies. The amounts imposed are 1.0 won/kWh for nuclear power generation, 0.3 won/kWh for thermal power (coal, LNG and oil), and 2 won/10 m3 for hydropower. For thermal power, 50% of the local resource facility tax is refunded to the taxpayers according to the power market settlement rules.

The import surcharge on the power sector was introduced with the purpose of contributing to national economic development and life improvement by ensuring the stability of oil supply–demand and prices and by securing the quality of petroleum products and alternative oil fuels. Import surcharges are collected from oil importers at a rate of less than 36 won/L for imported oil. The surcharge payers are oil speculators, oil importers and oil exporters. Crude oil and petroleum products (excluding liquefied petroleum gas, LPG) are charged at a rate of 16 won/L. LNG is charged at a rate of 24,242 won/ton. Within the power sector, the import surcharge is imposed only on heavy oil and LNG and not on uranium, anthracite coal, or bituminous coal. The charge imposed on LNG for gas heating and cooling and CHP is subject to a refund. Quality inspection fees and safety management charges are imposed to cover the financing of work carried out in the interest of the public such as quality control and safety management. The quality inspection fee is 0.469 won/L for fuel oil, 3.33 won/L for lubricating oil and 0.027 won/kg for LPG. The safety management charge is levied at a rate of 4.5 won/kg on LPG and 3.9 won/m3 on LNG as a quasi-tax. Fuels used for industrial use, power generation use, collective energy use, and self-CHP use are exempt. The power industry fund is a levy imposed at a rate of 37/1000 of the electricity bill of electricity users to secure funds for the development and base formation of the power industry. The nuclear fund is a levy on nuclear power generation imposed at a rate of 1.2 won/kWh. The purpose of this fund is to contribute to improving people’s lives and welfare by promoting academic and industry progress by facilitating research and development regarding nuclear power as well as the production and utilization of nuclear power. Nuclear safety management charges are imposed on nuclear power to provide funds for safety regulatory agencies to evaluate and inspect the use of nuclear facilities and radioactive isotopes. The level of the charge is set to reflect the labor costs incurred in regulatory evaluation and inspection each year. Spent fuel management charges are imposed to secure funds for the implementation of the spent fuel management project. This charge is a radioactive waste management fund. The air pollutant emission charge is 770 won/kg for PM and 500 won/kg for SOx (Sulfur oxide). This charge is imposed when a facility emits pollutants that exceed the emission standard. Charges for PM and SOx are not imposed on facilities that use LNG or LPG as fuel.

In the case of nuclear power, all national taxes, such as tariffs and excise taxes, are free, and only local taxes of 1.0 won/kWh (nonrefundable) are levied. The tax burden rate of nuclear power is lower than that of bituminous coal power and LNG power. However, the charges for nuclear power are larger than those for thermal power fuel because of the spent fuel management charge. The spent fuel management charge secures funds to cover a large amount of the disposal costs that will have to be paid in the future. Therefore, it is characterized as a production cost rather than as a charge imposed to provide public services. Without the spent fuel management charge, the sum of the charges for nuclear power is 1.93 won/kWh, which is not higher than that for other fuels. The tax (including the excise tax rates and excluding tariffs and VAT) for LNG is 1.67 times larger than that for bituminous coal because the calorific value is used as the tax base. If the tax rate is determined based on reflecting the environmental costs of air pollutant and GHG emissions, the tax for bituminous coal should be higher than that for LNG. The charge burden rate for LNG is higher than that for bituminous coal because bituminous coal is exempt from other taxes and charges, except for excise taxes and local resource facility taxes. The 2018 Tax Act Amendment lowered the excise tax and import charge on LNG, while the base tax rate of the excise tax on bituminous coal for power generation increased from 36 won/kg to 46 won/kg. Under the tax rate adjustment, the sum of taxes and charges decreases to 2.24 won/kWh for LNG, while the tax for bituminous coal reaches 17.43 won/kWh. There are more taxes on thermal power and more charges on nuclear power. All national taxes, such as tariffs and excise taxes, are imposed on thermal power, but nuclear power is exempt from all of these taxes and charges. Tariffs and excise taxes are imposed on LNG for power; in contrast, bituminous coal for power is tariff-free, but the excise tax is imposed. The taxes on thermal power fuels such as bituminous coal and LNG do not adequately reflect the external costs of the environment [

3,

4].

The 2018 Tax Act Amendment revised the energy tax structure in an environmentally friendly way, which changed the tax rate criteria from calorific values to the external costs of air pollutants [

3,

4]. This adjustment eased the burden on LNG power by adjusting the tax on bituminous coal and LNG to approximately 2:1, the relative ratio of the external costs of air pollutant emissions.

3. Analysis Model and Input Data

3.1. Analysis Model

In this study, the economic and environmental feasibility of each excise tax scenario is analyzed using the M-Core simulator. This simulator is an electricity system simulation engineering computable model that reflects Korea’s CBP pool market and is based on the Lagrangian relaxation (LR) method and single unit dynamic programming (SUDP) algorithm based on the annual generation plan simulation. Cost minimization is achieved through the use of the LR method for the modeling of each generator. SUDP is used to optimize the unit commitment each time [

6,

10].

For this model, the optimization is as follows. The object function in the unit commitment minimizes the sum of the start-up costs (

) and power generation costs (

) of each generator, as shown in Equation (1). When

is minimized, the unit commitment of time

becomes set. The supply–demand clearing condition, which is a system constraint, is Equation (2), and the output constraint of each generator is Equation (5). Apply the LR method to Equation (1) to rewrite Equation (3) of the Lagrange function subject to Equation (2). Furthermore, Equation (4) is obtained based on Equation (3) after the constant term is eliminated. Additionally, Equation (5) is obtained after Equation (4) is decoupled to minimize the generation costs of each generator. The total generation cost is minimized by decoupling the minimized generation cost of each generator based on the LR method.

: the generation cost of the generator

: the generation at time of the generator

: the start-up cost at time of the generator

: the start or stop sign at time of the generator (start 1, stop 0)

: the system load at time

: the minimum output of the generator

: the maximum output of the generator

T: the total simulation time

N: the total number of generators

3.2. Input Data

The electricity system simulation uses input data from the 8th basic plan, the Power Market Operation Regulations of 2017, and the characteristics of generators [

11,

12]. The preventive maintenance plan dates, forced outage rate (FOR), price per 10

6 kilo-calories (won/Gcal), heat rate (kcal/kWh), calorific value (kcal/kg), auxiliary power consumption, and transmission and distribution loss rates are obtained from the 8th basic plan. For the annual electricity demand, the target forecast of the 8th basic plan is used; for the generation capacity, the rated capacity of the 8th basic plan is used; and for generation, the forecast reference of the 8th basic plan is used. The composition of the generation sources is in accordance with the 8th basic plan. The Gori-1 and Wolseong-1 nuclear power plants are shut down, the life of other nuclear power plants is extended another 10 years, and no new nuclear power plants are allowed. Regarding coal power, the Yeongdong, Boryeong and Taean generators are shut down, and no new coal power generators are allowed. The LNG combined cycle power plants include the construction of the new Jeju, Hallym, Samcheonpo Alternative 1 and 2, Dangjin-Eco 1 and 2, and Taean 1 and 2 power plants. Renewable energy follows the forecast for renewable energy facilities and generation in the 8th basic plan. Additionally, the peak demand and electricity demand forecasts for this plan are applied. In the case of LNG power generation, the difference in the price per calorie by the generator is considered. Reference capacity payment (RCP), the time of day capacity factor (TCF), the regional capacity factor (RCF), and the fuel-switching factor (FSF) are applied based on the Power Market and Power System Operating Information in 2017 and Market Operation Regulation of 2017 [

11]. In the case of hydropower and pumping-up power, the average hourly generation during the 2016–2017 period is applied for the future generation. For renewable generation, the 2016–2017 two-year capacity rate and generation patterns of photovoltaic, wind and other renewable types of generation are used. Under these assumptions, the power generation of hydropower, pumping-up power and renewable power that satisfies the annual generation forecasts of the 8th basic plan is estimated and used.

The plan for the entry and abolition of power generation facilities applied to the 8th basic plan. For nuclear power, life extension, which is one of the factors that affects the ratio of generation sources, is not considered because the 8th basic plan did not include the life extension of nuclear power plants, which are uncertain supply facilities, in the total capacity. The electricity system simulation also reflects policies that have been implemented such as PM reduction and performance-improving schedules for coal power generators. The 8th basic plan forecasts the total generation at the quantity ceiling of generators over 30 years in spring, regardless of performance improvement. Therefore, the simulation analysis does so as well.

The 8th basic plan considers the generation of nondispatchable generators, such as coal-fired CHP, which are reflected in terms of distributed generation deployment forecasts. However, nondispatchable generators such as coal-fired CHP are not reflected in terms of resource scheduling and commitment. They do not affect the system marginal price (SMP), but they are included in the generation forecast of the scheduling for operation. Thus, the simulation analysis includes nondispatchable coal-fired CHP generators.

4. Empirical Analysis

4.1. Excise Tax Reform Scenario

Since this analysis considers the Pigouvian tax, which internalizes external costs of the environment, the scenarios contain two factors: the LNG base tax rate and the relative ratio of the external cost of the environment between fuels. These two factors are used to estimate the tax rates at which the merit order of bituminous coal and LNG is reversed to achieve an energy transition in the power sector. The LNG base tax rate, which is the initial value of the LNG excise tax, reflects the difference in the tax rate between bituminous coal and LNG. The 2018 Tax Act Amendment improved equity by raising the tax on bituminous coal and lowering the tax on LNG for power generation, taking into account air pollutant emissions. The relative ratio, which depends on the external costs of the air pollutant emissions from bituminous coal and LNG for generation, can also reverse the merit order. The ratio of the external costs of bituminous coal and LNG is 100:77 in the 7th electricity supply–demand basic plan (the 7th basic plan), 100:98 in the 8th basic plan, and 100:59 in the forecast by the Korean Industrial Organization Association (KIOA) [

12,

13,

14].

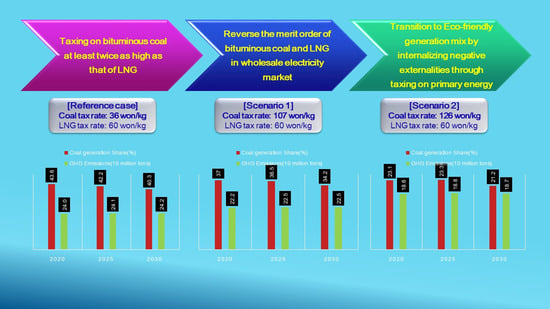

Four scenarios are set up to reflect these two factors. The reference scenario is the basic excise tax rate (36 won/kg of bituminous coal, 60 won/kg of LNG) applied when the 8th basic plan was established. These values are the base tax rates. In addition to the reference scenario, the first step consists of setting the LNG base tax rate or the bituminous coal base tax rate based on the excise tax rate at the time of the 8th basic plan. The second step consists of deriving the relative tax rate at which the merit order of bituminous coal and LNG is reversed under the LNG base tax rate or bituminous coal base tax rate set in the first stage. In deriving the relative tax rate, the fuel price (won/kWh) for bituminous coal and LNG power is estimated based on the heat rate (kcal/kWh), price per calorie (won/Gcal), and onsite consumption rate (%) in the 8th basic plan. The difference in calories per price is estimated based on the tax rate (won/kg) and calorific value (kcal/kg) for bituminous coal and LNG. In the last step, the bituminous coal tax rate, in which the fuel price for bituminous coal and LNG power is almost equal, is estimated. Additionally, the relative tax rate is derived as a ratio of this bituminous coal tax rate and the LNG tax rate.

Table 2 shows the tax reform scenarios. Scenario 1 sets the LNG tax rate to 60 won/kg at the time of the 8th basic plan, and the tax rate of bituminous coal is 107 won/kg based on the lower rate of the external costs of air pollutants (100:59) of bituminous coal and LNG from the KIOA [

13]. In Scenario 1, the bituminous coal tax rate is 107 won/kg, and the LNG tax rate is 60 won/kg. Scenario 2 sets the LNG tax rate to 60 won/kg at the time of the 8th basic plan and applies the relative tax rate (100:48) at which the fuel prices of bituminous coal and LNG power are reversed to derive the bituminous coal tax rate (126 won/kg). In Scenario 2, the bituminous coal tax rate is 126 won/kg, and the LNG tax rate is 60 won/kg. Scenario 3 sets the bituminous coal tax rate to 36 won/kg at the time of the 8th basic plan and applies the relative ratio of the external costs of air pollutants (100:98) of bituminous coal and LNG in the 8th basic plan to derive the LNG base tax rate (35 won/kg). The LNG base tax rate (35 won/kg) is applied to the relative tax rate (100:30) at which the fuel prices of bituminous coal and LNG power are reversed to derive the bituminous coal tax rate (118 won/kg). In Scenario 3, the bituminous coal tax rate is 118 won/kg, and the LNG tax rate is 35 won/kg. Scenarios 2 and 3 apply the relative tax rate at which the fuel prices of bituminous coal and LNG power are reversed. However, the relative tax rates are different because the criteria of the base tax rates are different. For LNG, the base tax rate in Scenario 2 is 60 won/kg, but for bituminous coal, the base tax rate in Scenario 3 is 36 won/kg. In addition to the four scenarios, the tax rate of bituminous coal (46 won/kg) and the tax rate of LNG (12 won/kg) in the 2018 Tax Act Amendment are included to estimate the effect on the energy transition.

4.2. Emission Coefficient

To estimate the environmental improvement from the use of the Pigouvian tax for generation source transition, the air pollutant (SOx, NOx (Nitrogen oxide), PM) and GHG emission coefficients by generation source of the 8th basic plan are used. The emission coefficient was derived as a weighted average of the emissions of each generator from 2014 to 2016. When estimating GHG emissions, the calorific value and heat rate in the 8th basic plan, the national emission (absorption) coefficient and carbon emission coefficient by fuel from 2012 to 2016, and the national GHG inventory report of 2016 and 2018 are used [

15,

16].

Table 3 shows the GHG and pollutant emission factor by generartion sources.

4.3. Results for Reversal of the Generation Merit Order

In the tax reform scenarios, the transition effect of the merit order is estimated by the fuel cost of bituminous coal and LNG, the capacity rate, the generation share, fuel consumption, etc. The forecasting years are 2020, 2025, and 2030, and the medium- and long-term effects are analyzed.

Table 4 indicates the analysis results of the fuel price (including the excise tax) of bituminous coal and LNG for each scenario. The fuel price of LNG is 81.67 won/kWh for the reference scenario in which the LNG excise tax is set at 60 won/kg. In the reference scenario, the fuel price of bituminous coal is 48.19 won/kWh, and to raise it to the fuel price of LNG, the excise tax on bituminous coal must be raised from 36 won/kg to 126 won/kg.

The fuel cost of bituminous coal power must be approximately 25 won/kWh higher than that of 48.19 Won/kWh in the reference scenario (74.64 won/kWh in Scenario 1 and 81.71 won/kWh in Scenario 2) to reverse the merit order. Scenarios 2 and 3 have reformed the tax rates so that the fuel costs of bituminous coal and LNG power are equal. As the fuel costs of bituminous coal and LNG power are close to equal, the two generation sources have a greater effect on reversing the merit order. To achieve an energy transition through the use of bituminous coal and LNG, the minimum relative tax rate of these two sources must be 100:56 in Scenario 1. In addition, for large-scale changes in generation to occur when the merit order of the two sources is reversed, the relative tax rate must be adjusted so that the fuel costs of bituminous coal and LNG power are close to equal (Scenario 2 and Scenario 3). In the tax adjustment for bituminous coal and LNG in the 2018 Tax Act Amendment, the fuel costs of bituminous coal and LNG power change by (+)3.72 won/kWh and (−)8.38 won/kWh, respectively, compared to the reference scenario. These results will not affect the merit order of bituminous coal and LNG. For the transition to an environmentally friendly generation share, additional relative tax rate adjustments for bituminous coal and LNG are inevitable.

The reversal of the merit order of bituminous coal and LNG in the tax reform scenarios can also be seen based on the changes in the capacity factor and the generation share between coal power and LNG power.

Table 5 and

Table 6 show the capacity factor and share of bituminous coal and LNG generation by scenario. In the reference scenario, the capacity factor of bituminous coal will drop from 80.6% in 2020 to 75.1% in 2030, and the share of bituminous coal generation will drop from 43.6% in 2020 to 40.3% in 2030. The estimated share of coal power generation is higher than the forecast, i.e., 36.1% in 2030 in the target scenario of the 8th basic plan. The share of bituminous coal generation in Scenario 1 is 37.0% in 2020, 36.5% in 2025, and 34.2% in 2030. These results are smaller than those in the reference scenario (43.6% in 2020, 42.2% in 2025, and 40.3% in 2030) and do not reach the level where a reversal of the generation share with LNG occurs. As with Scenario 2 and Scenario 3, the share of bituminous coal generation (23.1% in 2020, 23.5% in 2025, and 21.4% in 2030 in Scenario 2; 22.9% in 2020, 23.3% in 2025, and 21.2% in 2030 in Scenario 3) will decrease by approximately 10–20% compared to the reference scenario. In 2030, the share of bituminous coal generation will account for 40.3% in the reference scenario, 34.2% in Scenario 1, 21.4% in Scenario 2, and 21.2% in Scenario 3. When the fuel costs of the two generation sources become nearly the same, LNG power might significantly substitute for bituminous coal power.

If the tax reform changes the share of bituminous coal and LNG and results in a reversal of the merit order, the capacity factor of bituminous coal generation will fall to 40–50%. The share of LNG generation is 11.6–14.7% in the reference scenario, but it must increase to more than 30% to achieve an effective transition of the generation share through tax adjustment. The bituminous coal tax rate must be at least twice as high as that of LNG to achieve an effective transition of bituminous coal and LNG with relative tax rates of 100:56 in Scenario 1, 100:48 in Scenario 2, and 100:30 in Scenario 3. For bituminous coal power and LNG power generation to compete in the CBP market under the fuel costs in the 8th basic plan, the bituminous coal tax rate must be at least twice as high as the LNG tax rate. For a high-efficiency LNG generator to be more competitive in price than low-efficiency coal generators, uneconomical coal generators must naturally exit the market. In Scenario 2, with an LNG base tax rate of 60 won/kg, the tax rate equalizing the fuel costs of bituminous coal and LNG is 126 won/kg for bituminous coal and 60 won/kg for LNG. In Scenario 3, with an LNG base tax rate of 35 won/kg, the tax rate equalizing the fuel costs of bituminous coal and LNG is 118 won/kg for bituminous coal and 35 won/kg for LNG. Scenario 2 and Scenario 3 set the LNG base tax rates at 60 won/kg and 35 won/kg, respectively; thus, the relative tax rates equalizing the fuel costs of bituminous coal and LNG are also different. When the LNG base tax rate is lower at 35 won/kg, as in Scenario 3, the relative tax rate, which is similar to the two fuel costs, is 100:30 and should be larger than 100:48 in Scenario 2.

According to the analysis results, the share of bituminous coal generation varies depending on the level of the LNG base tax rate. Scenario 2 sets the LNG base tax rate at 60 won/kg, i.e., the current level, and the relative tax rate for bituminous coal and LNG at 100:48. In this scenario, the share of bituminous coal generation accounts for 21–23%. To derive a share of bituminous coal generation that is between 21% and 23%, the tax rate gap between bituminous coal and LNG should be widened if the LNG base tax rate is set low (relative tax rate of 100:48 in Scenario 2 and 100:30 in Scenario 3). Therefore, the relative tax rates of bituminous coal and LNG as well as the LNG base tax rates should be considered when the Pigouvian taxes are revised to achieve an environmentally friendly power generation mix that converts coal to LNG.

4.4. Results for Air Pollutant and GHG Emissions

According to the estimated emissions of air pollutants such as SOx, NOx, and PM by tax reform scenario, the emissions of SOx and PM will decrease by 2030 in all scenarios. The reason is that the 8th basic plan contains a long-term power plan that increases renewable and LNG power and reduces nuclear and coal power.

Table 7 and

Table 8 present the estimation results of SOx emissions and NOx emissions by scenario. As shown in the relationship among the base tax rate, fuel cost, and relative tax rate by the scenario in

Table 4, the difference between the relative tax rates of bituminous coal and LNG must be greater for the two fuel costs to be equal when the LNG base tax rate is low. To have a tax structure that achieves an energy transition in the power sector, it is necessary to increase the relative tax rates of bituminous coal and LNG with a low LNG base tax rate, thus reducing the share of bituminous coal generation, which reduces SOx, NOx and PM emissions. In the case of the bituminous coal and LNG tax rates in the 2018 Tax Act Amendment, the SOx emissions are similar to those of the reference scenario. Although the tax on bituminous coal and LNG was adjusted to 2:1, this Amendment did not consider the merit order. The reason is that the difference between the tax rates for bituminous coal and LNG must be widened to reverse the merit order with bituminous coal when the LNG tax rate is set low. The estimated NOx emissions have a trend that is similar to that of SOx emissions, but the reduction in NOx emissions from tax reform is smaller than the reduction in SOx emissions. The reason is that the share of LNG generation, which has relatively large NOx emissions, increases and the share of bituminous coal generation decreases, partially offsetting the reduction in NOx emissions.

Table 9 and

Table 10 present the estimation results of PM and GHG emissions by scenario. A reduction in PM by tax reform can be achieved through an adjustment of the relative tax rates for bituminous coal and LNG, similar to the SOx and NOx emissions reduction effects, to reverse the merit order of bituminous coal and LNG.

4.5. Discussion

According to the analysis results of the generation mix, air pollutant and GHG emissions change with tax reform scenarios that reflect the Pigouvian tax on external costs of the environment, and the relative tax rates for bituminous coal and LNG and the LNG base tax rates are the main factors. To configure an environmentally friendly power generation mix by reversing the merit order with excise tax reform, the bituminous coal tax rate should be adjusted based on the LNG tax rate.

According to the analysis results, the share of bituminous coal generation will be reduced to 10–20% depending on scenario, reflecting the relative tax rate equalizing the fuel costs of bituminous coal power and LNG power, as in Scenario 2 (tax rate of 126 won/kWh for bituminous coal and 60 won/kWh for LNG) and Scenario 3 (tax rate of 118 won/kWh for bituminous coal and 35 won/kWh for LNG). Comparing the results of Scenarios 2 and 3, in which the share of bituminous coal power generation significantly decreases compared to the reference scenario, we see that SOx, NOx, and GHG emissions decrease by 47%, 17%, and 22%, respectively. To effectively reverse the merit order, the relative tax rates for bituminous coal and LNG must be adjusted from 100:20 to 100:50, depending on the level of the LNG base tax rate. Based on these estimated results, the LNG tax rate is set below 35 won/kg, the relative tax rate should be adjusted to 100:20. If the LNG base tax rate is set low, the difference between the relative tax rates for bituminous coal and LNG must be widened to induce a reversal of the merit order. For LNG to be competitive with coal, it is necessary to raise the tax rate for bituminous coal to make the fuel cost of bituminous coal close to that of LNG power. To achieve an energy transition through a reversal of the merit order of bituminous coal power and LNG power, the tax rate for bituminous coal must be more than twice that for LNG. In analysis results for Belgium’s power market, the cost-effective carbon tax that causes changes in the power generation mix is 1–15 EUR/t-CO

2 and the optimal CO

2 tax ratio is 13 EUR/t-CO

2 [

8]. This estimated the range of carbon taxes in which merit order change appears. Meanwhile the result of this study is that the tax rate on coal must be at least twice the tax rate on LNG to induce merit order reversal. Therefore, it is inappropriate to directly compare these two results. Compared with the result of Sri Lanka’s case [

7], these analysis results are similar that higher tax rates should be applied to energy sources with higher environmental loads like coal. The carbon tax lowers the proportion of coal power generation [

7].

If external costs of the environment are internalized in prices through a Pigouvian tax or by levying taxes on the air pollutant emissions produced by each generator to induce price competition among power plants, relatively high-emission or low-efficiency generators will increase their competitiveness by investing or improving the efficiency of facilities, or they will choose to exit the market. This increases the efficiency of resource allocation and provides an incentive to invest in more environmentally-friendly facilities. The government’s direct regulations limiting coal power generation may achieve their intended purpose of reducing the share of coal power generation, but market efficiency is difficult based on the Pigouvian tax.

However, Pigouvian taxes are based on a partial equilibrium analysis and thus have the disadvantage of having difficulty accurately estimating the cost of social damage to set an optimal tax rate. To overcome this, a process was proposed to determine the target level of pollution by the government and to determine the tax rates that can achieve marginal abatement cost at the target level of pollution [

17]. In the power sector, the government can determine targets for reducing air pollutants or GHG emissions and then set the second-best level of the tax rate to achieve this goal. This analysis shows how the government can determine the level of tax rates that must be set to achieve air pollutants and GHG emission targets in the power sector.

5. Conclusions

The core of the Korean government’s energy policy is now energy transition. The 8th basic plan includes reducing coal power and nuclear power, expanding renewable and LNG power—which are relatively environmentally friendly sources—and increasing the share of renewable generation to 20% by 2030.

Before the 2018 Tax Act Amendment, the Korean government imposed a high tax rate for LNG with a high calorific value by reflecting commercial value rather than the external costs of the environment. However, since the Amendment, the excise tax rate criteria for LNG and bituminous coal have changed from the calorific value to the external costs of the environment. Nevertheless, for LNG generation to substitute for bituminous coal general, taxes are not enough because they reflect some external costs of the environment.

In this paper, taxation that is capable of achieving an energy transition in the power sector was analyzed by applying tax reform with regard to fuel costs in the form of a Pigouvian tax. The Pigouvian tax internalizes the external costs of the environment in prices and is a market mechanism-based policy measure for achieving the energy transition. This study estimated the merit order reversal effect of taxation on primary energy sources such as bituminous coal and LNG by applying different levels of base tax and relative tax rates. The consumption-based taxation mainly affects the behavioral change of end-users, but may have little effect on suppliers’ behavior. If the electricity demand decreases due to taxation on electricity consumption, a peak generator will be responsible for most of the reduction. It will be difficult to expect merit order reversals with bituminous coal power generation. Taxation on primary energy sources might be a more effective way to derive eco-friendly power generation configuration.

In the analysis, M-Core simulation was used to reflect Korea’s electricity systems and market structure. Regarding tax reform for bituminous coal and LNG, four scenarios were set based on the relative tax rate and base tax rates for bituminous coal and LNG. According to the analysis results, to achieve an energy transition through a reversal of the merit order of bituminous coal power and LNG power, the tax rate for bituminous coal must be more than twice that for LNG. If the LNG base tax rate is set low, the difference between the relative tax rates for bituminous coal and LNG must be widened to induce a reversal of the merit order. For LNG to be competitive with coal, it is necessary to raise the tax rate for bituminous coal to make the fuel cost of bituminous coal close to that of LNG power.

While it is best to accurately estimate external costs for each power source for an environmental-friendly generation mix, it is practically difficult to estimate social costs accurately. Thus, the government determine targets for air pollution and GHG emissions externally, and then set the level of tax rates that can be achieved. Taxes on fuels should be continuously adjusted to reflect current demand for environmentally friendly energy and socioeconomic circumstances while meeting the purpose of the tax. In addition, gradual and step-by-step adjustments will be useful for promoting public acceptance and alleviating any negative economic impacts or tax distortion and the stranded costs of coal generators. Environmentally friendly tax reform in the power sector should analyze the economic impact in detail and reach a social consensus based on this impact to minimize the negative impacts of policy enforcement.